Maritime Satellite Communication Market Report

Published Date: 31 January 2026 | Report Code: maritime-satellite-communication

Maritime Satellite Communication Market Size, Share, Industry Trends and Forecast to 2033

This report provides an in-depth analysis of the Maritime Satellite Communication market, covering key insights, trends, and forecasts for the period 2023 to 2033.

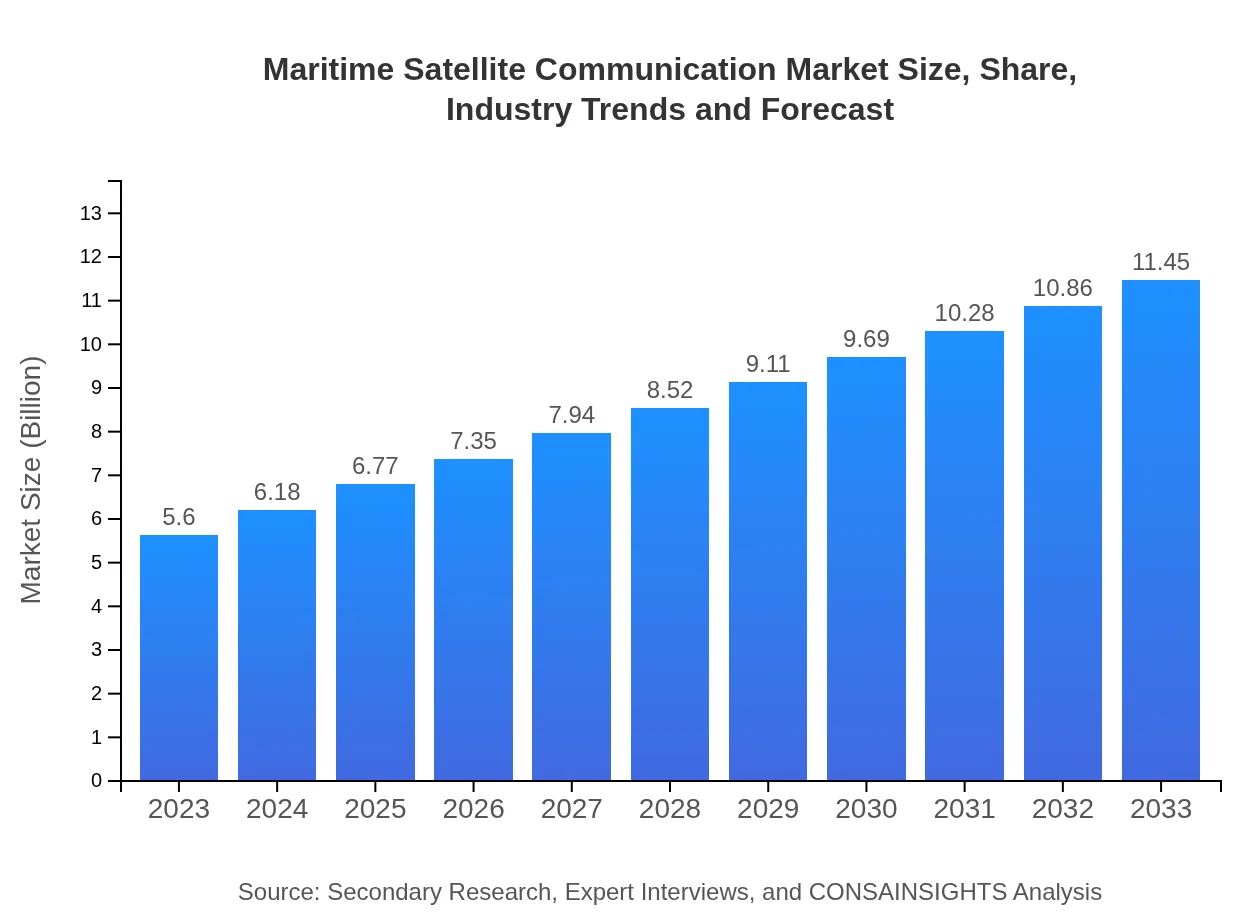

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $5.60 Billion |

| CAGR (2023-2033) | 7.2% |

| 2033 Market Size | $11.45 Billion |

| Top Companies | Inmarsat, Iridium Communications, SES S.A., Thuraya Telecommunications Company |

| Last Modified Date | 31 January 2026 |

Maritime Satellite Communication Market Overview

Customize Maritime Satellite Communication Market Report market research report

- ✔ Get in-depth analysis of Maritime Satellite Communication market size, growth, and forecasts.

- ✔ Understand Maritime Satellite Communication's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Maritime Satellite Communication

What is the Market Size & CAGR of Maritime Satellite Communication market in 2023?

Maritime Satellite Communication Industry Analysis

Maritime Satellite Communication Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Maritime Satellite Communication Market Analysis Report by Region

Europe Maritime Satellite Communication Market Report:

Europe's Maritime Satellite Communication market will likely see growth from $1.46 billion in 2023 to $2.99 billion by 2033, attributed to advanced maritime operations, focus on green shipping practices, and regulatory mandates for enhanced communication.Asia Pacific Maritime Satellite Communication Market Report:

The Asia Pacific Maritime Satellite Communication market is projected to grow from $1.13 billion in 2023 to $2.32 billion by 2033, at a CAGR of approximately 7.5%. Key factors include increased shipping activities in the region, advancements in satellite technology, and growing investments in maritime safety and communication infrastructure.North America Maritime Satellite Communication Market Report:

In North America, the market is expected to expand significantly, from $1.81 billion in 2023 to $3.70 billion by 2033, fueled by the adoption of cutting-edge maritime technology and stringent safety regulations.South America Maritime Satellite Communication Market Report:

South America’s market is poised for growth, rising from $0.53 billion in 2023 to $1.09 billion by 2033. The increase is driven by expanding shipping routes and investments in fisheries, which demand enhanced communication capabilities for operational efficiency.Middle East & Africa Maritime Satellite Communication Market Report:

The Middle East and Africa market is projected to grow from $0.66 billion in 2023 to $1.35 billion by 2033. Growing offshore oil and gas exploration activities and rising demand for fishing operations contribute to the region's growth.Tell us your focus area and get a customized research report.

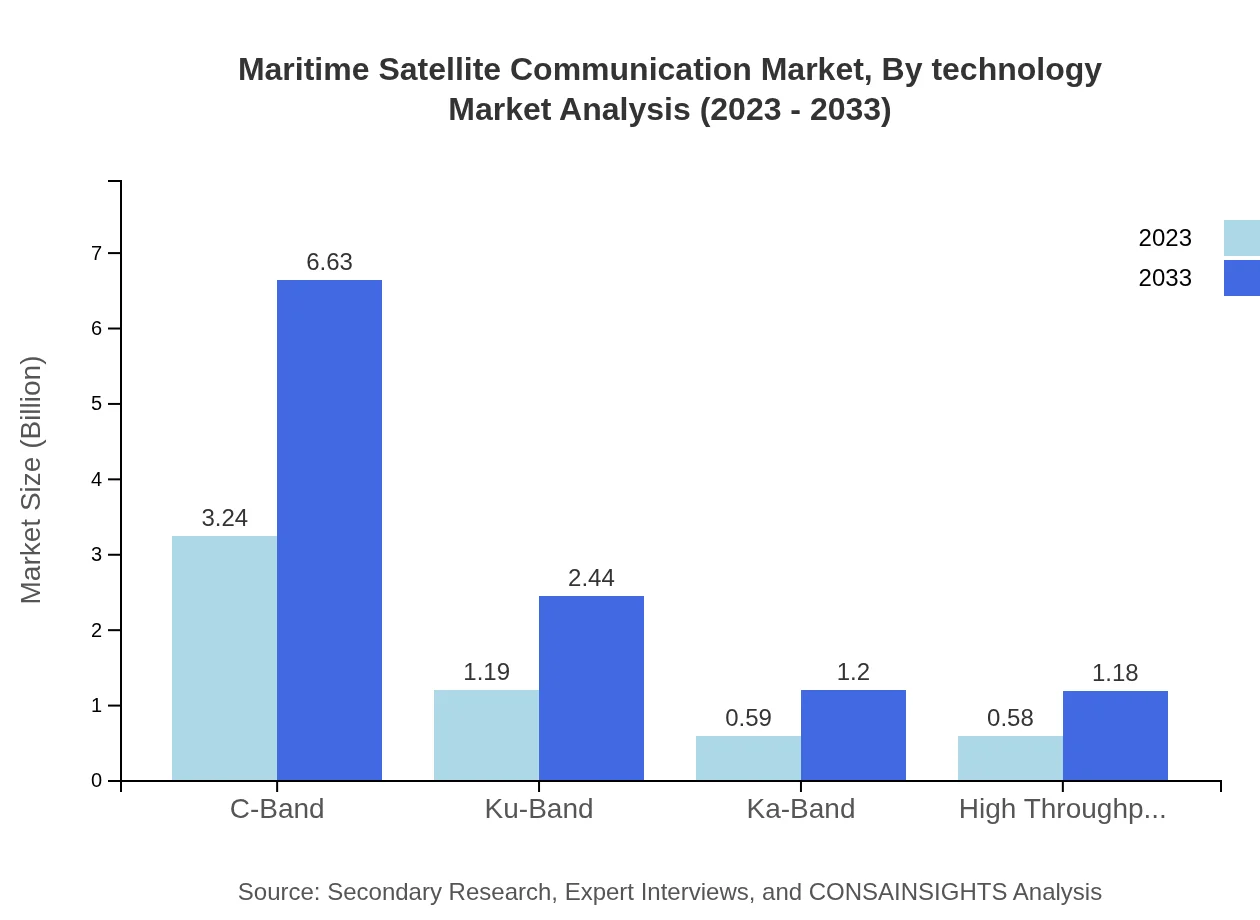

Maritime Satellite Communication Market Analysis By Technology

In the Maritime Satellite Communication market, C-Band technology dominates with a market share of 57.94% in 2023, valued at approximately $3.24 billion, expected to reach $6.63 billion by 2033. Ku-Band and Ka-Band technologies follow, offering significant capabilities in high-bandwidth applications for commercial shipping and offshore operations, with respective market sizes projected to increase from $1.19 billion to $2.44 billion and $0.59 billion to $1.20 billion during the same period. High Throughput Satellites (HTS) technology is also gaining traction, reflecting increasing demand for network capacity and connectivity.

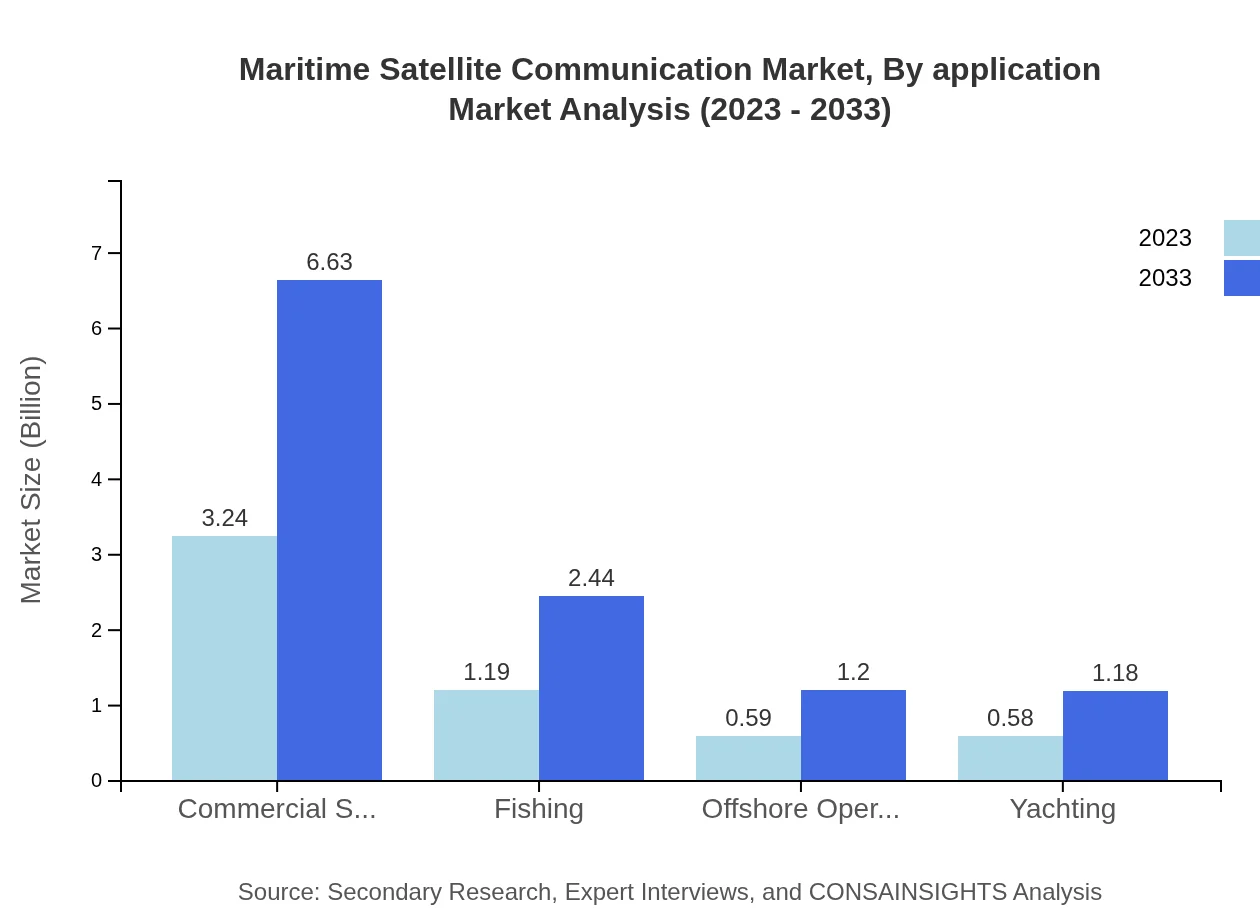

Maritime Satellite Communication Market Analysis By Application

The market segmentation by application reveals commercial shipping as the leading segment, accounting for 57.94% of the market share. In 2023, this segment is valued at approximately $3.24 billion and is expected to grow to $6.63 billion by 2033. Offshore operations and fishing industries are essential segments as they require constant connectivity for operational efficiency, and are projected to increase remarkably in market size over the forecast period.

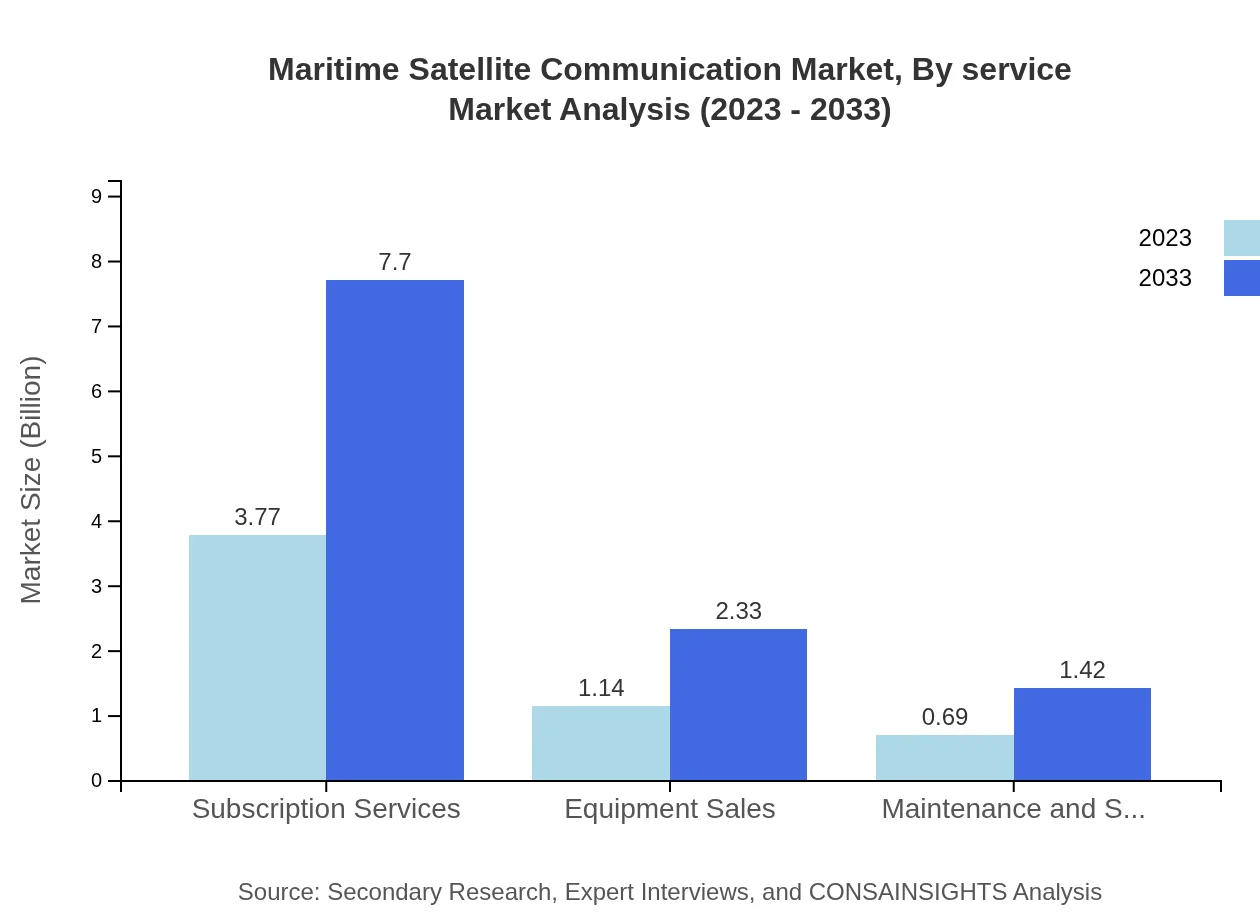

Maritime Satellite Communication Market Analysis By Service

The service segment highlights subscription services, which dominate the market with a significant share of 67.27%. In terms of size, this segment is expected to grow from $3.77 billion in 2023 to $7.70 billion by 2033. Equipment sales and maintenance support are crucial segments as well, accounting for $1.14 billion and $0.69 billion in 2023 respectively, both poised for substantial growth due to new technology implementations and evolving customer requirements.

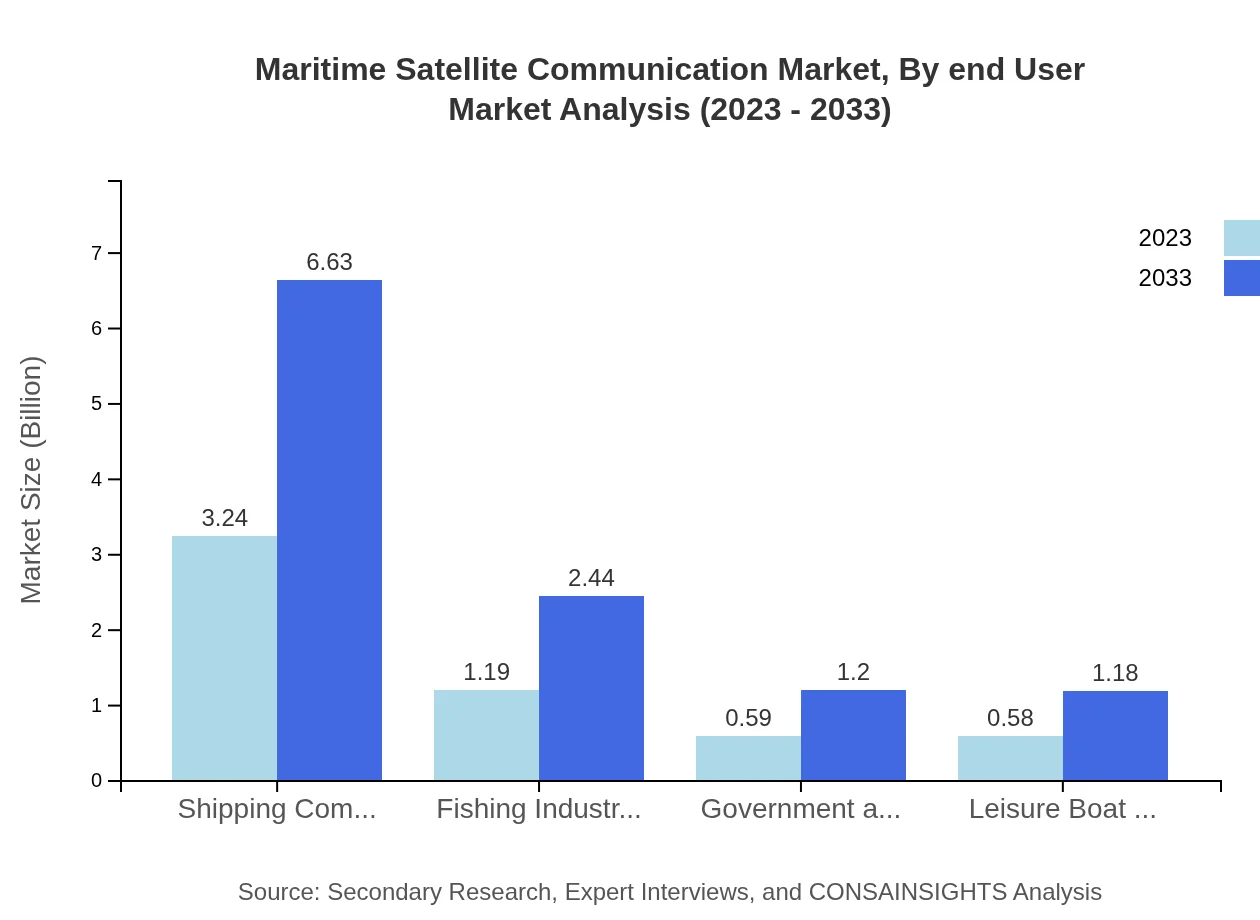

Maritime Satellite Communication Market Analysis By End User

The end-user analysis indicates that shipping companies remain the predominant end-users within the maritime satellite communication industry, making up 57.94% of the market share. They utilize robust communication solutions to ensure operational efficiency and compliance with maritime regulations. Other key end-users include government and military entities and leisure boat owners, both showing opportunities for growth due to increased emphasis on safety, environmental monitoring, and recreational maritime activities.

Maritime Satellite Communication Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Maritime Satellite Communication Industry

Inmarsat:

A leading provider of satellite communication services, Inmarsat offers advanced safety and operational communication solutions for the maritime industry.Iridium Communications:

Iridium provides innovative satellite communication systems, known for dependable global services, connecting maritime users in remote and challenging locations.SES S.A.:

SES specializes in satellite communications and offers High Throughput Satellite solutions catering to maritime customers, enhancing data delivery at sea.Thuraya Telecommunications Company:

Thuraya delivers satellite communication services focusing on voice and broadband solutions for the maritime sector across diverse geographic regions.We're grateful to work with incredible clients.

FAQs

What is the market size of maritime Satellite Communication?

The maritime satellite communication market is projected to reach USD 5.6 billion by 2033 with a CAGR of 7.2% from 2023. This growth reflects an increasing demand for reliable communication solutions in the maritime industry.

What are the key market players or companies in the maritime Satellite Communication industry?

Key players in the maritime satellite communication market include major satellite companies, telecommunications providers, and specialized technology firms. These companies focus on providing innovative communication solutions for the maritime sector, ensuring seamless connectivity.

What are the primary factors driving the growth in the maritime Satellite Communication industry?

The primary growth factors include rising demand for broadband connectivity at sea, increased reliance on digital navigation and logistics, and advancements in satellite technology. Additionally, regulatory requirements for vessel tracking also drive market expansion.

Which region is the fastest Growing in the maritime Satellite Communication?

North America is the fastest-growing region in the maritime satellite communication market, expected to reach USD 3.70 billion by 2033, up from USD 1.81 billion in 2023. This growth is driven by high adoption rates of advanced communication systems.

Does ConsaInsights provide customized market report data for the maritime Satellite Communication industry?

Yes, ConsaInsights does provide customized market report data tailored to specific needs in the maritime satellite communication industry. Clients can request bespoke analyses that cater to their unique market requirements.

What deliverables can I expect from this maritime Satellite Communication market research project?

Deliverables typically include detailed market analysis reports, segment-wise insights, competitive landscape overviews, regional performance data, and trend forecasts. These insights will help stakeholders make informed business decisions.

What are the market trends of maritime Satellite Communication?

Key trends include the increasing move towards High Throughput Satellite (HTS) services, integrated solutions for efficient fleet management, and the growth of data-driven services in maritime operations. These trends are reshaping industry dynamics.