Man Portable Military Electronics Market Report

Published Date: 03 February 2026 | Report Code: man-portable-military-electronics

Man Portable Military Electronics Market Size, Share, Industry Trends and Forecast to 2033

This report presents a comprehensive analysis of the Man Portable Military Electronics market, covering key insights, market trends, and forecasts from 2023 to 2033. It explores various segments, regional dynamics, and competitive landscapes, aimed at providing stakeholders with strategic information for informed decision-making.

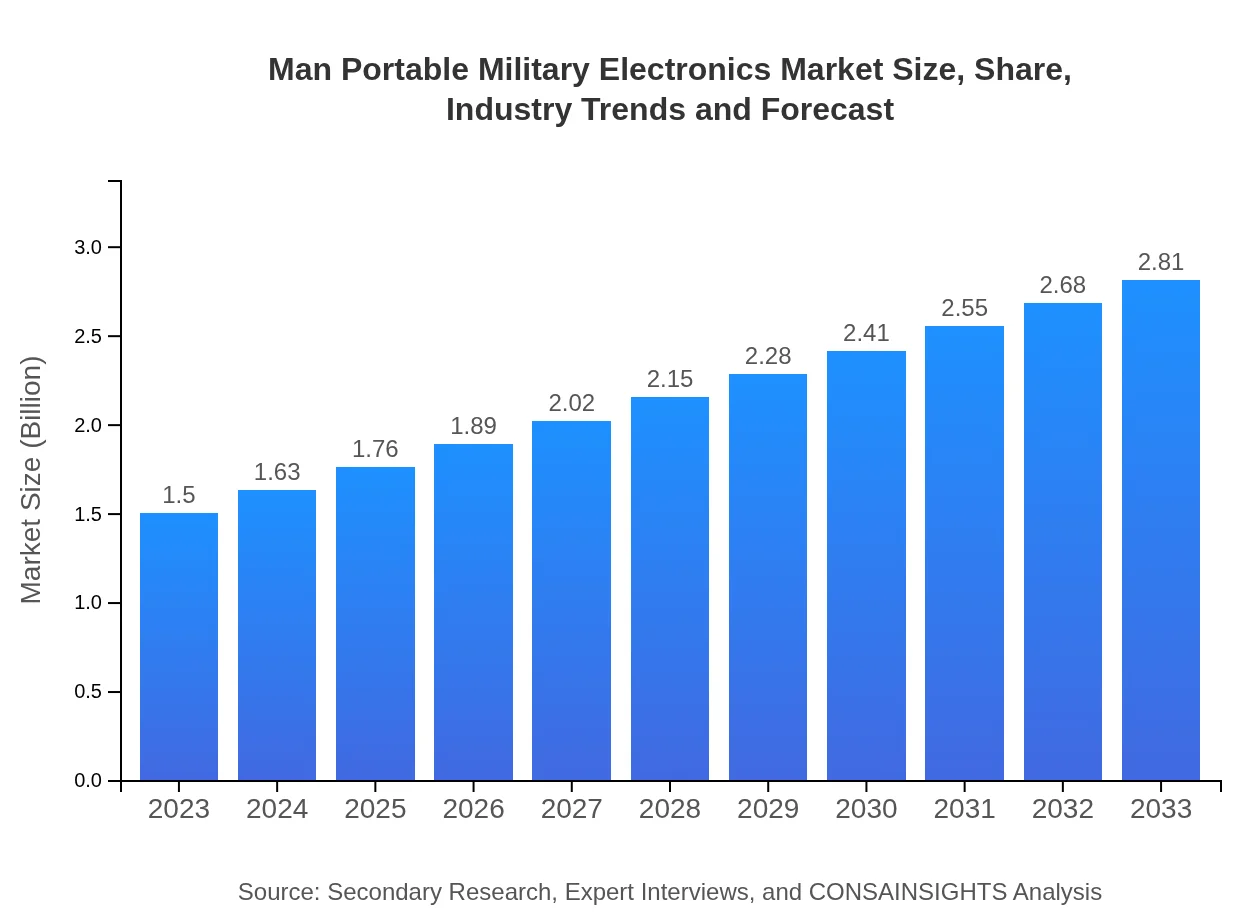

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $1.50 Billion |

| CAGR (2023-2033) | 6.3% |

| 2033 Market Size | $2.81 Billion |

| Top Companies | Thales Group, Harris Corporation, Leonardo S.p.A., General Dynamics, Elbit Systems |

| Last Modified Date | 03 February 2026 |

Man Portable Military Electronics Market Overview

Customize Man Portable Military Electronics Market Report market research report

- ✔ Get in-depth analysis of Man Portable Military Electronics market size, growth, and forecasts.

- ✔ Understand Man Portable Military Electronics's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Man Portable Military Electronics

What is the Market Size & CAGR of Man Portable Military Electronics market in 2023?

Man Portable Military Electronics Industry Analysis

Man Portable Military Electronics Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Man Portable Military Electronics Market Analysis Report by Region

Europe Man Portable Military Electronics Market Report:

Europe's market will grow from $0.45 billion in 2023 to $0.85 billion in 2033. The emphasis on NATO commitments and modernization of European armed forces has led to increased procurement and integration of advanced technologies in military operations.Asia Pacific Man Portable Military Electronics Market Report:

In the Asia Pacific region, the market is projected to grow from $0.32 billion in 2023 to $0.59 billion by 2033, reflecting a strategic focus on enhancing military capabilities among countries like India and China. Regional tensions and the rising importance of defense have spurred demand for advanced man-portable systems.North America Man Portable Military Electronics Market Report:

In North America, the market is anticipated to expand from $0.48 billion in 2023 to $0.90 billion by 2033. The United States maintains a leading position in military innovation and expenditure, leading to substantial investment in man-portable military electronics.South America Man Portable Military Electronics Market Report:

The South American market is expected to increase from $0.13 billion in 2023 to $0.25 billion by 2033. Countries in this region are investing in improving their defense mechanisms and thus are beginning to adopt advanced portable military electronics to stay current with global standards.Middle East & Africa Man Portable Military Electronics Market Report:

The Middle East and Africa region is projected to witness growth from $0.12 billion in 2023 to $0.22 billion by 2033, primarily driven by the need to combat terrorism and regional conflicts, which demands the adoption of advanced military electronics.Tell us your focus area and get a customized research report.

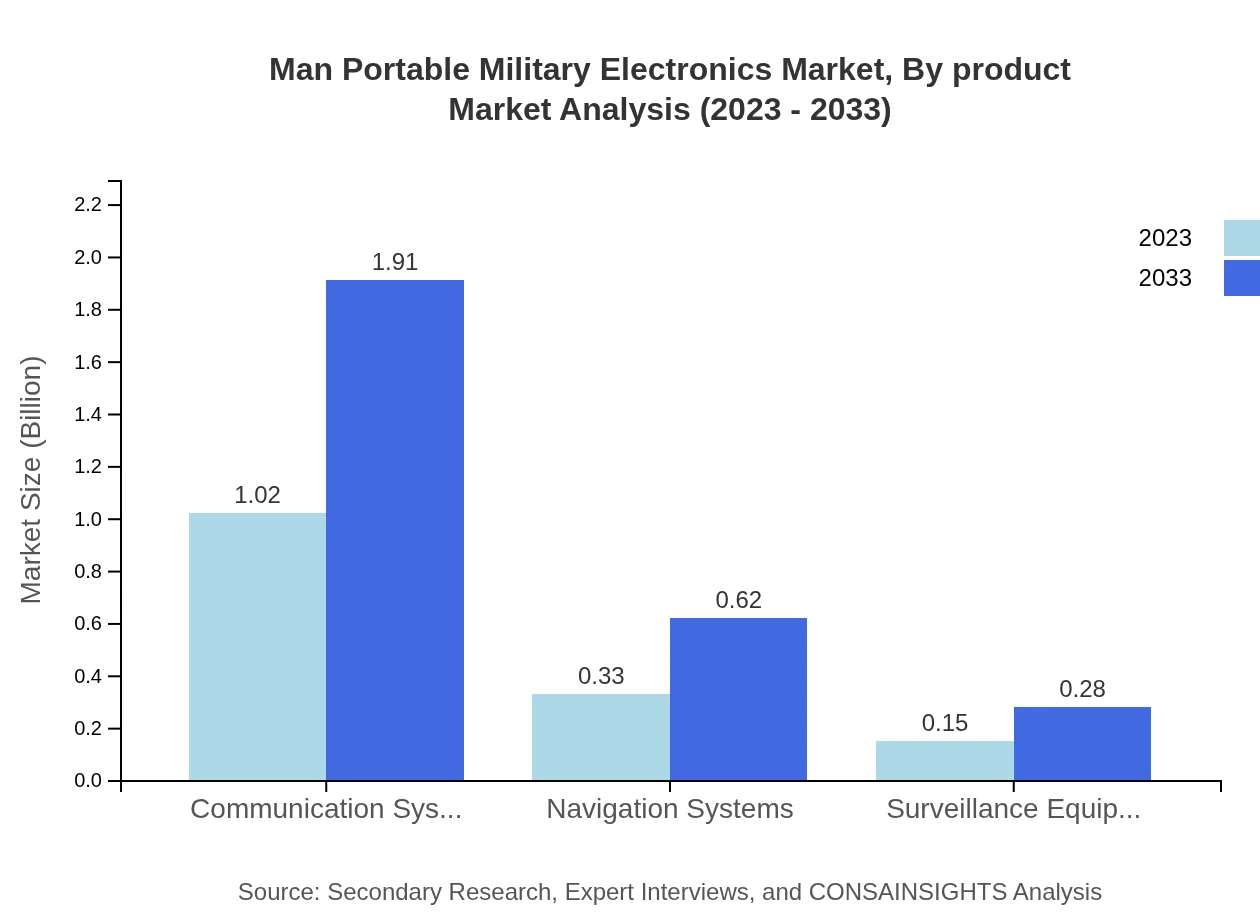

Man Portable Military Electronics Market Analysis By Product

The primary product segments in the market include communication systems, navigation systems, surveillance equipment, and wireless technology. As of 2023, communication systems dominate the market with a size of $1.02 billion, growing to $1.91 billion by 2033. Wireless technology also holds a significant share, reflecting the trend towards wireless communication solutions in military applications.

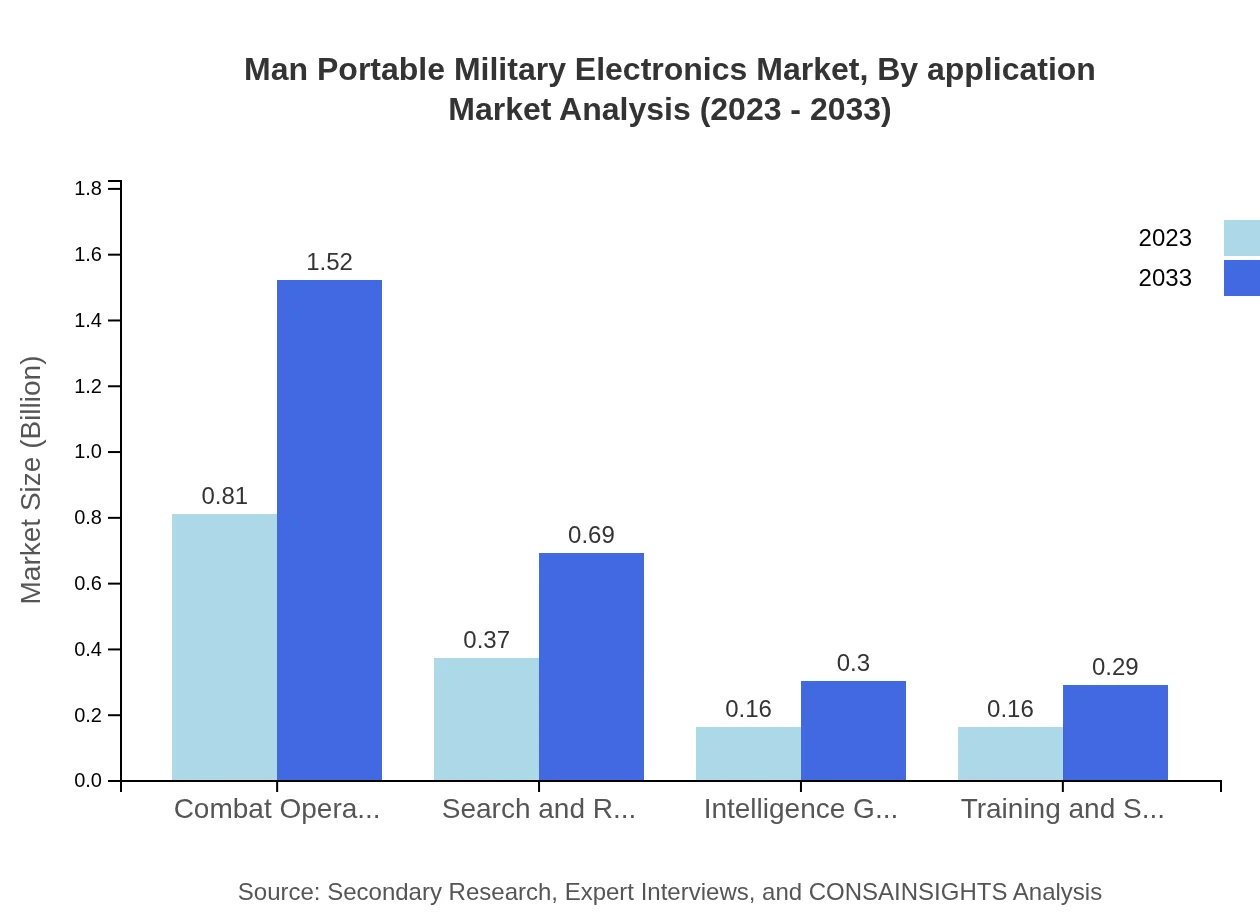

Man Portable Military Electronics Market Analysis By Application

Key applications for man-portable military electronics include combat operations, search and rescue operations, intelligence gathering, and training simulations. Each segment showcases robust growth, with combat operations leading with a market size of $0.81 billion in 2023 expanding to $1.52 billion by 2033.

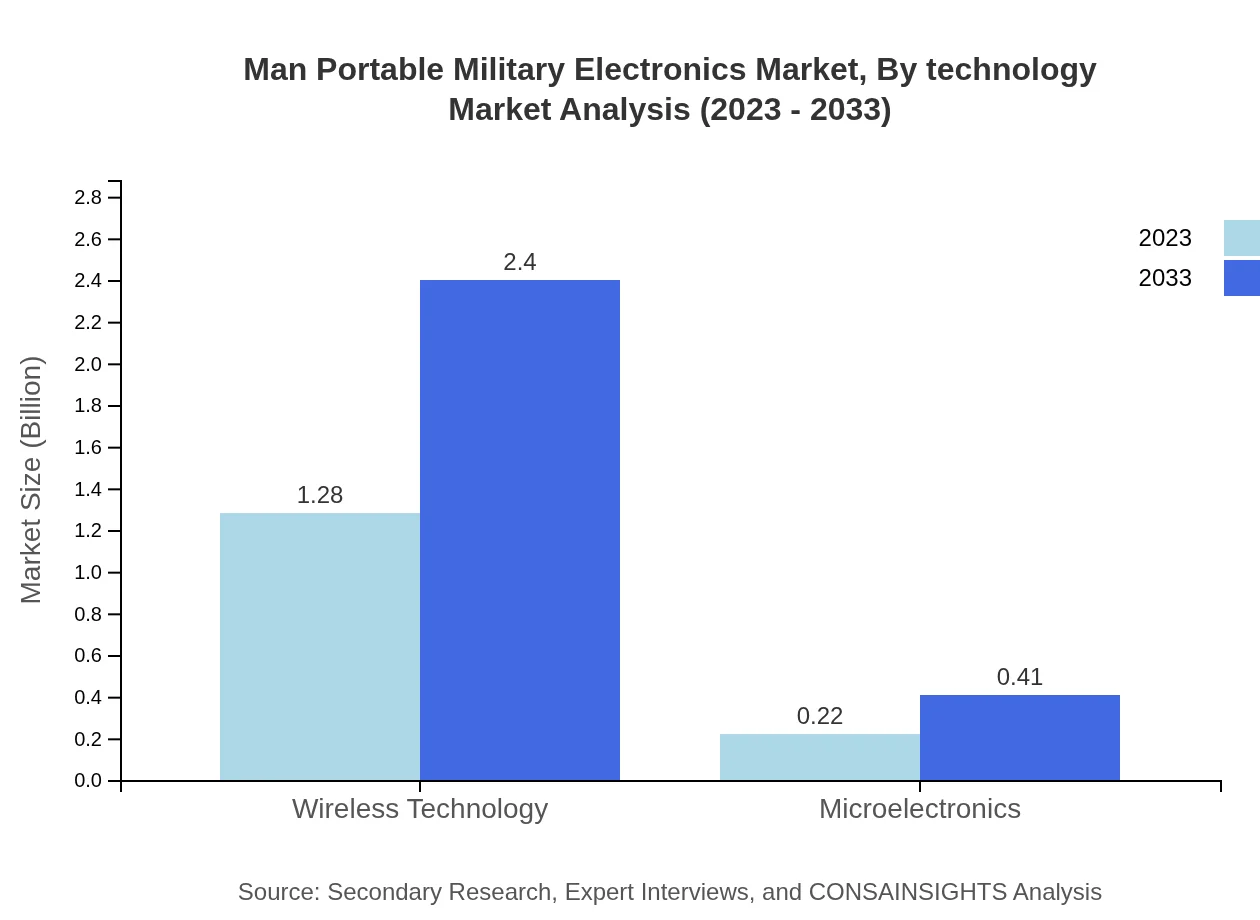

Man Portable Military Electronics Market Analysis By Technology

The integration of modern technologies such as AI, machine learning, and IoT is pivotal in enhancing the capabilities of man-portable military electronics. Advances in microelectronics and wireless technologies are essential for developing systems that meet the needs of modern military engagements.

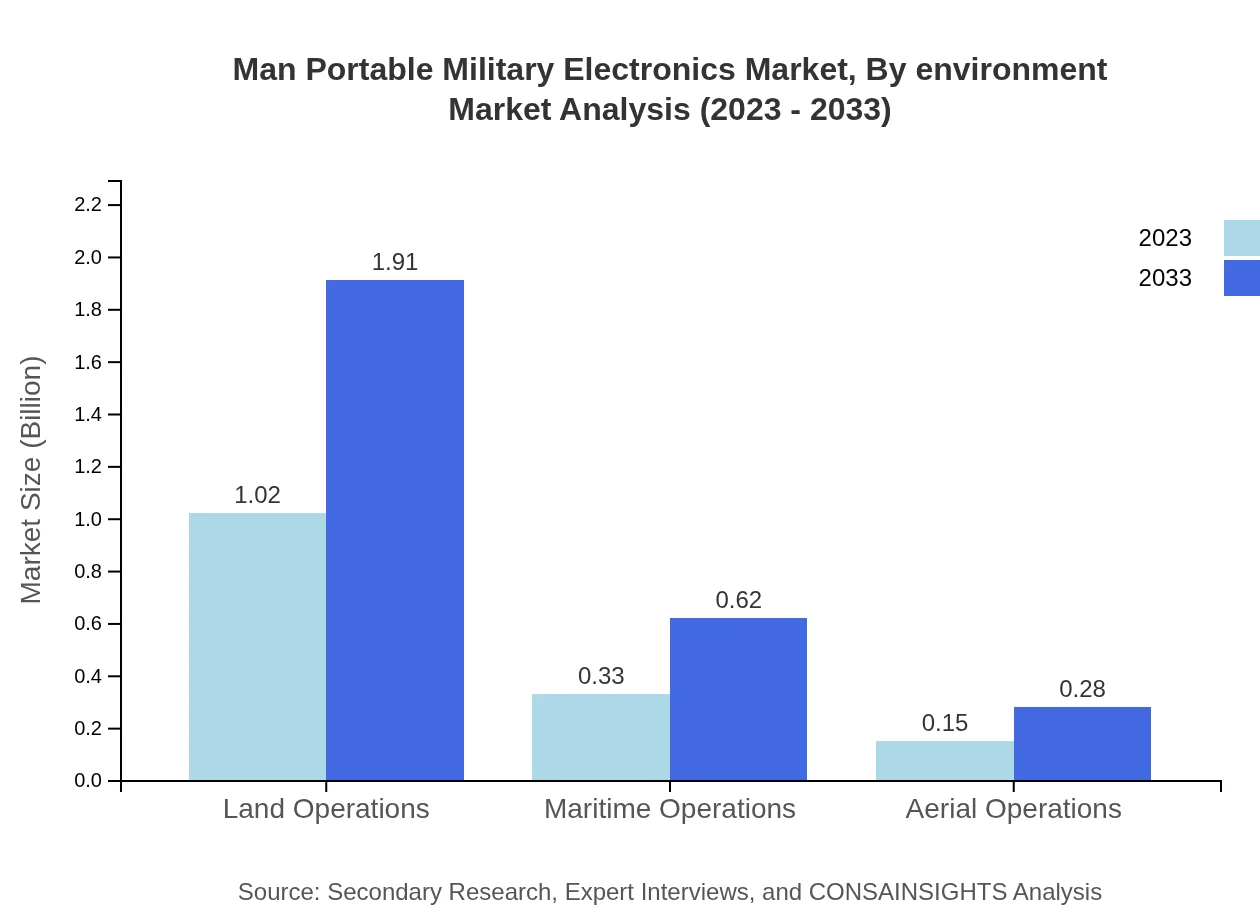

Man Portable Military Electronics Market Analysis By Environment

The operating environments for military electronics include land, maritime, and aerial operations. Land operations constitute the majority of the market share, estimated at 67.97% in 2023, while maritime and aerial operations are also significant, driven by the need for versatile operations across diverse terrains.

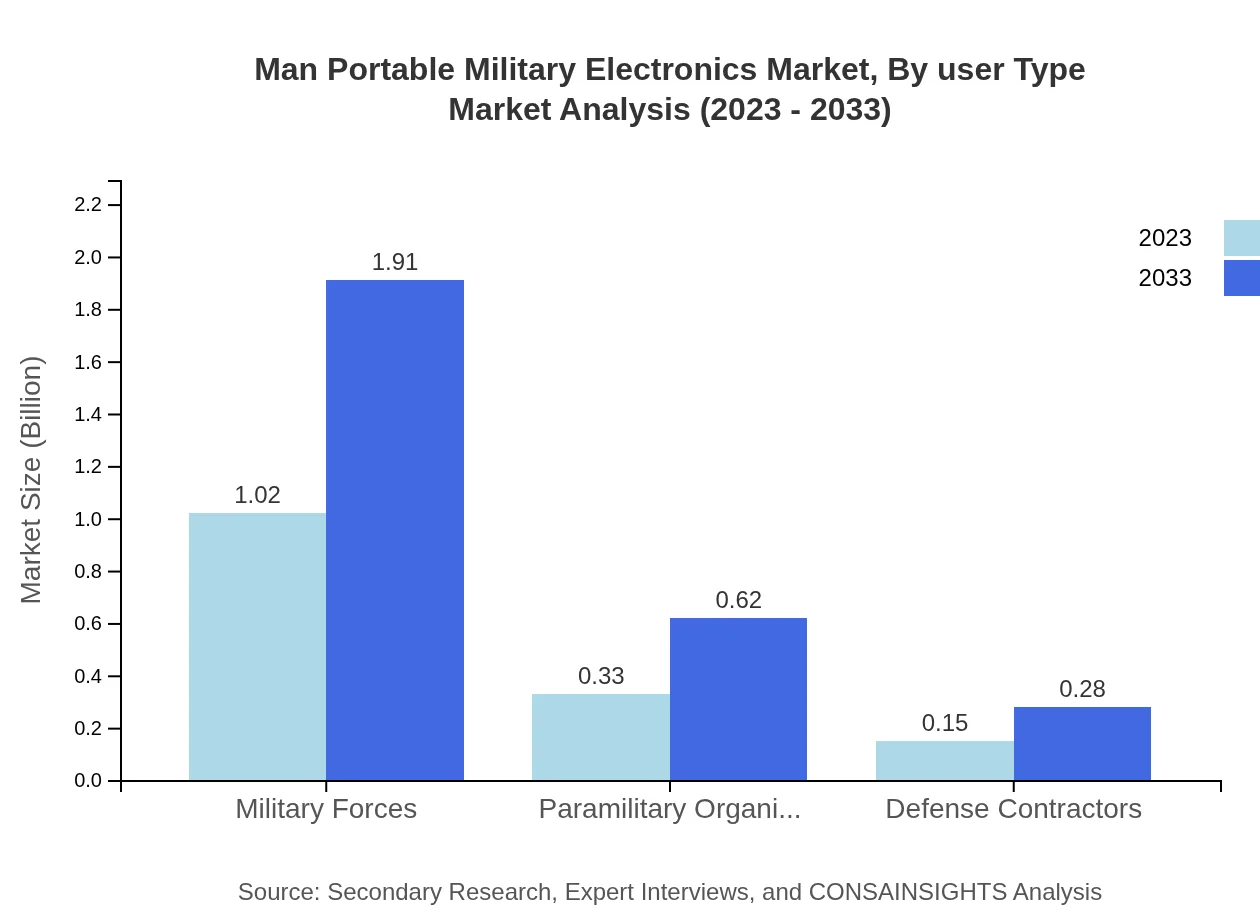

Man Portable Military Electronics Market Analysis By User Type

User types in the market include military forces, paramilitary organizations, and defense contractors. Military forces account for 67.97% of the share in 2023, indicating their primary role in deploying man-portable systems, followed by paramilitary organizations at 21.93%.

Man Portable Military Electronics Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Man Portable Military Electronics Industry

Thales Group:

A leading provider of advanced electronics and communication solutions for military applications, Thales focuses on developing innovative technologies that enhance operational efficiency and soldier safety.Harris Corporation:

Harris Corporation specializes in communication and electronic warfare technologies, providing critical systems that enable secure and effective military operations.Leonardo S.p.A.:

An Italian multinational specializing in aerospace, defense, and security, Leonardo supports various military projects with cutting-edge portable electronics.General Dynamics:

General Dynamics is a key player in the defense industry, known for producing advanced electronic systems that meet the needs of militaries around the globe.Elbit Systems:

An Israeli defense technology company, Elbit Systems is recognized for its innovative products in the realm of military electronics, particularly in communications and surveillance.We're grateful to work with incredible clients.

FAQs

What is the market size of man Portable Military Electronics?

The global man-portable military electronics market is valued at approximately $1.5 billion in 2023, with a projected CAGR of 6.3% from 2023 to 2033. By 2033, the market is expected to expand significantly.

What are the key market players or companies in this man Portable Military Electronics industry?

Key players in the man-portable military electronics market include major defense contractors, technology firms specializing in military technologies, and manufacturers of advanced communication and navigation systems, ensuring competitiveness and innovation in the sector.

What are the primary factors driving the growth in the man Portable military electronics industry?

Growth in the man-portable military electronics sector is driven by technological advancements, increased defense budgets, the military's need for advanced communication systems, and rising demand for real-time situational awareness in operations.

Which region is the fastest Growing in the man Portable military electronics?

The fastest-growing region in the man-portable military electronics market is projected to be North America, with the market size increasing from $0.48 billion in 2023 to $0.90 billion in 2033, reflecting strong defense spending.

Does ConsaInsights provide customized market report data for the man Portable military electronics industry?

Yes, ConsaInsights offers customized market report data tailored to the needs of clients within the man-portable military electronics industry, providing in-depth analysis and specific insights to guide strategic decision-making.

What deliverables can I expect from this man Portable military electronics market research project?

Deliverables from our market research project include a comprehensive report detailing market size, growth forecasts, competitive analysis, regional insights, segmentation data, and key trends influencing the man-portable military electronics market.

What are the market trends of man Portable military electronics?

Market trends for man-portable military electronics include a shift towards wireless technologies, increased integration of AI in defense operations, and a growing emphasis on portable communication systems for enhanced military readiness.