Locationbased Services Lbs And Realtime Location Systems Rtls Market Report

Published Date: 31 January 2026 | Report Code: locationbased-services-lbs-and-realtime-location-systems-rtls

Locationbased Services Lbs And Realtime Location Systems Rtls Market Size, Share, Industry Trends and Forecast to 2033

This report explores the Location-based Services (LBS) and Real-Time Location Systems (RTLS) market, providing detailed insights, market size, growth forecasts (2023-2033), and analysis of key trends, technologies, and competitive landscape.

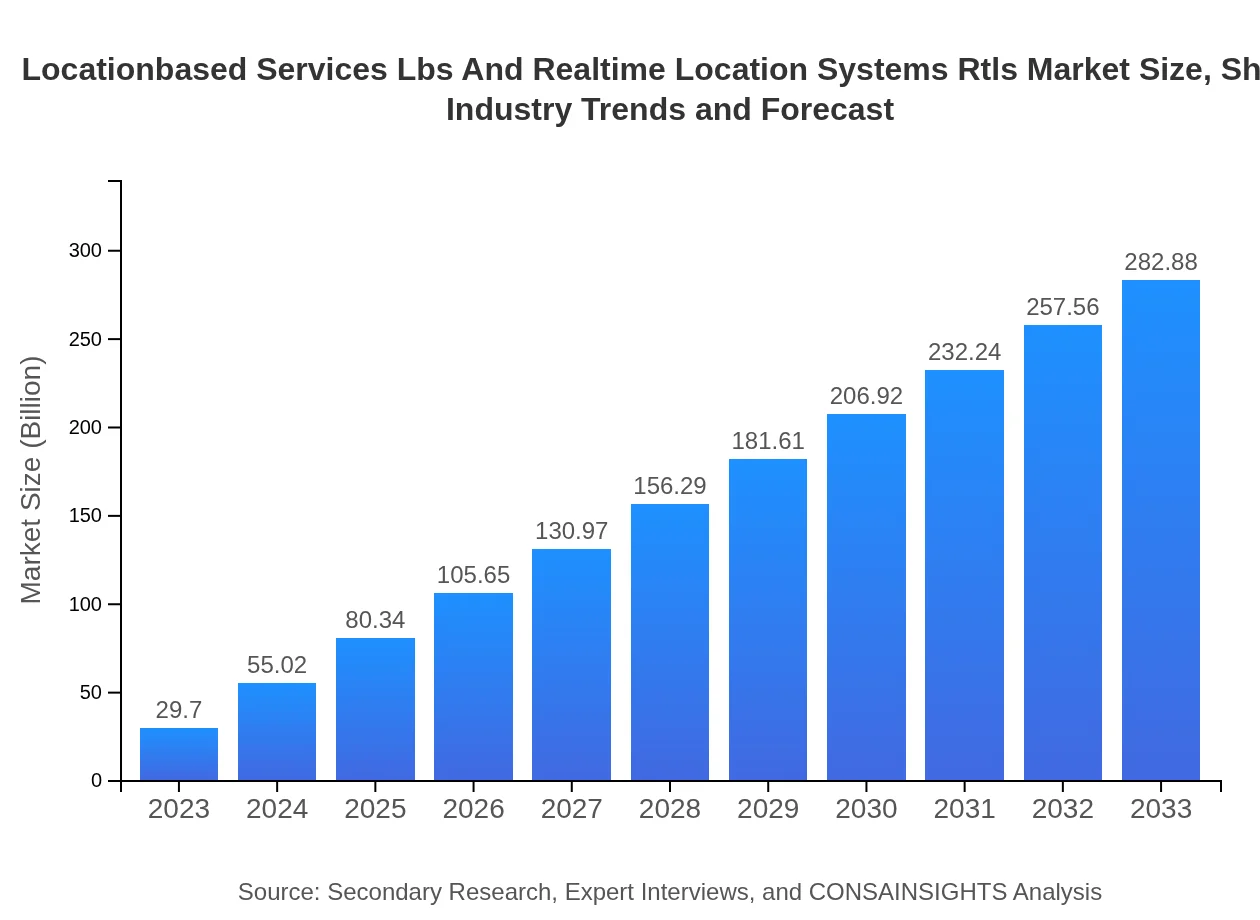

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $29.70 Billion |

| CAGR (2023-2033) | 23.7% |

| 2033 Market Size | $282.88 Billion |

| Top Companies | Zebra Technologies, Trimble Inc., Cisco Systems, Osram Licht AG, Baidu Inc. |

| Last Modified Date | 31 January 2026 |

Locationbased Services Lbs And Realtime Location Systems Rtls Market Overview

Customize Locationbased Services Lbs And Realtime Location Systems Rtls Market Report market research report

- ✔ Get in-depth analysis of Locationbased Services Lbs And Realtime Location Systems Rtls market size, growth, and forecasts.

- ✔ Understand Locationbased Services Lbs And Realtime Location Systems Rtls's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Locationbased Services Lbs And Realtime Location Systems Rtls

What is the Market Size & CAGR of Locationbased Services Lbs And Realtime Location Systems Rtls market in 2023?

Locationbased Services Lbs And Realtime Location Systems Rtls Industry Analysis

Locationbased Services Lbs And Realtime Location Systems Rtls Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Locationbased Services Lbs And Realtime Location Systems Rtls Market Analysis Report by Region

Europe Locationbased Services Lbs And Realtime Location Systems Rtls Market Report:

Europe's market was approximately $7.51 billion in 2023 and is projected to grow to $71.57 billion by 2033. The region is witnessing a strong emphasis on data privacy and effective location data management practices, which is boosting the adoption of location solutions that comply with regulations.Asia Pacific Locationbased Services Lbs And Realtime Location Systems Rtls Market Report:

In the Asia Pacific region, the market size for LBS and RTLS was approximately $5.68 billion in 2023, projected to grow to $54.09 billion by 2033. This growth is driven by rapid urbanization, increasing smartphone penetration, and burgeoning e-commerce activities. Countries like China and India are leading in implementing GPS and mobile technology to enhance logistical efficiency.North America Locationbased Services Lbs And Realtime Location Systems Rtls Market Report:

The North American market is a significant player, with a market size of $11.15 billion expected to rise drastically to $106.22 billion by 2033. Strong investments in urban infrastructure and advanced healthcare technology are key drivers, emphasizing the role of RTLS in hospitals and logistics management.South America Locationbased Services Lbs And Realtime Location Systems Rtls Market Report:

In South America, the market was valued at $2.80 billion in 2023 with expectations to reach $26.70 billion by 2033. The rise in demand for improved transportation infrastructure and the acceptance of technology in retail sectors are increasing the adoption of LBS solutions across Brazil and Argentina.Middle East & Africa Locationbased Services Lbs And Realtime Location Systems Rtls Market Report:

The Middle East and Africa market size stood at $2.55 billion in 2023, expected to grow to $24.30 billion by 2033. The increased focus on digitalization and smart solutions in sectors like oil and gas, logistics, and retail is driving the market growth in this region.Tell us your focus area and get a customized research report.

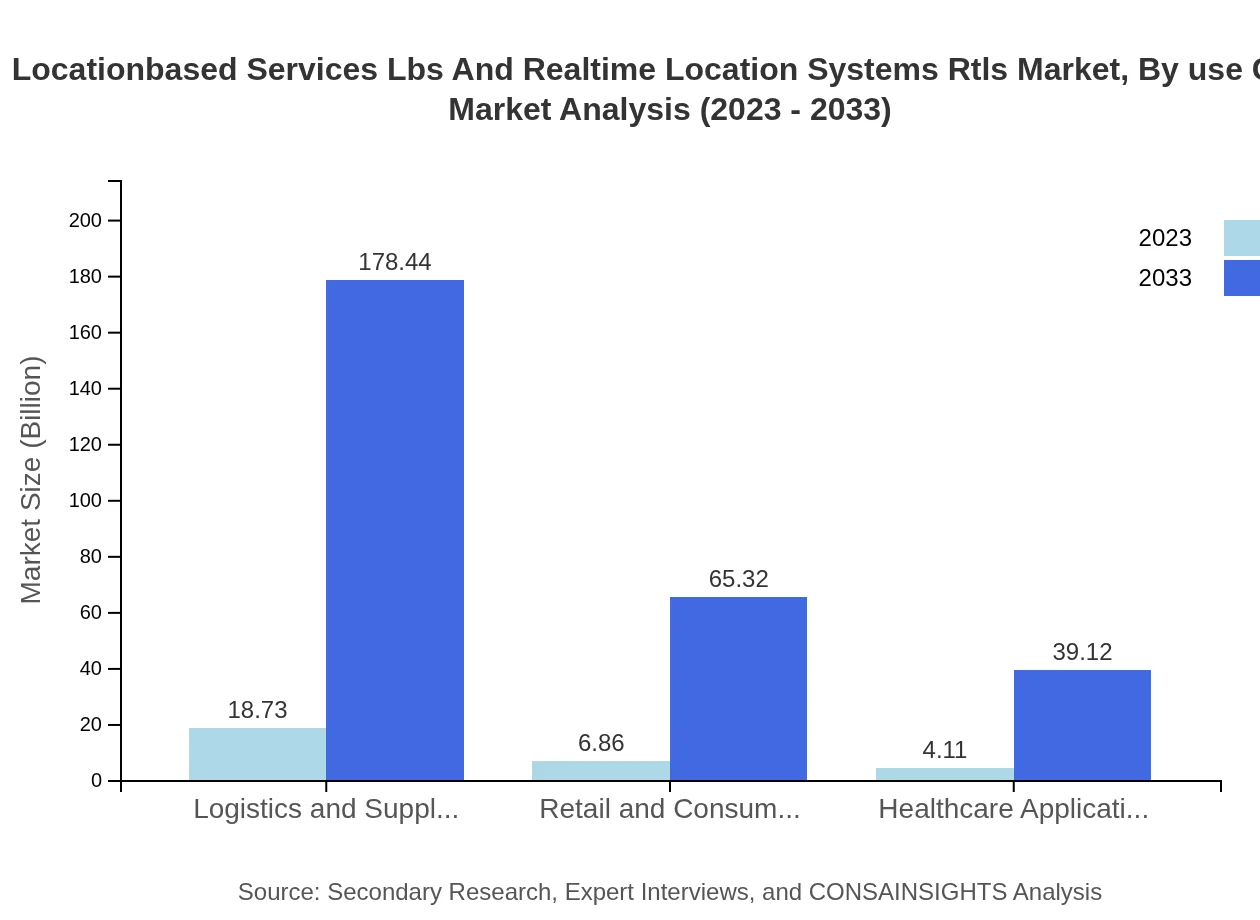

Locationbased Services Lbs And Realtime Location Systems Rtls Market Analysis By Use Case

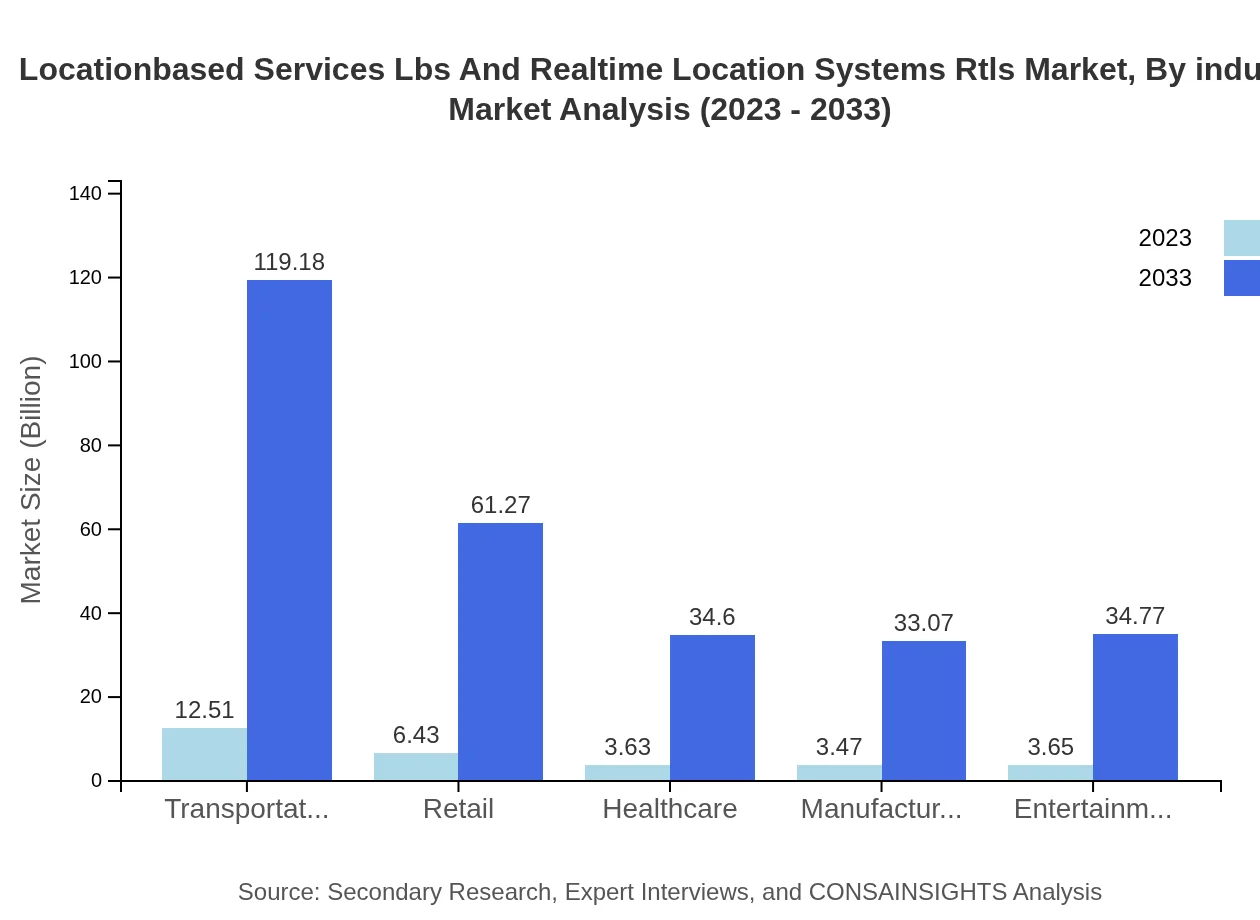

The major applications include transportation and logistics, retail, healthcare, manufacturing, and entertainment. Transportation and logistics accounted for $12.51 billion in 2023 and is expected to reach $119.18 billion by 2033. Retail and consumer engagement applications also see substantial growth, from $6.86 billion to $65.32 billion in the same period.

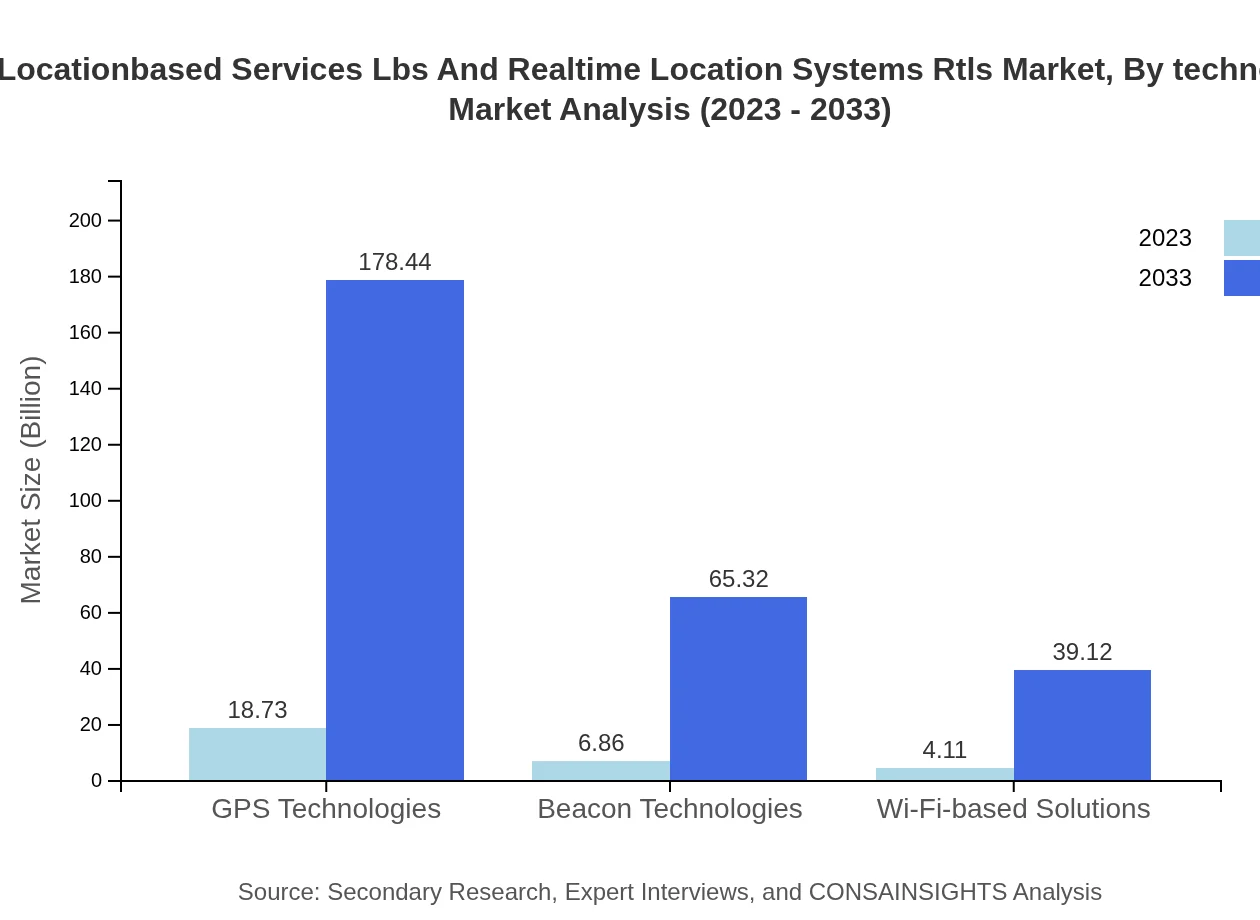

Locationbased Services Lbs And Realtime Location Systems Rtls Market Analysis By Technology

The market is segmented by technology into GPS, Beacon, and Wi-Fi-based solutions. GPS technologies are projected to dominate with sizes of $18.73 billion in 2023 expected to grow to $178.44 billion by 2033. Beacon technologies and Wi-Fi solutions are also witnessing significant growth driven by their widespread use in retail and customer engagement.

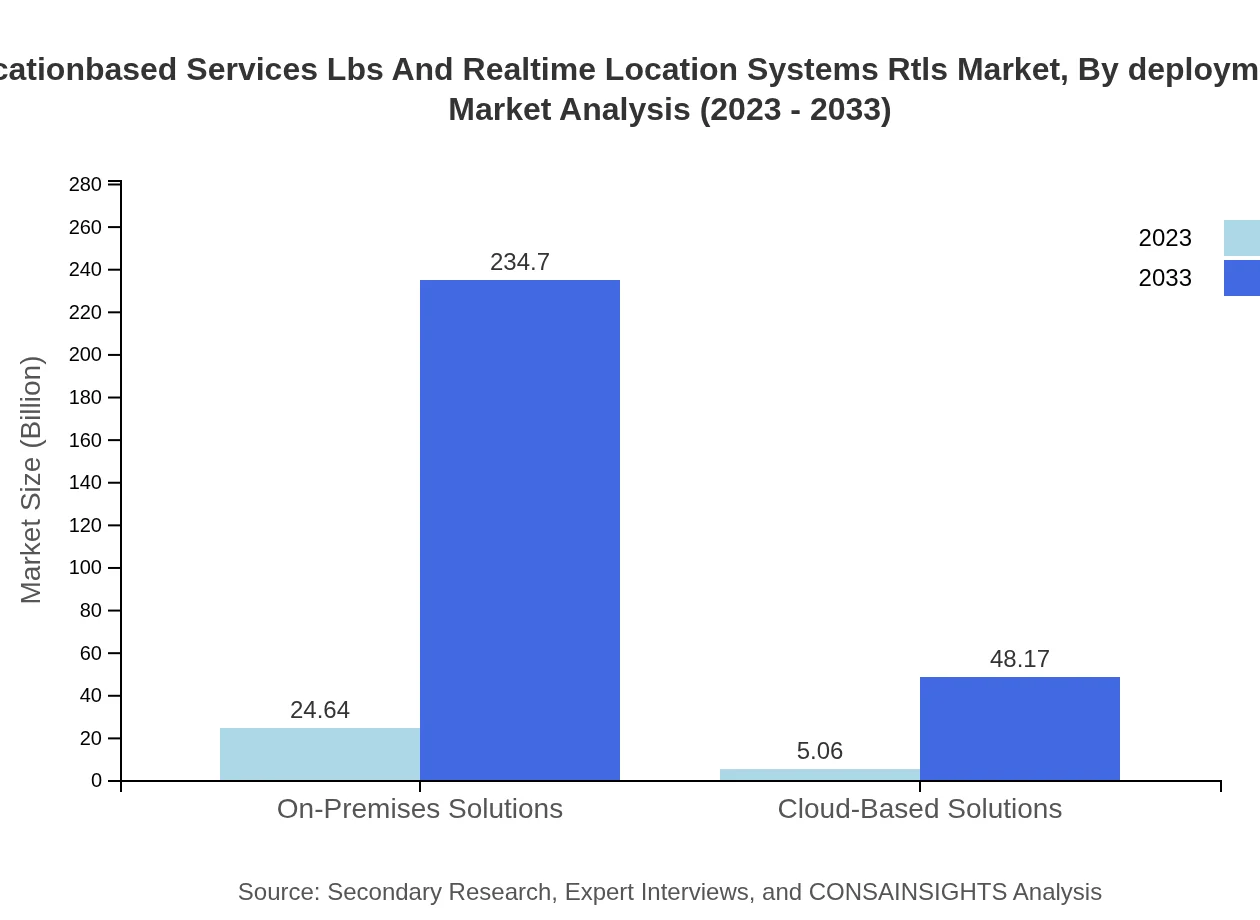

Locationbased Services Lbs And Realtime Location Systems Rtls Market Analysis By Deployment Type

The LBS and RTLS market is analyzed based on deployment types including on-premises solutions and cloud-based solutions. On-premises solutions hold a significant market share valued at $24.64 billion in 2023 and predicted to reach $234.70 billion by 2033.

Locationbased Services Lbs And Realtime Location Systems Rtls Market Analysis By Industry

Industries like healthcare and manufacturing play a major role in shaping market dynamics, with healthcare applications projected to grow from $3.63 billion in 2023 to $34.60 billion by 2033. The manufacturing sector also showcases significant growth, driven by increasing automation and efficiency demands.

Locationbased Services Lbs And Realtime Location Systems Rtls Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Locationbased Services Lbs And Realtime Location Systems Rtls Industry

Zebra Technologies:

Zebra Technologies offers a wide range of RTLS solutions tailored for logistics and supply chain management, enabling real-time asset tracking and management.Trimble Inc.:

Trimble provides advanced location technology to a variety of industries including agriculture, public safety, and transportation.Cisco Systems:

Cisco specializes in networking technology that supports location-based services across various sectors.Osram Licht AG:

Osram offers innovative lighting solutions integrated with location-based technologies for enhanced user experiences.Baidu Inc.:

Baidu is a major player in navigation and map services in China, driving LBS innovation within the region.We're grateful to work with incredible clients.

FAQs

What is the market size of locationbased Services Lbs And Realtime Location Systems Rtls?

The global market size for Location-based Services (LBS) and Real-time Location Systems (RTLS) is estimated at $29.7 billion in 2023, with a projected CAGR of 23.7% from 2023 to 2033.

What are the key market players or companies in this locationbased Services Lbs And Realtime Location Systems Rtls industry?

Key players in the LBS and RTLS market include major technology companies engaged in IoT, GPS solutions, and cloud-based services, as well as niche players focused on innovative access point solutions and real-time tracking technologies.

What are the primary factors driving the growth in the locationbased Services Lbs And Realtime Location Systems Rtls industry?

The growth in this industry is driven by increasing demand for real-time tracking solutions, advancements in GPS technology, the rising adoption of IoT devices, and the growing needs for operational efficiency across various sectors like logistics and healthcare.

Which region is the fastest Growing in the locationbased Services Lbs And Realtime Location Systems Rtls market?

The Asia Pacific region is projected to be the fastest-growing market, expanding from $5.68 billion in 2023 to $54.09 billion by 2033, driven by technological advancements and increasing investments in LBS and RTLS.

Does ConsaInsights provide customized market report data for the locationbased Services Lbs And Realtime Location Systems Rtls industry?

Yes, ConsaInsights offers customized market report data tailored to specific requirements, allowing clients to gain bespoke insights into the LBS and RTLS market's trends and forecasts according to their business needs.

What deliverables can I expect from this locationbased Services Lbs And Realtime Location Systems Rtls market research project?

Deliverables from the market research project typically include detailed reports, market size analysis, growth forecasts, segment breakdowns, competitive landscape assessments, and actionable insights to aid strategic decision-making.

What are the market trends of locationbased Services Lbs And Realtime Location Systems Rtls?

Emerging trends in the LBS and RTLS market include increased integration of AI for analytics, growth in cloud-based solutions, enhanced focus on mobile applications, and the evolution of on-premises and hybrid solutions catering to diverse industry applications.