Memory Packaging Market Report

Published Date: 31 January 2026 | Report Code: memory-packaging

Memory Packaging Market Size, Share, Industry Trends and Forecast to 2033

This report provides comprehensive insights into the Memory Packaging market, focusing on market trends, analysis by regions, and technological advancements. Forecasting from 2023 to 2033, we aim to shed light on current conditions and future expectations in this dynamic industry.

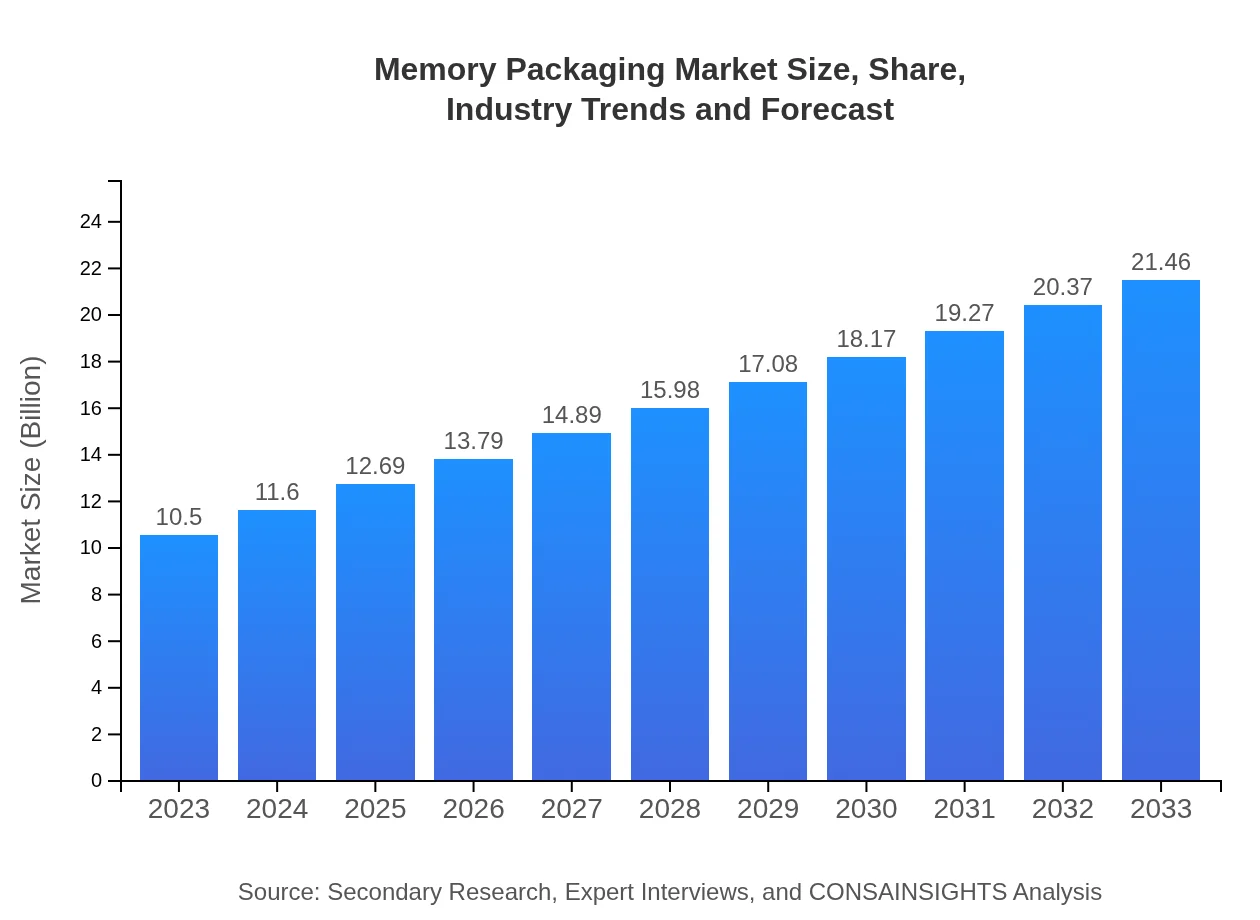

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $10.50 Billion |

| CAGR (2023-2033) | 7.2% |

| 2033 Market Size | $21.46 Billion |

| Top Companies | Intel Corporation, Samsung Electronics, Micron Technology, Texas Instruments, Taiwan Semiconductor Manufacturing Company (TSMC) |

| Last Modified Date | 31 January 2026 |

Memory Packaging Market Overview

Customize Memory Packaging Market Report market research report

- ✔ Get in-depth analysis of Memory Packaging market size, growth, and forecasts.

- ✔ Understand Memory Packaging's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Memory Packaging

What is the Market Size & CAGR of Memory Packaging market in 2023?

Memory Packaging Industry Analysis

Memory Packaging Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Memory Packaging Market Analysis Report by Region

Europe Memory Packaging Market Report:

Europe shows strong growth prospects as well, increasing from $2.91 billion in 2023 to $5.95 billion by 2033. The region benefits from a solid automotive and industrial sector, driving the demand for innovative memory solutions.Asia Pacific Memory Packaging Market Report:

The Asia Pacific region is a major player in the Memory Packaging market, projected to grow from a market size of $2.05 billion in 2023 to $4.18 billion by 2033. Key contributors include China, Japan, and South Korea, driven by their robust electronics manufacturing sectors and the increasing demand for advanced memory solutions.North America Memory Packaging Market Report:

The North American market is anticipated to expand from $3.97 billion in 2023 to an estimated $8.11 billion by 2033. The U.S. leads this growth with significant investments in technology and semiconductor innovations, fostering a favorable environment for memory packaging advancements.South America Memory Packaging Market Report:

In South America, the market shows potential growth from $0.58 billion in 2023 to approximately $1.19 billion by 2033, primarily fueled by rising technology adoption and an expanding telecommunications sector, introducing opportunities for enhanced memory packaging solutions.Middle East & Africa Memory Packaging Market Report:

The Middle East and Africa Memory Packaging market is expected to grow from $0.99 billion in 2023 to $2.03 billion by 2033, propelled by rising mobile device penetration and investments in ICT infrastructures.Tell us your focus area and get a customized research report.

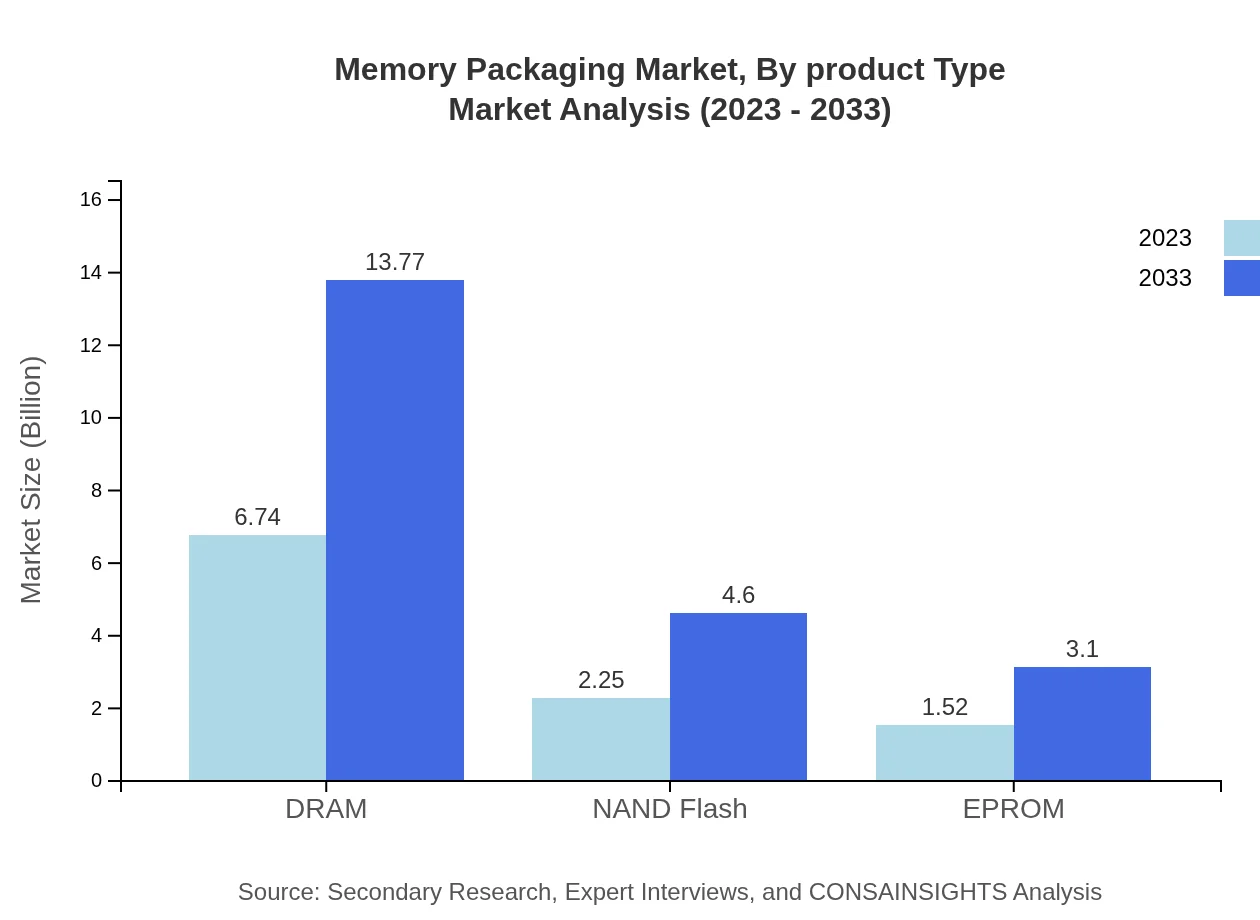

Memory Packaging Market Analysis By Product Type

In the Memory Packaging market, DRAM is expected to maintain a dominant position, growing from $6.74 billion (64.15% share) in 2023 to $13.77 billion (64.15% share) by 2033. NAND Flash also displays growth potential, evolving from $2.25 billion in 2023 to $4.60 billion by 2033.

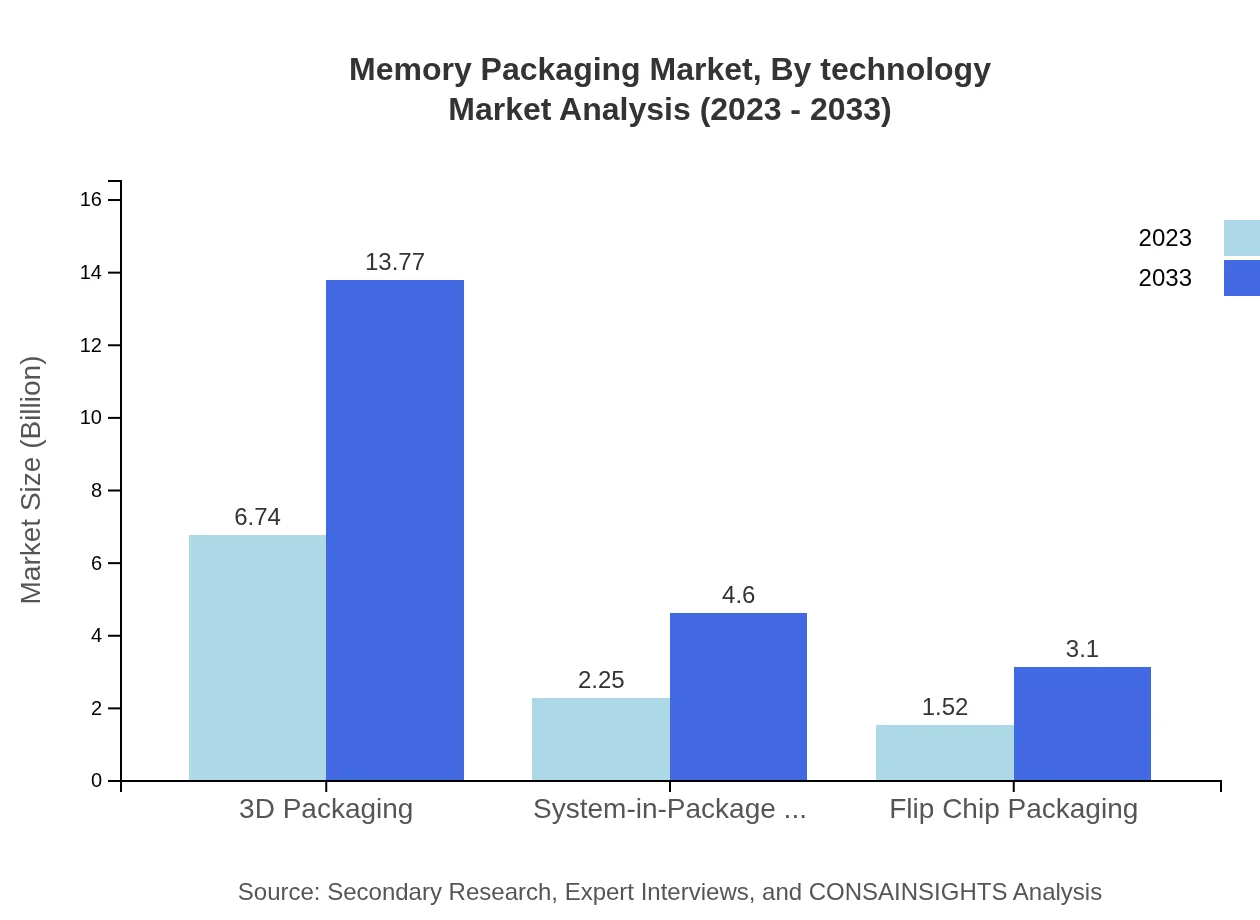

Memory Packaging Market Analysis By Technology

The market for 3D Packaging technology, currently at $6.74 billion (64.15% share) in 2023, is anticipated to reach $13.77 billion (64.15% share) in 2033. System-in-Package (SiP) will advance from $2.25 billion (21.41% share) in 2023 to $4.60 billion by 2033, demonstrating significant growth in diverse applications.

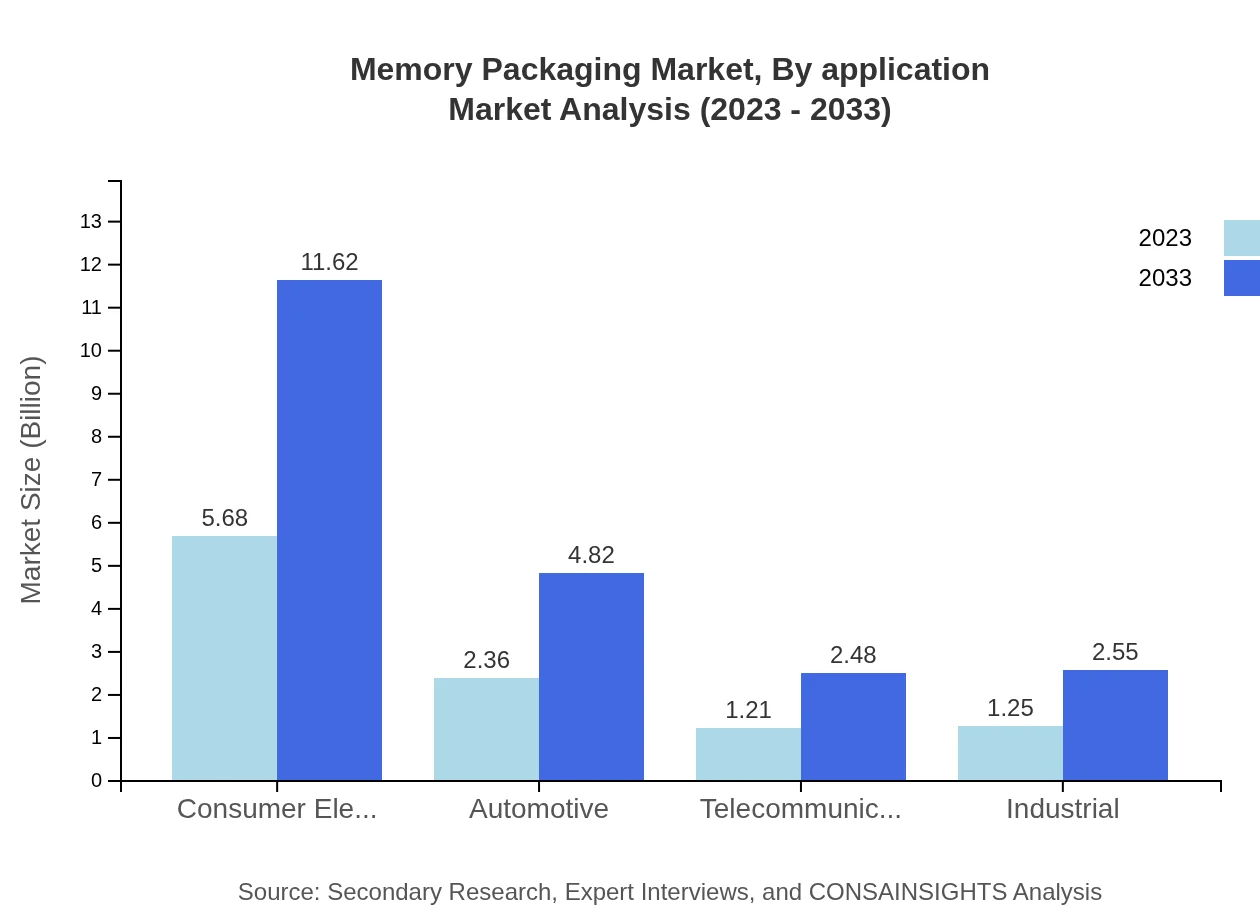

Memory Packaging Market Analysis By Application

The consumer electronics segment, currently accounting for $5.68 billion (54.12% share), is set to grow to $11.62 billion (54.12% share) by 2033. Telecommunications also make up $1.21 billion (11.55% share) in 2023, projected to rise to $2.48 billion by 2033.

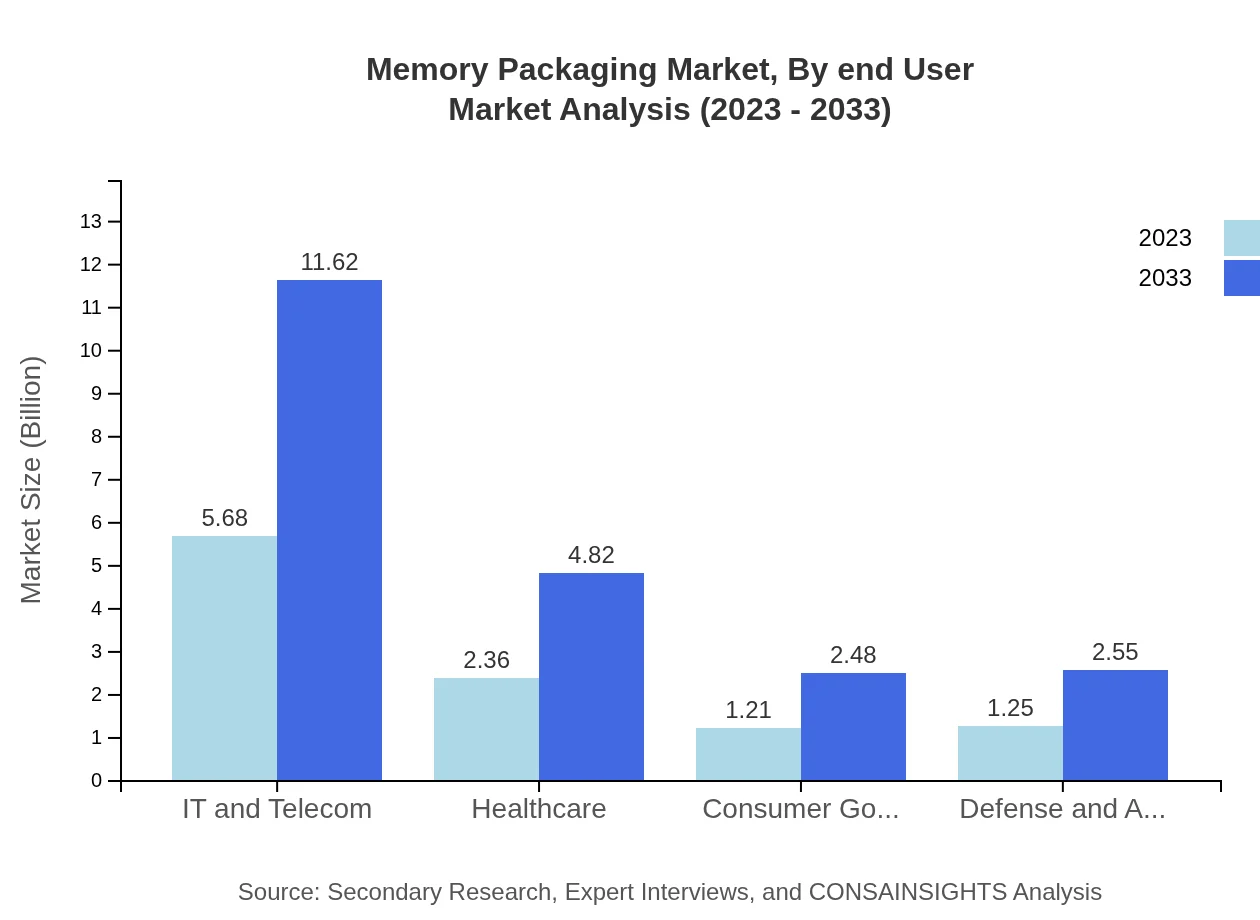

Memory Packaging Market Analysis By End User

The industrial sector, presently valued at $1.25 billion (11.88% share) in 2023, is expected to grow to $2.55 billion by 2033, reflecting the increasing integration of advanced memory solutions in industrial applications. Healthcare, with a market size of $2.36 billion (22.45% share) in 2023, is also projected to grow significantly.

Memory Packaging Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Memory Packaging Industry

Intel Corporation:

Intel is a leading player in the semiconductor and memory packaging industry, recognized for its innovative memory solutions and advanced manufacturing technologies.Samsung Electronics:

Samsung is a global leader in memory packaging, offering a wide array of products ranging from DRAM to NAND Flash memory, and is known for its robust research and development initiatives.Micron Technology:

Micron provides advanced memory packaging solutions and is focused on developing high-performance and energy-efficient memory products for various applications.Texas Instruments:

Texas Instruments is known for its semiconductor products, including memory packaging solutions, offering innovative designs catered to both consumer and industrial sectors.Taiwan Semiconductor Manufacturing Company (TSMC):

TSMC is a pioneer in the semiconductor manufacturing sector, specializing in advanced packaging technologies that enhance memory device performance.We're grateful to work with incredible clients.

FAQs

What is the market size of memory Packaging?

The global memory packaging market is currently sized at approximately $10.5 billion, with a projected CAGR of 7.2% from 2023 to 2033. This growth reflects increasing demand across various sectors such as IT, healthcare, and consumer electronics.

What are the key market players or companies in this memory Packaging industry?

Key players in the memory packaging industry include major semiconductor companies and packaging specialists who are focusing on advanced technologies to enhance performance and reduce costs. Exact names were not provided but typically include leading firms in the electronics sector.

What are the primary factors driving the growth in the memory Packaging industry?

Growth in the memory packaging industry is driven by advancements in technology, increasing demand for high-performance memory solutions, and the expanding market for consumer electronics, automotive applications, and IT infrastructure upgrades.

Which region is the fastest Growing in the memory Packaging?

North America is identified as the fastest-growing region in the memory packaging market, expected to grow from $3.97 billion in 2023 to $8.11 billion by 2033, reflecting strong demand from technology and telecommunications sectors.

Does ConsaInsights provide customized market report data for the memory Packaging industry?

Yes, ConsaInsights offers customized market report data tailored to specific client needs in the memory packaging industry, ensuring businesses receive insights that align with their strategic goals and market demands.

What deliverables can I expect from this memory Packaging market research project?

From a memory-packaging market research project, you can expect comprehensive reports detailing market size, growth trends, competitor analyses, and regional insights, along with graphical representations and strategic recommendations.

What are the market trends of memory packaging?

Key trends in the memory packaging market include increasing adoption of 3D packaging technologies, rising integration of memory solutions in IoT devices, and a shift towards environmentally sustainable packaging solutions, enhancing product longevity and performance.