Lte Base Station System Market Report

Published Date: 31 January 2026 | Report Code: lte-base-station-system

Lte Base Station System Market Size, Share, Industry Trends and Forecast to 2033

This report provides an in-depth analysis of the Lte Base Station System market from 2023 to 2033, including insights on market size, trends, segmentation, regional performance, and key players driving the industry's growth.

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

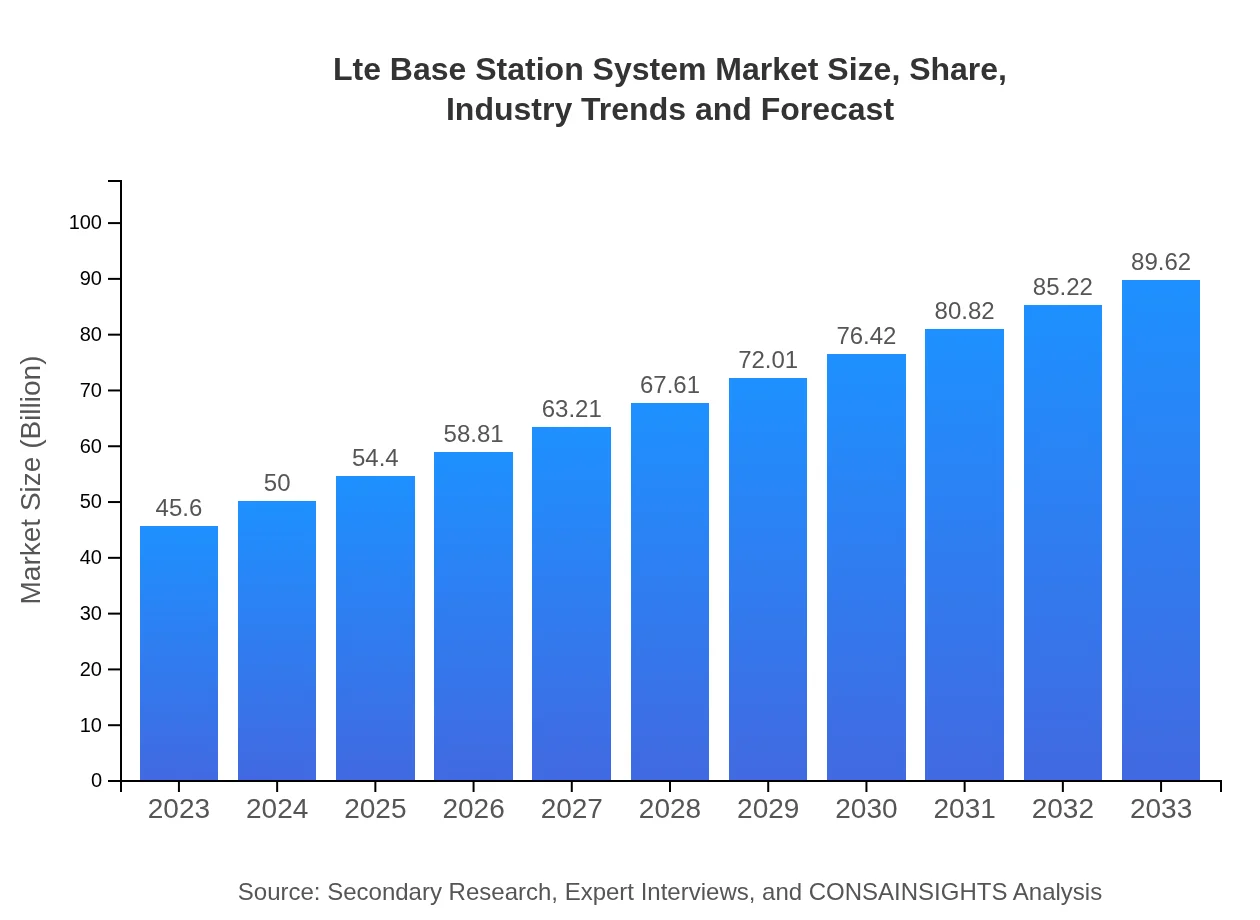

| 2023 Market Size | $45.60 Billion |

| CAGR (2023-2033) | 6.8% |

| 2033 Market Size | $89.62 Billion |

| Top Companies | Ericsson , Huawei Technologies Co., Ltd., Nokia Corporation, Samsung Electronics, ZTE Corporation |

| Last Modified Date | 31 January 2026 |

Lte Base Station System Market Overview

Customize Lte Base Station System Market Report market research report

- ✔ Get in-depth analysis of Lte Base Station System market size, growth, and forecasts.

- ✔ Understand Lte Base Station System's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Lte Base Station System

What is the Market Size & CAGR of the Lte Base Station System market in 2023?

Lte Base Station System Industry Analysis

Lte Base Station System Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Lte Base Station System Market Analysis Report by Region

Europe Lte Base Station System Market Report:

The European Lte Base Station System market is set to increase from $12.20 billion in 2023 to $23.97 billion by 2033. The growth is mainly driven by renewed investments in telecom infrastructure and a push towards innovative network solutions. Regulatory support for 5G and Internet of Things initiatives are also expected to foster this growth.Asia Pacific Lte Base Station System Market Report:

In the Asia Pacific region, the Lte Base Station System market is projected to grow from $8.92 billion in 2023 to $17.53 billion by 2033. Nations like China and India are key contributors due to their massive metropolitan and rural network expansions. The rise of smart cities and digital economies is also propelling growth, making this region a critical market for telecommunications advancements.North America Lte Base Station System Market Report:

North America is anticipated to experience significant growth, with the market size advancing from $15.94 billion in 2023 to $31.33 billion by 2033. The advanced telecommunications infrastructure and rapid 5G rollout in the U.S. are key drivers. Additionally, Canada and Mexico are investing heavily in upgrading legacy systems, thus ensuring robust market expansion.South America Lte Base Station System Market Report:

The South American market is expected to grow from $4.51 billion in 2023 to $8.86 billion by 2033. Factors such as increasing smartphone penetration and government initiatives to enhance digital infrastructure are driving the market. Although challenges like economic instability exist, the long-term outlook remains optimistic.Middle East & Africa Lte Base Station System Market Report:

In the Middle East and Africa, the market is projected to grow from $4.03 billion in 2023 to $7.92 billion by 2033. The deployment of LTE networks to support digital transformation in both urban and remote areas is a primary growth driver. Increasing mobile connectivity demands in the region also facilitate this upward trend.Tell us your focus area and get a customized research report.

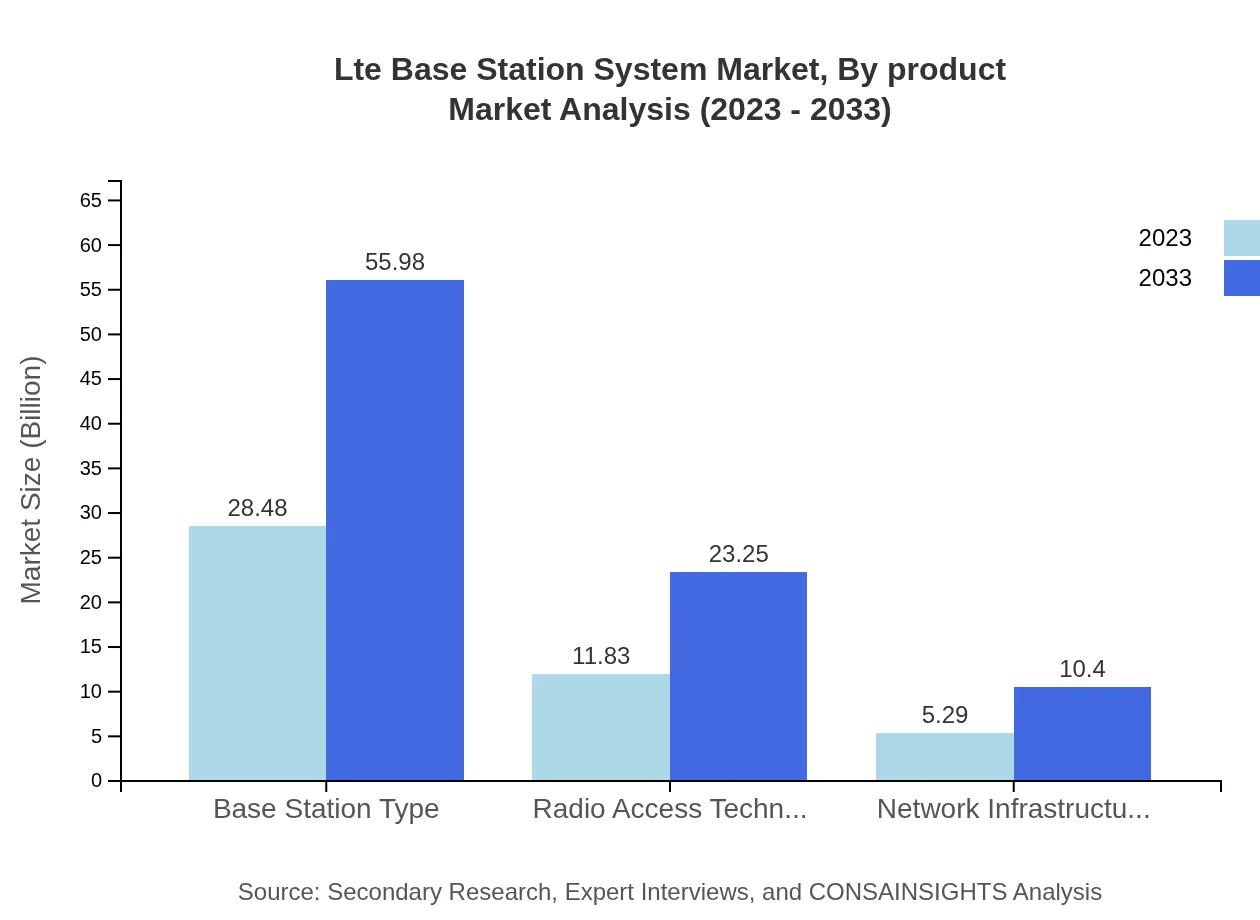

Lte Base Station System Market Analysis By Product

In 2023, the LTE Base Station System market by product is valued at $28.48 billion, expected to reach $55.98 billion by 2033. Base stations for mobile network operators dominate this segment, indicating a robust demand for network expansion and capacity enhancement.

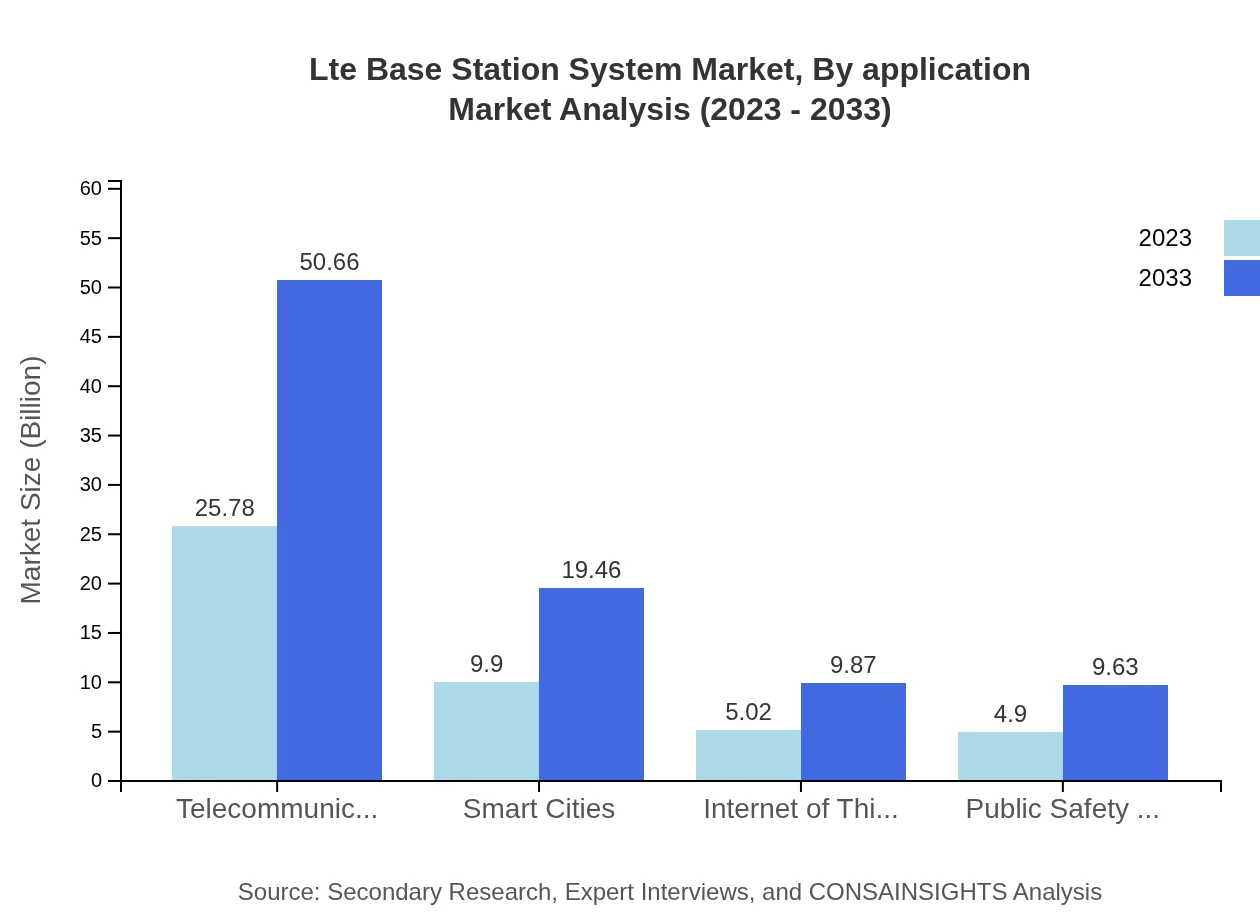

Lte Base Station System Market Analysis By Application

Various applications across telecommunications, government, and smart cities dictate the growth of the LTE Base Station System market. In 2023, telecommunications account for a significant share at $25.78 billion, highlighting its importance as a backbone for data transmission and service delivery.

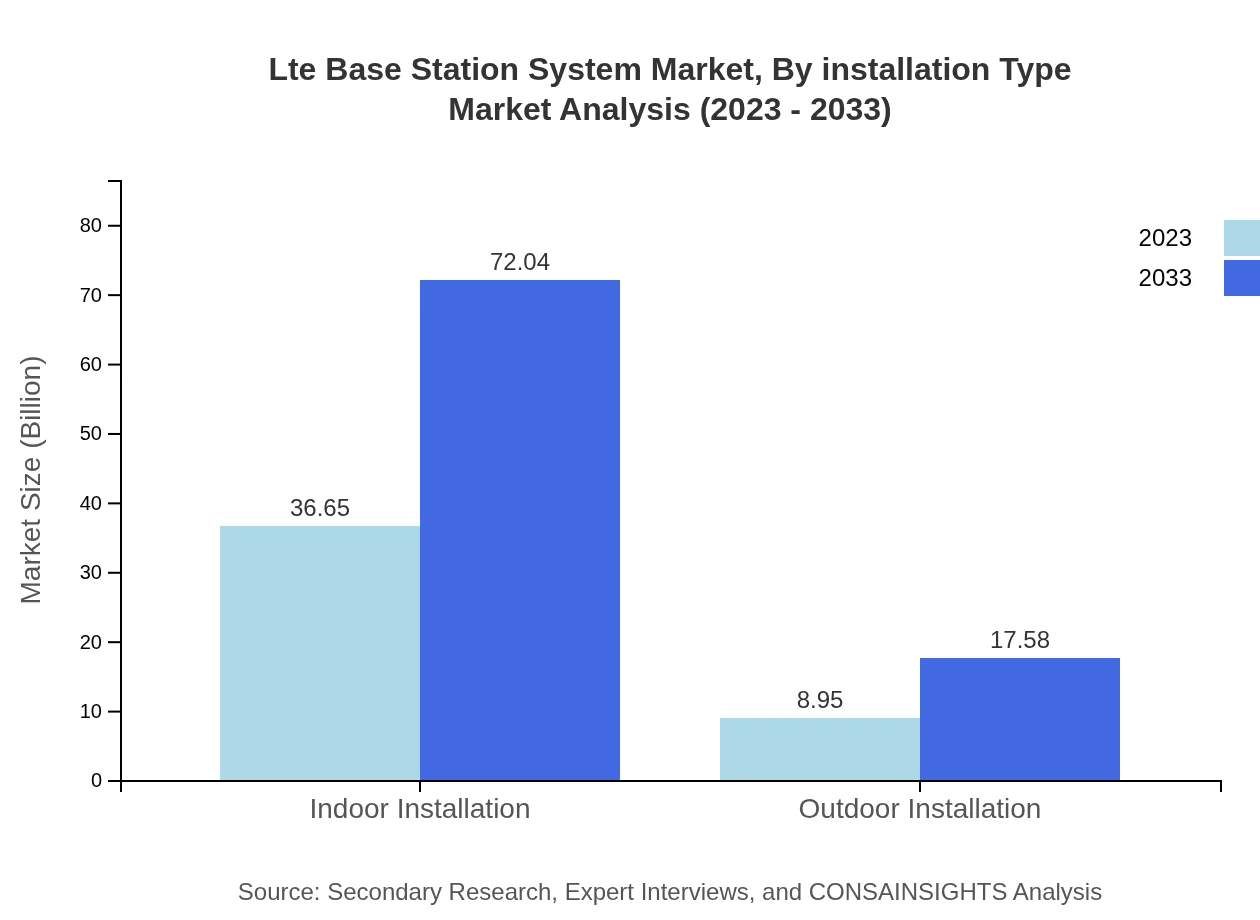

Lte Base Station System Market Analysis By Installation Type

The market is divided between indoor and outdoor installation types. Indoor installations are dominant, valued at $36.65 billion in 2023 with expectations to reach $72.04 billion by 2033. This emphasizes the shift towards enhancing urban connectivity and smart building solutions.

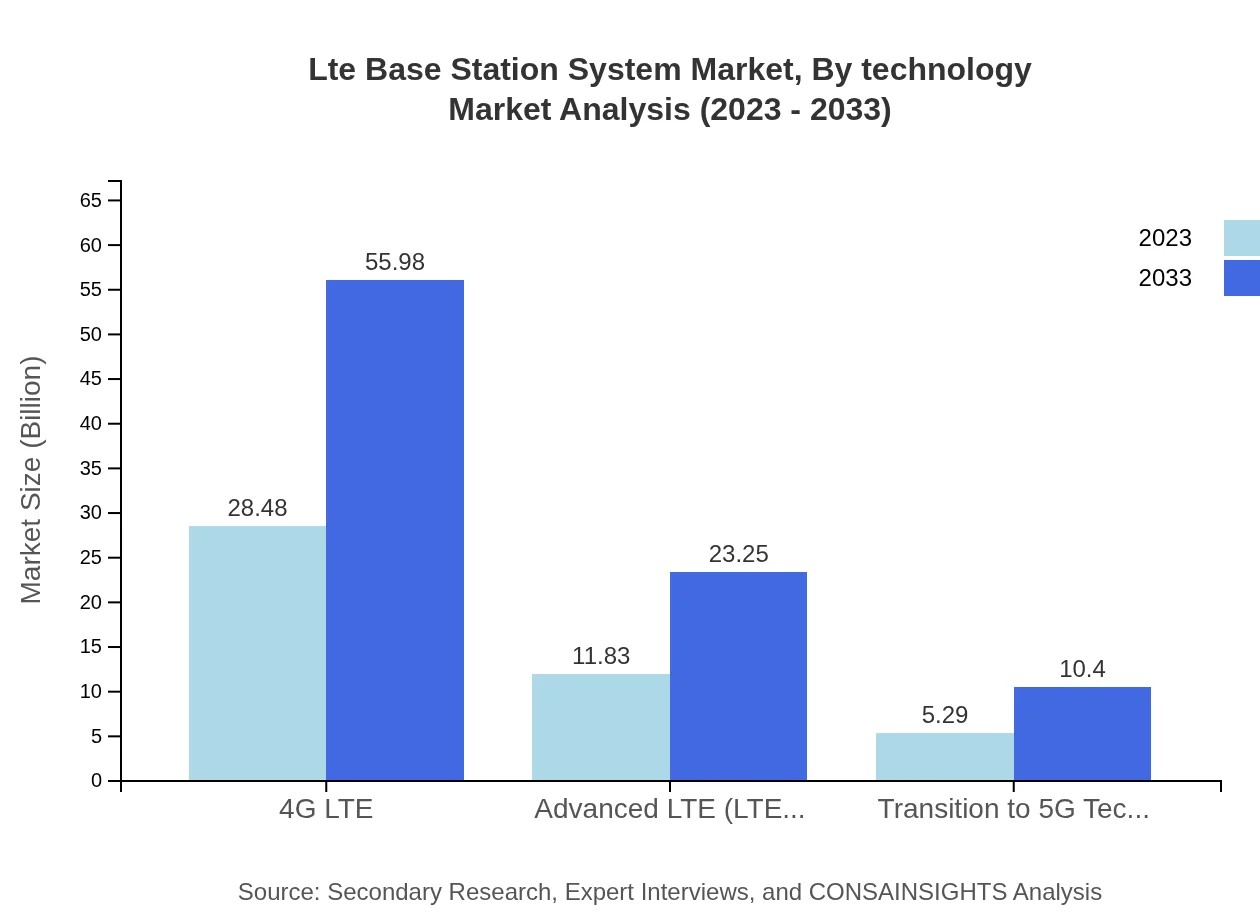

Lte Base Station System Market Analysis By Technology

The technological advancements in the industry have led to significant market division between 4G LTE and advanced technologies such as LTE-A. The 4G LTE segment was worth $28.48 billion in 2023, accounting for 62.46% of the market, while advanced LTE technologies account for a promising growth trajectory as upgrades become essential in competitive markets.

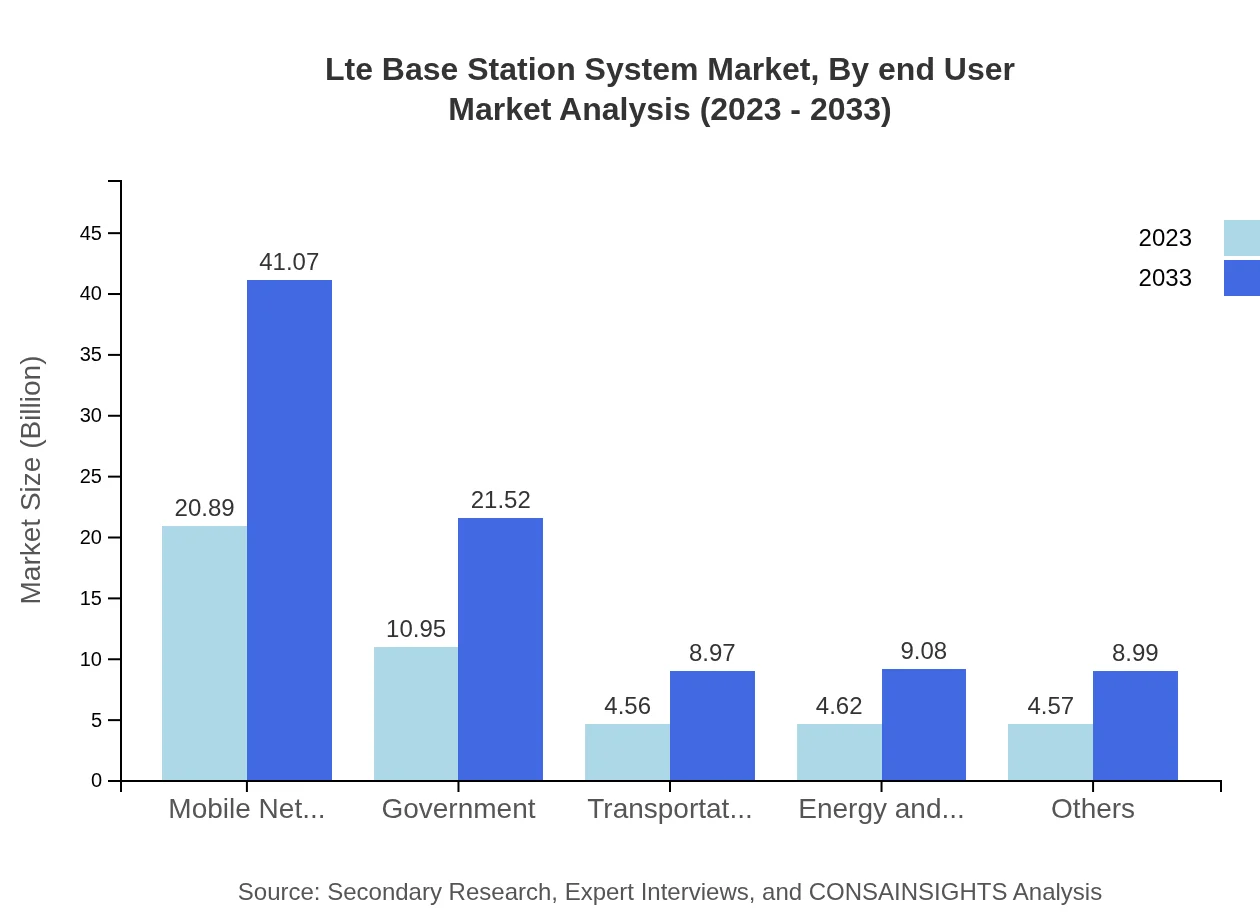

Lte Base Station System Market Analysis By End User

End-users from sectors such as telecommunications, government, and IoT significantly contribute to market dynamics. In 2023, telecommunications represent 56.53% of the market. The rising demand for mobile data, driven by the IoT sector's growth, suggests strong future prospects for the overall market.

Lte Base Station System Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Lte Base Station System Industry

Ericsson :

Ericsson is a global leader in telecommunications equipment and services, renowned for pioneering LTE and 5G network solutions which enhance connectivity worldwide.Huawei Technologies Co., Ltd.:

Huawei is a multinational technology company providing telecommunications equipment and consumer electronics, playing a key role in the deployment of LTE systems globally.Nokia Corporation:

Nokia focuses on telecommunications infrastructure and advanced wireless technologies, actively contributing to LTE deployment and innovation.Samsung Electronics:

Samsung is prominent in the telecommunications sector, actively developing LTE base station technology and expanding its network solutions to meet global demand.ZTE Corporation:

ZTE is a key player in providing telecommunications systems and services, specializing in LTE and 5G solutions that enhance global connectivity.We're grateful to work with incredible clients.

FAQs

What is the market size of lte Base Station System?

The LTE Base Station System market was valued at approximately $45.6 billion in 2023, with a projected growth at a CAGR of 6.8%. By 2033, it is expected to significantly increase, indicating robust expansion in this sector.

What are the key market players or companies in this lte Base Station System industry?

Key players in the LTE Base Station System industry include major telecommunications giants and technology firms. Their contributions span innovations in network infrastructure, and mobile technology, shaping competitive landscapes and advancements in product offerings.

What are the primary factors driving the growth in the lte Base Station System industry?

Growth in the LTE Base Station System industry is primarily driven by increasing data consumption, the expansion of mobile networks, and the demand for high-speed connectivity. Additionally, the transition towards 5G technology is fueling investments and advancements in LTE infrastructure.

Which region is the fastest Growing in the lte Base Station System?

The fastest-growing region for the LTE Base Station System is North America, anticipated to grow from $15.94 billion in 2023 to $31.33 billion by 2033. Rapid tech adoption and a strong telecommunications sector facilitate regional expansion.

Does ConsaInsights provide customized market report data for the lte Base Station System industry?

Yes, ConsaInsights offers customized market report data tailored to specific needs within the LTE Base Station System industry. Clients can request detailed analyses focusing on unique market segments and regional dynamics.

What deliverables can I expect from this lte Base Station System market research project?

Deliverables from the LTE Base Station System market research project typically include comprehensive reports with data analysis, segment insights, key player profiles, forecasts, and strategic recommendations, delivering a robust understanding of the market landscape.

What are the market trends of lte Base Station System?

Current trends in the LTE Base Station System market include increased deployment of small cells, the shift towards 5G infrastructure, and the growing emphasis on IoT connectivity. These trends are reshaping investment priorities and technological advancements.