Maritime Safety Market Report

Published Date: 02 February 2026 | Report Code: maritime-safety

Maritime Safety Market Size, Share, Industry Trends and Forecast to 2033

This report provides an in-depth analysis of the Maritime Safety market from 2023 to 2033, focusing on market conditions, size, growth forecasts, regional dynamics, key technologies, and leading companies, ensuring stakeholders have a comprehensive view of future trends and opportunities.

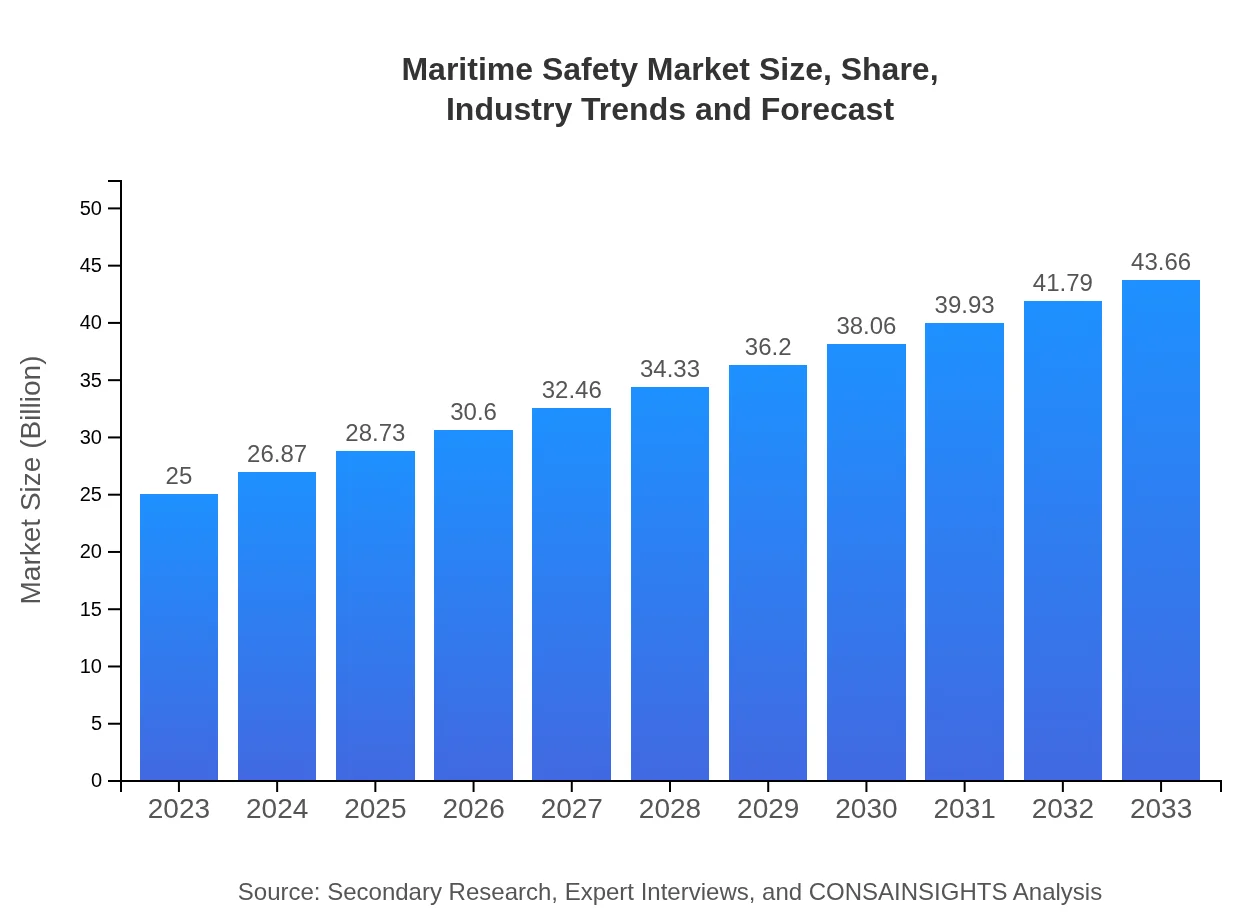

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $25.00 Billion |

| CAGR (2023-2033) | 5.6% |

| 2033 Market Size | $43.66 Billion |

| Top Companies | Wilhelmsen Group, DNV GL, Bureau Veritas, Lloyd's Register, Zodiac Aerospace |

| Last Modified Date | 02 February 2026 |

Maritime Safety Market Overview

Customize Maritime Safety Market Report market research report

- ✔ Get in-depth analysis of Maritime Safety market size, growth, and forecasts.

- ✔ Understand Maritime Safety's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Maritime Safety

What is the Market Size & CAGR of Maritime Safety market in 2023?

Maritime Safety Industry Analysis

Maritime Safety Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Maritime Safety Market Analysis Report by Region

Europe Maritime Safety Market Report:

Europe’s Maritime Safety market is resilient, valued at $6.18 billion in 2023, growing to $10.79 billion by 2033. The continent's emphasis on enhancing shipping efficiency and reducing maritime accidents signifies growing investments in safety technologies. The presence of leading maritime safety equipment manufacturers enhances innovation and compliance with international safety standards.Asia Pacific Maritime Safety Market Report:

The Asia Pacific region accounts for a substantial market share in Maritime Safety, estimated at $4.76 billion in 2023 and projected to reach $8.31 billion by 2033. Rapid industrialization and the growth of maritime logistics are key drivers. Additionally, countries like China and India are investing in upgrading their naval capabilities, contributing to market expansion. Technological adoption in safety protocols further enhances regional growth prospects.North America Maritime Safety Market Report:

North America dominates the Maritime Safety market with a significant valuation of $9.54 billion in 2023, expected to escalate to $16.66 billion by 2033. The presence of major shipping companies and stringent regulatory frameworks, particularly in the United States and Canada, drives investments in advanced maritime safety technologies and training programs. Additionally, heightened focus on cyber safety in maritime operations signifies ongoing investments in evolving safety standards.South America Maritime Safety Market Report:

In South America, the Maritime Safety market is valued at $1.67 billion in 2023, with expectations to expand to $2.92 billion by 2033. The region shows potential for growth driven by its vast maritime routes and emerging economies. Increased investments in port facilities and shipping safety measures are aimed at bolstering trade and cooperation amongst regional countries.Middle East & Africa Maritime Safety Market Report:

The Middle East and Africa’s marketplace reached $2.85 billion in 2023 and is anticipated to expand to $4.98 billion by 2033. The region's development of maritime infrastructure and oil exports necessitate effective safety protocols. Furthermore, awareness of navigating geopolitical tensions necessitates emphasis on enhancing port security and maritime safety measures.Tell us your focus area and get a customized research report.

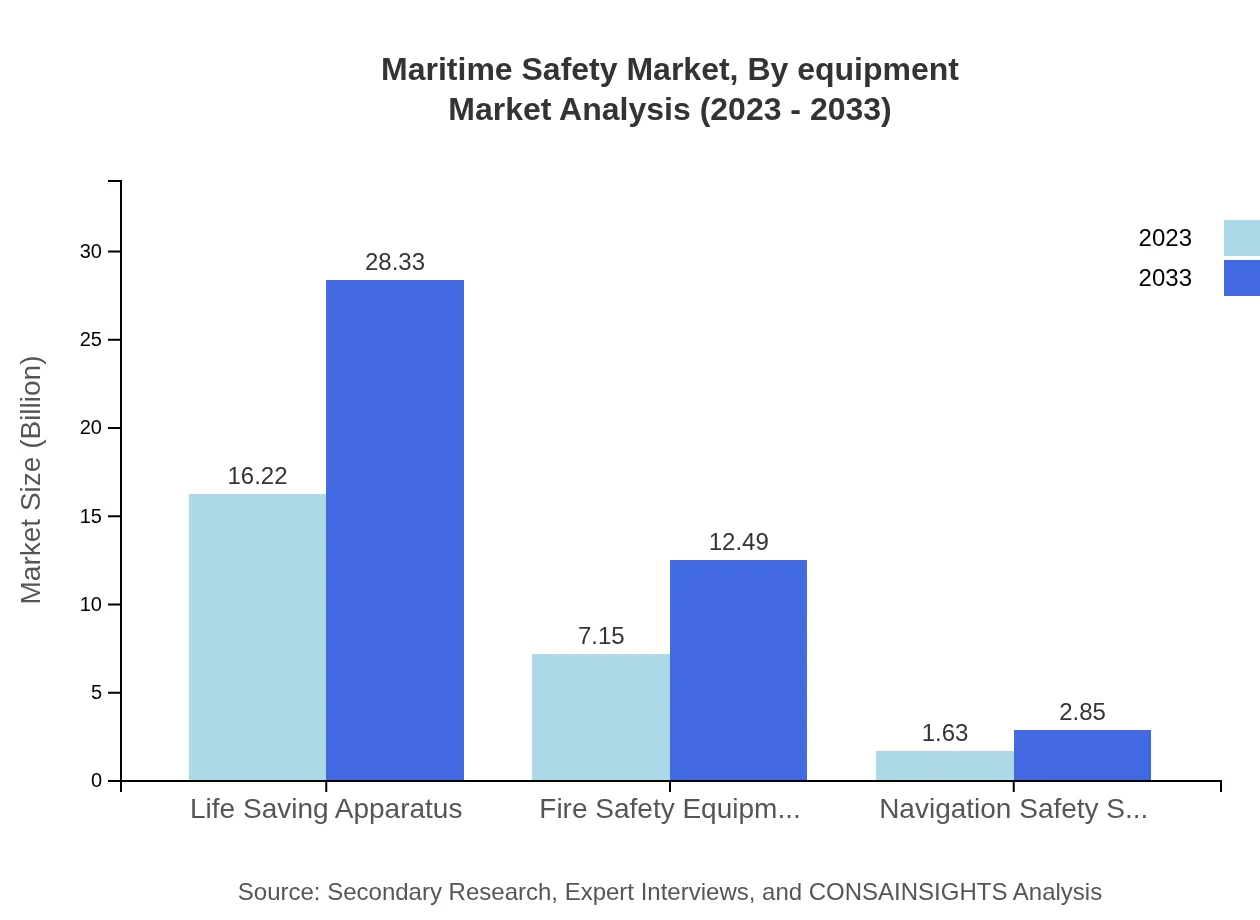

Maritime Safety Market Analysis By Equipment

The equipment segment remains pivotal to the Maritime Safety market, representing various essential products, such as life-saving apparatus valued at $16.22 billion in 2023, projected to reach $28.33 billion by 2033. Fire safety equipment, navigation safety systems, and communication systems are crucial components. The need for these systems arises from increasing maritime risks and regulatory compliance mandates, highlighting their significance in enhancing overall maritime safety.

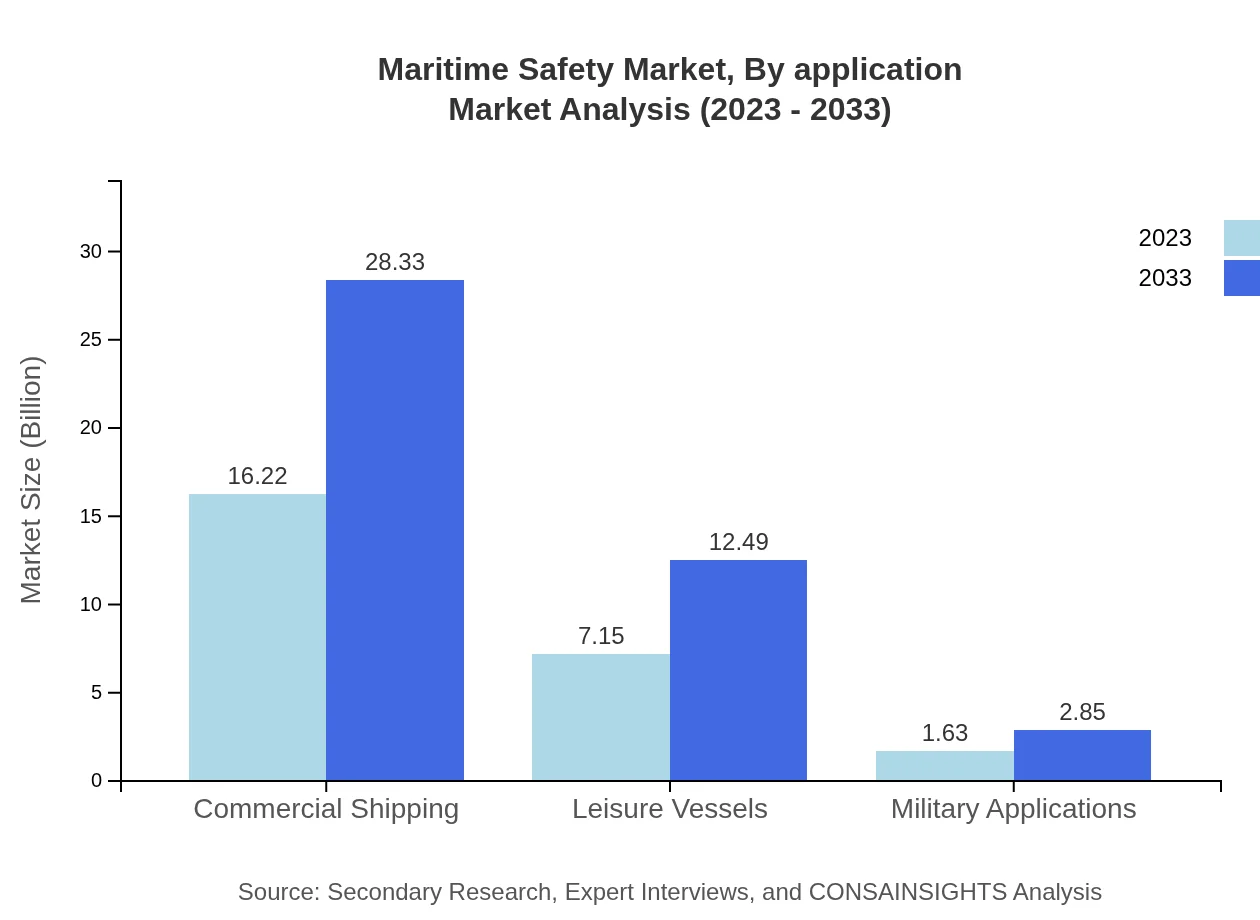

Maritime Safety Market Analysis By Application

In the application segment, commercial shipping leads with a forecast market size of $16.22 billion in 2023, escalating to $28.33 billion by 2033. The leisure vessels segment accounts for $7.15 billion in 2023 and is expected to grow to $12.49 billion by 2033. Military applications, though smaller, are crucial at $1.63 billion and are set to increase to $2.85 billion. Each segment demonstrates unique requirements for safety equipment and reflects market trends in operational priorities across various maritime activities.

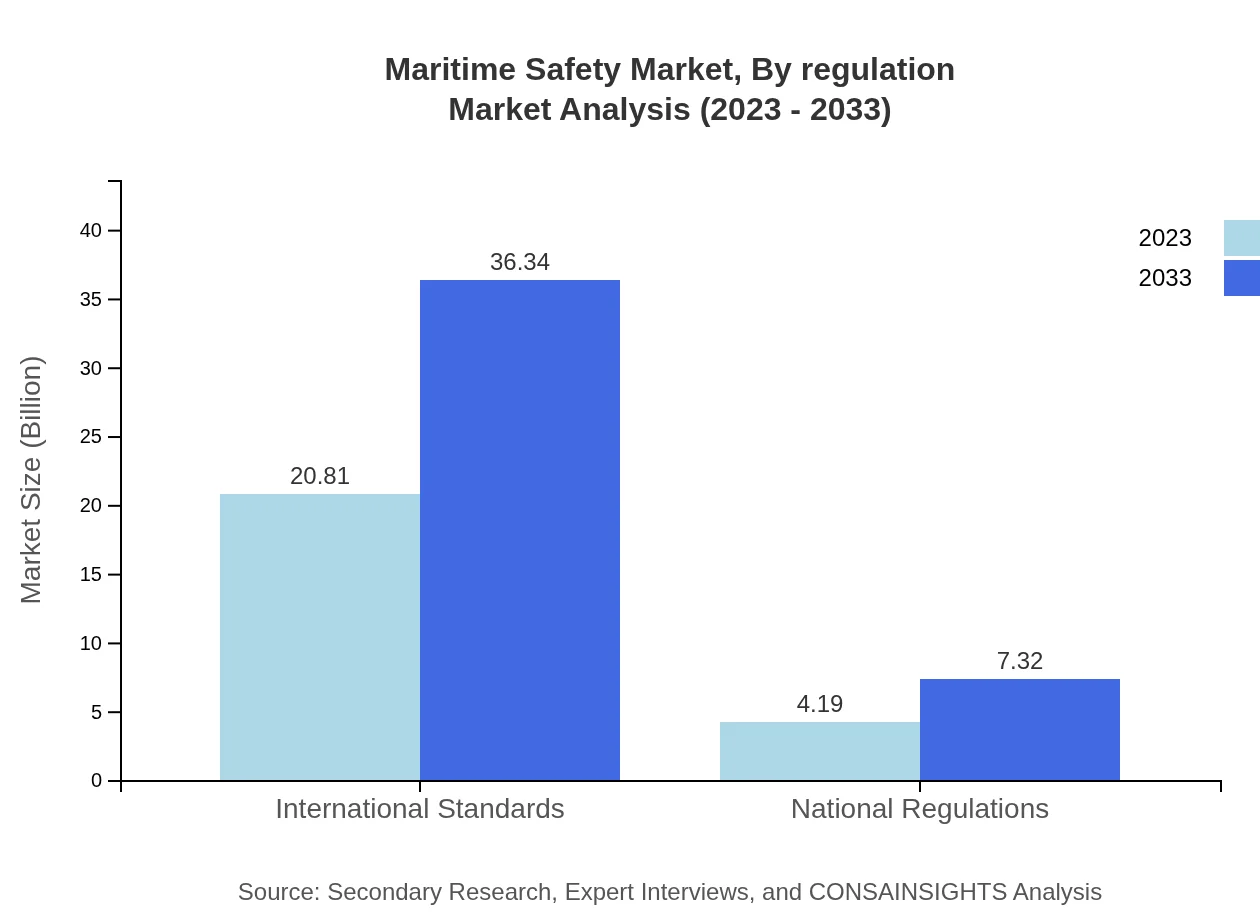

Maritime Safety Market Analysis By Regulation

The regulatory framework plays a foundational role in the Maritime Safety market. The international standards segment stands outs, estimated at $20.81 billion in 2023, growing to $36.34 billion by 2033. National regulations, providing localized compliance frameworks, are essential for ensuring operational adherence amongst maritime players across regions. These segments orchestrate market dynamics and influence investment decisions in maritime safety technologies and training.

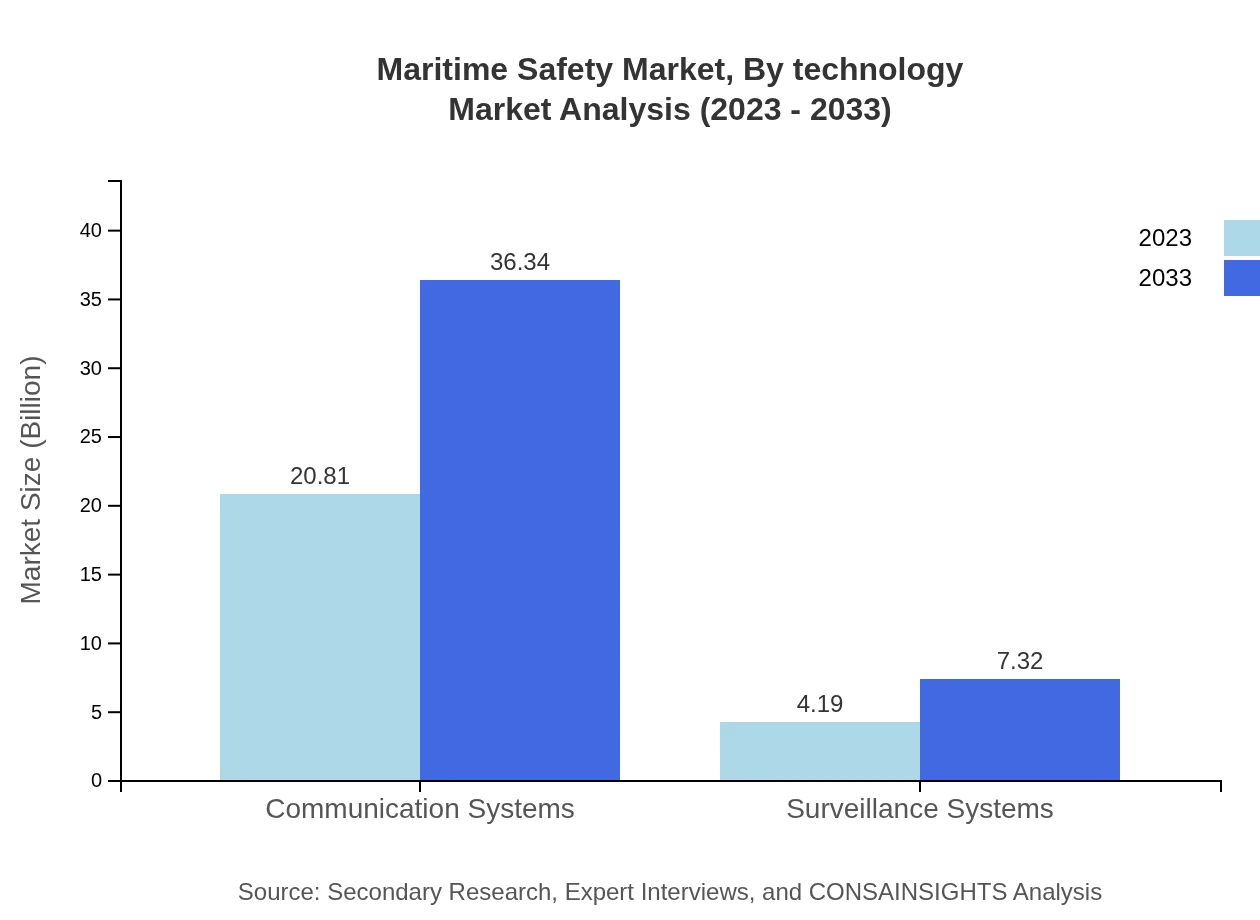

Maritime Safety Market Analysis By Technology

The technology segment in Maritime Safety encompasses several advancements, notably, the integration of surveillance and communication systems, which are expected to enhance safety protocols significantly. The focus on AI and IoT brings about innovative safety solutions. Increased reliance on data analytics and automation in navigating and monitoring maritime operations also aligns with evolving safety standards, promising remarkable growth in technological investments.

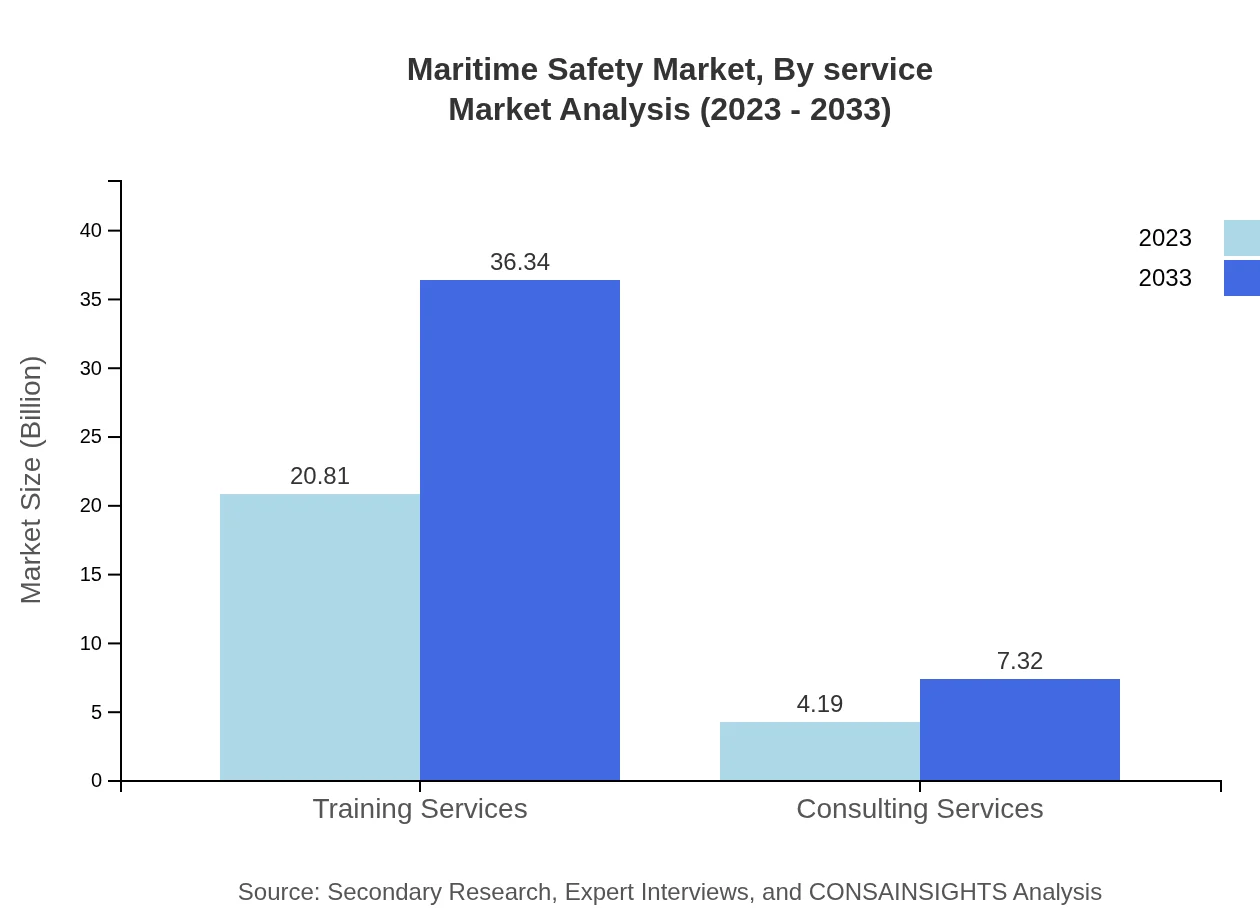

Maritime Safety Market Analysis By Service

In the services domain, training services capture the largest market share, expected to grow from $20.81 billion in 2023 to $36.34 billion by 2033. Consulting services, meanwhile, are projected to ascend from $4.19 billion to $7.32 billion. Emphasizing skills development and compliance, these segments are vital for establishing robust maritime operations that adhere to safety norms while continuous evolution in safety measures takes precedence.

Maritime Safety Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Maritime Safety Industry

Wilhelmsen Group:

A leading provider of maritime services, offering solutions across ship management and maritime safety products particularly focusing on compliance and operational safety training.DNV GL:

A global quality assurance and risk management company, providing classification, technical consultancy, and certification services to the maritime industry, emphasizing on safety standards.Bureau Veritas:

A global leader in testing, inspection, and certification services, Bureau Veritas is focused on improving safety standards in maritime operations through comprehensive compliance solutions.Lloyd's Register:

An international provider of maritime services offering classification, compliance, and consultancy services, ensuring high safety standards are upheld across maritime sectors.Zodiac Aerospace:

A major player in the aerospace and maritime safety markets, especially known for their life-saving apparatus and safety equipment for maritime operations.We're grateful to work with incredible clients.

FAQs

What is the market size of maritime Safety?

The maritime safety market is currently valued at approximately $25 billion with a projected CAGR of 5.6% from 2023 to 2033.

What are the key market players or companies in the maritime Safety industry?

Key players include marine safety equipment manufacturers, training providers, and regulatory bodies aiming to enhance global shipping safety standards.

What are the primary factors driving the growth in the maritime safety industry?

Growth is driven by increased maritime trade, stringent safety regulations, technological advancements, and rising awareness of navigation safety.

Which region is the fastest Growing in maritime safety?

North America is currently the fastest-growing region, expanding from $9.54 billion in 2023 to $16.66 billion by 2033.

Does ConsaInsights provide customized market report data for the maritime safety industry?

Yes, ConsaInsights offers tailored market reports that cater to specific client needs within the maritime safety sector.

What deliverables can I expect from this maritime safety market research project?

Deliverables include in-depth market analysis, forecasts, competitive landscape insights, and recommendations tailored to client specifications.

What are the market trends of maritime safety?

Current trends include increased investment in training services and life-saving apparatus, reflecting growing emphasis on proactive safety measures.