Logistics Automation Market Report

Published Date: 22 January 2026 | Report Code: logistics-automation

Logistics Automation Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive overview of the Logistics Automation market, delivering insights into market size, trends, and forecasts from 2023 to 2033, along with key regional analyses and competitive landscape.

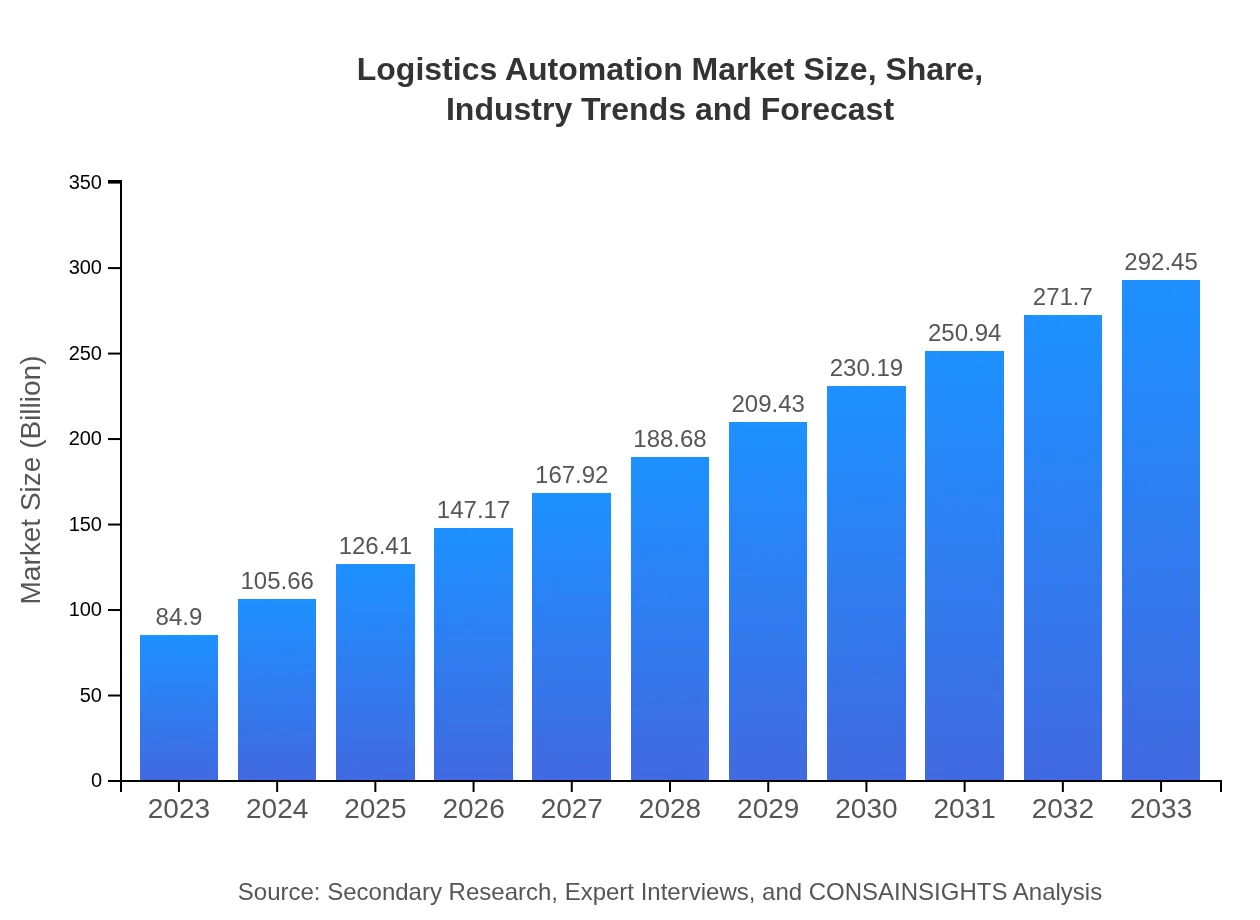

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $84.90 Billion |

| CAGR (2023-2033) | 12.6% |

| 2033 Market Size | $292.45 Billion |

| Top Companies | Siemens AG, Amazon Robotics, Kiva Systems, Honeywell Intelligrated, Dematic, JDA Software |

| Last Modified Date | 22 January 2026 |

Logistics Automation Market Overview

Customize Logistics Automation Market Report market research report

- ✔ Get in-depth analysis of Logistics Automation market size, growth, and forecasts.

- ✔ Understand Logistics Automation's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Logistics Automation

What is the Market Size & CAGR of the Logistics Automation market in 2023 and 2033?

Logistics Automation Industry Analysis

Logistics Automation Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Logistics Automation Market Analysis Report by Region

Europe Logistics Automation Market Report:

Europe's logistics automation market is set to witness substantial growth, with size increasing from $26.13 billion in 2023 to $90.02 billion by 2033. The region's emphasis on sustainability and smart logistics is driving automation investments, particularly among key players in Germany, France, and the UK, aligning with the EU's green logistics initiatives.Asia Pacific Logistics Automation Market Report:

Asia Pacific is poised to be a significant player in the Logistics Automation market, with a market value rising from $16.57 billion in 2023 to approximately $57.09 billion by 2033. The rapid adoption of automation, driven primarily by countries like China and India, reflects a growing emphasis on improving supply chain efficiencies and meeting the demands of an expanding consumer base.North America Logistics Automation Market Report:

North America remains a leader in the logistics automation landscape, with market size expected to grow from $29.11 billion in 2023 to about $100.28 billion by 2033. The robust e-commerce sector and advanced technological ecosystems in the U.S. and Canada are major contributors to this growth, as companies seek to enhance operational efficiency and customer satisfaction.South America Logistics Automation Market Report:

The South American logistics automation market is also growing, with a projected increase from $7.21 billion in 2023 to $24.83 billion by 2033. The region's focus on improving infrastructure and logistics capabilities, especially in countries like Brazil and Argentina, is propelling investments in automation technologies.Middle East & Africa Logistics Automation Market Report:

In the Middle East and Africa, the logistics automation market is growing from $5.88 billion in 2023 to about $20.24 billion by 2033. Investments in logistics infrastructure, along with rising e-commerce activities in countries like the UAE and South Africa, are key factors influencing this growth.Tell us your focus area and get a customized research report.

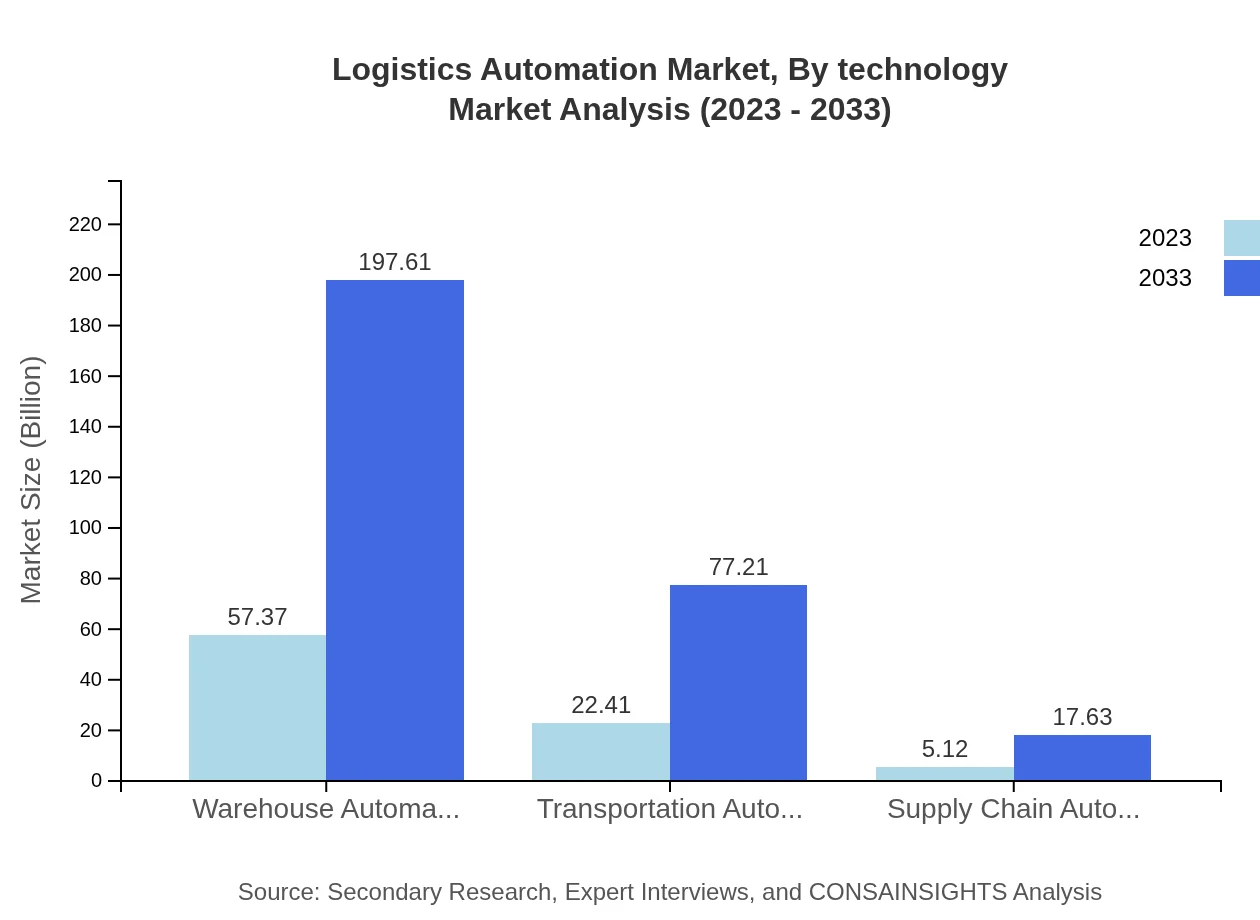

Logistics Automation Market Analysis By Technology

The Logistics Automation market is segmented by technology, with warehouse automation expected to lead growth, rising from $57.37 billion in 2023 to $197.61 billion by 2033. Transportation automation technologies are projected to increase significantly, from $22.41 billion to $77.21 billion. Additionally, supply chain automation is growing steadily alongside demand planning and inventory management technologies.

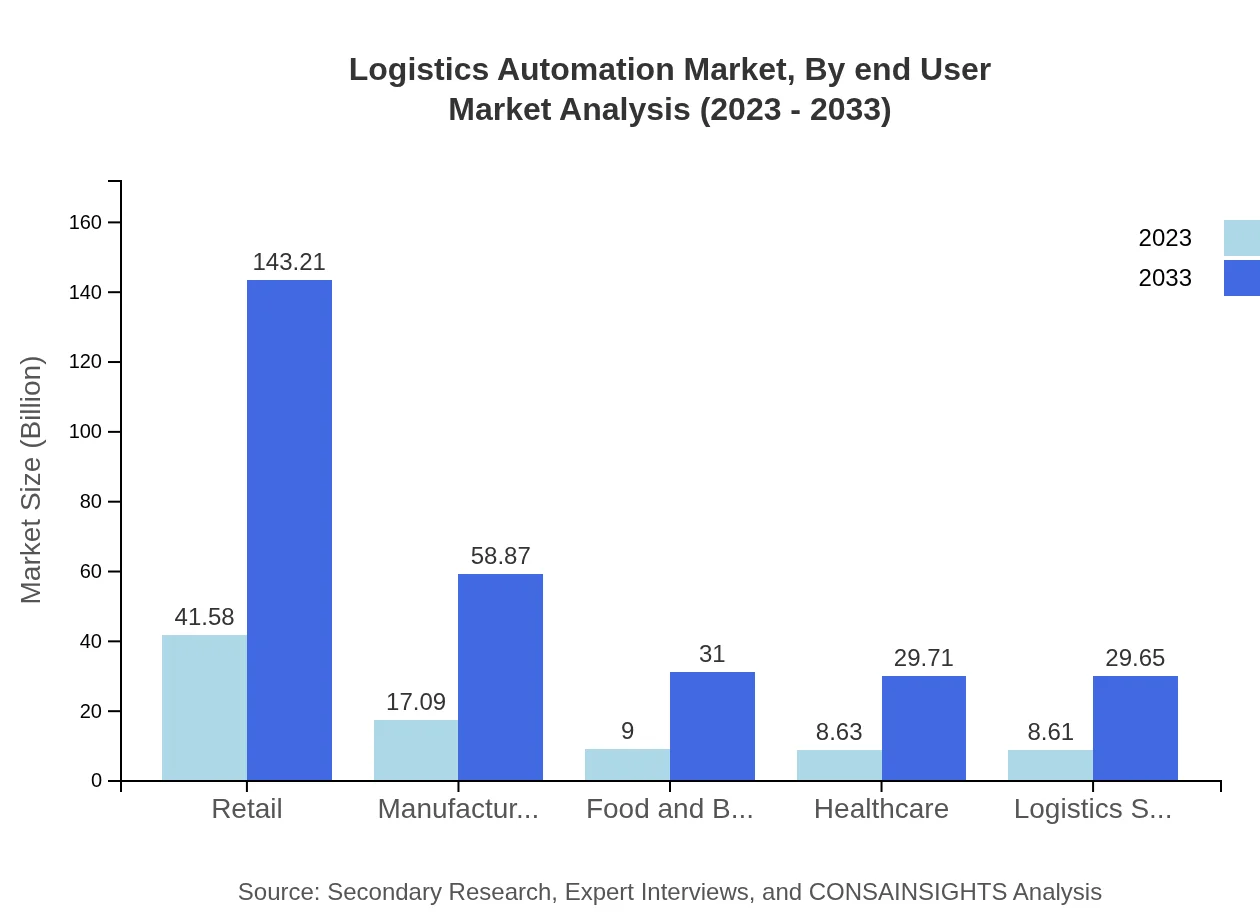

Logistics Automation Market Analysis By End User

End-user segmentation reveals that retail and manufacturing sectors are prominent, with retail automation growing from $41.58 billion to $143.21 billion and manufacturing from $17.09 billion to $58.87 billion by 2033. Other significant segments include food and beverage and healthcare, both showcasing increasing investments in automation solutions.

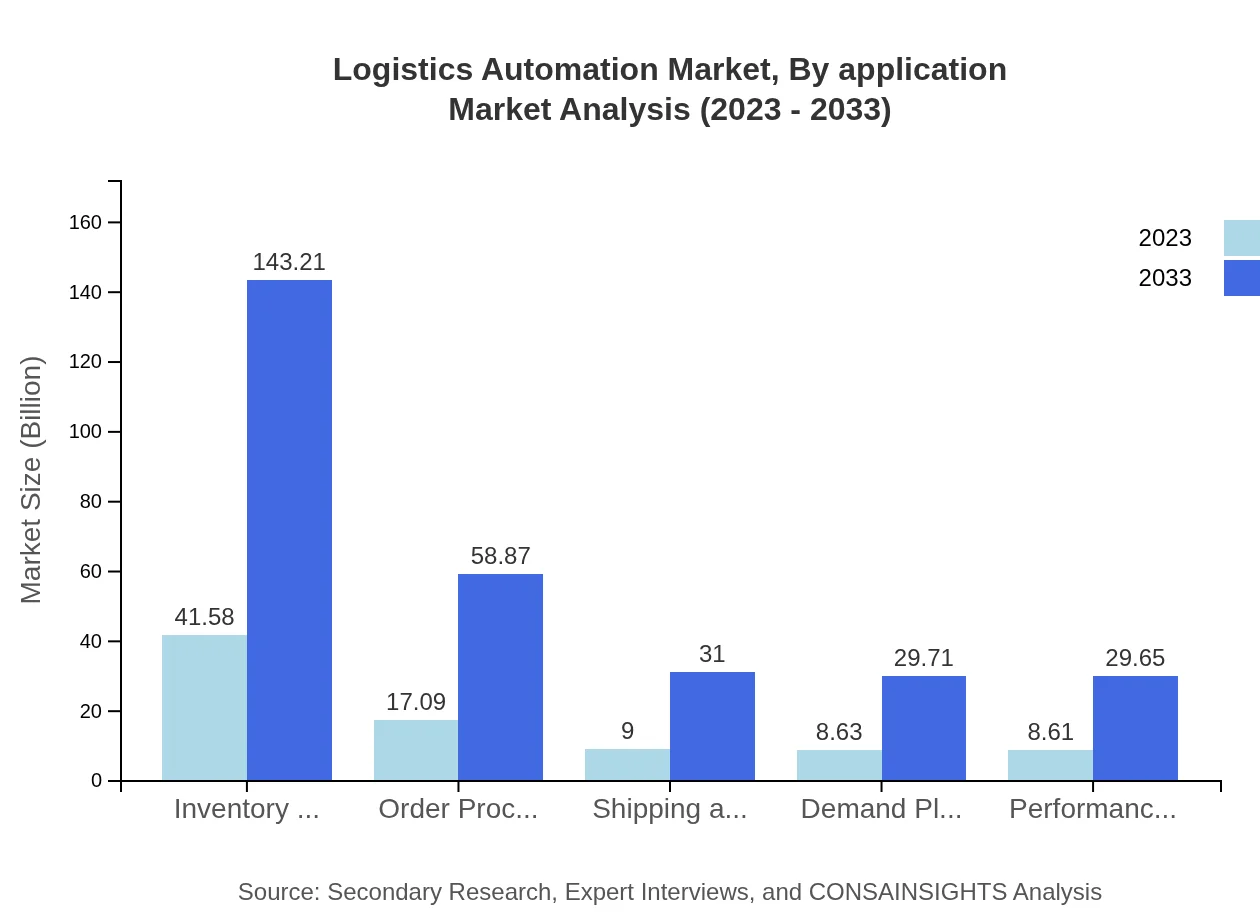

Logistics Automation Market Analysis By Application

Logistics automation applications include order processing, inventory management, and shipping and fulfillment. Order processing is expected to grow from $17.09 billion to $58.87 billion. Inventory management holds a substantial share, expanding from $41.58 billion to $143.21 billion, highlighting the critical nature of efficient inventory practices.

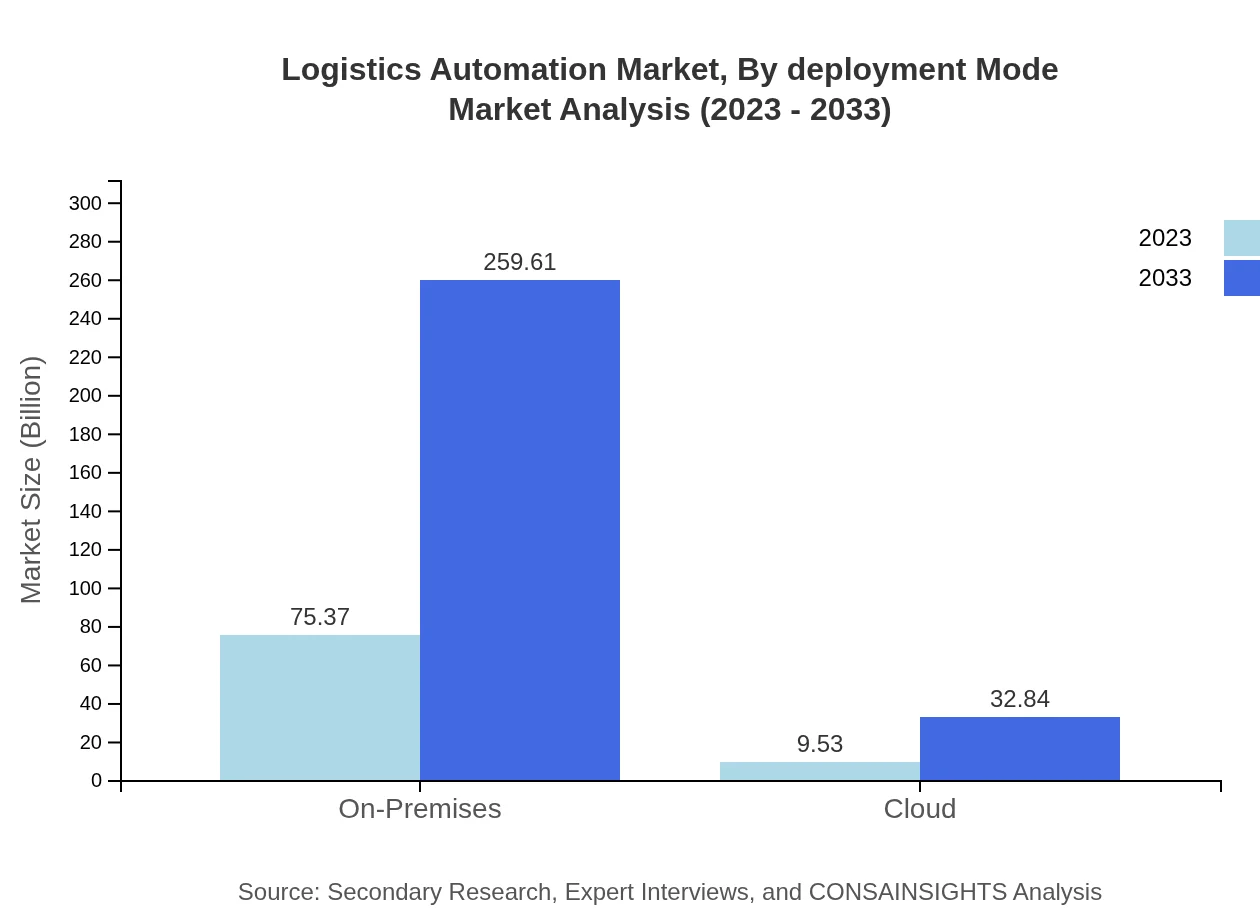

Logistics Automation Market Analysis By Deployment Mode

The market is split between on-premises and cloud deployment modes. On-premises solutions will maintain a substantial share, growing from $75.37 billion to $259.61 billion by 2033. In contrast, cloud-based solutions are gaining traction, increasing from $9.53 billion to $32.84 billion, as businesses seek flexible and scalable automation options.

Logistics Automation Market Analysis By Size

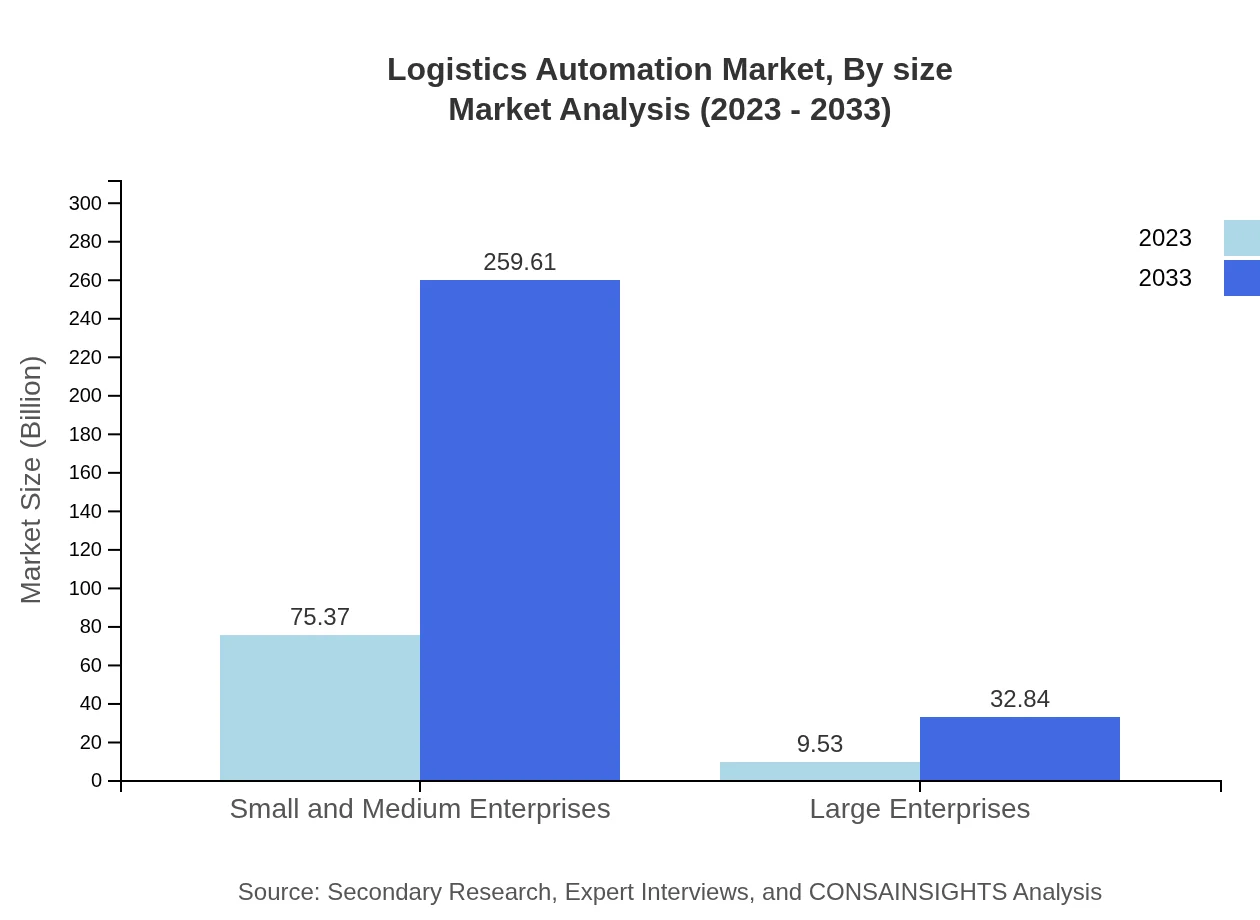

The segmentation by organization size shows that small and medium enterprises (SMEs) will dominate the market, rising from $75.37 billion to $259.61 billion from 2023 to 2033. Large enterprises will also show significant growth but will share a smaller portion, expanding from $9.53 billion to $32.84 billion.

Logistics Automation Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Logistics Automation Industry

Siemens AG:

Siemens AG is a leading industrial automation and digitalization company with extensive offerings in logistics automation, focusing on smart infrastructure and sustainability.Amazon Robotics:

Amazon Robotics, a subsidiary of Amazon, specializes in automating warehouses with innovative robotic solutions, enhancing efficiency in e-commerce fulfillment and logistics operations.Kiva Systems:

Kiva Systems, now known as Amazon Robotics, revolutionized the warehousing sector with its mobile robotic systems, paving the way for automated warehouse solutions.Honeywell Intelligrated:

Honeywell Intelligrated provides automated material handling systems and software solutions that improve distribution operations and warehouse productivity.Dematic:

Dematic offers a range of automation solutions for logistics and supply chains, including automated storage and retrieval systems that enhance warehouse efficiency.JDA Software:

JDA Software specializes in supply chain management solutions, integrating software with automation technologies to optimize logistics planning and execution.We're grateful to work with incredible clients.

FAQs

What is the market size of logistics automation?

The logistics automation market is projected to reach $84.9 billion by 2033, growing at a CAGR of 12.6% from 2023. This growth is driven by increased demand for efficient supply chain solutions.

What are the key market players or companies in the logistics automation industry?

Key players in the logistics automation market include leading companies that specialize in warehouse management, inventory management solutions, transportation automation, and supply chain technology.

What are the primary factors driving the growth in the logistics automation industry?

Factors driving growth include the rise of e-commerce, need for operational efficiency, and advancements in technology such as AI and IoT, which enhance automation in logistics processes.

Which region is the fastest Growing in the logistics automation?

The fastest-growing region in logistics automation is Europe, projected to grow from $26.13 billion in 2023 to $90.02 billion by 2033, showcasing significant market expansion.

Does ConsaInsights provide customized market report data for the logistics automation industry?

Yes, ConsaInsights offers tailored market report data that meets specific client needs, ensuring comprehensive insights into the logistics automation industry.

What deliverables can I expect from this logistics automation market research project?

Deliverables from the logistics automation market research project include detailed market analysis reports, segmented data insights, and forecasts, tailored to client requirements.

What are the market trends of logistics automation?

Current trends include increased use of robotics in warehousing, growth of cloud-based logistics solutions, and a shift towards real-time data analytics for enhanced decision-making.