Medicated Feed Additives Market Report

Published Date: 02 February 2026 | Report Code: medicated-feed-additives

Medicated Feed Additives Market Size, Share, Industry Trends and Forecast to 2033

This report provides comprehensive insights into the Medicated Feed Additives market, covering market dynamics, segmentation, and regional analyses. Forecasting from 2023 to 2033, it highlights current trends, growth opportunities, and technological advancements impacting the industry.

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

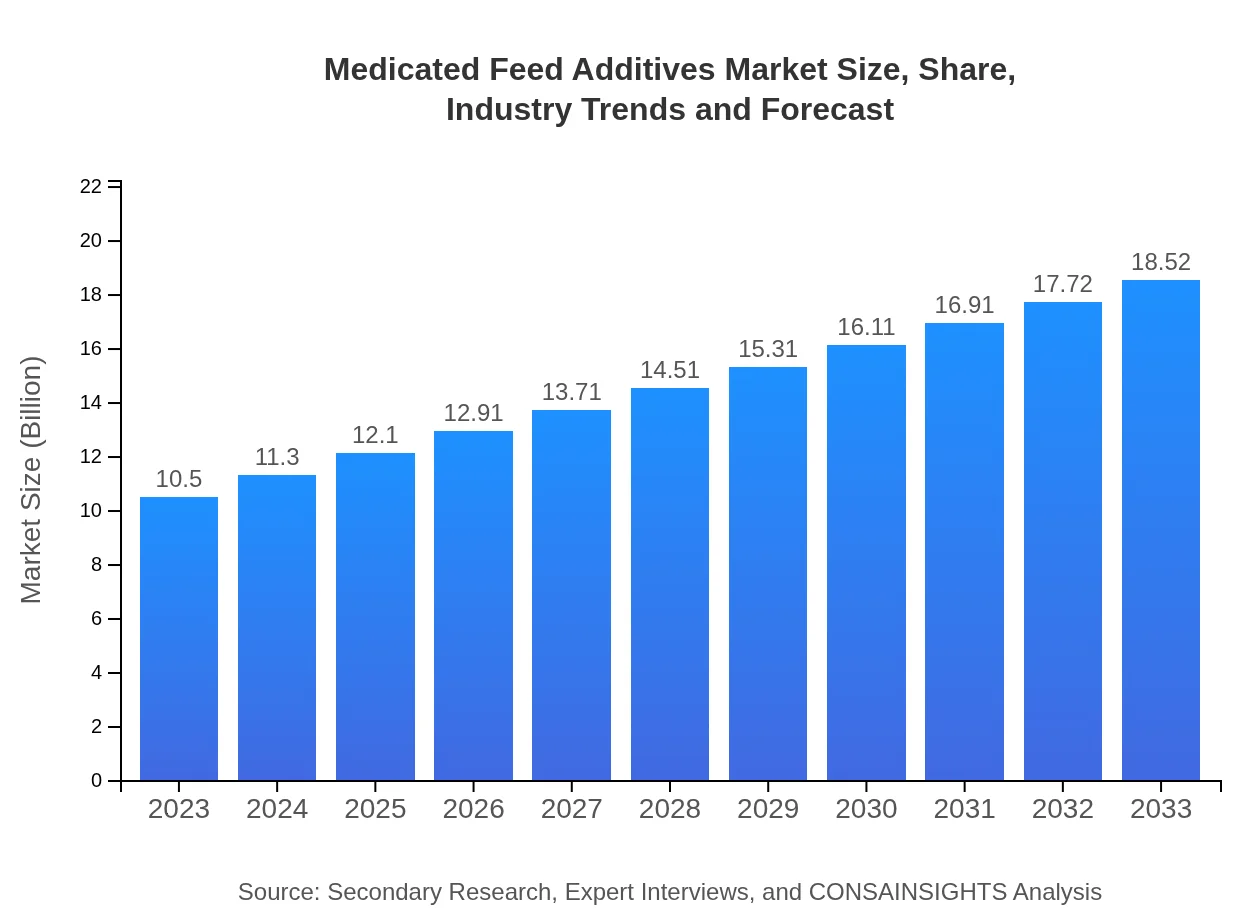

| 2023 Market Size | $10.50 Billion |

| CAGR (2023-2033) | 5.7% |

| 2033 Market Size | $18.52 Billion |

| Top Companies | Zoetis, BASF SE, Cargill, Inc., DowDuPont Inc. |

| Last Modified Date | 02 February 2026 |

Medicated Feed Additives Market Overview

Customize Medicated Feed Additives Market Report market research report

- ✔ Get in-depth analysis of Medicated Feed Additives market size, growth, and forecasts.

- ✔ Understand Medicated Feed Additives's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Medicated Feed Additives

What is the Market Size & CAGR of Medicated Feed Additives market in 2023?

Medicated Feed Additives Industry Analysis

Medicated Feed Additives Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Medicated Feed Additives Market Analysis Report by Region

Europe Medicated Feed Additives Market Report:

Europe’s market for Medicated Feed Additives was valued at $2.87 billion in 2023 and is projected to reach $5.06 billion by 2033. The stringent regulations on food safety and animal health, along with a growing trend towards clean label products, are propelling the demand for these additives.Asia Pacific Medicated Feed Additives Market Report:

In the Asia Pacific region, the market for Medicated Feed Additives is expected to grow from $2.28 billion in 2023 to $4.02 billion by 2033. Factors such as rising meat consumption, increasing livestock population, and improving farming practices are fuelling this growth. China and India are key markets in this region, focusing on enhancing livestock productivity and health.North America Medicated Feed Additives Market Report:

The North American market is anticipated to grow significantly, from $3.76 billion in 2023 to $6.63 billion by 2033. High meat consumption rates, advanced livestock farming practices, and strict regulations regarding animal health are key factors driving market development in this region.South America Medicated Feed Additives Market Report:

The South American market is projected to increase from $0.88 billion in 2023 to $1.55 billion in 2033. The region's livestock sector is expanding due to growing meat export demand, particularly in Brazil and Argentina, which enhances the need for effective medicated feed additives.Middle East & Africa Medicated Feed Additives Market Report:

The Middle East and Africa market is set to grow from $0.72 billion in 2023 to $1.26 billion by 2033, driven by increasing demand for meat and dairy products, alongside improving livestock management and veterinary services.Tell us your focus area and get a customized research report.

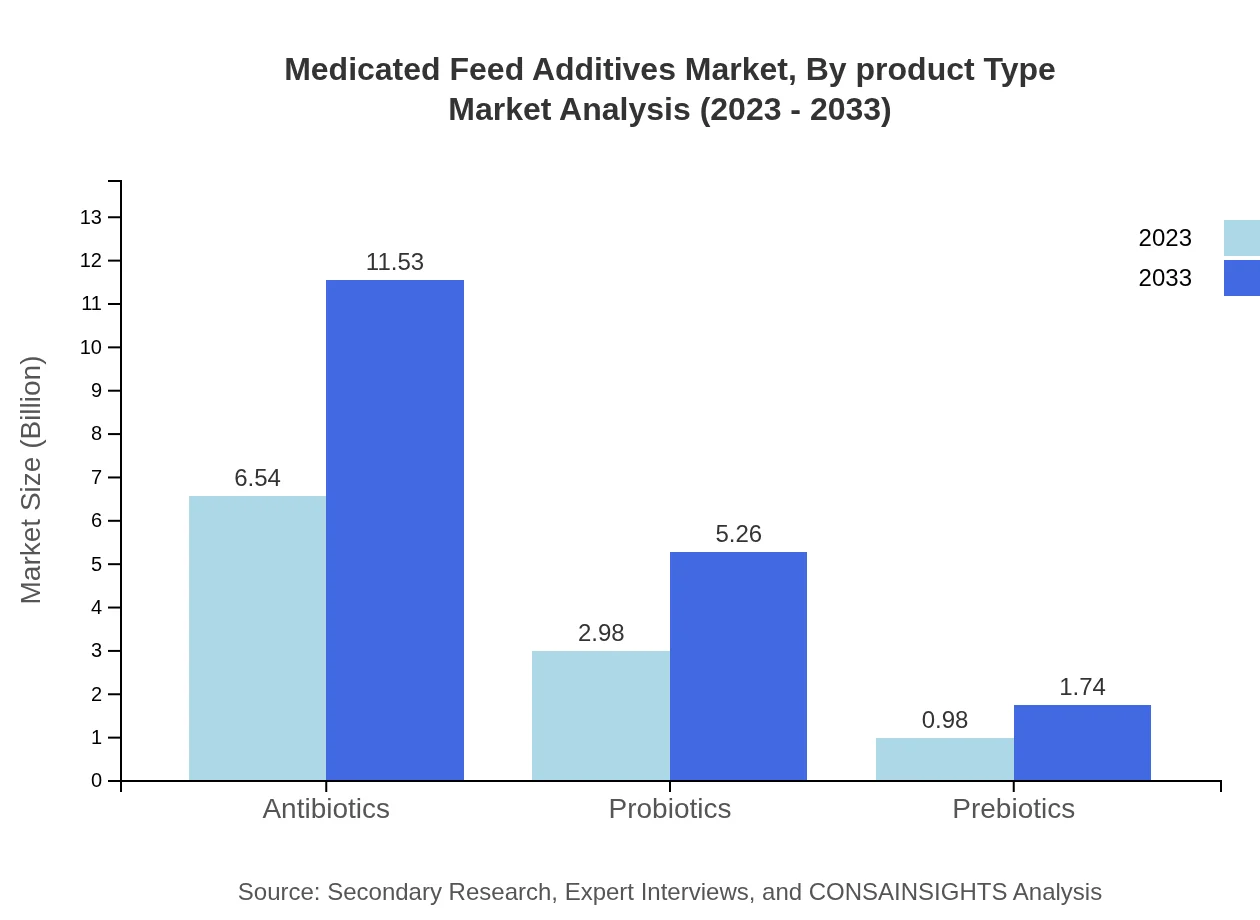

Medicated Feed Additives Market Analysis By Product Type

The product types in the Medicated Feed Additives market significantly influence market dynamics. Key segments include antibiotics, probiotics, prebiotics, and nutritional enhancers, with antibiotics dominating the market share due to their extensive use in livestock health management. Each product type serves a specific purpose, such as growth promotion, disease prevention, and improving feed efficiency.

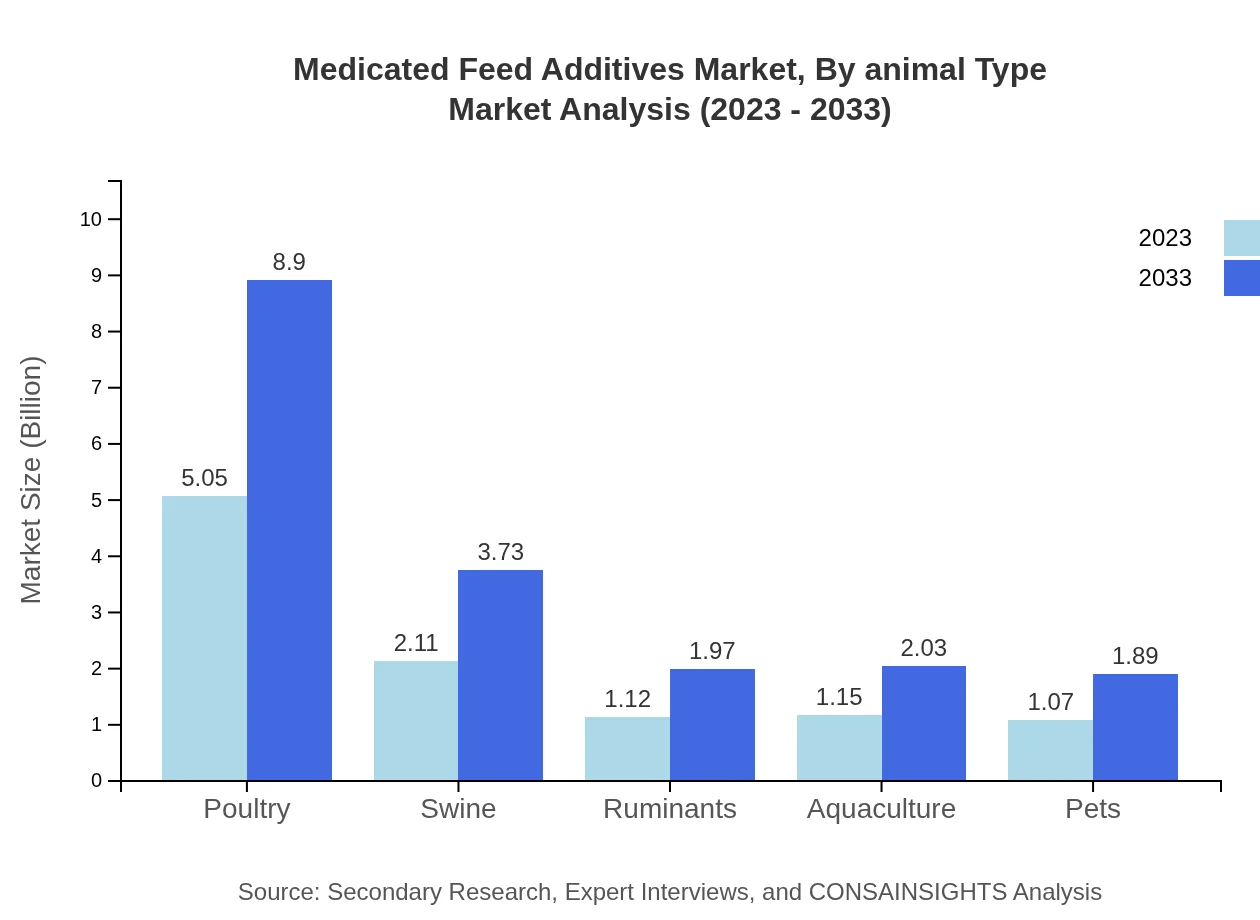

Medicated Feed Additives Market Analysis By Animal Type

The market is segmented by animal type, including poultry, swine, ruminants, aquaculture, and pets. Poultry accounts for the largest share due to high production volumes. As demand for meat increases globally, each segment plays a critical role in meeting nutritional needs, thereby influencing overall market dynamics.

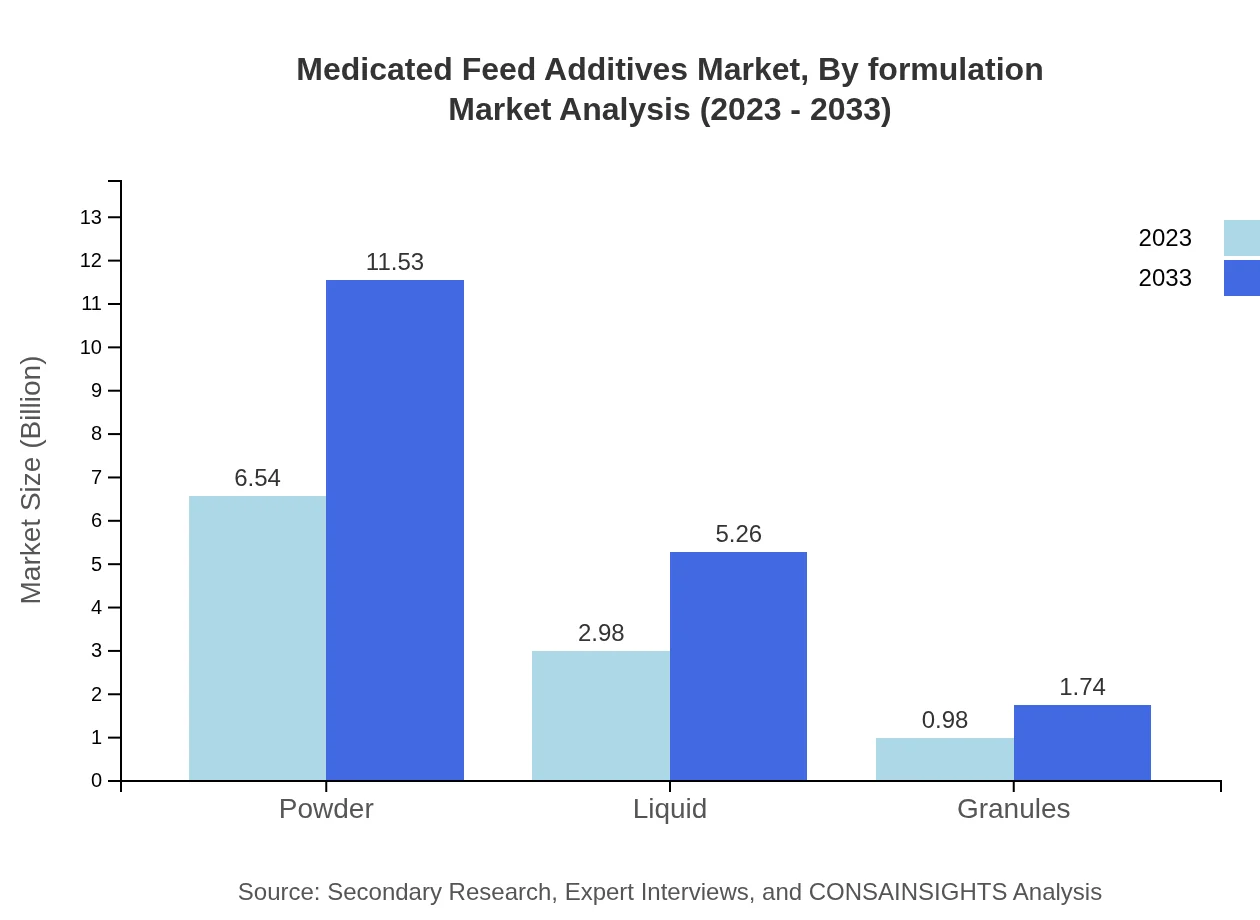

Medicated Feed Additives Market Analysis By Formulation

Different formulations—powder, liquid, and granules—cater to various consumer preferences, with powders accounting for the largest market share. Liquid forms are gaining traction due to ease of application, whereas granules are preferred for specific feeding methods. Understanding these formulations is essential for effective market positioning.

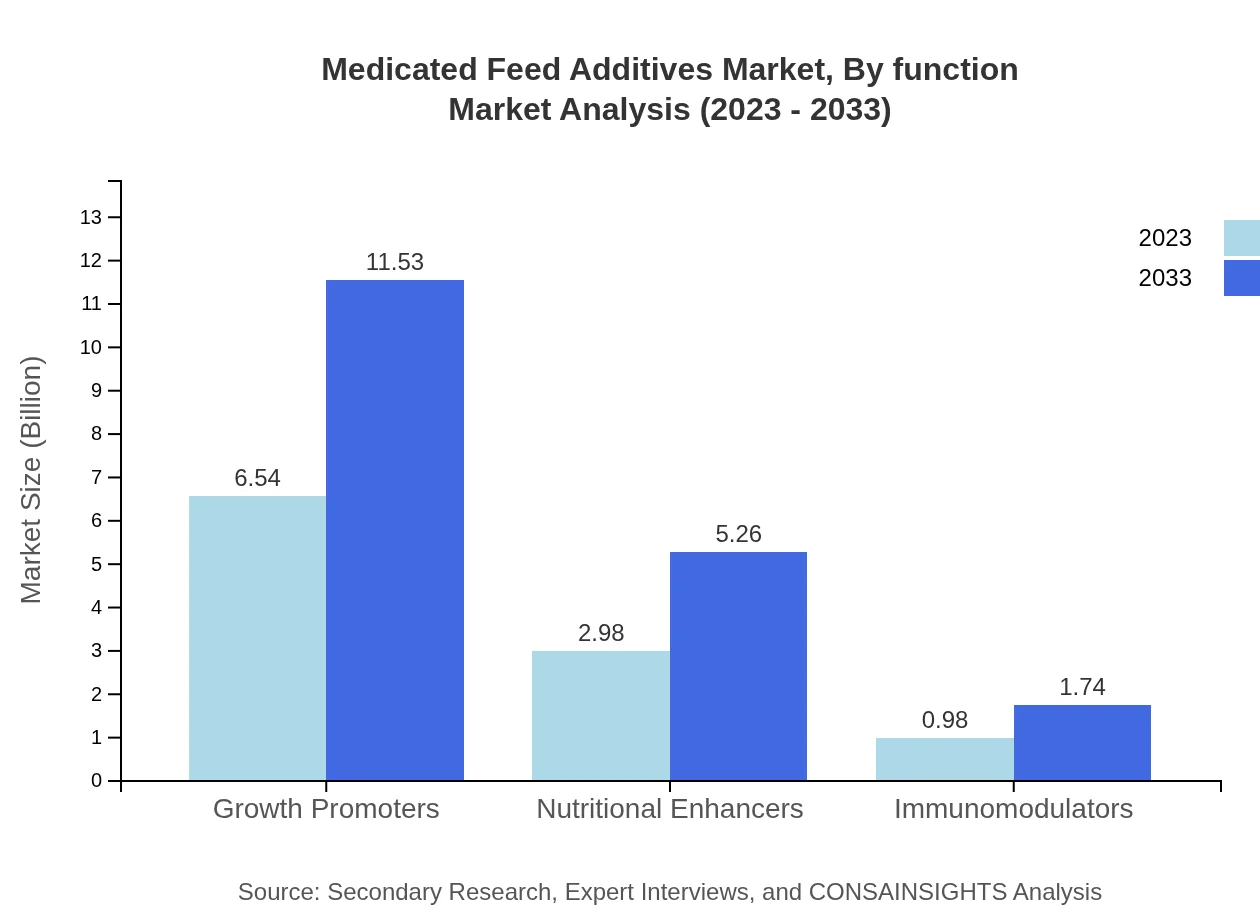

Medicated Feed Additives Market Analysis By Function

By function, the market can be segmented into growth promoters, nutritional enhancers, and immunomodulators. Growth promoters hold the largest market share, significantly impacting overall animal productivity. Nutritional enhancers are crucial for enhancing feed quality, while immunomodulators are gaining traction due to increasing awareness around animal immunity.

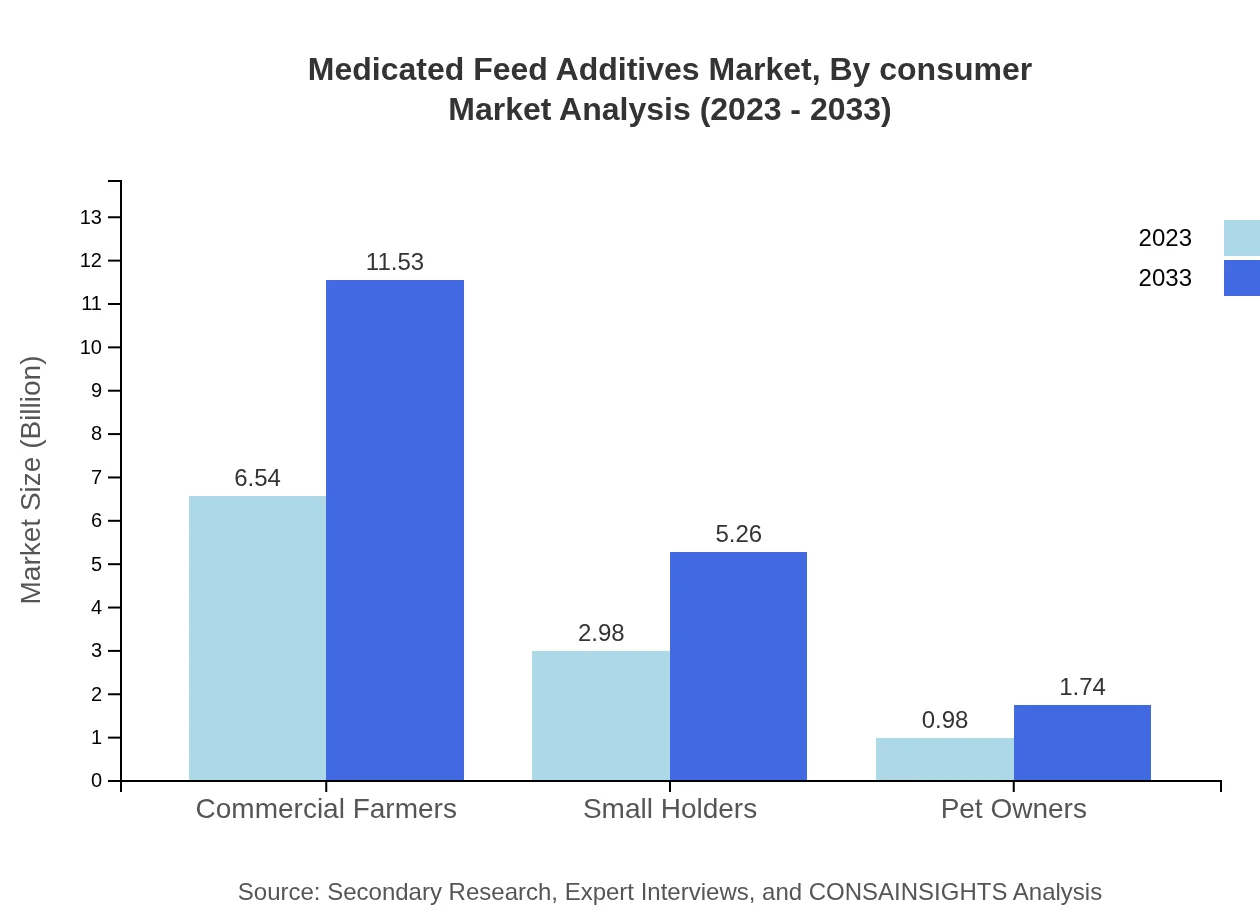

Medicated Feed Additives Market Analysis By Consumer

The consumer-type segmentation includes commercial farmers, smallholders, and pet owners. Commercial farmers dominate the market share due to high-volume feed requirements, while smallholders and pet owners contribute significantly to the growing demand for specialized products tailored for specific needs.

Medicated Feed Additives Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Medicated Feed Additives Industry

Zoetis:

A leader in animal health, Zoetis provides innovative solutions and products that help ensure the health and safety of livestock.BASF SE:

BASF is known for its advanced chemical solutions, including tailored feed additives enhancing animal health and performance.Cargill, Inc.:

Cargill offers a diverse range of feed additives and premixes that promote animal health and support livestock production.DowDuPont Inc.:

DowDuPont is recognized for its innovative agricultural products, focusing on enhancing feed formulations and livestock health.We're grateful to work with incredible clients.

FAQs

What is the market size of medicated Feed Additives?

The global medicated feed additives market is valued at approximately $10.5 billion in 2023 and is projected to grow at a CAGR of 5.7% through 2033. This consistent growth reflects the increasing demand for enhanced animal health solutions.

What are the key market players or companies in the medicated Feed Additives industry?

Key players dominating the medicated feed additives market include major corporations such as Cargill, BASF, Elanco, ADM, and Zoetis. Their extensive research and innovation in feed formulations significantly influence market dynamics.

What are the primary factors driving the growth in the medicated Feed Additives industry?

The primary factors driving growth in the medicated feed additives market include rising meat consumption, increasing awareness of animal health, and stringent regulations regarding livestock welfare, which prompt farmers to adopt quality nutrients and additives.

Which region is the fastest Growing in the medicated Feed Additives?

The Asia-Pacific region is expected to be the fastest-growing market for medicated feed additives, rising from $2.28 billion in 2023 to $4.02 billion by 2033, driven by increasing livestock production and demand for meat.

Does ConsaInsights provide customized market report data for the medicated Feed Additives industry?

Yes, Consainsights offers customized market reports tailored specifically for the medicated feed additives sector, providing insights relevant to distinct company needs, regional trends, and current market conditions.

What deliverables can I expect from this medicated Feed Additives market research project?

The market research project on medicated feed additives typically includes comprehensive reports, data analysis, market forecasts, competitive landscape overviews, and insights on consumer trends and regulatory frameworks.

What are the market trends of medicated Feed Additives?

Current trends in the medicated feed additives market include increased use of probiotics and prebiotics, the rising demand for organic feed options, and innovative delivery formats like powders and liquids to enhance animal nutrition.