Masonry White Cement Market Report

Published Date: 22 January 2026 | Report Code: masonry-white-cement

Masonry White Cement Market Size, Share, Industry Trends and Forecast to 2033

This report provides an in-depth analysis of the Masonry White Cement market, offering insights into market conditions, segmentation, technological advancements, and forecasts for the years 2023 to 2033.

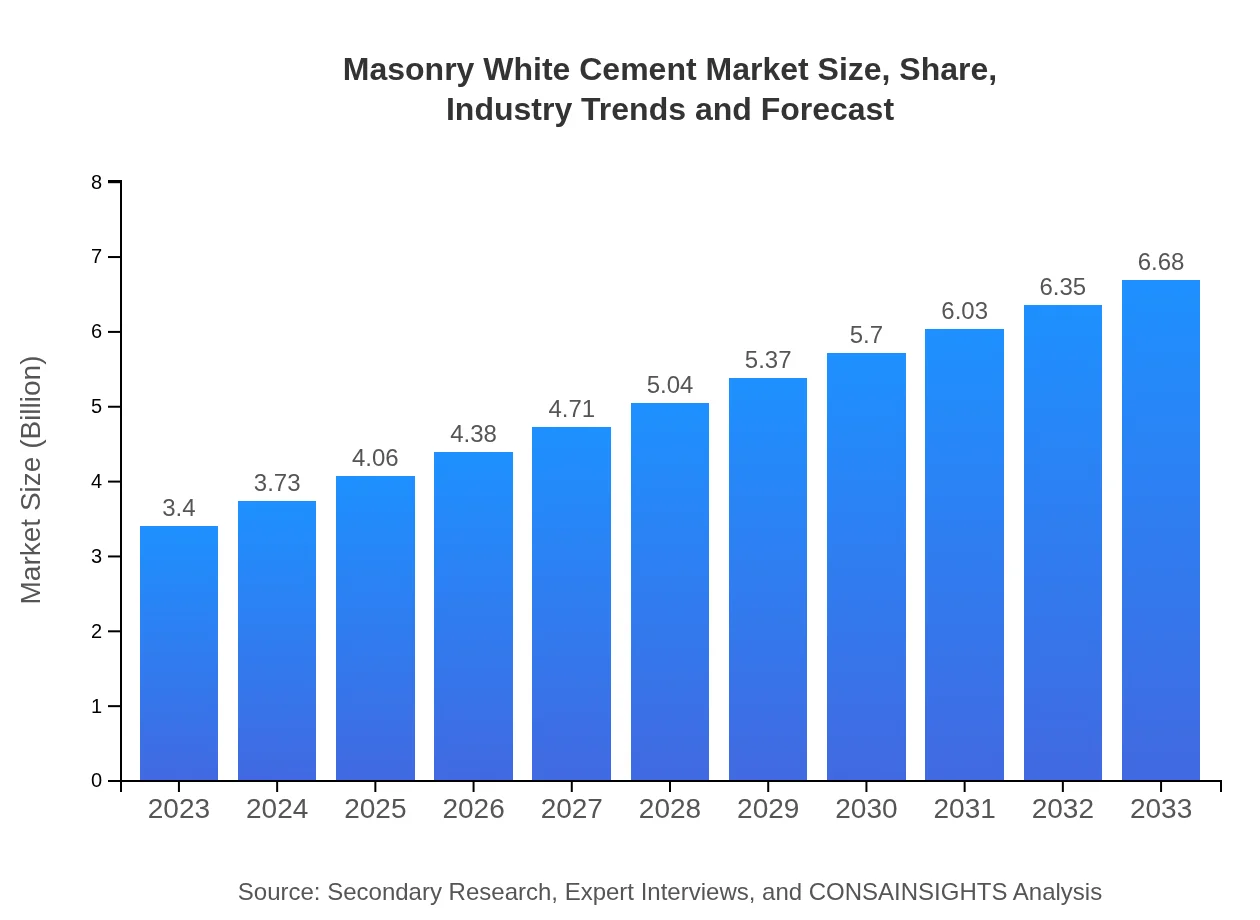

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $3.40 Billion |

| CAGR (2023-2033) | 6.8% |

| 2033 Market Size | $6.68 Billion |

| Top Companies | LafargeHolcim, HeidelbergCement, CEMEX, Buzzi Unicem |

| Last Modified Date | 22 January 2026 |

Masonry White Cement Market Overview

Customize Masonry White Cement Market Report market research report

- ✔ Get in-depth analysis of Masonry White Cement market size, growth, and forecasts.

- ✔ Understand Masonry White Cement's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Masonry White Cement

What is the Market Size & CAGR of Masonry White Cement market in 2023?

Masonry White Cement Industry Analysis

Masonry White Cement Market Segmentation and Scope

Tell us your focus area and get a customized research report.

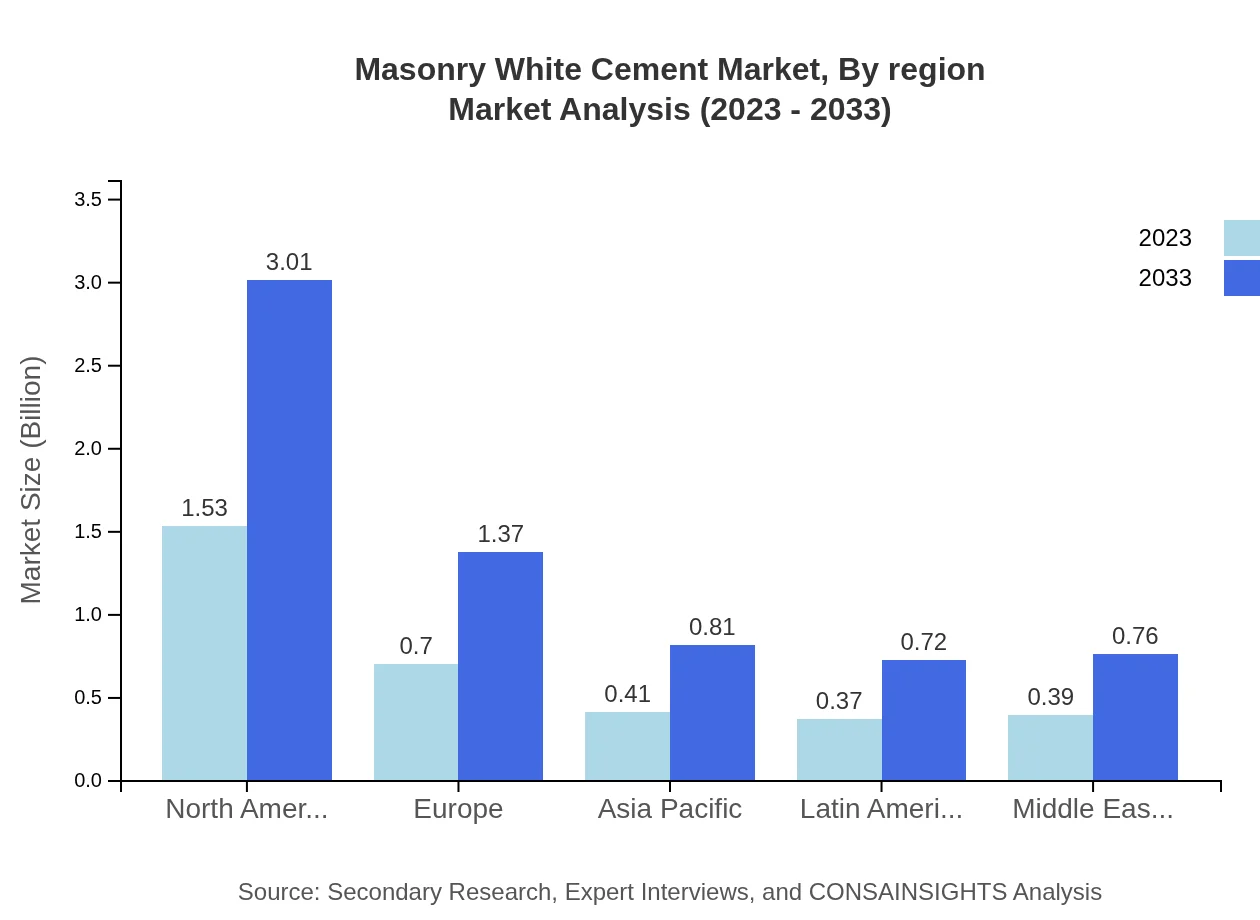

Masonry White Cement Market Analysis Report by Region

Europe Masonry White Cement Market Report:

The European Masonry White Cement market is anticipated to grow from USD 1.14 billion in 2023 to USD 2.25 billion by 2033. This growth is influenced by stringent building codes and a shift towards sustainable construction practices that require high-quality materials.Asia Pacific Masonry White Cement Market Report:

In the Asia Pacific region, the Masonry White Cement market is projected to expand from USD 0.58 billion in 2023 to USD 1.15 billion by 2033, driven by rapid urbanization and increasing construction activities in countries like China and India. The region's focus on infrastructure projects and high-end residential developments supports this growth.North America Masonry White Cement Market Report:

North America's market size is projected to increase from USD 1.18 billion in 2023 to USD 2.32 billion by 2033. The demand is propelled by a surge in commercial construction and residential development projects, particularly in the U.S. and Canada.South America Masonry White Cement Market Report:

South America's Masonry White Cement market is expected to grow from USD 0.29 billion in 2023 to USD 0.58 billion by 2033. The increasing investment in public infrastructure and economic recovery post-COVID-19 are key drivers. Brazil and Argentina are leading markets in this growth phase.Middle East & Africa Masonry White Cement Market Report:

The Middle East and Africa market is foreseen to rise from USD 0.20 billion in 2023 to USD 0.39 billion by 2033, aided by rapid urbanization and infrastructure developments, particularly in GCC countries.Tell us your focus area and get a customized research report.

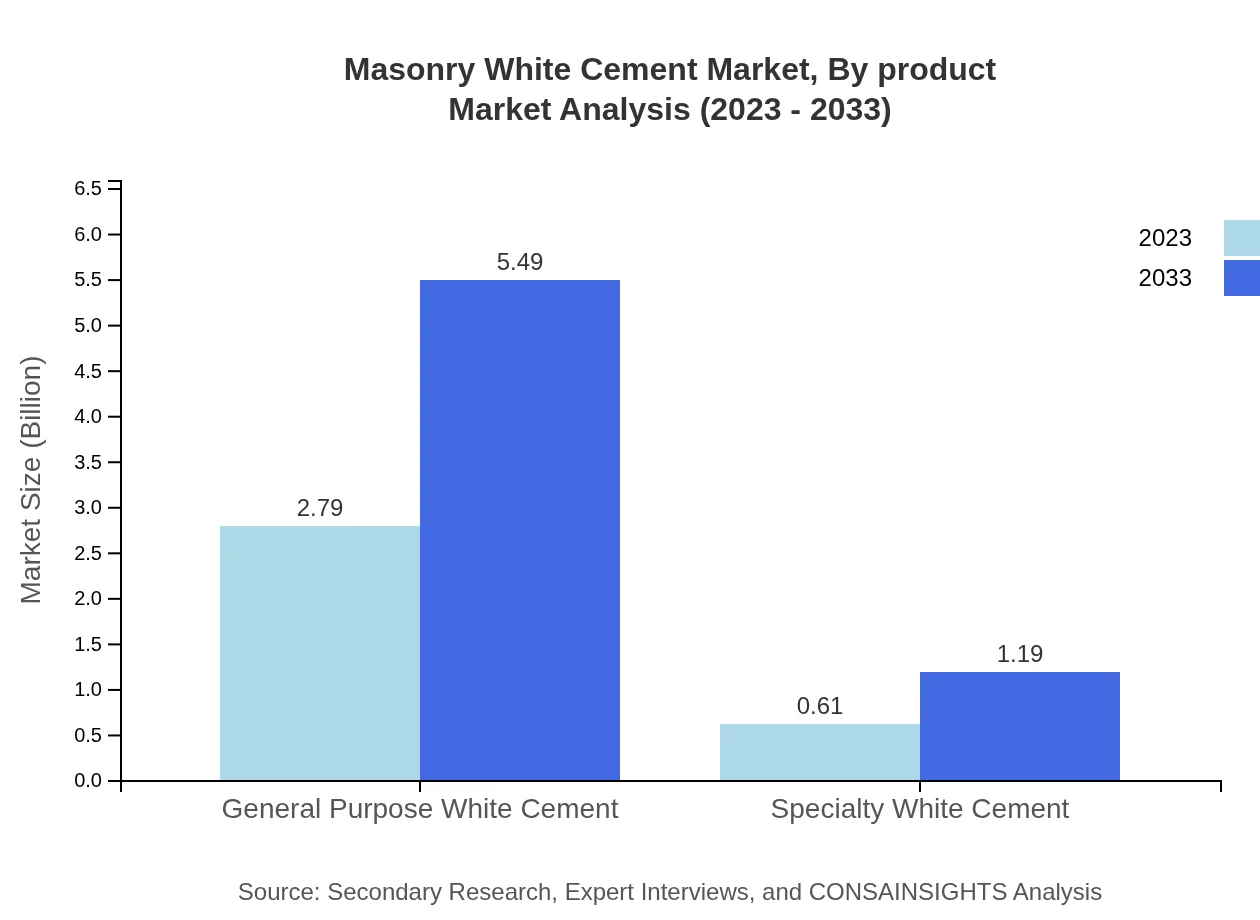

Masonry White Cement Market Analysis By Product

In 2023, General Purpose White Cement accounted for 82.17% of the market share, valued at USD 2.79 billion, and is projected to reach USD 5.49 billion by 2033. Conversely, Specialty White Cement holds a smaller share but is also expected to grow, demonstrating responsiveness to niche applications and demands.

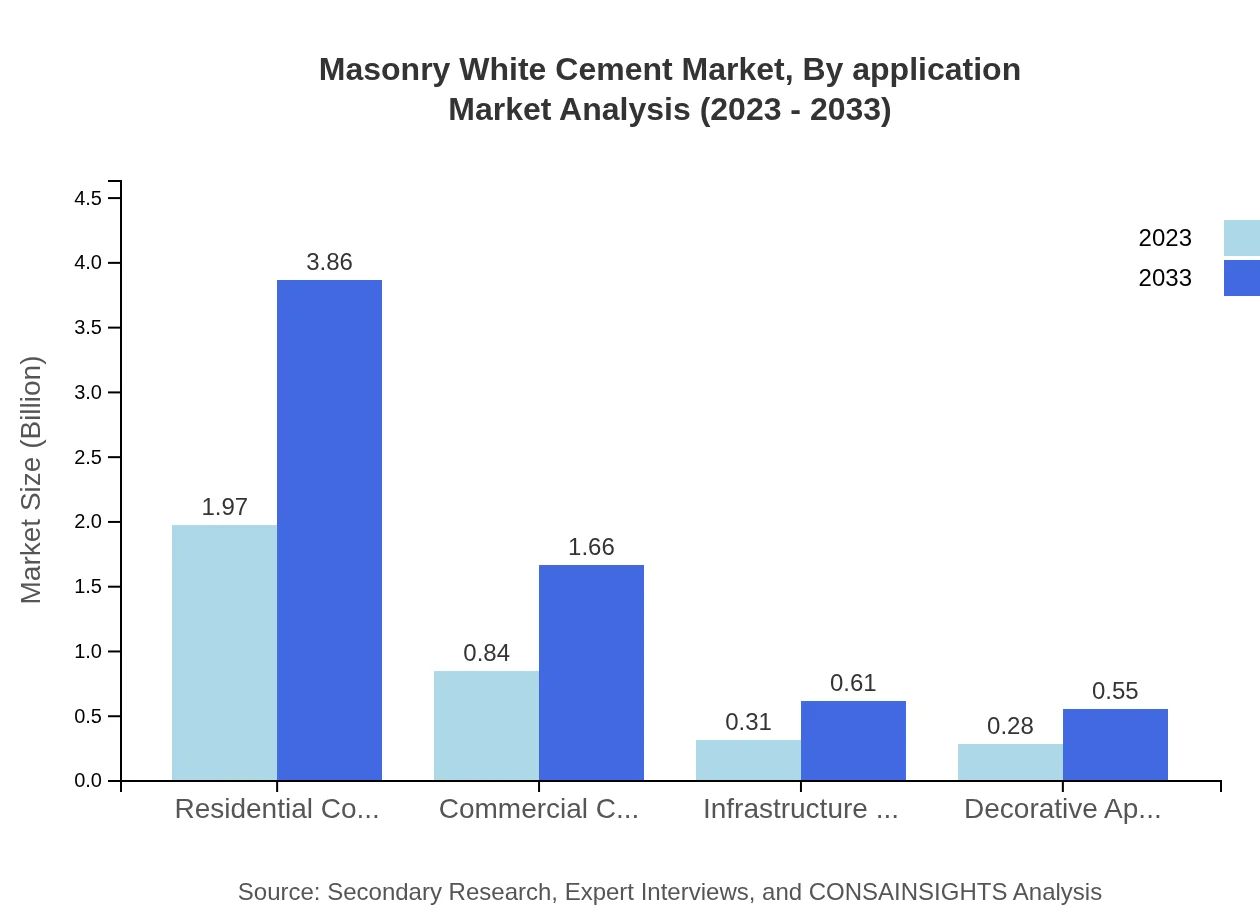

Masonry White Cement Market Analysis By Application

The residential construction sector dominates with a 57.83% share in 2023, expected to reach USD 3.86 billion by 2033. Commercial construction follows at 24.83%. Infrastructure projects are also significant, benefiting from government initiatives to enhance public works across regions.

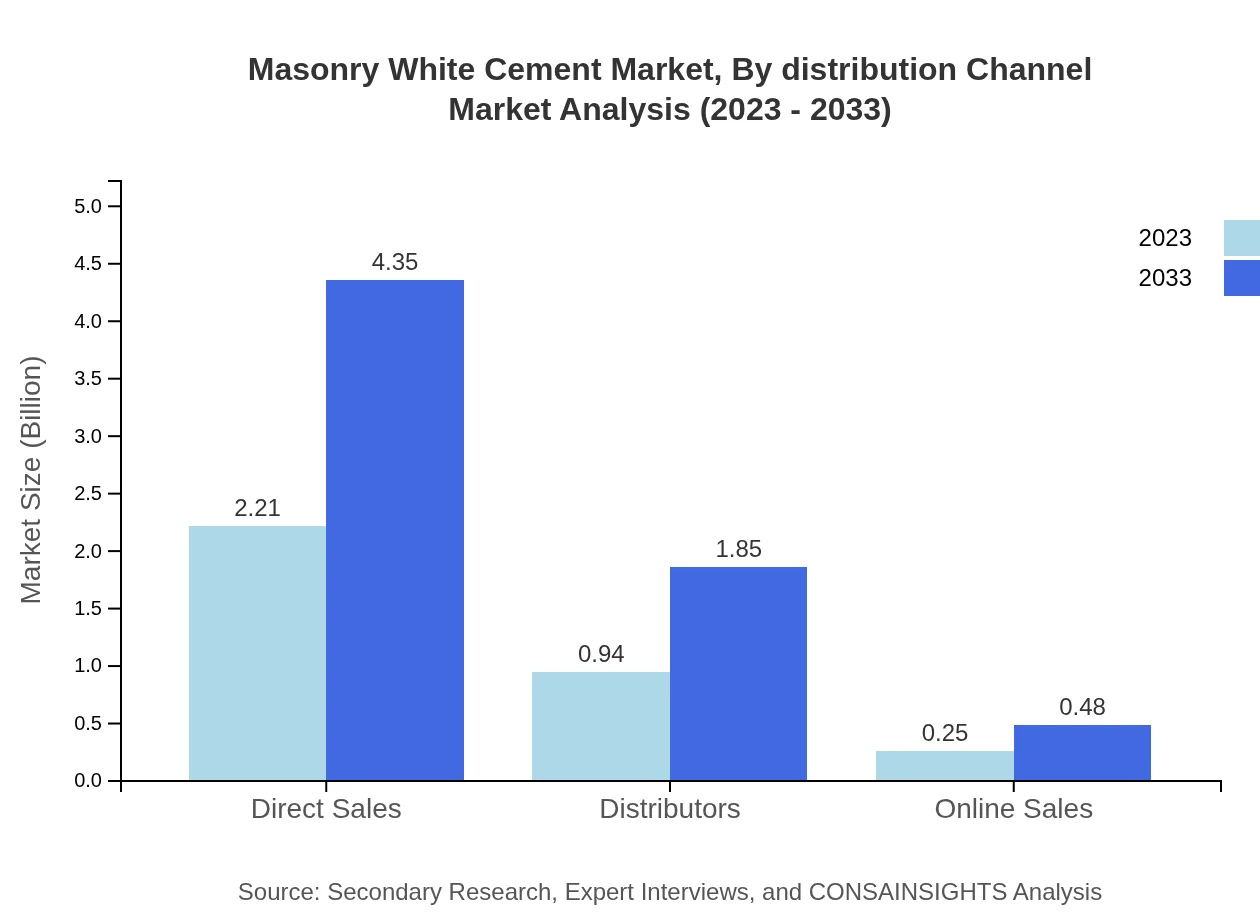

Masonry White Cement Market Analysis By Distribution Channel

Direct sales currently lead with 65.05% market share, supporting robust relationships between manufacturers and large projects. Distributors and online sales channels are emerging, capturing demands from smaller projects and consumers seeking convenience.

Masonry White Cement Market Analysis By Region

Regional analysis indicates North America as a leading market with significant growth potential. Europe follows closely, driven by advancements in construction regulations and sustainability initiatives. Asia Pacific shows rapid growth trends due to high urbanization rates.

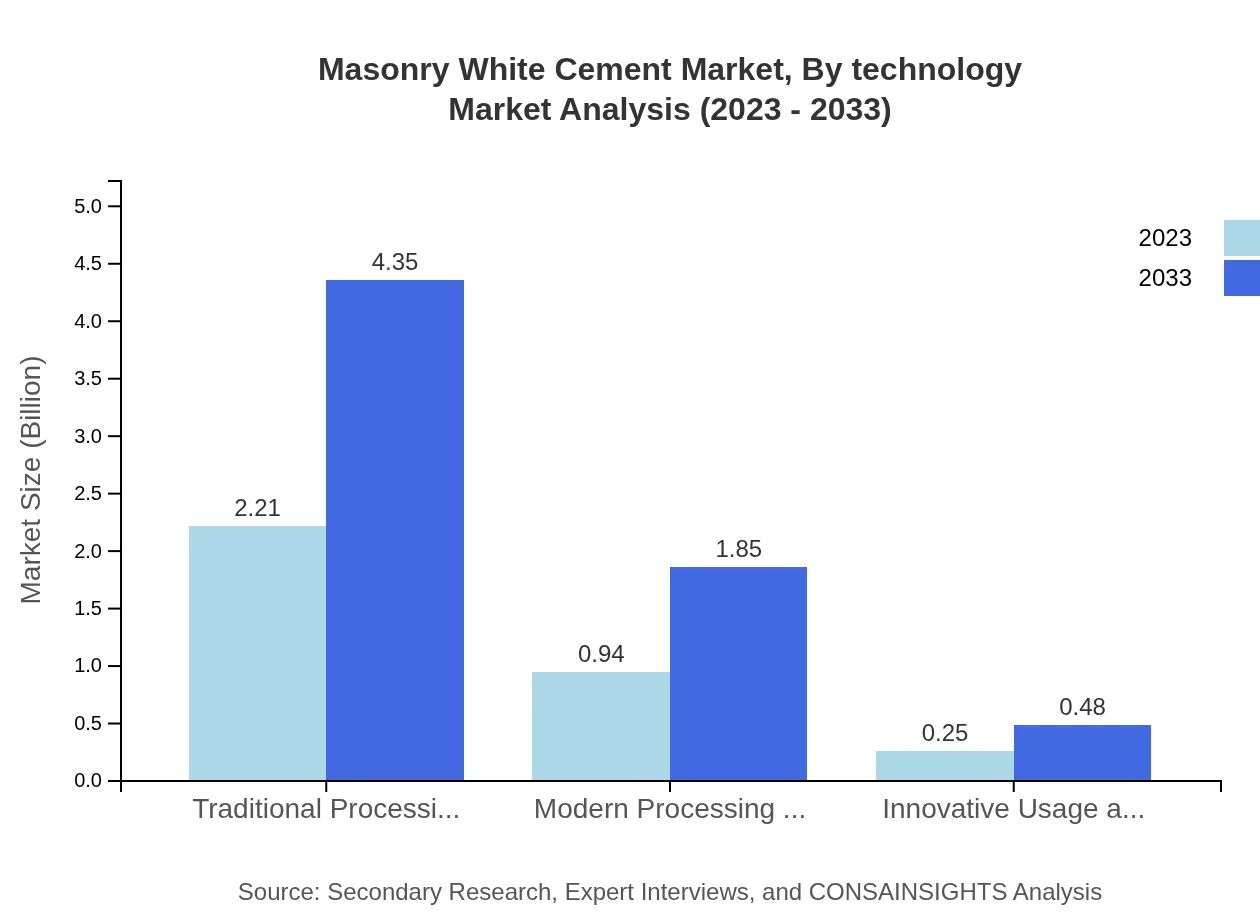

Masonry White Cement Market Analysis By Technology

The market is predominantly served by Traditional Processing Technology (65.05% share) but is seeing growth in Modern Processing Technology due to efficiency improvements. Innovations in application technology are also emerging, enhancing performance in specific projects.

Masonry White Cement Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Masonry White Cement Industry

LafargeHolcim:

A global leader in building materials, LafargeHolcim focuses on sustainable practices and innovative cement solutions.HeidelbergCement:

A key player in the global cement market, HeidelbergCement is known for its broad portfolio and commitment to sustainability initiatives.CEMEX:

CEMEX provides a wide range of construction materials, emphasizing sustainable practices and innovative products in the cement sector.Buzzi Unicem:

Buzzi Unicem specializes in cement and concrete products, focusing on quality and customizability to meet diverse client needs.We're grateful to work with incredible clients.

FAQs

What is the market size of masonry white cement?

As of 2023, the global masonry white cement market is valued at approximately $3.4 billion, with an expected Compound Annual Growth Rate (CAGR) of 6.8% projected through 2033, signifying robust growth in the sector.

What are the key market players or companies in this masonry white cement industry?

The masonry white cement industry is characterized by several key players, including notable manufacturers and distributors that collectively influence market trends, pricing, and distribution strategies across various geographic regions.

What are the primary factors driving the growth in the masonry white cement industry?

Key growth drivers include increasing demand for high-quality construction materials, urbanization trends leading to higher construction activities, and the introduction of innovative building technologies that utilize white cement.

Which region is the fastest Growing in the masonry white cement?

The fastest-growing region for masonry white cement is projected to be North America, with market growth soaring from $1.18 billion in 2023 to $2.32 billion by 2033, a testament to rising construction activities in the region.

Does ConsaInsights provide customized market report data for the masonry white cement industry?

Yes, ConsaInsights offers tailored market report data, catering to specific needs within the masonry white cement industry. Clients can request customized insights that reflect unique market conditions and trends.

What deliverables can I expect from this masonry white cement market research project?

Deliverables typically include detailed market analysis reports, segment breakdowns, competitive landscape assessments, regional insights, and forecasts that comprehensively cover anticipated market dynamics.

What are the market trends of masonry white cement?

Current trends showcase an increasing preference for environmentally sustainable building materials, innovations in white cement applications, and a growing focus on aesthetic architectural solutions that utilize masonry white cement.