Medical Refrigerators Market Report

Published Date: 22 January 2026 | Report Code: medical-refrigerators

Medical Refrigerators Market Size, Share, Industry Trends and Forecast to 2033

This report analyzes the Medical Refrigerators market, providing insights into its size, growth, trends, and forecasts from 2023 to 2033. It covers market dynamics, segmentation, regional analyses, and profiles of key players.

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

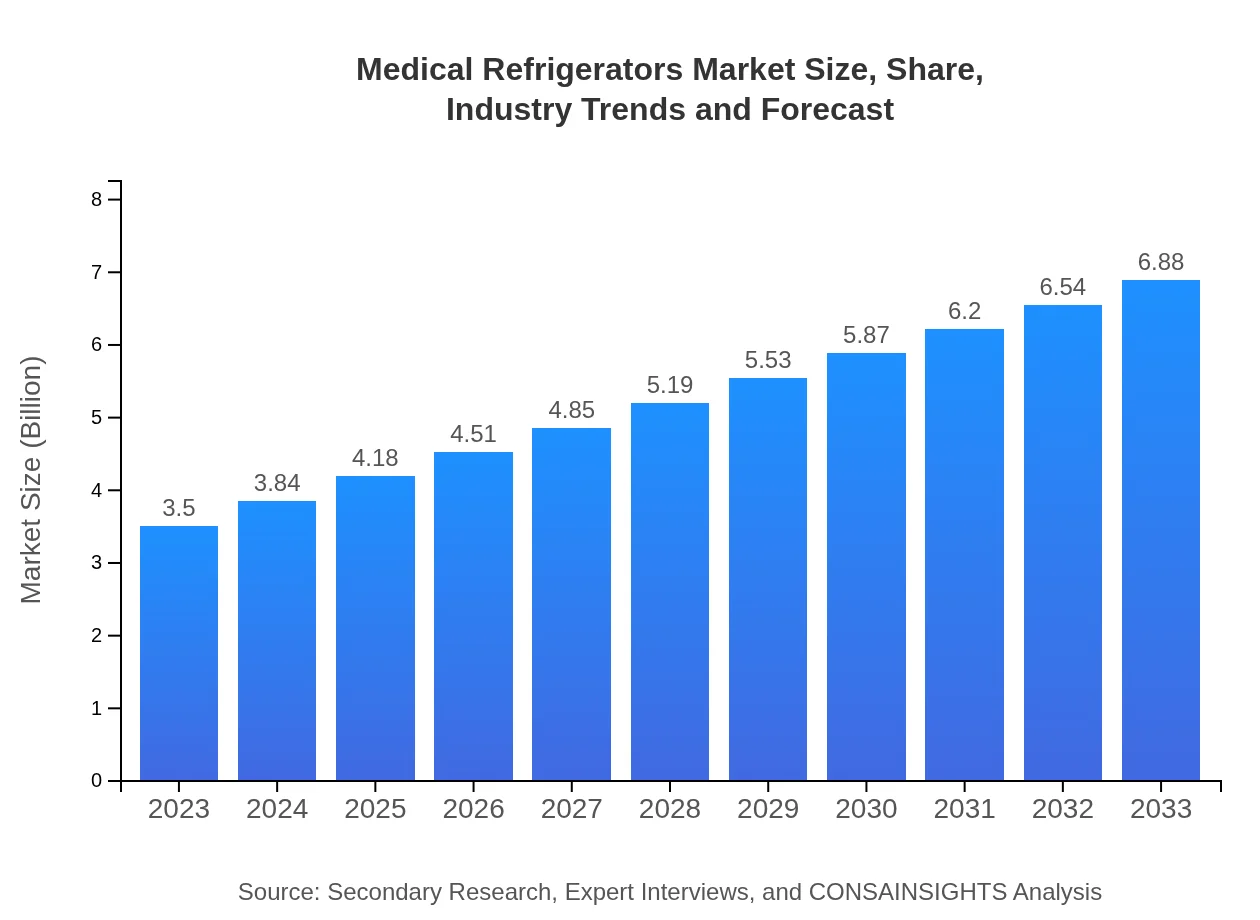

| 2023 Market Size | $3.50 Billion |

| CAGR (2023-2033) | 6.8% |

| 2033 Market Size | $6.88 Billion |

| Top Companies | Thermo Fisher Scientific, Haier Biomedical, Aqua Scientist, Panasonic Healthcare, Philips Medical Systems |

| Last Modified Date | 22 January 2026 |

Medical Refrigerators Market Overview

Customize Medical Refrigerators Market Report market research report

- ✔ Get in-depth analysis of Medical Refrigerators market size, growth, and forecasts.

- ✔ Understand Medical Refrigerators's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Medical Refrigerators

What is the Market Size & CAGR of Medical Refrigerators market in 2023?

Medical Refrigerators Industry Analysis

Medical Refrigerators Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Medical Refrigerators Market Analysis Report by Region

Europe Medical Refrigerators Market Report:

Europe's Medical Refrigerators market is expanding, projected to increase from $1.07 billion in 2023 to $2.11 billion by 2033, due to heightened regulatory standards and a growing emphasis on pharmaceutical advancements.Asia Pacific Medical Refrigerators Market Report:

The Asia Pacific region is poised for substantial growth, with the market size projected to grow from $0.64 billion in 2023 to $1.27 billion by 2033, driven by increasing healthcare investments and urbanization.North America Medical Refrigerators Market Report:

North America is the leading region, with a market forecast to grow from $1.27 billion in 2023 to $2.50 billion by 2033, fueled by advanced healthcare infrastructures and a high demand for innovative refrigeration technologies.South America Medical Refrigerators Market Report:

In South America, the market reflects a gradual increase from $0.18 billion in 2023 to $0.36 billion by 2033, supported by rising healthcare needs and government initiatives to improve medical infrastructure.Middle East & Africa Medical Refrigerators Market Report:

In the Middle East and Africa, the market is expected to rise from $0.33 billion in 2023 to $0.65 billion by 2033, driven by improving healthcare facilities and increasing awareness about medical storage requirements.Tell us your focus area and get a customized research report.

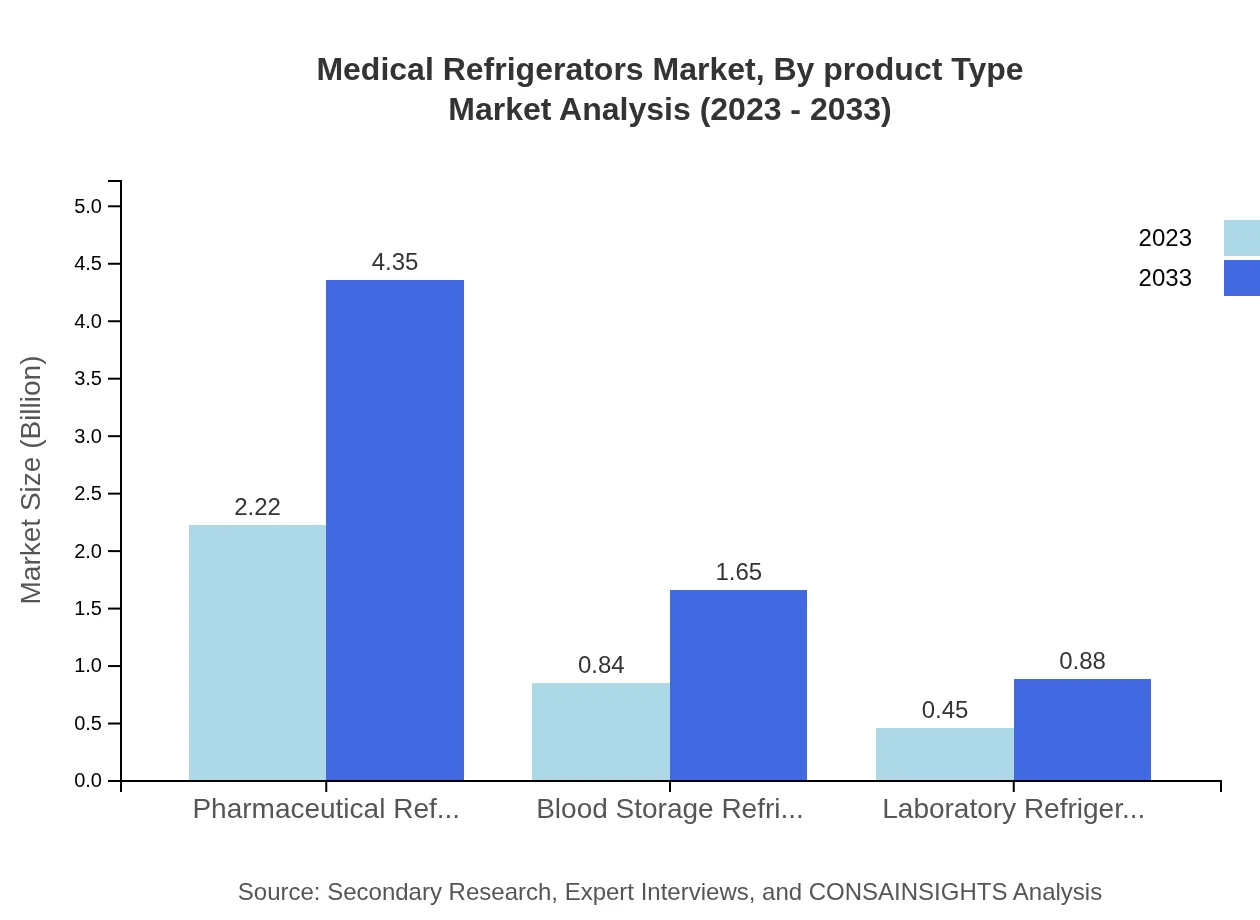

Medical Refrigerators Market Analysis By Product Type

The product type segmentation reveals that pharmaceutical refrigerators are anticipated to dominate the market from $2.22 billion in 2023 to $4.35 billion in 2033, accounting for 63.29% share throughout the forecast period.

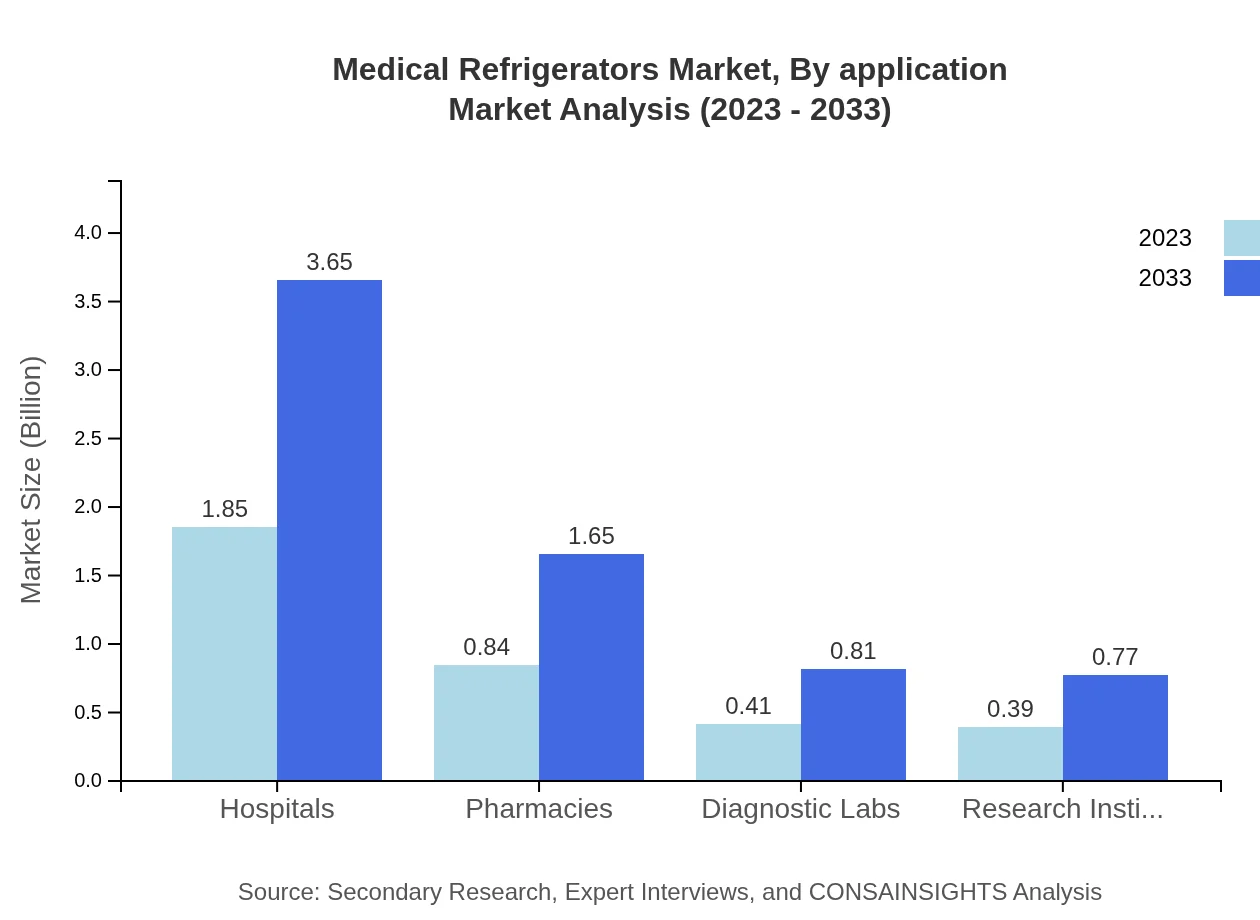

Medical Refrigerators Market Analysis By Application

In terms of application, hospitals emerge as the leading segment, expected to grow from $1.85 billion in 2023 to $3.65 billion by 2033, capturing a significant 53% market share due to the increasing number of healthcare facilities.

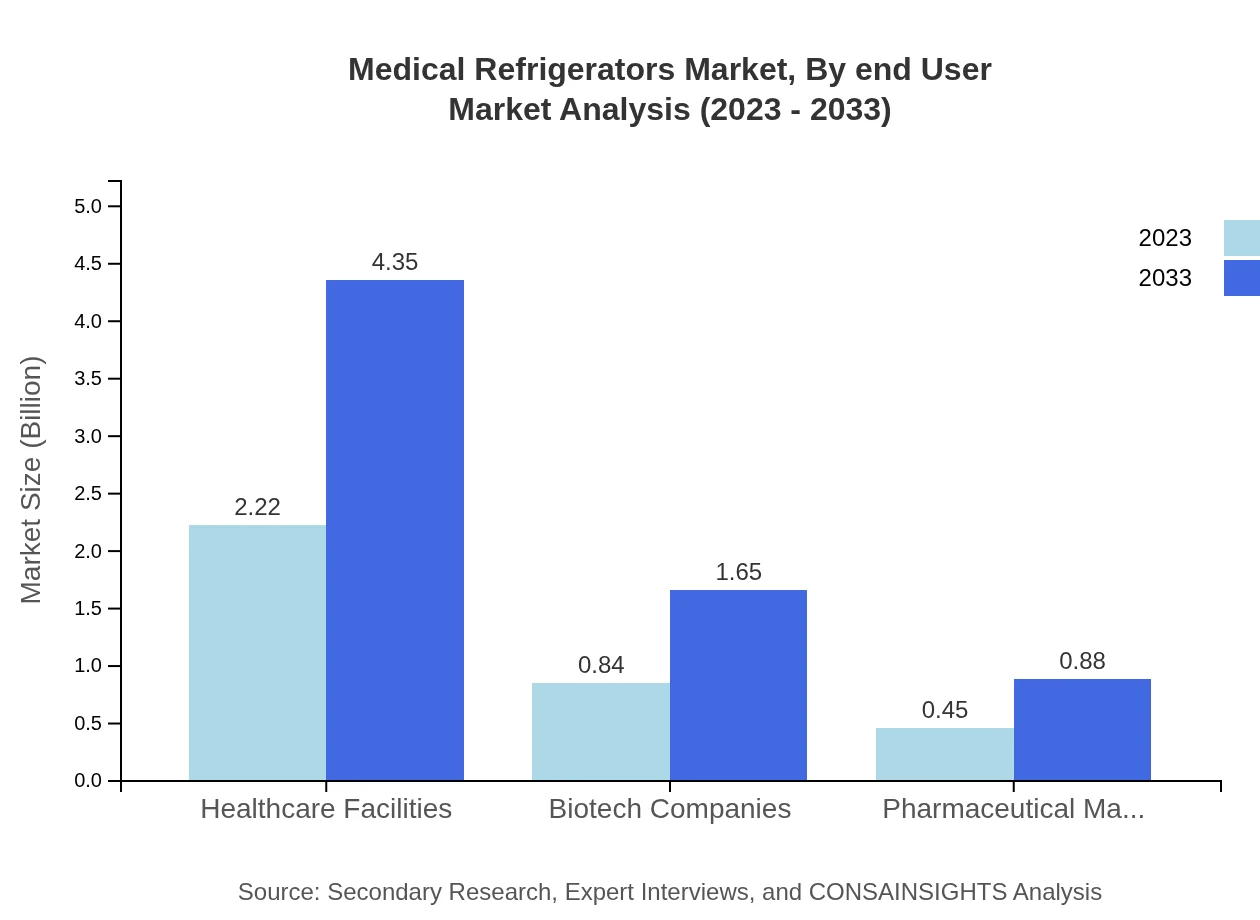

Medical Refrigerators Market Analysis By End User

The analysis of end-users shows healthcare facilities commanding a large portion, with an increase in market size from $2.22 billion in 2023 to $4.35 billion in 2033, reflecting the continuous need for effective medical storage.

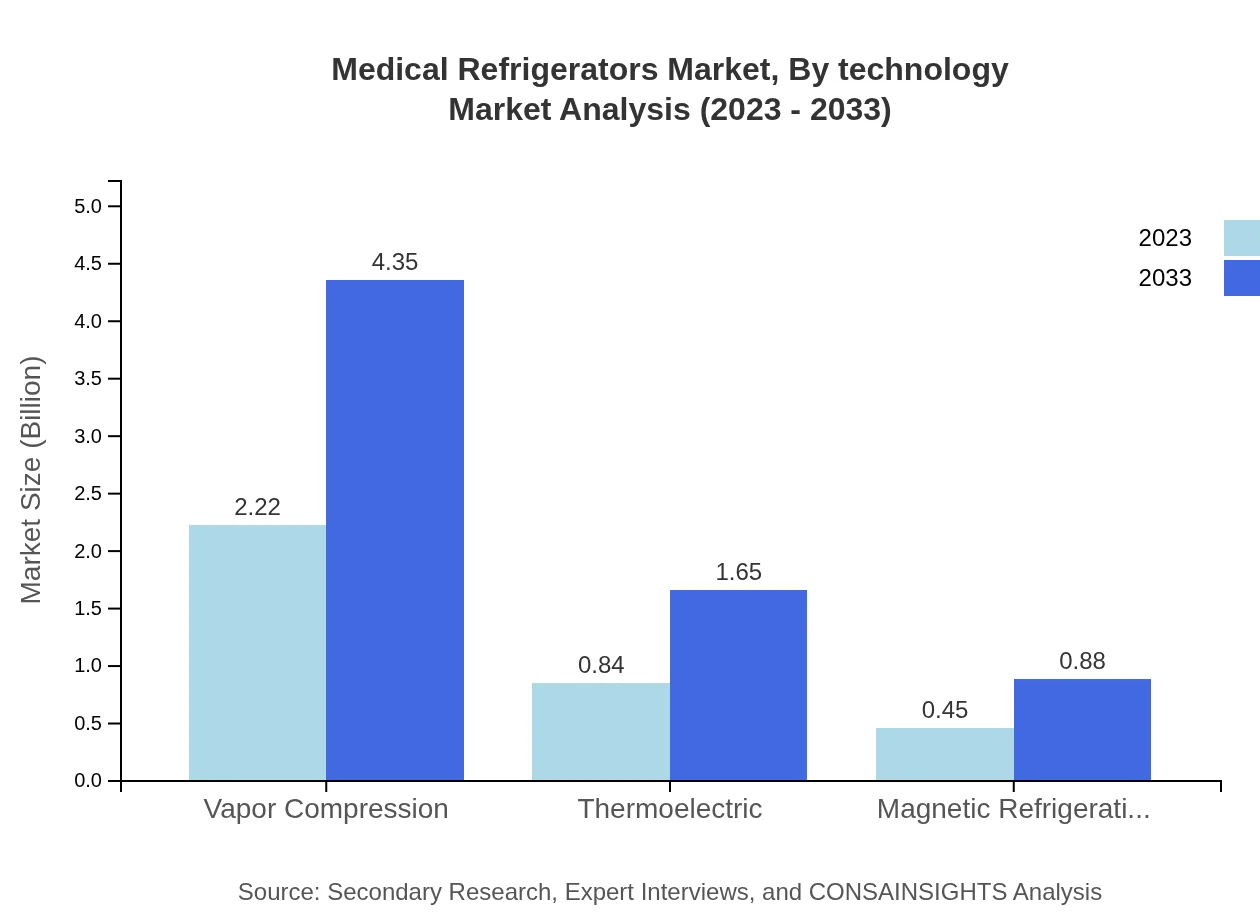

Medical Refrigerators Market Analysis By Technology

Vapor compression technology remains dominant in the Medical Refrigerators market, with expectations of size growth from $2.22 billion in 2023 to $4.35 billion in 2033, holding a 63.29% market share.

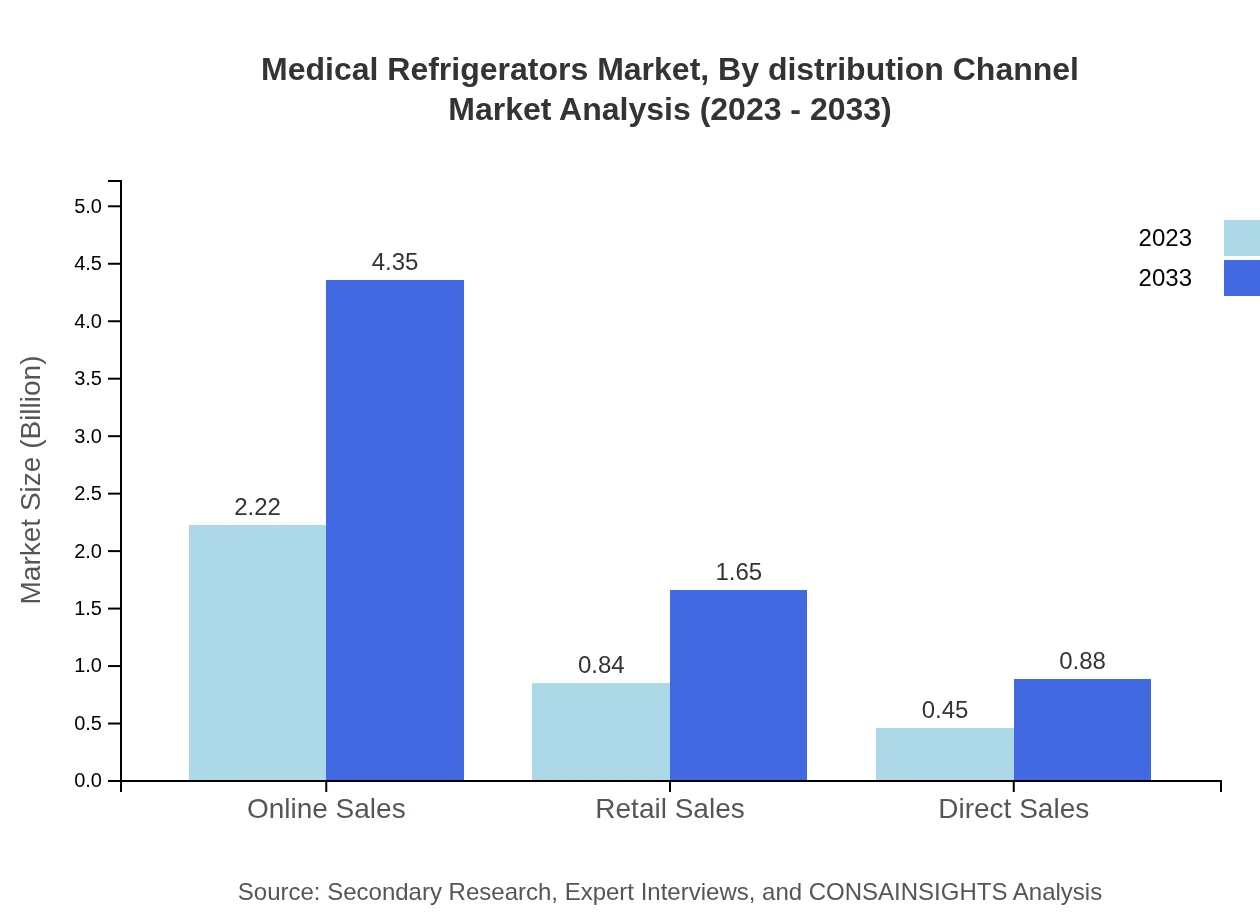

Medical Refrigerators Market Analysis By Distribution Channel

Online sales are projected to be the leading distribution channel, growing from $2.22 billion in 2023 to $4.35 billion by 2033, capturing a market share of 63.29%, supported by the increasing trend of e-commerce in healthcare.

Medical Refrigerators Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Medical Refrigerators Industry

Thermo Fisher Scientific:

A leader in the life sciences sector, offering high-quality refrigeration solutions that ensure safe storage of critical medical products.Haier Biomedical:

Recognized for advanced medical refrigeration systems, Haier offers innovative solutions tailored to the needs of healthcare providers.Aqua Scientist:

Known for its reliable medical refrigerators, Aqua Scientist focuses on meeting strict temperature control and compliance needs.Panasonic Healthcare:

A prominent player in the medical refrigeration market, Panasonic provides energy-efficient and technologically advanced refrigerators.Philips Medical Systems:

Philips offers a range of medical refrigerators, focusing on innovations that support rigorous medical storage applications.We're grateful to work with incredible clients.

FAQs

What is the market size of medical Refrigerators?

The global medical refrigerators market is valued at approximately $3.5 Billion as of 2023, with a projected CAGR of 6.8%, highlighting significant growth potential through 2033. This substantial market size underscores the increasing demand for reliable storage solutions in healthcare.

What are the key market players or companies in this medical Refrigerators industry?

Key players in the medical refrigerators market include global leading brands that specialize in manufacturing advanced refrigeration solutions. Innovations in product designs and emphasis on energy efficiency are paramount for these companies to maintain competitiveness within the evolving healthcare sector.

What are the primary factors driving the growth in the medical refrigerators industry?

The growth of the medical refrigerators industry is primarily driven by the increasing demand for vaccines, blood storage solutions, and advanced pharmaceuticals. Moreover, the rising number of healthcare facilities and the growing emphasis on the cold chain supply management further bolster market expansion.

Which region is the fastest Growing in the medical refrigerators?

Currently, North America is the fastest-growing region in the medical refrigerators market, with a market size of $1.27 billion in 2023, projected to reach $2.50 billion by 2033. Europe and Asia Pacific also exhibit strong growth, reflecting increasing healthcare investments.

Does ConsaInsights provide customized market report data for the medical refrigerators industry?

Yes, ConsaInsights offers customized market report data tailored to the specific needs of clients in the medical refrigerators industry, providing insights that can include detailed segmentation, trends, and growth forecasts to support strategic decision-making.

What deliverables can I expect from this medical refrigerators market research project?

Expect comprehensive deliverables from the medical refrigerators market research project, including detailed market sizing, growth forecasts, trend analysis, competitive landscape evaluations, and actionable insights tailored to specific segments and regional markets.

What are the market trends of medical refrigerators?

Current market trends in medical refrigerators include a growing preference for energy-efficient models, advancements in refrigeration technologies such as thermoelectric cooling, and increasing adoption of online sales channels, reflecting changing consumer purchasing behavior.