Livestock Enzymes Market Report

Published Date: 02 February 2026 | Report Code: livestock-enzymes

Livestock Enzymes Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the livestock enzymes market, covering key trends, segmentation, regional insights, and future forecasts from 2023 to 2033, aimed at understanding the market dynamics and growth opportunities.

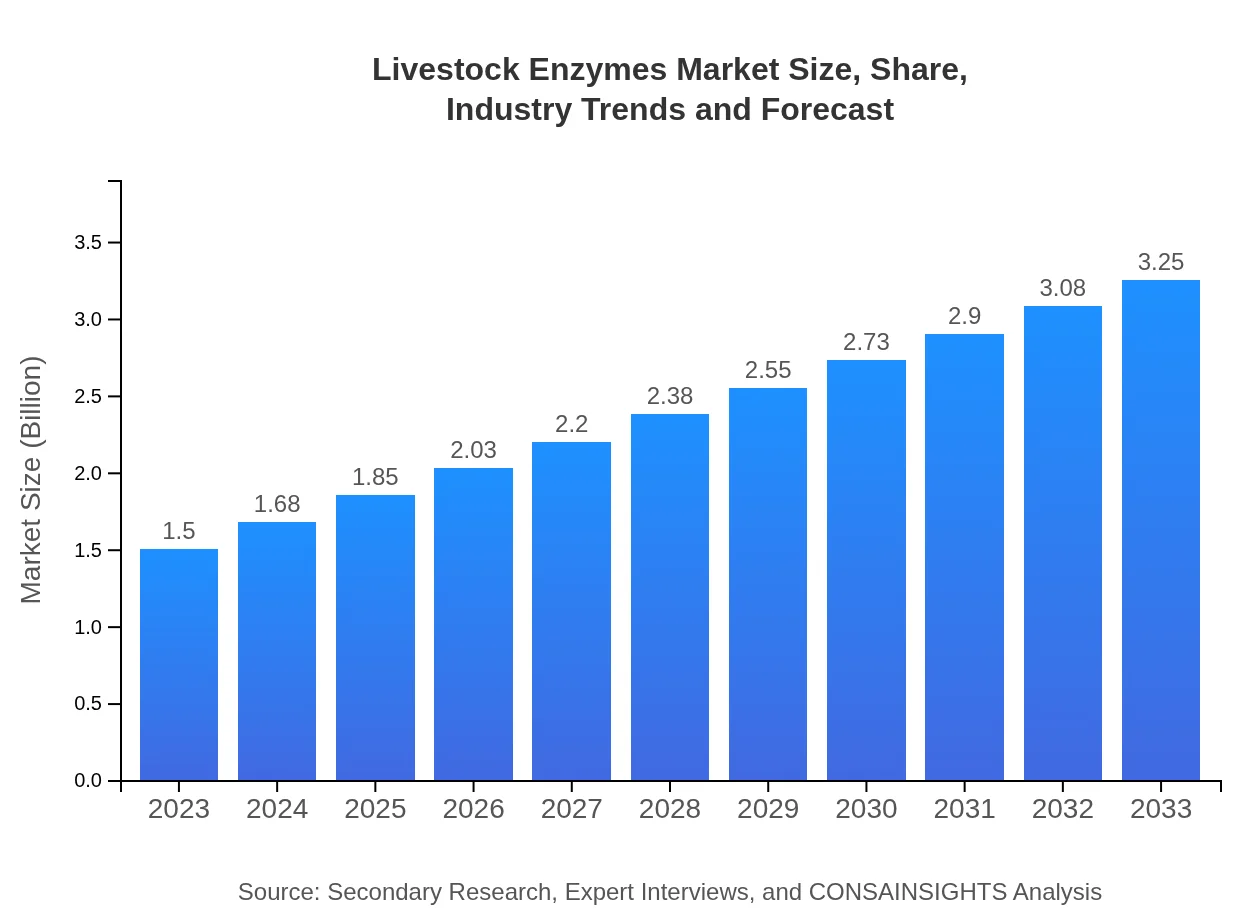

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $1.50 Billion |

| CAGR (2023-2033) | 7.8% |

| 2033 Market Size | $3.25 Billion |

| Top Companies | Novozymes, DuPont, BASF, Adisseo, Alltech |

| Last Modified Date | 02 February 2026 |

Livestock Enzymes Market Overview

Customize Livestock Enzymes Market Report market research report

- ✔ Get in-depth analysis of Livestock Enzymes market size, growth, and forecasts.

- ✔ Understand Livestock Enzymes's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Livestock Enzymes

What is the Market Size & CAGR of Livestock Enzymes market in 2023?

Livestock Enzymes Industry Analysis

Livestock Enzymes Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Livestock Enzymes Market Analysis Report by Region

Europe Livestock Enzymes Market Report:

Europe's livestock enzymes market is set to grow from USD 0.46 billion in 2023, reaching USD 0.99 billion by 2033. The increasing regulation around animal welfare and the push for sustainable farming practices drive up the demand for digestion and efficiency improving products.Asia Pacific Livestock Enzymes Market Report:

In Asia Pacific, the livestock enzymes market is projected to grow from USD 0.27 billion in 2023 to USD 0.58 billion in 2033, driven by increasing livestock populations and demand for higher quality animal feed. Countries like China and India are significant contributors to this growth with their expanding agricultural sectors and investments in livestock efficiency.North America Livestock Enzymes Market Report:

North America accounts for a significant share of the livestock enzymes market, growing from USD 0.56 billion in 2023 to USD 1.21 billion in 2033. This can be attributed to advanced farming techniques, high meat consumption rates, and strong research and development for enzyme technology.South America Livestock Enzymes Market Report:

South America’s market size is anticipated to expand from USD 0.11 billion in 2023 to USD 0.23 billion by 2033. The region's strong agricultural base, particularly in Brazil and Argentina, alongside the rising demand for meat products, creates a favorable environment for livestock enzymes.Middle East & Africa Livestock Enzymes Market Report:

In the Middle East and Africa, the market is expected to rise from USD 0.11 billion in 2023 to USD 0.24 billion in 2033, with investment in livestock production increasing and demand for protein rising amid economic development efforts.Tell us your focus area and get a customized research report.

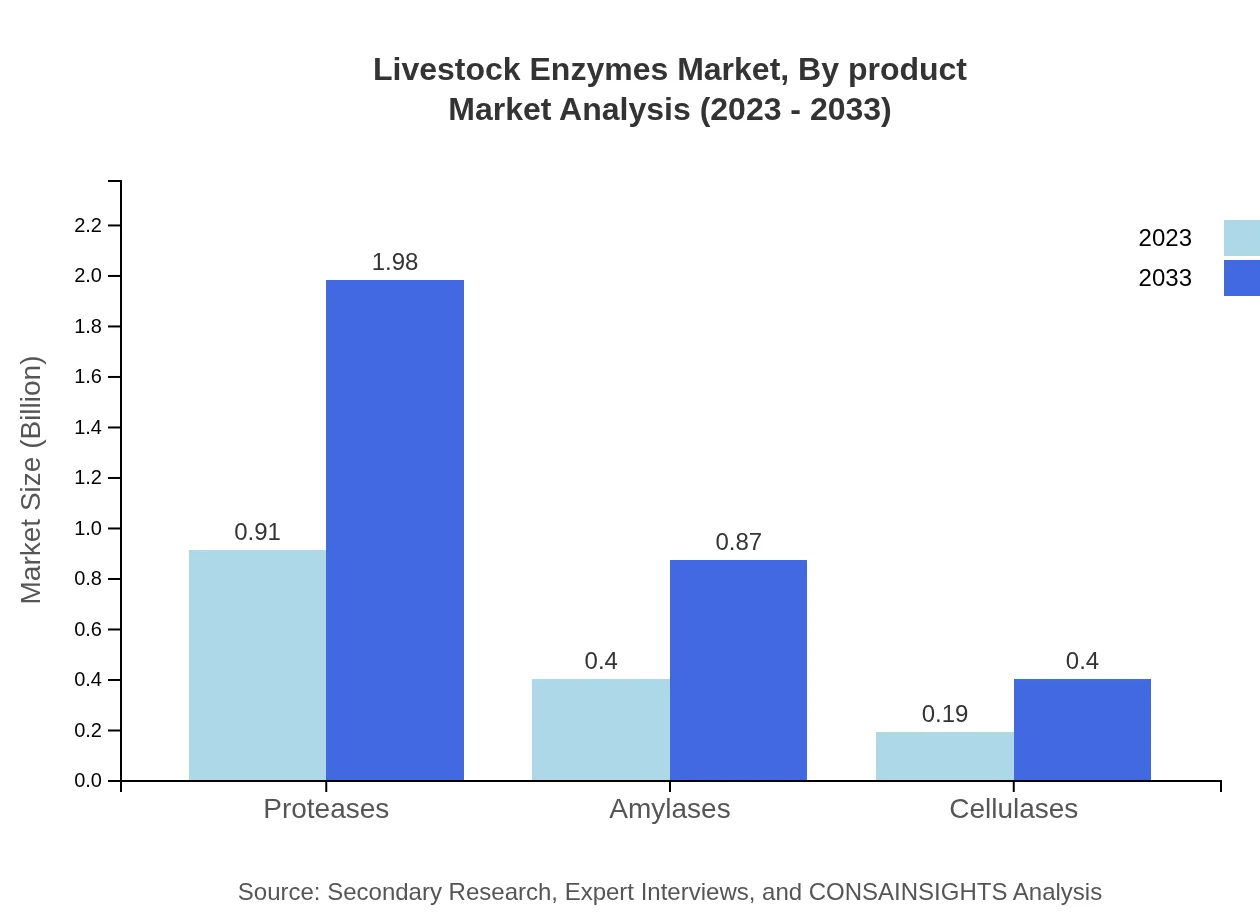

Livestock Enzymes Market Analysis By Product

The livestock enzymes market is dominated by proteases, accounting for a substantial share of the market. Proteases are anticipated to grow significantly due to their critical role in protein digestion, which is vital for livestock health. Amylases follow, benefiting from increased starch digestibility in feed. Cellulases, while smaller in market share, are also crucial as they aid in the digestion of fibrous plant materials, enhancing overall feed efficiency.

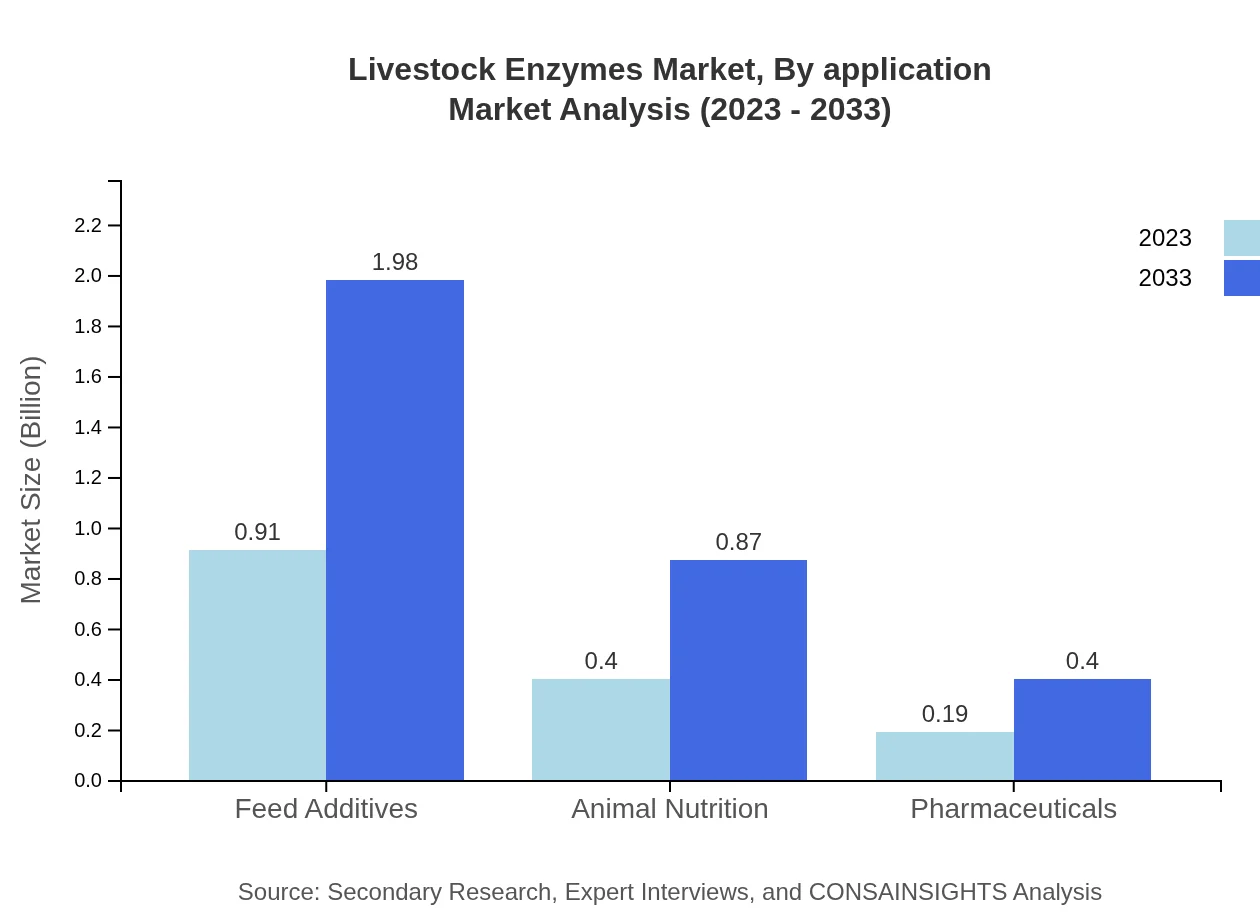

Livestock Enzymes Market Analysis By Application

Feed additives remain the leading application segment, as enzymes are incorporated into feed formulations to enhance nutritional uptake. Animal nutrition applications are also rising as farmers seek to optimize dietary efficiency. The shift towards nutritional supplements focusing on gut health is driving growth in this segment, with significant innovations in enzyme formulations improving animal performance.

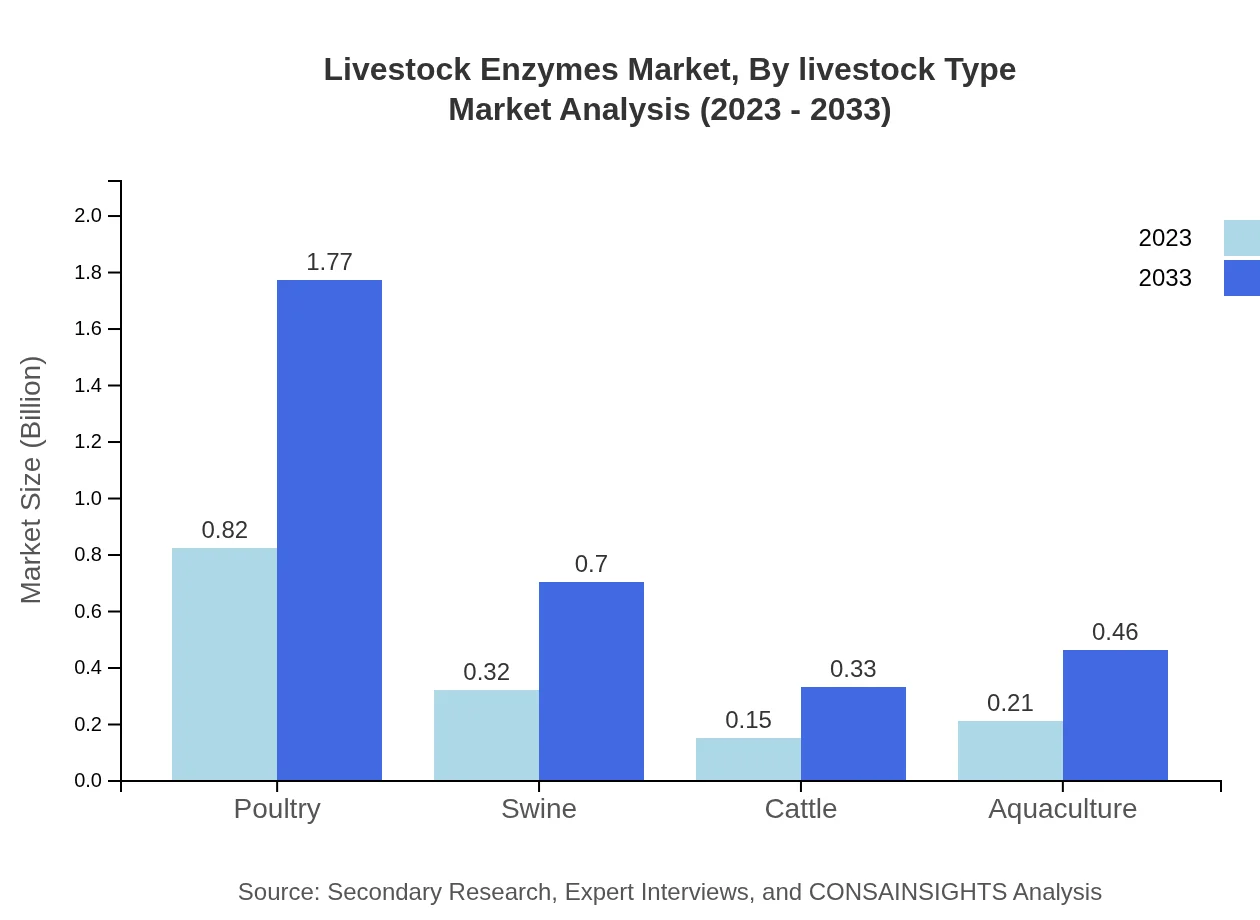

Livestock Enzymes Market Analysis By Livestock Type

Poultry is the largest segment within the livestock category, reflecting the high demand for poultry products globally. Swine and cattle also represent significant portions of the market, driven by dietary protein requirements and the need for improved feed conversion ratios. Aquaculture is the fastest-growing segment, spurred by increasing seafood consumption and the need for sustainable feed alternatives in fish farming.

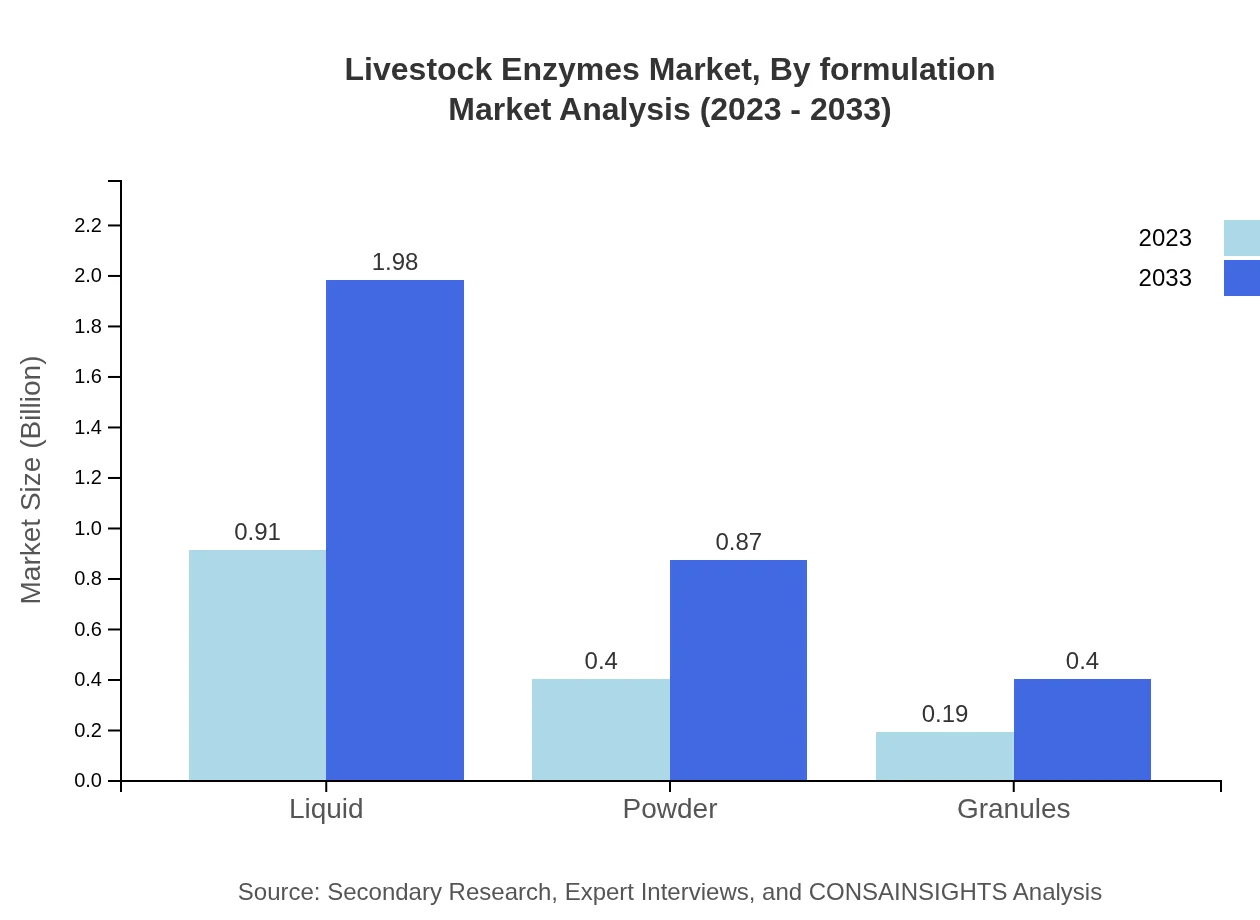

Livestock Enzymes Market Analysis By Formulation

Liquid formulations dominate the market, attributed to their ease of application and efficacy in feed mixing. Powder forms also hold a significant share, favored for their stability and concentrated enzyme content. Granules, though smaller in share, offer another viable formulation for specific application scenarios, aligning with diverse feed production processes.

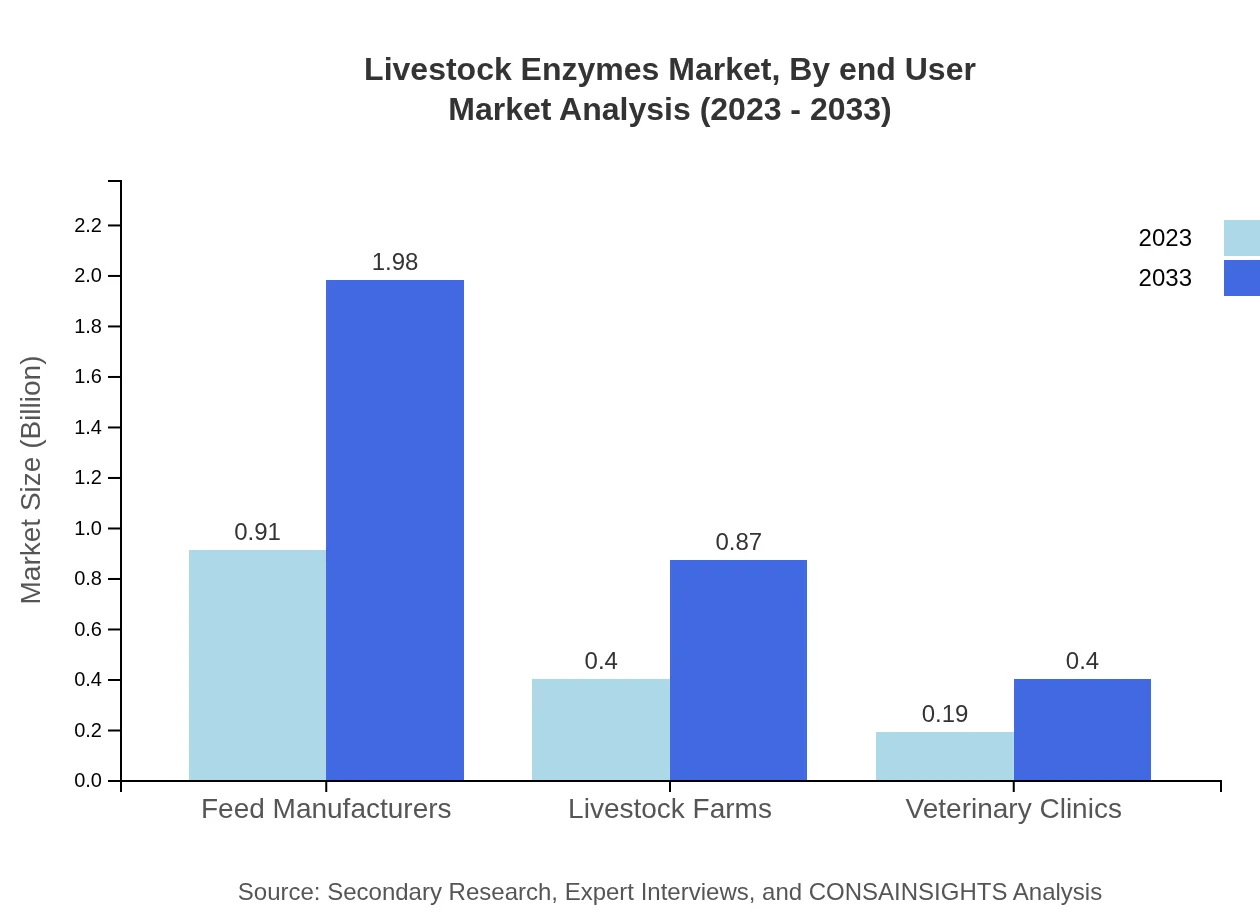

Livestock Enzymes Market Analysis By End User

Feed manufacturers are the principal end-users of livestock enzymes, utilizing them to enhance feed formulations and improve overall profitability. Livestock farms also represent a considerable market segment as they directly utilize enzymes to boost production efficiency. Veterinary clinics represent a niche but growing market as they integrate enzymes into health management strategies for livestock.

Livestock Enzymes Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Livestock Enzymes Industry

Novozymes:

A leading provider of enzyme solutions, Novozymes focuses on sustainability and innovation across livestock and agricultural applications, offering a broad range of enzymes to optimize feed and improve animal health.DuPont:

DuPont is renowned for its work in animal nutrition, providing enzyme products that enhance feed efficiency and animal health. Their research emphasizes the synergy between animal feed formulations and enzyme technologies.BASF:

BASF specializes in a range of specialty enzymes that support livestock health and productivity, focusing on innovative solutions that address the challenges within the agricultural sector.Adisseo:

Adisseo is a significant player in the livestock health sector, offering premium enzyme products that aid in feed conversion and enhance overall animal nutrition strategies.Alltech:

Alltech provides a variety of feed additives, including enzymes, committed to advancing animal health and productivity, utilizing cutting-edge technology to ensure effective solutions for livestock producers.We're grateful to work with incredible clients.

FAQs

What is the market size of livestock Enzymes?

The livestock enzymes market size is approximately $1.5 billion in 2023, with a projected CAGR of 7.8% through 2033, indicating robust growth opportunities in the industry over the next decade.

What are the key market players or companies in the livestock Enzymes industry?

Key players in the livestock enzymes market include industry leaders and innovative companies focusing on enzyme development to enhance animal feed efficiency, though specific company names are not disclosed in this summary.

What are the primary factors driving the growth in the livestock Enzymes industry?

Growth in the livestock enzymes market is driven by increasing demand for high-quality animal protein, rising awareness of animal nutrition, and the need for sustainable agricultural practices.

Which region is the fastest Growing in the livestock Enzymes?

The North America region is projected to witness the fastest growth in the livestock enzymes market, expanding from $0.56 billion in 2023 to $1.21 billion by 2033, driven by strong agricultural practices.

Does ConsaInsights provide customized market report data for the livestock Enzymes industry?

Yes, ConsaInsights offers customized market report data tailored to specific needs within the livestock enzymes industry, ensuring clients receive relevant and actionable information for strategic decision-making.

What deliverables can I expect from this livestock Enzymes market research project?

You can expect comprehensive market analysis reports, segment breakdowns, growth forecasts, and insights into competitive landscapes as key deliverables from the livestock-enzymes market research project.

What are the market trends of livestock Enzymes?

Current trends in the livestock enzymes market include increasing adoption of enzyme-based feed additives, rising investment in research and development, and a shift towards organic and natural products in livestock production.