Managed Detection And Response Market Report

Published Date: 31 January 2026 | Report Code: managed-detection-and-response

Managed Detection And Response Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Managed Detection and Response (MDR) market, covering market trends, size, segmentation, and regional insights from 2023 to 2033.

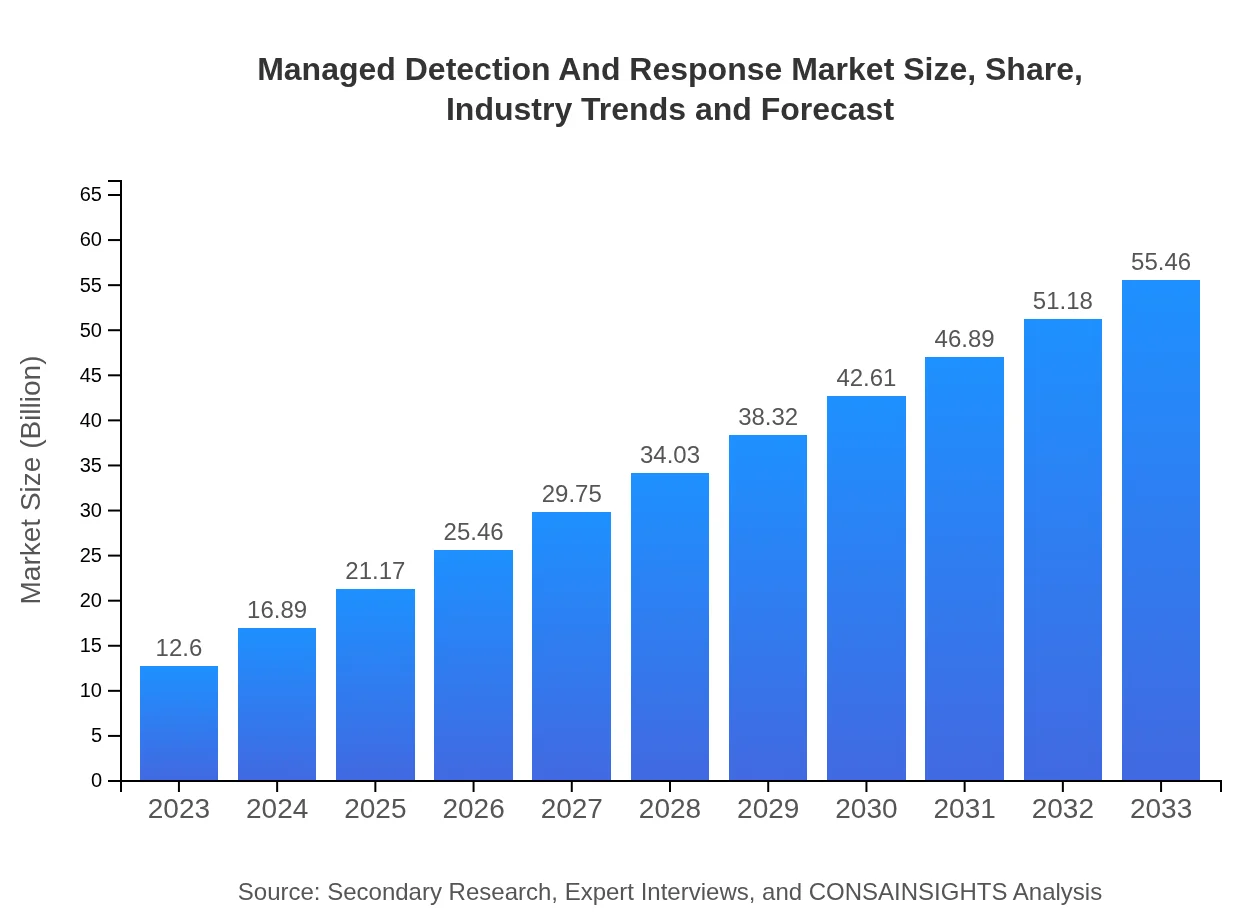

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $12.60 Billion |

| CAGR (2023-2033) | 15.2% |

| 2033 Market Size | $55.46 Billion |

| Top Companies | IBM, CrowdStrike, Fortinet, Palo Alto Networks |

| Last Modified Date | 31 January 2026 |

Managed Detection And Response Market Overview

Customize Managed Detection And Response Market Report market research report

- ✔ Get in-depth analysis of Managed Detection And Response market size, growth, and forecasts.

- ✔ Understand Managed Detection And Response's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Managed Detection And Response

What is the Market Size & CAGR of Managed Detection And Response market in 2023?

Managed Detection And Response Industry Analysis

Managed Detection And Response Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Managed Detection And Response Market Analysis Report by Region

Europe Managed Detection And Response Market Report:

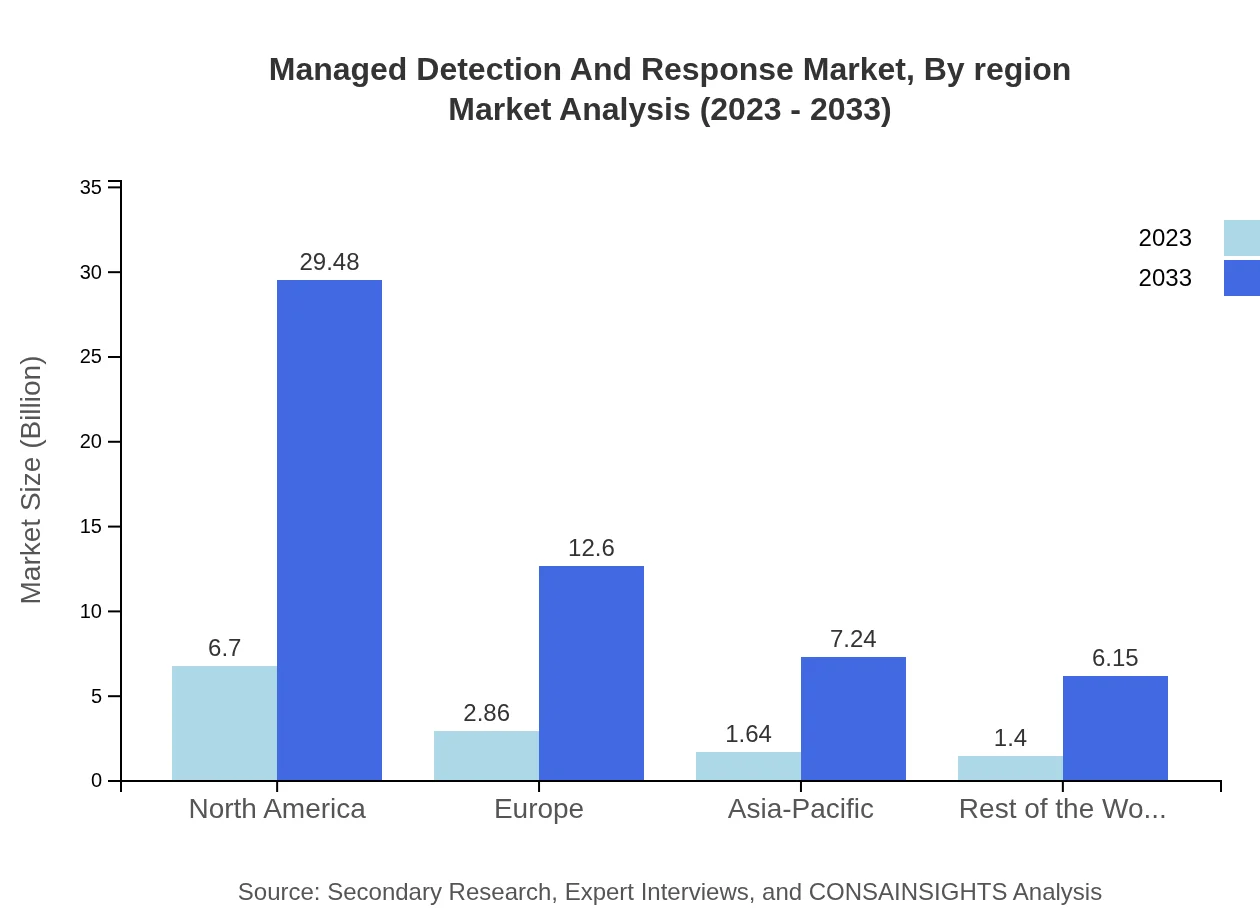

In Europe, the MDR market is anticipated to grow from $3.14 billion in 2023 to $13.82 billion by 2033, as organizations face stringent data protection regulations and a rise in sophisticated cyber threats. The European market is characterized by a growing emphasis on compliance and a shift toward more integrated cybersecurity strategies, creating increased demand for managed services.Asia Pacific Managed Detection And Response Market Report:

In the Asia-Pacific region, the MDR market is projected to grow from $2.51 billion in 2023 to $11.04 billion by 2033, driven by increasing investments in cybersecurity initiatives and rising awareness of cyber threats among organizations. The expanding digital landscape and adoption of advanced technologies further fuel this growth, as businesses seek robust protection against cyberattacks.North America Managed Detection And Response Market Report:

North America remains the largest market for Managed Detection and Response, with a market size of $4.61 billion in 2023, expected to reach $20.30 billion by 2033. The presence of major cybersecurity players, coupled with a high degree of technological adoption among enterprises, drives the demand for MDR services. Organizations are increasingly prioritizing cybersecurity investments to protect critical infrastructure and sensitive data.South America Managed Detection And Response Market Report:

The South American market for MDR is estimated to grow from $1.12 billion in 2023 to $4.95 billion by 2033. This growth is supported by ongoing digital transformation efforts across various sectors, alongside a rise in regulatory requirements aimed at enhancing data security. Companies in the region are increasingly leveraging MDR solutions to reduce risk and enhance resilience against cyber threats.Middle East & Africa Managed Detection And Response Market Report:

The Middle East and Africa market for MDR is projected to expand from $1.22 billion in 2023 to $5.36 billion by 2033. The growth is driven by the increasing focus on cybersecurity as part of national strategic plans and substantial investments in technology infrastructure. Governments and private sectors are recognizing the importance of managed security services to safeguard their digital ecosystems.Tell us your focus area and get a customized research report.

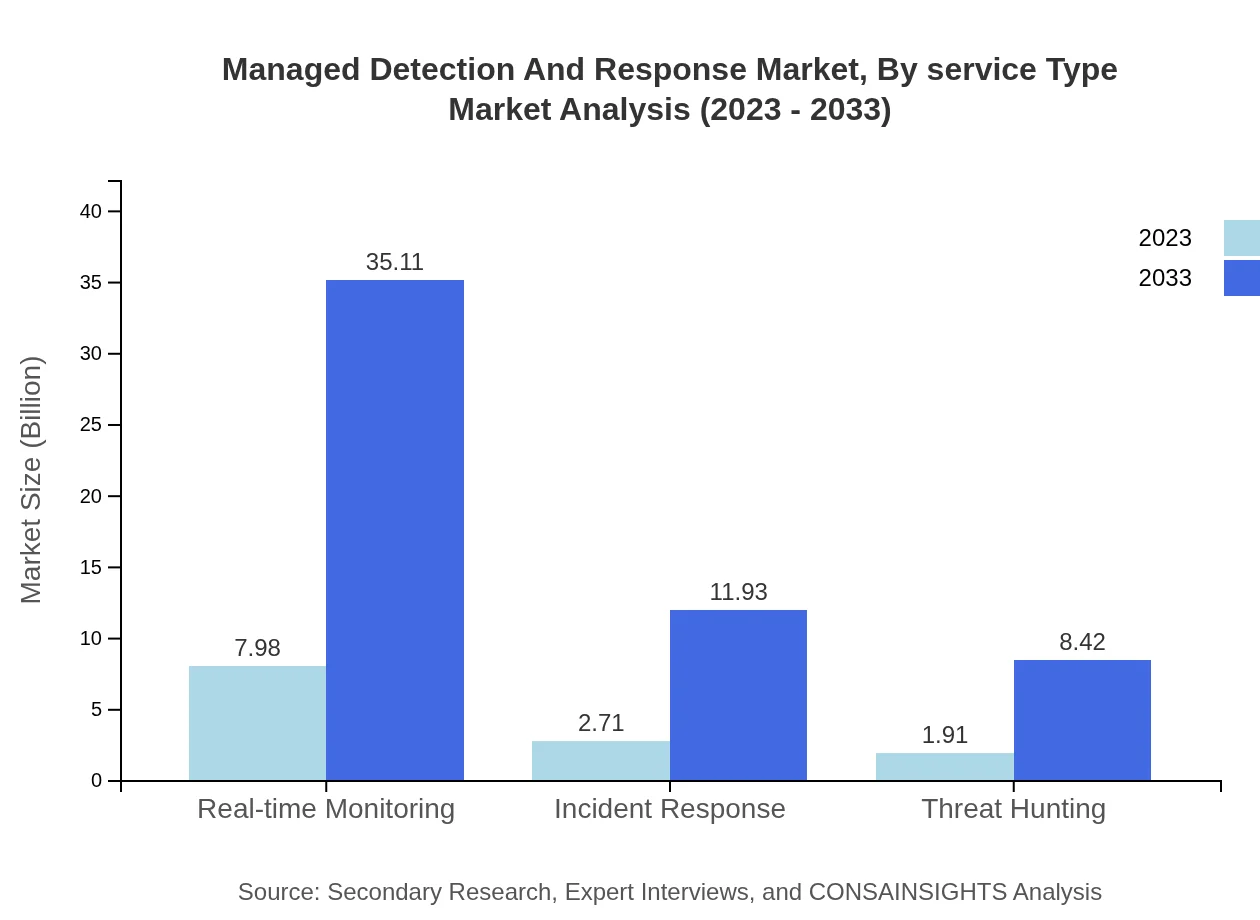

Managed Detection And Response Market Analysis By Service Type

The service types in the Managed Detection And Response market include Real-time Monitoring, Incident Response, and Threat Hunting. Real-time Monitoring is the largest segment, representing over 63.31% of the market in 2023 and expected to retain its lead due to the critical need for constant surveillance against evolving threats. Incident Response, while smaller, plays a vital role in remediation and mitigation of security breaches, capturing 21.51% of the market. Threat Hunting, though less dominant, is growing as organizations seek proactive measures to identify vulnerabilities.

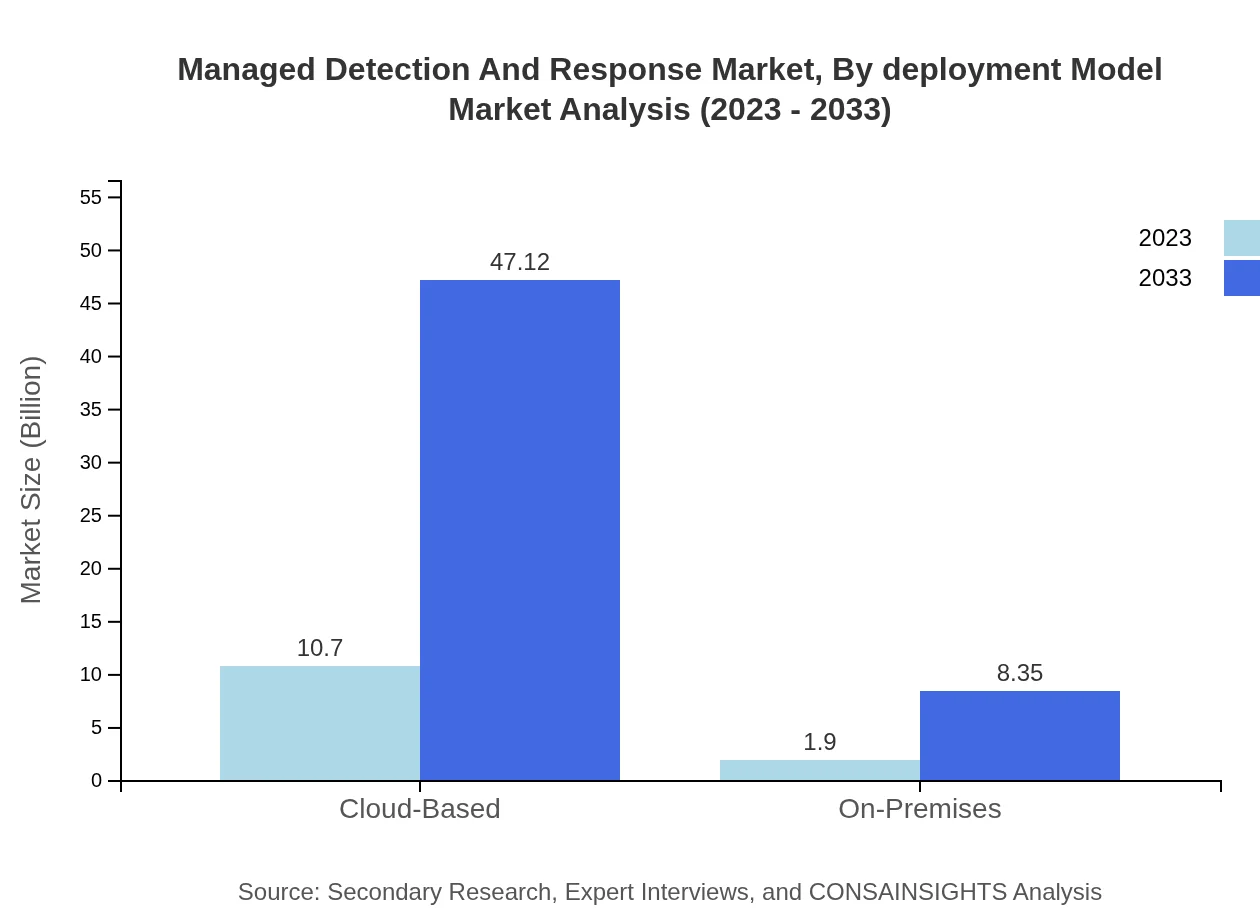

Managed Detection And Response Market Analysis By Deployment Model

The deployment models for Managed Detection And Response services are primarily 'Cloud-Based' and 'On-Premises'. The Cloud-Based segment is projected to dominate the market with 84.95% market share in 2023, reflecting its scalability and cost-effectiveness. In contrast, the On-Premises model accounts for 15.05%, preferred by organizations with strict compliance requirements or those seeking complete control over their security infrastructure.

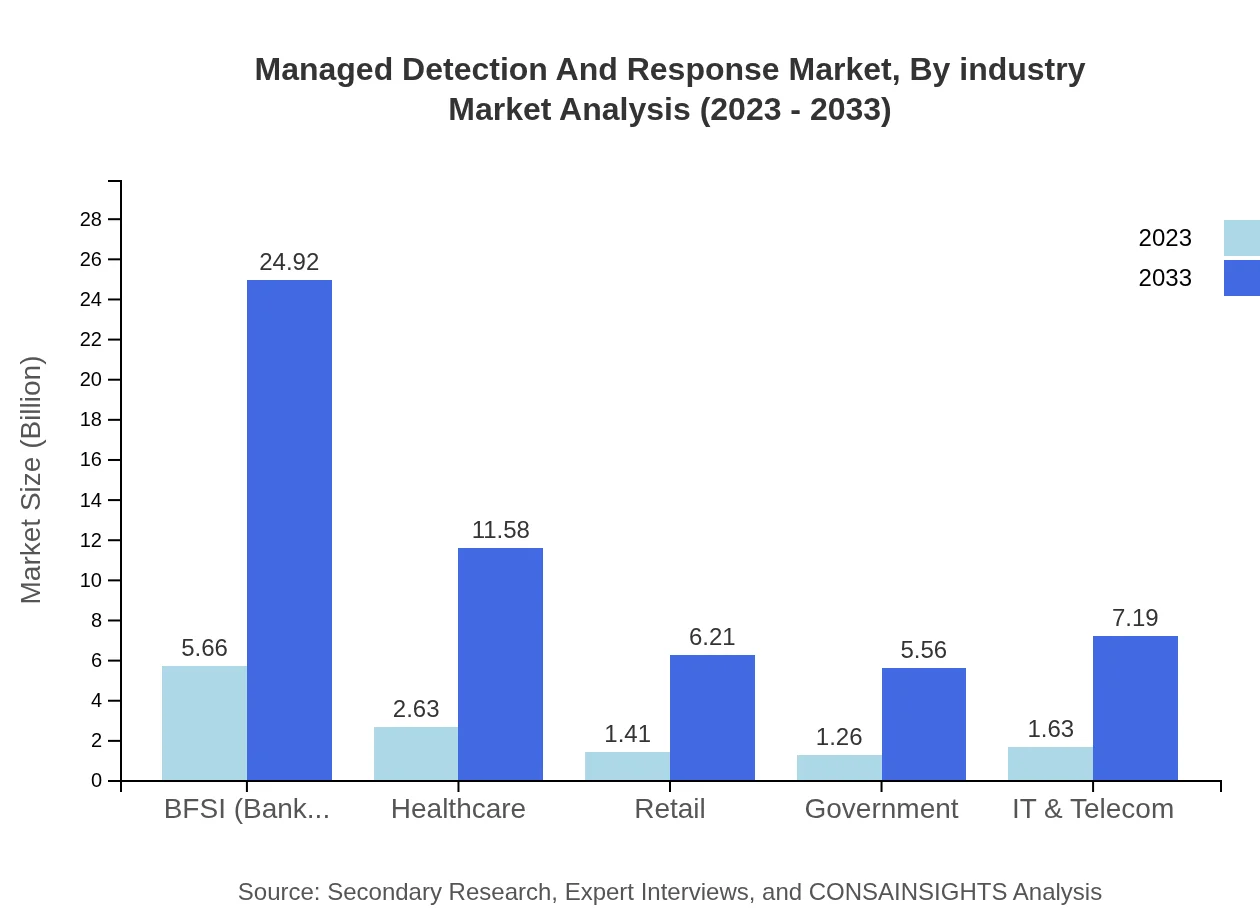

Managed Detection And Response Market Analysis By Industry

The Managed Detection And Response market is significantly influenced by various industries, with BFSI leading the segment with a size of $5.66 billion in 2023, projected to increase to $24.92 billion by 2033. Other notable sectors include Healthcare, which is growing rapidly due to the sensitive nature of health data, and Retail, which is increasingly targeted by cybercriminals. This diversification across industries signifies the broader recognition of cyber threats and the need for specialized security solutions.

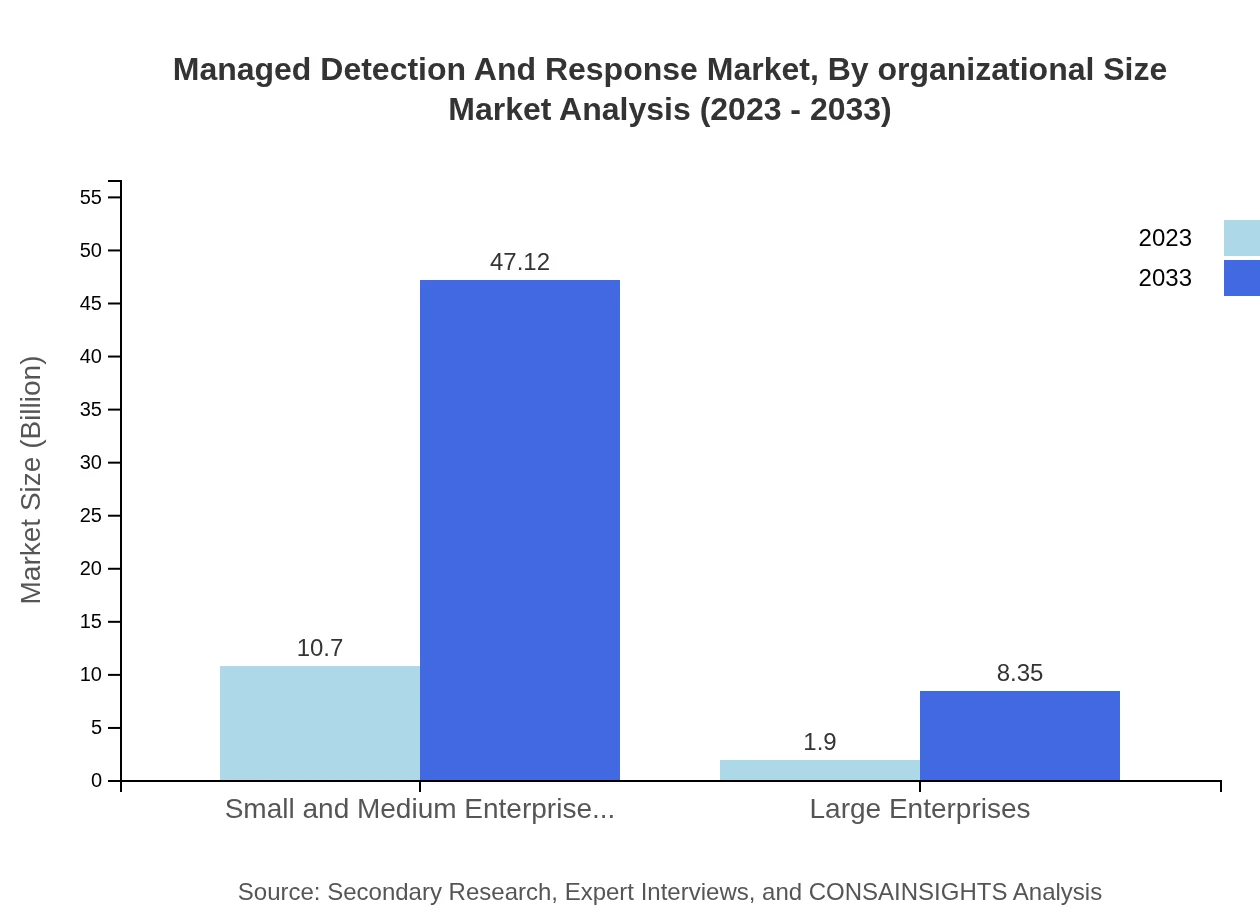

Managed Detection And Response Market Analysis By Organizational Size

The MDR market is segmented by organizational size into Small and Medium Enterprises (SMEs) and Large Enterprises. SMEs are predicted to lead the market with a considerable share of 84.95%, driven by their increasing investment in cybersecurity to mitigate risk and ensure business continuity. Meanwhile, Large Enterprises, while smaller in share at 15.05%, represent a lucrative market due to their complex security requirements and substantial budgets.

Managed Detection And Response Market Analysis By Region

The analysis of the Managed Detection and Response market by region showcases North America's dominance, capturing approximately 53.15% of the market share in 2023. Europe follows with 22.71%, while the Asia-Pacific region represents 13.05%, reflecting the global focus on cybersecurity. This bifurcation illustrates how regional factors influence the adoption and demand for MDR services.

Managed Detection And Response Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Managed Detection And Response Industry

IBM:

IBM offers comprehensive security solutions, including Managed Detection and Response services, leveraging its advanced analytics and AI capabilities to help organizations detect, respond, and recover from cyber threats.CrowdStrike:

CrowdStrike is a market leader in cybersecurity, providing next-gen endpoint protection and top-tier MDR services that enable organizations to proactively hunt for threats and respond effectively.Fortinet:

Fortinet specializes in network security and provides Managed Detection and Response solutions that incorporate threat intelligence and real-time analytics for advanced threat prevention.Palo Alto Networks:

Palo Alto Networks offers an extensive suite of cybersecurity solutions, including an innovative MDR service model that enhances visibility and protection across digital environments.We're grateful to work with incredible clients.

FAQs

What is the market size of Managed Detection and Response?

The Managed Detection and Response market size was valued at approximately $12.6 billion in 2023, with an impressive CAGR of 15.2%, projected to expand significantly in the next decade.

What are the key market players or companies in the Managed Detection and Response industry?

The Managed Detection and Response (MDR) sector is dominated by leading cybersecurity firms, including CrowdStrike, IBM Security, and Palo Alto Networks, which are key players providing innovative detection and response solutions.

What are the primary factors driving the growth in the Managed Detection and Response industry?

Growth in the MDR industry is propelled by rising cyber threats, increasing regulatory compliance demands, and the urgent need for advanced threat intelligence solutions to protect sensitive data, particularly in sectors like BFSI and healthcare.

Which region is the fastest Growing in the Managed Detection and Response market?

The Asia Pacific region is forecasted to experience rapid growth in the MDR market, increasing from $2.51 billion in 2023 to approximately $11.04 billion by 2033, driven by digital transformation initiatives and growing cybersecurity investments.

Does ConsaInsights provide customized market report data for the Managed Detection and Response industry?

Yes, ConsaInsights offers tailored market research reports, allowing businesses to access detailed insights specific to their needs within the Managed Detection and Response industry, enhancing strategic planning.

What deliverables can I expect from this Managed Detection and Response market research project?

Clients can expect comprehensive market analysis reports, competitive landscape assessments, regional insights, and trend forecasts specific to the Managed Detection and Response sector from this research project.

What are the market trends of Managed Detection and Response?

Market trends in the Managed Detection and Response sector indicate a shift towards cloud-based solutions, real-time monitoring enhancements, and an increasing focus on threat hunting services, highlighting technological advancements.