Magnetic Card Market Report

Published Date: 31 January 2026 | Report Code: magnetic-card

Magnetic Card Market Size, Share, Industry Trends and Forecast to 2033

This report provides an in-depth analysis of the Magnetic Card market, covering insights into market trends, segmentation, and forecasts from 2023 to 2033. Key data on market sizes, regional insights, competitive landscape, and technological advancements are included.

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

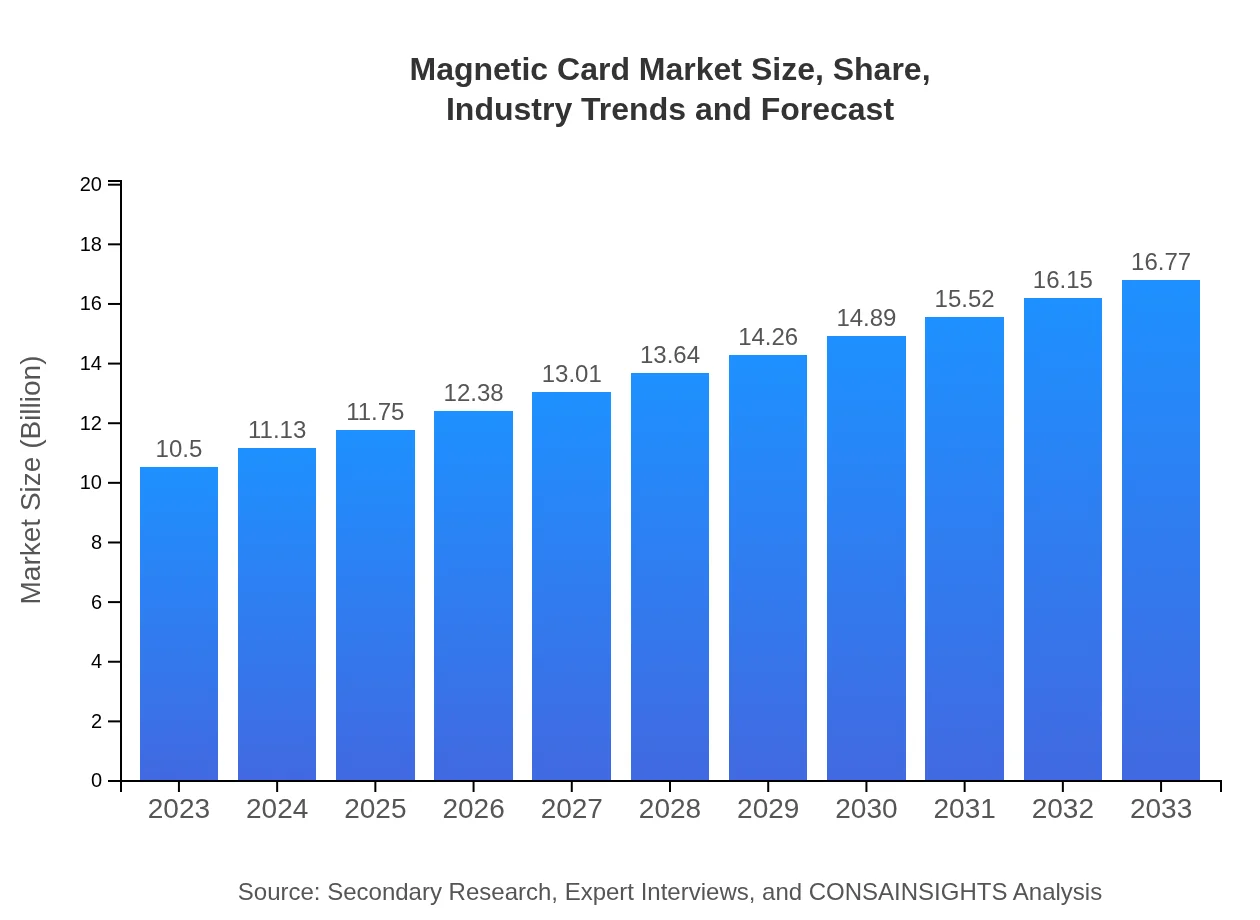

| 2023 Market Size | $10.50 Billion |

| CAGR (2023-2033) | 4.7% |

| 2033 Market Size | $16.77 Billion |

| Top Companies | Gemalto, IDEMIA, Visa Inc., MasterCard, Atos |

| Last Modified Date | 31 January 2026 |

Magnetic Card Market Overview

Customize Magnetic Card Market Report market research report

- ✔ Get in-depth analysis of Magnetic Card market size, growth, and forecasts.

- ✔ Understand Magnetic Card's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Magnetic Card

What is the Market Size & CAGR of Magnetic Card market in 2023?

Magnetic Card Industry Analysis

Magnetic Card Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Magnetic Card Market Analysis Report by Region

Europe Magnetic Card Market Report:

In Europe, the market is set to grow from $2.99 billion in 2023 to $4.77 billion in 2033, driven by stringent regulations on transaction security and the adoption of innovative payment solutions. Countries like Germany and France lead in the deployment of contactless technology.Asia Pacific Magnetic Card Market Report:

The Asia Pacific region, projected to grow from $2.10 billion in 2023 to $3.35 billion in 2033, is witnessing significant growth due to increasing urbanization and a surge in digital payment solutions. Countries like India and China are at the forefront, promoting cashless transactions and financial inclusion initiatives.North America Magnetic Card Market Report:

North America remains the largest market for Magnetic Cards, increasing from $3.48 billion in 2023 to $5.55 billion in 2033. The region benefits from high consumer spending power and the prevalence of advanced payment technologies, such as mobile wallets and contactless card payments.South America Magnetic Card Market Report:

In South America, the Magnetic Card market is anticipated to expand from $0.83 billion in 2023 to $1.32 billion in 2033. Factors such as rising e-commerce activities and financial technology advancements are propelling market growth, particularly in Brazil and Argentina.Middle East & Africa Magnetic Card Market Report:

The Middle East and Africa magnetic card market is expected to increase from $1.11 billion in 2023 to $1.78 billion in 2033. The growth is driven by a focus on enhancing cybersecurity measures and expanding payment processing capabilities in emerging markets.Tell us your focus area and get a customized research report.

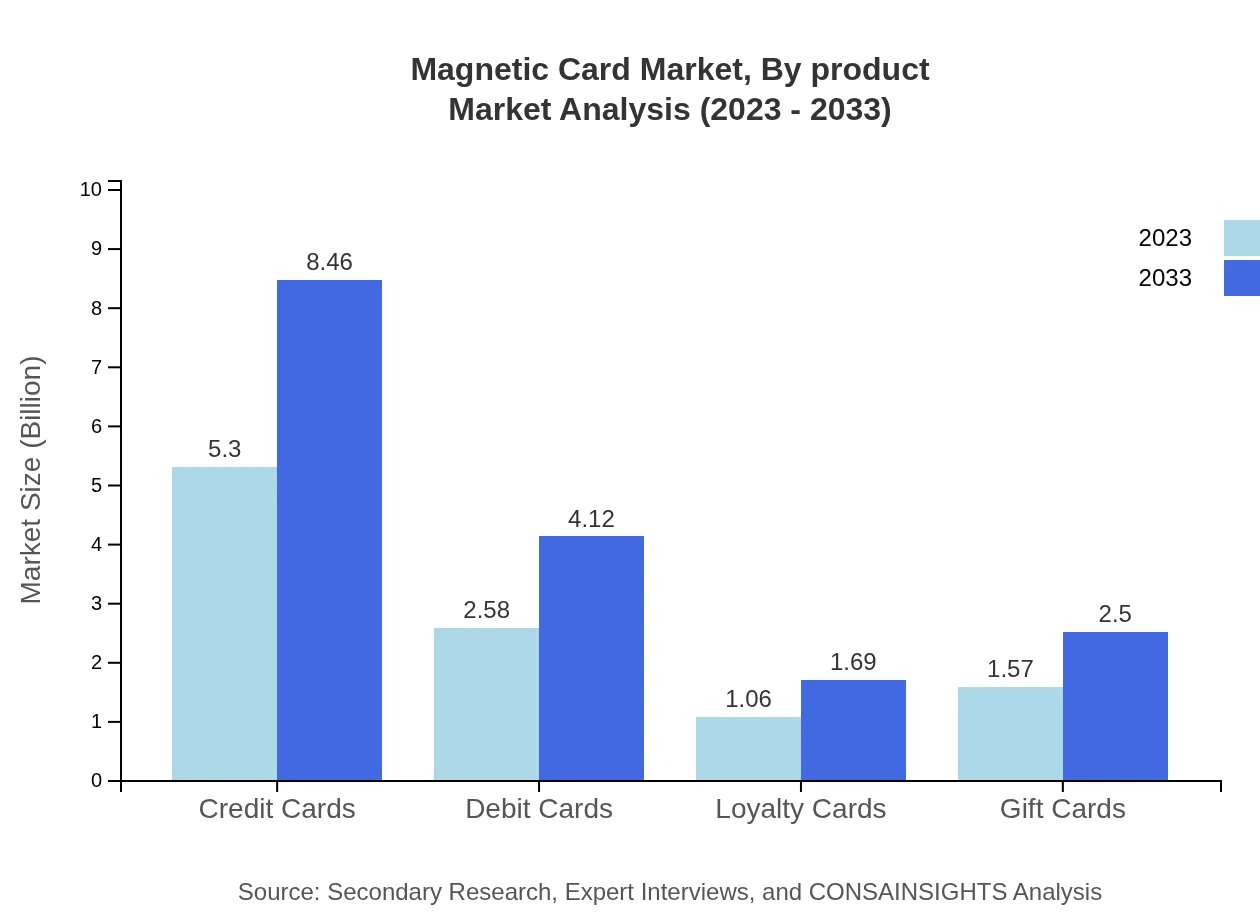

Magnetic Card Market Analysis By Product

The Magnetic Card market is dominated by credit cards, accounting for a size of $5.30 billion in 2023 and expected to reach $8.46 billion by 2033, holding a market share of 50.44%. Debit cards follow with a size of $2.58 billion in 2023 and a forecasted size of $4.12 billion by 2033 (24.58% share). Loyalty and gift cards also play significant roles, with sizes of $1.06 billion and $1.57 billion respectively in 2023, expected to grow to $1.69 billion and $2.50 billion by 2033.

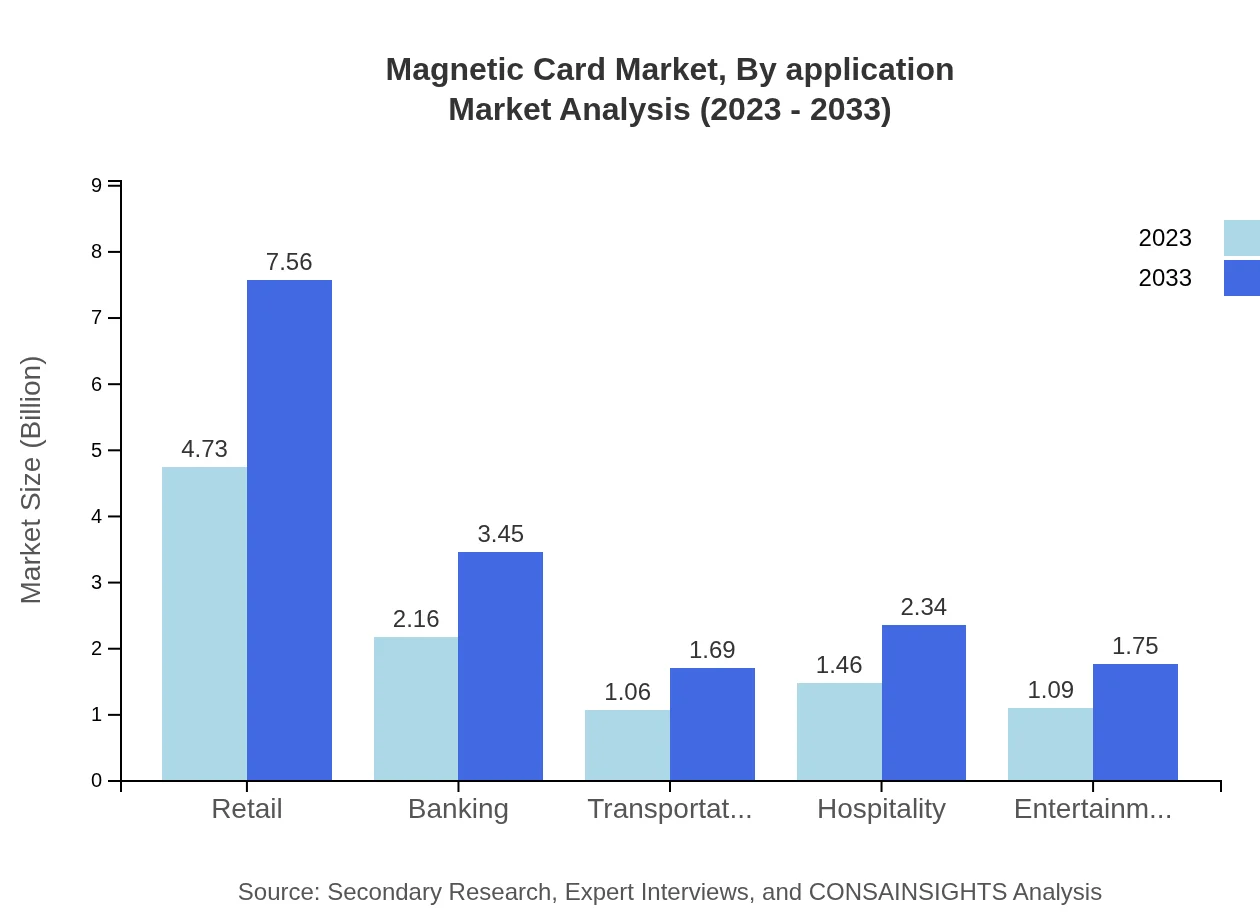

Magnetic Card Market Analysis By Application

Applications of Magnetic Cards span across retail, banking, entertainment, transportation, and hospitality sectors. The retail application leads with a size of $4.73 billion in 2023, projected to grow to $7.56 billion by 2033, maintaining a 45.06% share. Banking follows with a size of $2.16 billion in 2023, and expected growth to $3.45 billion by 2033 (20.55% share). Other applications such as transportation are expected to grow significantly due to increased mobility and transit card adoption.

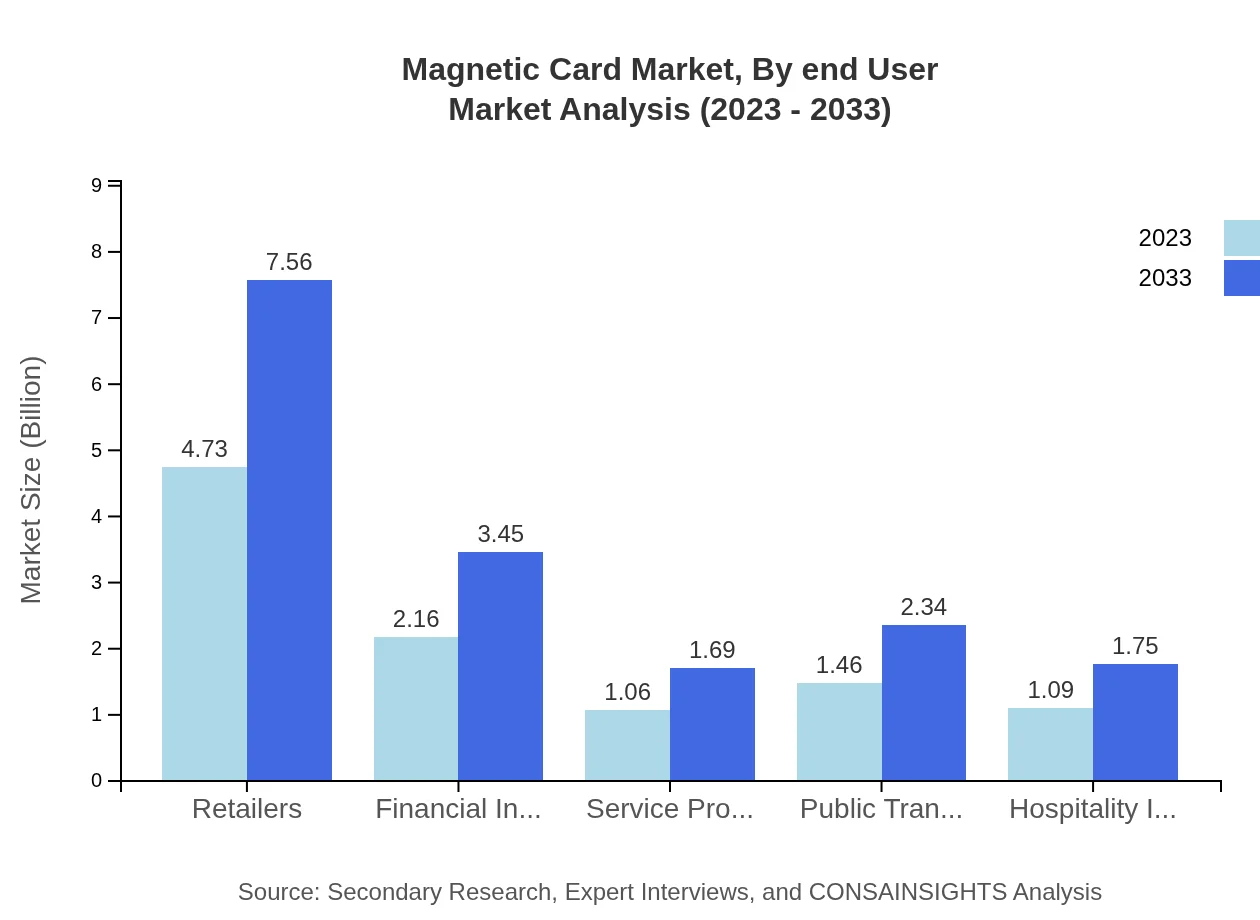

Magnetic Card Market Analysis By End User

End-user industries including financial institutions, service providers, public transport operators, and the hospitality sector play crucial roles in driving demand for magnetic cards. Financial institutions' market size stands at $2.16 billion in 2023, projected to grow to $3.45 billion by 2033, a 20.55% market share. Service providers and transport operators are also crucial, with anticipated growth spurred by new technologies and user demands for seamless payment solutions.

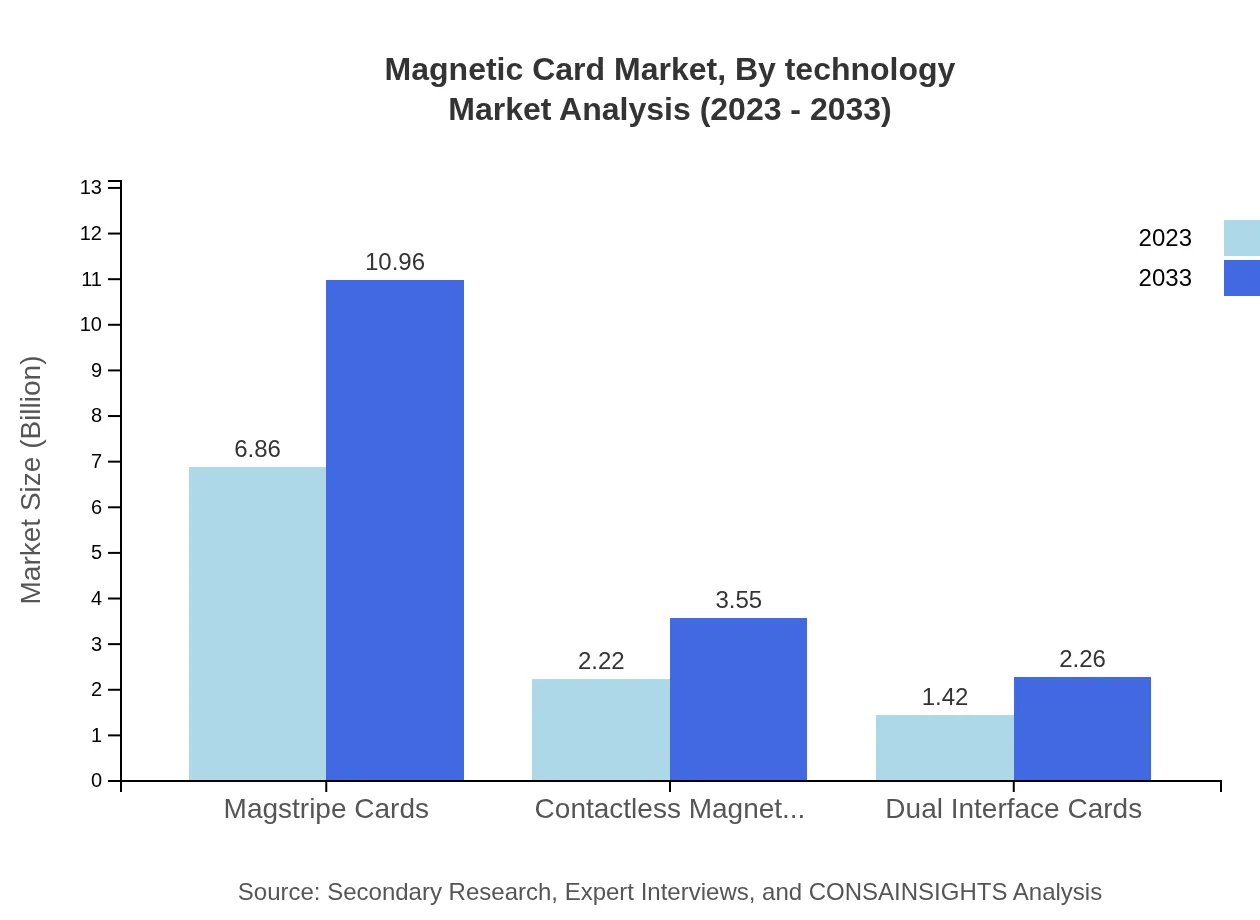

Magnetic Card Market Analysis By Technology

Technology segments such as magstripe cards, contactless magnetic cards, and dual interface cards illustrate the diverse landscape of magnetic cards. Magstripe cards lead with a size of $6.86 billion in 2023 and a forecast of $10.96 billion by 2033, holding a 65.34% share. Contactless magnetic cards are fostering rapid growth, with revenues projected to increase from $2.22 billion in 2023 to $3.55 billion by 2033 (21.18% share). The advancement and adoption of dual interface cards also emerge as a significant trend, catering to modern consumer preferences.

Magnetic Card Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Magnetic Card Industry

Gemalto:

Gemalto is a global leader in digital security, widely recognized for its innovation in smart card and mobile solutions.IDEMIA:

IDEMIA specializes in augmented identity solutions for an increasingly digital world, providing comprehensive card solutions to various sectors.Visa Inc.:

Visa Inc. is a leading payments technology company, enabling secure transactions globally through innovative products and services.MasterCard:

MasterCard offers a range of payment solutions, facilitating secure, cashless transactions through magnetic cards backed by robust security measures.Atos:

Atos is a global leader in digital transformation, offering various solutions in secure transaction processing and card services.We're grateful to work with incredible clients.

FAQs

What is the market size of magnetic Card?

The global magnetic card market is valued at approximately $10.5 billion in 2023, with a projected CAGR of 4.7%. By 2033, the market is expected to reach significant growth, enhancing its relevance in various sectors.

What are the key market players or companies in this magnetic Card industry?

Prominent players in the magnetic card industry include major financial institutions and technology firms. These companies are continuously innovating to improve security features and enhance user experiences through advancements in card technology.

What are the primary factors driving the growth in the magnetic Card industry?

Key drivers of growth in the magnetic card industry are rising consumer demand for contactless payment options, the expansion of e-commerce, and technological advancements in card manufacturing. Additionally, increasing adoption in various sectors contributes significantly to market expansion.

Which region is the fastest Growing in the magnetic Card market?

The fastest-growing region in the magnetic card market is North America, projected to expand from $3.48 billion in 2023 to $5.55 billion by 2033. This growth is fueled by technological advancements and increasing consumer adoption of digital payment solutions.

Does ConsaInsights provide customized market report data for the magnetic Card industry?

Yes, ConsaInsights offers customized market report data tailored to specific needs in the magnetic card industry. Clients can request in-depth analysis and insights focusing on specific segments, geographies, or market trends.

What deliverables can I expect from this magnetic Card market research project?

From the magnetic card market research project, you can expect comprehensive reports including data on market size, growth projections, segment analysis, competitive landscape, regional insights, and strategic recommendations tailored to your business needs.

What are the market trends of magnetic Card?

Current trends in the magnetic card market include the growing demand for contactless cards, increased focus on security and anti-fraud technologies, and the integration of loyalty programs. These trends are shaping the future of magnetic payment solutions.