Managed Information Services Market Report

Published Date: 31 January 2026 | Report Code: managed-information-services

Managed Information Services Market Size, Share, Industry Trends and Forecast to 2033

This report explores the Managed Information Services market, analyzing its size, growth trends, regional insights, and key players. It provides forecasts for 2023-2033, highlighting technological advancements and market segments within this dynamic industry.

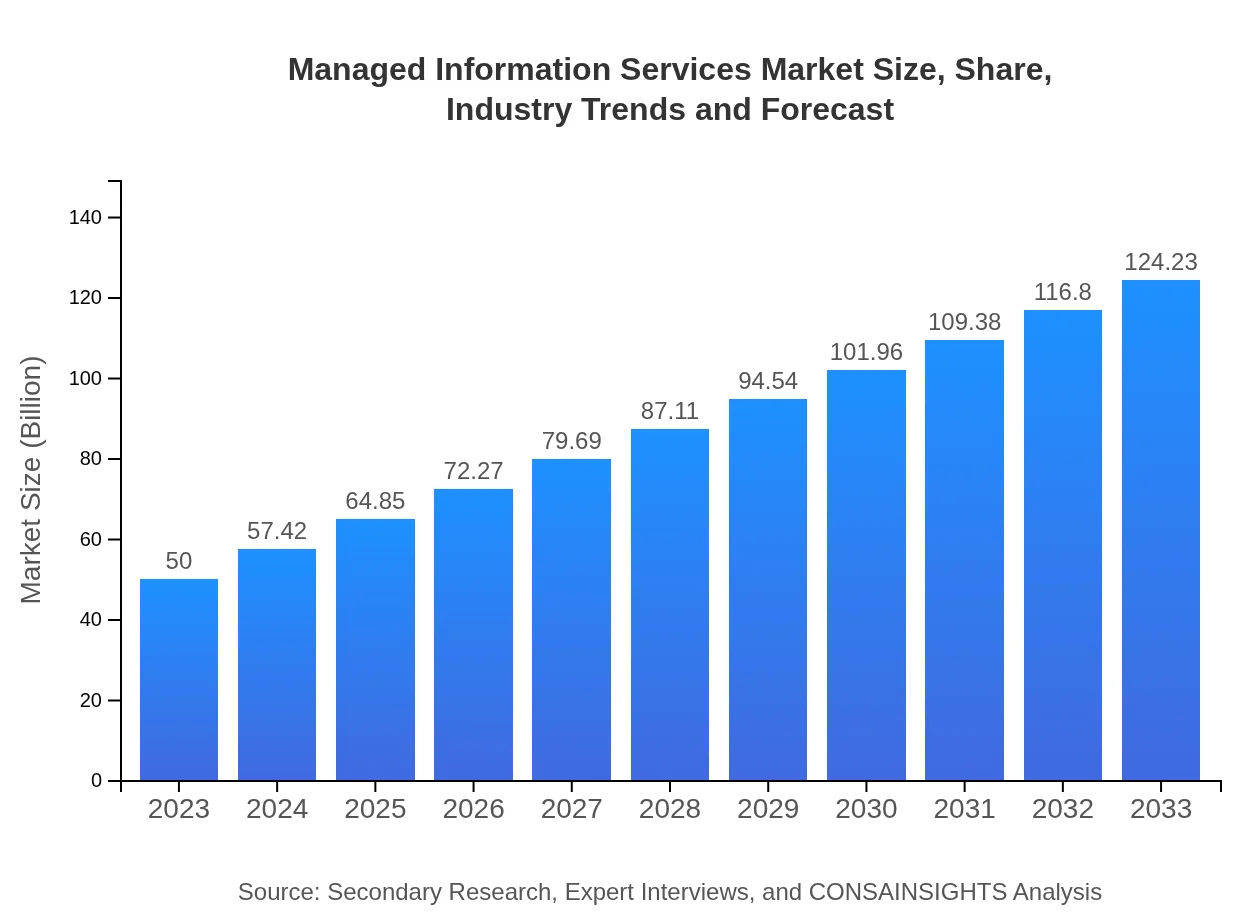

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $50.00 Billion |

| CAGR (2023-2033) | 9.2% |

| 2033 Market Size | $124.23 Billion |

| Top Companies | IBM Corporation, Accenture, Dell Technologies, Cisco Systems, Cognizant |

| Last Modified Date | 31 January 2026 |

Managed Information Services Market Overview

Customize Managed Information Services Market Report market research report

- ✔ Get in-depth analysis of Managed Information Services market size, growth, and forecasts.

- ✔ Understand Managed Information Services's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Managed Information Services

What is the Market Size & CAGR of Managed Information Services market in 2023?

Managed Information Services Industry Analysis

Managed Information Services Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Managed Information Services Market Analysis Report by Region

Europe Managed Information Services Market Report:

Europe's MIS market is projected to grow from $12.63 billion in 2023 to $31.39 billion by 2033. Regulatory pressures regarding data privacy and management are compelling organizations to adopt managed services, while the increasing trend towards cloud adoption plays a crucial role in driving market growth across major economies like Germany, the UK, and France.Asia Pacific Managed Information Services Market Report:

The Asia Pacific region is projected to exhibit rapid growth, with the market size expected to rise from $10.88 billion in 2023 to $27.03 billion by 2033. Factors contributing to this growth include increased digitalization efforts among businesses, a growing middle-class economy, and a rise in internet penetration. Countries like China and India are leading this growth due to their large populations and expanding technology sectors.North America Managed Information Services Market Report:

Dominating the MIS market, North America is estimated to grow from $18.96 billion in 2023 to $47.11 billion by 2033. The region's growth is fueled by advanced technological infrastructure, a strong emphasis on cybersecurity, and significant investments in AI and machine learning applications, attracting numerous providers to this lucrative market.South America Managed Information Services Market Report:

The South America MIS market is forecasted to grow from $4.17 billion in 2023 to $10.36 billion by 2033. While the market is smaller compared to other regions, local enterprises are increasingly adopting managed services to enhance efficiency and leverage digital tools, particularly in Brazil and Argentina, where market activities are concentrated.Middle East & Africa Managed Information Services Market Report:

The Middle East and Africa (MEA) region's market is expected to grow from $3.35 billion in 2023 to $8.34 billion by 2033. This growth will be driven by increased IT investments, a rising demand for data protection, and an evolving regulatory landscape that necessitates robust information management strategies.Tell us your focus area and get a customized research report.

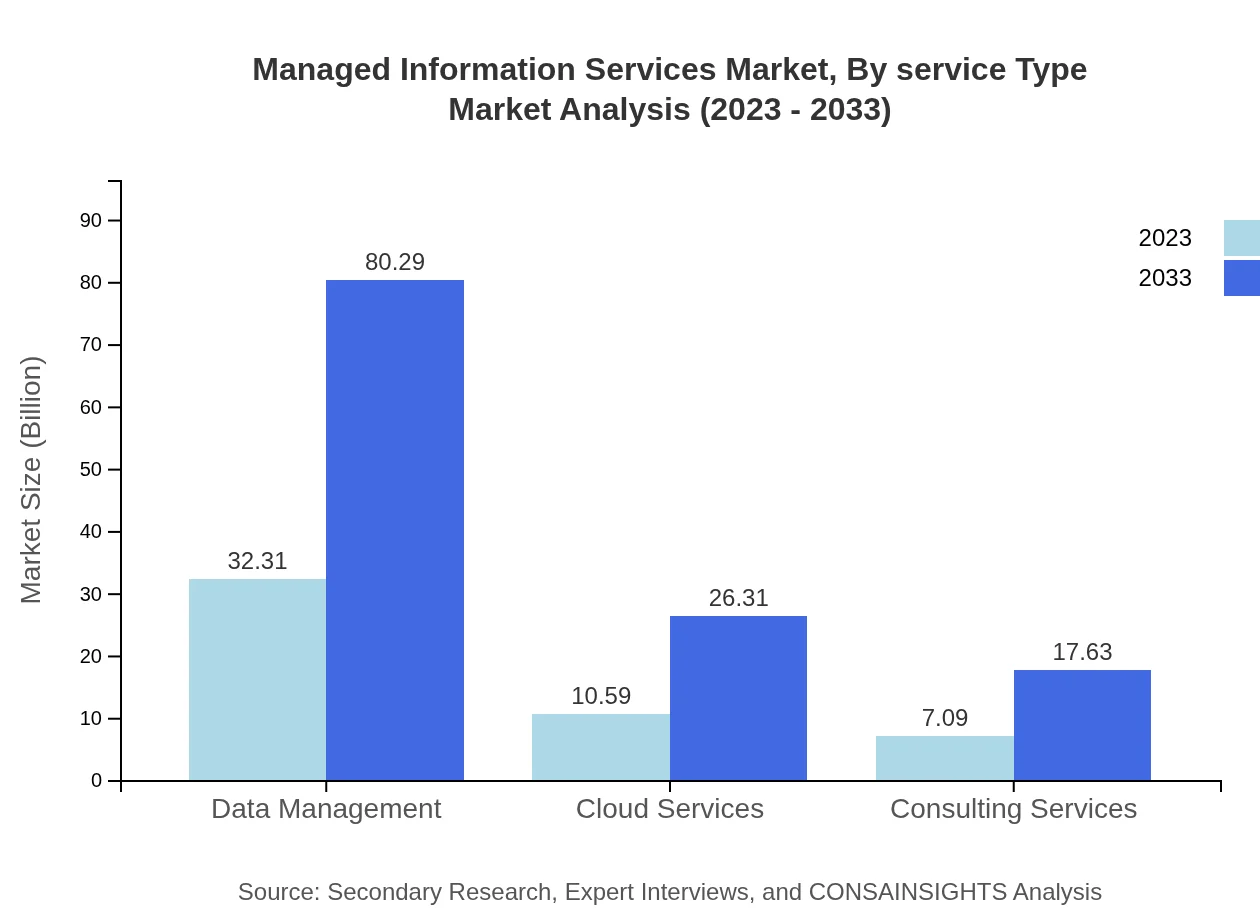

Managed Information Services Market Analysis By Service Type

The Managed Information Services market is primarily segmented based on service types which include data management services, cloud services, consulting services, and IT support. As of 2023, data management services dominate the market with $32.31 billion, expected to grow to $80.29 billion by 2033, reflecting a strong CAGR driven by the increasing need for effective data governance and analytics. Cloud services account for $10.59 billion and are projected to reach $26.31 billion, supported by the ongoing migration to cloud platforms. Consulting services, while smaller, are crucial for providing tailored solutions, currently valued at $7.09 billion and forecasted to grow significantly.

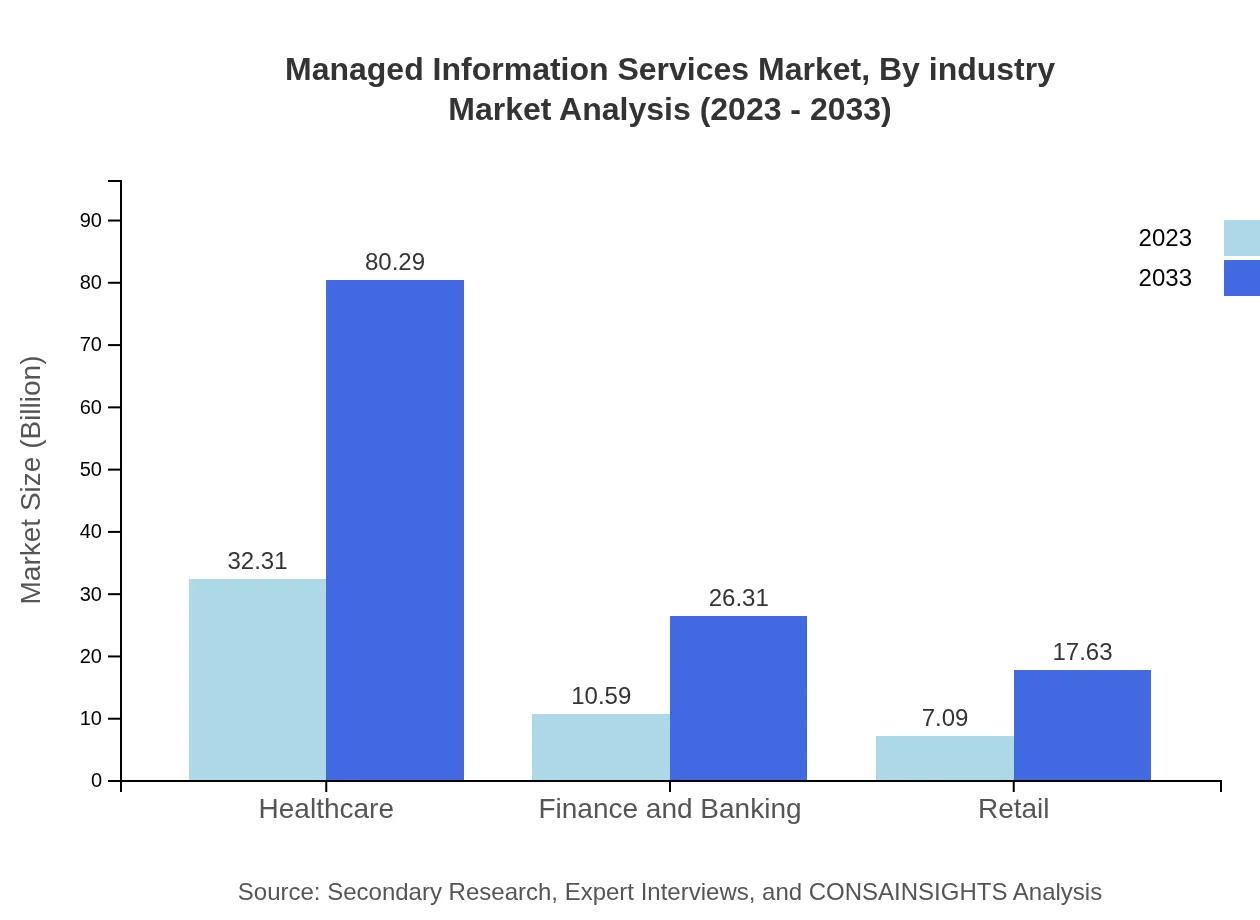

Managed Information Services Market Analysis By Industry

The industry segmentation reveals substantial demand from healthcare, finance, and retail sectors. Healthcare leads with a market size of $32.31 billion in 2023, expanding to $80.29 billion by 2033, fueled by data-intensive operations and regulatory requirements. The finance sector, valued at $10.59 billion in 2023, is also on a growth trajectory, reaching $26.31 billion, as firms seek enhanced cybersecurity and compliance. Retail, although smaller with a market size of $7.09 billion now, is set to grow to $17.63 billion, reflecting the importance of customer data management in purchasing behaviors.

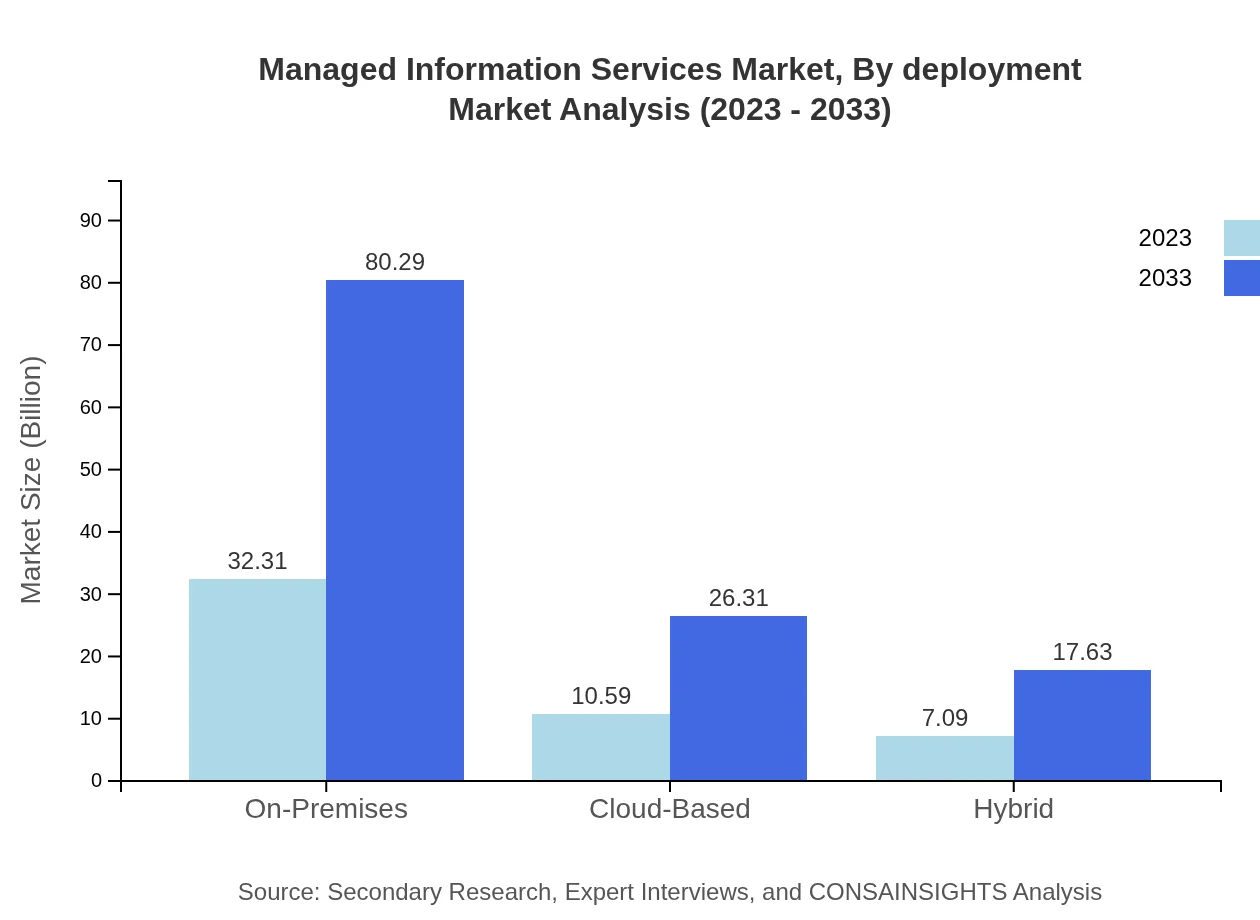

Managed Information Services Market Analysis By Deployment

Deployment types are another vital segmentation aspect. On-premises solutions currently hold a considerable market share at $32.31 billion, with a projected rise to $80.29 billion, as companies prefer traditional setups for sensitive data. Cloud-based services, starting at $10.59 billion, reach $26.31 billion, highlighting the successful shift towards remote infrastructures. Hybrid models, valued at $7.09 billion, are also gaining traction, expected to rise to $17.63 billion as organizations pursue flexible strategies combining both on-premises and cloud solutions.

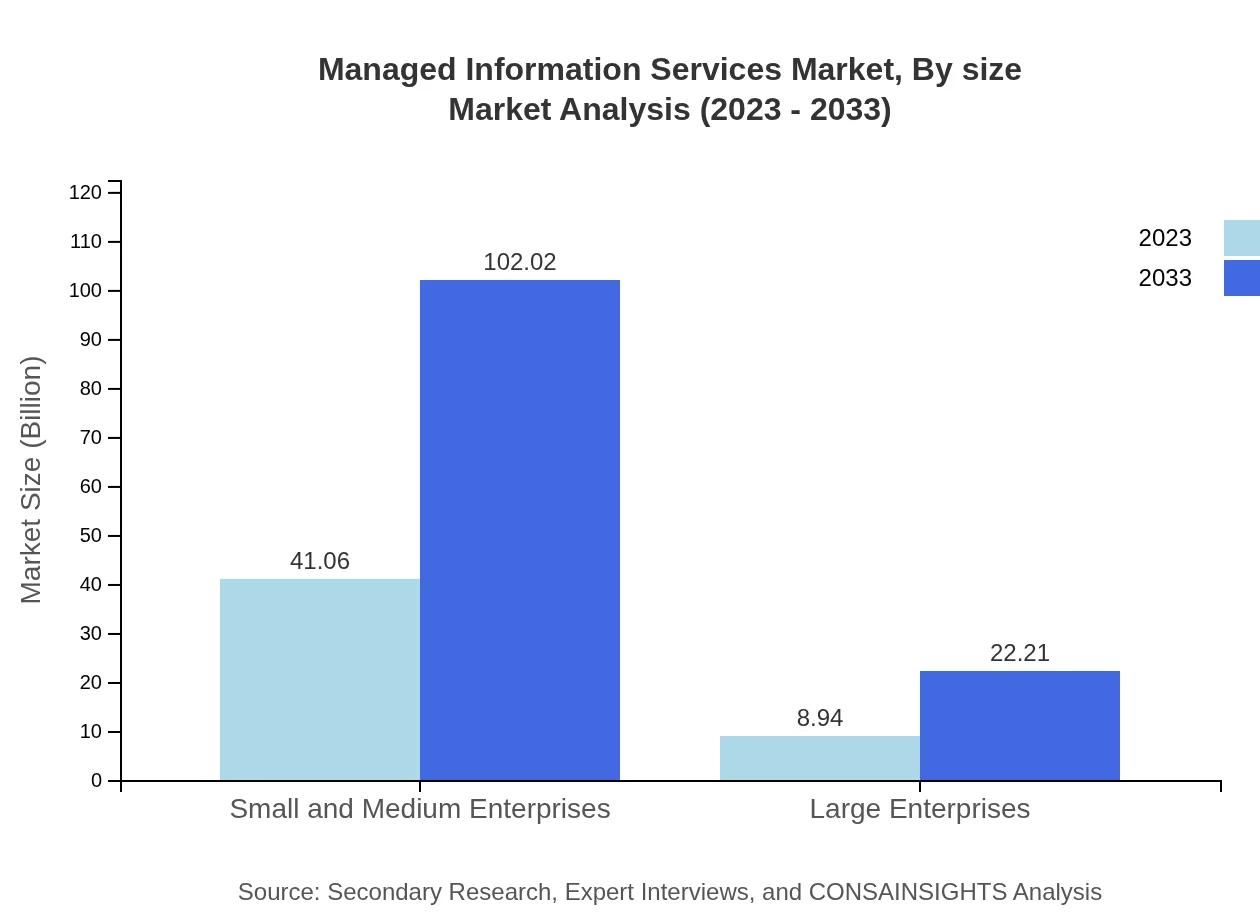

Managed Information Services Market Analysis By Size

The segmentation by organization size shows SMEs dominating the market with $41.06 billion in 2023, projected to grow to $102.02 billion, demonstrating their increasing focus on leveraging managed services for operational efficiency. Large enterprises, while smaller currently at $8.94 billion, are anticipated to grow to $22.21 billion, reflecting their need for robust management solutions due to complex operations.

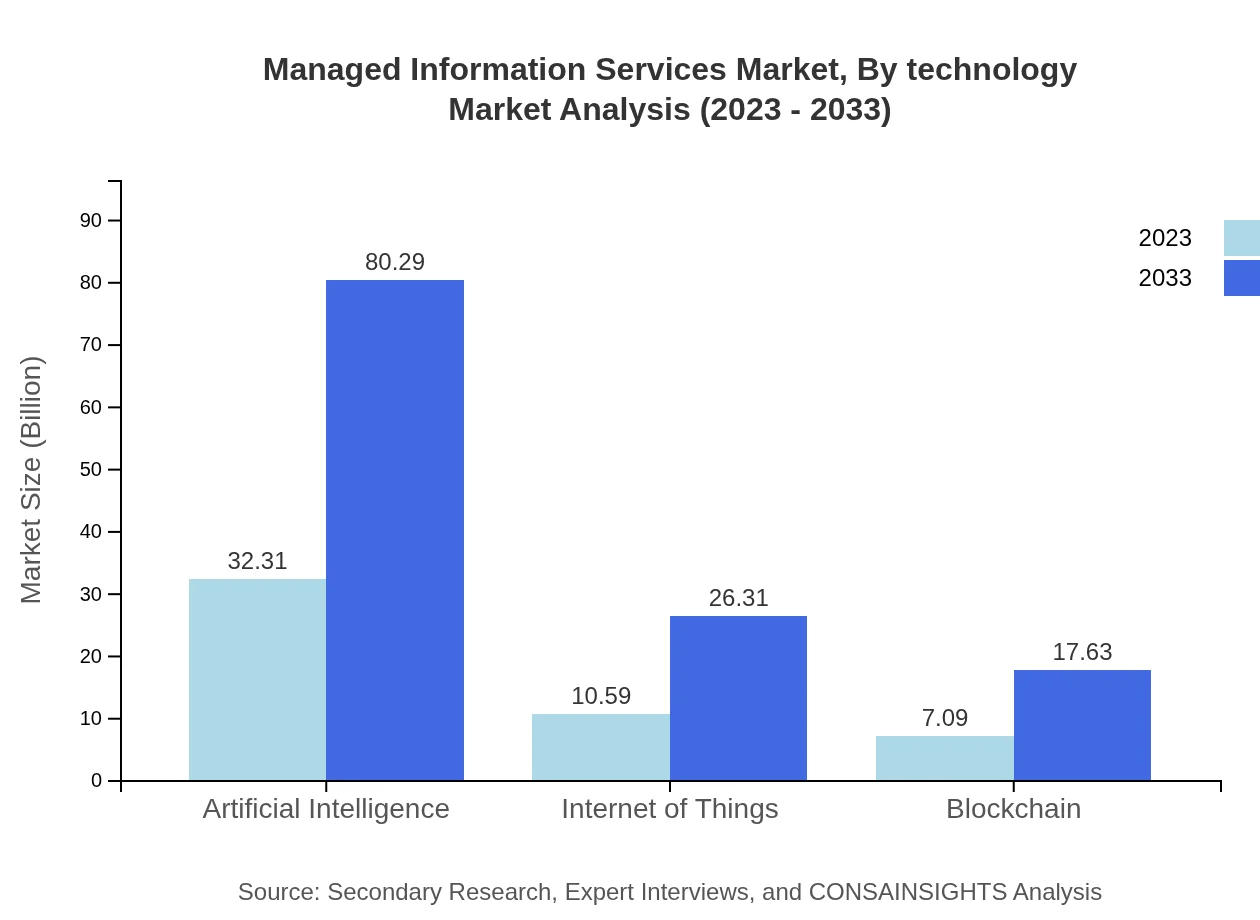

Managed Information Services Market Analysis By Technology

The technology segment includes AI, IoT, and blockchain plays a substantial role. AI, leading with a valuation of $32.31 billion in 2023, is expected to reach $80.29 billion due to its ability to enhance decision-making processes. IoT services earn $10.59 billion, on track for $26.31 billion growth, as connected technologies proliferate. Blockchain, at $7.09 billion, is also witnessing interest with resilience in data integrity solutions, poised to grow to $17.63 billion.

Managed Information Services Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Managed Information Services Industry

IBM Corporation:

IBM is a major player in the managed services sector, providing a broad range of information management solutions and AI-driven services, addressing diverse industry needs.Accenture:

Accenture specializes in consulting and technology services, offering comprehensive managed information solutions, helping organizations optimize their digital transformation.Dell Technologies:

Dell provides end-to-end managed services focusing on cloud solutions and high-level data management for businesses of all sizes, enhancing operational efficiency.Cisco Systems:

Cisco is known for its robust IT infrastructure solutions, delivering managed information services that secure and optimize networks for organizations globally.Cognizant:

Cognizant offers digital services and consulting expertise with a significant focus on data management and technology integration, supporting clients’ information needs.We're grateful to work with incredible clients.

FAQs

What is the market size of managed Information Services?

The managed information services market is projected to reach approximately $50 billion by 2033, growing at a CAGR of 9.2%. This highlights significant incremental growth and rising demand for information management solutions.

What are the key market players or companies in this managed Information Services industry?

Key players in the managed information services industry include top technology providers, cloud service specialists, and established consulting firms that dominate the competitive landscape.

What are the primary factors driving the growth in the managed Information Services industry?

The growth of managed information services is driven by increasing data complexity, demand for optimized IT expenditures, and regulatory compliance requirements across various sectors.

Which region is the fastest Growing in the managed Information Services?

North America leads the managed information services market, projected to grow from $18.96 billion in 2023 to $47.11 billion by 2033, making it the fastest-growing region.

Does ConsaInsights provide customized market report data for the managed Information Services industry?

Yes, ConsaInsights offers tailored market report data that can provide insights according to specific client needs within the managed information services industry.

What deliverables can I expect from this managed Information Services market research project?

Expect comprehensive reports, detailed market analysis, regional breakdowns, and insightful trends, along with strategic recommendations tailored for the managed information services sector.

What are the market trends of managed Information Services?

Market trends indicate a shift towards cloud-based solutions, data management enhancements, and the growing influence of artificial intelligence and machine learning within managed information services.