Master Data Management Market Report

Published Date: 31 January 2026 | Report Code: master-data-management

Master Data Management Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Master Data Management (MDM) market, highlighting market trends, segments, and forecasts for 2023 to 2033. Insights include market size, regional dynamics, and key industry players.

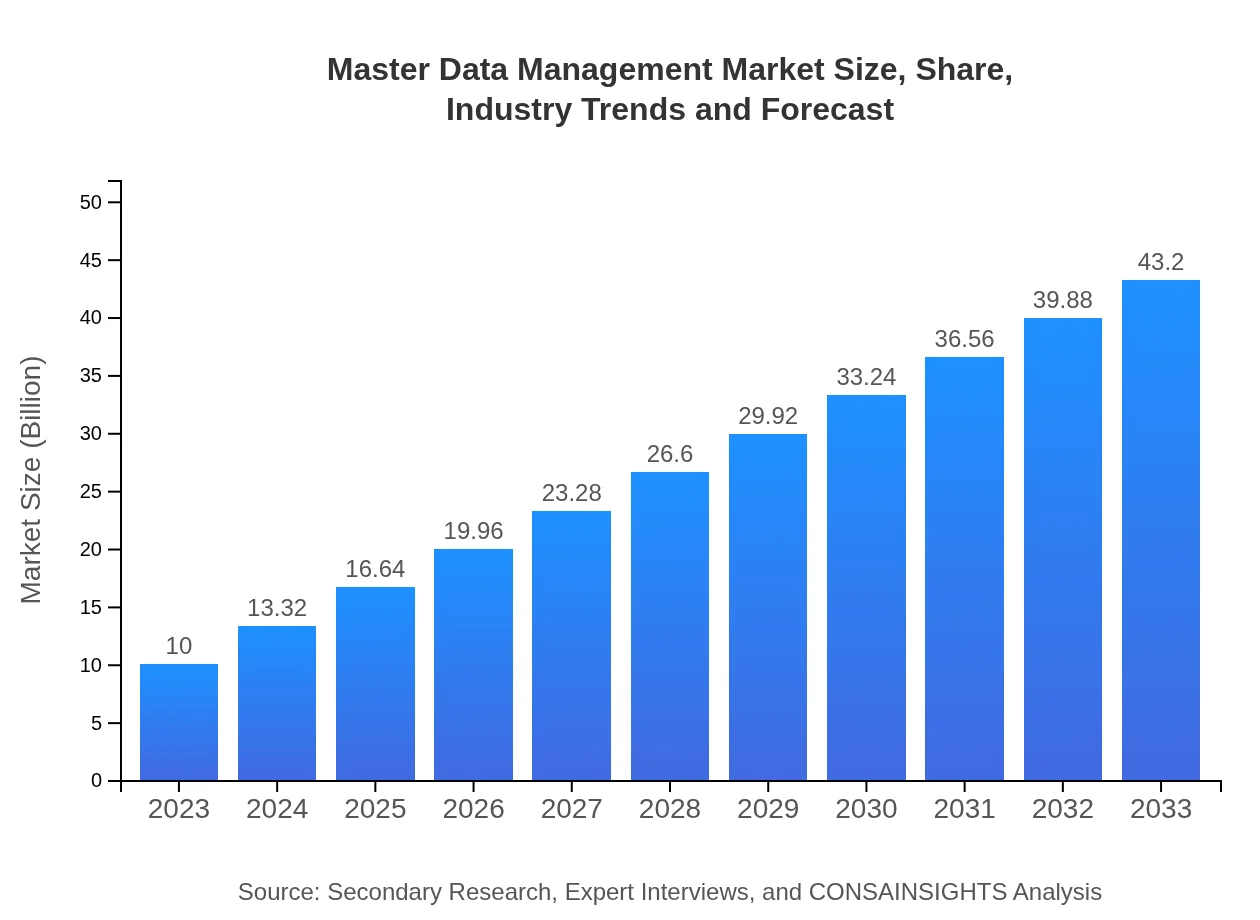

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $10.00 Billion |

| CAGR (2023-2033) | 15% |

| 2033 Market Size | $43.20 Billion |

| Top Companies | Informatica Corporation, SAP SE, IBM Corporation, Oracle Corporation, TIBCO Software Inc. |

| Last Modified Date | 31 January 2026 |

Master Data Management Market Overview

Customize Master Data Management Market Report market research report

- ✔ Get in-depth analysis of Master Data Management market size, growth, and forecasts.

- ✔ Understand Master Data Management's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Master Data Management

What is the Market Size & CAGR of Master Data Management market in 2023?

Master Data Management Industry Analysis

Master Data Management Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Master Data Management Market Analysis Report by Region

Europe Master Data Management Market Report:

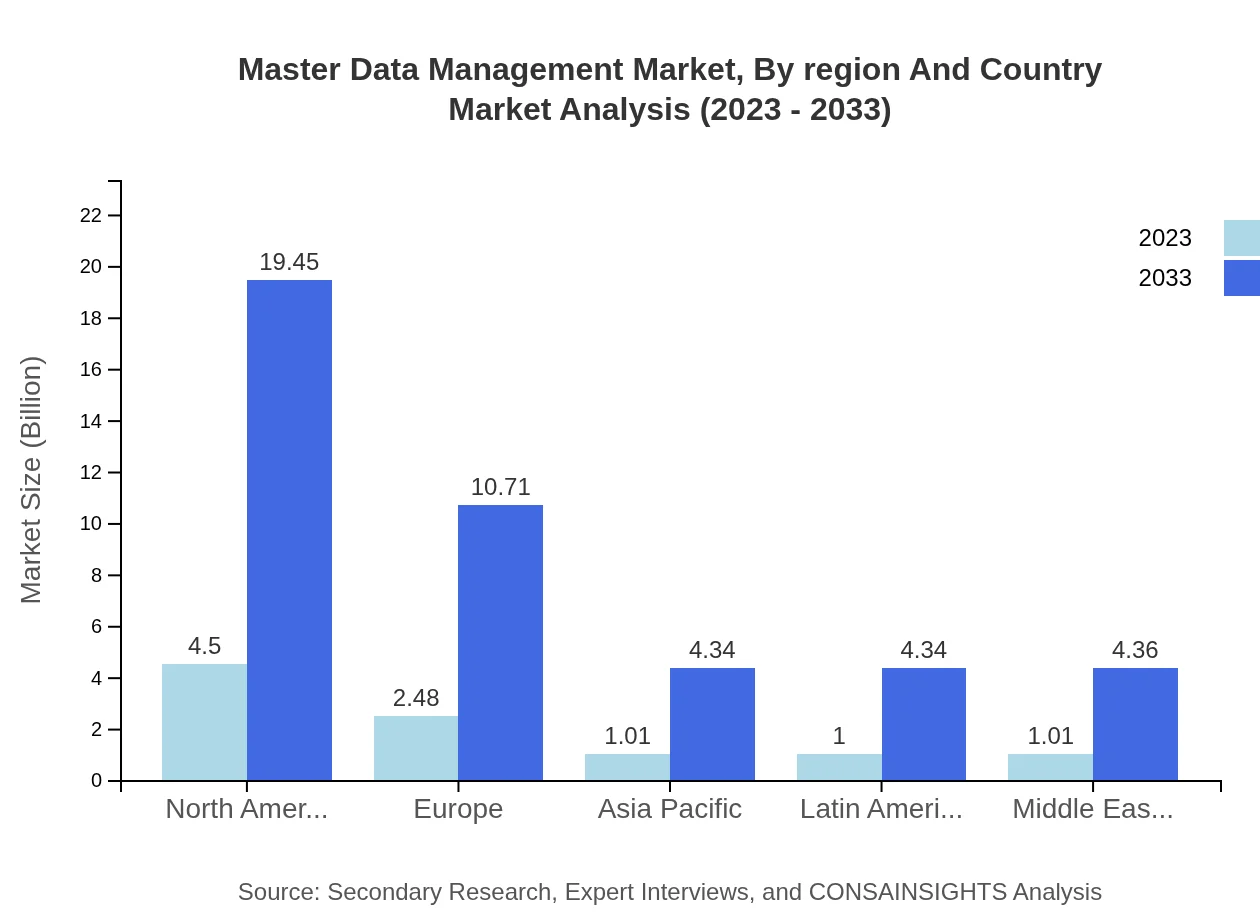

The European MDM market is projected at $2.95 billion in 2023 with an expected increase to $12.73 billion by 2033. Compliance with stringent data regulations and a focus on transparency in data management drives the demand for MDM solutions in this region.Asia Pacific Master Data Management Market Report:

In the Asia Pacific region, the Master Data Management market is valued at $1.97 billion in 2023, projected to grow to $8.50 billion by 2033. The region is witnessing rapid digital transformation and increasing investments in data management technologies among emerging economies.North America Master Data Management Market Report:

North America holds a significant share of the MDM market, valued at $3.37 billion in 2023 and projected to grow to $14.55 billion by 2033. The presence of key technology players and a strong focus on data-driven strategies bolster growth in this region.South America Master Data Management Market Report:

The South American Master Data Management market is estimated at $0.46 billion in 2023, with expectations to rise to $1.98 billion by 2033, driven mainly by the expanding adoption of cloud technologies and the need for improved data governance.Middle East & Africa Master Data Management Market Report:

The Middle East and Africa MDM market is valued at $1.26 billion in 2023, forecasted to rise to $5.44 billion by 2033. Factors such as the increasing digitalization of businesses and government initiatives promoting data management are key growth drivers.Tell us your focus area and get a customized research report.

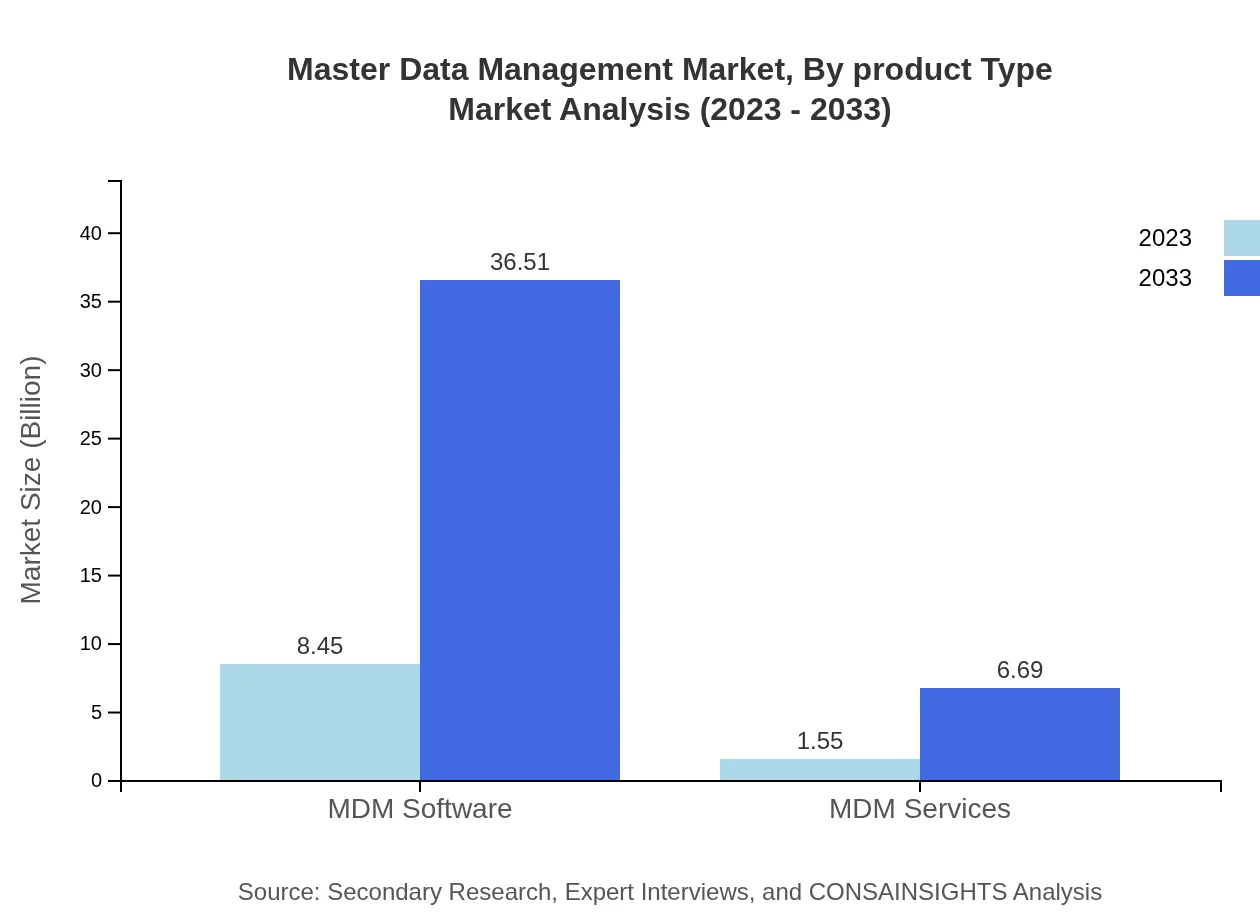

Master Data Management Market Analysis By Product Type

MDM software dominates the market segment, expected to grow from $8.45 billion in 2023 to $36.51 billion by 2033, representing a share of approximately 84.51% in the same year. MDM services are projected to grow from $1.55 billion to $6.69 billion, maintaining a share of 15.49%.

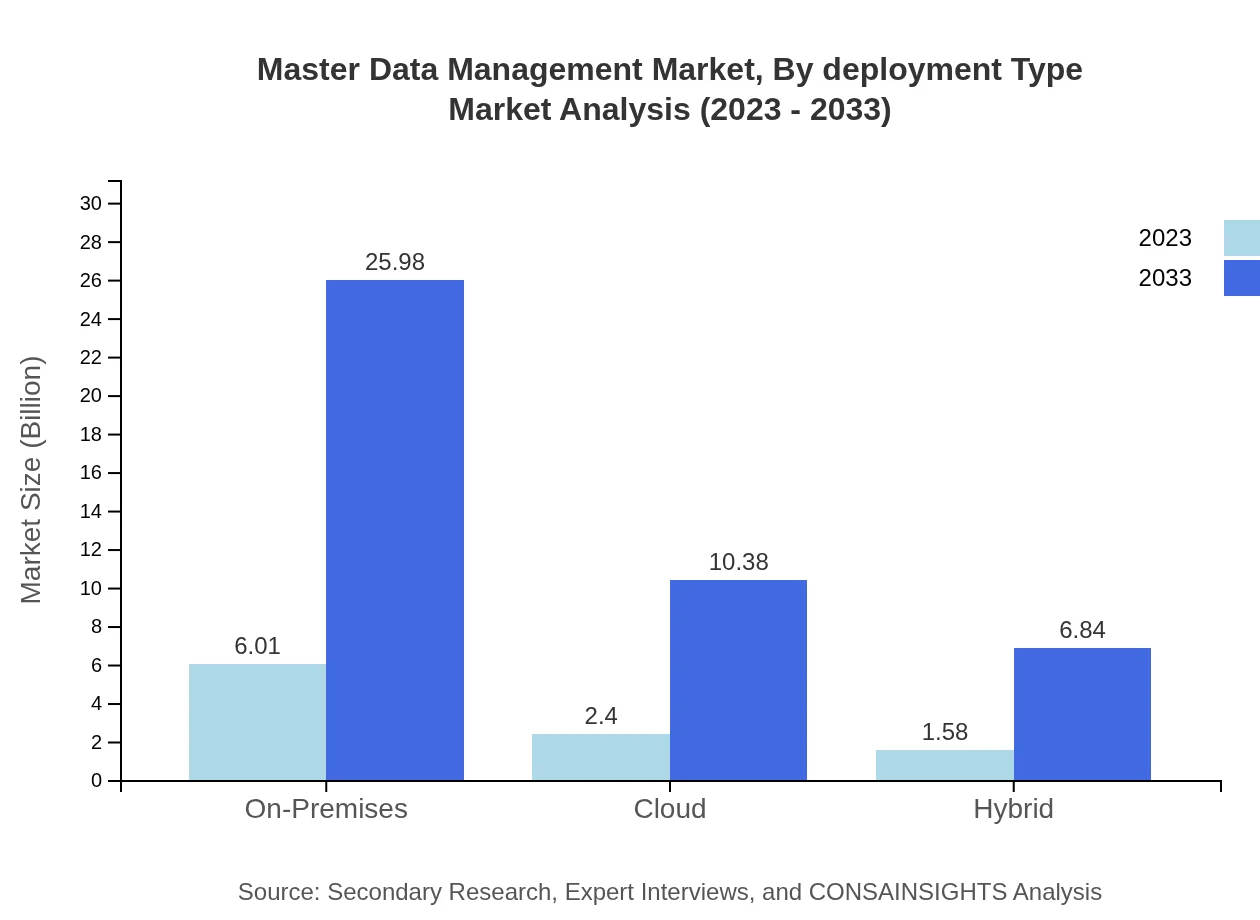

Master Data Management Market Analysis By Deployment Type

The on-premises segment will continue to lead, with a market size projected at $6.01 billion in 2023 and $25.98 billion by 2033, accounting for 60.14%. Cloud-based MDM solutions are on the rise, growing from $2.40 billion to $10.38 billion while hybrid deployments expand from $1.58 billion to $6.84 billion.

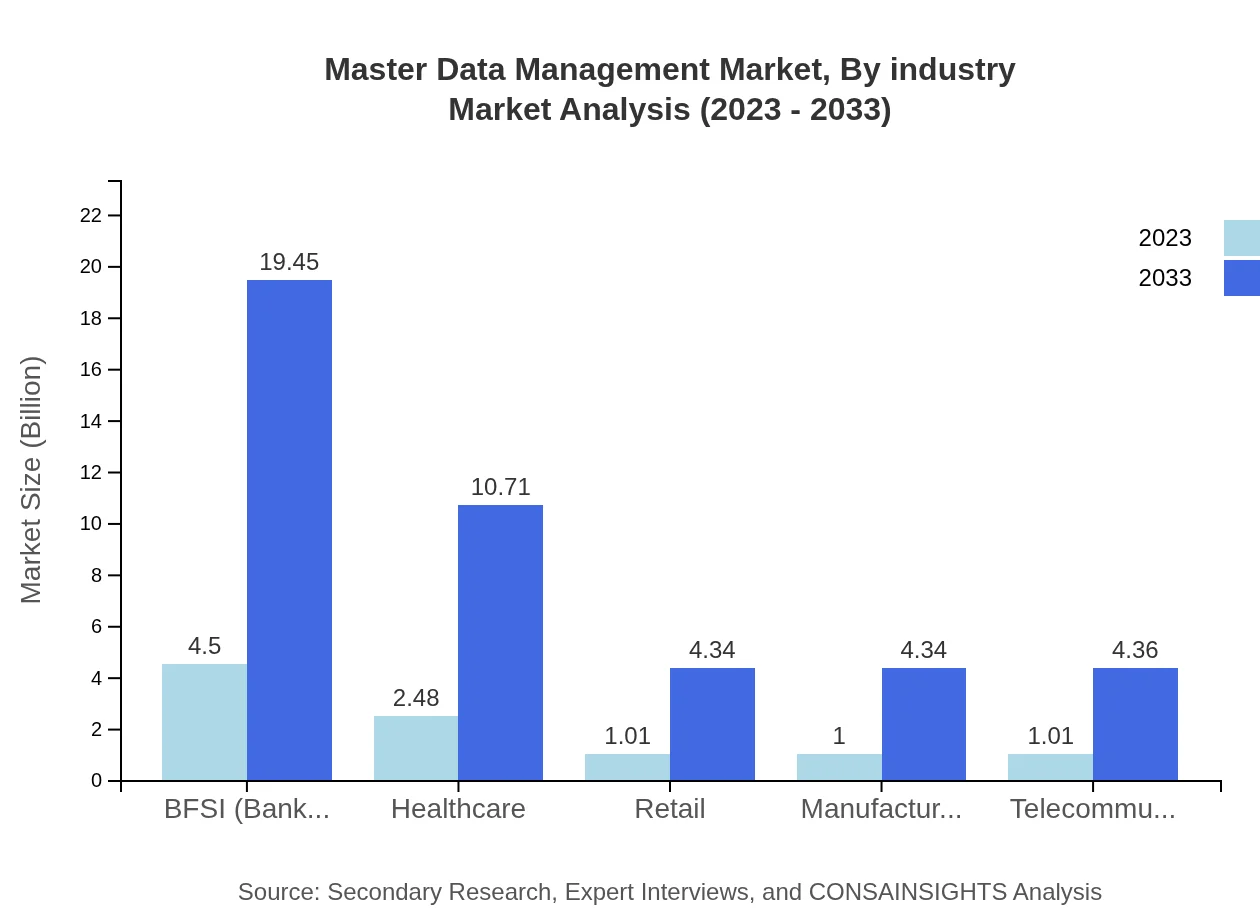

Master Data Management Market Analysis By Industry

The BFSI sector leads the MDM market, growing from $4.50 billion in 2023 to $19.45 billion in 2033, maintaining a significant market share. Healthcare is also significant, expanding from $2.48 billion to $10.71 billion during the same period. Retail, manufacturing, and telecommunications are vital contributors, characterizing their growth trajectories between 2023 and 2033.

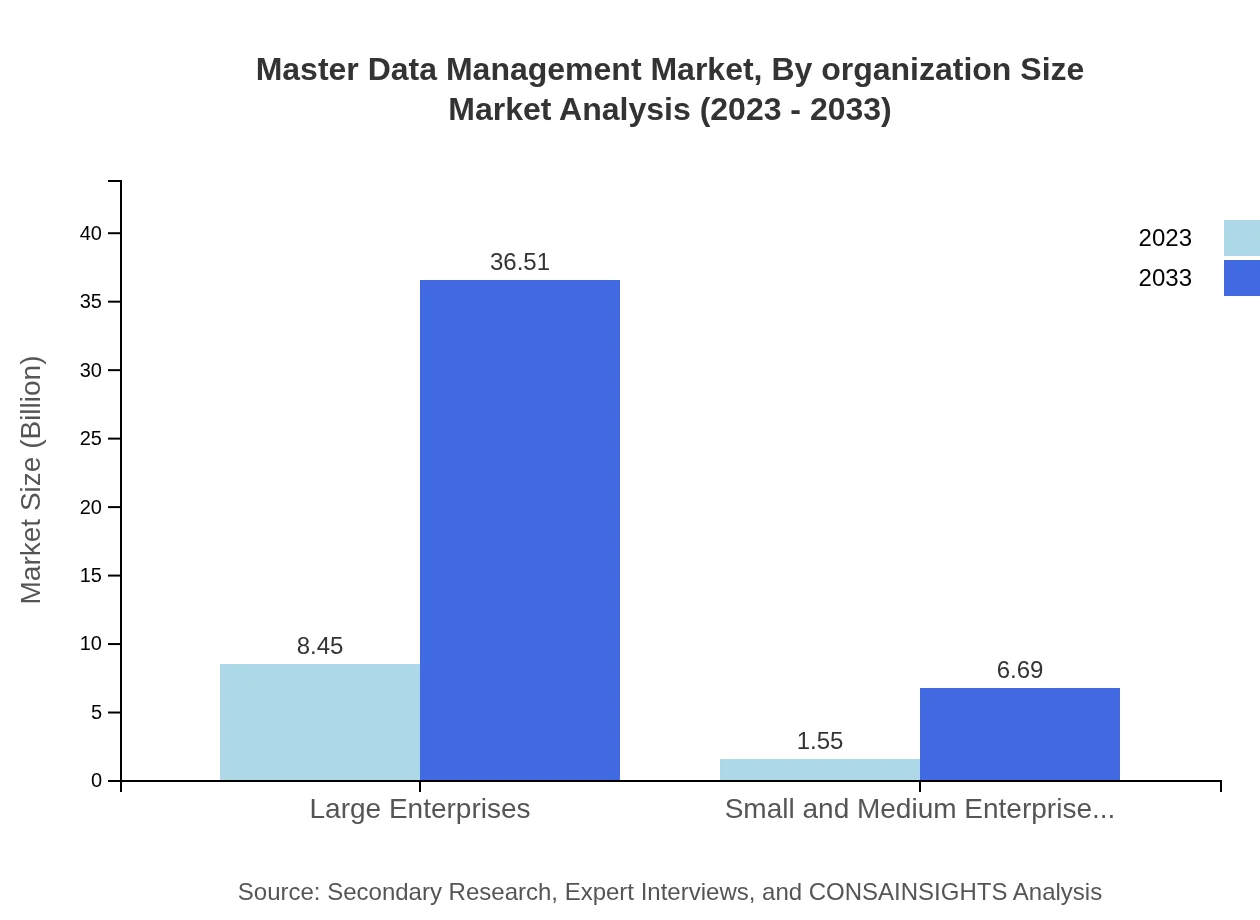

Master Data Management Market Analysis By Organization Size

Large enterprises dominate the MDM market, growing from $8.45 billion in 2023 to $36.51 billion by 2033, with a 84.51% share. SMEs are also vital, expanding from $1.55 billion to $6.69 billion, representing a crucial segment in developing streamlined MDM solutions.

Master Data Management Market Analysis By Region And Country

Regional analysis indicates North America as a leader, expected to grow significantly. Europe is following closely due to stringent regulatory demands, while the Asia Pacific region showcases enormous growth potential driven by its rapid modernization and digital strategies.

Master Data Management Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Master Data Management Industry

Informatica Corporation:

A leader in the data management space, Informatica offers comprehensive MDM solutions that empower organizations to manage data across various systems seamlessly.SAP SE:

SAP provides robust MDM solutions integrated with its enterprise resource planning systems, facilitating streamlined workflows and enhanced data visibility.IBM Corporation:

IBM's MDM solutions enable organizations to improve data governance while leveraging artificial intelligence for better data integration.Oracle Corporation:

Oracle offers extensive MDM services, focusing on cloud integration and data security to meet organizational data management needs.TIBCO Software Inc.:

TIBCO provides data integration and MDM solutions that support real-time data access and management across various platforms.We're grateful to work with incredible clients.

FAQs

What is the market size of master data management?

The master data management market is currently valued at approximately $10 billion, with a robust CAGR of 15%. This indicates strong growth potential, positioning the market for significant expansion by 2033.

What are the key market players or companies in this master data management industry?

Key players in the master data management sector include IBM, Informatica, Oracle, SAP, and SAS. These companies drive innovation and competition, offering diverse solutions to meet the growing demands of organizations worldwide.

What are the primary factors driving the growth in the master data management industry?

Key growth factors for the master data management industry include increasing data volumes, regulatory compliance demands, and the need for effective data governance. Additionally, businesses are seeking enhanced customer insights and operational efficiency.

Which region is the fastest Growing in the master data management?

The fastest-growing region in the master data management sector is North America, projected to grow from $4.5 billion in 2023 to $19.45 billion by 2033. This region holds a significant market share, reflecting its technological advancements.

Does ConsaInsights provide customized market report data for the master data management industry?

Yes, ConsaInsights offers customized market report data tailored to specific needs in the master data management industry. Clients can request insights specific to their requirements, enhancing decision-making capabilities.

What deliverables can I expect from this master data management market research project?

Deliverables from the master data management market research project typically include comprehensive reports, market forecasts, competitor analysis, and trend assessments. These insights support strategic planning and informed business decisions.

What are the market trends of master data management?

Current trends in master data management include increased adoption of cloud solutions, emphasis on data governance, and integration of AI technologies. Companies are also focusing on leveraging MDM for enhanced analytics and customer engagement.