Manufacturing Execution Systems Market Report

Published Date: 22 January 2026 | Report Code: manufacturing-execution-systems

Manufacturing Execution Systems Market Size, Share, Industry Trends and Forecast to 2033

This report covers the comprehensive analysis of the Manufacturing Execution Systems (MES) market from 2023 to 2033, providing insights into market size, industry trends, segmentation, regional performance, and forecasts.

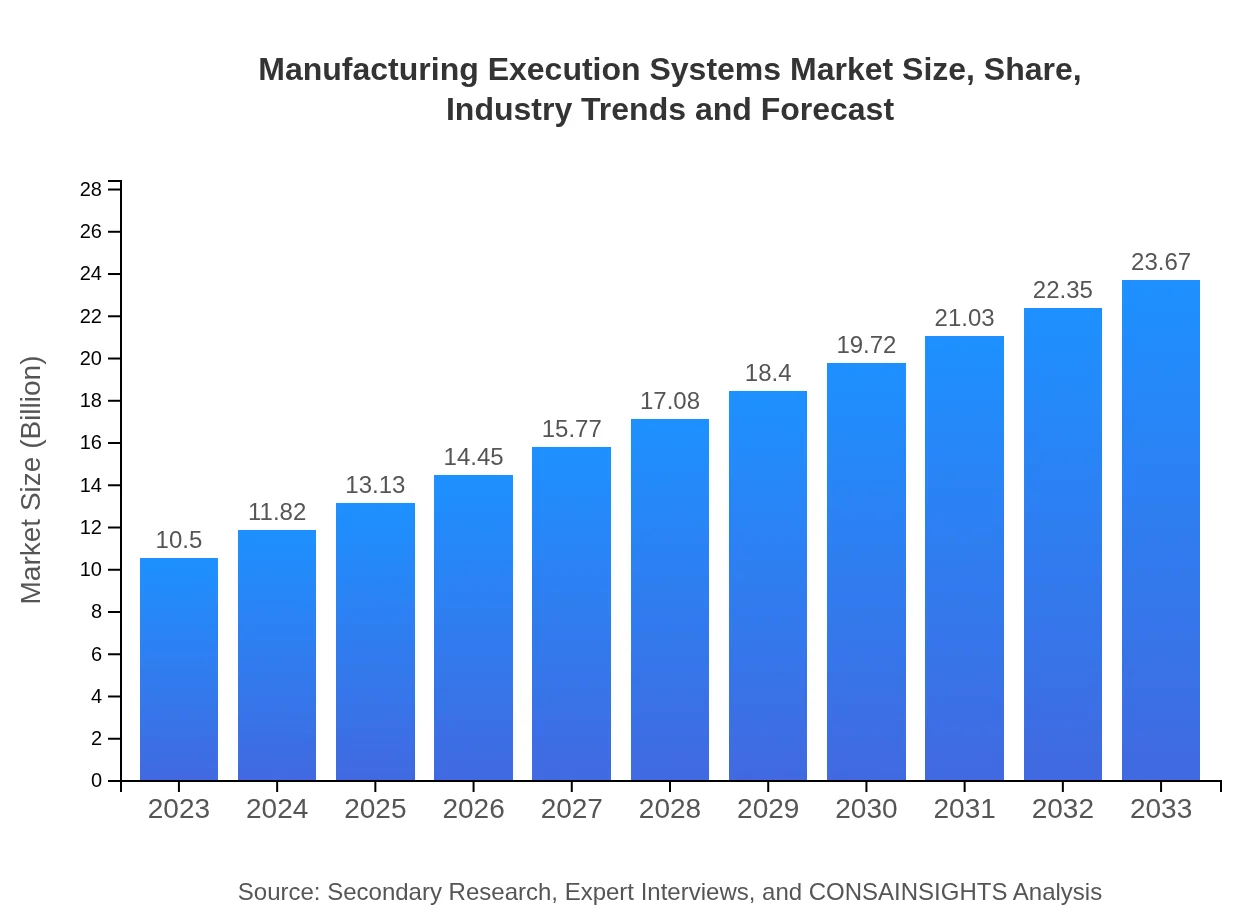

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $10.50 Billion |

| CAGR (2023-2033) | 8.2% |

| 2033 Market Size | $23.67 Billion |

| Top Companies | Siemens AG, Rockwell Automation, Schneider Electric, Honeywell , SAP SE |

| Last Modified Date | 22 January 2026 |

Manufacturing Execution Systems Market Overview

Customize Manufacturing Execution Systems Market Report market research report

- ✔ Get in-depth analysis of Manufacturing Execution Systems market size, growth, and forecasts.

- ✔ Understand Manufacturing Execution Systems's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Manufacturing Execution Systems

What is the Market Size & CAGR of Manufacturing Execution Systems market in 2023?

Manufacturing Execution Systems Industry Analysis

Manufacturing Execution Systems Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Manufacturing Execution Systems Market Analysis Report by Region

Europe Manufacturing Execution Systems Market Report:

The European MES market is forecasted to grow from $2.77 billion in 2023 to $6.25 billion by 2033. Countries like Germany and France are leading the charge in manufacturing automation, which is significantly boosting MES adoption rates.Asia Pacific Manufacturing Execution Systems Market Report:

In the Asia Pacific region, the MES market is projected to grow from $2.18 billion in 2023 to $4.91 billion by 2033. This growth is facilitated by the rapid industrialization of countries such as China, Japan, and India, where manufacturers are increasingly adopting advanced technologies to enhance production efficiency.North America Manufacturing Execution Systems Market Report:

North America remains a dominant region for the MES market, with a market size projected to reach $8.04 billion by 2033 from $3.57 billion in 2023. The presence of advanced manufacturing infrastructure and a focus on digitization are key growth drivers in this region.South America Manufacturing Execution Systems Market Report:

The South American MES market is expected to expand from $0.68 billion in 2023 to $1.54 billion in 2033. The region's focus on improving manufacturing capacity and efficiency is driving investments in MES solutions, particularly in Brazil and Argentina.Middle East & Africa Manufacturing Execution Systems Market Report:

In the Middle East and Africa, the MES market is projected to increase from $1.30 billion in 2023 to $2.93 billion by 2033. This growth is being propelled by the rising need for operational excellence and adherence to regulatory requirements in manufacturing sectors across the region.Tell us your focus area and get a customized research report.

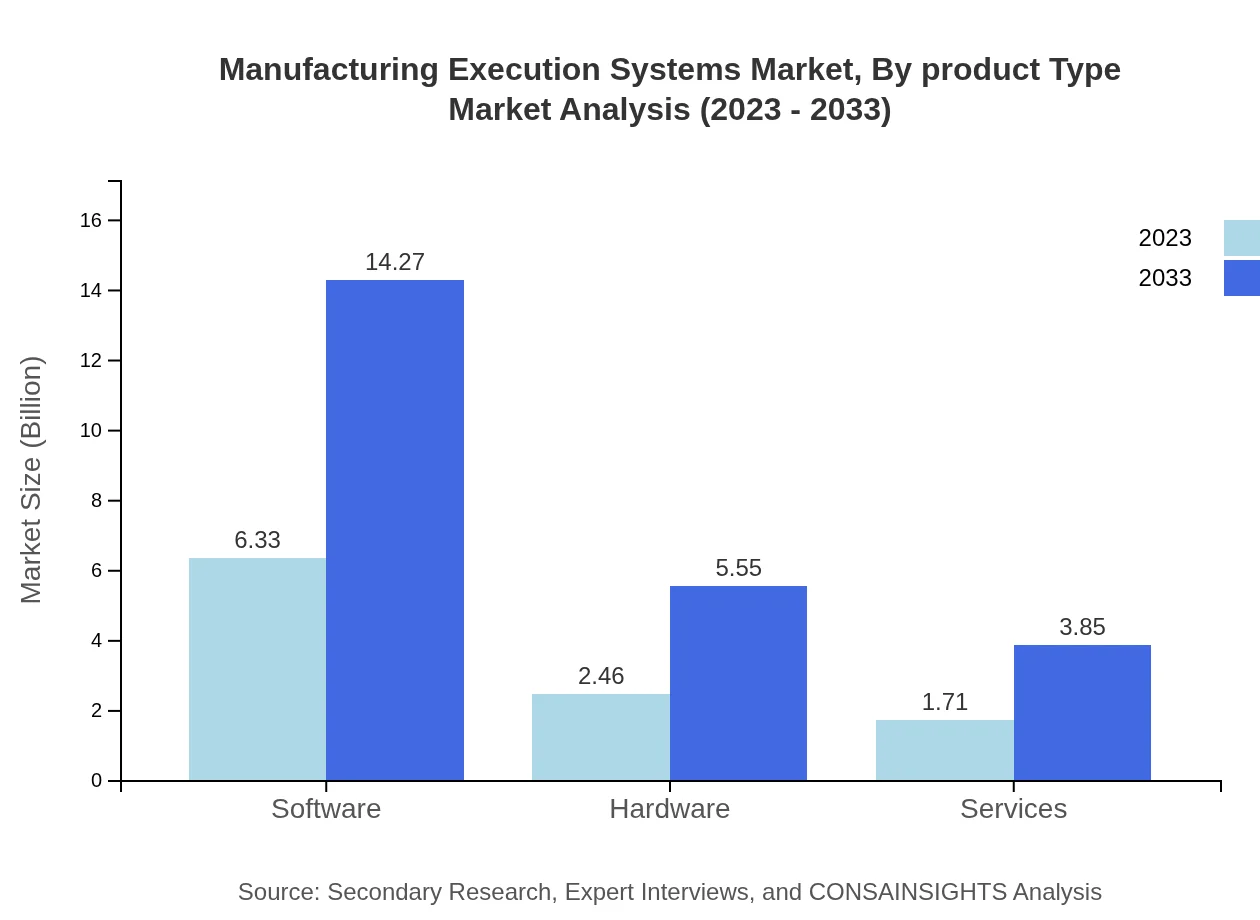

Manufacturing Execution Systems Market Analysis By Product Type

The Manufacturing Execution Systems market segmentation by product type comprises software, hardware, and services. The software segment, accounting for the largest market share, is crucial for real-time data processing and analytics. With continuous advances in software solutions, the growth of cloud-based approaches is on the rise, facilitating greater accessibility and flexibility.

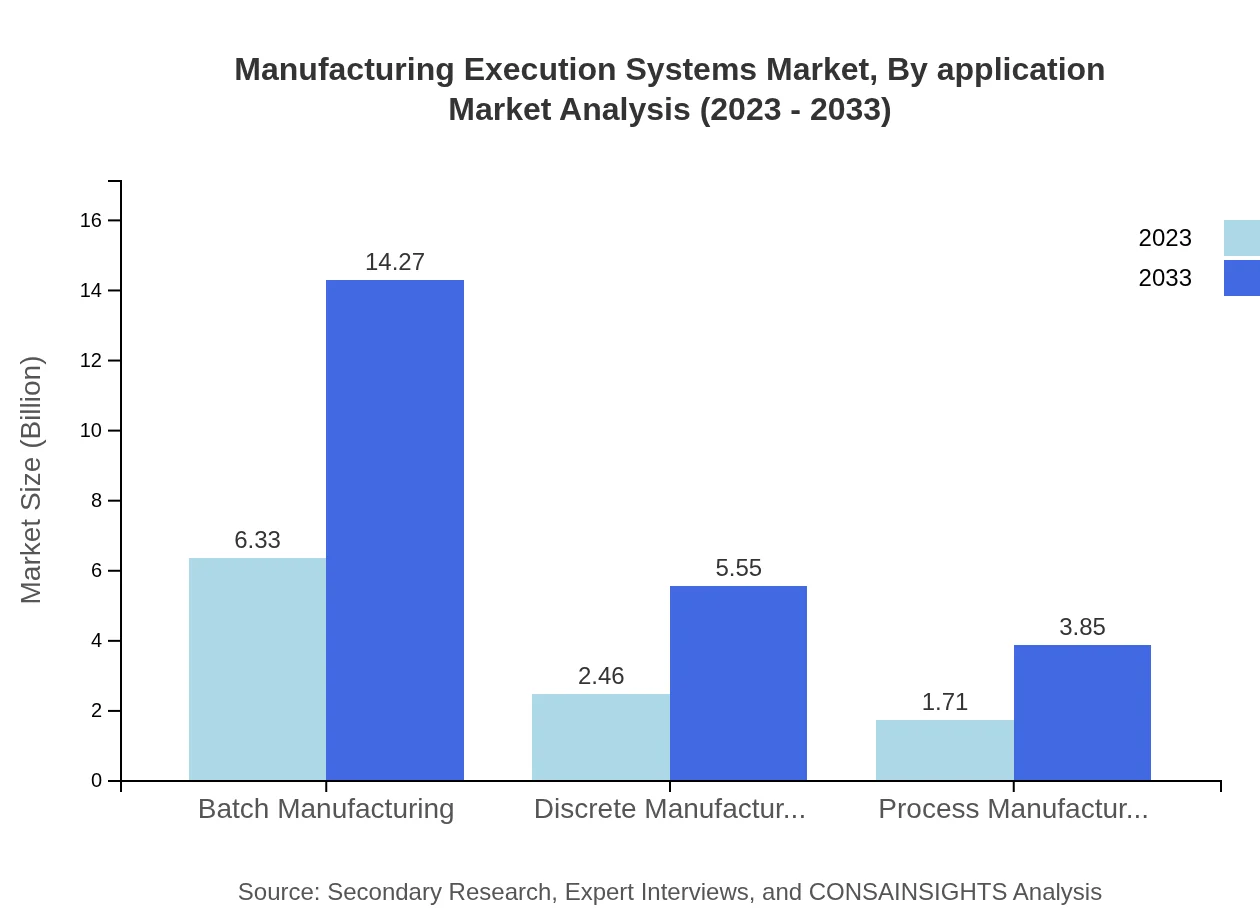

Manufacturing Execution Systems Market Analysis By Application

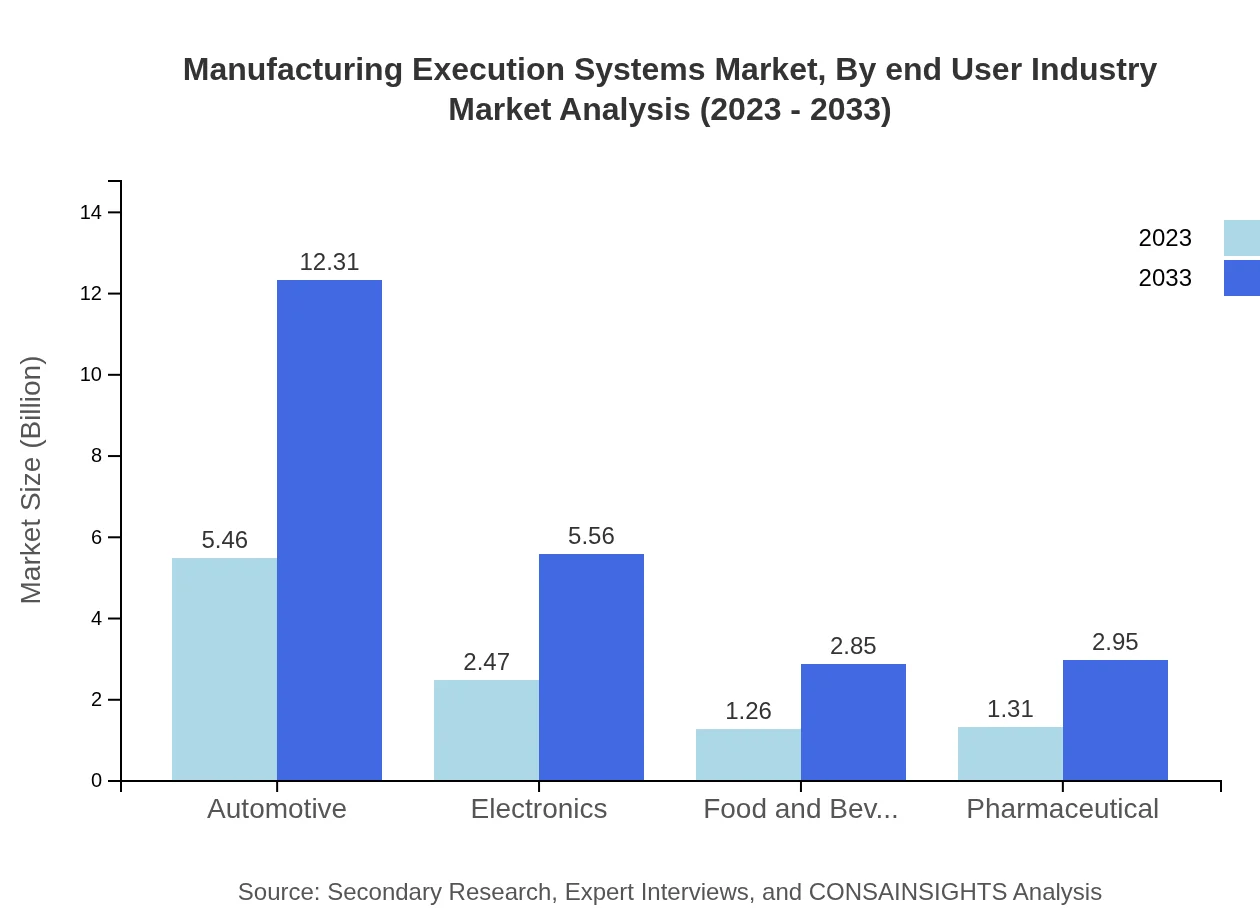

Applications of MES span across various industries, including automotive, electronics, pharmaceuticals, and food and beverage. The automotive sector is seen as the leading segment due to its urgent need for real-time monitoring and optimization of supply chains, resulting in significant MES investments.

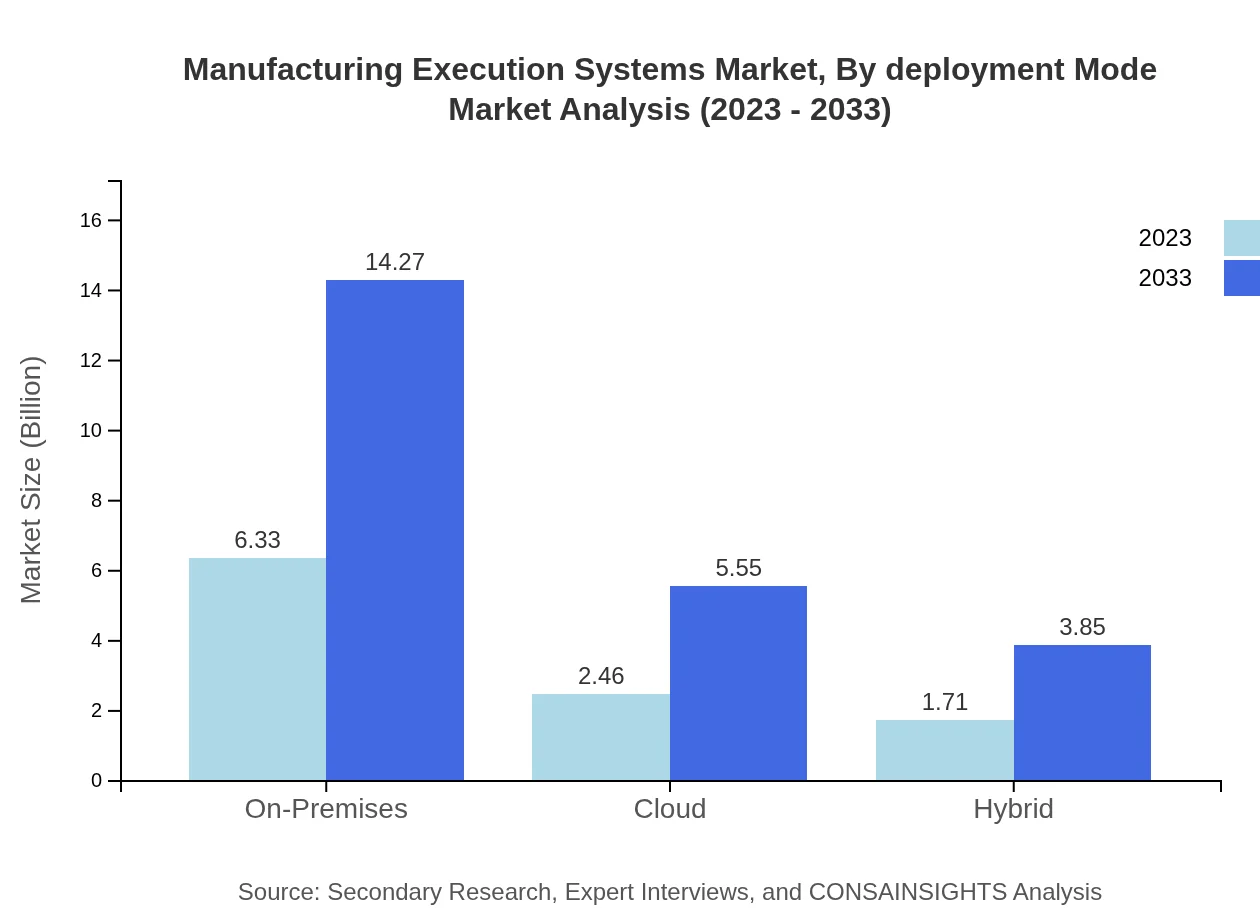

Manufacturing Execution Systems Market Analysis By Deployment Mode

The MES market deployment modes are classified into on-premises, cloud, and hybrid solutions. On-premises solutions dominate the market due to their extensive data control capabilities, although the cloud segment is expected to grow significantly as flexibility and operational costs gain importance.

Manufacturing Execution Systems Market Analysis By End User Industry

Different industries drive the MES market, with the automotive sector holding the largest share, followed by electronics and pharmaceuticals. This landscape is influenced by the increasing demand for automation and real-time insights within these high-stakes industries.

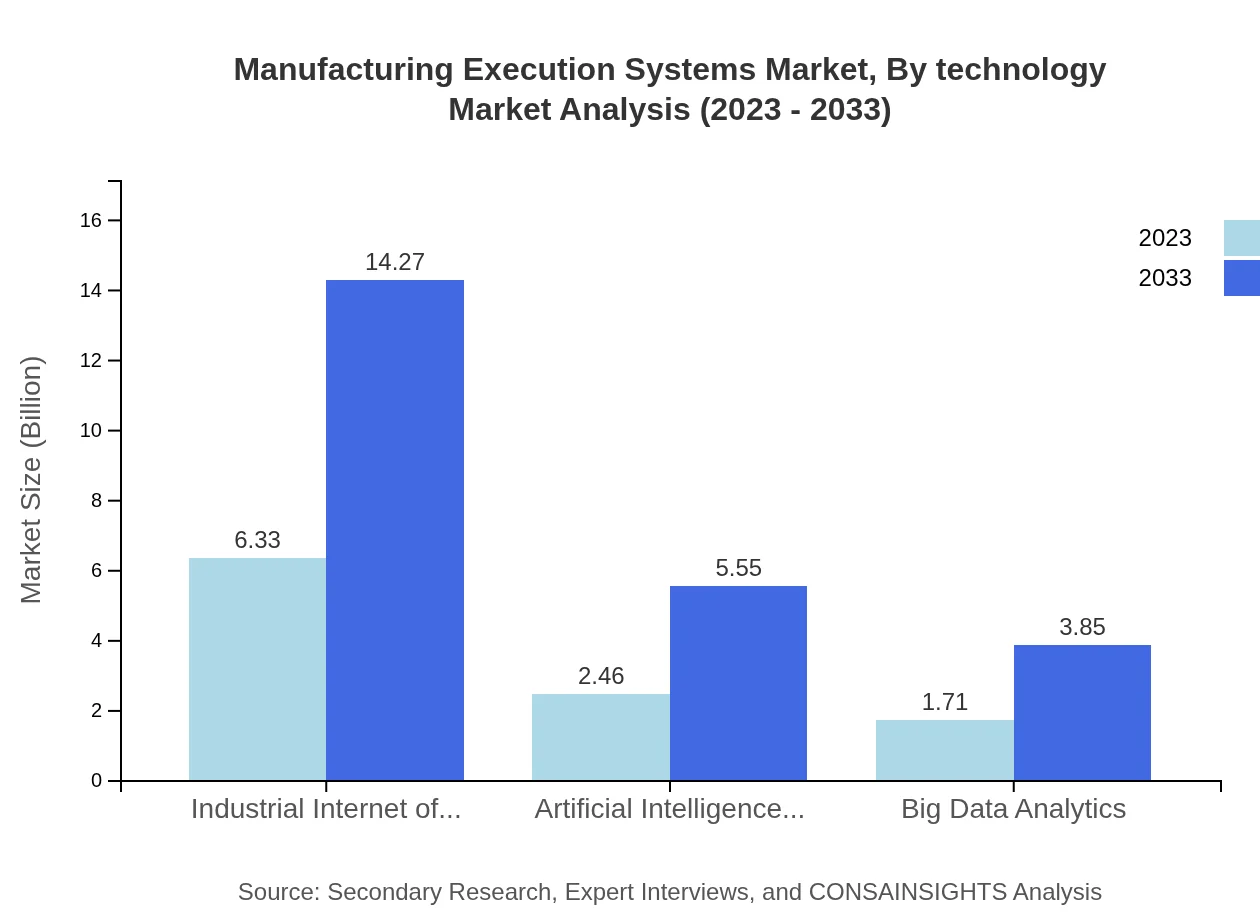

Manufacturing Execution Systems Market Analysis By Technology

Technological advancements such as the introduction of the Industrial Internet of Things (IIoT), artificial intelligence, automation, and big data analytics are reshaping the MES industry. These technologies enhance efficiency and lead to smarter manufacturing practices.

Manufacturing Execution Systems Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Manufacturing Execution Systems Industry

Siemens AG:

Siemens provides advanced MES solutions that leverage data from production lines to optimize manufacturing processes across various industries including automotive and electronics.Rockwell Automation:

Rockwell Automation offers comprehensive MES solutions that integrate with existing enterprise systems, helping manufacturers improve operational efficiency and compliance.Schneider Electric:

Schneider Electric's MES solutions are designed to enhance manufacturing performance with a focus on energy management and operational efficiency.Honeywell :

Honeywell delivers niche MES solutions that cater to industries such as chemicals and manufacturing, facilitating real-time monitoring and analytics.SAP SE:

SAP offers MES solutions tailored to integrate with larger enterprise resource plan systems, providing real-time visibility across supply chains.We're grateful to work with incredible clients.

FAQs

What is the market size of Manufacturing Execution Systems?

The global Manufacturing Execution Systems market is projected to reach $10.5 billion by 2033, showcasing a robust CAGR of 8.2% from 2023. This growth reflects increasing automation and digitization across manufacturing sectors.

What are the key market players or companies in this Manufacturing Execution Systems industry?

Key players in the Manufacturing Execution Systems industry include Siemens AG, Rockwell Automation, Schneider Electric, Honeywell International Inc., and Dassault Systèmes. These companies are recognized for their innovative solutions and extensive industry experience.

What are the primary factors driving the growth in the Manufacturing Execution Systems industry?

Growth in the Manufacturing Execution Systems industry is driven by the adoption of Industry 4.0 technologies, increased demand for real-time data analytics, the need for improved operational efficiency, and the growing trend of automation across various manufacturing sectors.

Which region is the fastest Growing in the Manufacturing Execution Systems?

Asia-Pacific is expected to be the fastest-growing region for Manufacturing Execution Systems, projected to grow from $2.18 billion in 2023 to $4.91 billion by 2033. This growth is fueled by rising industrialization and technology adoption in emerging economies.

Does ConsaInsights provide customized market report data for the Manufacturing Execution Systems industry?

Yes, ConsaInsights offers customized market report data tailored to specific needs within the Manufacturing Execution Systems industry. Clients can access in-depth analysis, segmentation, and insights based on targeted parameters.

What deliverables can I expect from this Manufacturing Execution Systems market research project?

Upon completion of the Manufacturing Execution Systems market research project, clients can expect comprehensive reports, data visualization, trend analysis, competitive landscape insights, and tailored recommendations to support strategic decision-making.

What are the market trends of Manufacturing Execution Systems?

Key trends in the Manufacturing Execution Systems market include increased integration with IoT and AI technologies, a shift towards cloud-based solutions, and rising focus on sustainability and regulatory compliance in manufacturing practices.