Low Power Wide Area Network Market Report

Published Date: 31 January 2026 | Report Code: low-power-wide-area-network

Low Power Wide Area Network Market Size, Share, Industry Trends and Forecast to 2033

This report presents an in-depth analysis of the Low Power Wide Area Network (LPWAN) market from 2023 to 2033, covering key insights, market size estimations, industry trends, and forecasts across various domains and regions.

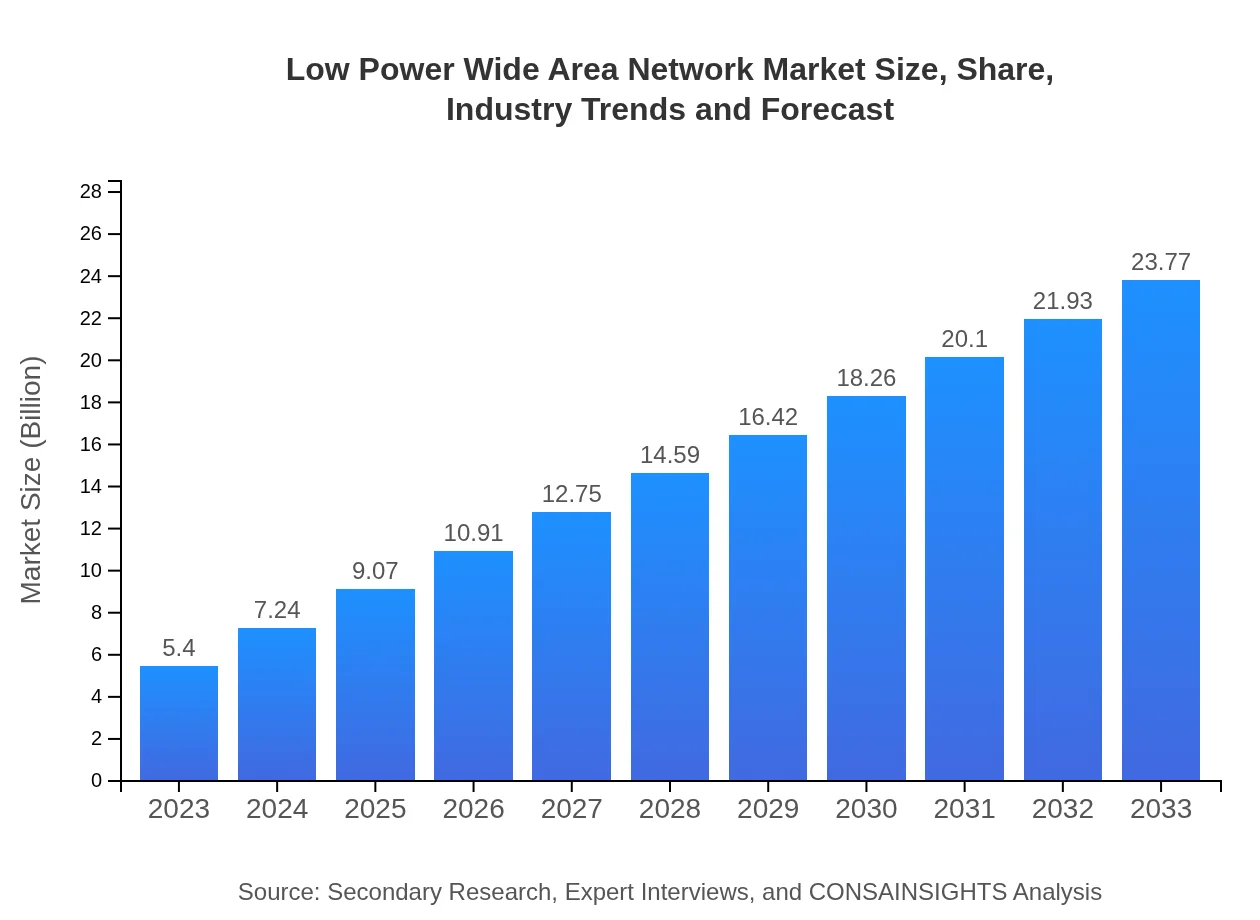

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $5.40 Billion |

| CAGR (2023-2033) | 15.2% |

| 2033 Market Size | $23.77 Billion |

| Top Companies | Semtech Corporation, Cisco Systems, Inc., Telefónica S.A., Sigfox, Huawei |

| Last Modified Date | 31 January 2026 |

Low Power Wide Area Network Market Overview

Customize Low Power Wide Area Network Market Report market research report

- ✔ Get in-depth analysis of Low Power Wide Area Network market size, growth, and forecasts.

- ✔ Understand Low Power Wide Area Network's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Low Power Wide Area Network

What is the Market Size & CAGR of Low Power Wide Area Network market in 2023?

Low Power Wide Area Network Industry Analysis

Low Power Wide Area Network Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Low Power Wide Area Network Market Analysis Report by Region

Europe Low Power Wide Area Network Market Report:

Europe's LPWAN market, estimated at $1.79 billion in 2023, is anticipated to grow to $7.86 billion by 2033, driven by regulatory support, innovation in IoT solutions, and increased demand for smart cities.Asia Pacific Low Power Wide Area Network Market Report:

In 2023, the Asia Pacific region is valued at $0.95 billion, expected to reach $4.19 billion by 2033, driven by rapid urbanization and increasing adoption of IoT applications across various sectors.North America Low Power Wide Area Network Market Report:

North America, with a market size of $1.98 billion in 2023, is expected to reach $8.73 billion by 2033, propelled by prominent technology players and extensive investments in IoT and smart city projects.South America Low Power Wide Area Network Market Report:

The South American LPWAN market was valued at $0.42 billion in 2023 and is projected to grow to $1.83 billion by 2033, benefiting from heightened investments in smart infrastructure and agriculture optimization.Middle East & Africa Low Power Wide Area Network Market Report:

The market in the Middle East and Africa is expected to grow from $0.26 billion in 2023 to $1.16 billion by 2033, driven by increasing connectivity needs and investment in infrastructure development.Tell us your focus area and get a customized research report.

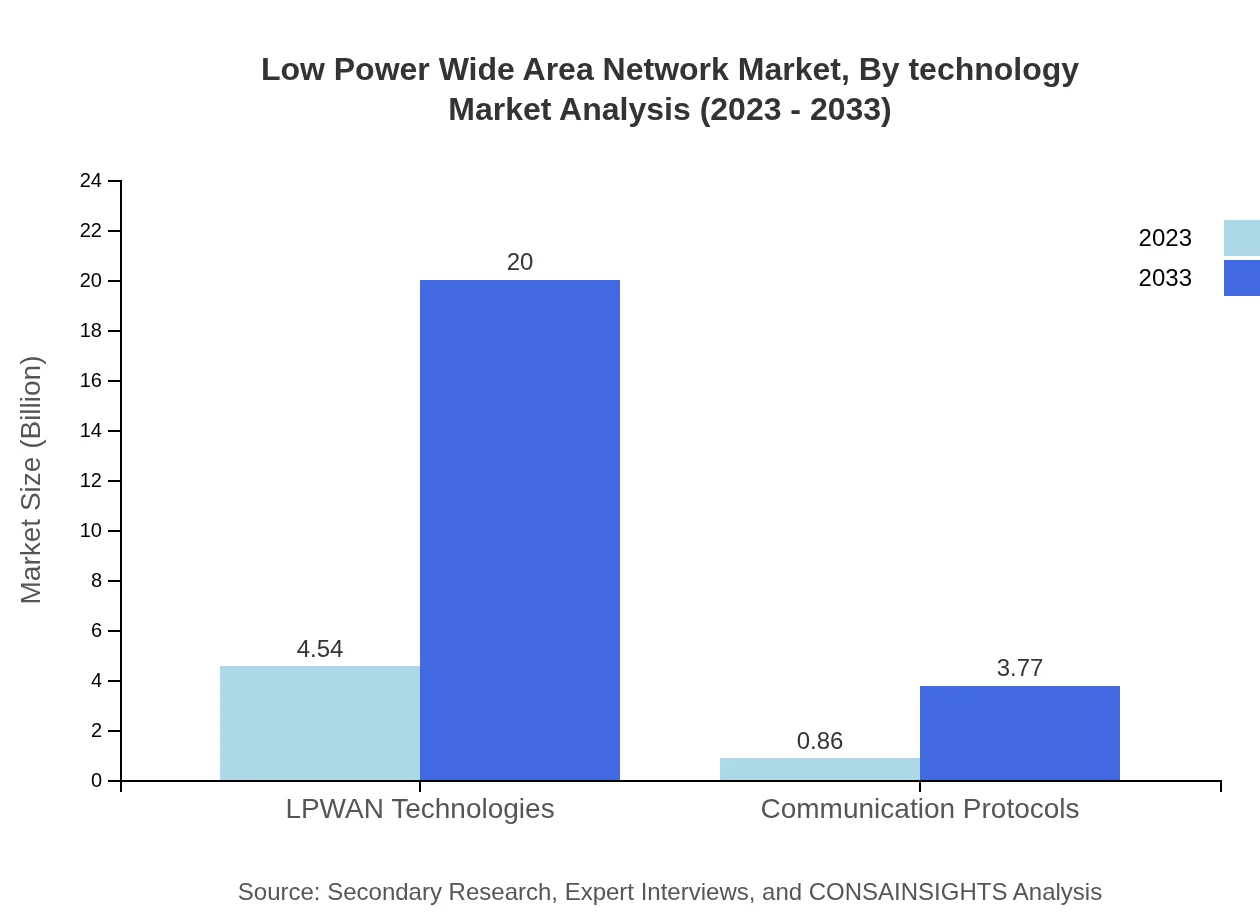

Low Power Wide Area Network Market Analysis By Technology

The LPWAN market by technology is dominated by LPWAN technologies such as LoRaWAN, which captures significant market share due to its expansive range and low energy requirements. Sigfox and NB-IoT are also emerging players, offering unique advantages suited for specific applications.

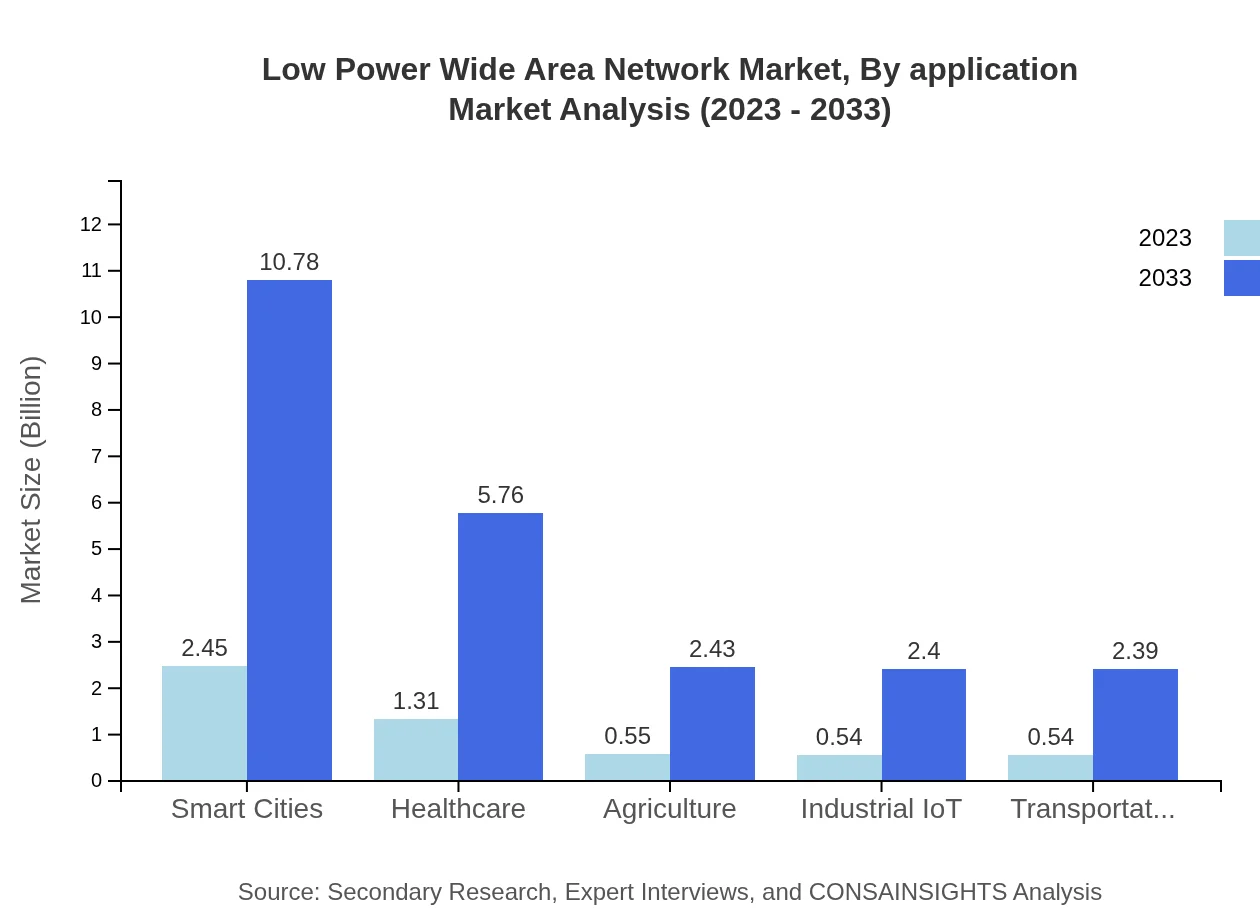

Low Power Wide Area Network Market Analysis By Application

The application segment shows robust growth, particularly in smart cities, healthcare, and agriculture. These sectors leverage LPWAN for real-time data monitoring and management, improving efficiency in operations and resource utilization.

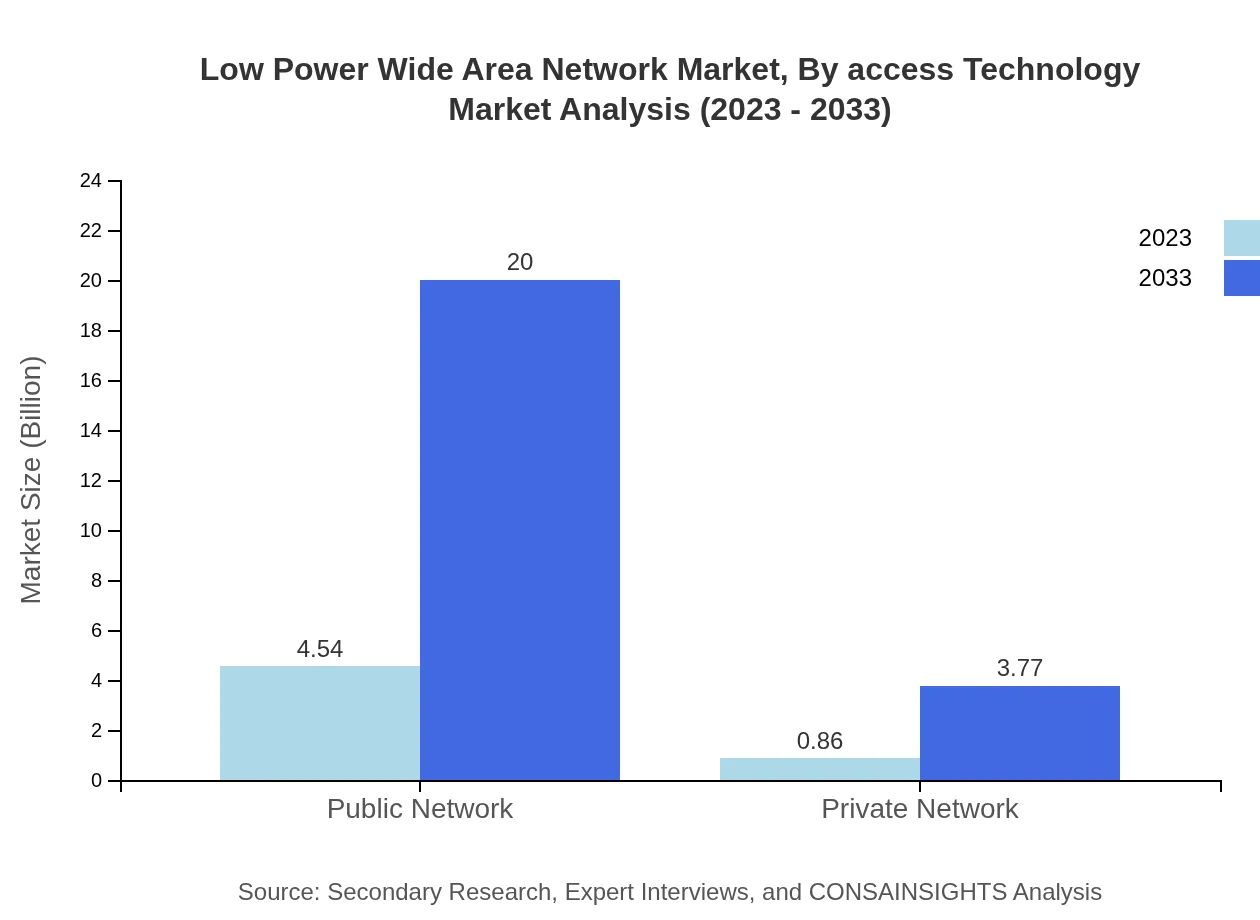

Low Power Wide Area Network Market Analysis By Access Technology

Public network solutions dominate the access technology market due to lower costs and extensive coverage, while private networks are gaining traction in sectors that require enhanced privacy and control over their data.

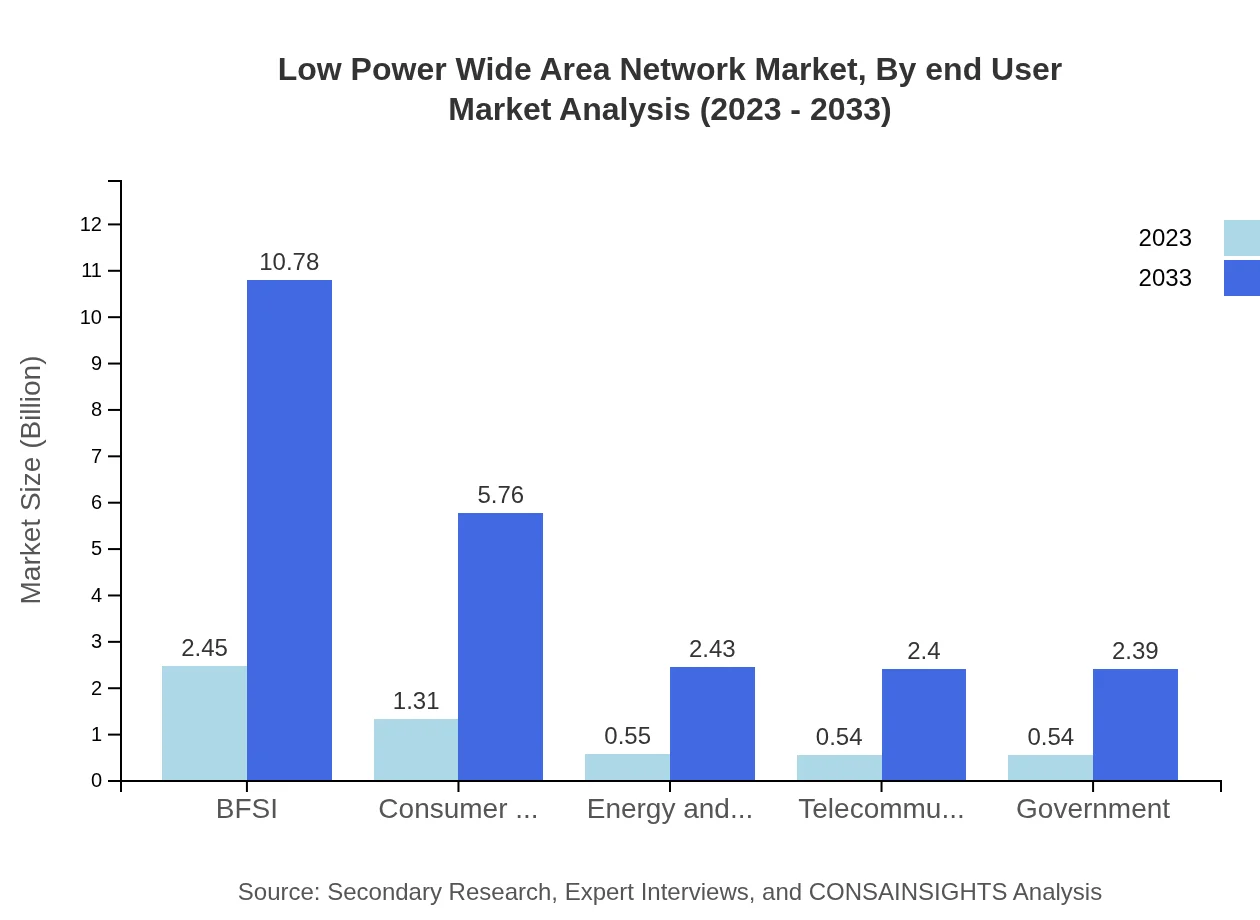

Low Power Wide Area Network Market Analysis By End User

Key end-user industries like BFSI and telecommunications show significant demand for LPWAN solutions, contributing to market growth as they incorporate IoT for improved customer engagement and operational efficiency.

Low Power Wide Area Network Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Low Power Wide Area Network Industry

Semtech Corporation:

Semtech is a leading provider of wireless communication technologies and semiconductors, well-known for its LoRa technology that plays a crucial role in LPWAN applications.Cisco Systems, Inc.:

Cisco is a major player in networking and cybersecurity solutions, delivering comprehensive IoT solutions that integrate LPWAN technologies to enhance connectivity.Telefónica S.A.:

As a global telecommunications leader, Telefónica has invested substantially in LPWAN technologies to facilitate IoT services across urban and rural landscapes.Sigfox:

Sigfox is a pioneer in providing dedicated IoT connectivity solutions based on LPWAN technology, helping industries deploy low-power, wide-area connectivity.Huawei :

Huawei is a leading global information and communications technology (ICT) solutions provider, actively advancing LPWAN as part of its IoT strategy.We're grateful to work with incredible clients.

FAQs

What is the market size of low Power Wide Area Network?

The global Low Power Wide Area Network (LPWAN) market is sized at approximately $5.4 billion in 2023, with a projected compound annual growth rate (CAGR) of 15.2% over the next decade.

What are the key market players or companies in this low Power Wide Area Network industry?

Key players in the LPWAN market include Semtech Corporation, LoRa Alliance, Sigfox, and Ingenu, among others. These companies are pivotal in developing innovative solutions and advancing LPWAN technology.

What are the primary factors driving the growth in the low Power Wide Area Network industry?

The growth of the LPWAN market is driven by the increasing demand for long-range communication, advancements in IoT technology, and the need for cost-effective solutions in various sectors such as agriculture and smart cities.

Which region is the fastest Growing in the low Power Wide Area Network?

The LPWAN market is experiencing rapid growth in Europe, expected to escalate from $1.79 billion in 2023 to $7.86 billion by 2033, followed closely by Asia Pacific and North America.

Does ConsaInsights provide customized market report data for the low Power Wide Area Network industry?

Yes, Consainsights offers customized market reports tailored to specific requirements within the LPWAN industry, providing insights relevant to client needs.

What deliverables can I expect from this low Power Wide Area Network market research project?

Expect detailed reports containing market size, trends, forecasts, and competitive analysis, along with insights on regional and segment-wise performance.

What are the market trends of low Power Wide Area Network?

Current trends include a rise in public and private network segments, with LPWAN technologies dominating market share, indicating a shift towards IoT applications and connectivity solutions.