Loan Origination Software Market Report

Published Date: 31 January 2026 | Report Code: loan-origination-software

Loan Origination Software Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Loan Origination Software market from 2023 to 2033, detailing market trends, size forecasts, segments, and regional insights for stakeholders and decision-makers.

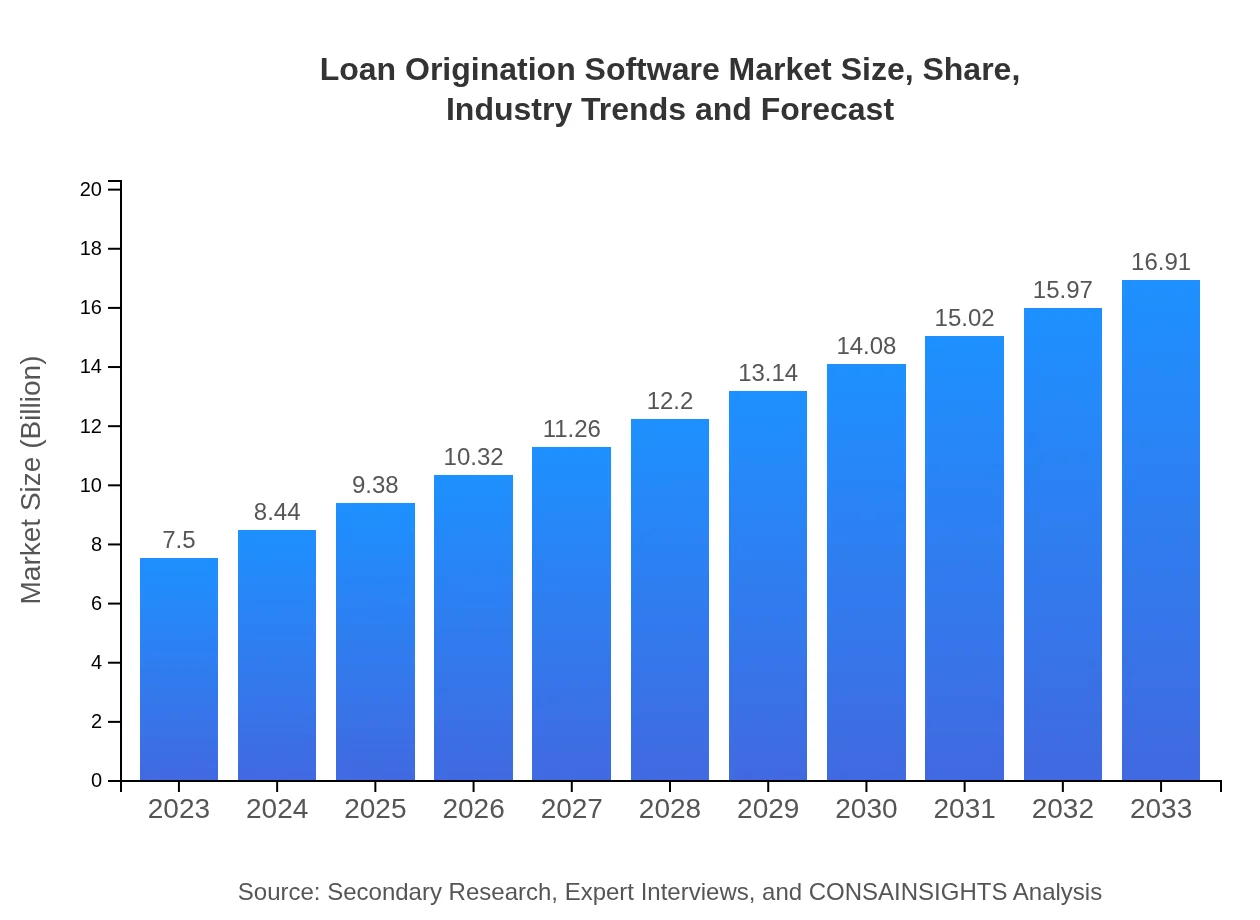

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $7.50 Billion |

| CAGR (2023-2033) | 8.2% |

| 2033 Market Size | $16.91 Billion |

| Top Companies | FICO, NICE Ltd., Ellie Mae, NerdWallet |

| Last Modified Date | 31 January 2026 |

Loan Origination Software Market Overview

Customize Loan Origination Software Market Report market research report

- ✔ Get in-depth analysis of Loan Origination Software market size, growth, and forecasts.

- ✔ Understand Loan Origination Software's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Loan Origination Software

What is the Market Size & CAGR of Loan Origination Software market in 2023?

Loan Origination Software Industry Analysis

Loan Origination Software Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Loan Origination Software Market Analysis Report by Region

Europe Loan Origination Software Market Report:

Europe presents significant potential, with the market size at $2.18 billion in 2023, forecasted to grow to $4.92 billion by 2033. Factors such as regulatory changes and increasing consumer expectations are influencing the market's expansion.Asia Pacific Loan Origination Software Market Report:

In the Asia Pacific region, the Loan Origination Software market is valued at $1.47 billion in 2023 and is projected to reach $3.32 billion by 2033. The growth is driven by increasing digitization and the rise of fintech companies, contributing to competitive loan offerings and improving customer service.North America Loan Origination Software Market Report:

North America leads with the Loan Origination Software market valued at $2.60 billion in 2023, with projections to reach $5.85 billion by 2033. The region’s growth is fueled by robust banking frameworks and a strong emphasis on digital transformation.South America Loan Origination Software Market Report:

The South American market is noted for its emerging demand, starting at $0.26 billion in 2023 and expected to grow to $0.58 billion by 2033. Key factors include evolving banking infrastructure and a shift towards digital solutions in traditional lending practices.Middle East & Africa Loan Origination Software Market Report:

The Middle East and Africa market is anticipated to increase from $0.99 billion in 2023 to $2.23 billion by 2033, driven by rising investment in technology and financial services seeking greater operational efficiency.Tell us your focus area and get a customized research report.

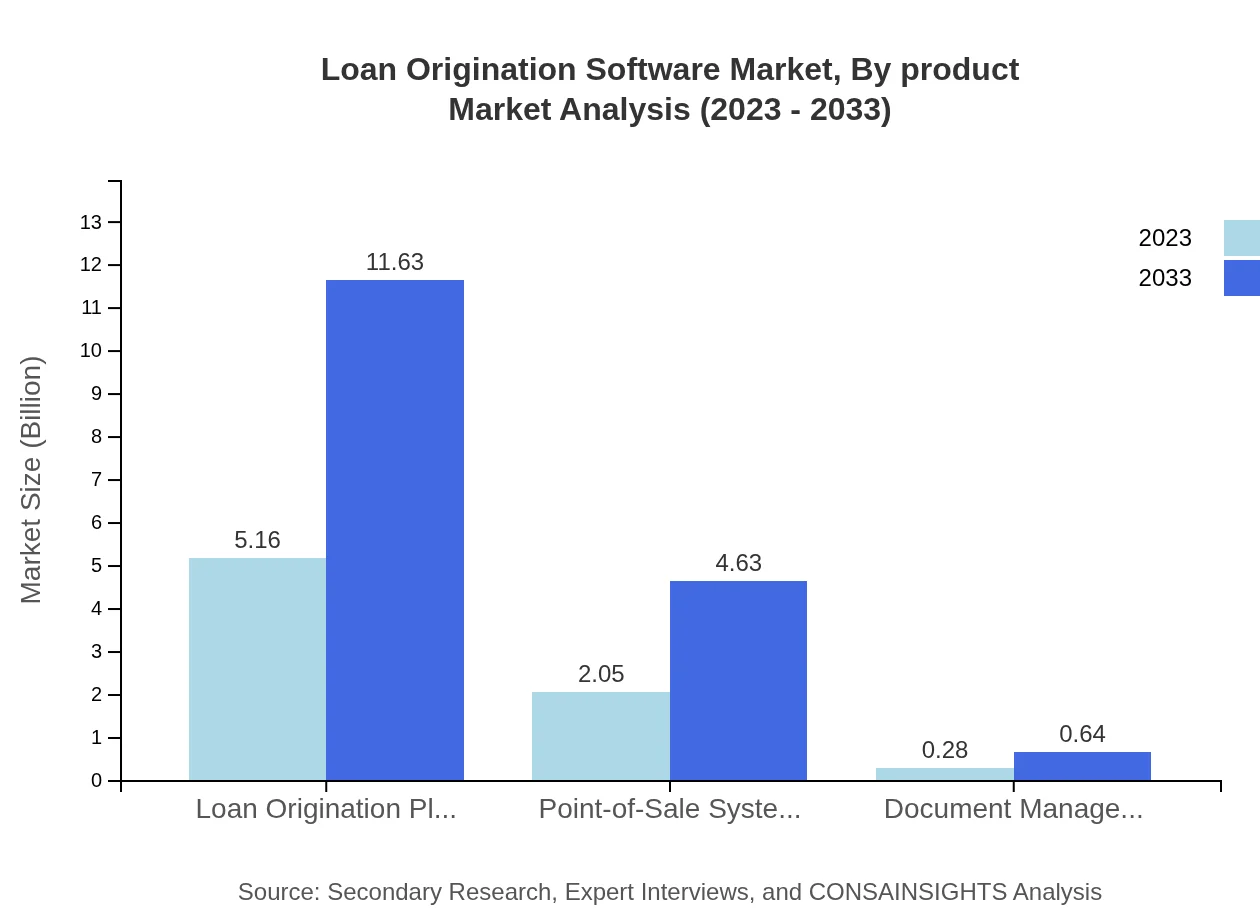

Loan Origination Software Market Analysis By Product

The Loan Origination Platforms dominate the market, with a projected size of $5.16 billion in 2023, expanding to $11.63 billion by 2033. Point-of-Sale Systems follow at $2.05 billion, increasing to $4.63 billion within the same period, demonstrating their critical role in customer interaction and loan processing.

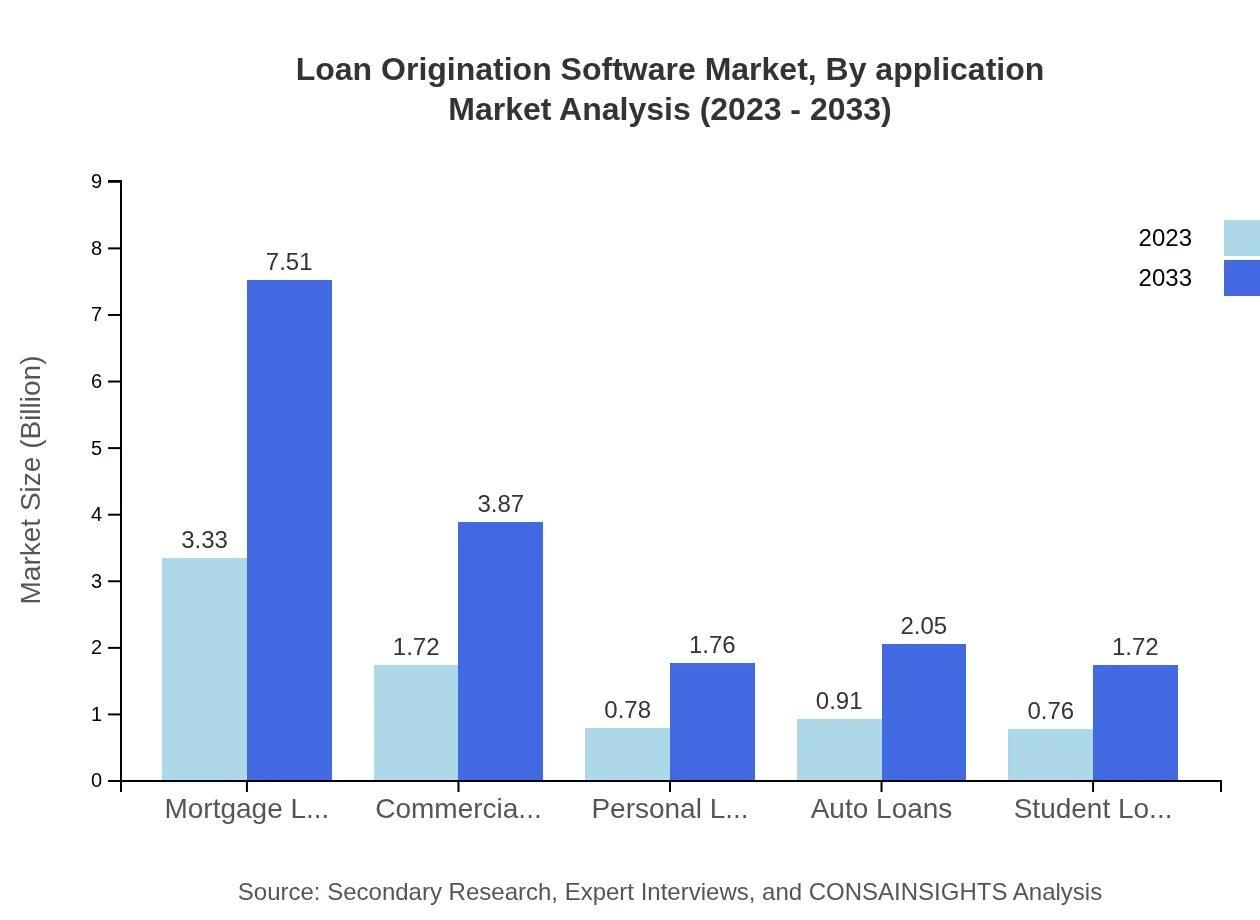

Loan Origination Software Market Analysis By Application

In terms of application, Mortgage Lending constitutes the largest segment with $3.33 billion in 2023 and expected to rise to $7.51 billion by 2033. Commercial Lending and Personal Loans also show significant growth trajectories, representing 22.88% and 10.4% market share respectively.

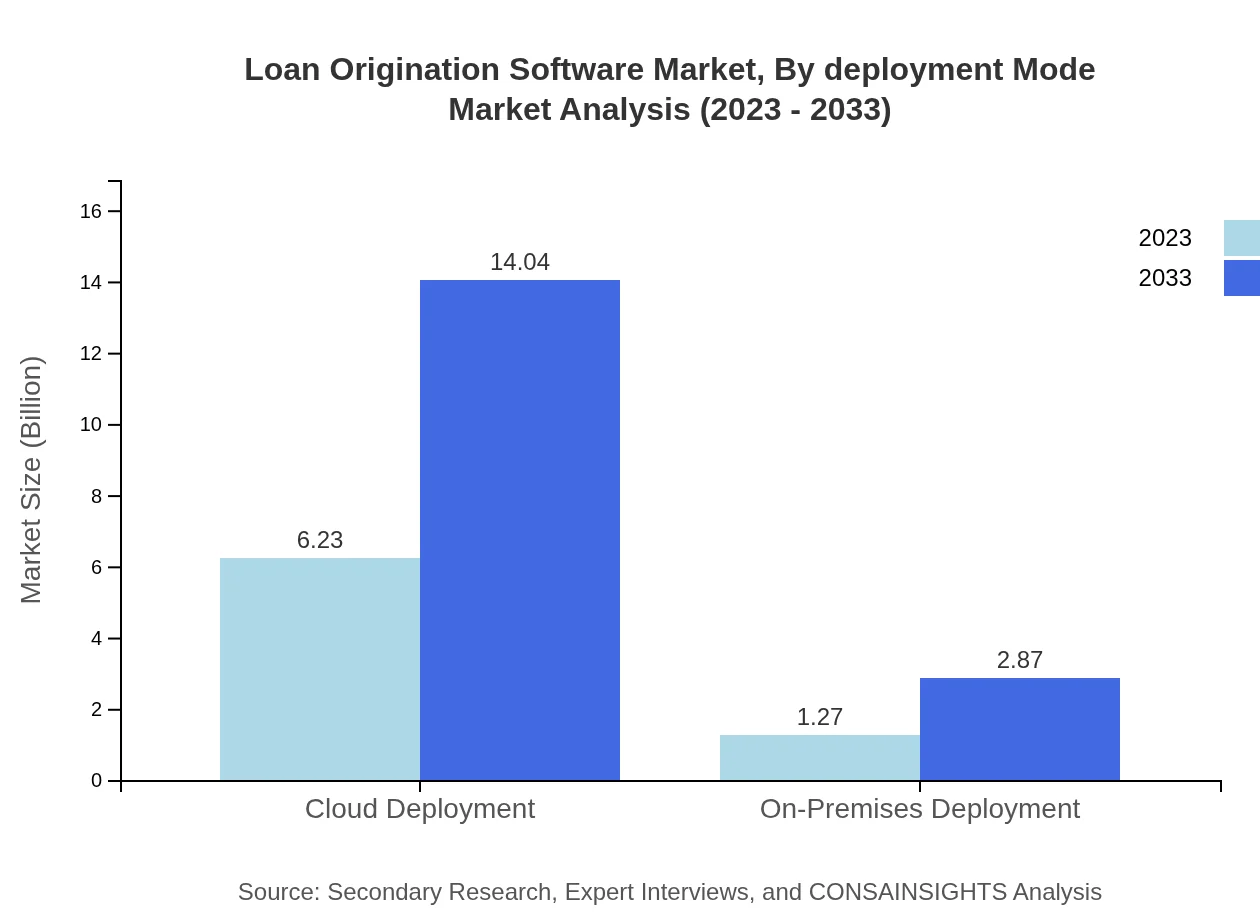

Loan Origination Software Market Analysis By Deployment Mode

Cloud Deployment takes the lead with a substantial market size of $6.23 billion in 2023, forecasted to grow to $14.04 billion by 2033, driven by demand for scalable, cost-effective solutions. On-Premises Deployment, while smaller, is still relevant with projections of $1.27 billion in 2023 growing to $2.87 billion.

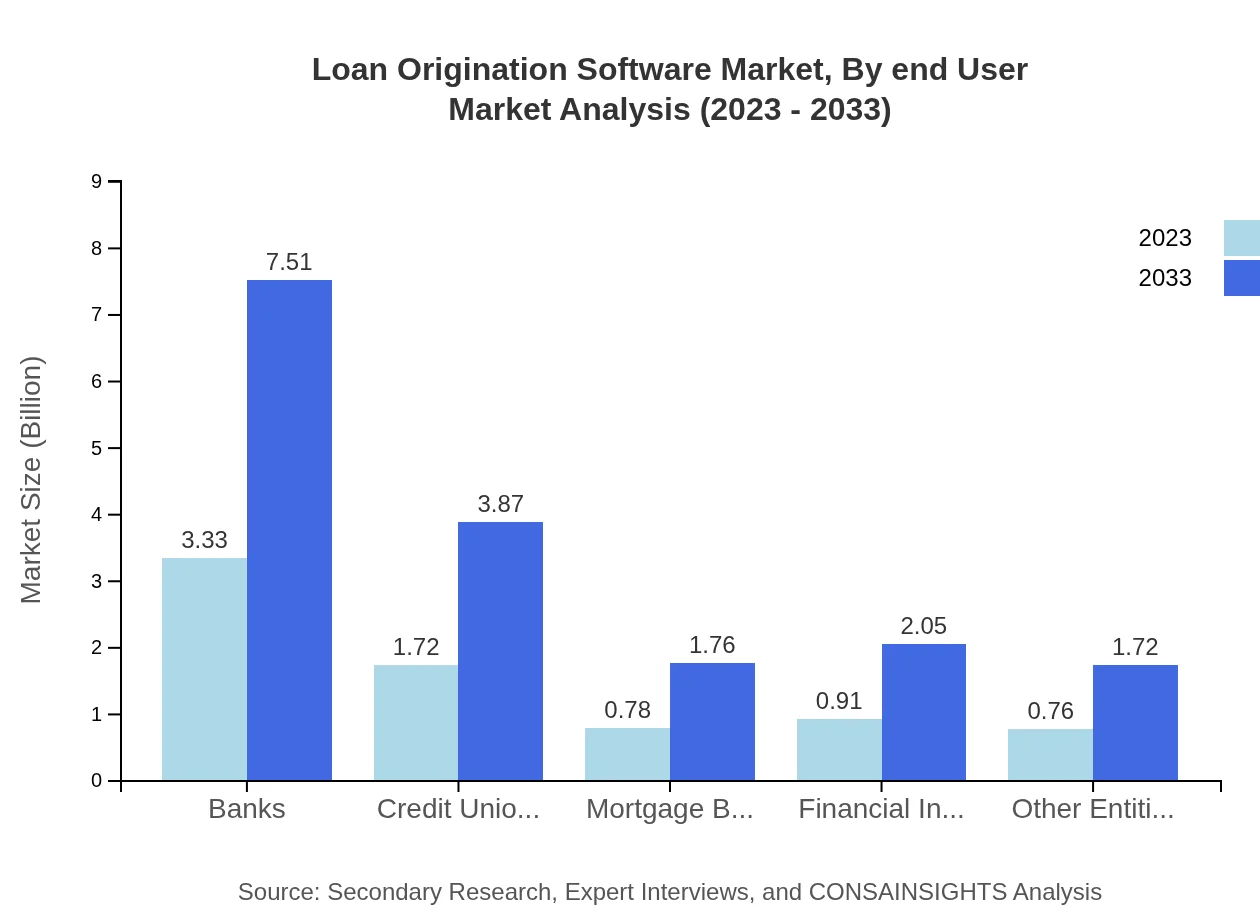

Loan Origination Software Market Analysis By End User

Banks represent the largest end-user segment, valued at $3.33 billion in 2023 and expected to reach $7.51 billion by 2033, signifying the importance of streamlined loan processing in traditional banking sectors. Credit Unions and Mortgage Brokers also maintain substantial shares, comprising 22.88% and 10.4% respectively.

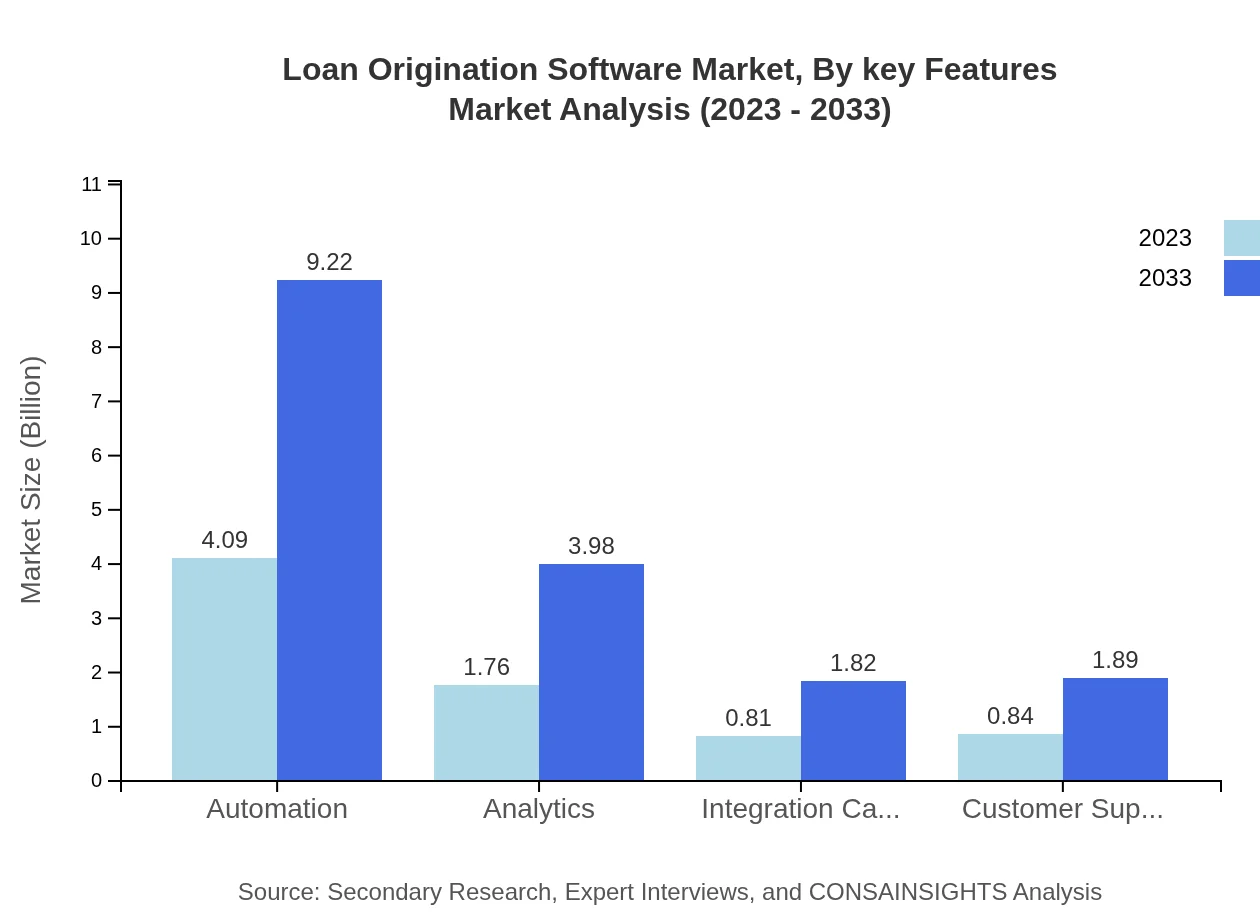

Loan Origination Software Market Analysis By Key Features

Automation features dominate with a market share of $4.09 billion in 2023, enhancing efficiency and reducing turnaround times. Analytics and Customer Support functionalities add further value, providing institutions with crucial insights and maintaining customer satisfaction.

Loan Origination Software Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Loan Origination Software Industry

FICO:

A leader in analytics and decision management, FICO offers a suite of solutions that enhance risk assessment and loan management processes.NICE Ltd.:

NICE provides cloud-based solutions that facilitate efficient loan processing and customer engagement, particularly within financial services.Ellie Mae:

Ellie Mae specializes in cloud-based loan origination software specifically for the mortgage industry, enabling lenders to automate the process from application to closing.NerdWallet:

NerdWallet functions as a financial advisor and marketplace, integrating loan origination solutions to help consumers find the best financial products.We're grateful to work with incredible clients.

FAQs

What is the market size of loan Origination Software?

The Loan Origination Software market is valued at approximately $7.5 billion in 2023, with an expected CAGR of 8.2% over the next decade, indicating significant growth potential in the industry.

What are the key market players or companies in this loan Origination Software industry?

Key players in the Loan Origination Software sector include top lenders and fintech firms globally. They focus on innovation, scalability, and enhanced client services to capture emerging market opportunities.

What are the primary factors driving the growth in the loan Origination Software industry?

Drivers for growth include increased automation in loan processing, rising demand for quick loan approvals, and an expanding range of products, alongside the shift towards digital banking solutions.

Which region is the fastest Growing in the loan Origination Software?

North America is currently the fastest-growing region, projected to reach a market size of $5.85 billion by 2033. Europe and Asia-Pacific also show strong growth trajectories, contributing significantly to global revenues.

Does ConsaInsights provide customized market report data for the loan Origination Software industry?

Yes, ConsaInsights offers tailored market report data for the Loan Origination Software industry, catering to specific business needs and insights for various market segments.

What deliverables can I expect from this loan Origination Software market research project?

Deliverables from the project typically include comprehensive reports, data analyses, market forecasts, competitive landscape assessments, and recommendations tailored to your business needs.

What are the market trends of loan Origination Software?

Trends include greater integration of AI and machine learning, a shift towards cloud deployments, and increasing demand for mobile-friendly solutions, reflecting the changing needs of consumers in financial technology.