Mcad Software Market Report

Published Date: 31 January 2026 | Report Code: mcad-software

Mcad Software Market Size, Share, Industry Trends and Forecast to 2033

This report analyzes the Mcad Software market, covering market size, growth forecasts, segmentation, regional insights, and industry trends from 2023 to 2033. It provides a comprehensive overview of key players and emerging technologies shaping the sector.

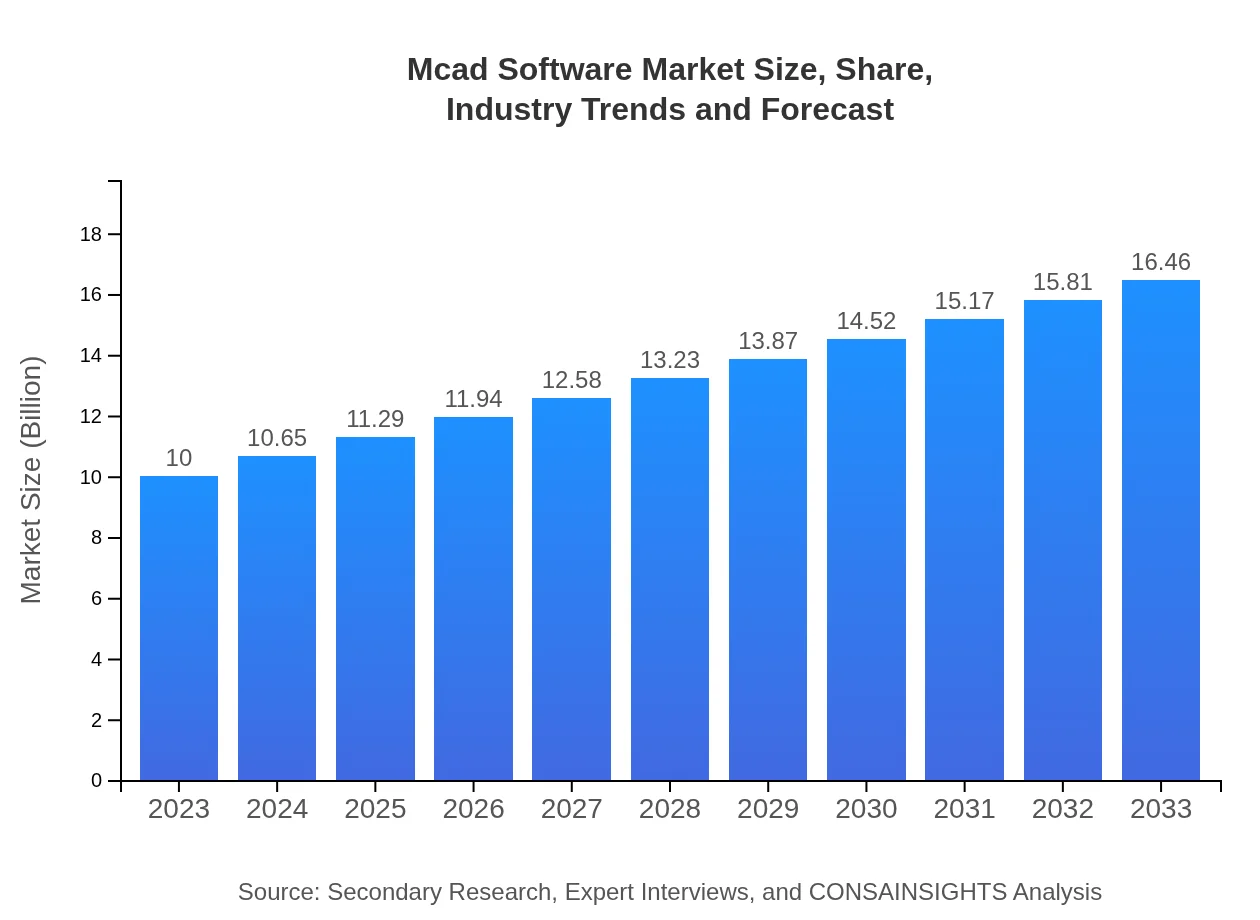

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $10.00 Billion |

| CAGR (2023-2033) | 5% |

| 2033 Market Size | $16.46 Billion |

| Top Companies | Autodesk , Siemens PLM Software, Dassault Systèmes, PTC |

| Last Modified Date | 31 January 2026 |

Mcad Software Market Overview

Customize Mcad Software Market Report market research report

- ✔ Get in-depth analysis of Mcad Software market size, growth, and forecasts.

- ✔ Understand Mcad Software's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Mcad Software

What is the Market Size & CAGR of Mcad Software market in 2023?

Mcad Software Industry Analysis

Mcad Software Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Mcad Software Market Analysis Report by Region

Europe Mcad Software Market Report:

In Europe, the market is anticipated to grow from $3.60 billion in 2023 to $5.92 billion by 2033. The region's focus on sustainability and innovation in design practices is propelling investments in streamlined MCAD tools, particularly in manufacturing hubs such as Germany and France.Asia Pacific Mcad Software Market Report:

In Asia Pacific, the MCAD Software market is expected to grow from $1.78 billion in 2023 to $2.93 billion by 2033. Rapid industrialization and increasing investments in infrastructure development are key factors driving the growth. Additionally, a rise in the manufacturing sector in countries like China and India increases the demand for effective design software solutions.North America Mcad Software Market Report:

The North American region, particularly the United States, remains a market leader with significant growth, projected to increase from $3.39 billion in 2023 to $5.57 billion by 2033. The concentration of major aerospace and automotive firms drives the demand for advanced MCAD solutions, along with a strong trend toward adopting cloud technologies.South America Mcad Software Market Report:

The South American market, although smaller, shows potential growth from $0.29 billion in 2023 to $0.48 billion by 2033. Countries such as Brazil are focusing on enhancing their manufacturing capabilities, leading to a gradual increase in MCAD Software adoption as firms modernize their design processes.Middle East & Africa Mcad Software Market Report:

The MCAD software market in the Middle East and Africa is set to grow from $0.95 billion in 2023 to $1.56 billion by 2033. Ongoing construction projects and an emphasis on smart cities in the region are spurring demand for robust design software to facilitate architectural and engineering processes.Tell us your focus area and get a customized research report.

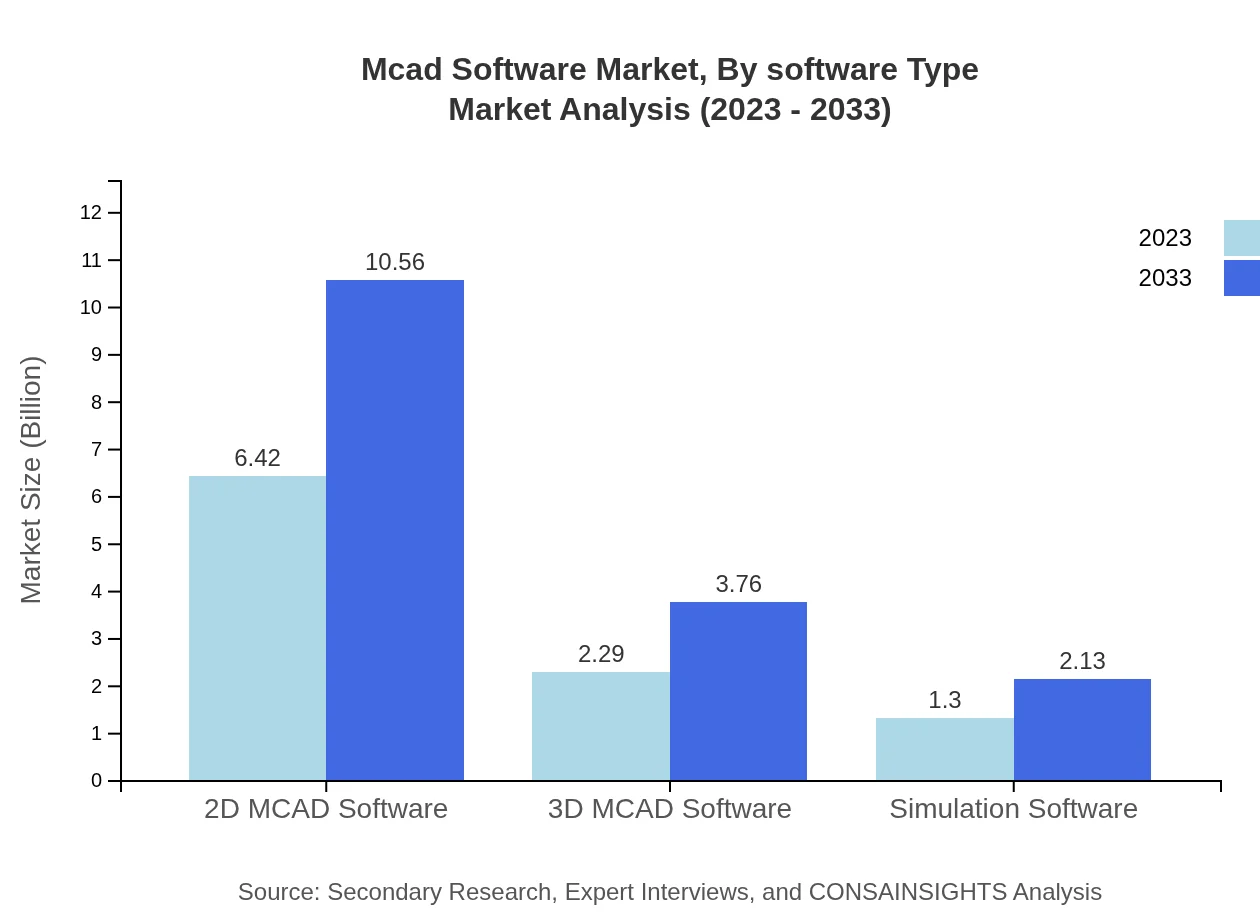

Mcad Software Market Analysis By Software Type

The MCAD software market is segmented into 2D MCAD Software, 3D MCAD Software, and Simulation Software. In 2023, the size of 2D MCAD Software is estimated at $6.42 billion, expected to grow to $10.56 billion by 2033. The 3D MCAD Software segment, currently valued at $2.29 billion, is forecasted to reach $3.76 billion by 2033. Simulation Software, with a current size of $1.30 billion, is projected to grow to $2.13 billion by 2033, reflecting a rising emphasis on accurate simulations in design workflows.

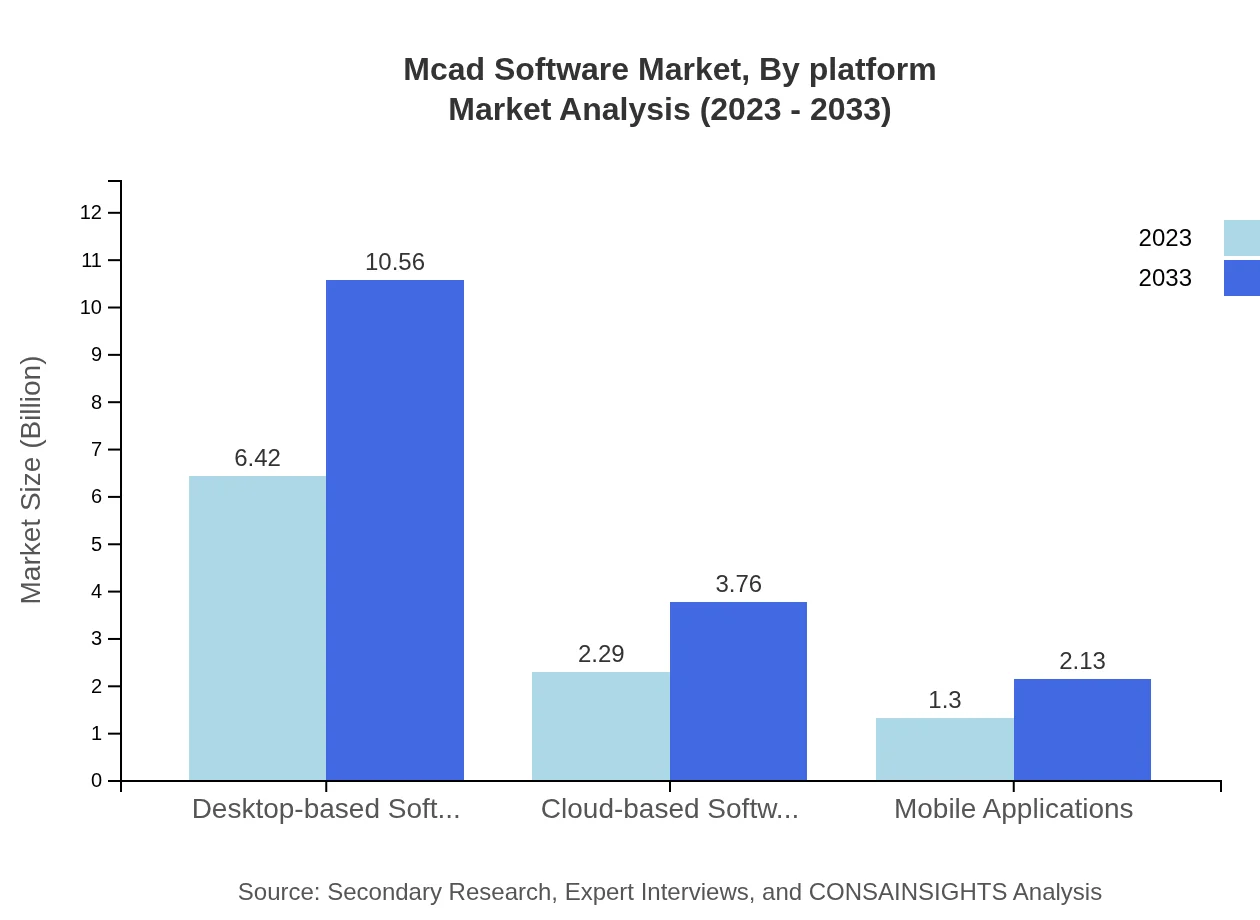

Mcad Software Market Analysis By Platform

The MCAD Software market can be segmented by platform into desktop-based, cloud-based, and mobile applications. Desktop-based Software currently holds a significant market share at 64.17% in 2023, with a projected growth in size from $6.42 billion to $10.56 billion by 2033. Cloud-based Software, with a market size of $2.29 billion in 2023, is set to grow rapidly, reflecting ongoing shifts towards collaborative tools in design processes. Mobile applications, while a smaller segment at $1.30 billion, also show promise with a growth forecast to $2.13 billion by 2033.

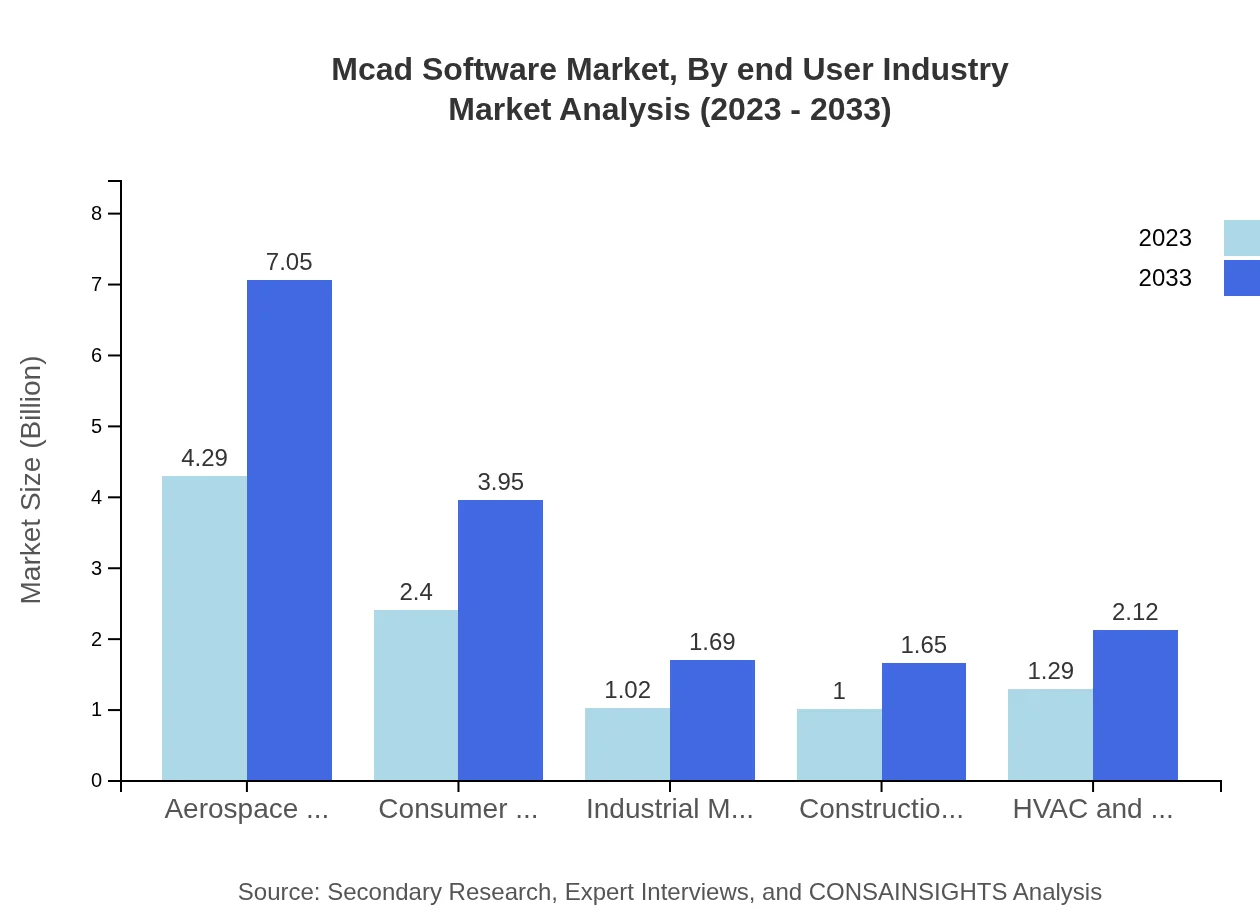

Mcad Software Market Analysis By End User Industry

In terms of end-user industries, the aerospace and automotive sectors dominate the MCAD software landscape, showcasing a significant market size of $4.29 billion in 2023, expected to reach $7.05 billion by 2033. Other sectors like consumer electronics and industrial manufacturing also contribute notably, growing from $2.40 billion to $3.95 billion and $1.02 billion to $1.69 billion, respectively. Additionally, construction and engineering represent a key segment, forecasted to expand from $1.00 billion to $1.65 billion by 2033, driven by rising infrastructure development.

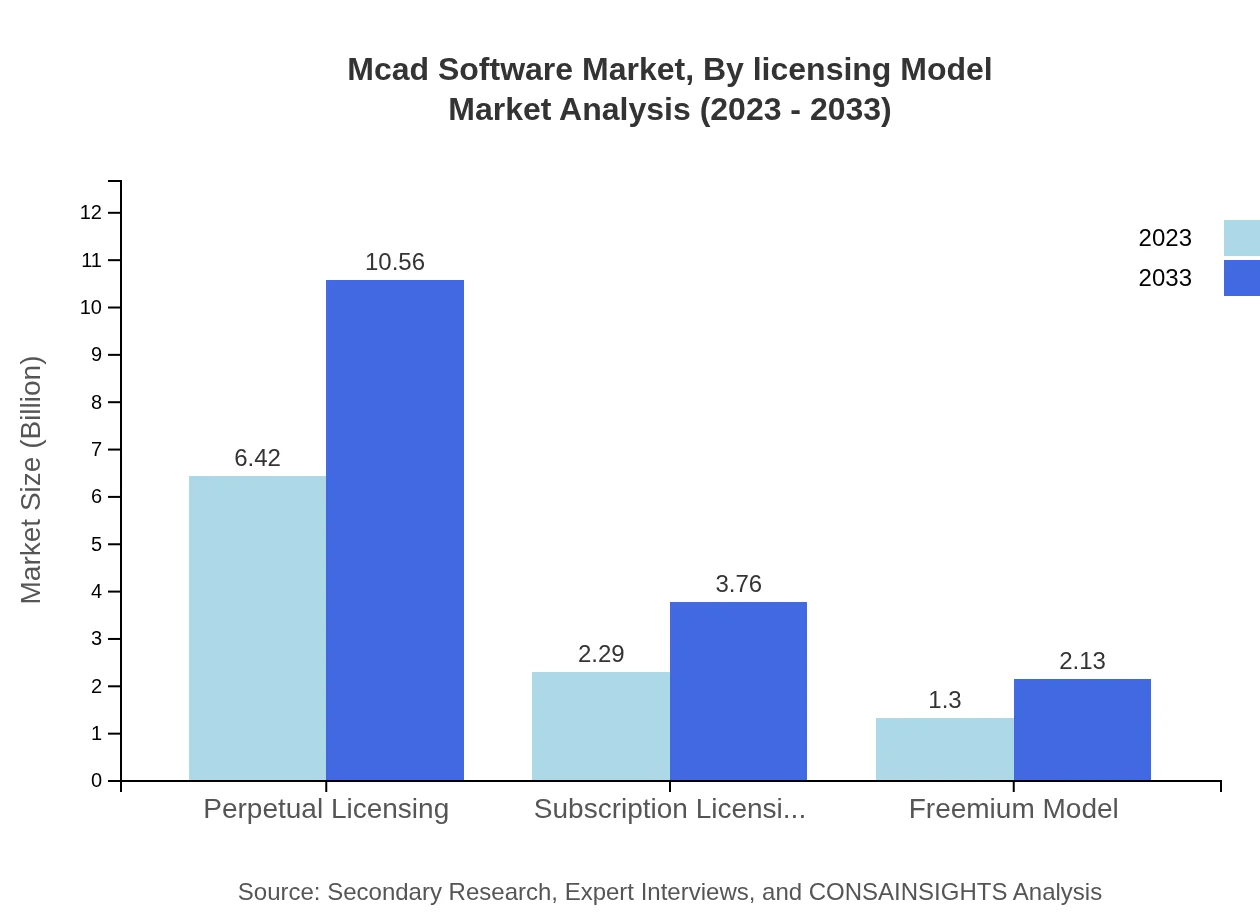

Mcad Software Market Analysis By Licensing Model

The licensing model for MCAD software is categorized into perpetual licensing, subscription licensing, and freemium model. Perpetual licensing remains the largest segment with a market size of $6.42 billion in 2023, expected to grow to $10.56 billion by 2033. Subscription licensing, currently at $2.29 billion, is experiencing increasing popularity rooted in flexibility and cost-effectiveness, predicted to grow to $3.76 billion. The freemium model is also emerging, expected to rise from $1.30 billion to $2.13 billion, appealing to users seeking cost-efficient entry points into MCAD solutions.

Mcad Software Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Mcad Software Industry

Autodesk :

A leading provider of 3D design, engineering, and entertainment software, Autodesk offers a comprehensive suite of MCAD solutions that facilitate efficient product design and development.Siemens PLM Software:

Siemens PLM Software is known for its extensive MCAD and Product Lifecycle Management solutions, enabling manufacturers to improve product quality and innovation across various sectors.Dassault Systèmes:

With a strong platform for 3D design, Dassault Systèmes offers MCAD software that integrates across multiple domains, enhancing collaboration and product development efficiency.PTC:

PTC provides MCAD software solutions focused on innovative product design, featuring capabilities in augmented reality and Internet of Things (IoT) integration.We're grateful to work with incredible clients.

FAQs

What is the market size of MCAD software?

The MCAD software market is currently valued at approximately $10 billion. It exhibits a consistent growth trajectory, with a projected CAGR of 5% from 2023 to 2033. This growth underscores the increasing reliance on MCAD solutions across various sectors.

What are the key market players or companies in this MCAD software industry?

Key players in the MCAD software industry include established companies such as Autodesk, Dassault Systèmes, PTC, Siemens, and ANSYS. These companies are crucial in enhancing software capabilities and driving innovation in the MCAD sector.

What are the primary factors driving the growth in the MCAD software industry?

The MCAD software industry is driven by technological advancements, increased automation, and a rising demand for precise modeling in manufacturing and engineering. Additionally, the growth of the aerospace, automotive, and construction sectors significantly contributes.

Which region is the fastest Growing in the MCAD software market?

The Asia Pacific region is currently the fastest-growing market for MCAD software. Growth in this region is bolstered by expanding manufacturing sectors and technological advancements, with market size projected to grow from $1.78 billion in 2023 to $2.93 billion by 2033.

Does ConsaInsights provide customized market report data for the MCAD software industry?

Yes, ConsaInsights offers tailored market report data specifically for the MCAD software industry. Our custom reports can provide insights tailored to your strategic planning and market analysis needs.

What deliverables can I expect from this MCAD software market research project?

From the MCAD software market research project, you can expect detailed reports summarizing market size, growth projections, competitive landscape, and segment analysis, along with data in graphical formats for better visualization.

What are the market trends of MCAD software?

Current trends in the MCAD software market include a shift towards cloud-based solutions for increased accessibility and collaboration, adoption of subscription models, and integration of AI and machine learning for enhanced design capabilities.