Maritime Freight Transport Market Report

Published Date: 02 February 2026 | Report Code: maritime-freight-transport

Maritime Freight Transport Market Size, Share, Industry Trends and Forecast to 2033

This report provides insights into the Maritime Freight Transport market, covering key trends, market size, segmentation, regional analysis, and forecasts from 2023 to 2033.

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

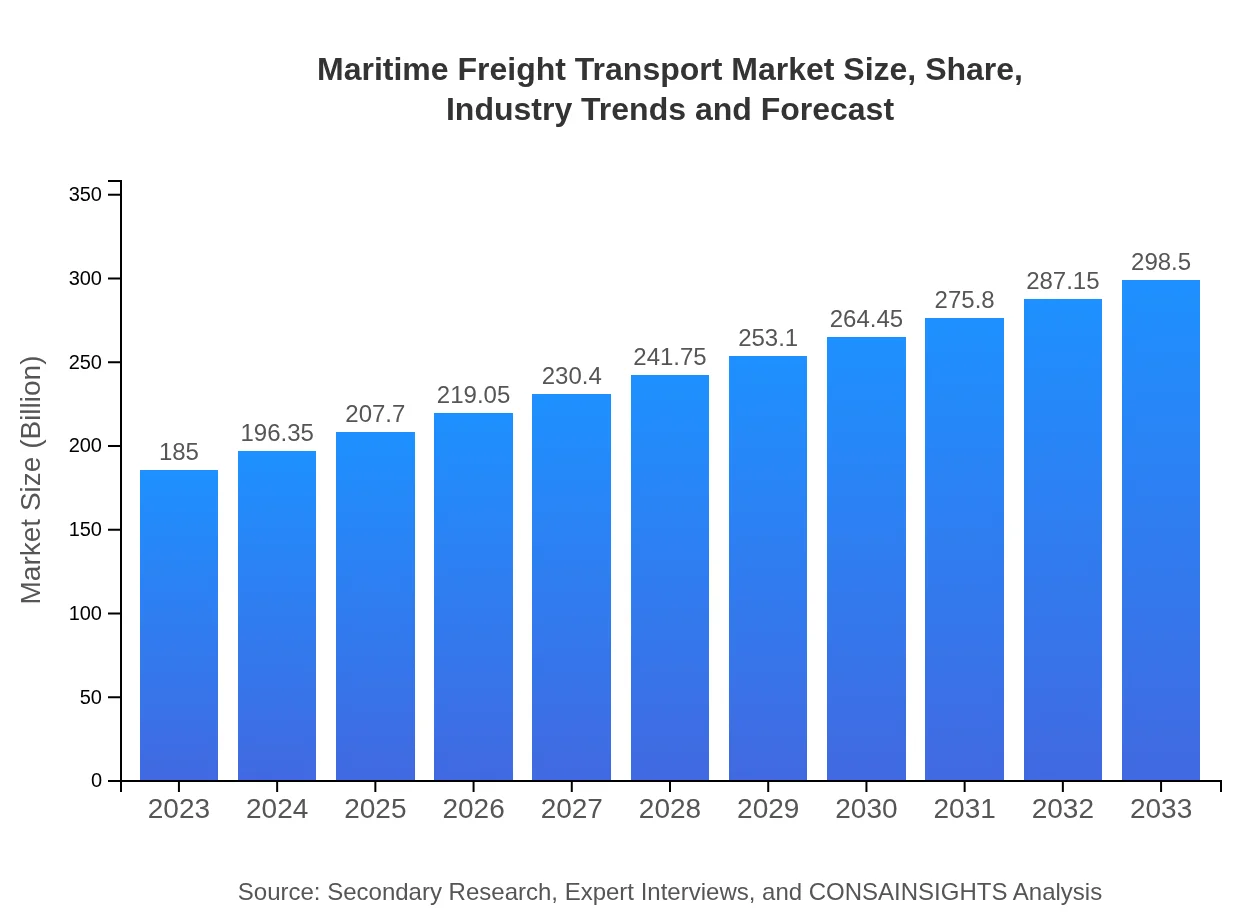

| 2023 Market Size | $185.00 Billion |

| CAGR (2023-2033) | 4.8% |

| 2033 Market Size | $298.50 Billion |

| Top Companies | Maersk, MSC (Mediterranean Shipping Company), CMA CGM Group, Hapag-Lloyd, Evergreen Marine Corporation |

| Last Modified Date | 02 February 2026 |

Maritime Freight Transport Market Overview

Customize Maritime Freight Transport Market Report market research report

- ✔ Get in-depth analysis of Maritime Freight Transport market size, growth, and forecasts.

- ✔ Understand Maritime Freight Transport's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Maritime Freight Transport

What is the Market Size & CAGR of the Maritime Freight Transport market in 2033?

Maritime Freight Transport Industry Analysis

Maritime Freight Transport Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Maritime Freight Transport Market Analysis Report by Region

Europe Maritime Freight Transport Market Report:

The European maritime freight transport market is notable, with a size of $46.99 billion in 2023, expected to reach $75.82 billion by 2033. The EU's stringent regulations push companies towards greener practices, and its dynamic trade policies significantly affect shipping volumes, especially in intra-European trade.Asia Pacific Maritime Freight Transport Market Report:

The Asia Pacific region is a powerhouse in maritime freight transport, with a market size of $38.87 billion in 2023, projected to grow to $62.71 billion by 2033. The region is driving global trade, with major ports in China, Japan, and India handling significant freight volumes. Additionally, increasing manufacturing activities and e-commerce growth boost demand for maritime transport services.North America Maritime Freight Transport Market Report:

North America is a significant player, with a market size of $68.49 billion in 2023, projected to expand to $110.50 billion by 2033. The region benefits from its advanced logistics networks and strong trade relationships, particularly with Asia. The growth of e-commerce is also fueling demand for efficient shipping solutions.South America Maritime Freight Transport Market Report:

In South America, the market is smaller, starting at $6.53 billion in 2023, with expectations of growth to $10.54 billion by 2033. Key players in the region focus on exporting agricultural products and natural resources, which are facilitated through maritime transport. However, infrastructure challenges and economic volatility can impact growth.Middle East & Africa Maritime Freight Transport Market Report:

The Middle East and Africa market stands at $24.12 billion in 2023, expected to grow to $38.92 billion by 2033. This region is critical for oil transport, with major shipping routes passing through its waters. Increasing investments in port infrastructure and logistics services are likely to foster growth.Tell us your focus area and get a customized research report.

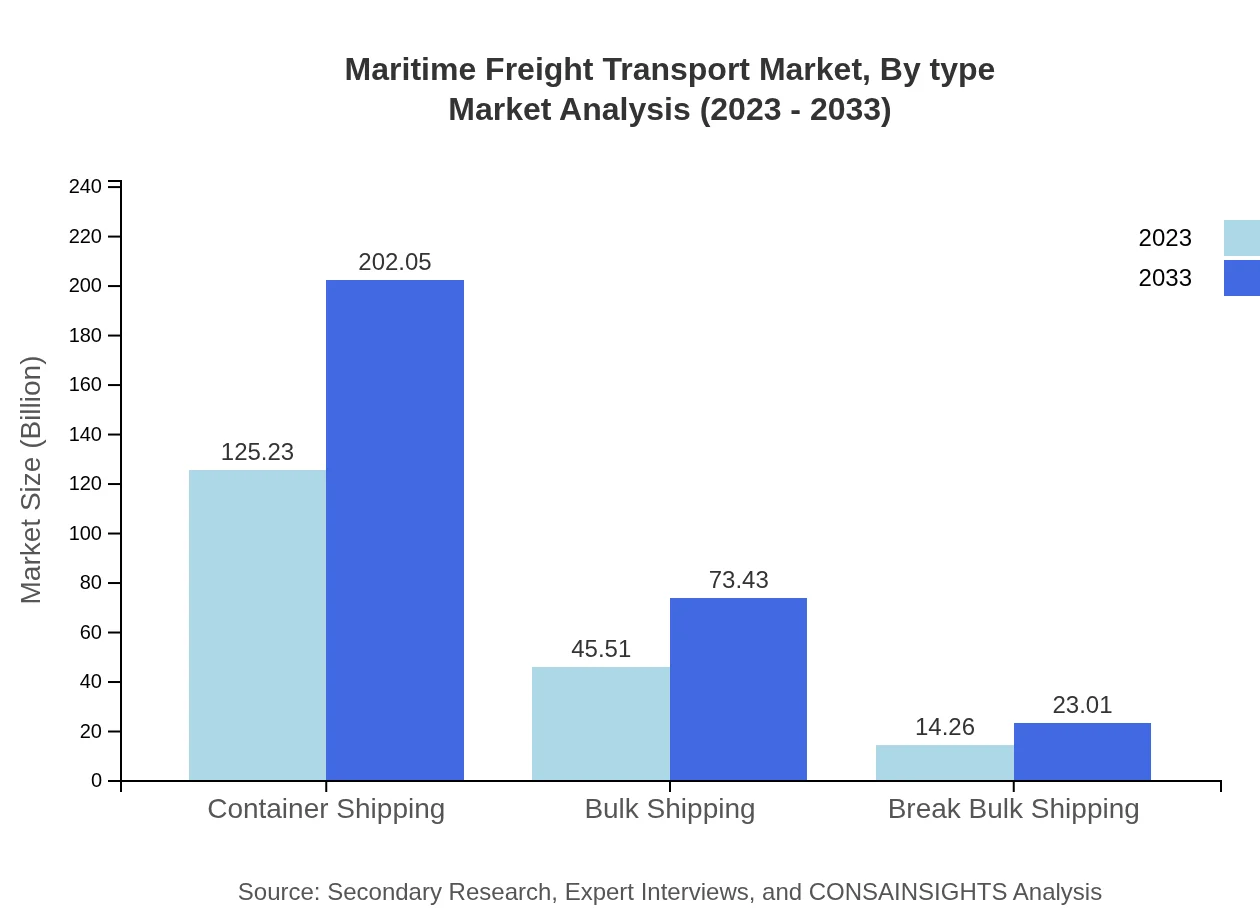

Maritime Freight Transport Market Analysis By Type

The container shipping segment dominates the Maritime Freight Transport market, accounting for $125.23 billion in 2023, expected to reach $202.05 billion by 2033, reflecting a steady demand due to global trade dynamics. Bulk shipping, essential for commodities, holds a market size of $45.51 billion in 2023, growing to $73.43 billion in 2033. Break-bulk shipping focuses on project cargo, currently valued at $14.26 billion, projected to reach $23.01 billion by 2033 as project logistics increase. Digital and emerging technologies are also leveraging innovative operational frameworks, with traditional shipping methods improving significantly.

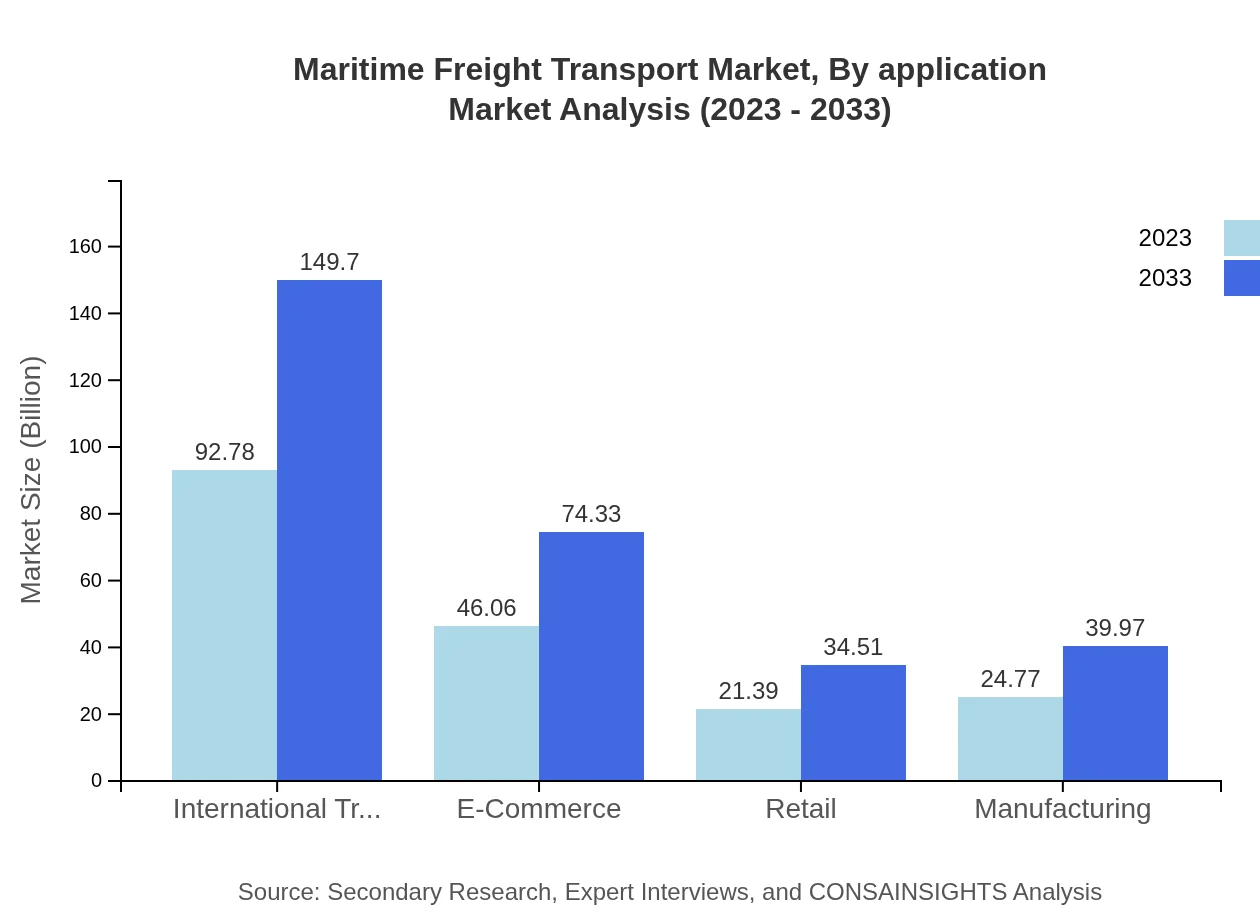

Maritime Freight Transport Market Analysis By Application

The primary application of maritime freight transport is international trade, representing a robust $92.78 billion in 2023 and expected to grow to $149.70 billion by 2033. E-commerce is becoming increasingly significant, with its market value rising from $46.06 billion to $74.33 billion during the forecast period, underlining changing consumer behavior. Additionally, the retail sector and manufacturing industry play crucial roles, reflecting significant contributions to overall demand.

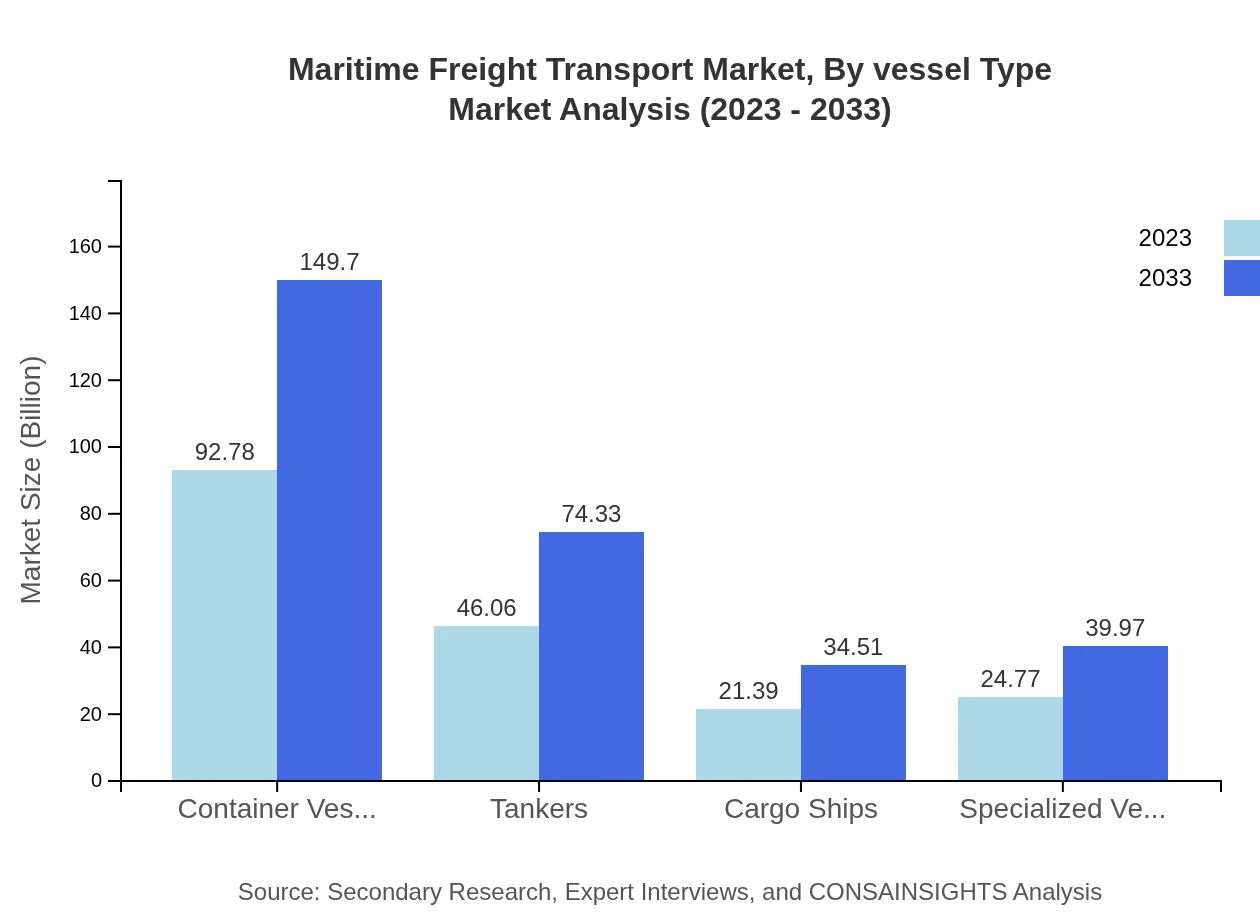

Maritime Freight Transport Market Analysis By Vessel Type

Container vessels are critical to the maritime transport landscape, with a market size of $92.78 billion in 2023 and projected to grow to $149.70 billion by 2033. Tankers, essential for transporting liquid cargo, reflect a market size of $46.06 billion, expanding to $74.33 billion. Cargo ships, vital for general goods transport, are projected to grow from $21.39 billion to $34.51 billion, while specialized vessels are essential for niche markets, expected to rise from $24.77 billion to $39.97 billion.

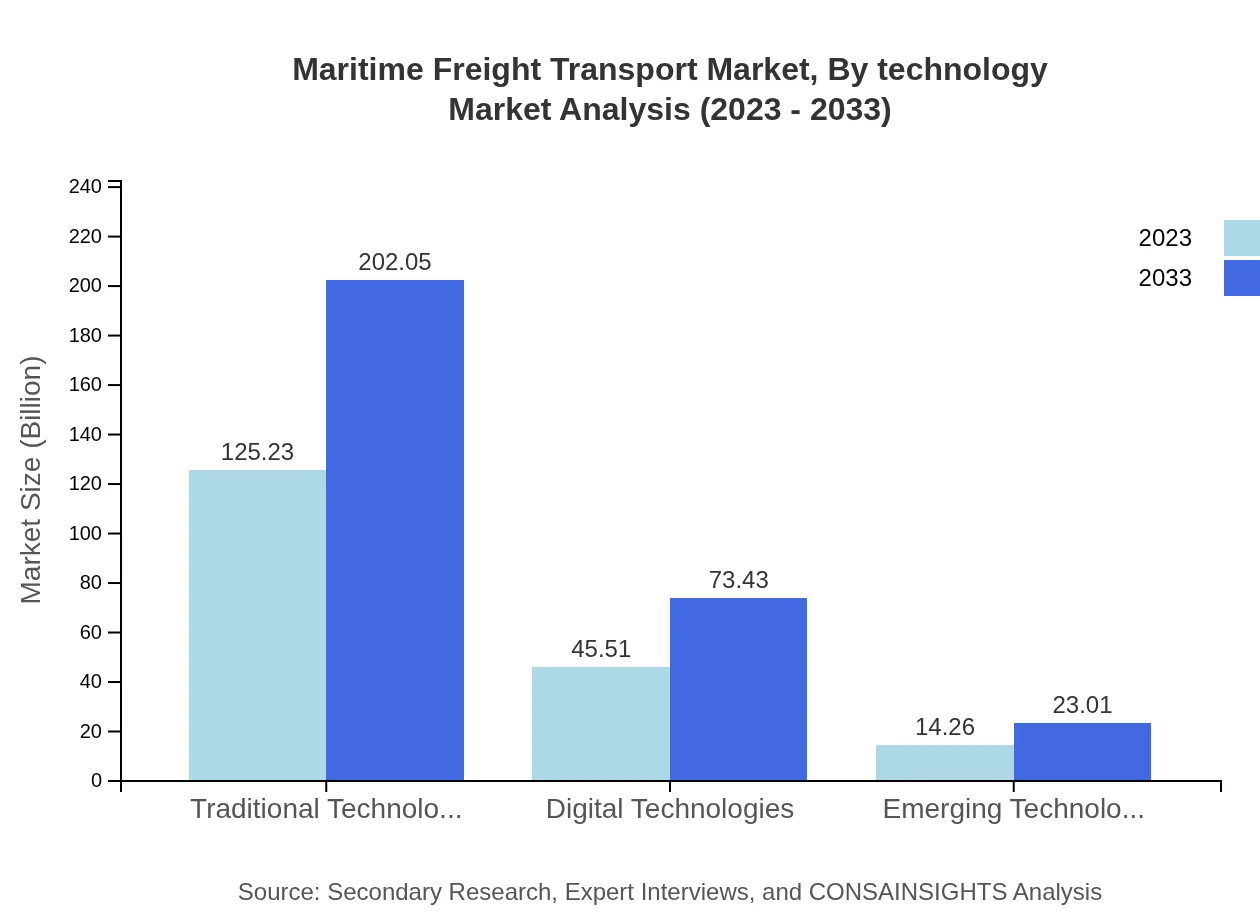

Maritime Freight Transport Market Analysis By Technology

The integration of traditional technologies and digital solutions is pivotal in the maritime transport industry. Traditional technologies hold a significant share of $125.23 billion, while digital technologies, enhancing operational efficiency, are currently valued at $45.51 billion, expected to grow to $73.43 billion. Emerging technologies are nevertheless impacting the sector, valued at $14.26 billion, expected to reach $23.01 billion, showcasing innovation and new business practices.

Maritime Freight Transport Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Maritime Freight Transport Industry

Maersk:

A leader in container shipping, Maersk operates a vast fleet of vessels and provides integrated logistics services globally, known for its innovative supply chain solutions.MSC (Mediterranean Shipping Company):

MSC is one of the world’s leading container shipping lines, focusing on providing efficient services and expanding its global reach through strategic acquisitions and investments in fleet expansion.CMA CGM Group:

CMA CGM is a global shipping group offering container shipping and logistics services, with a focus on digital transformation and sustainability in its operations.Hapag-Lloyd:

Hapag-Lloyd is a key player in the international container shipping market, recognized for its commitment to industry-leading standards in safety and sustainability.Evergreen Marine Corporation:

Evergreen is a major participant in the container shipping sector, known for its extensive fleet and pioneering shipping solutions that enhance operational efficiency.We're grateful to work with incredible clients.

FAQs

What is the market size of maritime Freight Transport?

The maritime freight transport market is valued at approximately $185 billion in 2023, projected to grow at a CAGR of 4.8%. By 2033, this market size is expected to substantially increase, reflecting the industry's resilience and expanding global trade.

What are the key market players or companies in this industry?

Key players in the maritime freight transport industry include Maersk, MSC, COSCO Shipping, Hapag-Lloyd, and CMA CGM. These companies dominate the market due to their extensive fleets and logistical networks that cater to various shipping needs globally.

What are the primary factors driving the growth in the maritime freight transport industry?

Key growth drivers include globalization of trade, e-commerce expansion, and increased demand for efficient shipping solutions. Additionally, advancements in shipping technologies and infrastructure developments also contribute significantly to market growth.

Which region is the fastest Growing in maritime freight transport?

The Asia Pacific region is rapidly growing in the maritime freight transport market, with market size surging from $38.87 billion in 2023 to $62.71 billion by 2033. This growth is driven by rising industrial activities and trade in the region.

Does ConsaInsights provide customized market report data for the maritime freight transport industry?

Yes, ConsaInsights offers customized market report data tailored to specific needs within the maritime freight transport industry. Clients can access detailed insights and analysis tailored to their strategic objectives and market interests.

What deliverables can I expect from this maritime freight transport market research project?

Deliverables from this market research project include comprehensive reports, data analysis, market forecasts, regional insights, competitive landscape assessments, and trend identification, providing valuable information for informed decision-making.

What are the market trends of maritime freight transport?

Current market trends include a shift towards digital technologies, increased focus on sustainability, and the rise of automation in shipping practices. Additionally, there is a significant push to enhance supply chain resilience amid global disruptions.