Managed Network Services Market Report

Published Date: 31 January 2026 | Report Code: managed-network-services

Managed Network Services Market Size, Share, Industry Trends and Forecast to 2033

This report provides an in-depth analysis of the Managed Network Services market from 2023 to 2033, detailing market size, drivers, trends, and regional insights to inform strategic business decisions.

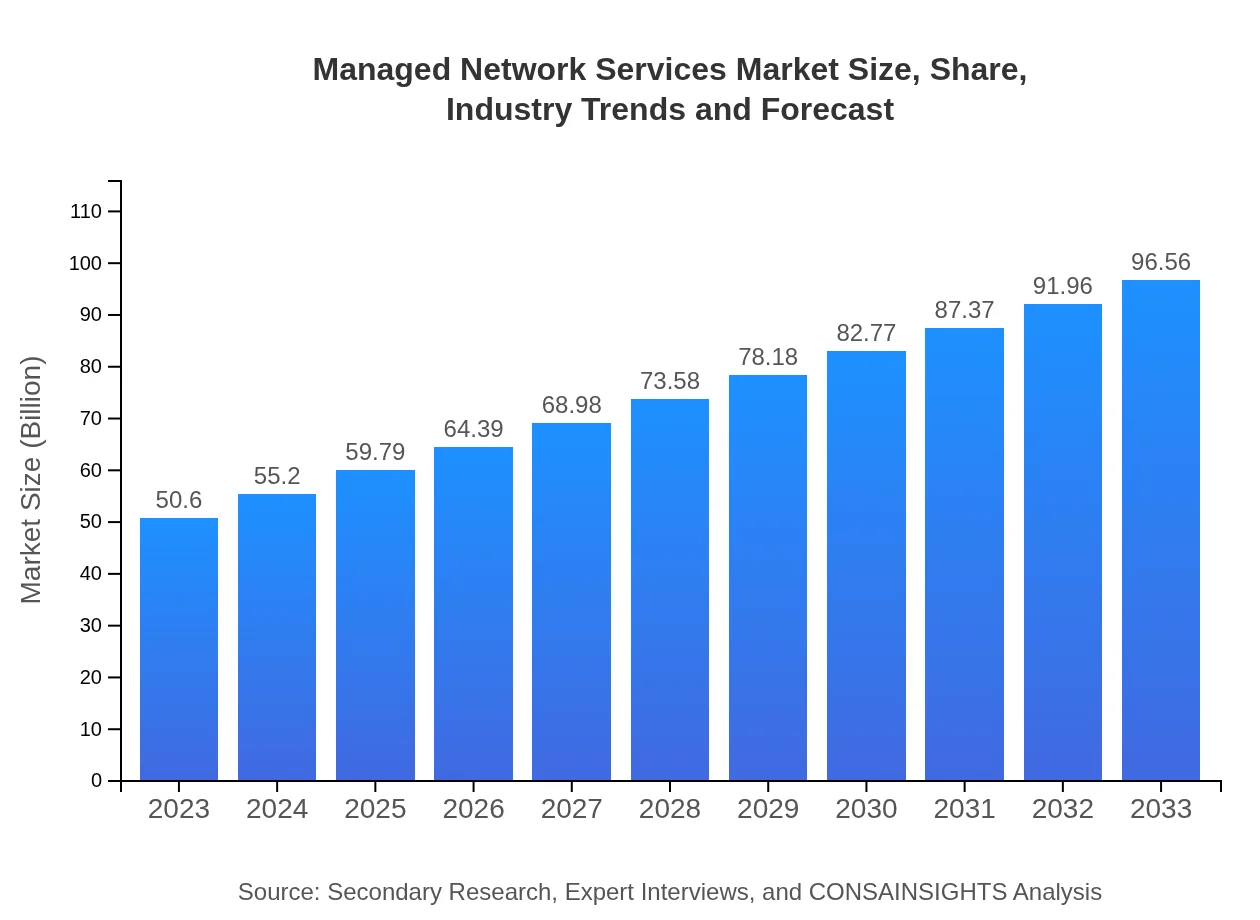

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $50.60 Billion |

| CAGR (2023-2033) | 6.5% |

| 2033 Market Size | $96.56 Billion |

| Top Companies | IBM, Cisco, AT&T, NTT Communications |

| Last Modified Date | 31 January 2026 |

Managed Network Services Market Overview

Customize Managed Network Services Market Report market research report

- ✔ Get in-depth analysis of Managed Network Services market size, growth, and forecasts.

- ✔ Understand Managed Network Services's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Managed Network Services

What is the Market Size & CAGR of Managed Network Services market in 2023?

Managed Network Services Industry Analysis

Managed Network Services Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Managed Network Services Market Analysis Report by Region

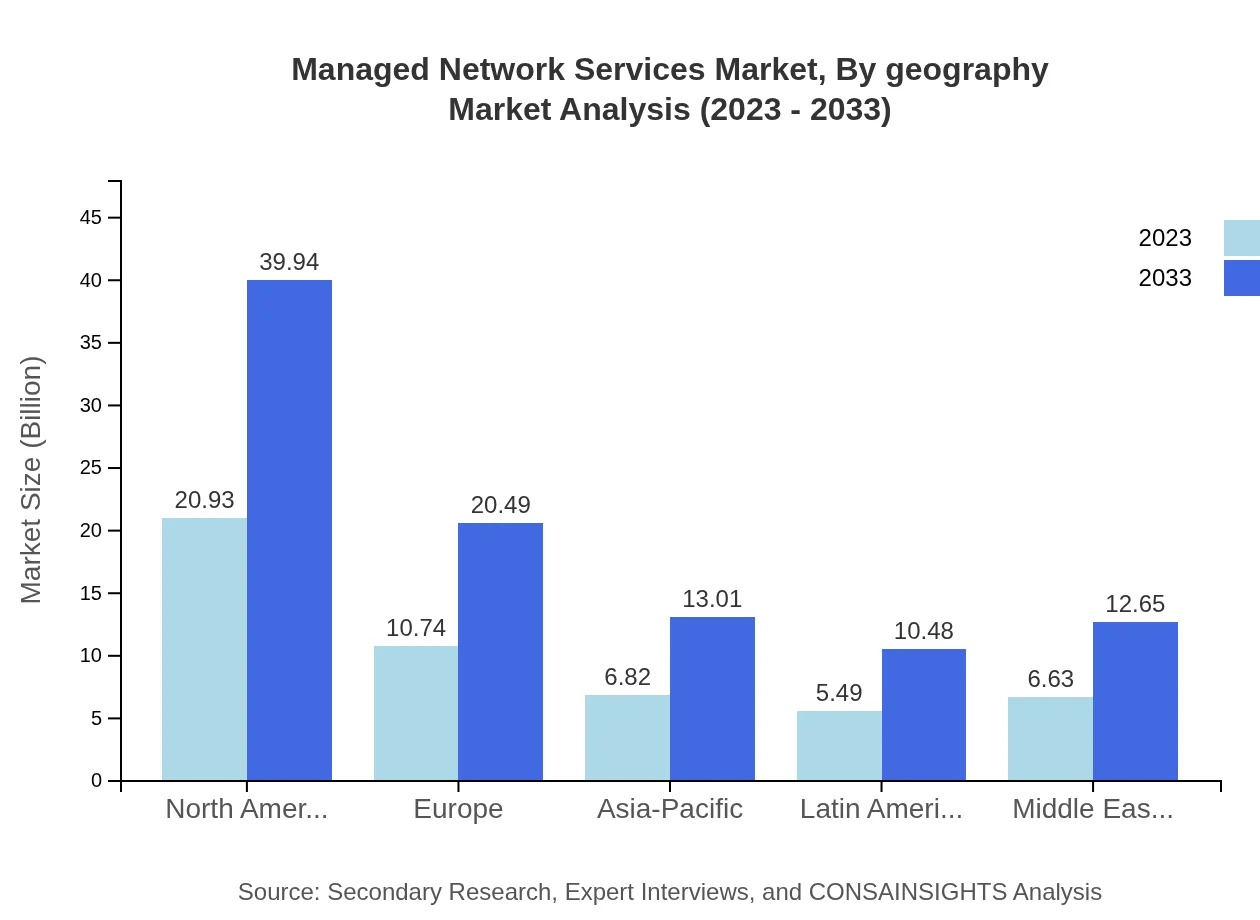

Europe Managed Network Services Market Report:

In Europe, the market is expected to increase from USD 12.26 billion in 2023 to USD 23.39 billion by 2033. The growth trajectory is supported by favorable regulatory frameworks and a booming technological landscape.Asia Pacific Managed Network Services Market Report:

In the Asia Pacific region, the Managed Network Services market is projected to grow from USD 9.66 billion in 2023 to USD 18.43 billion by 2033. This growth is driven by increasing digitalization and a growing number of startups, which are increasingly adopting managed services to enhance their IT capabilities.North America Managed Network Services Market Report:

North America remains a leader in the Managed Network Services market with an estimated size of USD 18.23 billion in 2023, projected to rise to USD 34.79 billion by 2033. The region's strong emphasis on cybersecurity and technological advancements contribute substantially to this growth.South America Managed Network Services Market Report:

The South American market is estimated to expand from USD 4.39 billion in 2023 to USD 8.38 billion in 2033, with significant growth opportunities in Brazil and Argentina as they improve their network infrastructures.Middle East & Africa Managed Network Services Market Report:

The Middle East and Africa market is poised to grow from USD 6.06 billion in 2023 to USD 11.57 billion by 2033, spurred by increased investments in ICT and the digital economy.Tell us your focus area and get a customized research report.

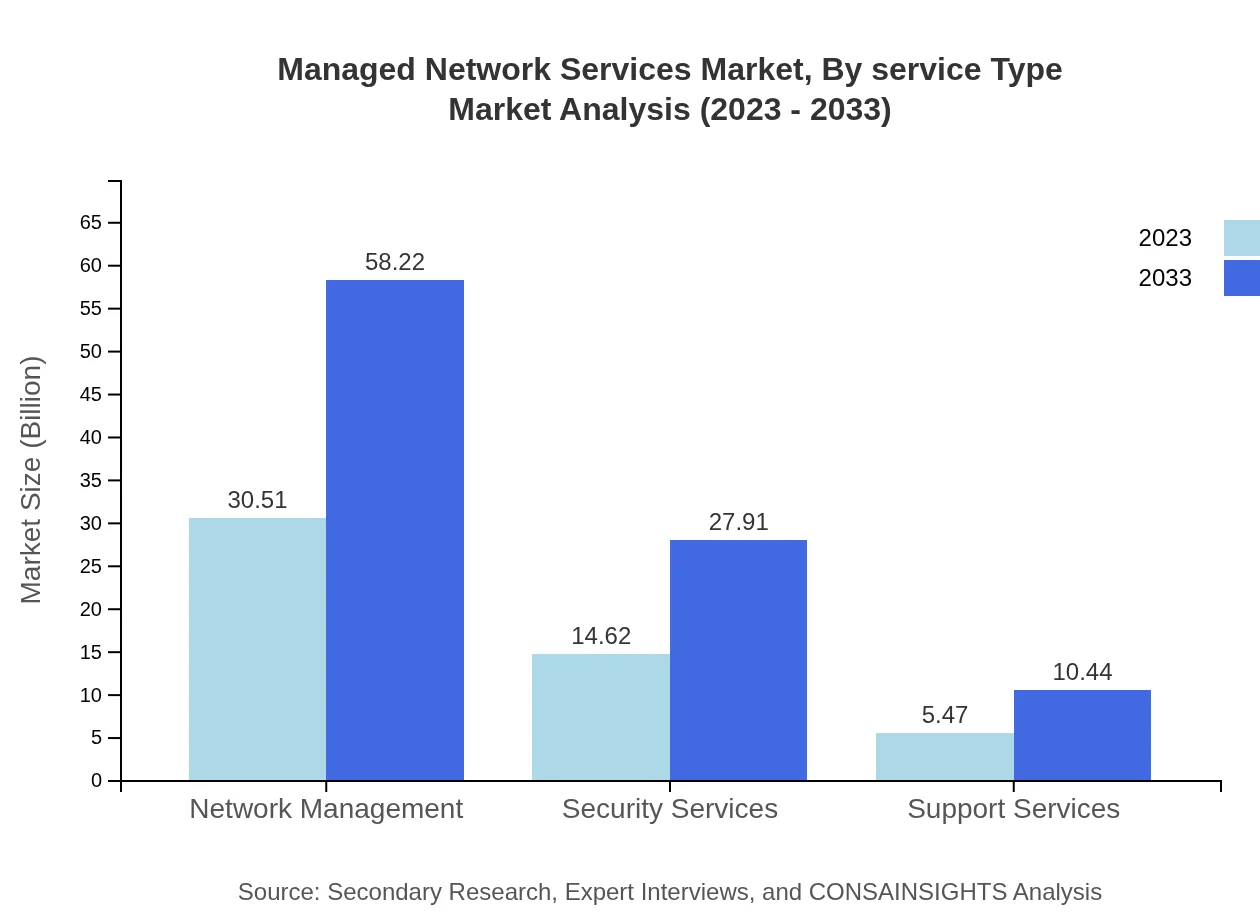

Managed Network Services Market Analysis By Service Type

The Managed Network Services market can be segmented by service type, including Network Management, Security Services, and Support Services. Network Management holds a significant share, accounting for approximately 60.29% of revenue in 2023, set to grow to 60.29% by 2033. Security Services account for 28.9% in 2023 and are expected to maintain a similar share as organizations prioritize data protection. Support Services, while smaller, also show promising growth.

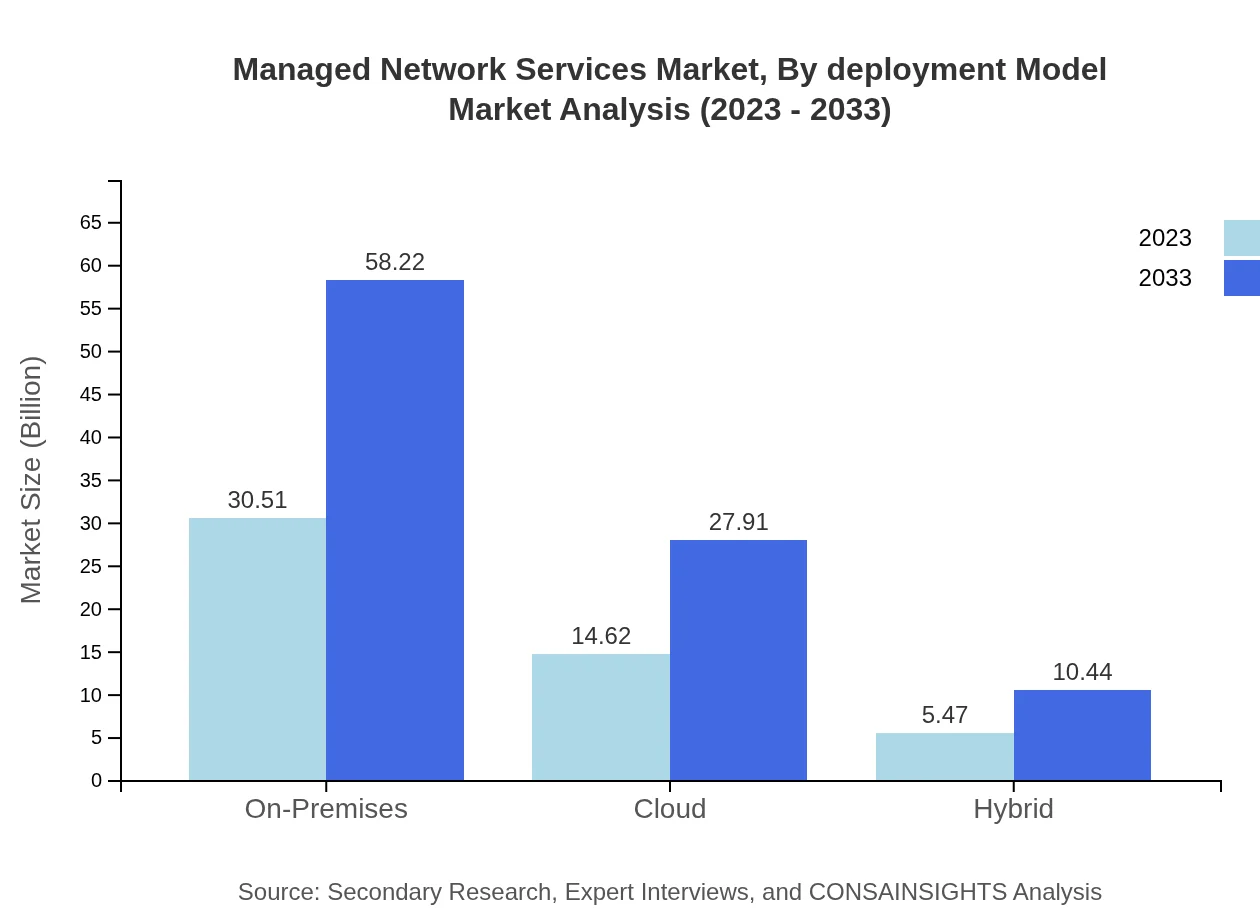

Managed Network Services Market Analysis By Deployment Model

Deployment models encompass On-Premises, Cloud, and Hybrid. On-premises solutions represent the largest market share at 60.29% in 2023. Cloud-based services are gradually increasing in adoption, expecting a share of 28.9% by 2033 as businesses seek flexibility and scalability, while Hybrid models are projected to grow from 10.81% in 2023.

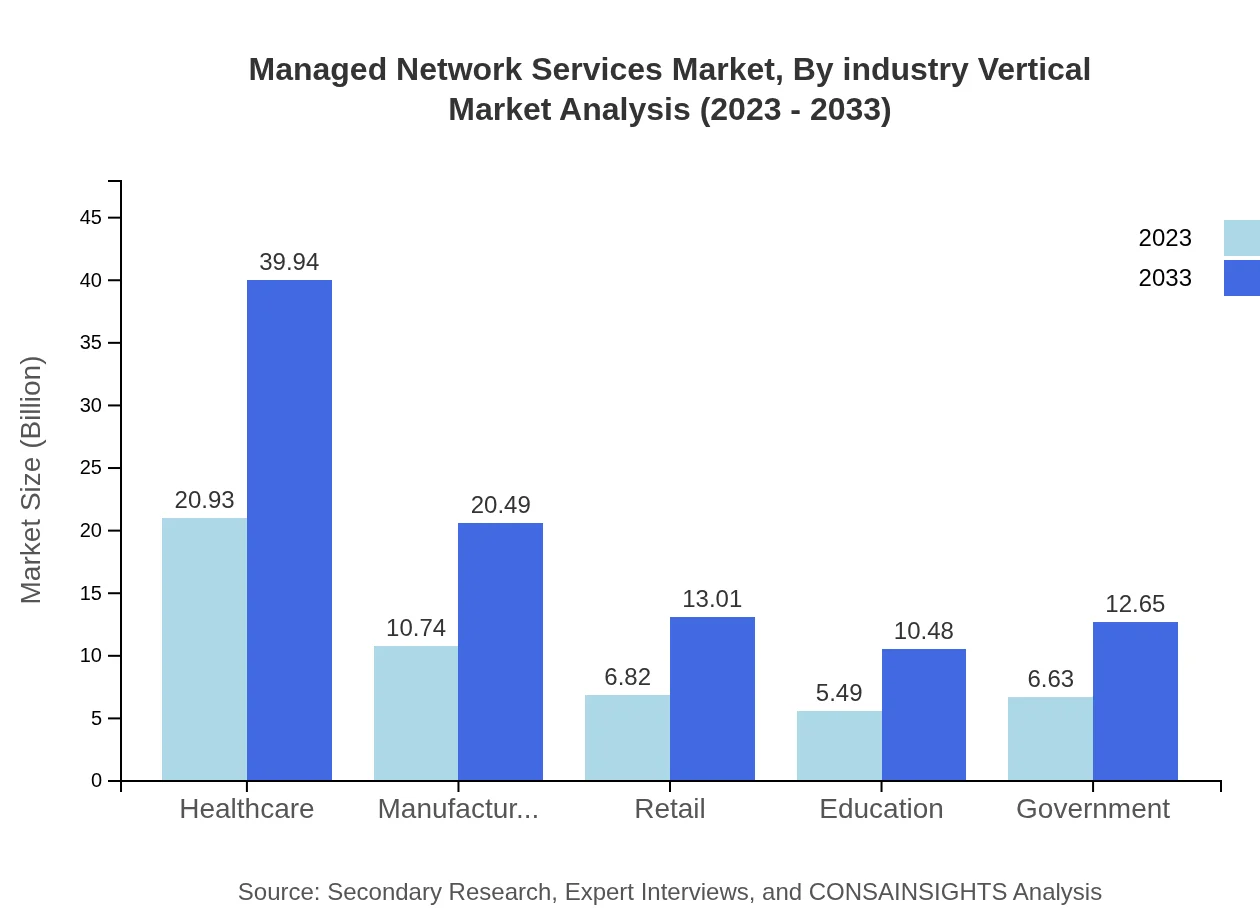

Managed Network Services Market Analysis By Industry Vertical

Industries such as Healthcare, Manufacturing, Retail, Education, and Government show varied adoption rates for Managed Network Services. Healthcare leads with a share of 41.36% in 2023, driven by regulatory compliance needs, while Manufacturing and Retail follow at 21.22% and 13.47% respectively.

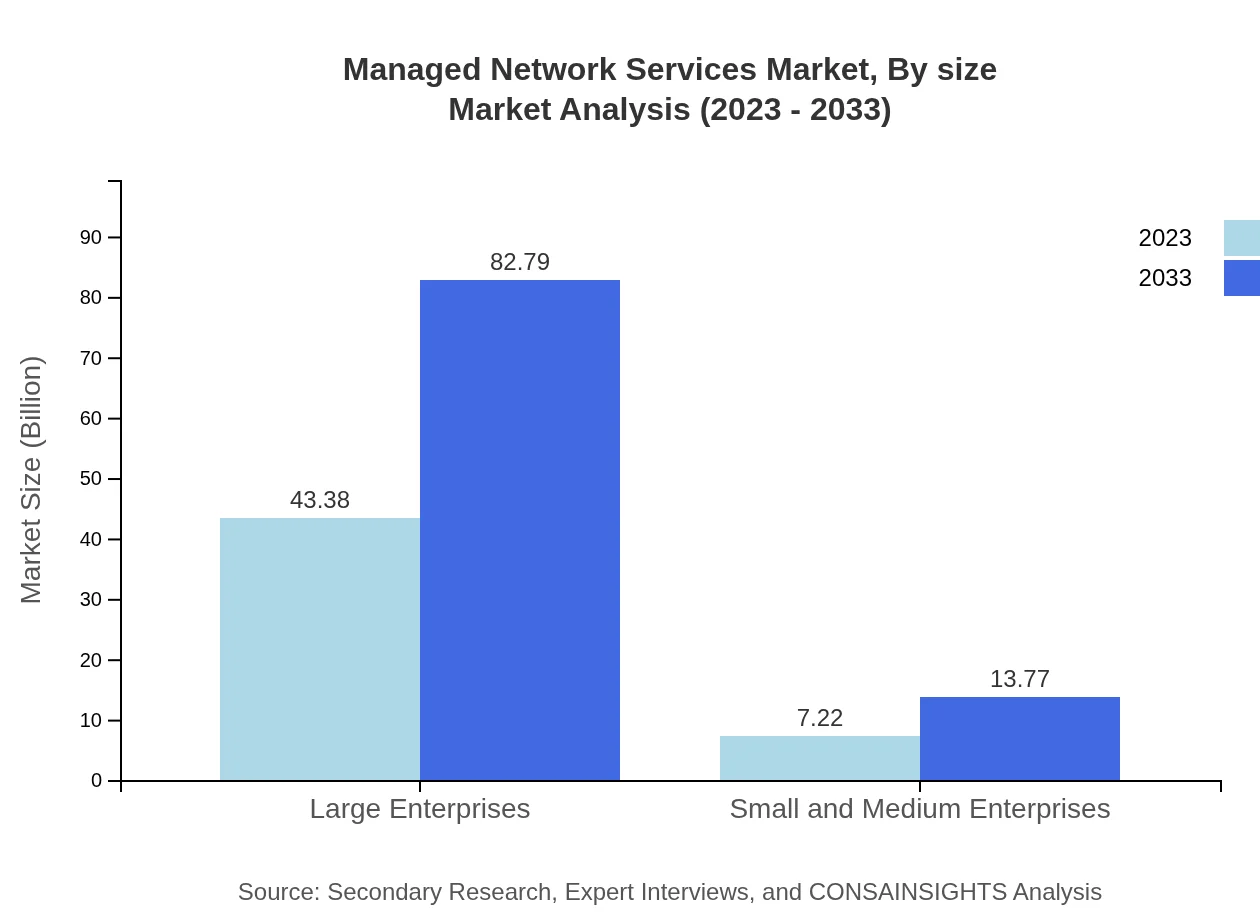

Managed Network Services Market Analysis By Size

Large Enterprises dominate the market, contributing 85.74% of revenues in 2023 and expected to remain consistent. Small and Medium Enterprises are also a growing segment, increasing their share to 14.26%, highlighting the democratization of access to managed services.

Managed Network Services Market Analysis By Geography

Geographically, North America holds the largest share at 41.36% in 2023, driven by established IT infrastructure. Europe follows with 21.22%, bolstered by strong regulations. Asia-Pacific, however, is rapidly closing the gap with significant growth prospects.

Managed Network Services Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Managed Network Services Industry

IBM:

A global leader in technology and consulting, offering advanced managed services to enhance business performance.Cisco:

Specializes in networking technology, providing robust managed network services solutions across various sectors.AT&T:

Offers comprehensive managed network services, focusing on security solutions and network reliability.NTT Communications:

A leading provider of network services with an emphasis on digital transformation strategies.We're grateful to work with incredible clients.

FAQs

What is the market size of managed Network Services?

The global Managed Network Services market is projected to reach approximately $50.6 billion by 2033, growing at a CAGR of 6.5% from 2023. This growth reflects increasing demand for efficient network management across various sectors.

What are the key market players or companies in this managed Network Services industry?

Key players in the managed-network-services industry include major technology companies such as Cisco Systems, IBM, and AT&T. These companies offer a variety of services ranging from network management to comprehensive IT solutions and are critical in shaping market dynamics.

What are the primary factors driving the growth in the managed Network Services industry?

Primary growth factors in managed-network-services include the increasing complexity of network infrastructure, the rise in cybersecurity threats, the demand for cost-effective IT solutions, and the shift towards automation and cloud-based services which enhance efficiency and reliability.

Which region is the fastest Growing in the managed Network Services?

The North American region is expected to grow the fastest in the managed-network-services market, reaching $34.79 billion by 2033, following a robust increase from $18.23 billion in 2023, driven by advanced technology infrastructure and high adoption rates.

Does ConsaInsights provide customized market report data for the managed Network Services industry?

Yes, ConsaInsights offers customized market report data tailored to specific needs within the managed-network-services sector. This includes in-depth analysis at various levels, catering to niche segments and geographical areas for targeted insights.

What deliverables can I expect from this managed Network Services market research project?

From the managed-network-services market research project, clients can expect comprehensive deliverables including detailed market analysis reports, segment data, regional insights, forecasts, and strategic recommendations, all aimed at aiding informed business decisions.

What are the market trends of managed Network Services?

Current trends in the managed-network-services market include a shift towards cloud-based solutions, increased investment in cybersecurity measures, the adoption of AI for proactive management, and a growing focus on customer-centric service models to address client needs effectively.