Managed Infrastructure Services Market Report

Published Date: 31 January 2026 | Report Code: managed-infrastructure-services

Managed Infrastructure Services Market Size, Share, Industry Trends and Forecast to 2033

This report explores the Managed Infrastructure Services market, providing insights on market dynamics, size, segmentation, regional analysis, and future forecasts from 2023 to 2033.

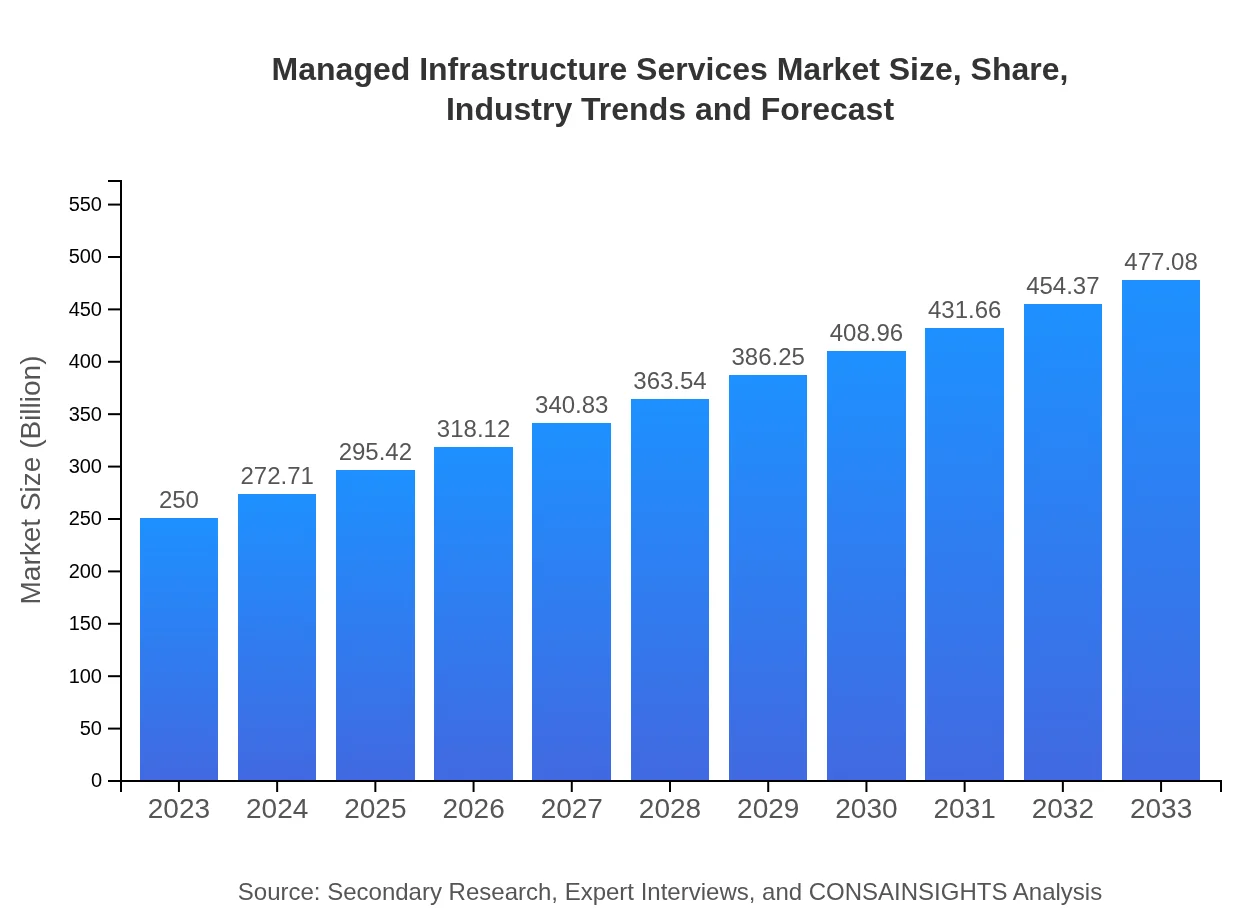

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $250.00 Billion |

| CAGR (2023-2033) | 6.5% |

| 2033 Market Size | $477.08 Billion |

| Top Companies | IBM, Accenture, Cisco Systems, Hewlett Packard Enterprise (HPE), Microsoft |

| Last Modified Date | 31 January 2026 |

Managed Infrastructure Services Market Overview

Customize Managed Infrastructure Services Market Report market research report

- ✔ Get in-depth analysis of Managed Infrastructure Services market size, growth, and forecasts.

- ✔ Understand Managed Infrastructure Services's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Managed Infrastructure Services

What is the Market Size & CAGR of Managed Infrastructure Services market in 2023?

Managed Infrastructure Services Industry Analysis

Managed Infrastructure Services Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Managed Infrastructure Services Market Analysis Report by Region

Europe Managed Infrastructure Services Market Report:

Europe's Managed Infrastructure Services market stands at $80.12 billion in 2023, with a forecast of $152.90 billion by 2033. Factors such as GDPR compliance, data protection concerns, and the shift towards hybrid cloud solutions are propelling growth, as businesses seek expertise to navigate complex regulations.Asia Pacific Managed Infrastructure Services Market Report:

The Asia Pacific region is experiencing rapid growth in the Managed Infrastructure Services market, primarily driven by digital transformation initiatives across various sectors. In 2023, the market is valued at $43.38 billion, projected to reach $82.77 billion by 2033, marking significant expansion fueled by increased IT spending and cloud adoption in countries like India and Japan.North America Managed Infrastructure Services Market Report:

The North American market, leading the Managed Infrastructure Services space, reports a size of $93.28 billion in 2023, forecasted to surge to $178 billion by 2033. The region's growth is driven by increased reliance on cloud computing, stringent regulatory compliance, and robust cybersecurity needs across industries.South America Managed Infrastructure Services Market Report:

In South America, the Managed Infrastructure Services market is valued at $21.72 billion in 2023 and is expected to grow to $41.46 billion by 2033. The rise of digital services and mobile connectivity is reshaping business priorities, leading to a greater demand for managed services to ensure operational efficiency amid economic challenges.Middle East & Africa Managed Infrastructure Services Market Report:

In the Middle East and Africa, the market is currently valued at $11.50 billion in 2023, aiming for $21.95 billion by 2033. The growing emphasis on improving IT infrastructure for economic diversification and investment in smart technologies are driving demand for managed services in this region.Tell us your focus area and get a customized research report.

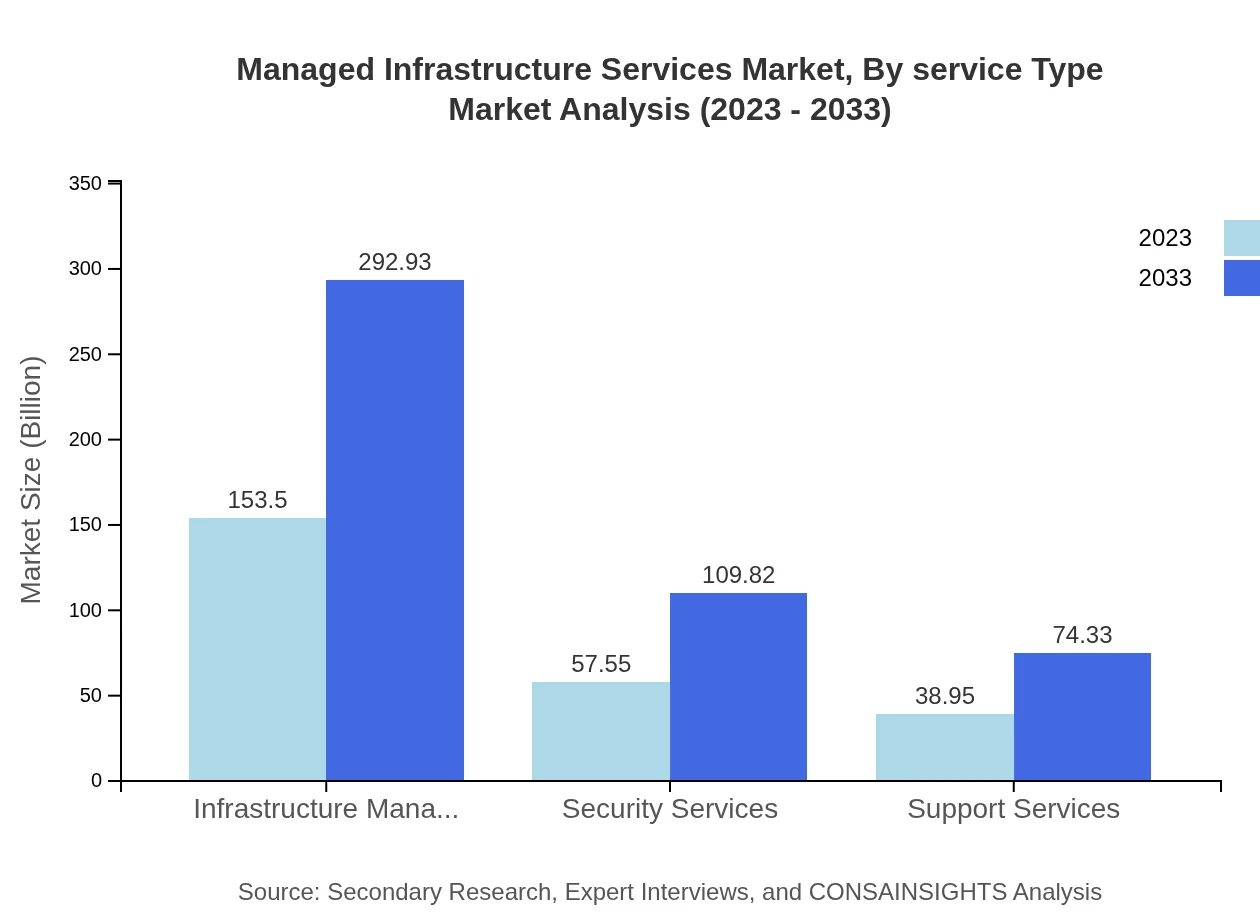

Managed Infrastructure Services Market Analysis By Service Type

The Managed Infrastructure Services market is notably segmented into infrastructure management, security services, and support services. Infrastructure management, accounting for $153.50 billion in 2023 and projected to grow to $292.93 billion by 2033, demonstrates significant importance as organizations seek comprehensive management of their IT resources. Security services are also critical, showing an increase from $57.55 billion in 2023 to $109.82 billion by 2033, reflecting heightened cybersecurity concerns. Support services, currently at $38.95 billion, are expected to grow to $74.33 billion, emphasizing the need for technical assistance to ensure seamless operation of infrastructure.

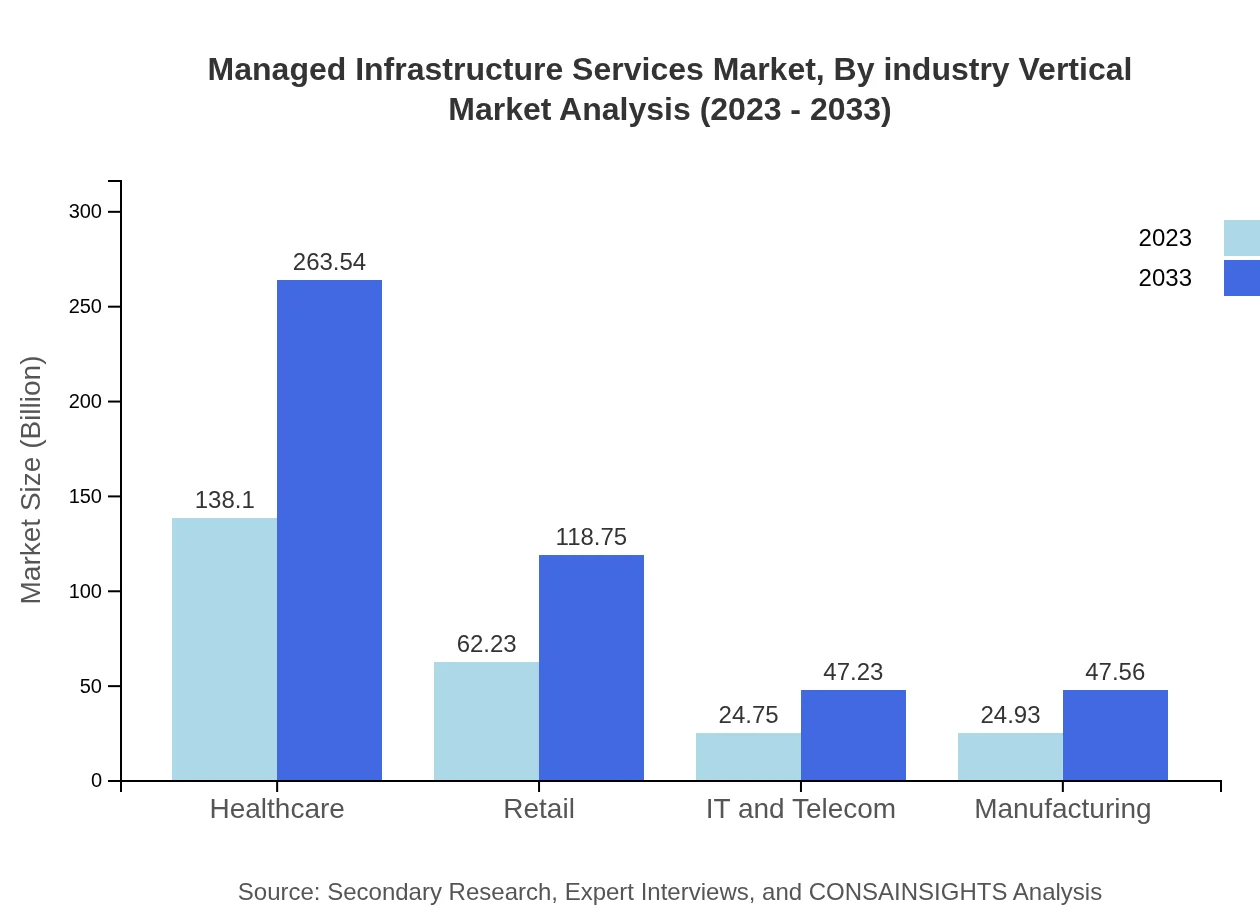

Managed Infrastructure Services Market Analysis By Industry Vertical

In terms of industry verticals, key segments include healthcare, retail, IT & telecom, and manufacturing. The healthcare segment, valued at $138.10 billion in 2023 and projected to reach $263.54 billion by 2033, highlights the critical role of managed services in adhering to strict compliance regulations. The retail sector, starting at $62.23 billion, is also set for growth to $118.75 billion, driven by demands for online services and omnichannel strategies.

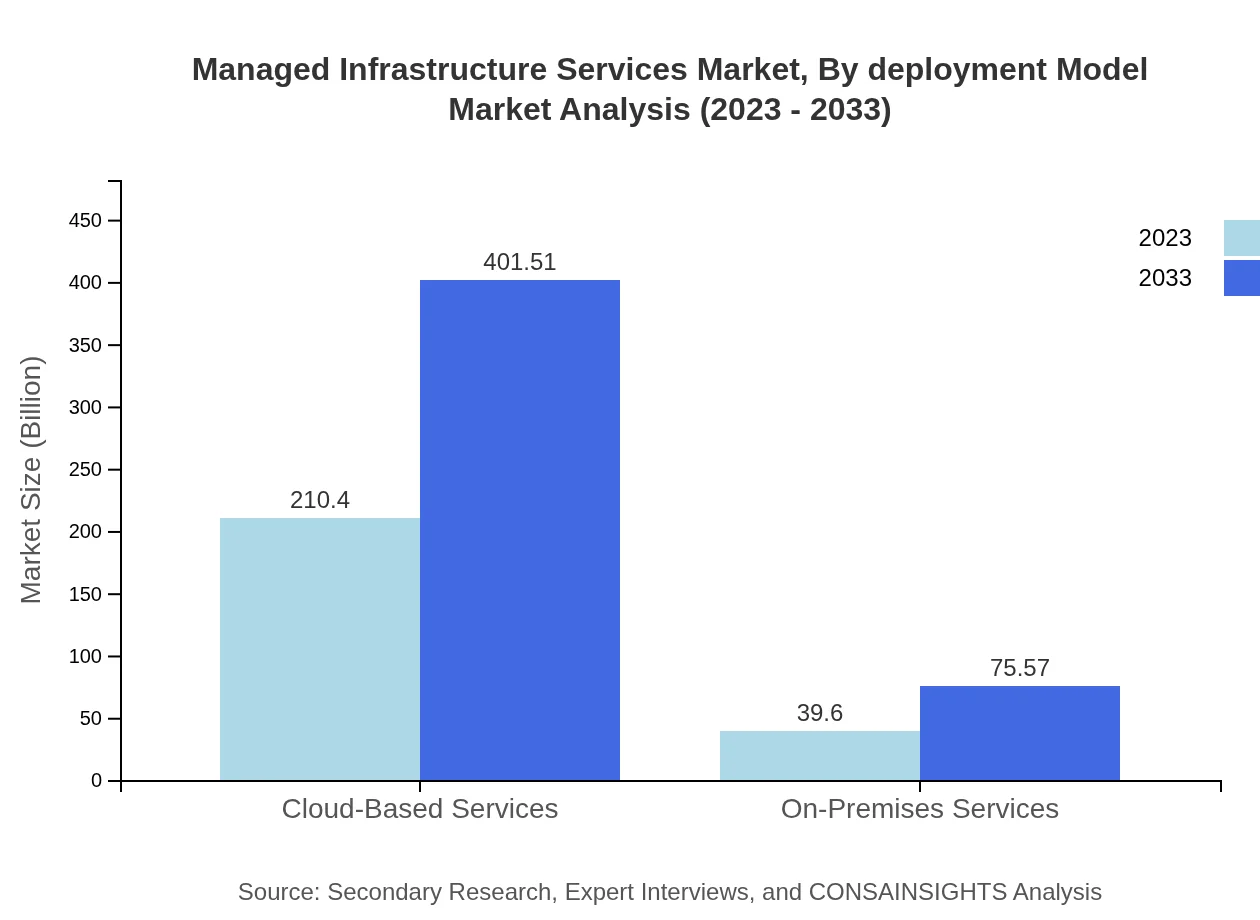

Managed Infrastructure Services Market Analysis By Deployment Model

The Managed Infrastructure Services market is segmented into cloud-based and on-premises services. Cloud-based services dominate the market at $210.40 billion in 2023, expected to double to $401.51 billion by 2033, showcasing the shift towards scalable and flexible IT solutions. On-premises services remain relevant, growing from $39.60 billion to $75.57 billion as organizations invest in localized data management.

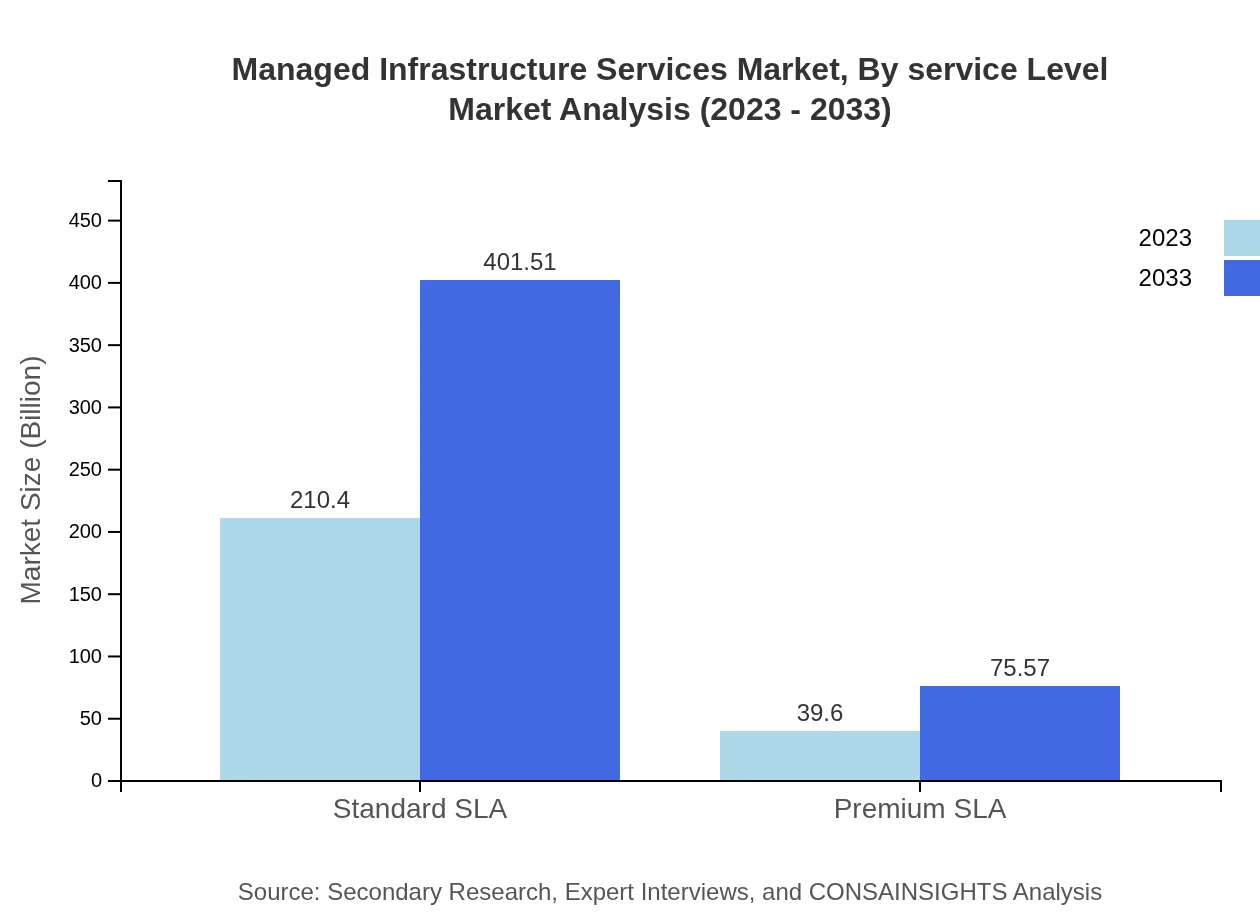

Managed Infrastructure Services Market Analysis By Service Level

The market is also segmented based on service-level agreements (SLAs), with standard SLAs and premium SLAs being the main focus. Standard SLAs are expected to grow from $210.40 billion in 2023 to $401.51 billion by 2033, representing a major share of the service segments due to their widespread adoption. Premium SLAs, while gaining traction, account for $39.60 billion in 2023, projected to scale up to $75.57 billion as businesses recognize the value of enhanced service levels.

Managed Infrastructure Services Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Managed Infrastructure Services Industry

IBM:

IBM offers a wide range of managed infrastructure solutions that help organizations enhance their IT environments with cloud services and AI integration.Accenture:

Accenture provides extensive managed services designed to optimize service delivery and enable digital transformation for businesses of all sizes.Cisco Systems:

Cisco is renowned for its networking technologies and manages an extensive range of cloud infrastructure services to support enterprises globally.Hewlett Packard Enterprise (HPE):

HPE delivers managed services with a strong focus on hybrid IT solutions, aiding companies in transition to cloud-based infrastructures.Microsoft:

Microsoft's Azure services feature prominent managed infrastructure solutions, enhancing cloud readiness and operational efficiency for global clients.We're grateful to work with incredible clients.

FAQs

What is the market size of Managed Infrastructure Services?

The Managed Infrastructure Services market is currently valued at approximately $250 billion, with a projected CAGR of 6.5% through 2033, indicating significant growth opportunities in this sector.

What are the key market players or companies in this Managed Infrastructure Services industry?

Key players in the Managed Infrastructure Services industry include major technology firms and service providers, such as IBM, Oracle, Microsoft, Cisco, and Accenture, known for their robust infrastructure solutions and service offerings.

What are the primary factors driving the growth in the Managed Infrastructure Services industry?

The growth drivers in the Managed Infrastructure Services industry include the increasing need for cost-effective solutions, the rise of cloud computing, demand for cybersecurity, and the global shift towards digital transformation.

Which region is the fastest Growing in the Managed Infrastructure Services?

The fastest-growing region in Managed Infrastructure Services is North America, expected to grow from $93.28 billion in 2023 to $178 billion by 2033, showcasing a strong demand for infrastructure services.

Does ConsaInsights provide customized market report data for the Managed Infrastructure Services industry?

Yes, ConsaInsights offers customized market report data tailored to client needs in the Managed Infrastructure Services sector, ensuring insights are relevant and actionable for specific business contexts.

What deliverables can I expect from this Managed Infrastructure Services market research project?

Deliverables from the Managed Infrastructure Services market research project typically include detailed market analysis reports, trend assessments, competitive landscape reviews, and region-specific forecasts.

What are the market trends of Managed Infrastructure Services?

Market trends in Managed Infrastructure Services include increased adoption of cloud-based services, focus on cybersecurity, expansion of service delivery models, and a shift towards managed solutions for operational efficiency.