Livestock And Meat Market Report

Published Date: 02 February 2026 | Report Code: livestock-and-meat

Livestock And Meat Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Livestock and Meat market from 2023 to 2033, exploring market dynamics, sizes, trends, opportunities, and challenges faced by the industry.

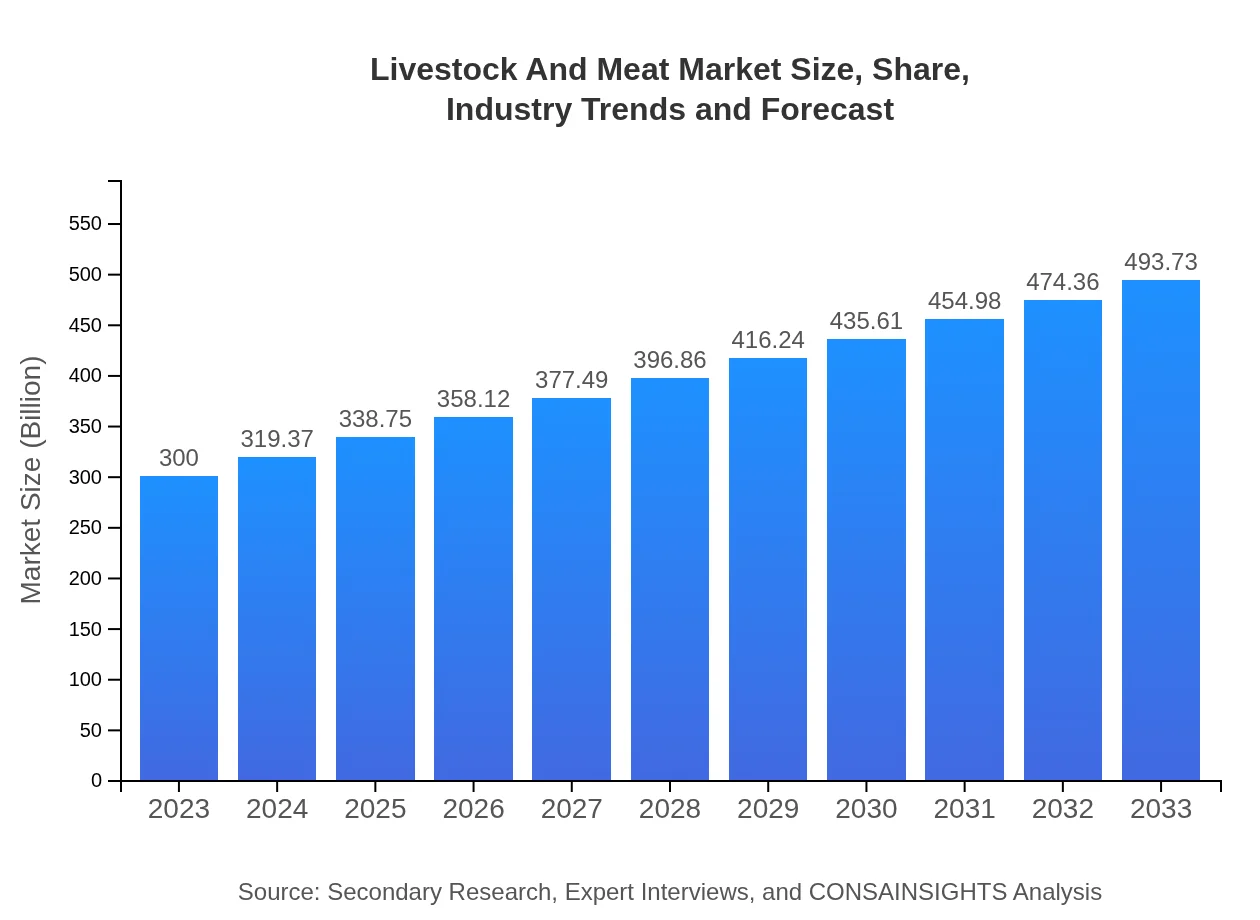

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $300.00 Billion |

| CAGR (2023-2033) | 5% |

| 2033 Market Size | $493.73 Billion |

| Top Companies | JBS S.A., Tyson Foods, Inc., Cargill, Inc., BRF S.A. |

| Last Modified Date | 02 February 2026 |

Livestock And Meat Market Overview

Customize Livestock And Meat Market Report market research report

- ✔ Get in-depth analysis of Livestock And Meat market size, growth, and forecasts.

- ✔ Understand Livestock And Meat's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Livestock And Meat

What is the Market Size & CAGR of Livestock And Meat market in 2023?

Livestock And Meat Industry Analysis

Livestock And Meat Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Livestock And Meat Market Analysis Report by Region

Europe Livestock And Meat Market Report:

In Europe, the market is valued at $88.65 billion in 2023 and is projected to expand to $145.90 billion by 2033. The region emphasizes animal welfare and sustainable farming practices, impacting production methods. The demand for organic and high-quality meat products is on the rise.Asia Pacific Livestock And Meat Market Report:

In 2023, the Asia Pacific region's livestock and meat market is valued at approximately $63.93 billion, with estimates growing to $105.21 billion by 2033. The region is characterized by high demand for poultry and pork, influenced by rapidly growing populations and rising middle-class income. Key players are focusing on improving production efficiency through technological innovations and sustainable practices.North America Livestock And Meat Market Report:

North America showcases a robust market valued at $102.09 billion in 2023, expected to grow to $168.02 billion by 2033. The U.S. and Canada dominate this market, driven by a strong consumer preference for meat and advanced farming methods. Increasing transparency regarding sourcing and sustainability practices are significant trends shaping the industry.South America Livestock And Meat Market Report:

The South American market is valued at $25.74 billion in 2023 and is projected to reach $42.36 billion by 2033. The region is one of the largest beef exporters globally, with Brazil and Argentina leading production. Challenges include environmental concerns and trade regulations that might impact growth. However, there’s significant potential for organic and sustainable meat products.Middle East & Africa Livestock And Meat Market Report:

The Middle East and Africa market is valued at $19.59 billion in 2023, predicted to reach $32.24 billion by 2033. This region has a growing population and increasing demand for meat products, especially lamb and goat. Import dependence remains high, but local production initiatives are gaining traction.Tell us your focus area and get a customized research report.

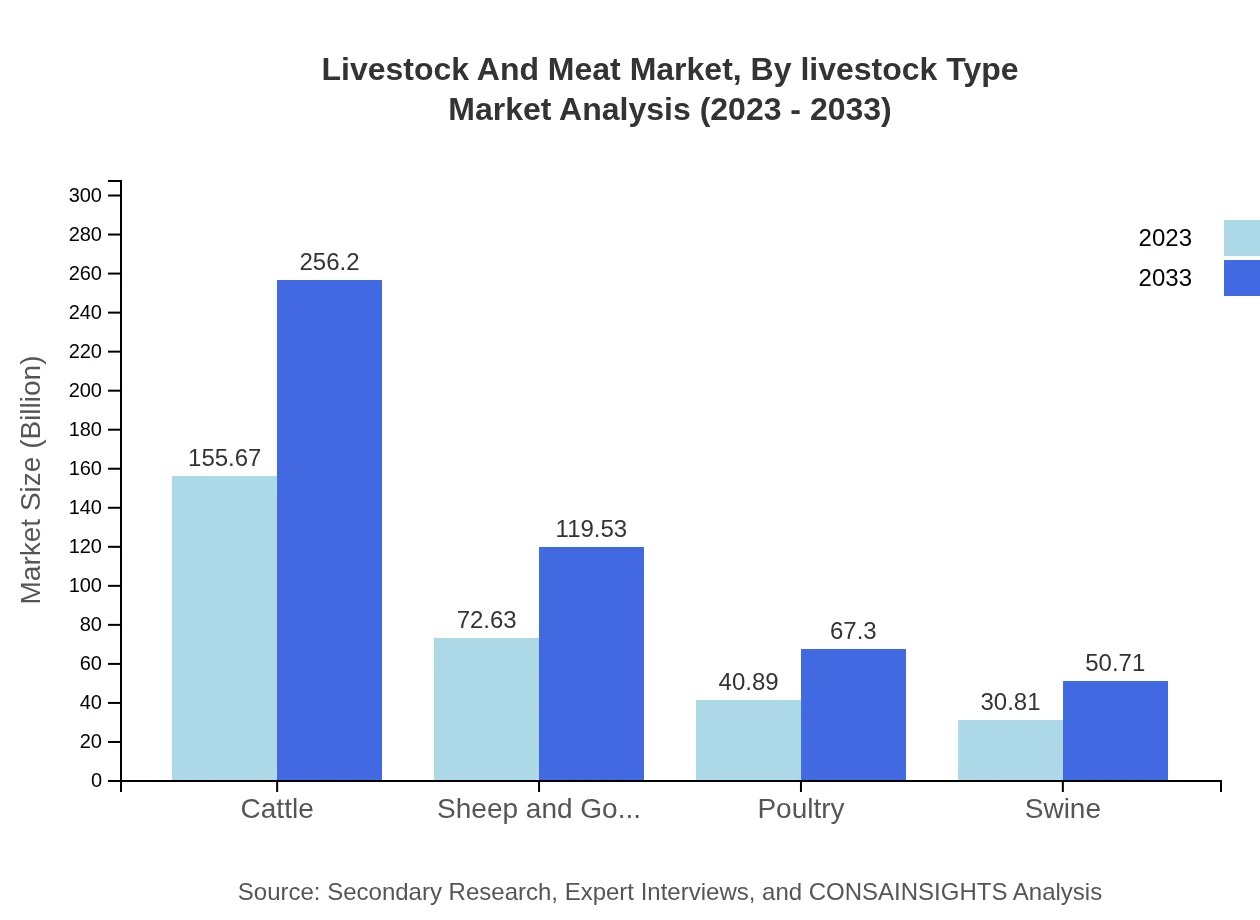

Livestock And Meat Market Analysis By Livestock Type

Cattle dominate the livestock segment, holding a market size of $155.67 billion in 2023 and projected to grow to $256.20 billion by 2033, accounting for approximately 51.89% market share. Poultry, valued at $40.89 billion, is also experiencing growth driven by health trends towards lean protein, growing from $67.30 billion in 2033. Meanwhile, sheep and goats contribute significantly, valued at $72.63 billion in 2023, expected to reach $119.53 billion.

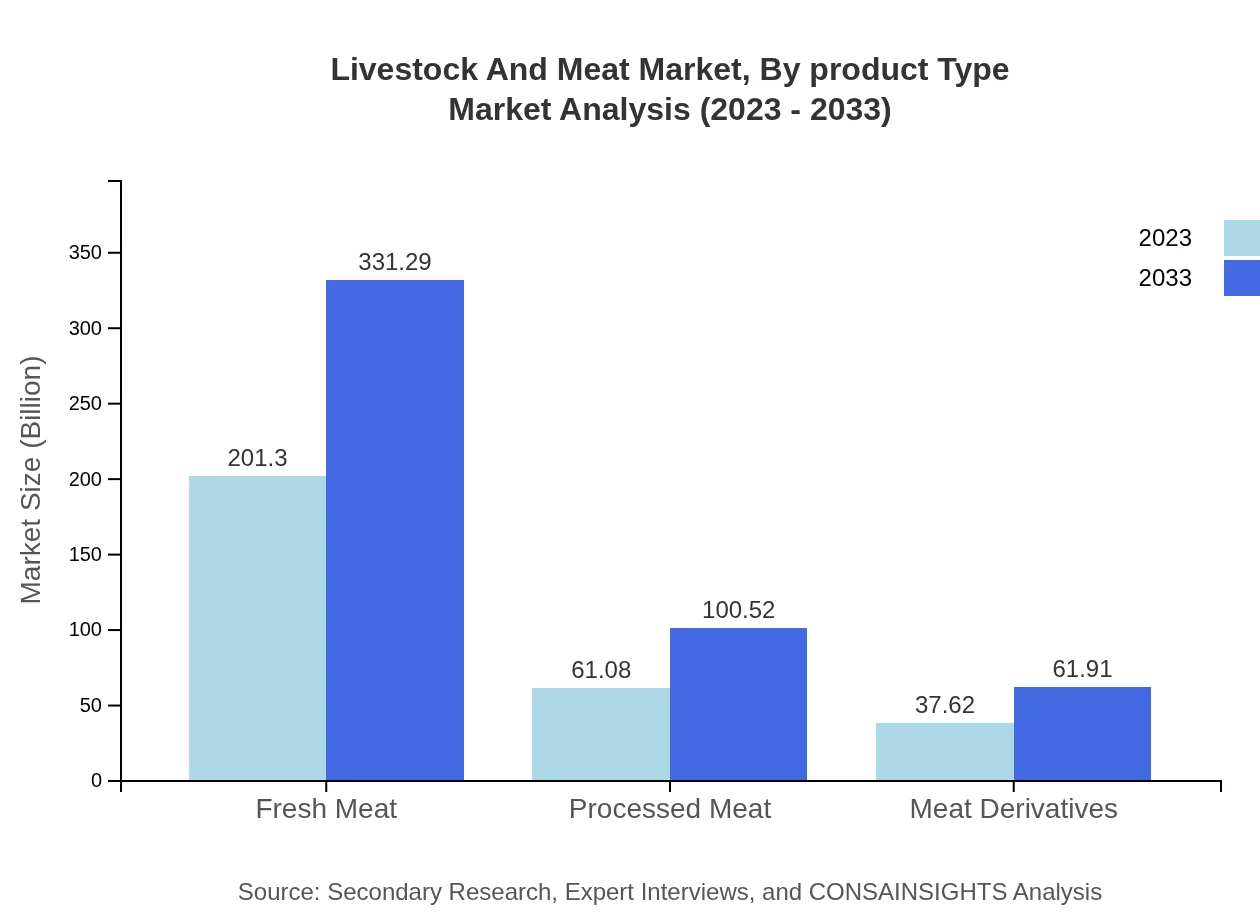

Livestock And Meat Market Analysis By Product Type

Fresh meat leads the product segment with a sizable market of $201.30 billion in 2023, projected to grow to $331.29 billion by 2033, resulting in a share of 67.1%. Processed meat shows considerable growth, starting at $61.08 billion with an expectation of $100.52 billion by 2033. Meat derivatives, meanwhile, reflect a growth pattern from $37.62 billion to $61.91 billion, with steady consumer demand.

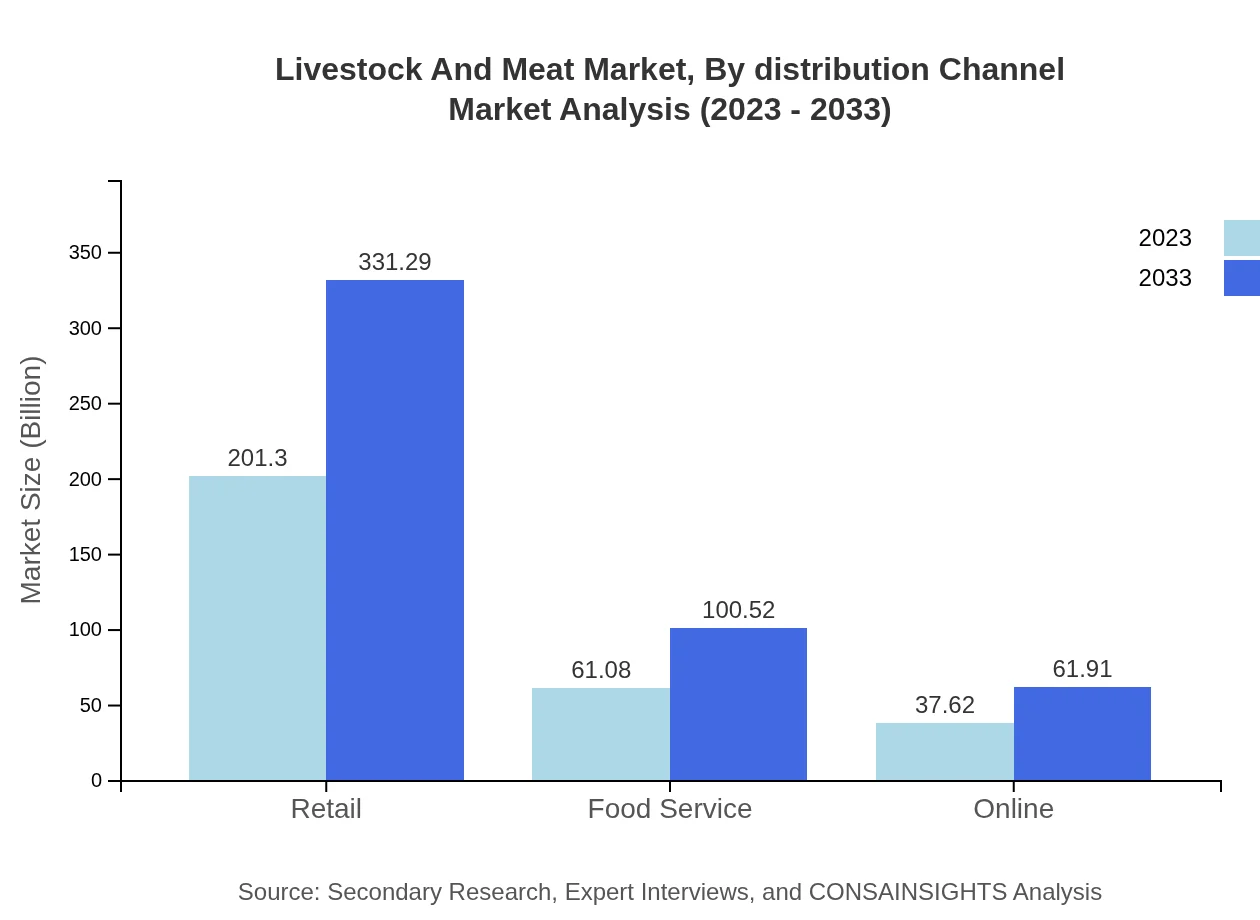

Livestock And Meat Market Analysis By Distribution Channel

The retail channel represents the largest market challenger with a valuation of $201.30 billion in 2023, predicted to grow to $331.29 billion by 2033, maintaining a 67.1% share. The food service industry is also significant, with market values expanding from $61.08 billion to $100.52 billion. Notably, online meat purchasing is gaining popularity, expected to grow from $37.62 billion to $61.91 billion, reflecting changing consumer preferences.

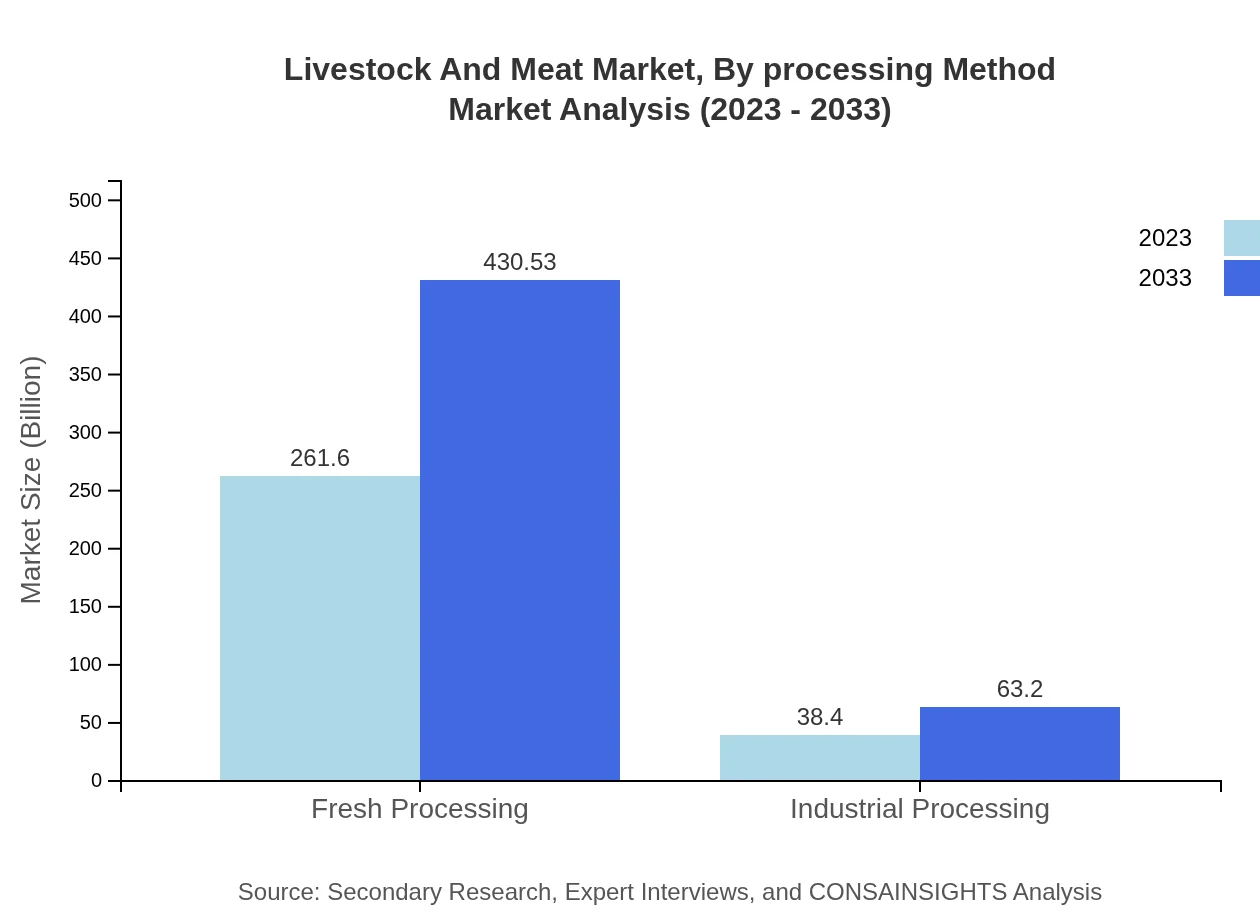

Livestock And Meat Market Analysis By Processing Method

The fresh processing method holds a dominant share in the market with initial values of $261.60 billion, growing to $430.53 billion, claiming 87.2% market share. Industrial processing also plays a role with projected growth from $38.40 billion to $63.20 billion, accounting for 12.8%. The split between fresh and processed methods signifies varied consumer demands across regions.

Livestock And Meat Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Livestock And Meat Industry

JBS S.A.:

A Brazilian company, JBS is one of the largest meat producers globally, involved principally in beef, chicken, and pork processing, with a commitment to sustainability and innovation in production practices.Tyson Foods, Inc.:

Based in the USA, Tyson is a leading meat and poultry producer, recognized for its extensive product range and commitment to food safety and quality.Cargill, Inc.:

An American multinational company, Cargill operates in various areas of agriculture, including meat processing. The company emphasizes innovation and sustainability in supply chain management.BRF S.A.:

Another key player from Brazil, BRF is a global leader in the production of chicken and processed foods, operating internationally with a focus on high-quality products.We're grateful to work with incredible clients.

FAQs

What is the market size of livestock And Meat?

The livestock and meat market is valued at approximately $300 billion in 2023, with a projected CAGR of 5% from 2023 to 2033. This growth indicates a healthy expansion in both demand and supply of livestock products.

What are the key market players or companies in the livestock And Meat industry?

Key players in the livestock and meat industry include multinational corporations involved in processing and distribution. Companies such as Tyson Foods, JBS S.A., and Tyson Fresh Meats dominate the market, each contributing significantly to production and innovation.

What are the primary factors driving the growth in the livestock And Meat industry?

Growth in the livestock and meat industry is primarily driven by increasing global population demands, rising disposable incomes, and a growing preference for protein-rich diets. Additionally, advancements in farming technology and practices contribute to enhanced efficiency and production capacity.

Which region is the fastest Growing in the livestock And Meat market?

The Asia Pacific region is the fastest-growing in the livestock and meat market. It is projected to grow from $63.93 billion in 2023 to $105.21 billion by 2033, fueled by rising population and changing dietary preferences.

Does ConsaInsights provide customized market report data for the livestock And Meat industry?

Yes, ConsaInsights provides customized market report data tailored to the specific needs of clients in the livestock and meat industry. These reports include in-depth analysis, regional evaluations, and segment insights, which cater to individual requirements.

What deliverables can I expect from this livestock And Meat market research project?

Deliverables from the livestock and meat market research project include comprehensive reports outlining market size, CAGR, key segments, competitive analysis, and regional breakdowns to inform strategic decision-making.

What are the market trends of livestock And Meat?

Current trends in the livestock and meat market show a shift towards sustainable and organic practices, increasing demand for plant-based alternatives, and the integration of technology in farming. These trends reflect consumer preferences leaning towards health and sustainability.