Mems Automobile Sensors Market Report

Published Date: 31 January 2026 | Report Code: mems-automobile-sensors

Mems Automobile Sensors Market Size, Share, Industry Trends and Forecast to 2033

This report offers a comprehensive overview of the MEMS Automobile Sensors market, covering key trends, market size, technology advancements, and regional insights from 2023 to 2033.

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

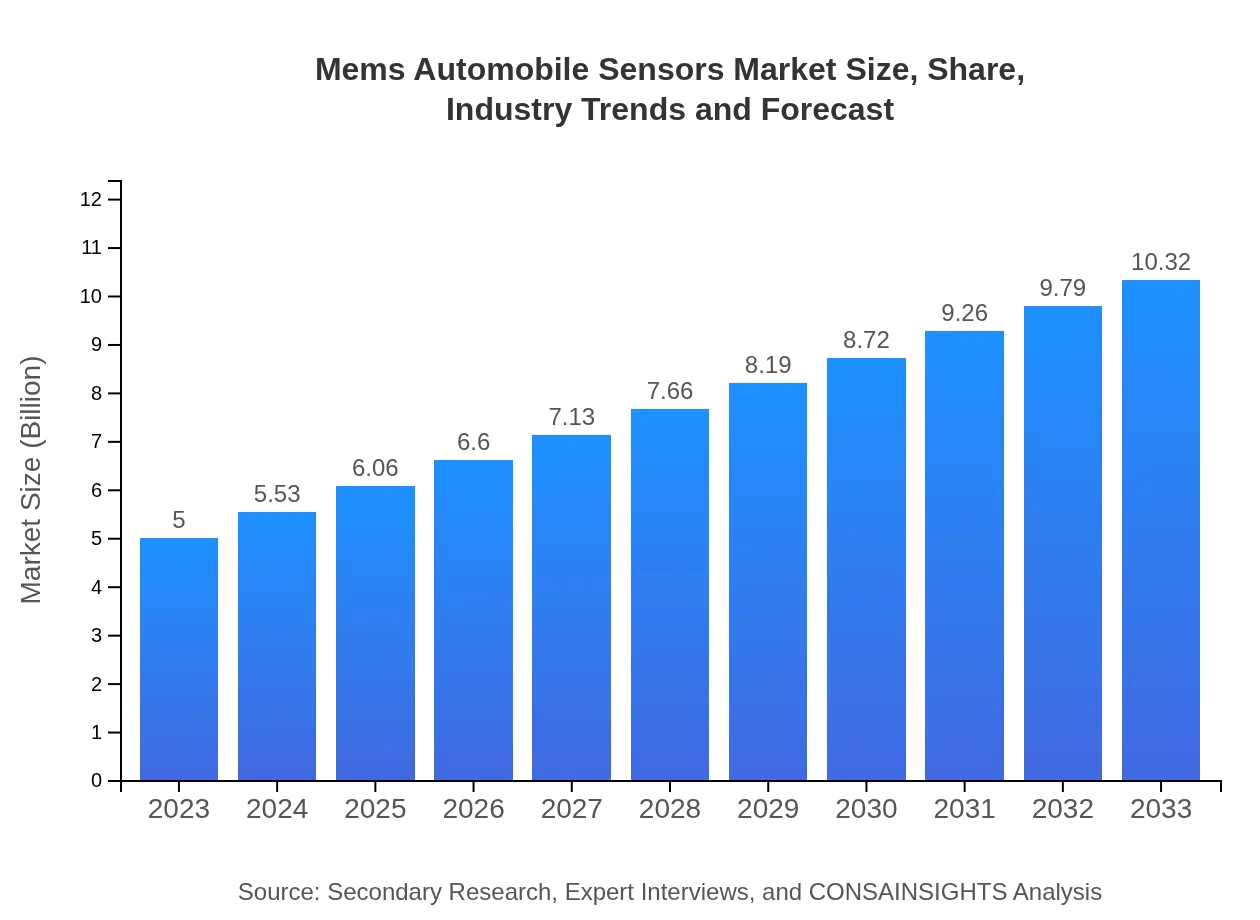

| 2023 Market Size | $5.00 Billion |

| CAGR (2023-2033) | 7.3% |

| 2033 Market Size | $10.32 Billion |

| Top Companies | Bosch Sensortec, STMicroelectronics, Analog Devices, Texas Instruments |

| Last Modified Date | 31 January 2026 |

Mems Automobile Sensors Market Overview

Customize Mems Automobile Sensors Market Report market research report

- ✔ Get in-depth analysis of Mems Automobile Sensors market size, growth, and forecasts.

- ✔ Understand Mems Automobile Sensors's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Mems Automobile Sensors

What is the Market Size & CAGR of Mems Automobile Sensors market in 2033?

Mems Automobile Sensors Industry Analysis

Mems Automobile Sensors Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Mems Automobile Sensors Market Analysis Report by Region

Europe Mems Automobile Sensors Market Report:

Europe's MEMS Automobile Sensors market was valued at $1.55 billion in 2023 and is expected to reach $3.19 billion by 2033. The presence of major automotive manufacturers and an emphasis on vehicle safety and emissions controls drive the regional growth.Asia Pacific Mems Automobile Sensors Market Report:

The Asia-Pacific region accounted for a market size of $1.02 billion in 2023, projected to grow to $2.10 billion by 2033. This growth can be attributed to the booming automotive industry in countries like China and Japan, along with the increasing deployment of ADAS technologies.North America Mems Automobile Sensors Market Report:

North America experienced a market size of $1.67 billion in 2023, forecasted to grow to $3.44 billion by 2033. The USA's stringent safety regulations and a higher adoption of technology-intensive vehicles bolster this market's growth.South America Mems Automobile Sensors Market Report:

In South America, the MEMS Automobile Sensors market is valued at $0.28 billion in 2023, anticipated to reach $0.57 billion by 2033. Growth in this region is driven by increasing automotive production and a gradual shift towards adopting advanced vehicle technologies.Middle East & Africa Mems Automobile Sensors Market Report:

In the Middle East and Africa, the market size in 2023 was $0.49 billion, projected to grow to $1.01 billion by 2033. Growing urbanization and increasing investments in infrastructure development contribute to the rising demand for automobiles equipped with advanced sensor technologies.Tell us your focus area and get a customized research report.

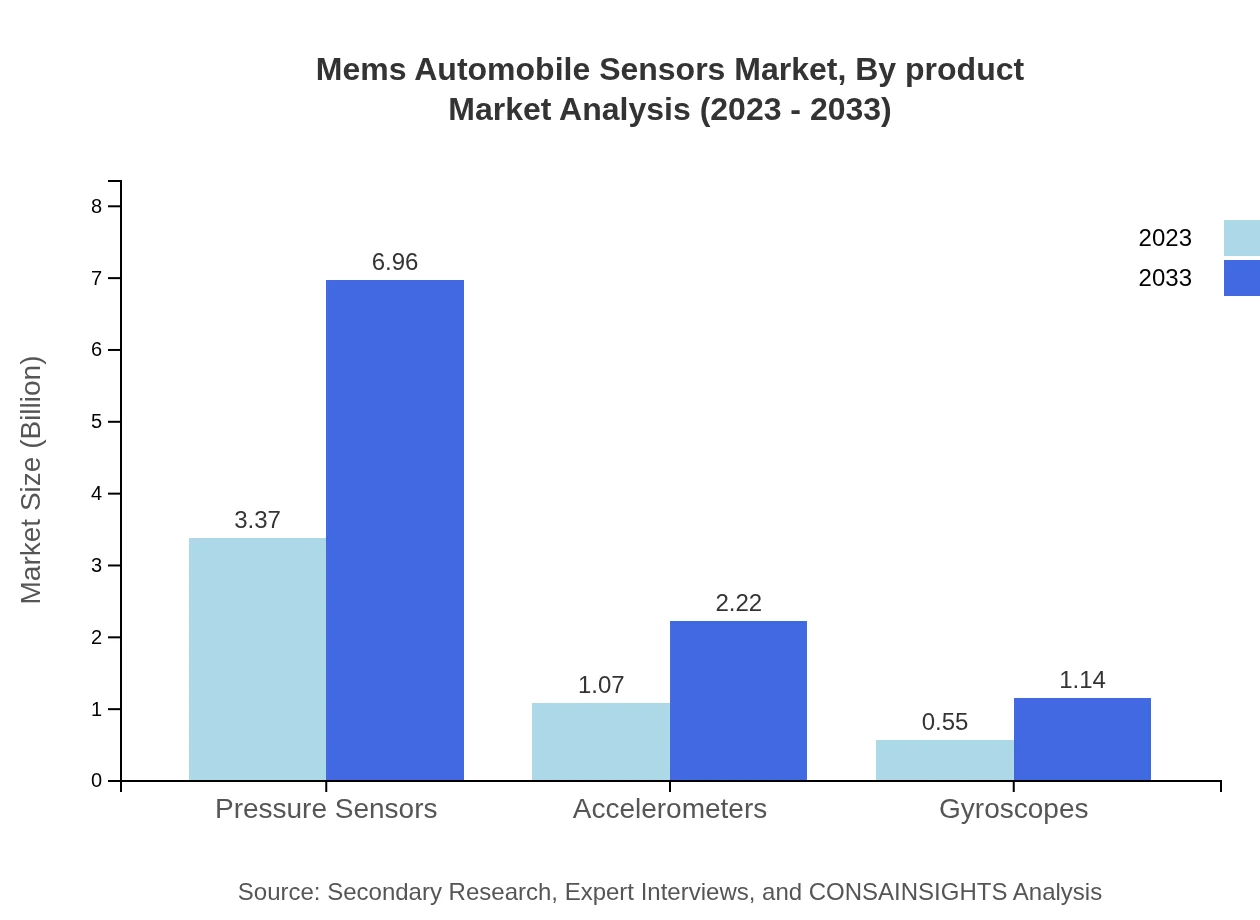

Mems Automobile Sensors Market Analysis By Product

In 2023, the pressure sensors segment leads the MEMS market with a size of $3.37 billion, expected to grow to $6.96 billion by 2033, holding a consistent market share of 67.47%. Accelerometers follow with a market size of $1.07 billion, projected to expand to $2.22 billion, representing 21.48% market share. Gyroscopes, although smaller, are also significant, with an anticipated growth from $0.55 billion to $1.14 billion.

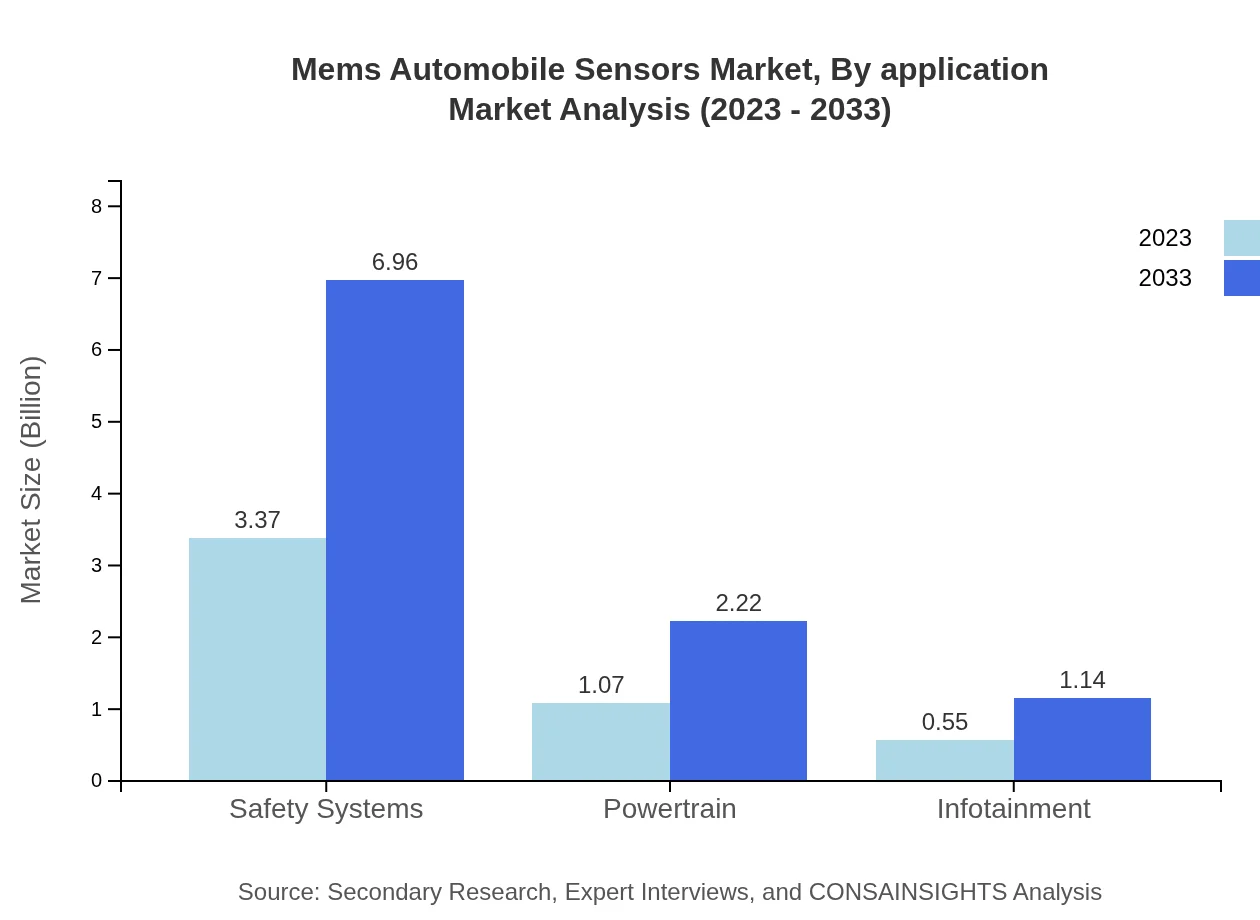

Mems Automobile Sensors Market Analysis By Application

The applications of MEMS sensors in automotive fall into categories like Safety Systems ($3.37 billion in 2023, projected to grow to $6.96 billion), Powertrain ($1.07 billion to $2.22 billion), and Infotainment ($0.55 billion to $1.14 billion) by 2033, driven by safety regulations and consumer demand for advanced features.

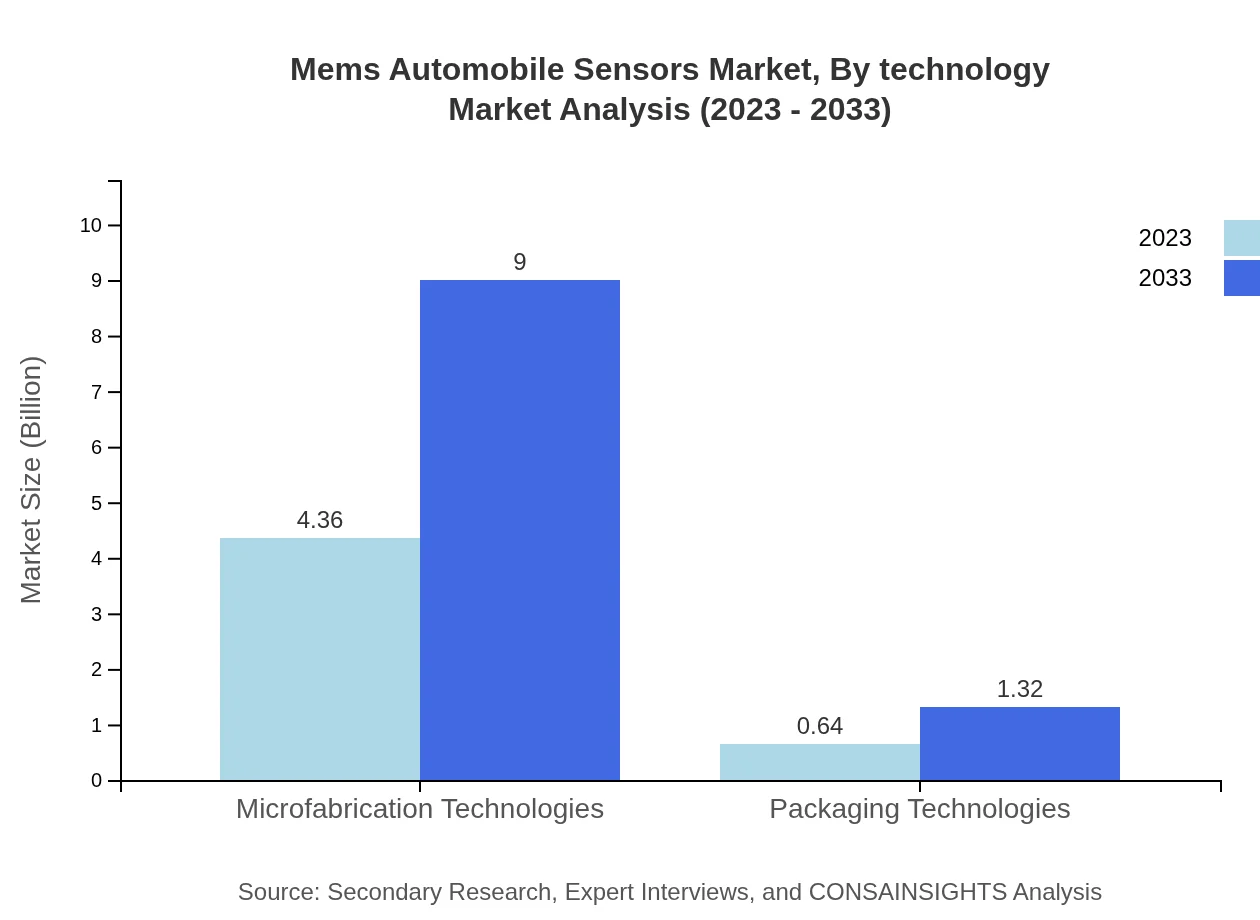

Mems Automobile Sensors Market Analysis By Technology

Technologies such as Microfabrication are dominating the MEMS Automobile Sensors market, valued at $4.36 billion in 2023, with a projected increase to $9.00 billion by 2033, while Packaging Technologies grow from $0.64 billion to $1.32 billion by 2033.

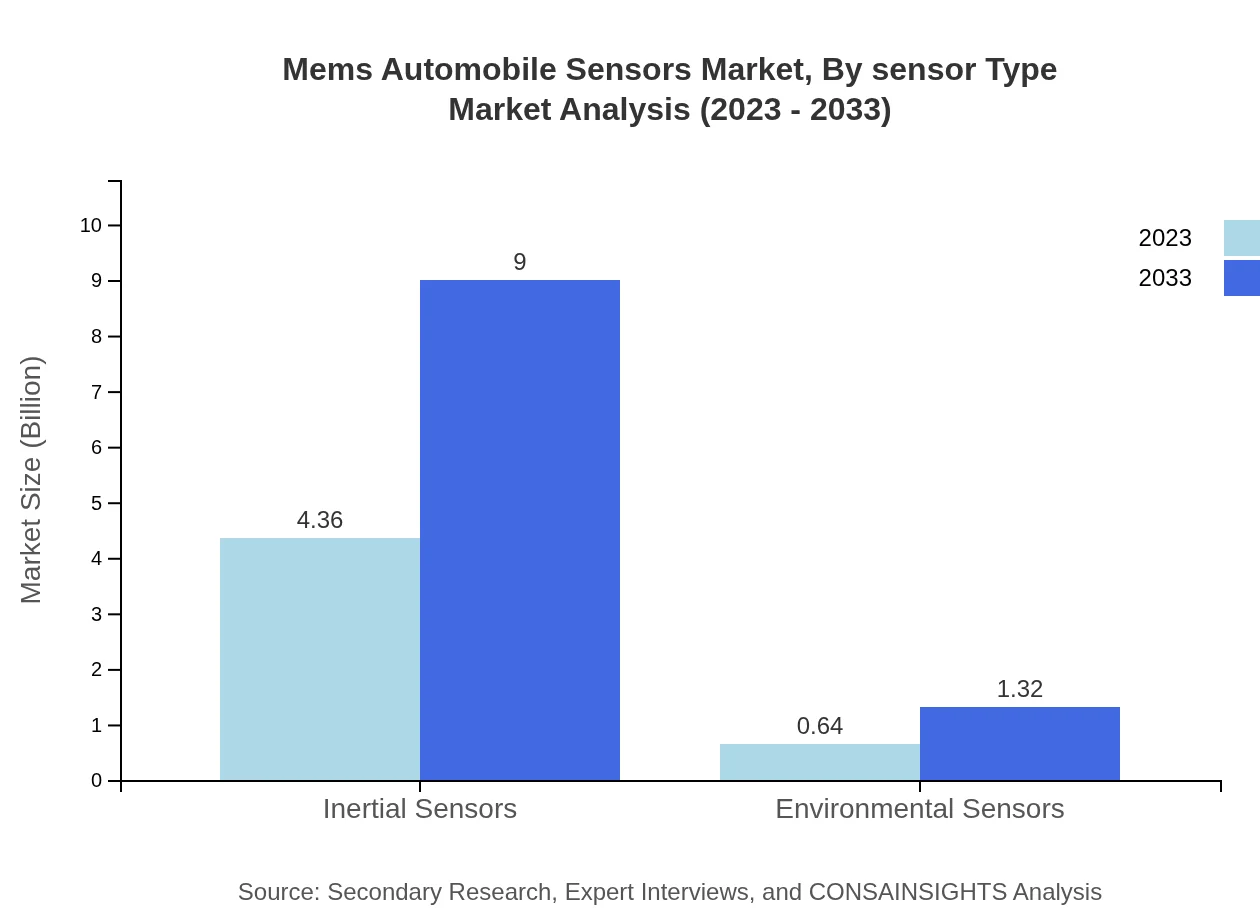

Mems Automobile Sensors Market Analysis By Sensor Type

Inertial sensors and Environmental sensors play critical roles, with Inertial sensors at $4.36 billion growing to $9.00 billion by 2033 and Environmental sensors increasing from $0.64 billion to $1.32 billion.

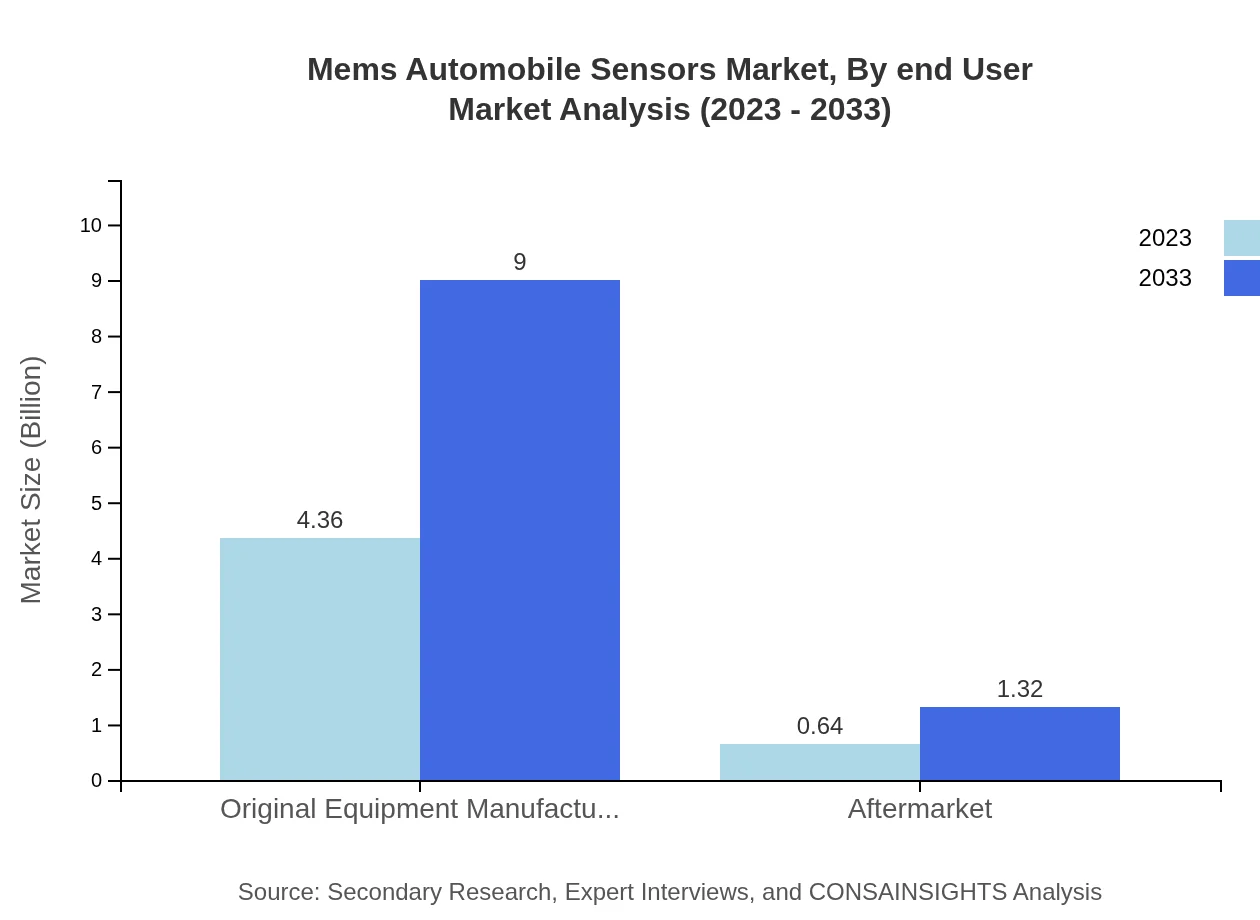

Mems Automobile Sensors Market Analysis By End User

The market performance by end-users shows OEMs dominating at $4.36 billion to $9.00 billion by 2033, while aftermarket segments, although smaller at $0.64 billion now, are projected to grow to $1.32 billion.

Mems Automobile Sensors Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Mems Automobile Sensors Industry

Bosch Sensortec:

A leading provider of MEMS sensors and automotive solutions, Bosch Sensortec focuses on innovative high-performance automotive sensors for ADAS applications.STMicroelectronics:

This technology company specializes in embedded microelectronics and MEMS sensors, contributing significantly to vehicle safety and efficiency.Analog Devices:

Analog Devices is known for its high-performance MEMS sensors that are widely used in automotive applications, providing reliable solutions for sensor technology.Texas Instruments:

They offer a broad range of MEMS sensors with applications in automotive electronics, enhancing vehicle performance and safety.We're grateful to work with incredible clients.

FAQs

What is the market size of mems Automobile Sensors?

The global MEMS automobile sensors market is currently valued at approximately $5 billion, with a projected compound annual growth rate (CAGR) of 7.3% through 2033, indicating significant growth opportunities in the sector.

What are the key market players or companies in this mems Automobile Sensors industry?

Key market players in the MEMS automobile sensors industry include established companies like Bosch, STMicroelectronics, and Honeywell. These companies are leading the development and innovation in MEMS technologies for automotive applications, contributing to evolving sensor capabilities.

What are the primary factors driving the growth in the mems Automobile Sensors industry?

Primary growth factors in the MEMS automobile sensors industry include advancing automotive technologies, increasing demand for safety and autonomous driving features, and the integration of smart sensors in vehicles. This trend is fueled by consumer preferences for enhanced safety and efficiency.

Which region is the fastest Growing in the mems Automobile Sensors?

The Asia Pacific region is the fastest-growing in the MEMS automobile sensors market, with a market size projected to rise from $1.02 billion in 2023 to $2.10 billion by 2033, driven by increasing automotive production and technological advancements.

Does ConsaInsights provide customized market report data for the mems Automobile Sensors industry?

Yes, ConsaInsights offers customized market report data for the MEMS automobile sensors industry. Clients can request tailored insights that align with specific needs, enhancing the strategic decision-making process.

What deliverables can I expect from this mems Automobile Sensors market research project?

From this MEMS automobile sensors market research project, clients can expect comprehensive reports detailing market size, growth forecasts, competitive landscapes, segment analysis, and strategic recommendations for market entry or expansion.

What are the market trends of mems Automobile Sensors?

Current market trends in the MEMS automobile sensors industry include increased automation in vehicles, a focus on environmental sustainability, and the rise of connected car technologies, which enhance vehicle functionality and user experience.