Mega Data Center Market Report

Published Date: 31 January 2026 | Report Code: mega-data-center

Mega Data Center Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Mega Data Center market, focusing on its growth trajectory from 2023 to 2033. It includes critical insights on market size, trends, segmentation, technological advancements, regional analyses, and major players, aimed at guiding stakeholders in decision-making.

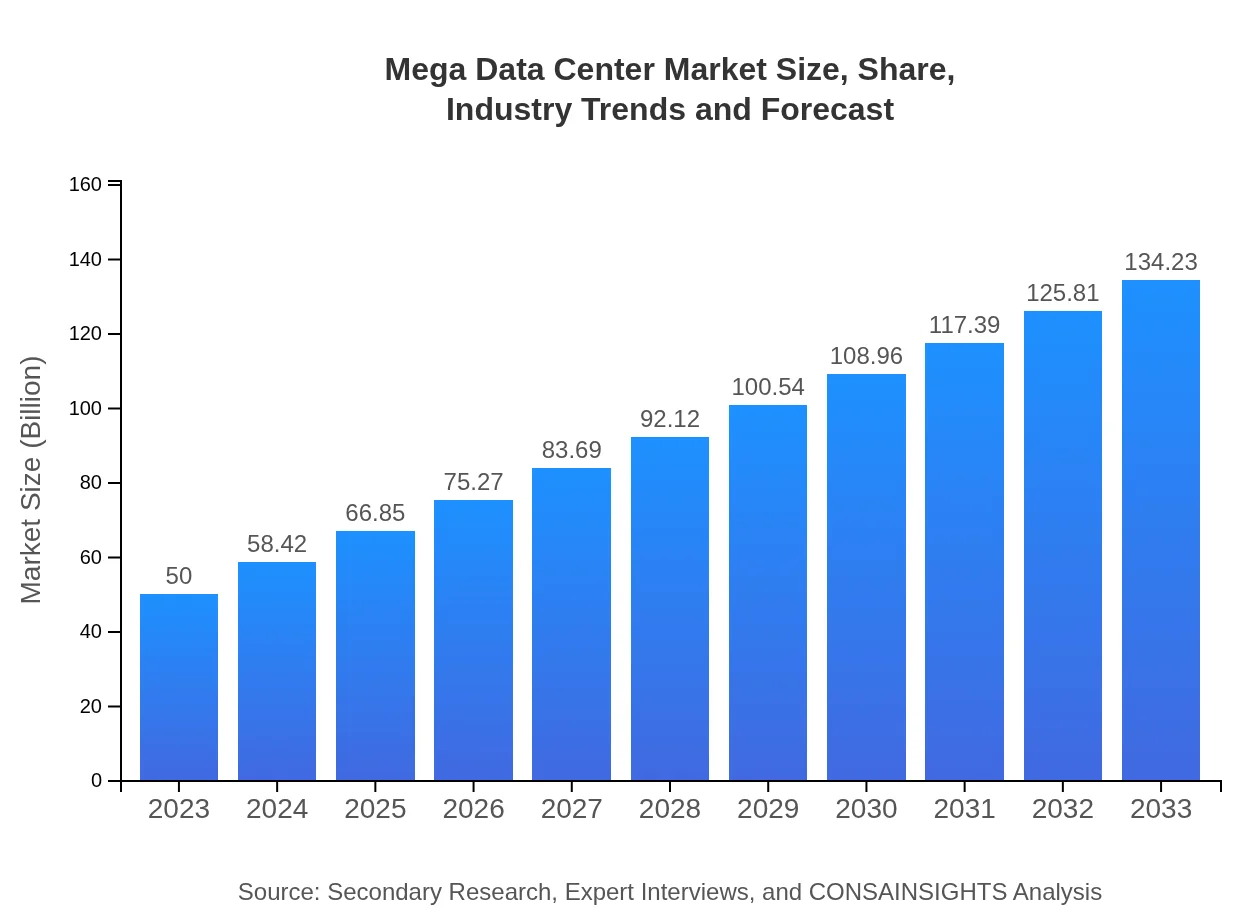

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $50.00 Billion |

| CAGR (2023-2033) | 10% |

| 2033 Market Size | $134.23 Billion |

| Top Companies | Amazon Web Services (AWS), Microsoft Azure, Google Cloud Platform, IBM, Equinix |

| Last Modified Date | 31 January 2026 |

Mega Data Center Market Overview

Customize Mega Data Center Market Report market research report

- ✔ Get in-depth analysis of Mega Data Center market size, growth, and forecasts.

- ✔ Understand Mega Data Center's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Mega Data Center

What is the Market Size & CAGR of Mega Data Center market in 2023?

Mega Data Center Industry Analysis

Mega Data Center Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Mega Data Center Market Analysis Report by Region

Europe Mega Data Center Market Report:

Europe's Mega Data Center market is poised for significant growth, transitioning from $17.84 billion in 2023 to $47.88 billion by 2033. This growth is driven by digital transformation initiatives, increasing data compliance requirements, and the eurozone's growing tech sector.Asia Pacific Mega Data Center Market Report:

In 2023, the Asia Pacific Mega Data Center market is valued at approximately $8.38 billion, expected to grow to $22.51 billion by 2033. Factors driving this growth include increasing internet penetration, substantial investments in cloud infrastructure, and the rapid expansion of e-commerce platforms.North America Mega Data Center Market Report:

North America remains a dominant player in the Mega Data Center market, with a valuation of $16.60 billion in 2023, projected to soar to $44.57 billion by 2033. Key factors include the presence of leading tech companies, a strong focus on innovation, and growing cloud adoption rates across various industries.South America Mega Data Center Market Report:

The South American Mega Data Center market is relatively small, with a market size of about $0.38 billion in 2023, projected to reach $1.01 billion by 2033. The growth is fueled by an increasing demand for reliable data storage and IT services among local businesses and global enterprises entering the region.Middle East & Africa Mega Data Center Market Report:

The Middle East and Africa market is estimated to reach $6.80 billion in 2023, with projected growth to $18.27 billion by 2033. Growth factors include rising digital infrastructure investments and the region's efforts to become a global technology hub.Tell us your focus area and get a customized research report.

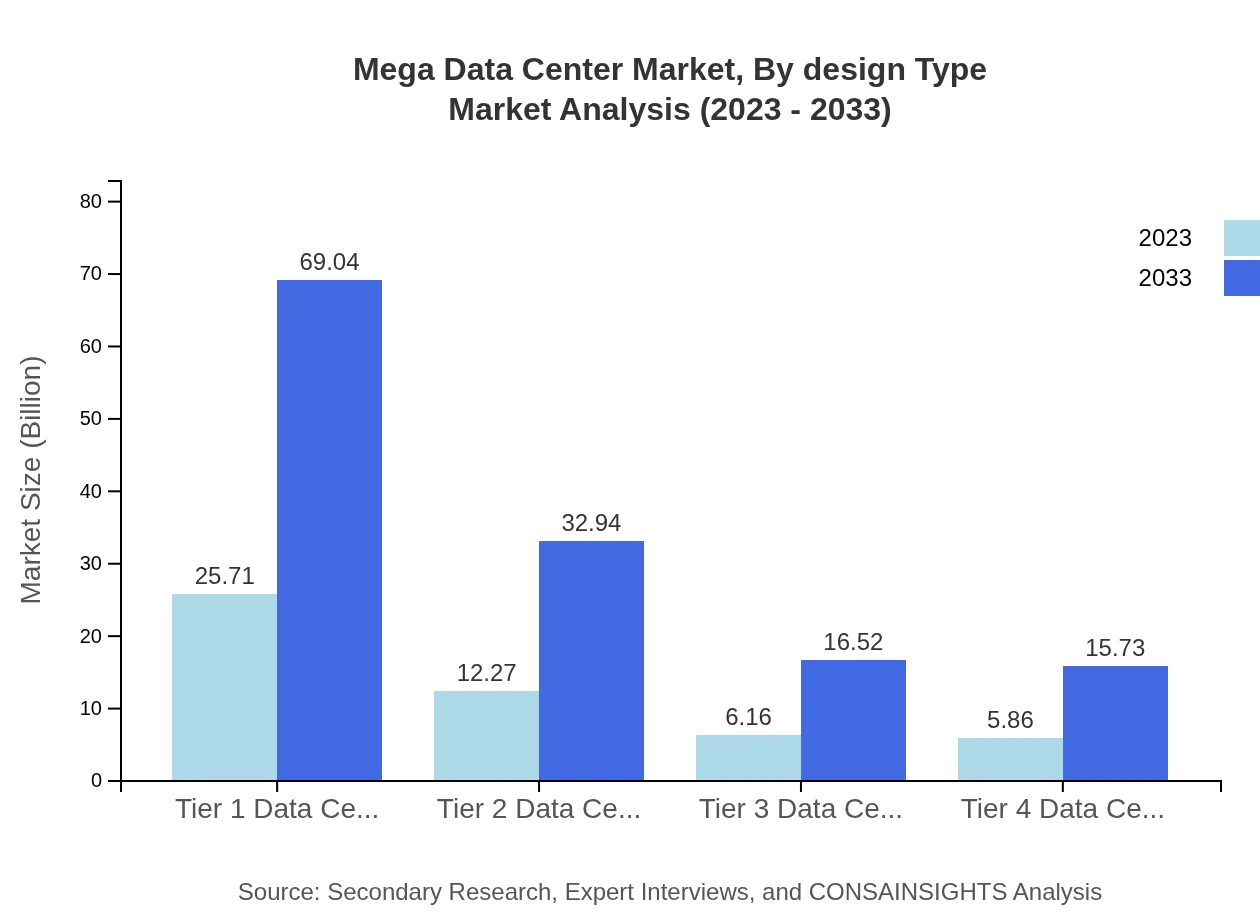

Mega Data Center Market Analysis By Design Type

The design type segment includes Tier 1, Tier 2, Tier 3, and Tier 4 data centers, with Tier 1 data centers leading the market in terms of revenue, driven by their high reliability and uptime guarantees. For instance, the market size for Tier 1 data centers in 2023 is $25.71 billion, expected to reach $69.04 billion by 2033.

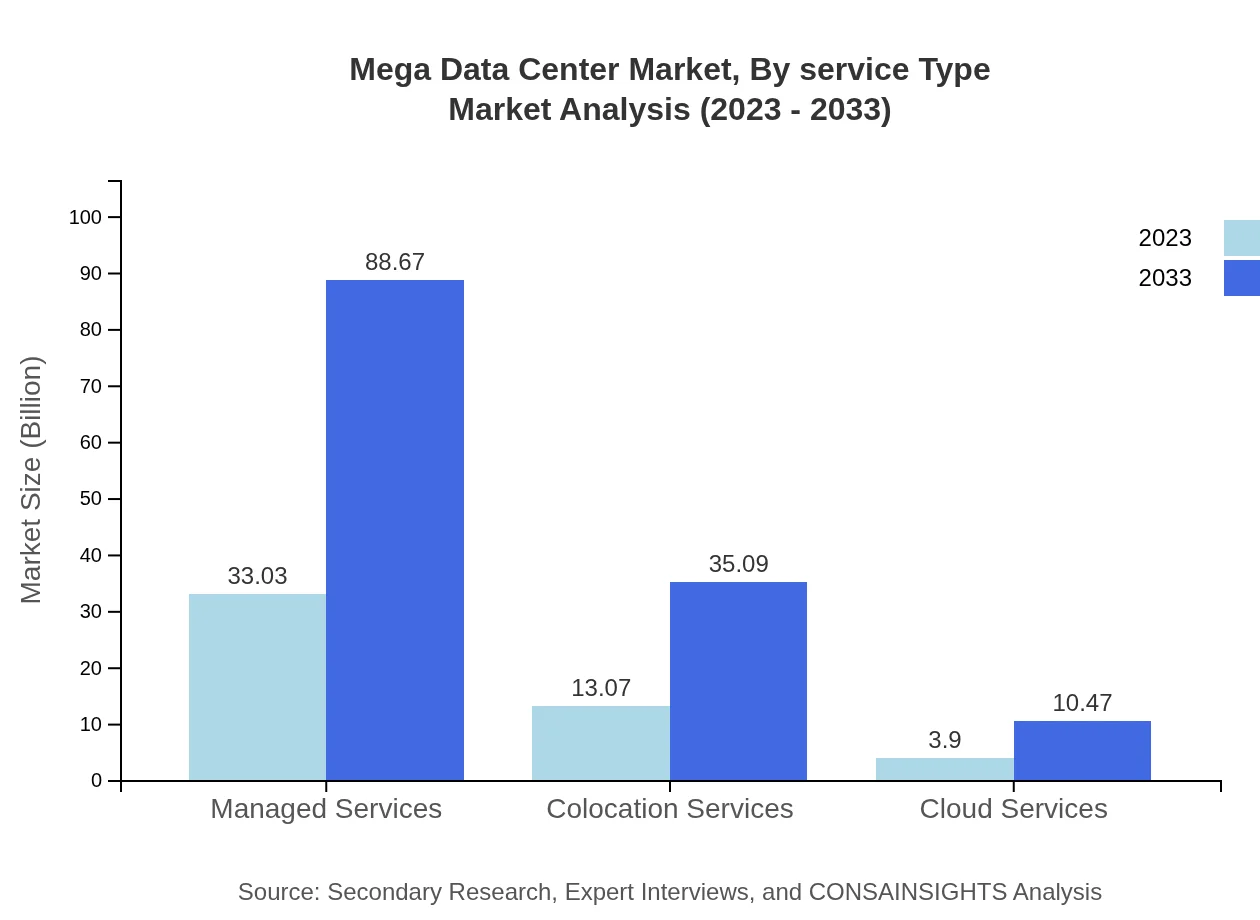

Mega Data Center Market Analysis By Service Type

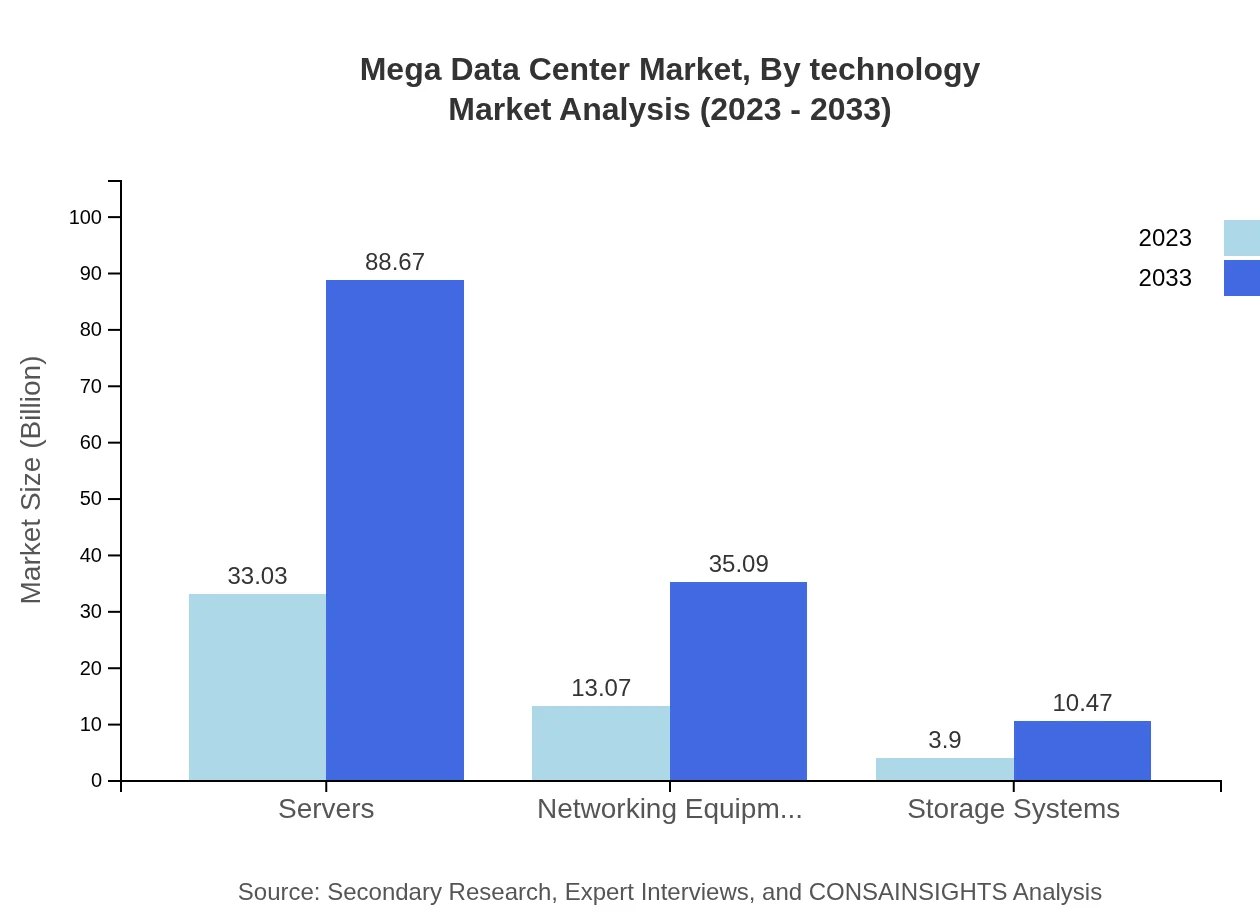

Service types in the Mega Data Center market include managed services, colocation services, and cloud services. Managed Services dominate the market with a size of $33.03 billion in 2023, projected to grow to $88.67 billion by 2033, reflecting the trend of enterprises outsourcing IT infrastructure management.

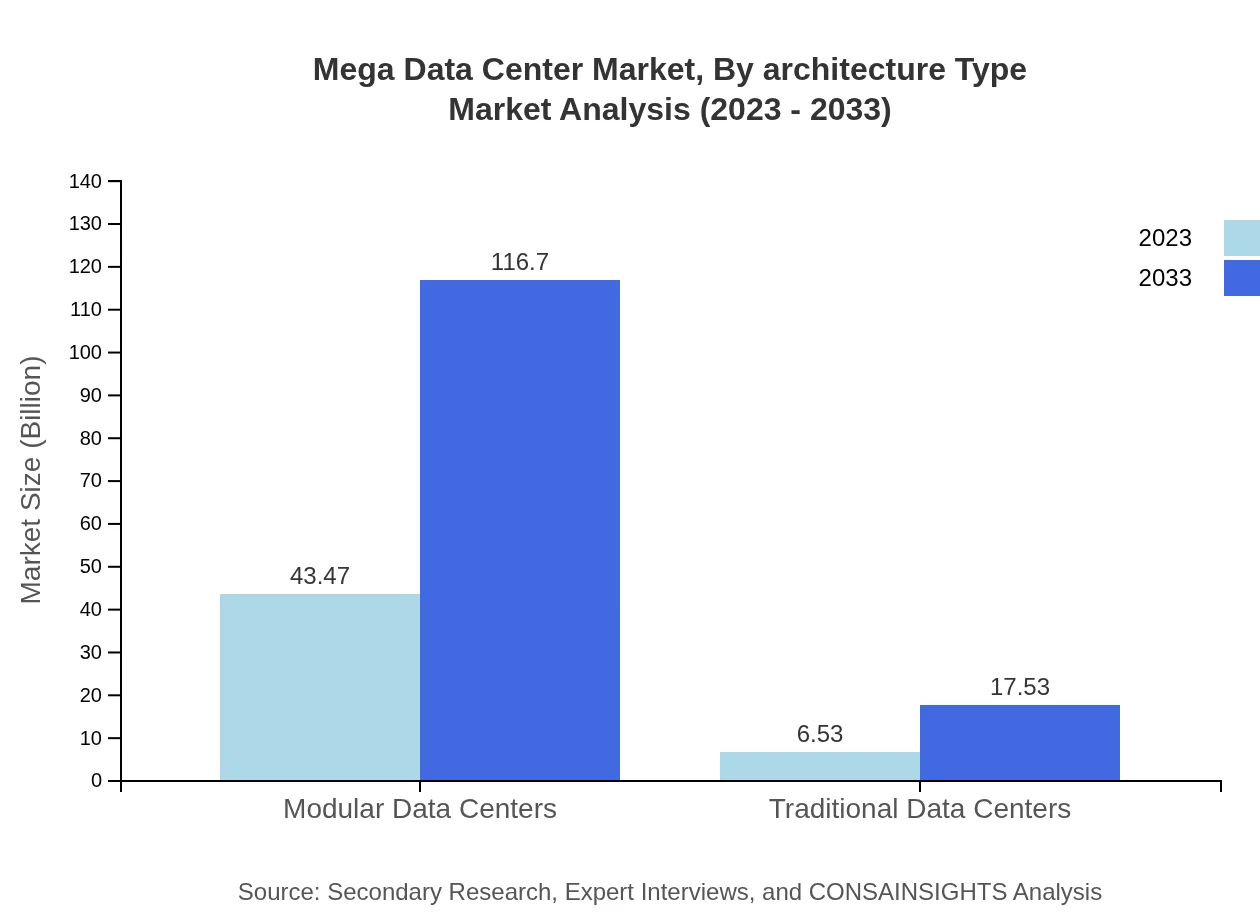

Mega Data Center Market Analysis By Architecture Type

The architecture type segment encompasses traditional and modular data centers. In 2023, modular data centers represent a significant market share, valued at $43.47 billion, and predicted to rise to $116.70 billion by 2033, as they offer flexibility and quick deployment options.

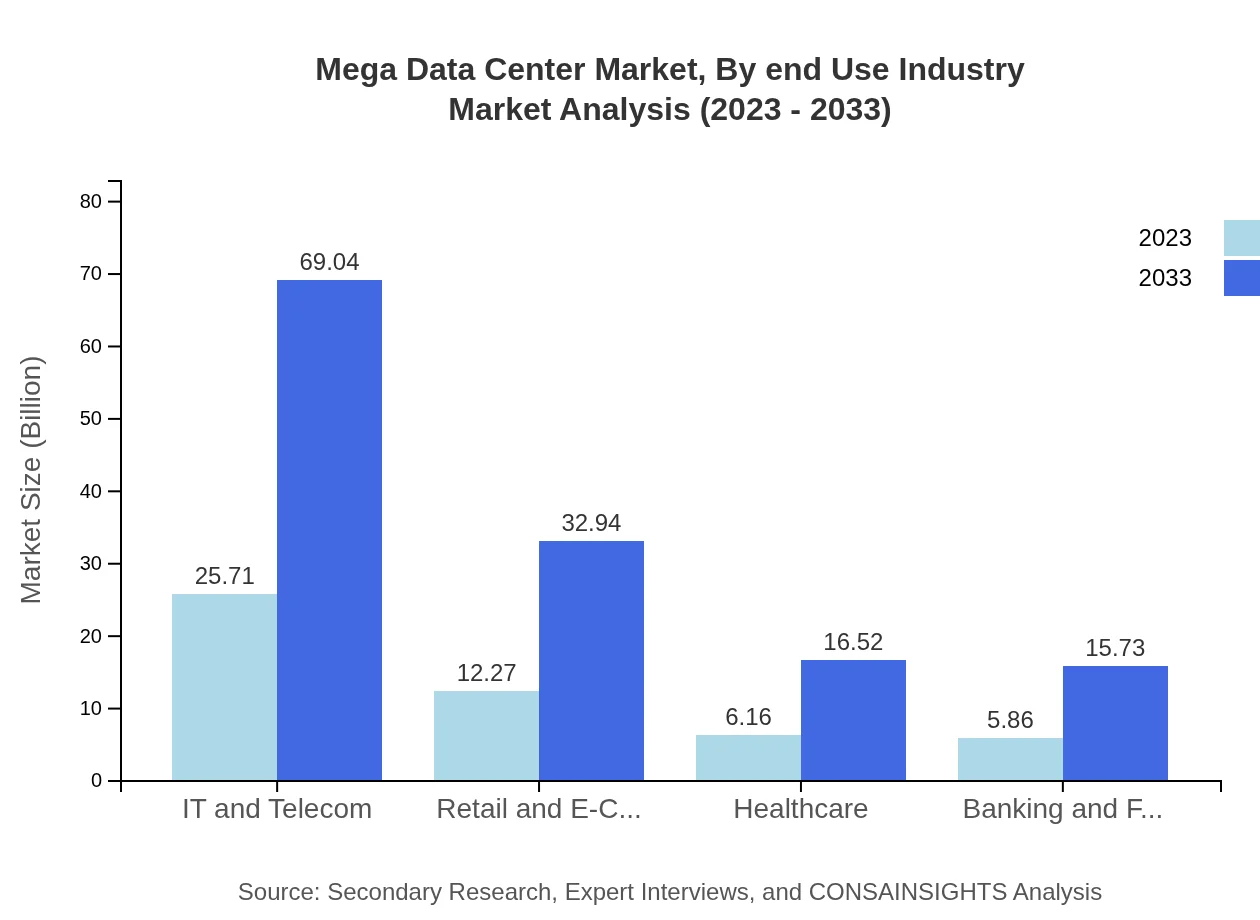

Mega Data Center Market Analysis By End Use Industry

Various industries utilize Mega Data Centers, including IT and Telecom, Retail and E-commerce, and Healthcare. The IT and Telecom sector commands the largest share, reaching $25.71 billion in 2023, and expected to grow to $69.04 billion by 2033, fueled by ever-increasing data traffic.

Mega Data Center Market Analysis By Technology

Technologies impacting the Mega Data Center market include AI, cloud computing, and virtualization. These technologies enhance efficiency, reduce costs, and optimize resource management, leading to substantial market growth.

Mega Data Center Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Mega Data Center Industry

Amazon Web Services (AWS):

AWS offers a wide range of cloud services, including computing power, storage options, and networking capabilities, making it a leader in the Mega Data Center space.Microsoft Azure:

Microsoft Azure provides an extensive suite of cloud services, allowing companies to build, manage, and deploy applications in a global network of data centers.Google Cloud Platform:

Google Cloud Platform is known for its big data and machine learning capabilities, enabling businesses to leverage data-driven insights in their operations.IBM:

IBM is a key player in hybrid cloud and AI-driven data solutions, offering infrastructure that supports extensive data center operations.Equinix :

Equinix is a leading provider of data center services, specializing in interconnection and colocation services across global locations.We're grateful to work with incredible clients.

FAQs

What is the market size of mega Data Center?

The global mega-data-center market is projected to grow from USD 50 billion in 2023 to a staggering USD 130 billion by 2033, reflecting a robust CAGR of 10%. This substantial growth underscores the increasing reliance on data centers across various industries.

What are the key market players or companies in the mega Data Center industry?

Key players in the mega-data-center market include industry giants such as Amazon Web Services, Microsoft Azure, Google Cloud, IBM, and Oracle. These companies are at the forefront of innovation, pushing the boundaries of data center capabilities with advanced technologies.

What are the primary factors driving the growth in the mega Data Center industry?

Factors driving growth in the mega-data-center industry include increasing data generation from IoT devices, demand for cloud computing services, and the rise of artificial intelligence applications. Additionally, businesses are increasingly prioritizing data security, which necessitates advanced data center solutions.

Which region is the fastest Growing in the mega Data Center?

Asia Pacific is identified as the fastest-growing region in the mega-data-center market, with the market projected to grow from USD 8.38 billion in 2023 to USD 22.51 billion by 2033. Europe follows closely, with growth from USD 17.84 billion to USD 47.88 billion.

Does ConsaInsights provide customized market report data for the mega Data Center industry?

Yes, ConsaInsights offers customized market reports tailored to specific client needs in the mega-data-center industry. Our reports can include targeted insights, detailed analyses, and unique data segments to help clients strategize effectively.

What deliverables can I expect from this mega Data Center market research project?

Clients can expect comprehensive deliverables, including detailed market size analysis, growth forecasts, competitive landscape breakdowns, segment-wise data, and insights into emerging trends. Additional custom requirements can also be accommodated based on client specifications.

What are the market trends of mega Data Center?

Current trends in the mega-data-center market include a shift towards energy-efficient technologies, the adoption of modular data centers, and enhanced focus on sustainability. There's also an increasing trend in the use of automated systems for better operation and management.