Maritime Security Market Report

Published Date: 03 February 2026 | Report Code: maritime-security

Maritime Security Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the maritime security market, covering market size, segmentation, regional insights, technological advancements, and future forecasts from 2023 to 2033.

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

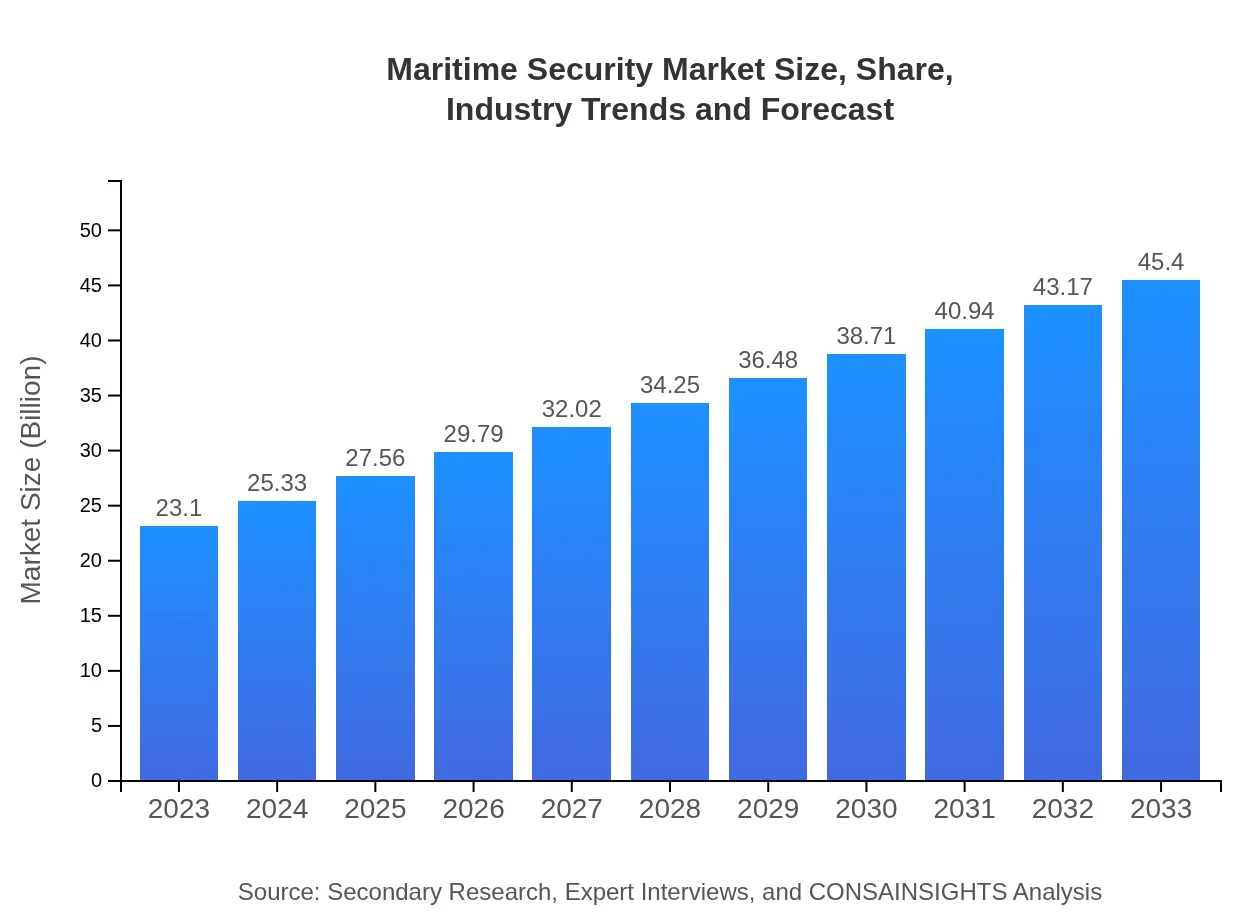

| 2023 Market Size | $23.10 Billion |

| CAGR (2023-2033) | 6.8% |

| 2033 Market Size | $45.40 Billion |

| Top Companies | Raytheon Technologies, Lockheed Martin, Thales Group, BAE Systems |

| Last Modified Date | 03 February 2026 |

Maritime Security Market Overview

Customize Maritime Security Market Report market research report

- ✔ Get in-depth analysis of Maritime Security market size, growth, and forecasts.

- ✔ Understand Maritime Security's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Maritime Security

What is the Market Size & CAGR of the Maritime Security Market in 2023?

Maritime Security Industry Analysis

Maritime Security Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Maritime Security Market Analysis Report by Region

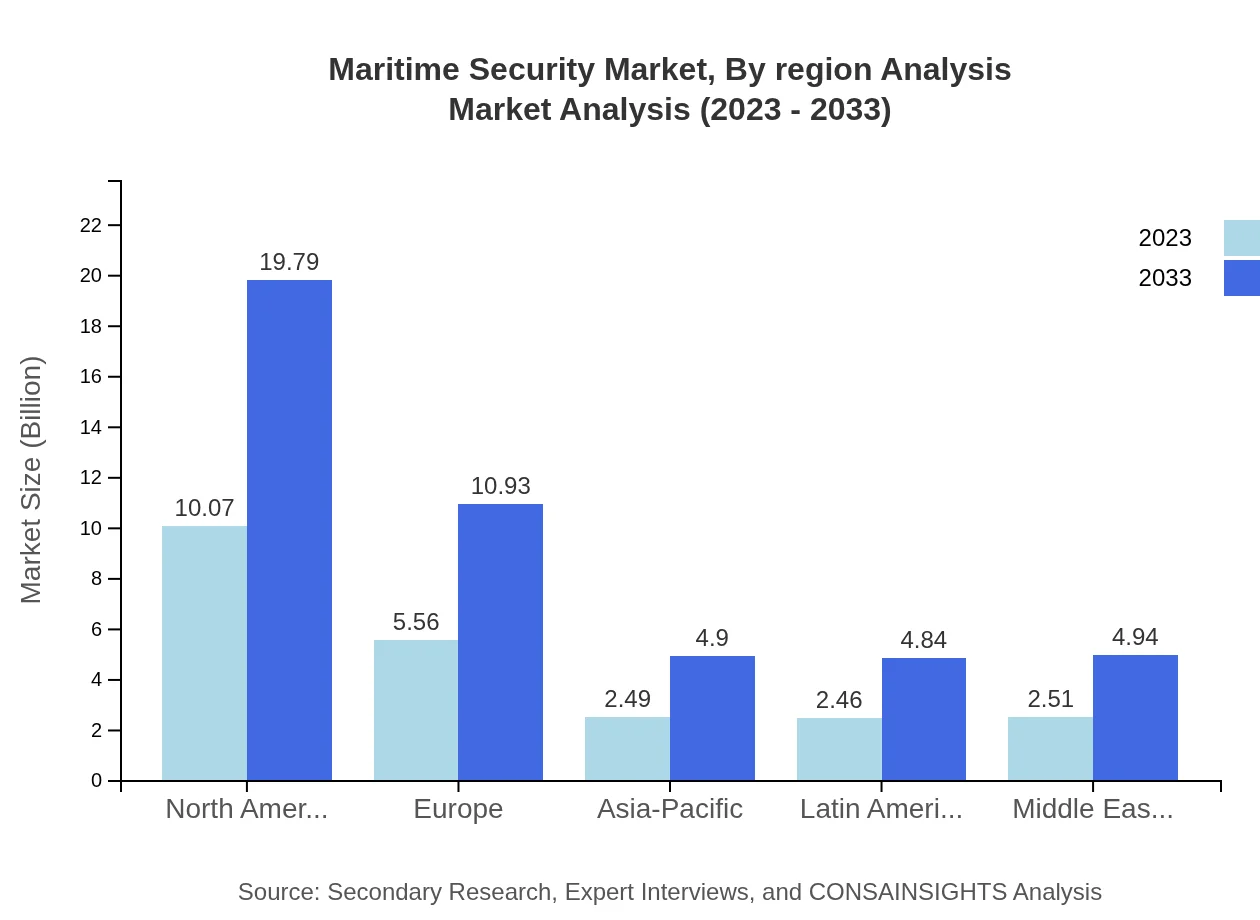

Europe Maritime Security Market Report:

Europe's maritime security market is valued at $7.23 billion in 2023 and is expected to double to $14.21 billion by 2033. The European Union's regulations and initiatives to tackle maritime security issues further stimulate market growth.Asia Pacific Maritime Security Market Report:

The Asia-Pacific region's maritime security market was valued at $4.54 billion in 2023, projected to reach $8.93 billion by 2033. This growth is driven by increased import-export activities, concerns over piracy in regions like Southeast Asia, and investments in naval modernization.North America Maritime Security Market Report:

North America's market stands at $7.68 billion in 2023 and is projected to grow to $15.10 billion by 2033. The region is bolstered by advanced technologies and governmental initiatives focusing on securing maritime routes against threats.South America Maritime Security Market Report:

The South American maritime security market is expected to grow from $0.98 billion in 2023 to $1.93 billion by 2033. This growth is significantly influenced by the rise in illegal fishing, smuggling, and the need for effective coastal management.Middle East & Africa Maritime Security Market Report:

The Middle East and Africa region is forecasted to expand from $2.66 billion to $5.23 billion between 2023 and 2033. The growth is largely due to geopolitical tensions and rising oil transit security needs.Tell us your focus area and get a customized research report.

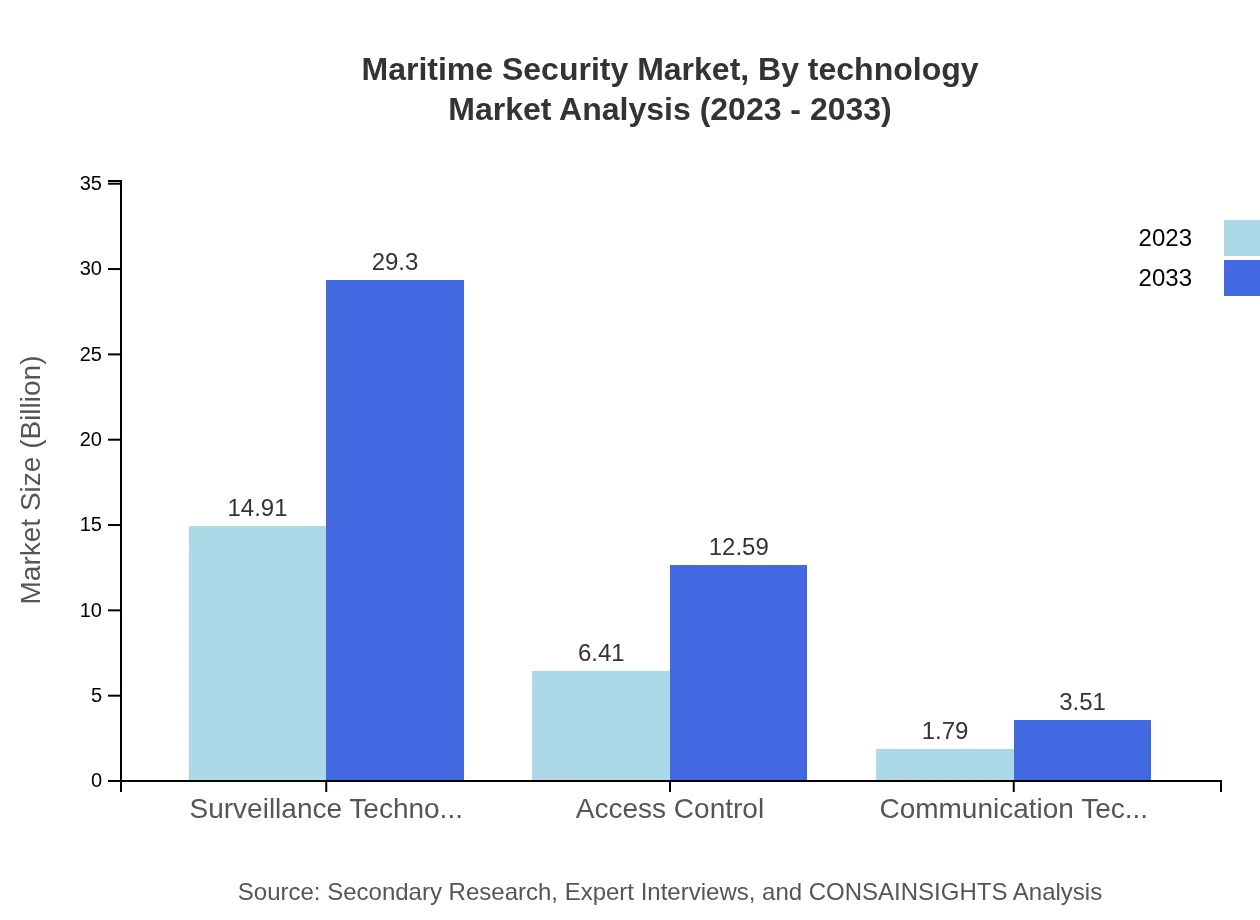

Maritime Security Market Analysis By Technology

The maritime security market exhibits significant expansion across various technological segments. Surveillance technology leads the market with a size of $14.91 billion in 2023, forecasted to reach $29.30 billion by 2033, accounting for 64.54% of the total market share. Access control measures are also vital, showing an increase from $6.41 billion in 2023 to $12.59 billion by 2033, capturing 27.73% of the market share.

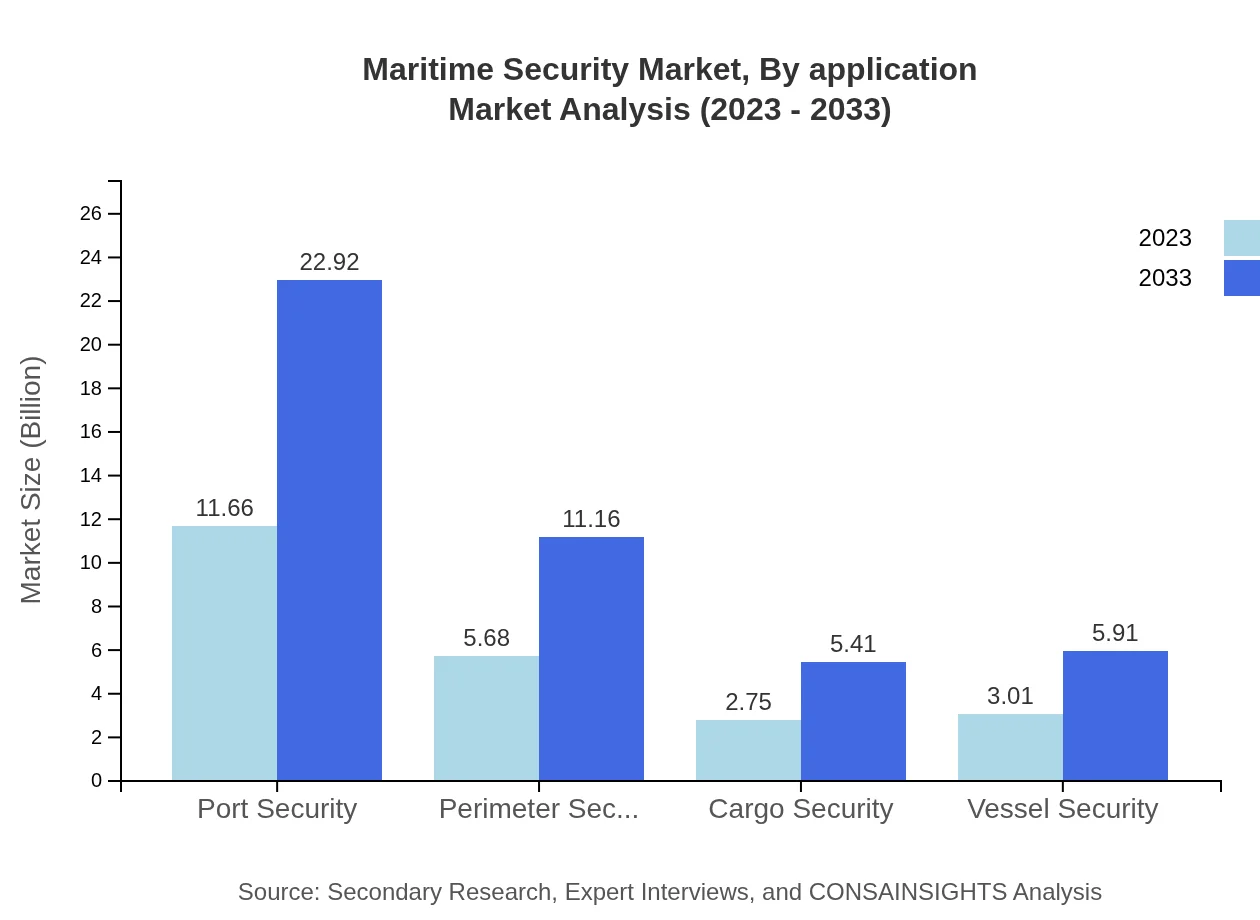

Maritime Security Market Analysis By Application

In application segments, port security dominates with $11.66 billion in 2023, projected to grow to $22.92 billion by 2033 (50.49% market share). Vessel security and cargo security are also critical, with significant growth trajectories expected as companies ensure comprehensive security across their shipping operations.

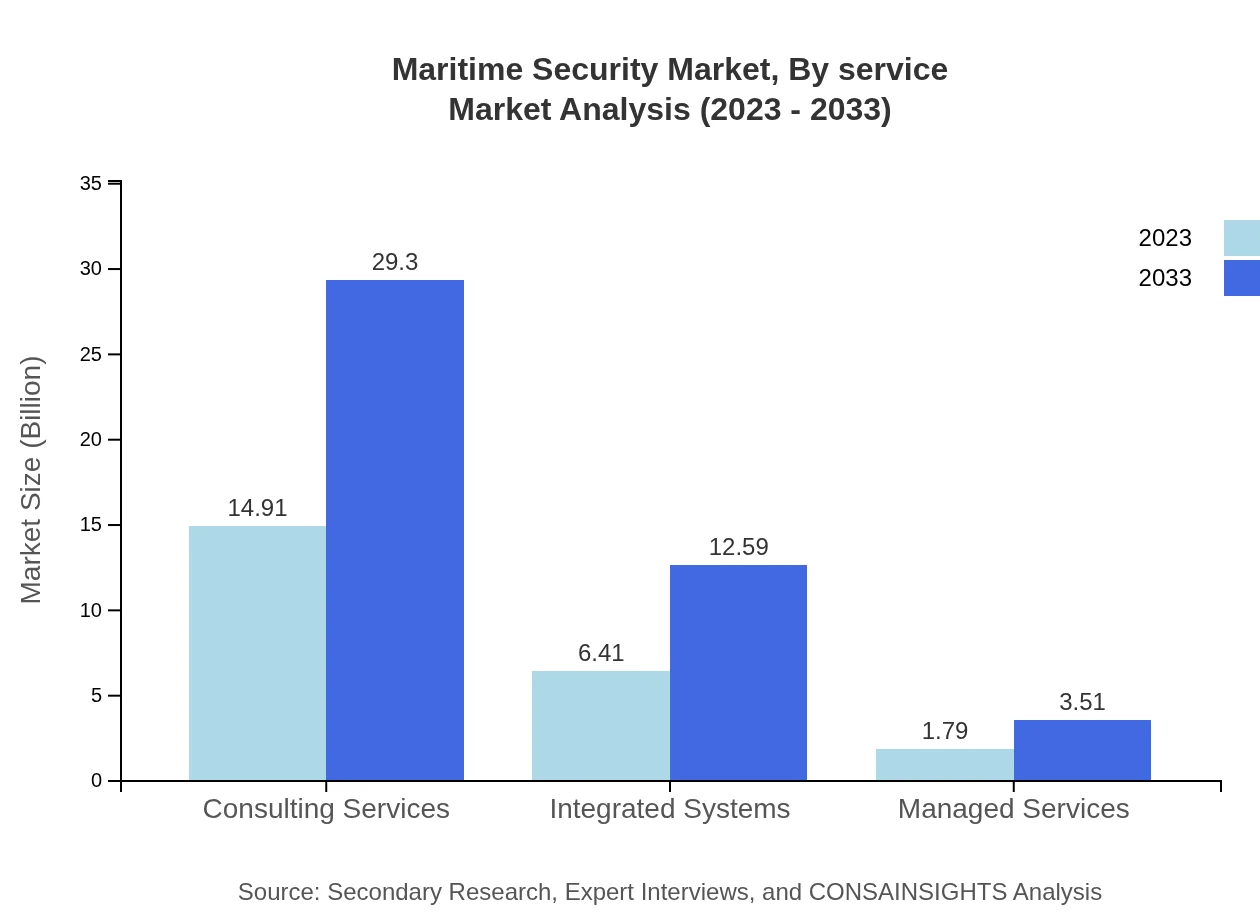

Maritime Security Market Analysis By Service

Consulting services represent a significant market segment, growing from $14.91 billion in 2023 to $29.30 billion by 2033, maintaining a steady market share of 64.54%. Managed services, albeit smaller, are also forecasted to grow from $1.79 billion to $3.51 billion over the same period, reflecting the increasing demand for outsourced security solutions.

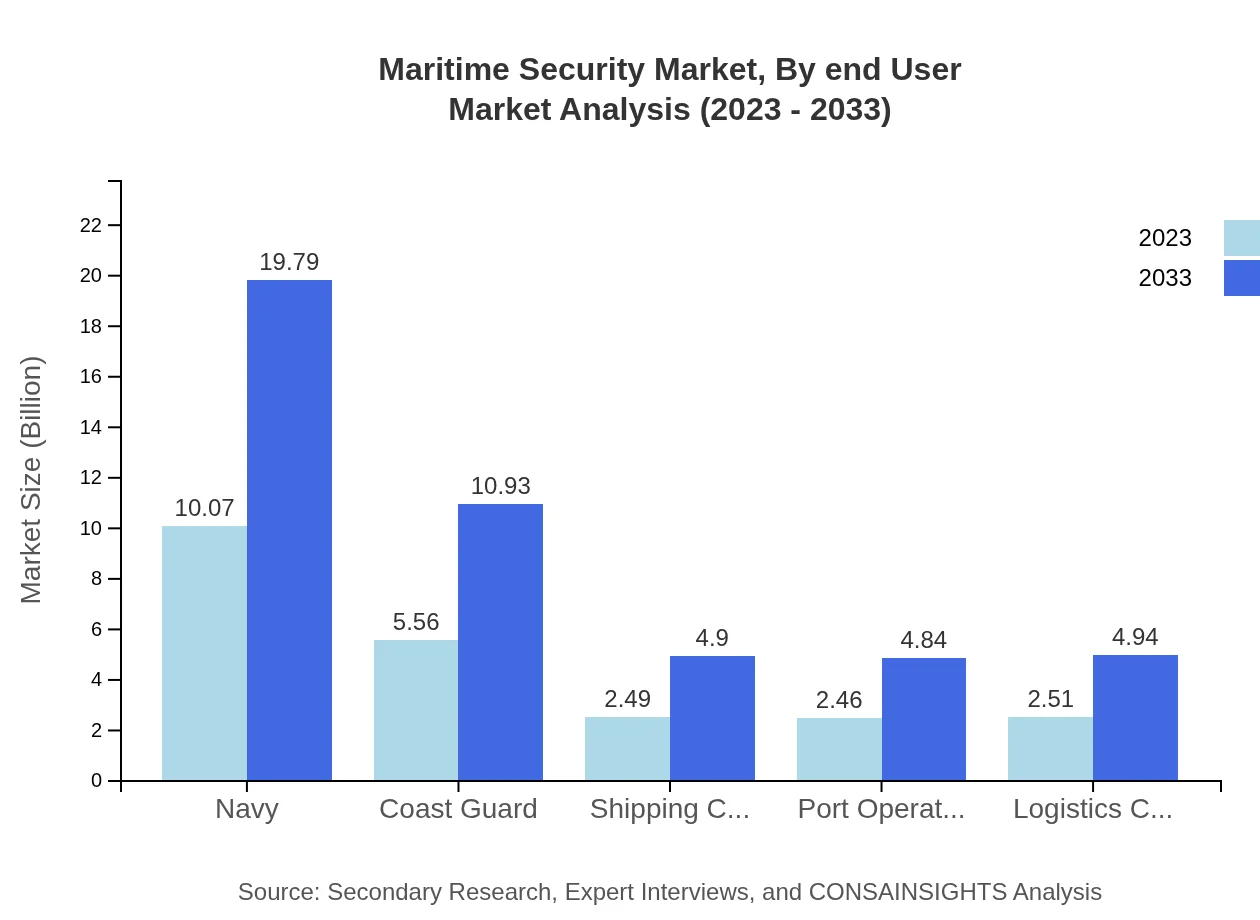

Maritime Security Market Analysis By End User

Key end-users include government agencies, shipping companies, and port operators. The Navy holds a substantial share, demonstrating growth from $10.07 billion in 2023 to $19.79 billion by 2033, while commercial shipping players are increasingly investing in security measures, enhancing their market representation.

Maritime Security Market Analysis By Region Analysis

Analysis by region reveals distinct growth patterns, with North America and Europe leading in market size due to advanced technologies and strong enforcement of maritime security regulations. The Asia-Pacific region, however, is anticipated to experience the fastest growth due to rising shipping traffic and piracy threats.

Maritime Security Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in the Maritime Security Industry

Raytheon Technologies:

A prominent player in defense technology, Raytheon develops advanced maritime security solutions, integrating cutting-edge technology for surveillance and threat detection.Lockheed Martin:

Specializing in aerospace and defense, Lockheed Martin provides a wide range of maritime security systems enhancing naval operations' safety and efficiency.Thales Group:

Thales offers advanced security solutions in the maritime sector, focusing on technologies for intelligent surveillance and cyber resilience in shipping.BAE Systems:

BAE Systems is known for its extensive defense capabilities, providing integrated solutions focused on ensuring maritime security and protecting critical waterways.We're grateful to work with incredible clients.

FAQs

What is the market size of maritime Security?

The maritime security market is projected to reach a value of $23.1 billion by 2033, growing at a CAGR of 6.8% from its current size. This growth reflects increasing investment in security to safeguard maritime operations.

What are the key market players or companies in this maritime Security industry?

Leading players in the maritime security market include major defense contractors and technology firms providing integrated systems, consulting services, and specialized surveillance technologies that enhance maritime security operations globally.

What are the primary factors driving the growth in the maritime Security industry?

Key drivers of growth in the maritime security industry include escalating geopolitical tensions, increased trade volumes, the rise of piracy, and regulatory requirements for safer shipping practices, creating demand for advanced security solutions.

Which region is the fastest Growing in the maritime Security?

North America is the fastest-growing region, projected to grow from $7.68 billion in 2023 to $15.10 billion by 2033. Europe follows closely, expanding from $7.23 billion to $14.21 billion in the same period.

Does ConsaInsights provide customized market report data for the maritime Security industry?

Yes, ConsaInsights offers customized market reports tailored to specific client needs. This allows for in-depth insights and analysis aligned with unique requirements and strategic goals within the maritime security industry.

What deliverables can I expect from this maritime Security market research project?

Deliverables typically include comprehensive reports, data analytics, market forecasts, segmentation analysis, competitive landscape reviews, and actionable insights tailored to enhance strategic decision-making in maritime security.

What are the market trends of maritime Security?

Trends in maritime security include increased adoption of digital surveillance technology, integration of IoT for real-time monitoring, and a shift towards collaborative security networks among nations to counter emerging maritime threats.