Manufacturing Analytics Market Report

Published Date: 31 January 2026 | Report Code: manufacturing-analytics

Manufacturing Analytics Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Manufacturing Analytics market from 2023 to 2033. It covers market dynamics, trends, regional insights, and key players, offering valuable data and forecasts to support strategic business decisions.

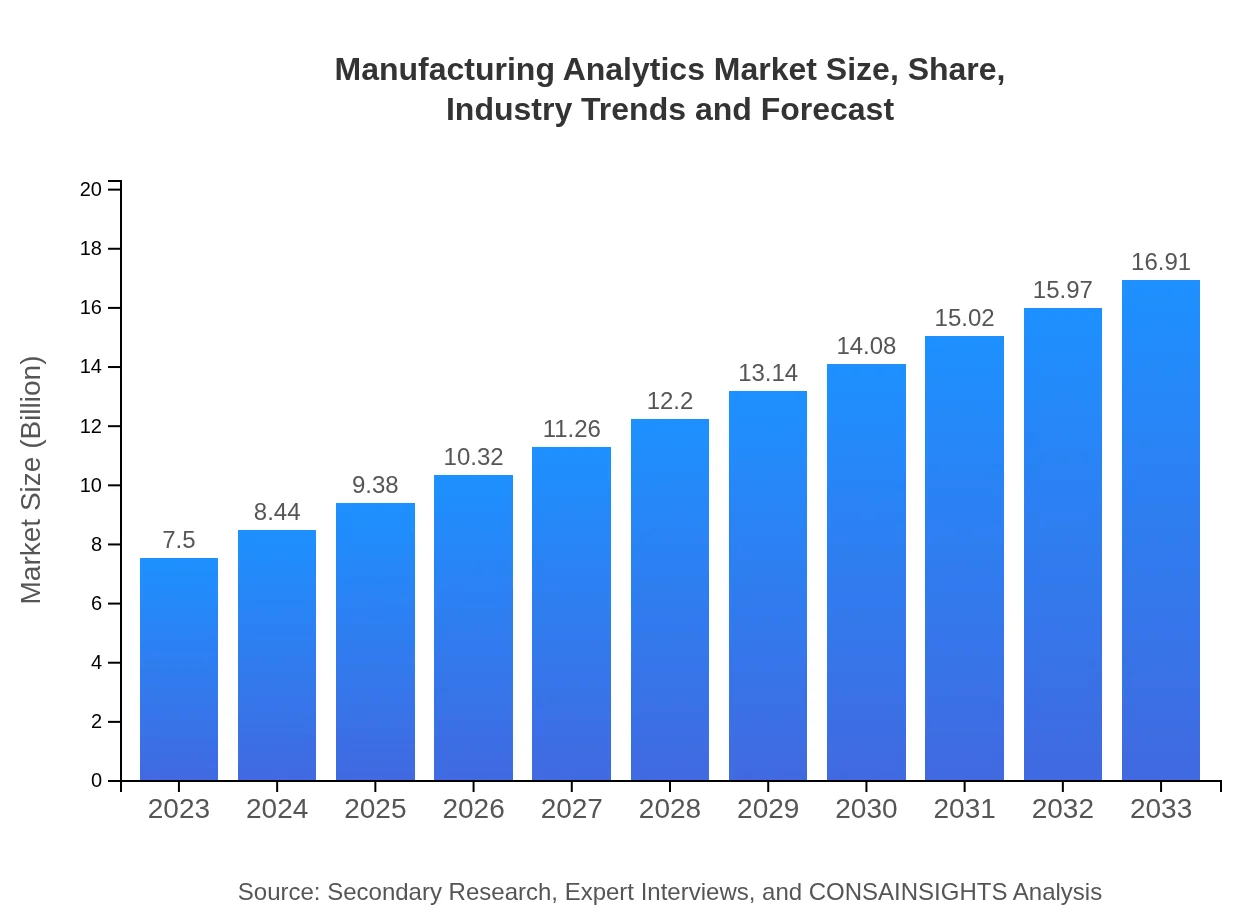

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $7.50 Billion |

| CAGR (2023-2033) | 8.2% |

| 2033 Market Size | $16.91 Billion |

| Top Companies | Siemens AG, IBM Corporation, SAS Institute Inc., Microsoft Corporation, Rockwell Automation, Inc. |

| Last Modified Date | 31 January 2026 |

Manufacturing Analytics Market Overview

Customize Manufacturing Analytics Market Report market research report

- ✔ Get in-depth analysis of Manufacturing Analytics market size, growth, and forecasts.

- ✔ Understand Manufacturing Analytics's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Manufacturing Analytics

What is the Market Size & CAGR of Manufacturing Analytics market in 2023?

Manufacturing Analytics Industry Analysis

Manufacturing Analytics Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Manufacturing Analytics Market Analysis Report by Region

Europe Manufacturing Analytics Market Report:

In Europe, the market size is estimated at $2.05 billion in 2023, reaching $4.62 billion by 2033. The region is witnessing robust growth due to increased investment in smart manufacturing and sustainability initiatives.Asia Pacific Manufacturing Analytics Market Report:

In 2023, the Asia Pacific Manufacturing Analytics market is valued at $1.44 billion and is projected to grow to $3.24 billion by 2033, driven by the rapid industrialization and adoption of advanced analytics technologies in countries like China and India.North America Manufacturing Analytics Market Report:

North America holds a significant share of the market with a valuation of $2.85 billion in 2023, projected to reach $6.41 billion by 2033. The presence of major manufacturing firms and a strong emphasis on innovation are driving this growth.South America Manufacturing Analytics Market Report:

The South American market is expected to reach $0.28 billion in 2023, increasing to $0.64 billion by 2033. Growth in this region is primarily influenced by the increasing focus on digital transformation in manufacturing processes.Middle East & Africa Manufacturing Analytics Market Report:

The Middle East and Africa market is valued at $0.88 billion in 2023, projected to grow to $1.99 billion by 2033. This growth is driven by increasing automation and modernization efforts within the manufacturing sector.Tell us your focus area and get a customized research report.

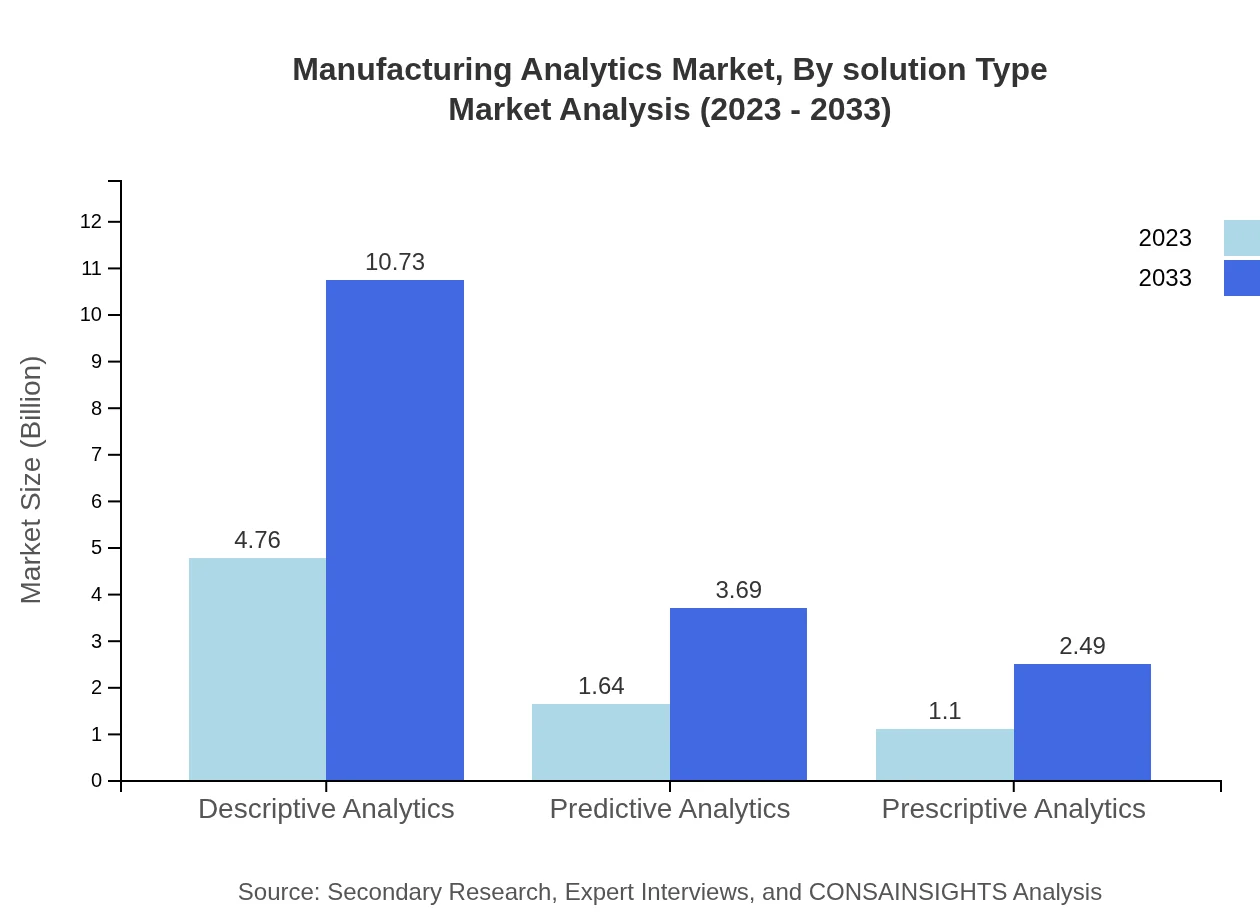

Manufacturing Analytics Market Analysis By Solution Type

The solution type segment shows robust growth, with Descriptive Analytics leading the market at $4.76 billion in 2023 and expected to grow to $10.73 billion by 2033, consistently holding a 63.46% market share. Predictive and Prescriptive Analytics are also growing, driven by their applications in improving manufacturing efficiency.

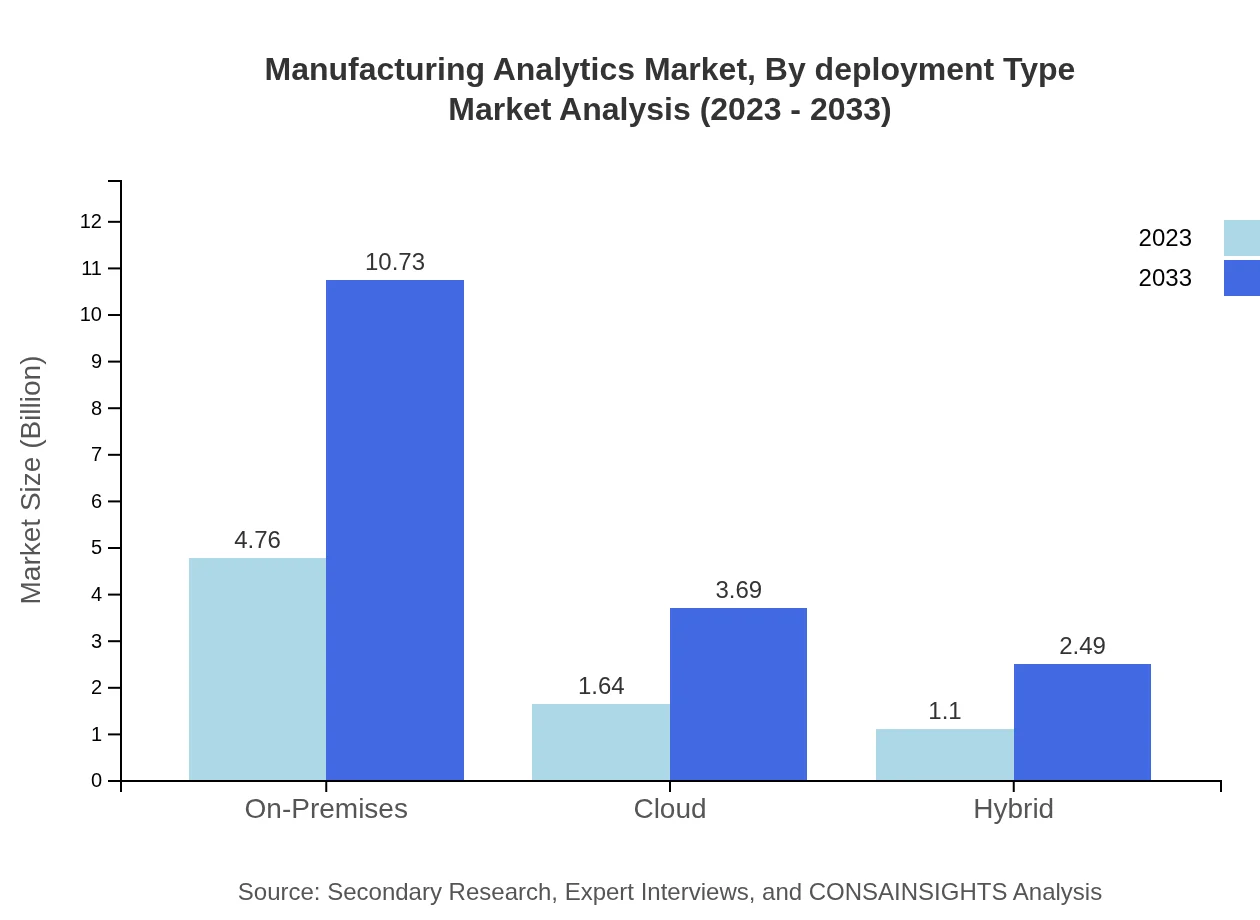

Manufacturing Analytics Market Analysis By Deployment Type

On-Premises solutions comprise 63.46% of the market share, valued at $4.76 billion in 2023 and projected to grow to $10.73 billion by 2033. Cloud and Hybrid deployments are gaining traction, expected to benefit from the increasing demand for flexibility and scalability in analytics solutions.

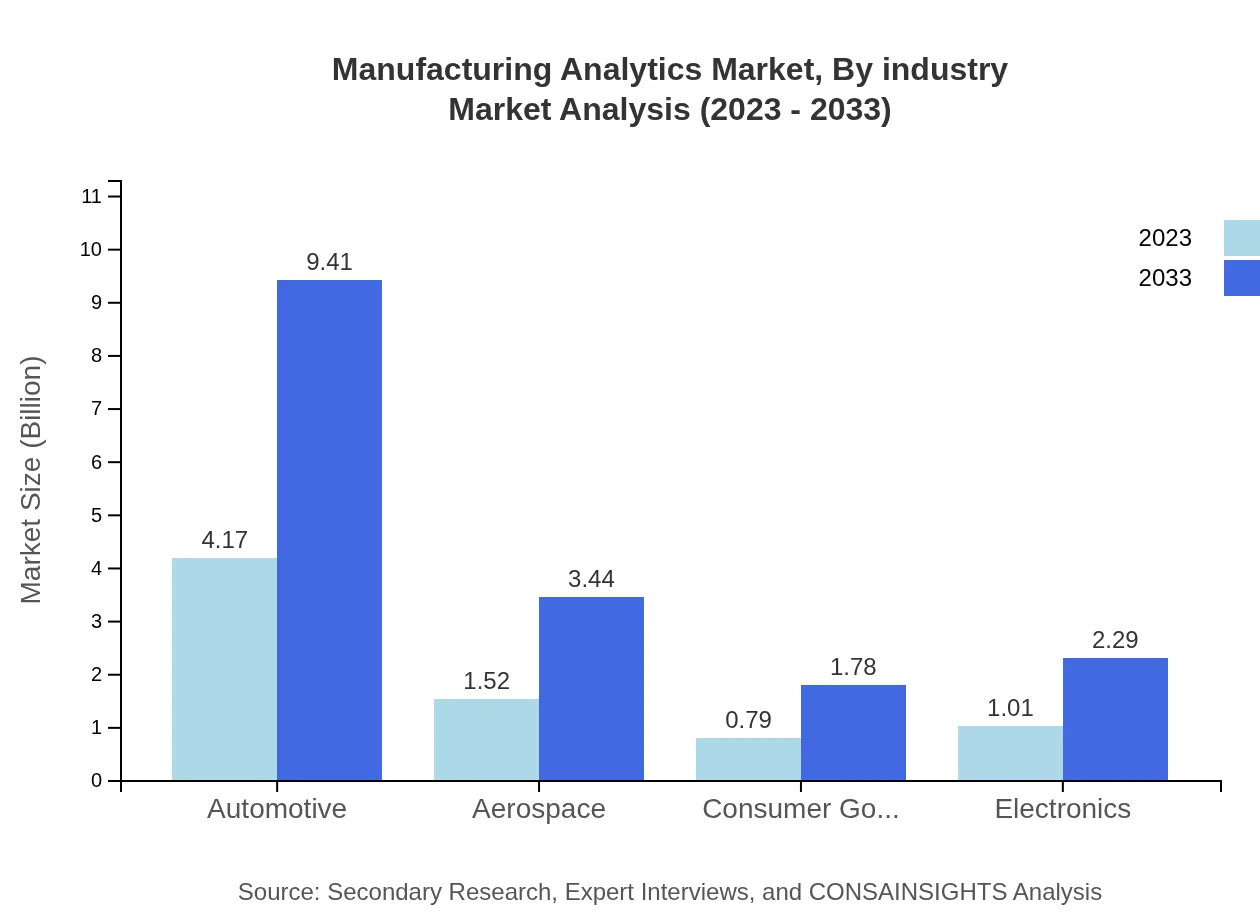

Manufacturing Analytics Market Analysis By Industry

The Automotive industry represents the largest segment, accounting for a market size of $4.17 billion in 2023 and expected to reach $9.41 billion by 2033, retaining a 55.66% market share. Other industries like Aerospace and Electronics are also expected to grow, emphasizing the need for analytics to enhance quality and production processes.

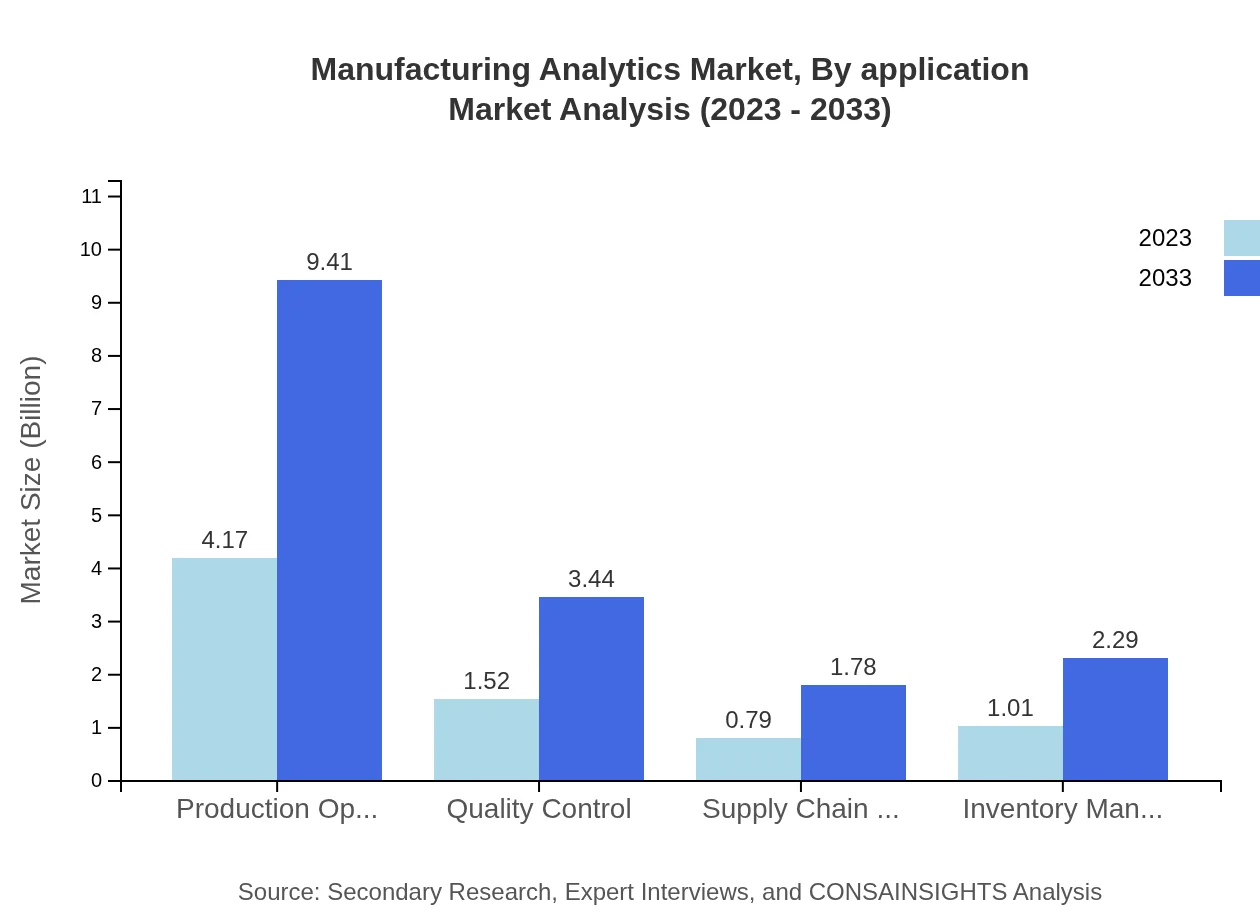

Manufacturing Analytics Market Analysis By Application

Production Optimization is a key application area, with a market size of $4.17 billion in 2023 and projected to grow to $9.41 billion by 2033. Quality Control and Inventory Management are also significant, reflecting the industry's focus on operational efficiency and effectiveness.

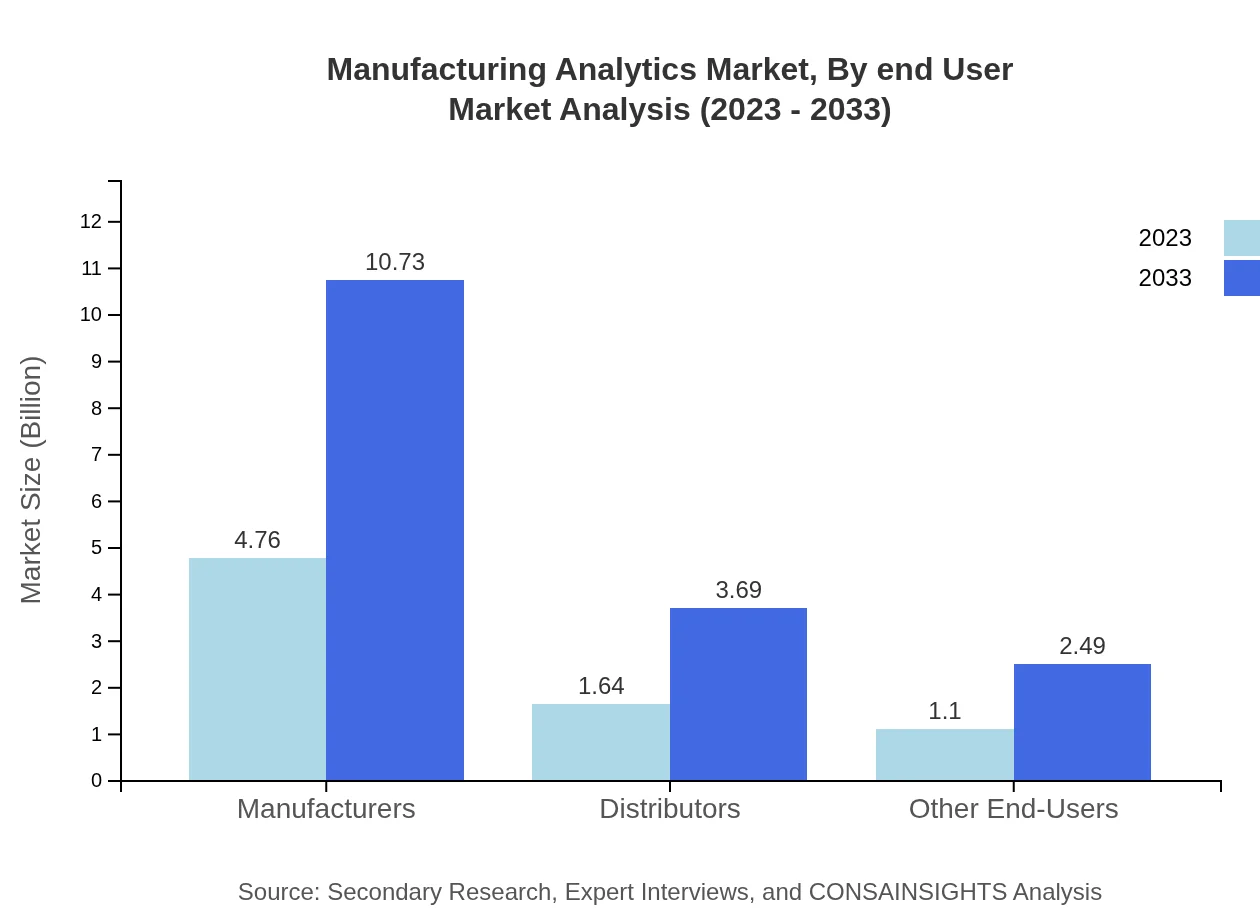

Manufacturing Analytics Market Analysis By End User

Manufacturers dominate the end-user segment, representing a market size of $4.76 billion in 2023, growing to $10.73 billion by 2033. Distributors and other end-users also contribute to market dynamics, showcasing the diverse applications of analytics in manufacturing.

Manufacturing Analytics Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Manufacturing Analytics Industry

Siemens AG:

Siemens AG is a global leader in automation and digitalization in manufacturing. The company's advanced analytics solutions enable manufacturers to optimize operations and improve productivity.IBM Corporation:

IBM offers a comprehensive suite of analytics tools that help manufacturers leverage data for better decision-making, enhancing efficiency and innovation in production.SAS Institute Inc.:

SAS specializes in analytics solutions, including predictive analytics and data visualization tools that empower manufacturers to uncover insights.Microsoft Corporation:

Microsoft's Azure platform provides scalable analytics solutions for manufacturers, facilitating integration with IoT and enabling real-time data insights.Rockwell Automation, Inc.:

Rockwell Automation integrates advanced analytics with industry-specific solutions, focusing on streamlining manufacturing processes and gaining actionable insights.We're grateful to work with incredible clients.

FAQs

What is the market size of manufacturing analytics?

The manufacturing analytics market is projected to reach $7.5 billion by 2033, growing at a CAGR of 8.2% from its current valuation. This growth reflects the increasing adoption of data analytics in manufacturing processes.

What are the key market players or companies in the manufacturing analytics industry?

Key players in manufacturing analytics include major technology and analytics firms specializing in IoT, big data, and AI-based solutions. They contribute significantly to the industry's framework and innovation.

What are the primary factors driving the growth in the manufacturing analytics industry?

The growth in manufacturing analytics is driven by automation technologies, an increasing need for operational efficiency, data-driven decision-making, and the rise of IoT solutions that enhance real-time data collection.

Which region is the fastest Growing in the manufacturing analytics?

North America is the fastest-growing region, expected to see a market increase from $2.85 billion in 2023 to $6.41 billion by 2033, due to robust investments in smart manufacturing and advanced analytics technologies.

Does ConsaInsights provide customized market report data for the manufacturing analytics industry?

Yes, ConsaInsights offers tailored market reports that provide in-depth analysis and insights tailored to specific needs in the manufacturing analytics industry, ensuring relevance and accuracy.

What deliverables can I expect from this manufacturing analytics market research project?

Expect comprehensive reports detailing market size, growth forecasts, competitive analysis, trends, and strategic recommendations relevant to the manufacturing analytics market.

What are the market trends of manufacturing analytics?

Key trends include the integration of AI and machine learning for predictive insights, the shift toward cloud-based analytics, and a focus on enhancing supply chain efficiency through advanced data analytics.