Long Range Radar Market Report

Published Date: 03 February 2026 | Report Code: long-range-radar

Long Range Radar Market Size, Share, Industry Trends and Forecast to 2033

This report provides an in-depth analysis of the Long Range Radar market from 2023 to 2033, including insights on market size, trends, segmentation, and forecasts by region. The data presented aims to assist stakeholders in making informed decisions in this evolving industry.

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

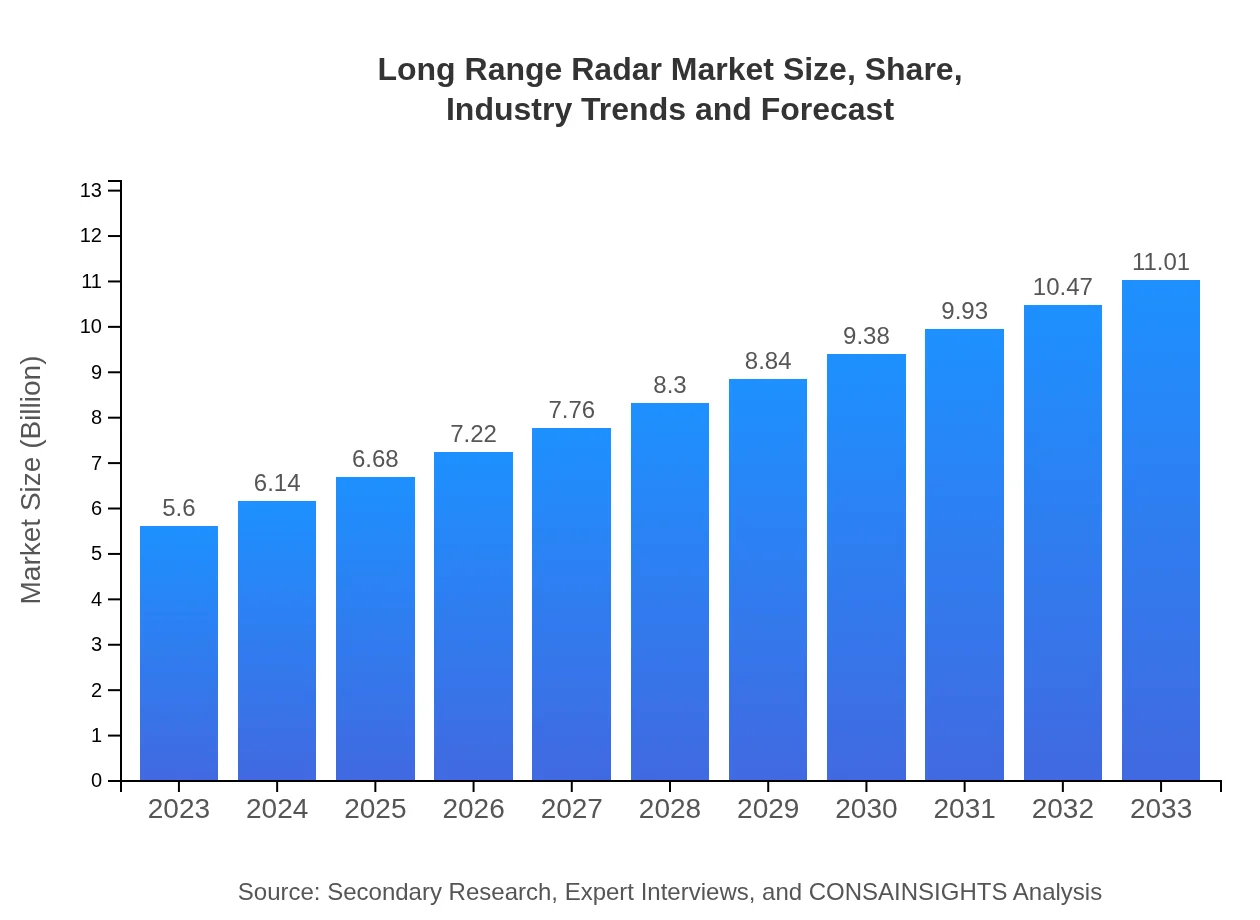

| 2023 Market Size | $5.60 Billion |

| CAGR (2023-2033) | 6.8% |

| 2033 Market Size | $11.01 Billion |

| Top Companies | Lockheed Martin, Northrop Grumman, Raytheon Technologies, Thales Group |

| Last Modified Date | 03 February 2026 |

Long Range Radar Market Overview

Customize Long Range Radar Market Report market research report

- ✔ Get in-depth analysis of Long Range Radar market size, growth, and forecasts.

- ✔ Understand Long Range Radar's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Long Range Radar

What is the Market Size & CAGR of Long Range Radar market in 2023?

Long Range Radar Industry Analysis

Long Range Radar Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Long Range Radar Market Analysis Report by Region

Europe Long Range Radar Market Report:

Europe's Long Range Radar market is also growing steadily. With an estimated market size of $1.35 billion in 2023, it is projected to reach $2.66 billion by 2033. The increase is attributed to enhanced focus on defense capabilities, border security, and advanced air traffic management technologies.Asia Pacific Long Range Radar Market Report:

The Asia Pacific region has showcased a growing demand for Long Range Radar technology, driven by military modernization programs and increasing investments in air traffic control systems. In 2023, the market is valued at approximately $1.10 billion and is projected to reach $2.16 billion by 2033, reflecting significant growth opportunities, particularly in countries like China and India.North America Long Range Radar Market Report:

North America remains the largest market for Long Range Radar, with a size of approximately $2.06 billion in 2023, expected to grow to $4.05 billion by 2033. This growth is supported by high defense spending and constant technological advancements in radar systems, particularly within military operations and commercial aerospace.South America Long Range Radar Market Report:

In South America, the Long Range Radar market is poised for expansion due to rising security concerns and the need to enhance border patrol capabilities. Starting with a market size of $0.52 billion in 2023, it is expected to grow to $1.02 billion by 2033, primarily driven by government initiatives toward infrastructural advancements.Middle East & Africa Long Range Radar Market Report:

The Middle East and Africa region is witnessing substantial investments in radar technology, mainly driven by military spending to counter regional threats. The market is projected to grow from $0.57 billion in 2023 to $1.12 billion by 2033, reflecting the region's commitment to enhancing defense mechanisms and surveillance.Tell us your focus area and get a customized research report.

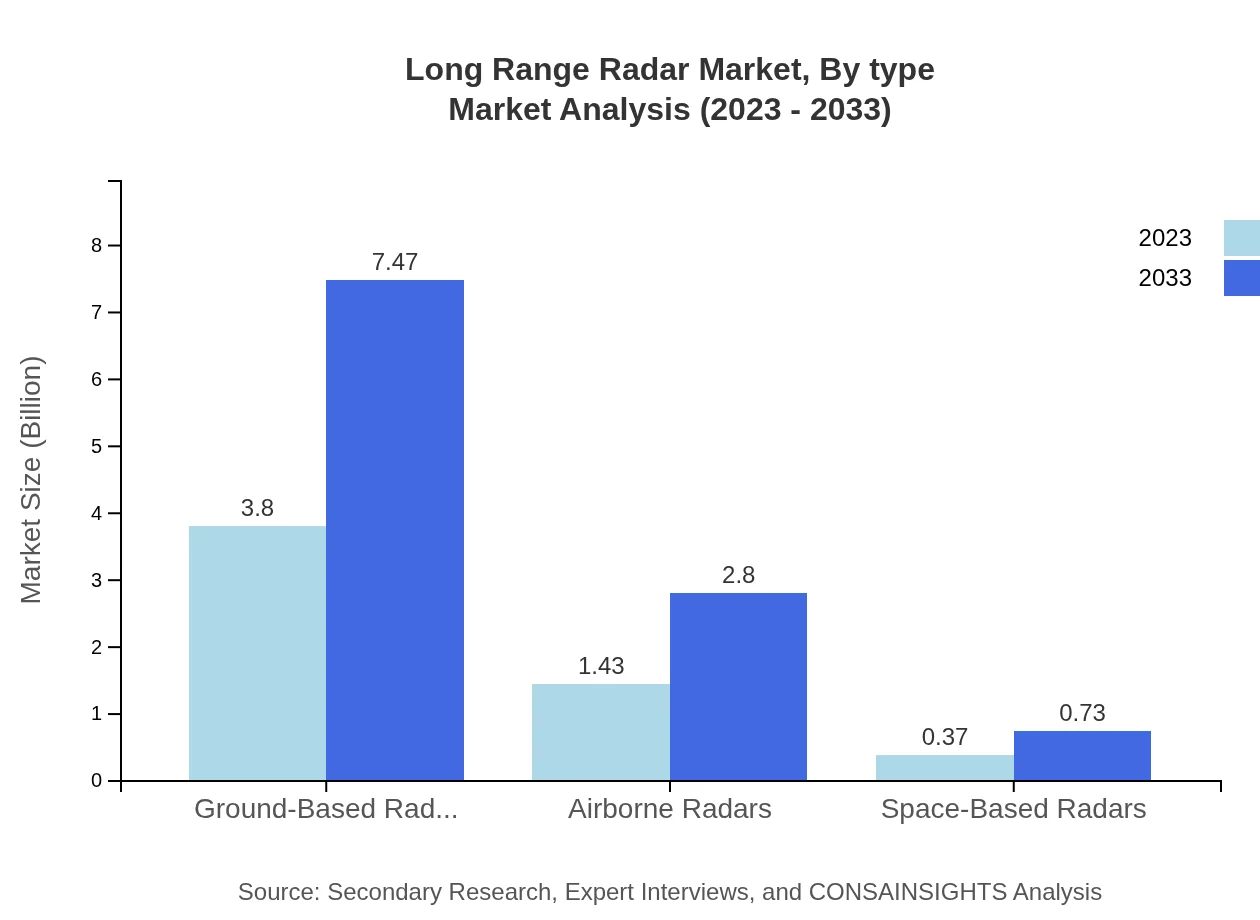

Long Range Radar Market Analysis By Type

The Long Range Radar market is segmented by type into Ground-Based Radars, Airborne Radars, and Space-Based Radars. Ground-Based Radars dominated the market in 2023 with a size of $3.80 billion, projected to grow to $7.47 billion by 2033, maintaining a share of 67.86%. Airborne Radars follow with a market size of $1.43 billion in 2023 and an expected growth to $2.80 billion by 2033, holding 25.48% share. Space-Based Radars, although smaller, show potential growth from $0.37 billion to $0.73 billion during the same period.

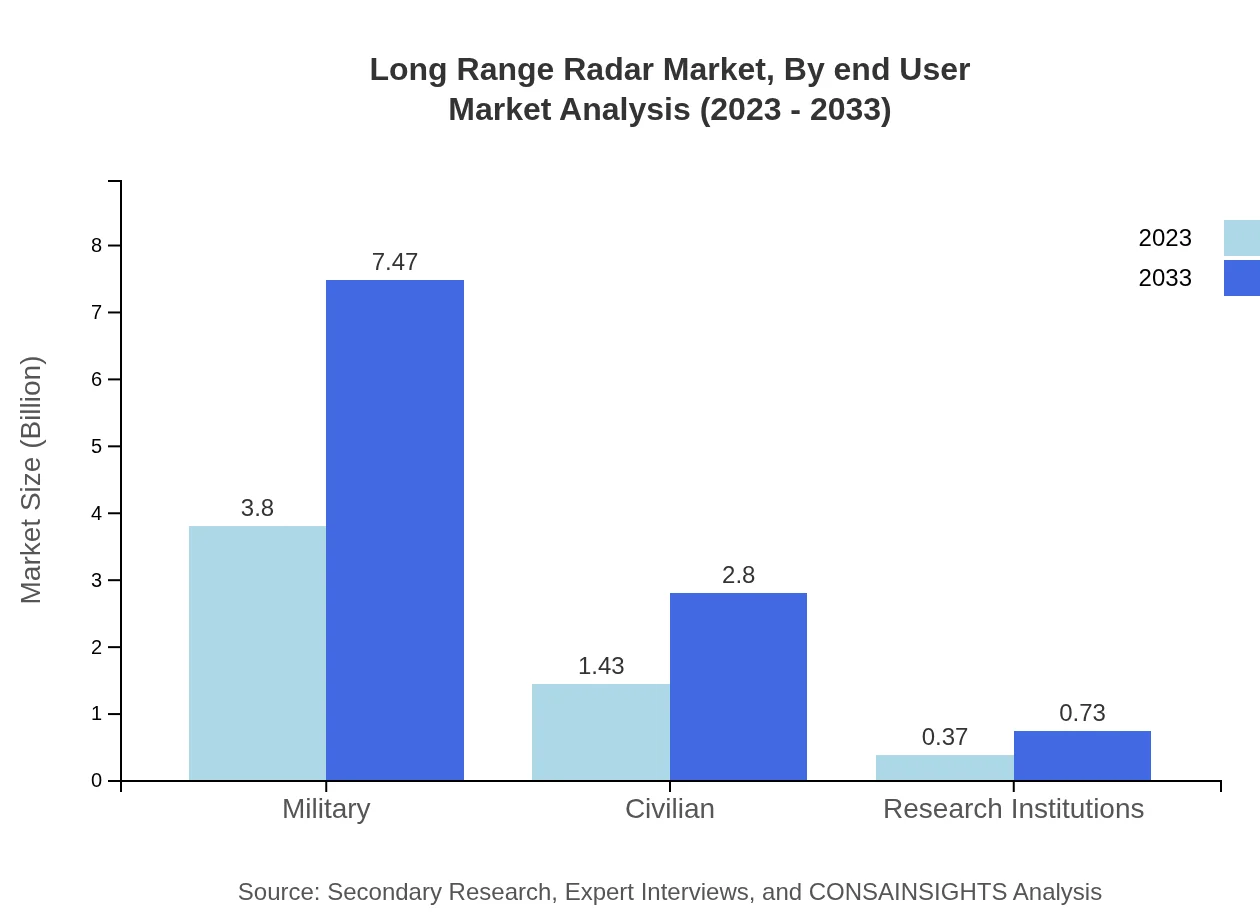

Long Range Radar Market Analysis By Application

The applications of Long Range Radar include Military, Civilian, and Research Institutions. The military sector remains the largest segment with a market size of $3.80 billion in 2023, projected to increase to $7.47 billion in 2033 with an unchanged share of 67.86%. The civilian application, notably in traffic management and airport surveillance, is also growing, with a market size of $1.43 billion in 2023, culminating at $2.80 billion by 2033, sustaining a share of 25.48%.

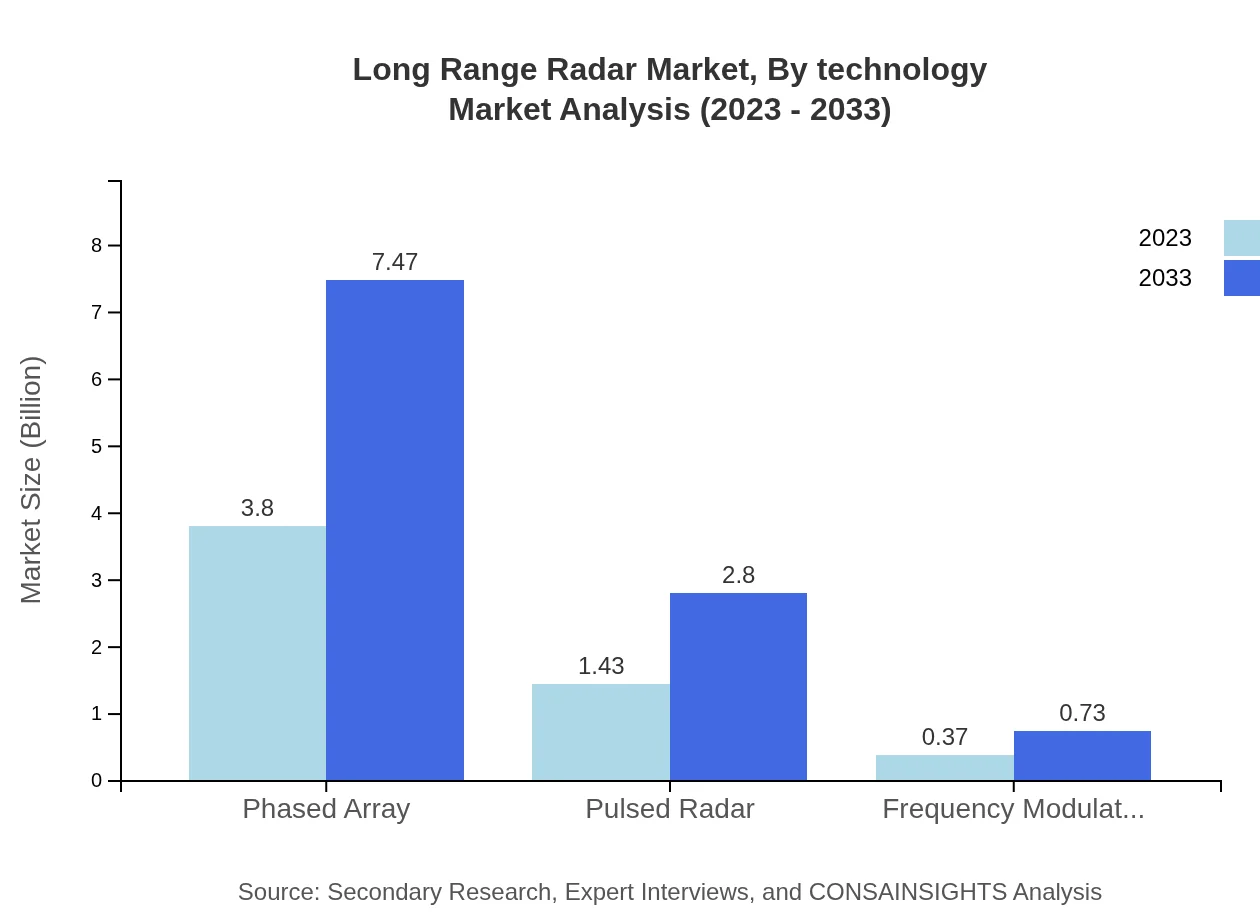

Long Range Radar Market Analysis By Technology

Market segments by technology include Phased Array, Pulsed Radar, and Frequency Modulated Continuous Wave (FMCW). Phased Array technology leads the market with revenue of $3.80 billion in 2023 and $7.47 billion by 2033, while maintaining a market share of 67.86%. Pulsed Radars also hold significant importance, growing from $1.43 billion to $2.80 billion alongside a steady share of 25.48%. FMCW technology, while smaller, is expected to amass growth from $0.37 billion to $0.73 billion, holding a market share of 6.66%.

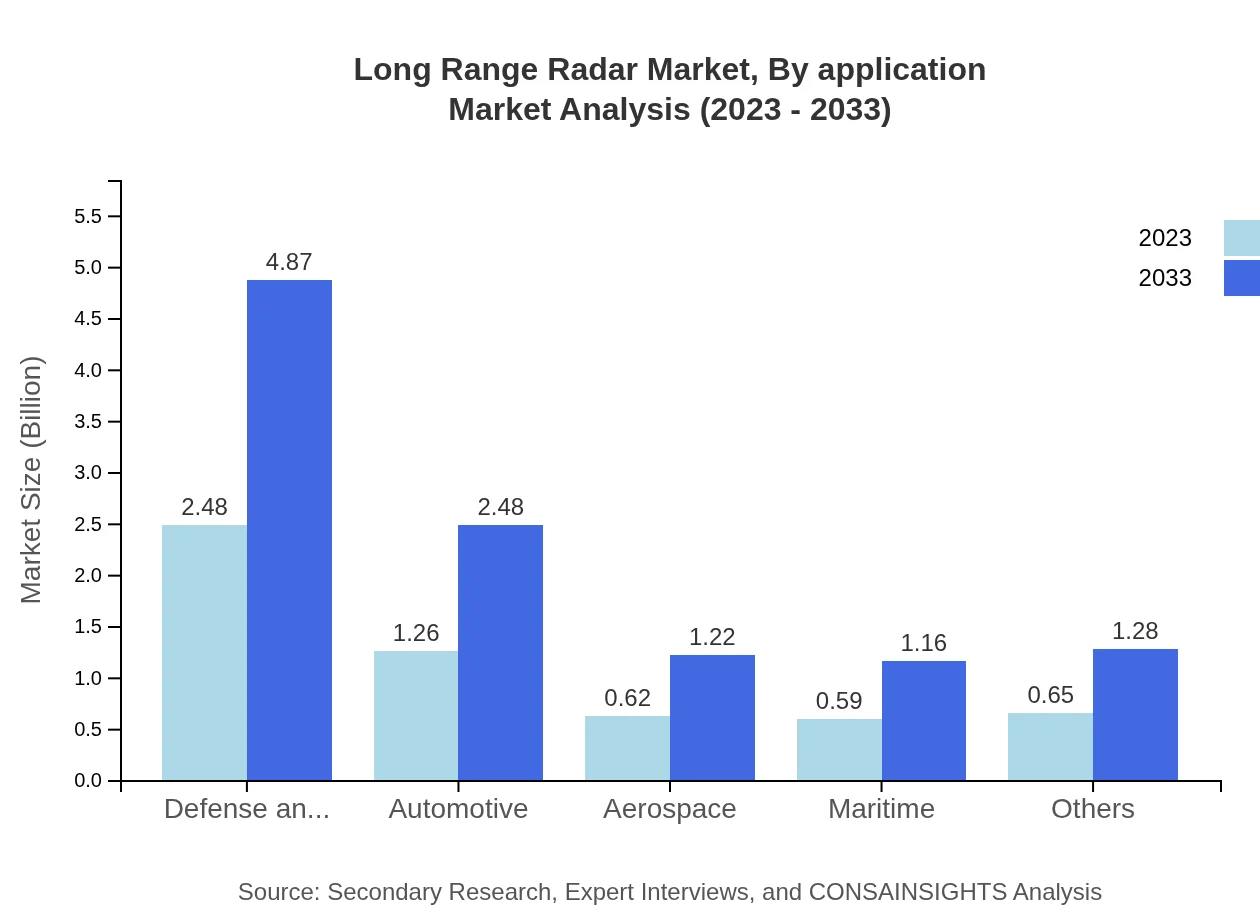

Long Range Radar Market Analysis By End User

End-user segments include Defense and Security, Automotive, Aerospace, Maritime, and Others. The Defense and Security segment is notably substantial with a sizable market of $2.48 billion in 2023 extending to $4.87 billion by 2033, representing 44.27% market share. Similarly, the Automotive and Aerospace sectors are also noteworthy, showcasing distinctions with respective sizes of $1.26 billion and $0.62 billion in 2023, growing to $2.48 billion and $1.22 billion by 2033.

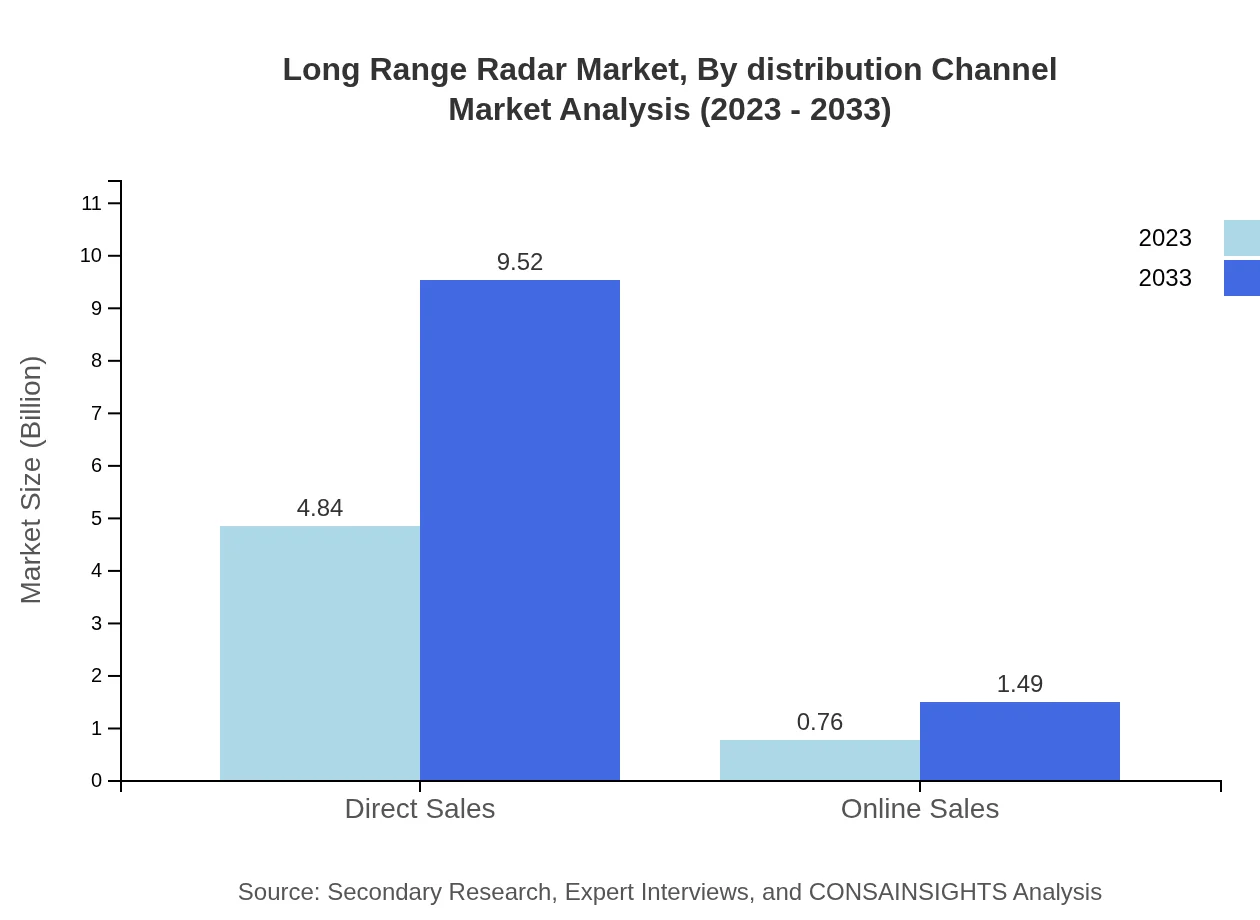

Long Range Radar Market Analysis By Distribution Channel

Distribution channels for Long Range Radar include Direct Sales and Online Sales. Direct Sales represent the bulk of the market, valued at $4.84 billion in 2023, anticipated to reach $9.52 billion by 2033 with a commanding share of 86.45%. Online Sales, while smaller, will grow from $0.76 billion to $1.49 billion, securing a 13.55% share in the same timeframe.

Long Range Radar Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Long Range Radar Industry

Lockheed Martin:

Lockheed Martin stands as a leader in defense technology, providing advanced long-range radar systems for air and missile defense applications.Northrop Grumman:

Northrop Grumman specializes in aerospace and defense technology, offering comprehensive radar solutions that enhance situational awareness for military and civilian use.Raytheon Technologies:

Raytheon Technologies is a prominent player in radar technology, known for its innovative systems designed for precision guidance and tracking in various applications.Thales Group:

Thales Group is engaged in various sectors, including aerospace, defense, and security, providing cutting-edge radar solutions for enhanced surveillance and monitoring capabilities.We're grateful to work with incredible clients.

FAQs

What is the market size of long Range Radar?

The long-range radar market is valued at approximately $5.6 billion in 2023, with an expected compound annual growth rate (CAGR) of 6.8% from 2023 to 2033. This indicates a robust growth trajectory, aligning with increasing demand across various sectors.

What are the key market players or companies in this long Range Radar industry?

Key players in the long-range radar industry include Northrop Grumman, Raytheon Technologies, Thales Group, and Leonardo S.p.A. These companies lead in technology innovation and have a significant presence globally, influencing market dynamics effectively.

What are the primary factors driving the growth in the long Range radar industry?

Factors driving growth include escalating military expenditures, technological advancements in radar systems, and increased demand for aviation safety systems. These elements are crucial in propelling market dynamics and expanding opportunities in diverse applications.

Which region is the fastest Growing in the long Range radar?

North America is the fastest-growing region in the long-range radar market, with its market size projected to grow from $2.06 billion in 2023 to $4.05 billion by 2033. This growth is attributed to significant defense budgets and technological advancements.

Does ConsaInsights provide customized market report data for the long Range radar industry?

Yes, ConsaInsights offers tailored market report data for the long-range radar industry, catering to specific needs of clients. This customization ensures that relevant data and insights are aligned with industry requirements and user objectives.

What deliverables can I expect from this long Range radar market research project?

Clients can expect comprehensive deliverables from the long-range radar market research project, including detailed reports on market size, trends, competitive analysis, and projections, as well as insights into key segments and regional markets.

What are the market trends of long Range radar?

Market trends for long-range radar include growing adoption of phased array and FMCW technologies, increasing demand in defense and automotive sectors, and a shift towards automated systems, reflecting the industry's evolution towards advanced functionalities.