Managed It Infrastructure Services Market Report

Published Date: 31 January 2026 | Report Code: managed-it-infrastructure-services

Managed It Infrastructure Services Market Size, Share, Industry Trends and Forecast to 2033

This report provides an in-depth analysis of the Managed IT Infrastructure Services market, detailing insights on market size, trends, segmentation, regional analysis, and key players for the forecast period of 2023 to 2033.

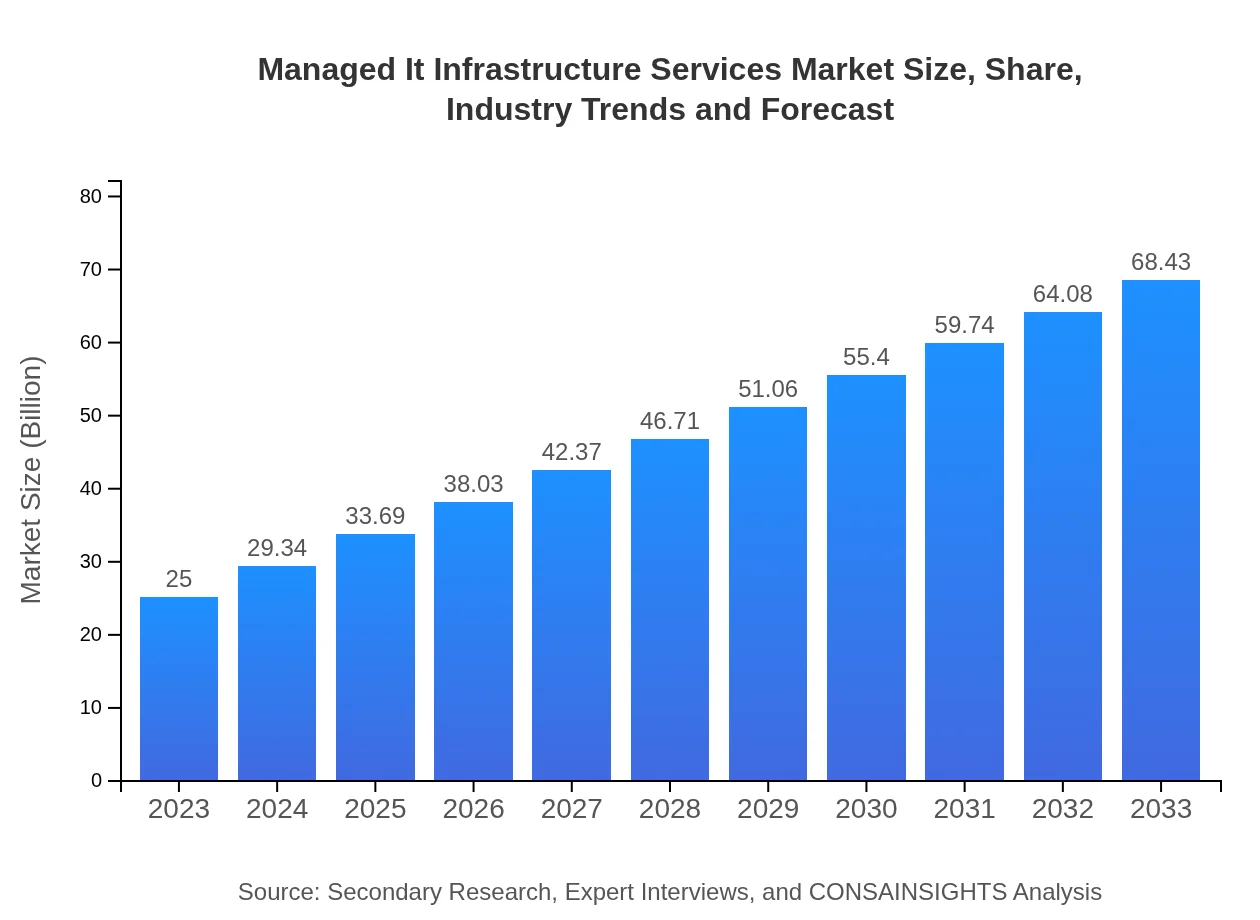

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $25.00 Billion |

| CAGR (2023-2033) | 10.2% |

| 2033 Market Size | $68.43 Billion |

| Top Companies | IBM, Cisco Systems, Amazon Web Services (AWS), Accenture |

| Last Modified Date | 31 January 2026 |

Managed IT Infrastructure Services Market Overview

Customize Managed It Infrastructure Services Market Report market research report

- ✔ Get in-depth analysis of Managed It Infrastructure Services market size, growth, and forecasts.

- ✔ Understand Managed It Infrastructure Services's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Managed It Infrastructure Services

What is the Market Size & CAGR of the Managed IT Infrastructure Services market in 2023?

Managed IT Infrastructure Services Industry Analysis

Managed IT Infrastructure Services Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Managed IT Infrastructure Services Market Analysis Report by Region

Europe Managed It Infrastructure Services Market Report:

The European Managed IT Infrastructure Services market is expected to increase from $8.41 billion in 2023 to $23.01 billion by 2033. Factors such as strict regulatory compliance requirements and increasing cybersecurity threats are prompting organizations to opt for managed services.Asia Pacific Managed It Infrastructure Services Market Report:

In 2023, the Asia Pacific Managed IT Infrastructure Services market is valued at approximately $4.44 billion and is anticipated to grow to $12.16 billion by 2033. The growth in this region is driven by increasing digitalization, a burgeoning middle-class population demanding improved IT services, and government initiatives aimed at promoting IT infrastructure development across various sectors.North America Managed It Infrastructure Services Market Report:

North America is the largest market, valued at $8.87 billion in 2023 and projected to grow to $24.27 billion by 2033. The region benefits from advanced technological infrastructure and the presence of major IT service providers. The high demand for innovative solutions and digital transformation initiatives are fueling growth in this segment.South America Managed It Infrastructure Services Market Report:

The South American market is valued at $0.66 billion in 2023, expecting to reach $1.79 billion by 2033. Economic recovery in the region and expanding IT infrastructure investments are key contributors to this growth. Organizations are increasingly adopting managed services to improve operational efficiency while dealing with economic challenges.Middle East & Africa Managed It Infrastructure Services Market Report:

In the Middle East and Africa, the market is projected to grow from $2.63 billion in 2023 to $7.19 billion by 2033. This growth is driven by economic diversification initiatives and the increasing focus on enhancing IT governance and compliance among organizations.Tell us your focus area and get a customized research report.

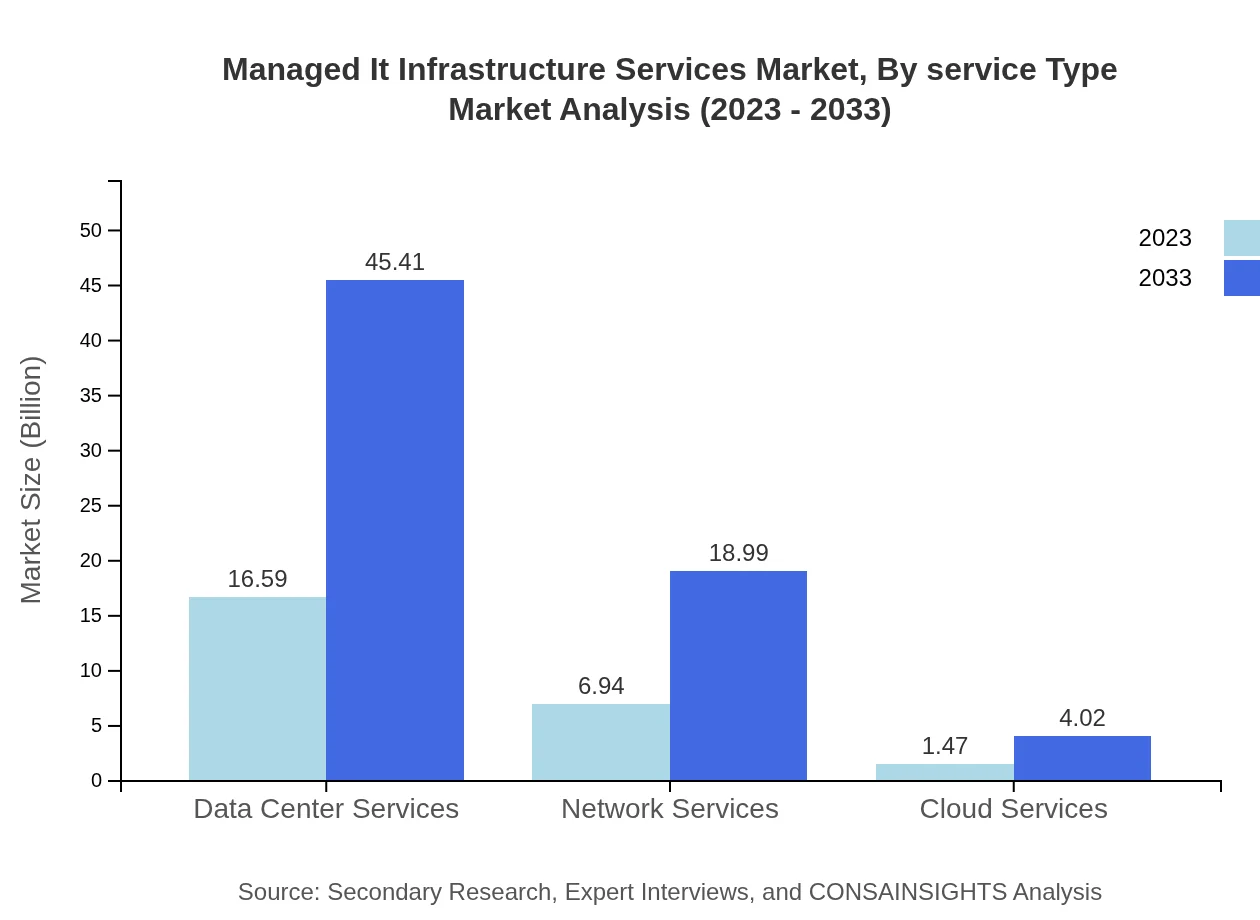

Managed It Infrastructure Services Market Analysis By Service Type

The services segment includes cloud services, data center services, and network services. In 2023, cloud services accounted for $1.47 billion, growing to $4.02 billion by 2033. Data center services dominate the market with revenues of $16.59 billion in 2023, expected to rise to $45.41 billion by 2033, emphasizing the shift towards complex data storage solutions. Network services, valued at $6.94 billion in 2023, are projected to reach $18.99 billion by 2033, reflecting businesses’ need for consistent and reliable connectivity.

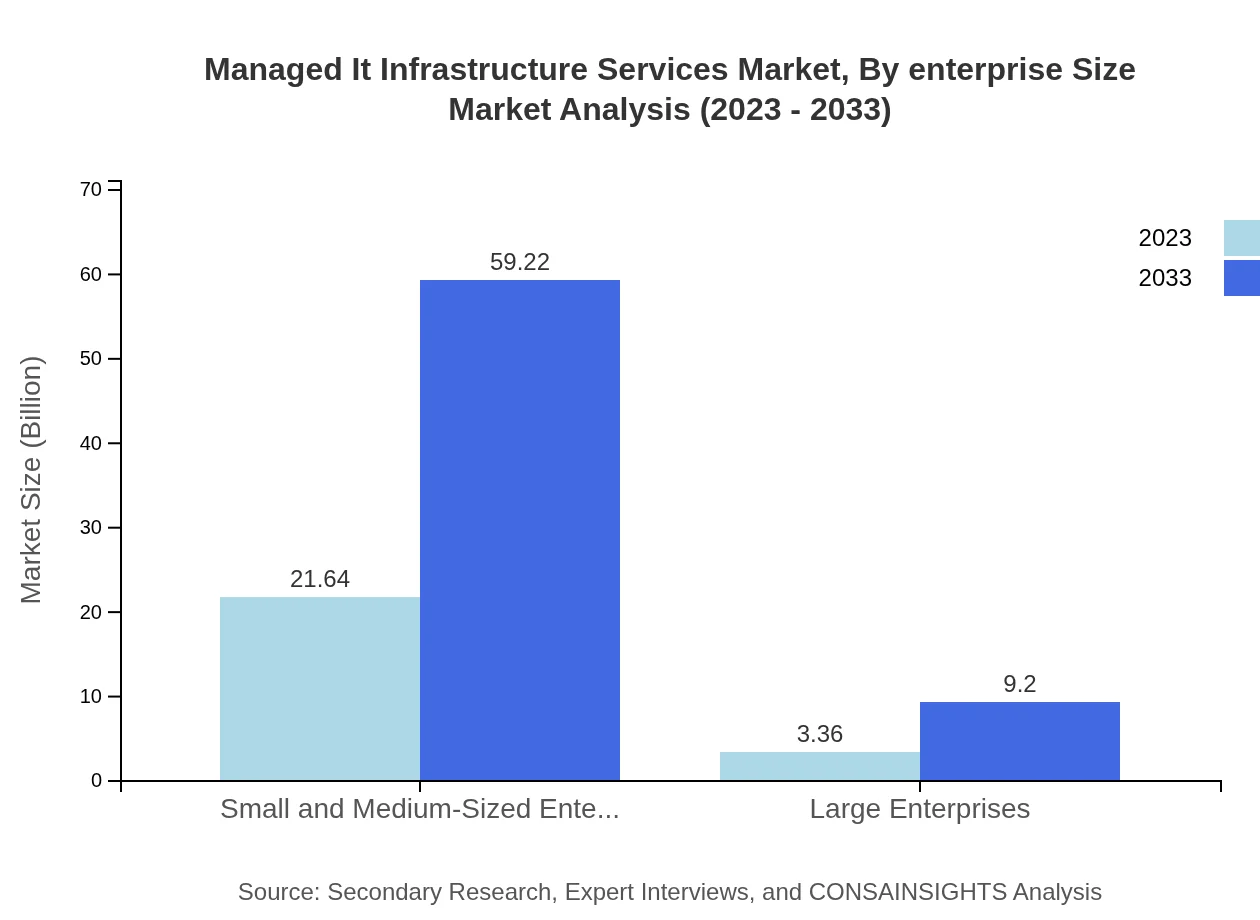

Managed It Infrastructure Services Market Analysis By Enterprise Size

Analysis reveals that small and medium-sized enterprises (SMEs) will dominate the market, reflecting a significant value of $21.64 billion in 2023, potentially reaching $59.22 billion by 2033. SMEs increasingly leverage managed IT services to enhance productivity while reducing costs. Conversely, large enterprises, with a much smaller share, will increase from $3.36 billion in 2023 to $9.20 billion by 2033, focusing on efficiency and innovation.

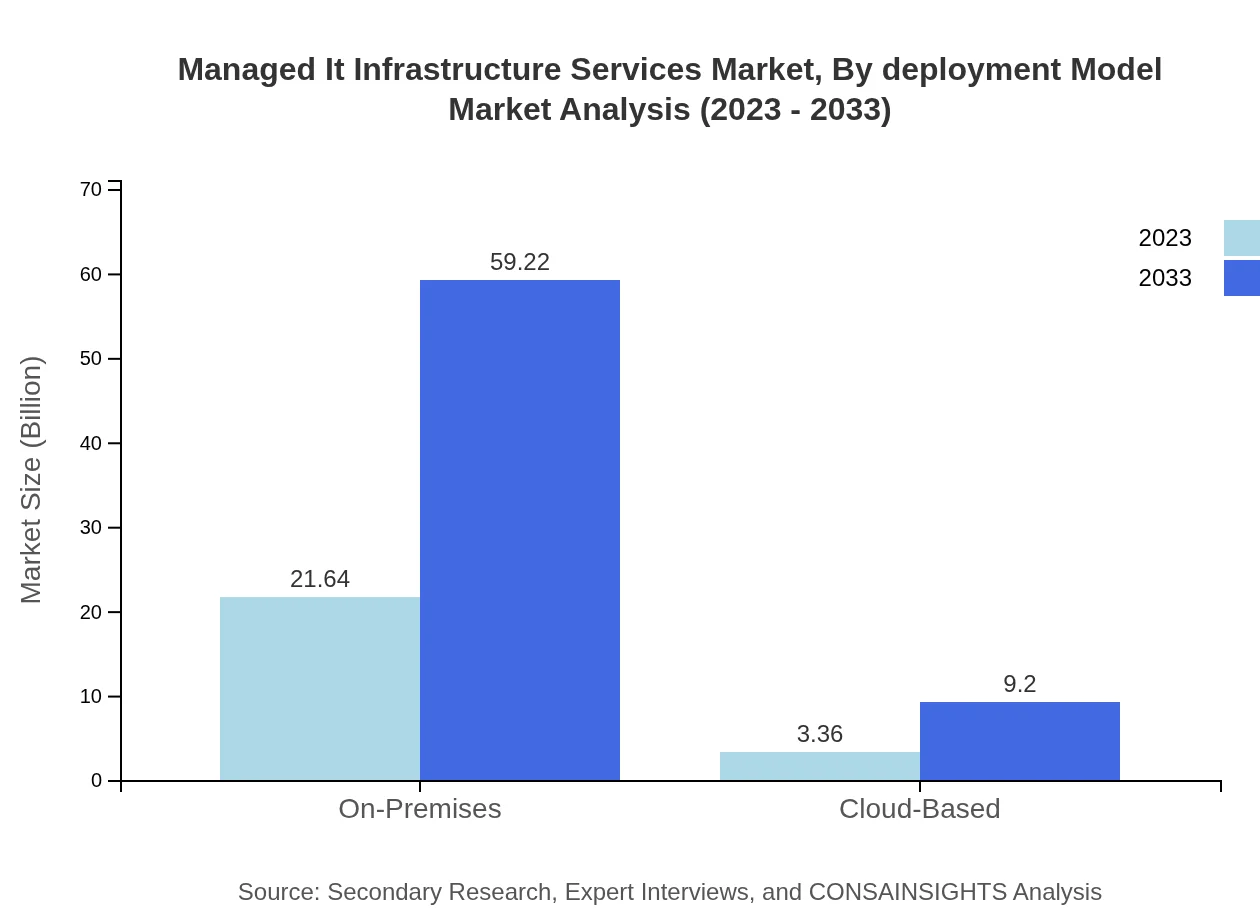

Managed It Infrastructure Services Market Analysis By Deployment Model

The deployment model segment comprises on-premises and cloud-based solutions. On-premises solutions are significant, starting at $21.64 billion in 2023 and expected to reach $59.22 billion by 2033. Meanwhile, cloud-based solutions are growing in popularity, yet comparatively smaller, projected to expand from $3.36 billion in 2023 to $9.20 billion by 2033. The growing acceptance of cloud computing technologies is pushing organizations toward integrating more flexible, cloud-based managed services.

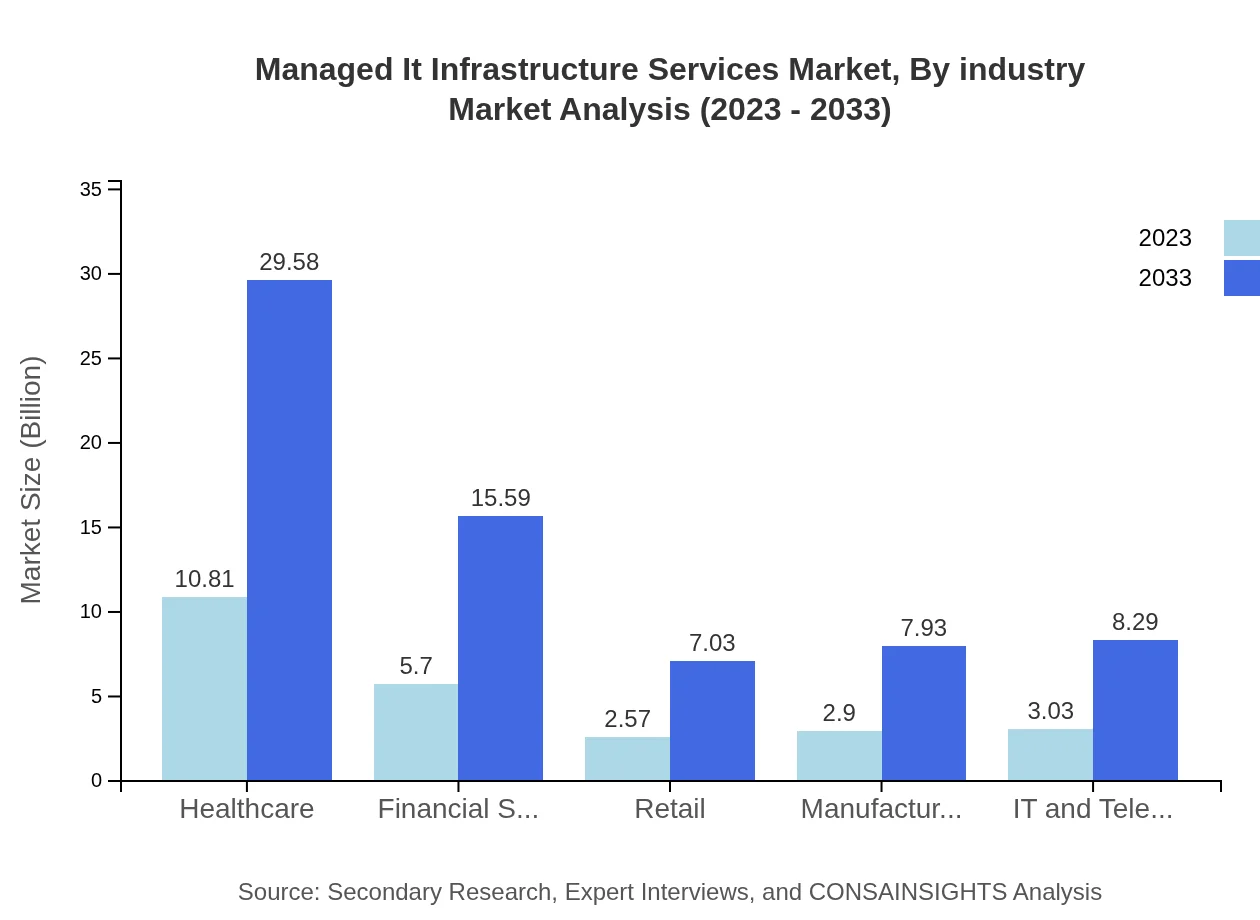

Managed It Infrastructure Services Market Analysis By Industry

Industries such as healthcare, education, and financial services significantly contribute to market growth. The healthcare sector, valued at $10.81 billion in 2023 and growing to $29.58 billion by 2033, heavily relies on managed services for compliance and patient data management. The financial services industry is also notable, moving from $5.70 billion to $15.59 billion within the same period, due to strict regulations demanding advanced IT management.

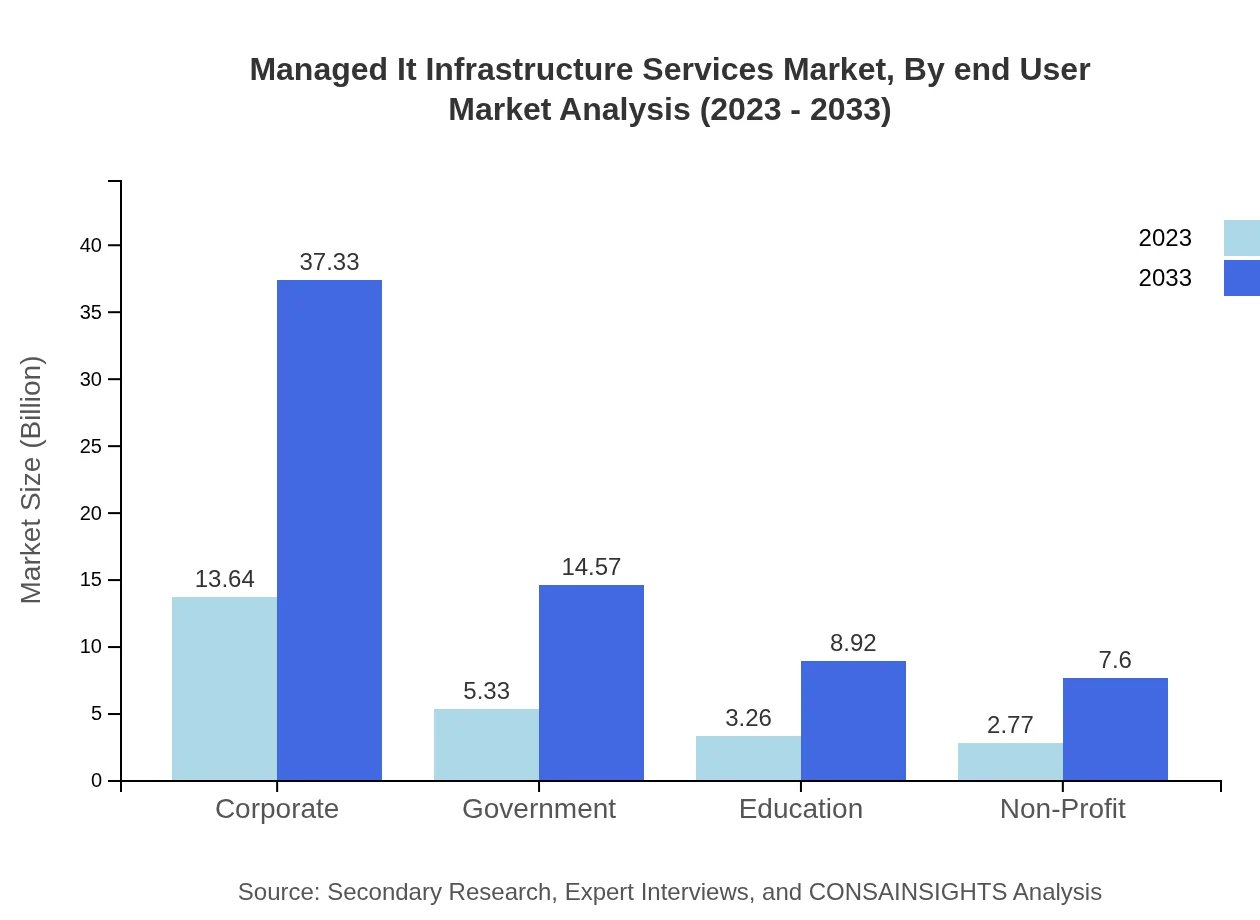

Managed It Infrastructure Services Market Analysis By End User

End-users of managed IT infrastructure services span various sectors, with corporate clients leading the charge, valued at $13.64 billion in 2023, anticipated to grow to $37.33 billion by 2033. The Government sector, tracking from $5.33 billion to $14.57 billion within the forecast period, reflects increasing investments in IT infrastructure management. Niche segments like non-profits and education are also emerging as significant contributors due to the global focus on digital transformation.

Managed IT Infrastructure Services Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in the Managed IT Infrastructure Services Industry

IBM:

IBM provides comprehensive managed services that include data center management, cloud computing, and AI-driven analytics solutions, helping clients leverage technology to enhance performance.Cisco Systems:

Cisco Systems specializes in network infrastructure management services, emphasizing advanced security solutions and robust connectivity for enterprises worldwide.Amazon Web Services (AWS):

As a leader in cloud services, AWS offers a suite of managed IT services supporting organizations’ digital transformations through scalable and flexible cloud solutions.Accenture:

Accenture delivers tailored managed services that integrate consulting and technology to help businesses adapt to evolving market demands efficiently.We're grateful to work with incredible clients.

FAQs

What is the market size of managed It Infrastructure Services?

The global Managed IT Infrastructure Services market is projected to grow from $25 billion in 2023 to significant values by 2033, reflecting a robust CAGR of 10.2%. This growth indicates rising demand across various sectors.

What are the key market players or companies in the managed It Infrastructure Services industry?

Key players in the Managed IT Infrastructure Services industry include large firms such as IBM, HP, and Accenture. These companies dominate through innovative solutions, strategic partnerships, and a comprehensive range of services catering to diverse client needs.

What are the primary factors driving the growth in the managed It Infrastructure Services industry?

The growth in managed IT infrastructure services is driven by increased adoption of cloud-based solutions, rising demand for automation, and need for enhanced data security. Organizations seek operational efficiency, fostering a greater reliance on managed service providers.

Which region is the fastest Growing in the managed It Infrastructure Services?

Europe is the fastest-growing region in the Managed IT Infrastructure Services market, with projections rising from $8.41 billion in 2023 to $23.01 billion by 2033. Asia Pacific also shows significant growth from $4.44 billion to $12.16 billion.

Does ConsaInsights provide customized market report data for the managed It Infrastructure Services industry?

Yes, ConsaInsights offers customized market report data tailored to specific needs in the Managed IT Infrastructure Services industry, allowing organizations to gain deep insights aligned with their business objectives and target markets.

What deliverables can I expect from this managed It Infrastructure Services market research project?

Deliverables from the Managed IT Infrastructure Services market research project typically include a comprehensive report, data analytics, segmentation insights, market forecasts, and tailored recommendations for strategic planning and investment decisions.

What are the market trends of managed It Infrastructure Services?

Current market trends in the Managed IT Infrastructure Services sector include a shift towards cloud services, increasing importance of cybersecurity measures, and a rising focus on AI-driven solutions that enhance operational efficiency and customer service.