Membranes Market Report

Published Date: 22 January 2026 | Report Code: membranes

Membranes Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the membranes market, highlighting current trends, market size, growth forecasts, and regional analyses from 2023 to 2033. It aims to deliver strategic insights that stakeholders can utilize for informed decision-making.

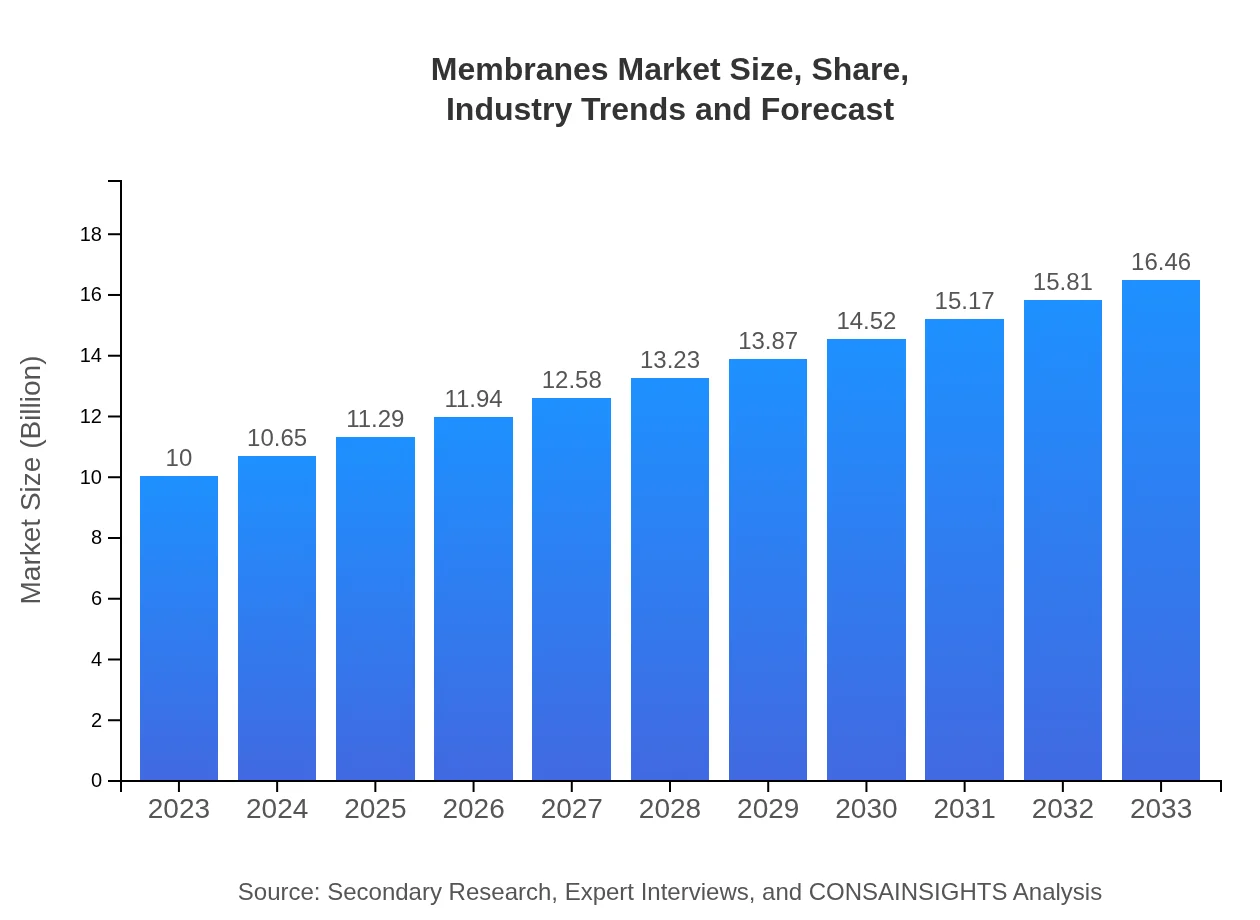

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $10.00 Billion |

| CAGR (2023-2033) | 5% |

| 2033 Market Size | $16.46 Billion |

| Top Companies | Dow Chemical, GE Water & Process Technologies, Membrane Technology and Research, Inc., Xerium Technologies, Inc., Koch Membrane Systems |

| Last Modified Date | 22 January 2026 |

Membranes Market Overview

Customize Membranes Market Report market research report

- ✔ Get in-depth analysis of Membranes market size, growth, and forecasts.

- ✔ Understand Membranes's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Membranes

What is the Market Size & CAGR of Membranes market in 2023?

Membranes Industry Analysis

Membranes Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Membranes Market Analysis Report by Region

Europe Membranes Market Report:

Europe's membranes market is initially valued at $3.01 billion, expected to rise to $4.96 billion by 2033. The growth is supported by innovative technologies in water treatment and robust regulatory frameworks ensuring clean water supply.Asia Pacific Membranes Market Report:

In 2023, the Asia Pacific membranes market is valued at $1.99 billion, projected to reach $3.28 billion by 2033, driven by growing urban populations and increasing investments in water and wastewater treatment infrastructures.North America Membranes Market Report:

The North American membranes market stands at $3.33 billion in 2023, with projections of $5.49 billion by 2033. This is fueled by the demand for efficient water purification solutions and stringent regulations on wastewater discharge.South America Membranes Market Report:

The Latin American membranes market, valued at $0.62 billion in 2023, is anticipated to reach $1.02 billion by 2033. Key drivers include expanding food processing sectors and advances in water treatment technologies.Middle East & Africa Membranes Market Report:

In the Middle East and Africa, the membranes market is estimated at $1.04 billion in 2023, with an anticipated growth to $1.72 billion by 2033. Increasing water scarcity and the need for desalination technologies are critical factors driving this growth.Tell us your focus area and get a customized research report.

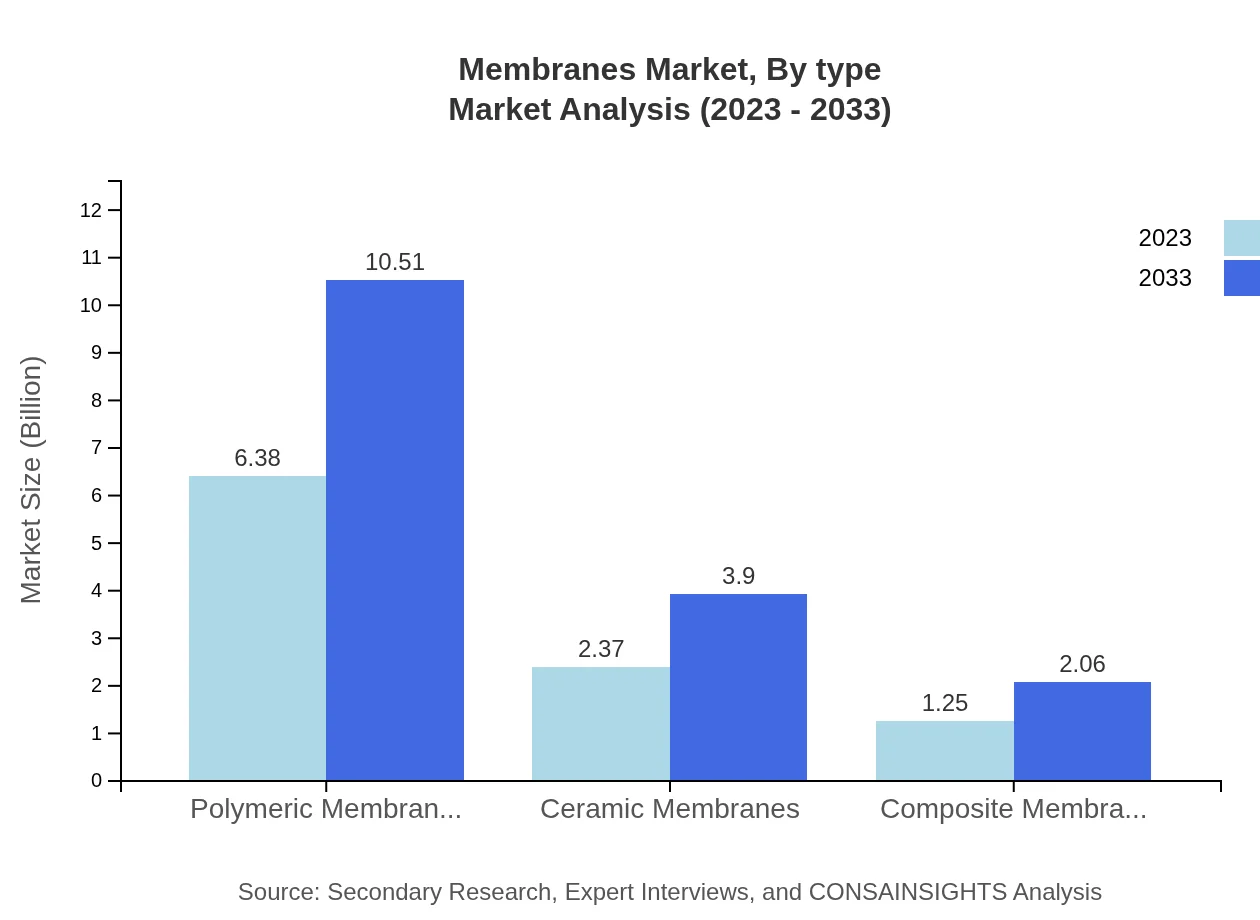

Membranes Market Analysis By Type

The membranes market is significantly influenced by the type of membrane materials used. Polymeric membranes dominate the market in both size and share, projected to be valued at $10.51 billion by 2033. Ceramic membranes, while smaller in size at $3.90 billion, present advantages in chemical resistance and durability. Composite membranes, capturing $2.06 billion by 2033, offer versatility in applications. Each membrane type contributes distinct advantages, impacting performance and cost.

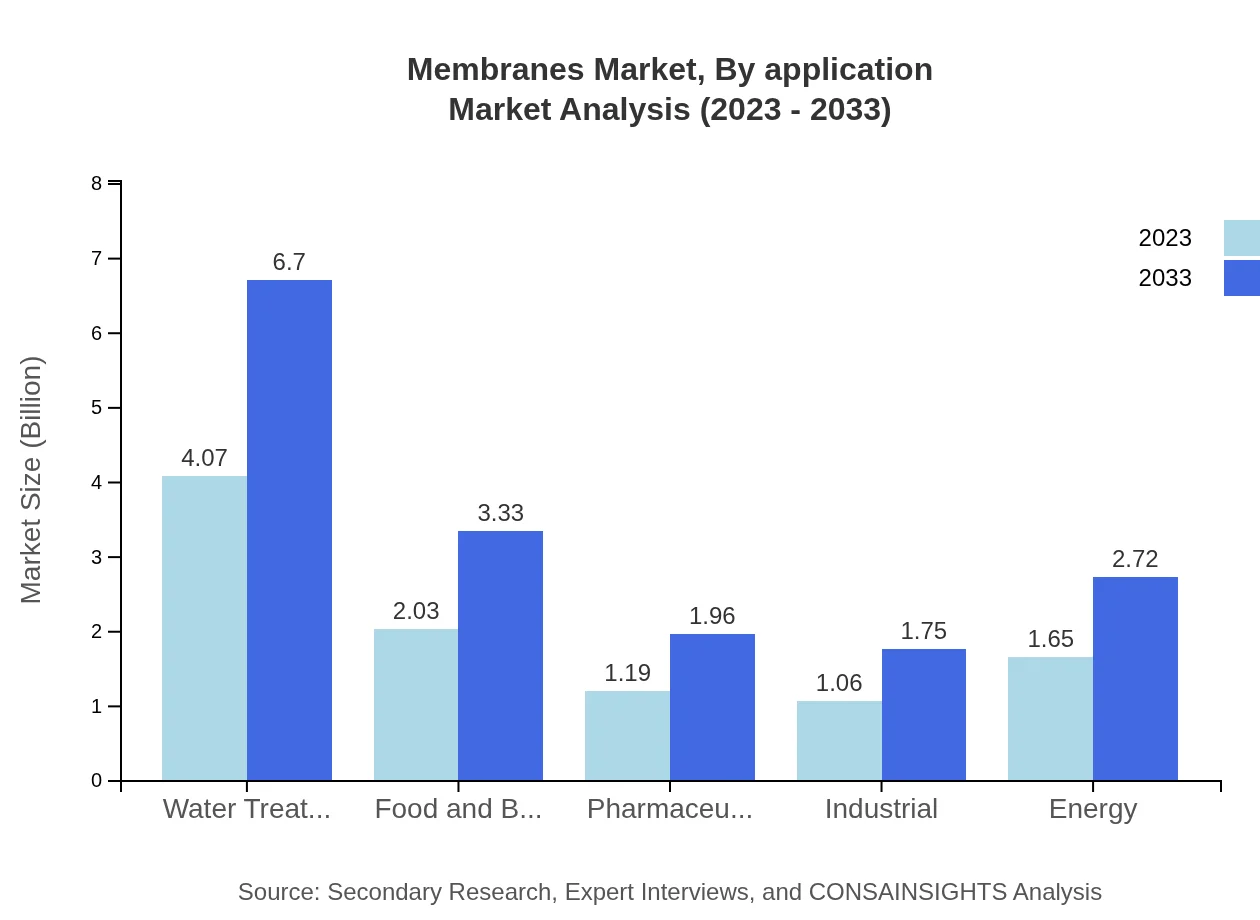

Membranes Market Analysis By Application

Applications of membranes are broad and include sectors like water treatment, food & beverage, pharmaceuticals, and industrial processes. Water treatment holds the largest market share, projected to grow significantly due to increasing pollution and stringent regulations. Food and beverage applications are also growing rapidly, driven by the need for better preservation methods. As industries evolve, the penetration of membranes within these applications continues to escalate.

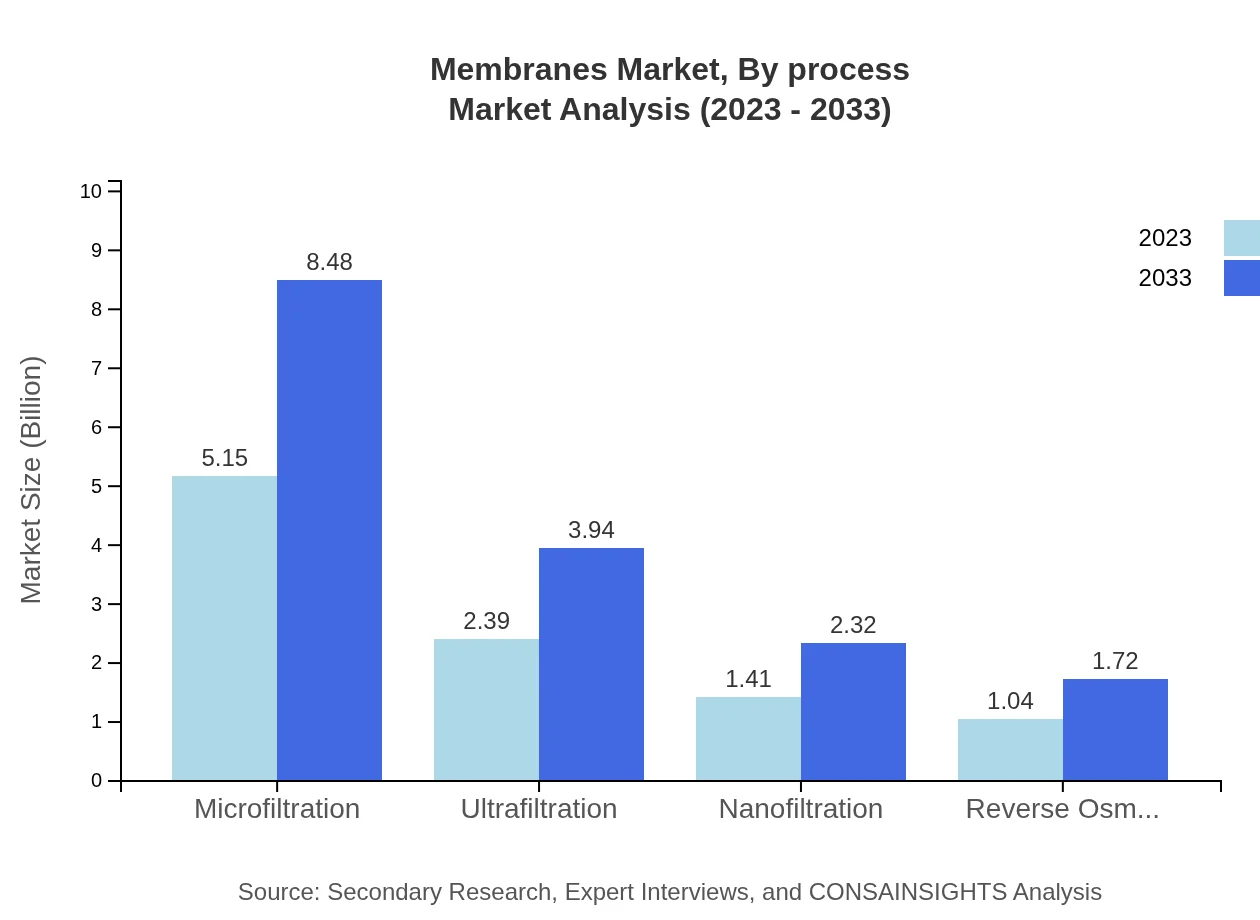

Membranes Market Analysis By Process

The membranes market product processes include microfiltration, ultrafiltration, nanofiltration, and reverse osmosis. Microfiltration holds the majority share and is primarily used in water treatment applications. Nanofiltration and reverse osmosis are also significant due to their effectiveness in separating smaller particles and salts. This process segmentation showcases technical advancements and the tailored approaches required for various applications.

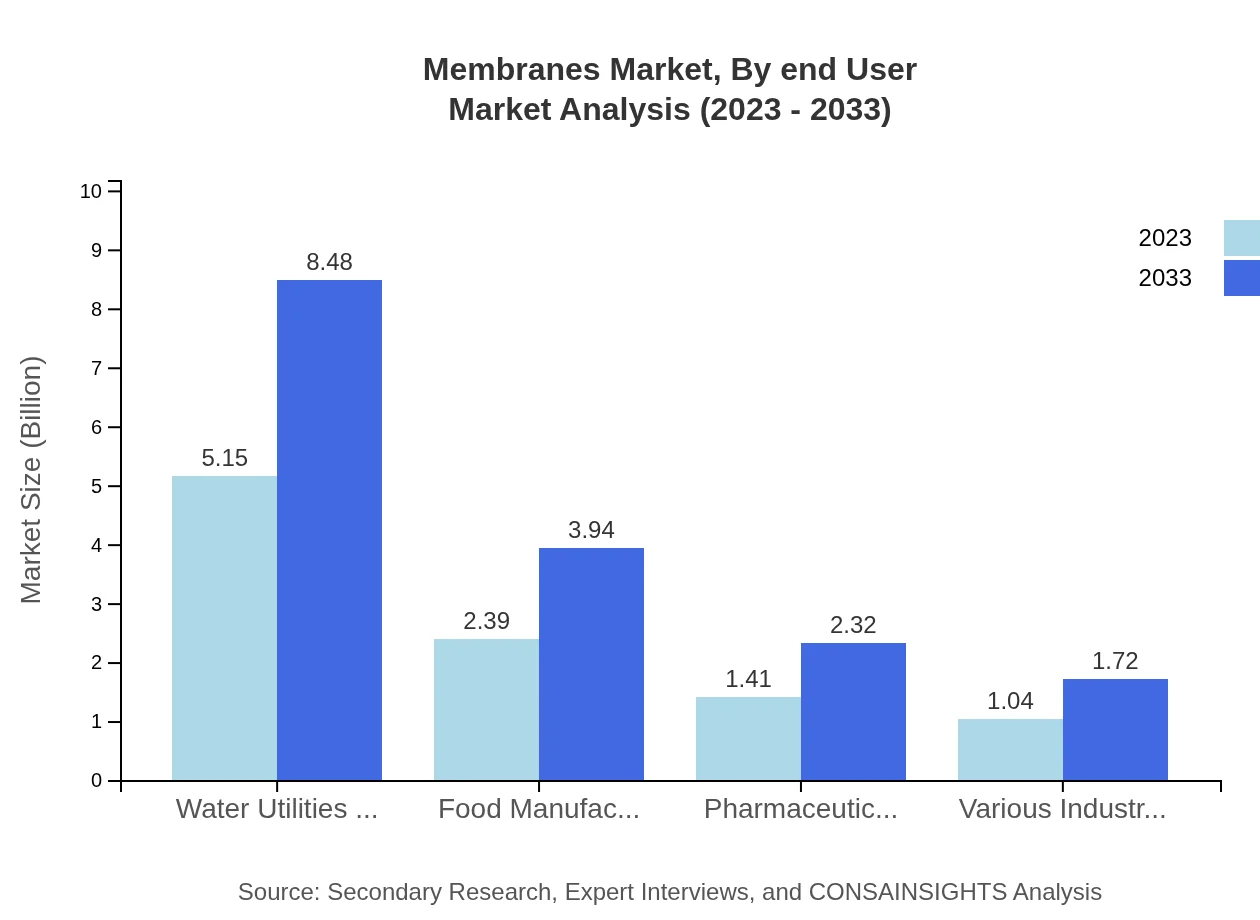

Membranes Market Analysis By End User

The primary end-users of membranes are water utilities and manufacturers, pharmaceuticals, food manufacturers, and various industrial sectors. Water utilities are projected to remain the largest consumers due to ongoing urbanization and the need for purified water. The pharmaceutical sector is also notable, growing with advances in production technologies requiring purification processes. As these industries evolve, the demand for specialized membranes will likely rise.

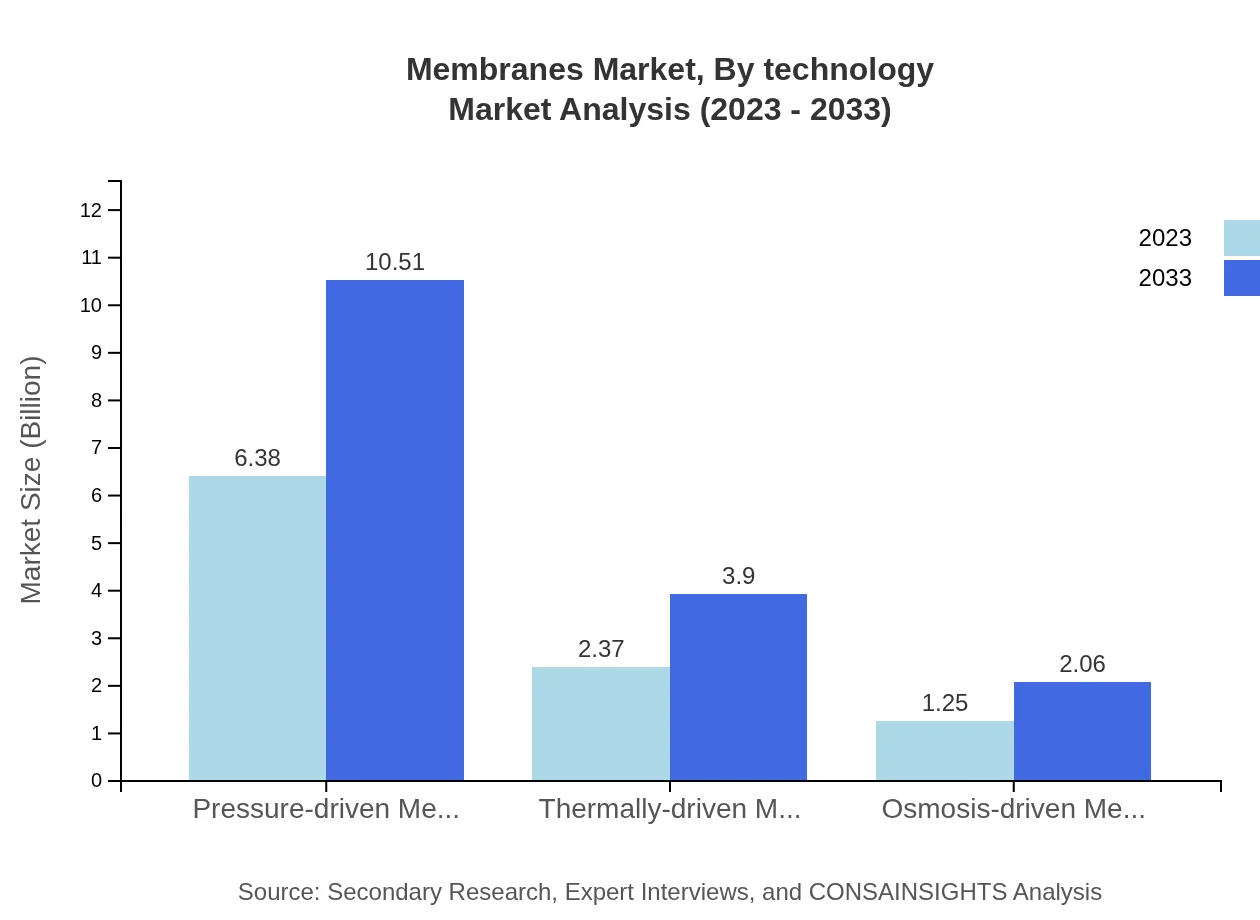

Membranes Market Analysis By Technology

Technological advancements are a major driver of the membranes market, influencing both efficiency and application range. Pressure-driven membrane technologies continue to lead with an expected market size of $10.51 billion by 2033, while thermally-driven and osmosis-driven technologies are increasingly adopted in specialized applications, improving overall efficiency and sustainability in various sectors.

Membranes Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Membranes Industry

Dow Chemical:

A leader in polymeric membranes, Dow provides advanced filtration solutions for various applications, including water purification and food processing.GE Water & Process Technologies:

Part of General Electric, this company specializes in water treatment solutions and membrane technologies aimed at enhancing process efficiency.Membrane Technology and Research, Inc.:

Focused on natural gas processing and CO2 removal, this company excels in membrane separation technologies.Xerium Technologies, Inc.:

Xerium specializes in the development of engineered membranes, particularly for industrial processes and paper manufacturing.Koch Membrane Systems:

A division of Koch Industries, this company markets a range of membrane technologies for municipal, industrial, and commercial applications.We're grateful to work with incredible clients.

FAQs

What is the market size of membranes?

The global membranes market is valued at approximately $10 billion in 2023, with a projected growth at a CAGR of 5% through 2033, indicating robust development and significant expansion opportunities in the sector.

What are the key market players or companies in the membranes industry?

The membranes industry features major players such as Dow Inc., 3M Company, and BASF SE, among others. These companies play a pivotal role in innovating and expanding the market, contributing significantly to advancements in membrane technology.

What are the primary factors driving the growth in the membranes industry?

Key factors driving growth include rising demand for water purification, advancements in nanotechnology, increased use in pharmaceutical applications, and growing environmental concerns necessitating effective filtration solutions across various sectors.

Which region is the fastest Growing in the membranes market?

Asia Pacific is currently the fastest-growing region in the membranes market, with its market size anticipated to increase from $1.99 billion in 2023 to $3.28 billion by 2033, driven by rapid industrialization and urbanization.

Does ConsaInsights provide customized market report data for the membranes industry?

Yes, ConsaInsights offers customized market reports tailored to specific client needs within the membranes industry, providing detailed insights and data analysis to support decision-making and strategic planning.

What deliverables can I expect from this membranes market research project?

Deliverables include comprehensive market analysis reports, trend assessments, competitive landscape evaluations, and data on segmented markets, covering insights into regional dynamics and growth forecasts for the membranes sector.

What are the market trends of membranes?

Current trends include increased adoption of energy-efficient membrane technologies, focus on sustainable materials, growing investments in water treatment, and innovation in applications such as food processing and pharmaceuticals.