Managed Data Center Services Market Report

Published Date: 31 January 2026 | Report Code: managed-data-center-services

Managed Data Center Services Market Size, Share, Industry Trends and Forecast to 2033

This report delves into the Managed Data Center Services market, offering comprehensive insights and robust data, including growth forecasts from 2023 to 2033.

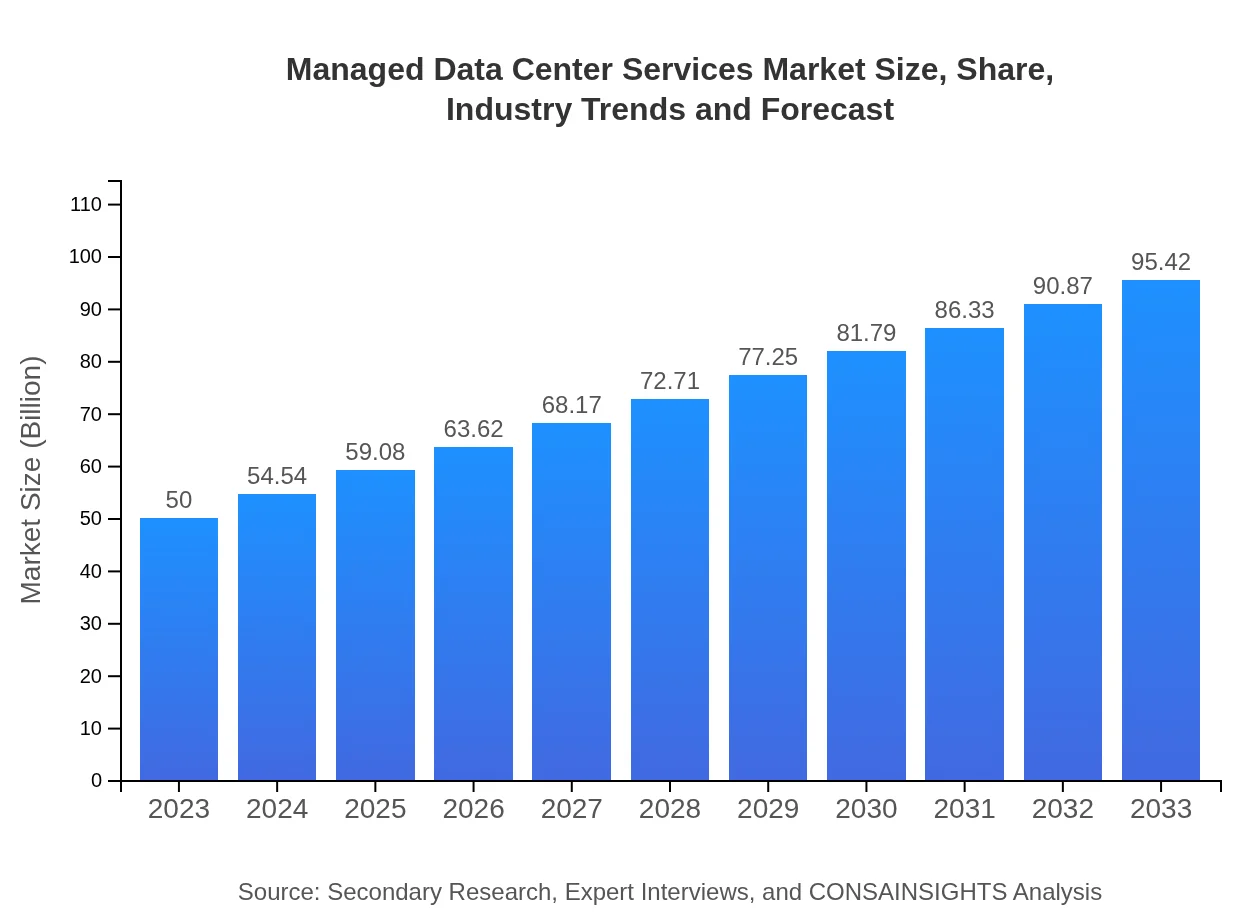

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $50.00 Billion |

| CAGR (2023-2033) | 6.5% |

| 2033 Market Size | $95.42 Billion |

| Top Companies | Amazon Web Services (AWS), IBM, Microsoft Azure, Google Cloud, Equinix , Digital Realty |

| Last Modified Date | 31 January 2026 |

Managed Data Center Services Market Overview

Customize Managed Data Center Services Market Report market research report

- ✔ Get in-depth analysis of Managed Data Center Services market size, growth, and forecasts.

- ✔ Understand Managed Data Center Services's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Managed Data Center Services

What is the Market Size & CAGR of Managed Data Center Services market in 2033?

Managed Data Center Services Industry Analysis

Managed Data Center Services Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Managed Data Center Services Market Analysis Report by Region

Europe Managed Data Center Services Market Report:

Europe's managed data center services market will expand from $13.41 billion in 2023 to $25.59 billion in 2033, driven by significant investments in data privacy regulations and a booming tech landscape.Asia Pacific Managed Data Center Services Market Report:

With a market size of $9.51 billion in 2023 projected to grow to $18.15 billion by 2033, the Asia Pacific region is rapidly adopting managed services driven by digital transformation initiatives and government investments in technology infrastructure.North America Managed Data Center Services Market Report:

North America dominates the region, with a market forecasted to increase from $18.71 billion in 2023 to $35.71 billion by 2033, largely fueled by the presence of leading technology firms and an uptick in cloud adoption.South America Managed Data Center Services Market Report:

In South America, the market is expected to grow from $3.54 billion in 2023 to $6.76 billion by 2033. This growth reflects the increasing need for data center solutions amongst local businesses amidst economic recovery and investment in technology.Middle East & Africa Managed Data Center Services Market Report:

The Middle East and Africa market, estimated at $4.83 billion in 2023 rising to $9.21 billion by 2033, is characterized by growing digital ventures and increased investment in smart technologies.Tell us your focus area and get a customized research report.

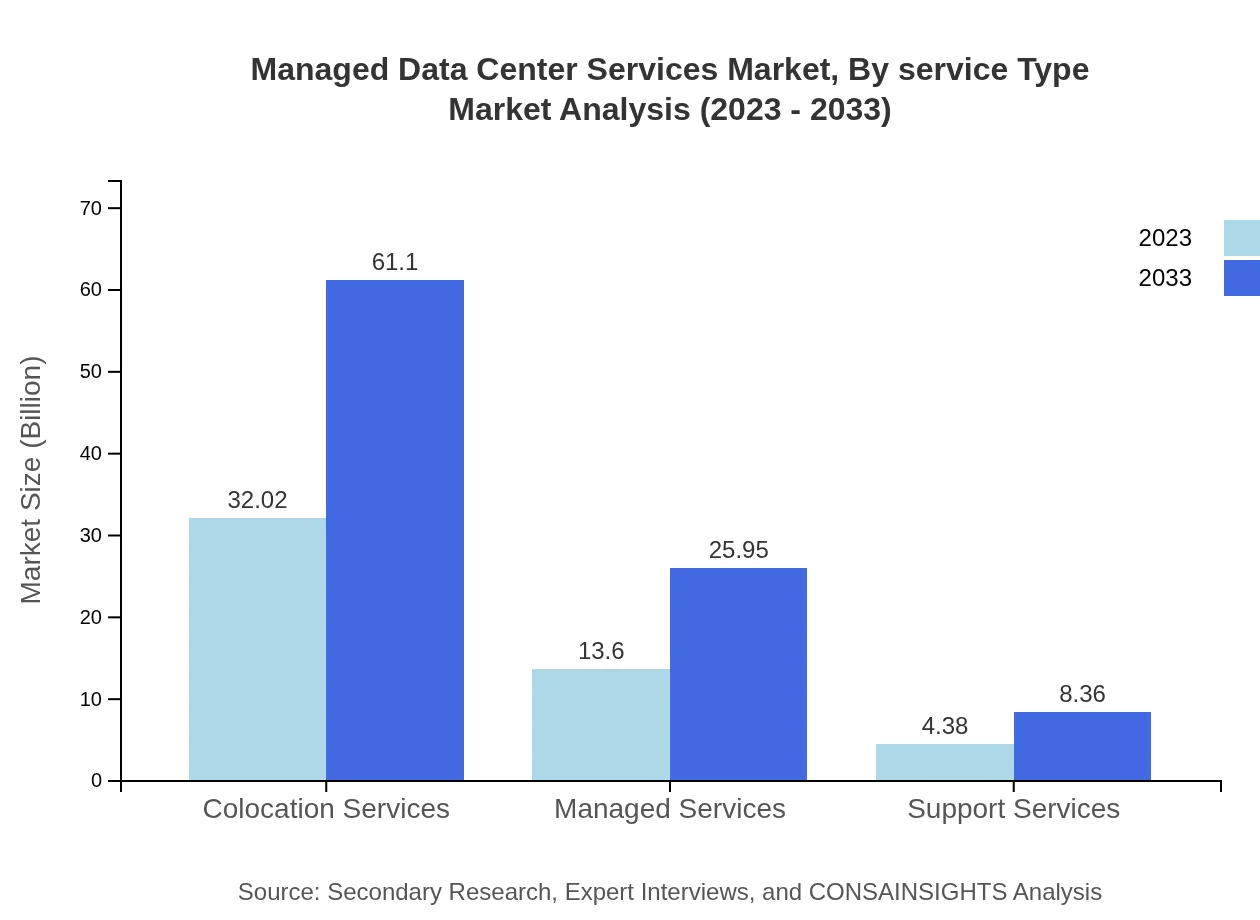

Managed Data Center Services Market Analysis By Service Type

Colocation Services dominate the market with a size of $32.02 billion in 2023, expected to rise to $61.10 billion by 2033, holding 64.04% market share. Managed Services account for $13.60 billion, projected to reach $25.95 billion, while Support Services will grow from $4.38 billion to $8.36 billion. The demand for cloud-based solutions continues to grow, expected to transition from $9.45 billion to $18.02 billion within the forecast period.

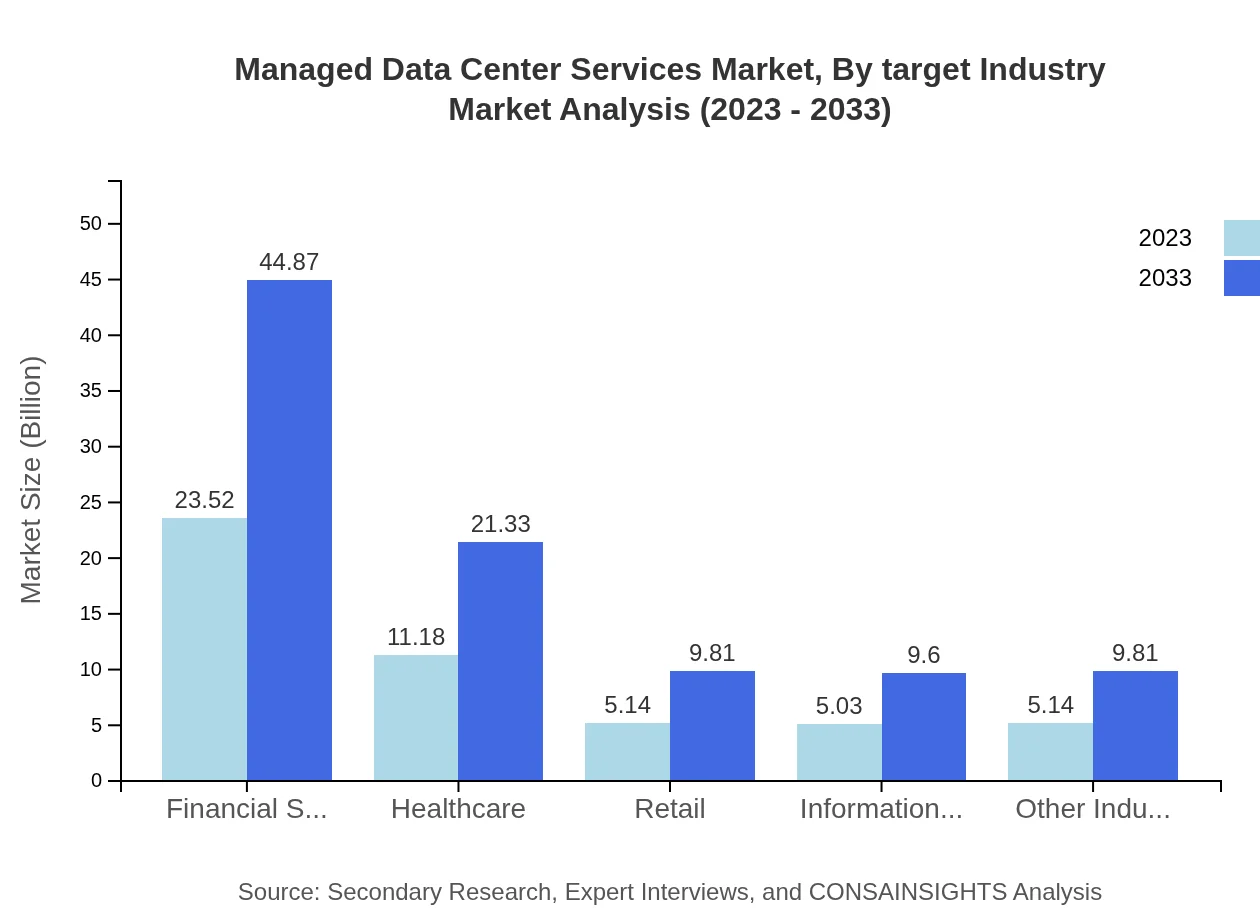

Managed Data Center Services Market Analysis By Target Industry

The financial services sector leads the target industries in the managed data center market, with a size of $23.52 billion in 2023, anticipated to grow to $44.87 billion. Healthcare follows with $11.18 billion to $21.33 billion, marking a growing dependence on data infrastructure. The retail and IT services sectors show stable performances, contributing significantly but with lower volume compared to finance.

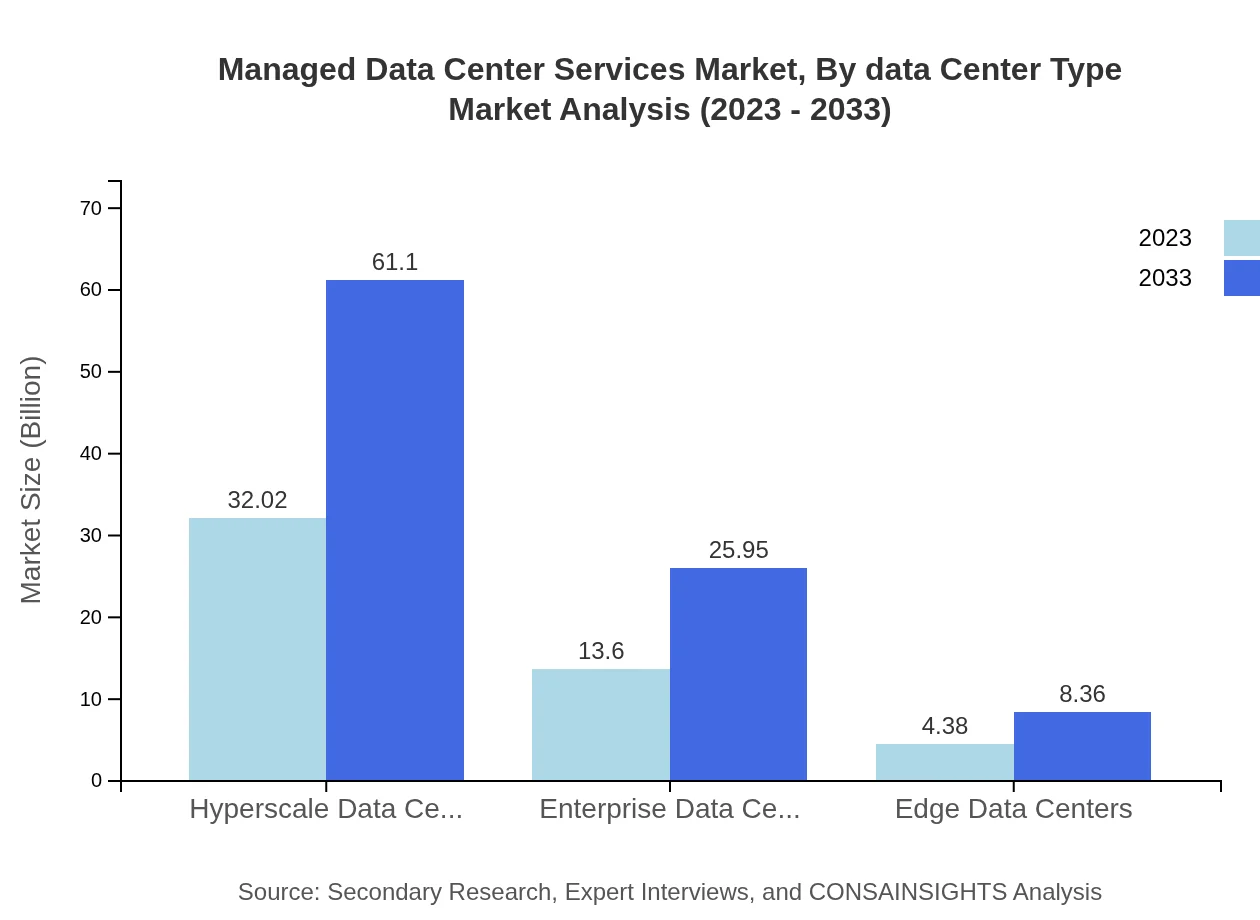

Managed Data Center Services Market Analysis By Data Center Type

Hyperscale Data Centers show strong growth, expected to rise from $32.02 billion to $61.10 billion, with a 64.04% market share. Enterprise Data Centers will expand from $13.60 billion to $25.95 billion, while Edge Data Centers will increase from $4.38 billion to $8.36 billion, reflecting growing demand for localized data processing.

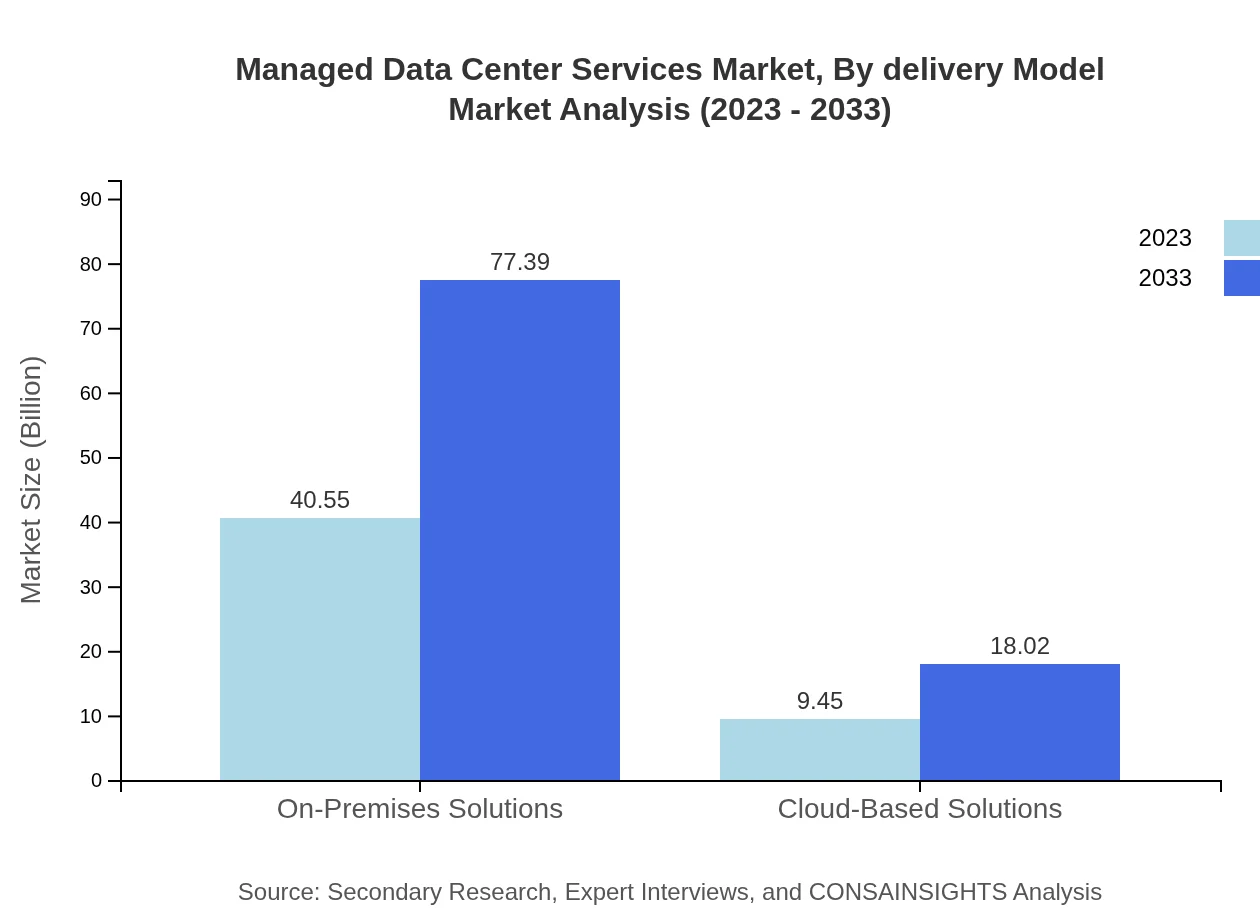

Managed Data Center Services Market Analysis By Delivery Model

On-Premises Solutions take the bulk of the market at 81.11% with a projected growth from $40.55 billion to $77.39 billion. Meanwhile, Cloud-Based Solutions are forecast to grow from $9.45 billion to $18.02 billion, highlighting a shift towards cloud infrastructures.

Managed Data Center Services Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Managed Data Center Services Industry

Amazon Web Services (AWS):

AWS offers comprehensive cloud solutions and managed services, driving innovation in the data center landscape with offerings such as AWS Outposts.IBM:

IBM provides managed data center services through its extensive IBM Cloud portfolio, emphasizing security and industry-specific solutions.Microsoft Azure:

Azure combines cloud services with analytics, AI, and security features, positioning itself as a leader in managed services.Google Cloud:

Google Cloud offers robust managed solutions focused on scalability and data insights, fostering innovation in data management.Equinix :

Equinix specializes in colocation and interconnection services globally, enhancing the managed data center offerings through extensive global reach.Digital Realty:

Digital Realty provides colocation services and management for large-scale data centers, ensuring high availability and performance.We're grateful to work with incredible clients.

FAQs

What is the market size of managed Data Center Services?

The global managed data center services market is projected to grow from approximately $50 billion in 2023, with a CAGR of 6.5%. This significant growth reflects the increasing demand for data management solutions across various industries.

What are the key market players or companies in this managed Data Center Services industry?

Key players in the managed data center services industry include major companies such as IBM, AWS, Microsoft, and Rackspace. These companies are instrumental in driving innovations and improving service delivery in the sector.

What are the primary factors driving the growth in the managed Data Center Services industry?

Factors driving growth in the managed data center services industry include increasing data requirements, cloud computing adoption, the need for improved data security, and the growth of IoT and big data analytics, which necessitate robust data management solutions.

Which region is the fastest Growing in the managed Data Center Services?

The fastest-growing region for managed data center services is North America, projected to rise from $18.71 billion in 2023 to $35.71 billion by 2033. Europe and Asia Pacific also exhibit significant growth potential in this market.

Does ConsaInsights provide customized market report data for the managed Data Center Services industry?

Yes, ConsaInsights offers customized market report data for the managed data center services industry, allowing clients to gain tailored insights that meet their specific business needs and market analysis requirements.

What deliverables can I expect from this managed Data Center Services market research project?

Deliverables from the managed data center services market research project will typically include comprehensive reports, data analyses, market forecasts, segment insights, competitive analysis, and strategic recommendations for market engagement.

What are the market trends of managed Data Center Services?

Current trends in the managed data center services market include the growing shift towards cloud-based solutions, enhancements in automation and AI, increasing focus on energy efficiency, and the strategy towards hybrid infrastructure integration.