Medical Engineered Materials Market Report

Published Date: 22 January 2026 | Report Code: medical-engineered-materials

Medical Engineered Materials Market Size, Share, Industry Trends and Forecast to 2033

This report provides an in-depth analysis of the Medical Engineered Materials market, covering market sizes, trends, and forecasts from 2023 to 2033. It offers valuable insights into market segmentation, regional developments, and key players in the industry.

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

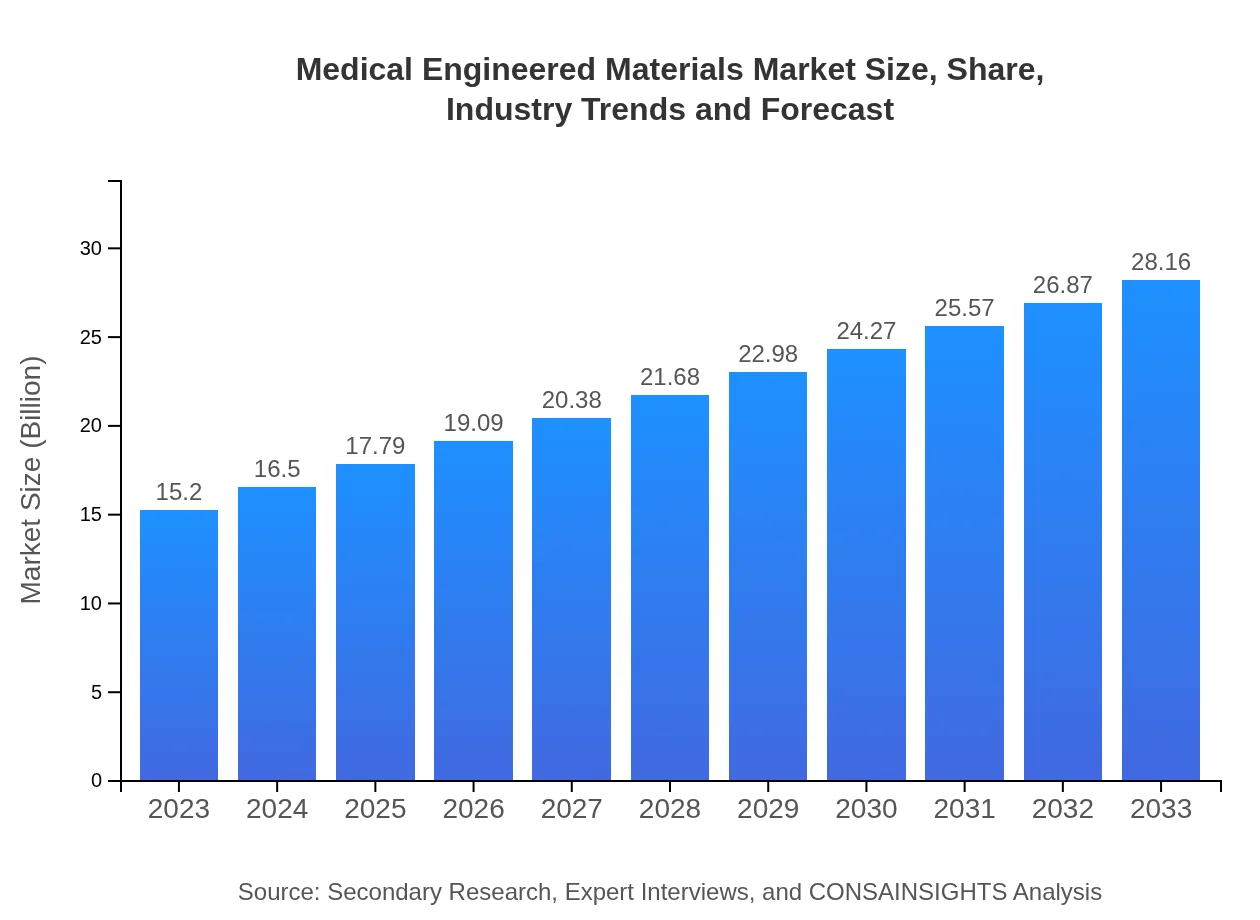

| 2023 Market Size | $15.20 Billion |

| CAGR (2023-2033) | 6.2% |

| 2033 Market Size | $28.16 Billion |

| Top Companies | Rogers Corporation, Medtronic , Bishop-Wisecarver, Covestro AG |

| Last Modified Date | 22 January 2026 |

Medical Engineered Materials Market Overview

Customize Medical Engineered Materials Market Report market research report

- ✔ Get in-depth analysis of Medical Engineered Materials market size, growth, and forecasts.

- ✔ Understand Medical Engineered Materials's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Medical Engineered Materials

What is the Market Size & CAGR of the Medical Engineered Materials market in 2023?

Medical Engineered Materials Industry Analysis

Medical Engineered Materials Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Medical Engineered Materials Market Analysis Report by Region

Europe Medical Engineered Materials Market Report:

The European Medical Engineered Materials market is forecasted to expand from $4.97 billion in 2023 to $9.20 billion by 2033, driven by advancements in material science and a strong emphasis on the development of minimally invasive surgeries.Asia Pacific Medical Engineered Materials Market Report:

The Asia-Pacific region is experiencing rapid growth in the Medical Engineered Materials market, anticipated to reach $4.98 billion by 2033, up from $2.69 billion in 2023. The growth is driven by rising healthcare expenditure, an increasing aging population, and expanding medical device manufacturing capabilities in countries such as China and India.North America Medical Engineered Materials Market Report:

North America holds a significant share of the Medical Engineered Materials market, projected to grow from $5.60 billion in 2023 to $10.38 billion by 2033. This growth is bolstered by stringent healthcare regulations, advanced research in biomaterials, and high investments in healthcare technologies.South America Medical Engineered Materials Market Report:

In South America, the market for Medical Engineered Materials is expected to grow from $0.31 billion in 2023 to $0.57 billion by 2033. Factors influencing market growth include an increasing focus on improving healthcare infrastructure and the growing demand for advanced medical treatments.Middle East & Africa Medical Engineered Materials Market Report:

The Middle East and Africa's market for Medical Engineered Materials is poised for growth, expected to reach $3.02 billion by 2033 from $1.63 billion in 2023. Increased healthcare investments and a rise in lifestyle-related diseases are key factors driving this market.Tell us your focus area and get a customized research report.

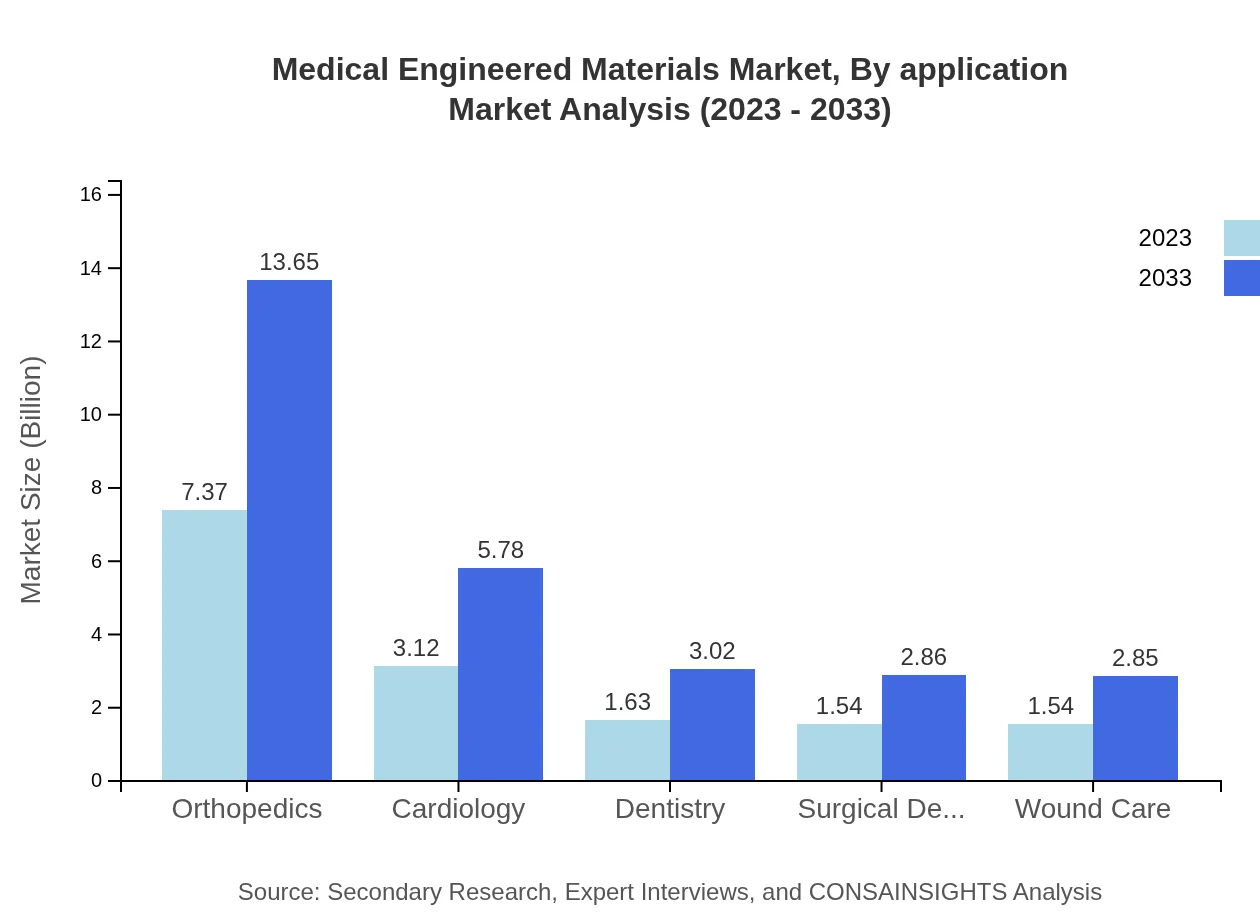

Medical Engineered Materials Market Analysis By Application

The application segment of the Medical Engineered Materials market reflects the diverse uses in healthcare. Key applications include: - Hospitals: $8.37 billion in 2023, expanding to $15.51 billion by 2033. Hospitals represent 55.09% of the market share as they utilize medical engineered materials extensively in surgeries, diagnostics, and patient care. - Clinics: Expected to grow from $3.13 billion in 2023 to $5.80 billion in 2033, holding a 20.59% market share. - Home Care: Projected to increase from $1.57 billion to $2.90 billion, representing a 10.31% share. - Research Institutions: Anticipated growth from $2.13 billion to $3.95 billion with a share of 14.01%. Regions and end-use categories illustrate the wide footprint of engineered materials within various healthcare settings.

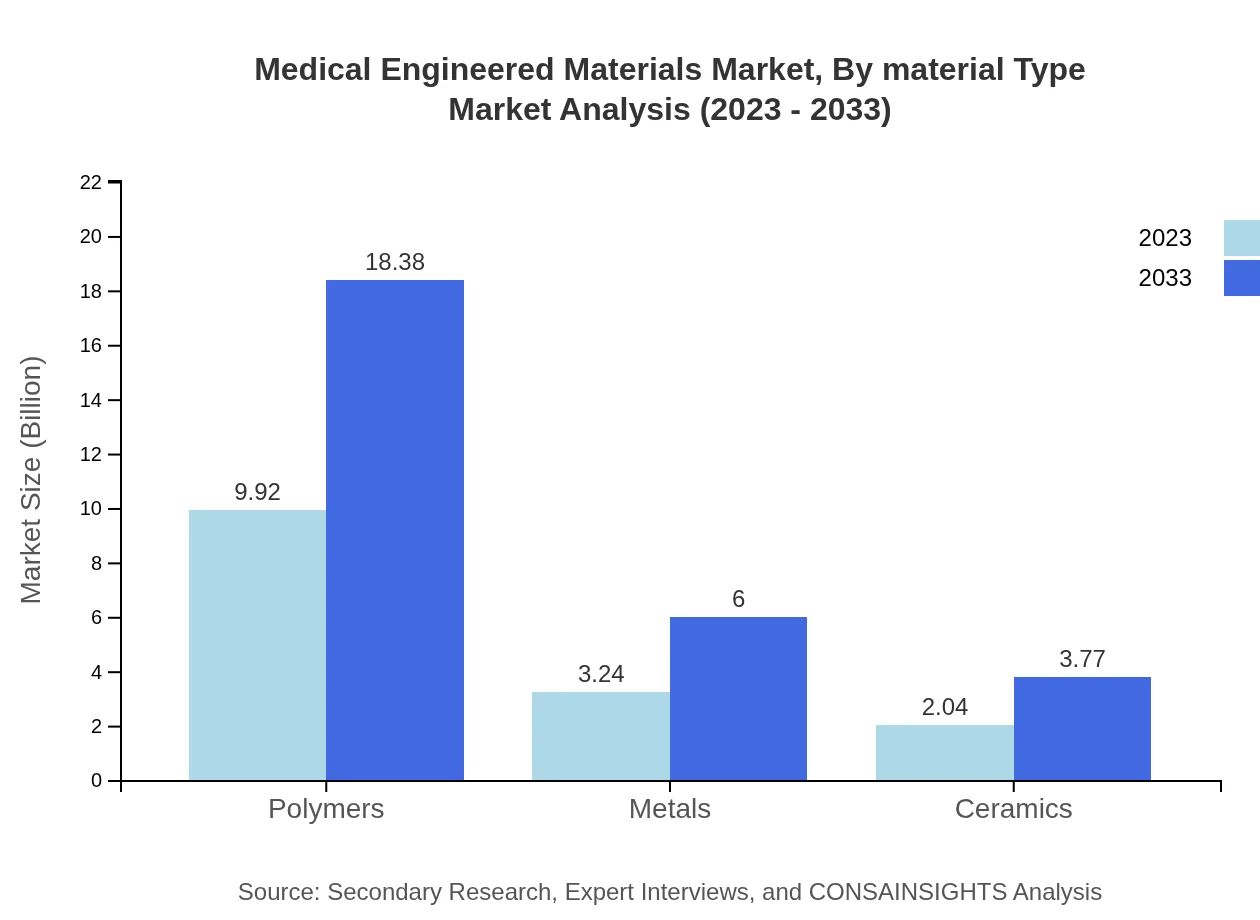

Medical Engineered Materials Market Analysis By Material Type

The market is broadly segmented by material types: - Polymers: Expected to grow from $9.92 billion in 2023 to $18.38 billion by 2033, dominating with a 65.28% market share as they are widely used in various medical devices. - Metals: Forecasted to increase from $3.24 billion to $6.00 billion, holding a 21.32% share, essential for implants and surgical components. - Ceramics: Market growth from $2.04 billion to $3.77 billion, capturing 13.40% market share, primarily used in dental and orthopedic applications.

Medical Engineered Materials Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Medical Engineered Materials Industry

Rogers Corporation:

A leading manufacturer of advanced materials and engineered products used in medical applications, known for innovation in polymer technology.Medtronic :

A global leader in medical technology, services, and solutions, Medtronic develops devices that incorporate engineered materials for various therapeutic areas.Bishop-Wisecarver:

Specializing in linear motion products, this company also focuses on providing engineered materials suited for medical applications.Covestro AG:

A leading manufacturer of high-performance polymers, Covestro produces materials used across diverse medical applications.We're grateful to work with incredible clients.

FAQs

What is the market size of medical Engineered Materials?

The medical-engineered-materials market is valued at approximately $15.2 billion as of 2023, with a projected CAGR of 6.2% through 2033, indicating robust growth in various applications within the healthcare sector.

What are the key market players or companies in this medical Engineered Materials industry?

Key players in the medical-engineered materials market include well-established companies that specialize in medical devices, polymers, and advanced materials. They are pivotal in innovation and supply chain efficiency, wielding significant influence on market dynamics.

What are the primary factors driving the growth in the medical Engineered Materials industry?

Growth in the medical-engineered materials industry is driven by technological advancements, rising healthcare expenditures, increasing demand for personalized medicine, and the need for safer and more effective medical devices and materials.

Which region is the fastest Growing in the medical Engineered Materials?

North America currently leads the market for medical-engineered materials, projected to grow from $5.60 billion in 2023 to $10.38 billion by 2033, reflecting a strong healthcare infrastructure and innovation investment.

Does ConsaInsights provide customized market report data for the medical Engineered Materials industry?

Yes, ConsaInsights offers tailored market report data for the medical-engineered materials industry, allowing clients to receive insights specific to their needs, objectives, and market segments.

What deliverables can I expect from this medical Engineered Materials market research project?

Deliverables from the medical-engineered materials market research project include comprehensive reports, market forecasts, competitive analysis, and segmented data, ensuring actionable insights for stakeholders.

What are the market trends of medical Engineered Materials?

Current trends in the medical-engineered materials market include a shift towards biodegradable materials, increased integration of digital technologies, and enhanced focus on sustainability to meet evolving healthcare demands.