Machine Vision Camera Market Report

Published Date: 22 January 2026 | Report Code: machine-vision-camera

Machine Vision Camera Market Size, Share, Industry Trends and Forecast to 2033

This report provides an in-depth analysis of the Machine Vision Camera market, covering current trends, market size, and growth forecasts from 2023 to 2033. It includes insights into regional performance, technological advancements, and key market players.

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

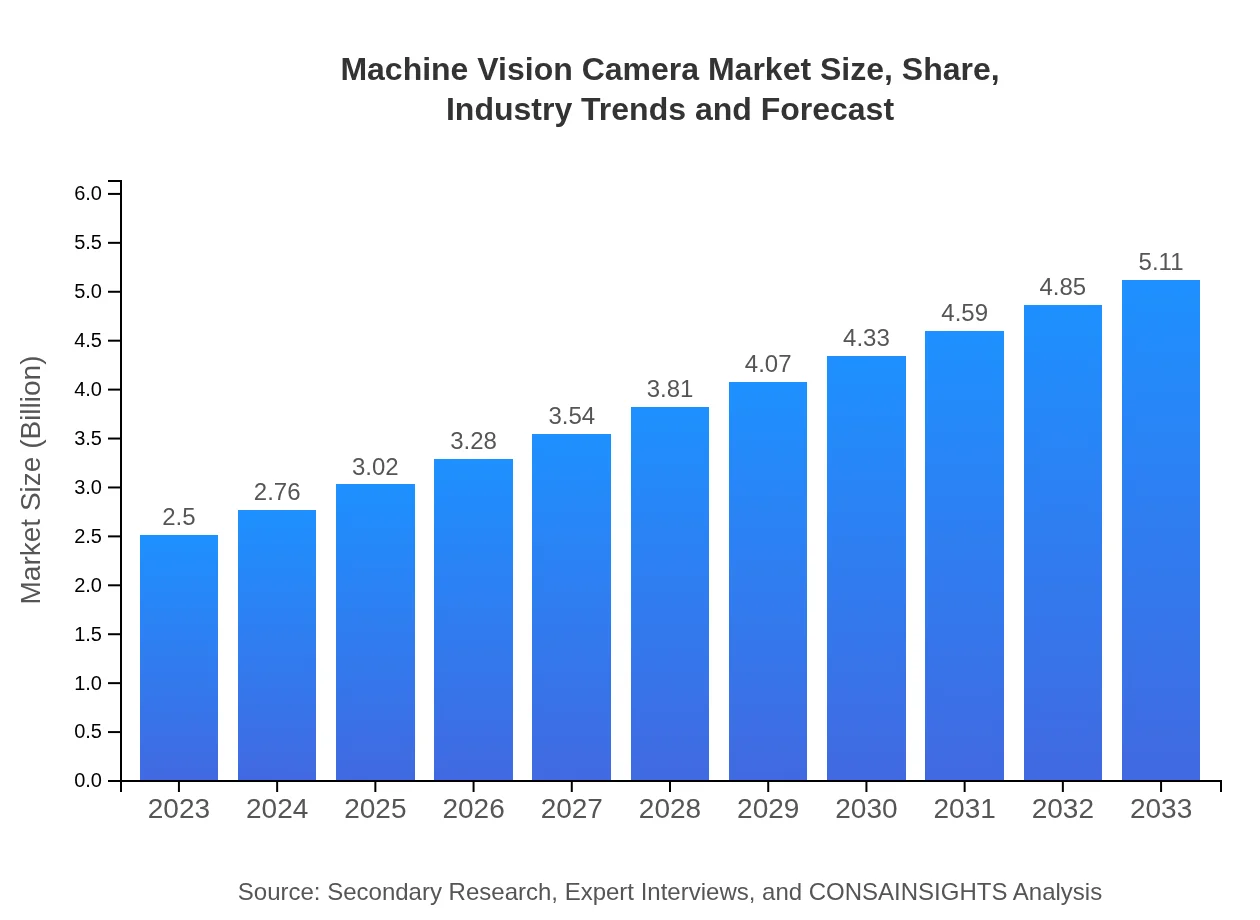

| 2023 Market Size | $2.50 Billion |

| CAGR (2023-2033) | 7.2% |

| 2033 Market Size | $5.11 Billion |

| Top Companies | Cognex Corporation, Basler AG, Teledyne Technologies, Omron Corporation, Keyence Corporation |

| Last Modified Date | 22 January 2026 |

Machine Vision Camera Market Overview

Customize Machine Vision Camera Market Report market research report

- ✔ Get in-depth analysis of Machine Vision Camera market size, growth, and forecasts.

- ✔ Understand Machine Vision Camera's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Machine Vision Camera

What is the Market Size & CAGR of Machine Vision Camera market in 2023?

Machine Vision Camera Industry Analysis

Machine Vision Camera Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Machine Vision Camera Market Analysis Report by Region

Europe Machine Vision Camera Market Report:

Europe's market is projected to expand from $0.76 billion to $1.54 billion during the same period. Strong regulatory frameworks favoring quality control and safety in manufacturing significantly boost demand for machine vision solutions across various industries.Asia Pacific Machine Vision Camera Market Report:

In the Asia Pacific region, the Machine Vision Camera market is projected to grow from $0.55 billion in 2023 to $1.12 billion by 2033. The region is witnessing increased investments in manufacturing technology and automation, particularly in countries like China and Japan, which are major players in electronics and automotive sectors.North America Machine Vision Camera Market Report:

North America remains a stronghold for the Machine Vision Camera market, moving from $0.82 billion in 2023 to an anticipated $1.67 billion in 2033. This growth is attributed to technological innovations and the presence of numerous key players actively driving advancements in industrial automation.South America Machine Vision Camera Market Report:

South America is expected to see modest growth, with the market size increasing from $0.08 billion in 2023 to $0.16 billion by 2033. The growth is primarily driven by improvements in local manufacturing capabilities and the gradual adoption of automation processes in industries like food and beverage.Middle East & Africa Machine Vision Camera Market Report:

In the Middle East and Africa, the market is expected to grow from $0.30 billion in 2023 to $0.61 billion by 2033, driven by increasing interests in automation and advanced manufacturing technologies in industries like oil and gas, as well as food safety.Tell us your focus area and get a customized research report.

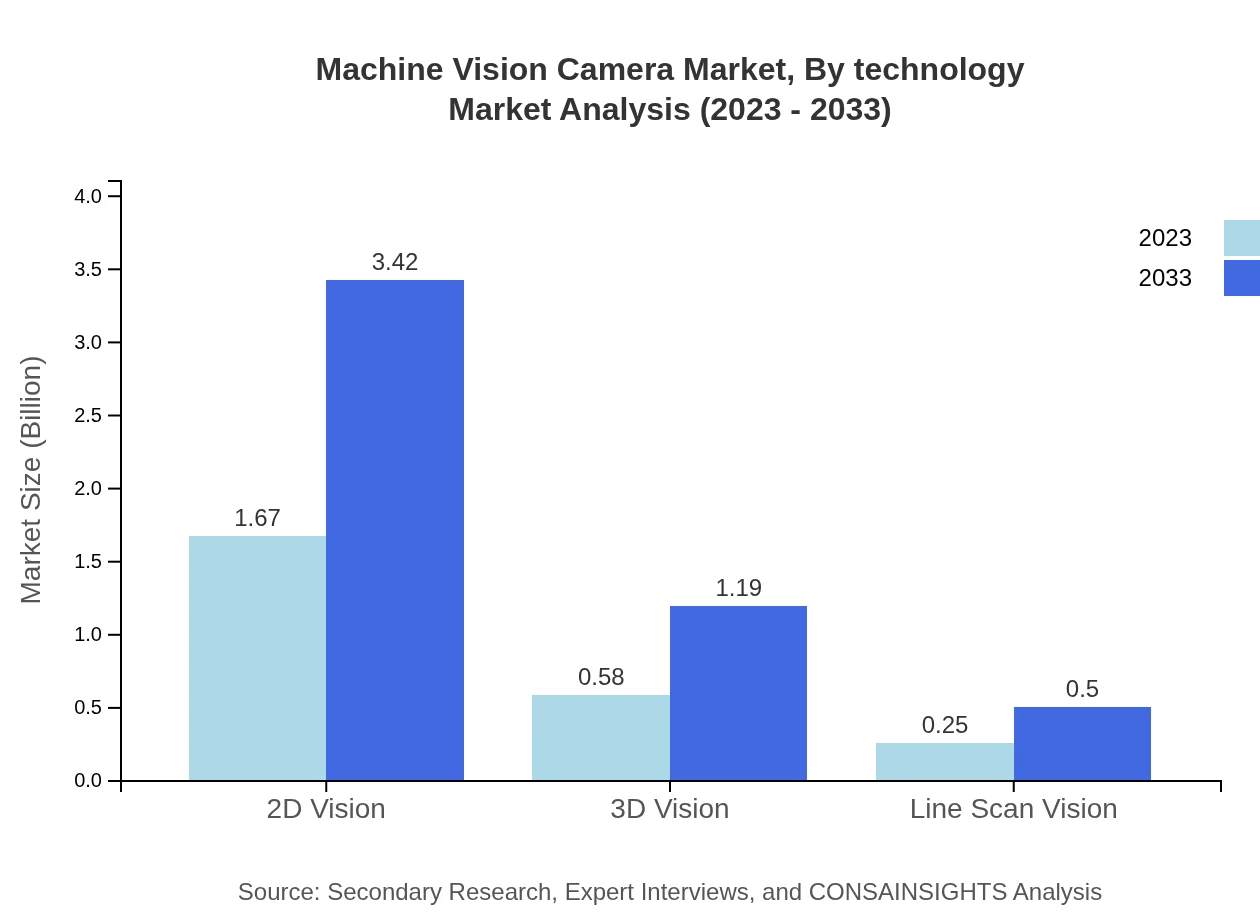

Machine Vision Camera Market Analysis By Technology

In 2023, the hardware segment dominates the market, standing at $1.67 billion, and maintaining a steady share of 66.86%. The 2D vision technology also takes a substantial market share, valued at $1.67 billion. The 3D vision segment is projected to grow from $0.58 billion to $1.19 billion, capturing a share of 23.29%, while line scan vision shows considerable potential with a market size of $0.25 billion.

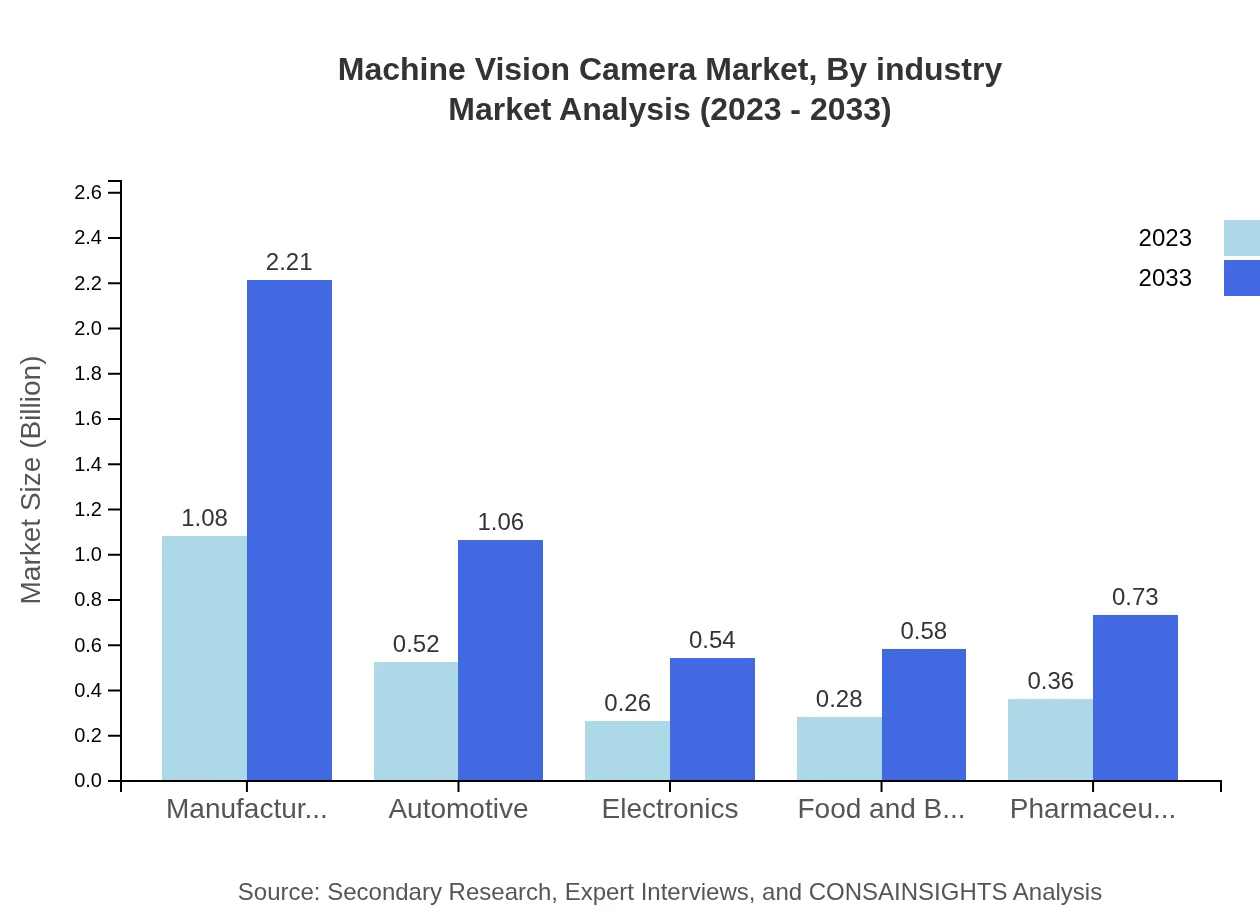

Machine Vision Camera Market Analysis By Industry

The manufacturing sector has a significant market presence, growing from $1.08 billion in 2023 to $2.21 billion by 2033, while automotive sector growth is remarkable, moving from $0.52 billion to $1.06 billion. The electronics market shows steady growth from $0.26 billion to $0.54 billion. The pharmaceutical and food & beverage industries also represent crucial segments, reflecting their growing adoption of machine vision for quality and compliance.

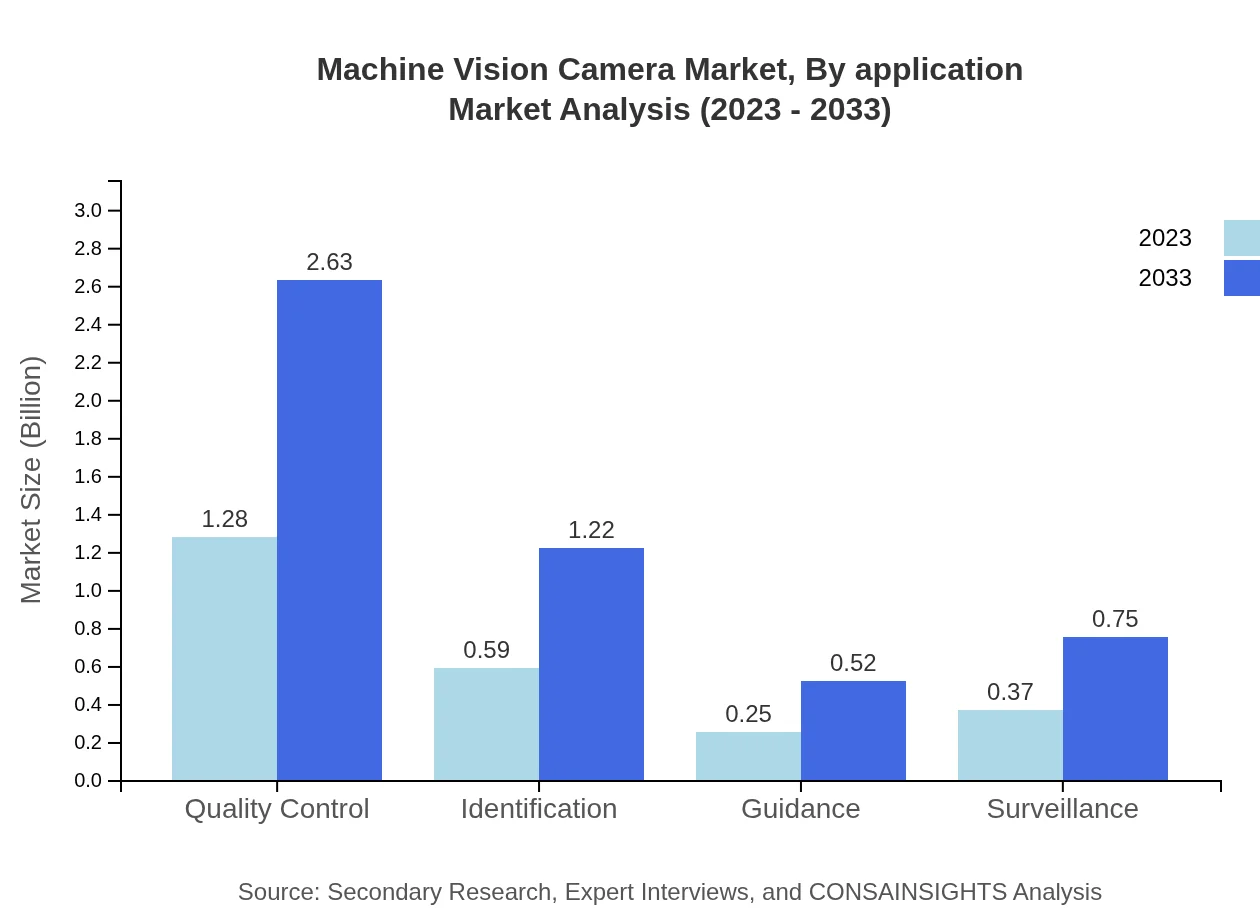

Machine Vision Camera Market Analysis By Application

Quality control applications are poised to capture the largest share of the market, with value projected at $1.28 billion in 2023 and reaching $2.63 billion by 2033. Identification applications will hold a market size of $0.59 billion, with expected growth driven by increased automation in production processes, while guidance applications anticipate growth from $0.25 billion to $0.52 billion.

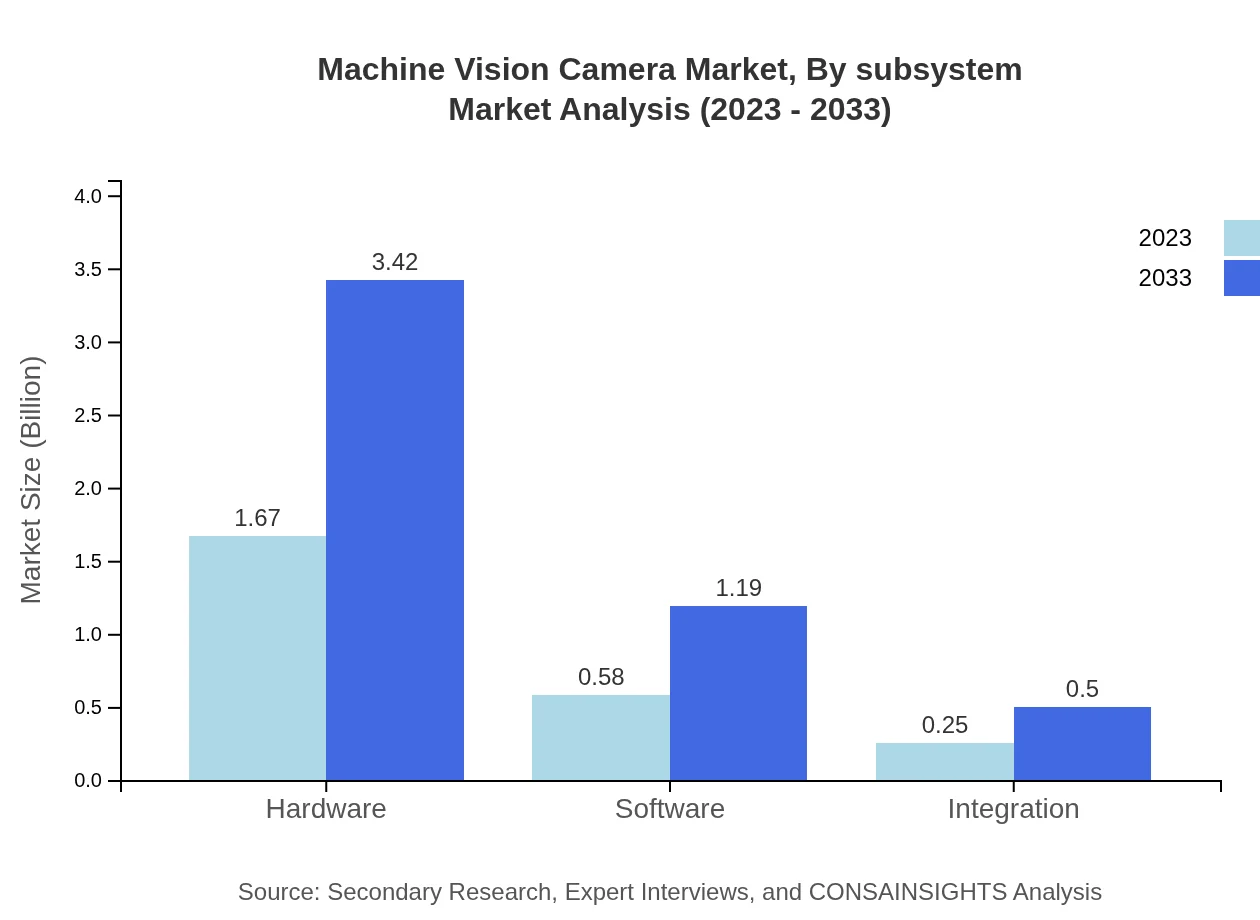

Machine Vision Camera Market Analysis By Subsystem

The integration subsystem will maintain notable importance, with a size forecast of $0.25 billion in 2023 to $0.50 billion by 2033. Hardware continues to command the largest portion at $1.67 billion, demonstrating its critical role in successful machine vision implementations.

Machine Vision Camera Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Machine Vision Camera Industry

Cognex Corporation:

A pioneer in machine vision technology, Cognex provides a wide range of imaging and machine vision systems to enhance productivity and quality in manufacturing environments.Basler AG:

Basler AG is renowned for its high-performance cameras and imaging software that cater to diverse applications in industrial automation and process control.Teledyne Technologies:

Teledyne Technologies specializes in advanced imaging sensors and delivery of comprehensive machine vision solutions for various industrial applications.Omron Corporation:

A leader in factory automation, Omron offers integrated machine vision systems designed to boost operational efficiency and minimize defects in manufacturing.Keyence Corporation:

Keyence designs and manufactures cutting-edge sensors and vision systems, significantly contributing to the automation and quality assurance in different industries.We're grateful to work with incredible clients.

FAQs

What is the market size of machine Vision Camera?

The machine vision camera market is valued at $2.5 billion in 2023, with a projected CAGR of 7.2% through 2033, indicating robust growth as technology advances and applications expand across various sectors.

What are the key market players or companies in the machine Vision Camera industry?

Prominent players in the machine vision camera market include Cognex Corporation, Basler AG, Teledyne Technologies, Keyence Corporation, and Omron Corporation, all contributing to innovative technologies and solutions that drive market dynamics.

What are the primary factors driving the growth in the machine Vision Camera industry?

Key growth factors for the machine vision camera market include increased automation in manufacturing, the demand for quality control in production processes, and advancements in imaging technologies that enhance performance and reliability.

Which region is the fastest Growing in the machine Vision Camera market?

Asia Pacific is the fastest-growing region in the machine vision camera market, expected to grow from $0.55 billion in 2023 to $1.12 billion by 2033, driven by rising industrial automation and technological adoption.

Does ConsaInsights provide customized market report data for the machine Vision Camera industry?

Yes, ConsaInsights offers customized market reports tailored to the specific needs and interests of clients, allowing for in-depth analysis and insights into the machine vision camera industry.

What deliverables can I expect from this machine Vision Camera market research project?

Deliverables from the machine vision camera market research include comprehensive market analysis reports, regional insights, competitive landscape assessments, and detailed forecasts segmented by application and technology.

What are the market trends of machine Vision Camera?

Current trends in the machine vision camera market include a shift towards 3D vision technology, increased integration of AI for image processing, and heightened focus on quality control and automation in various industries.