Mems For Mobile Devices Market Report

Published Date: 31 January 2026 | Report Code: mems-for-mobile-devices

Mems For Mobile Devices Market Size, Share, Industry Trends and Forecast to 2033

This report provides a detailed market analysis of MEMS for Mobile Devices from 2023 to 2033, comprising insights into market size, trends, segments, regional analysis, global leaders, and future forecasts.

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

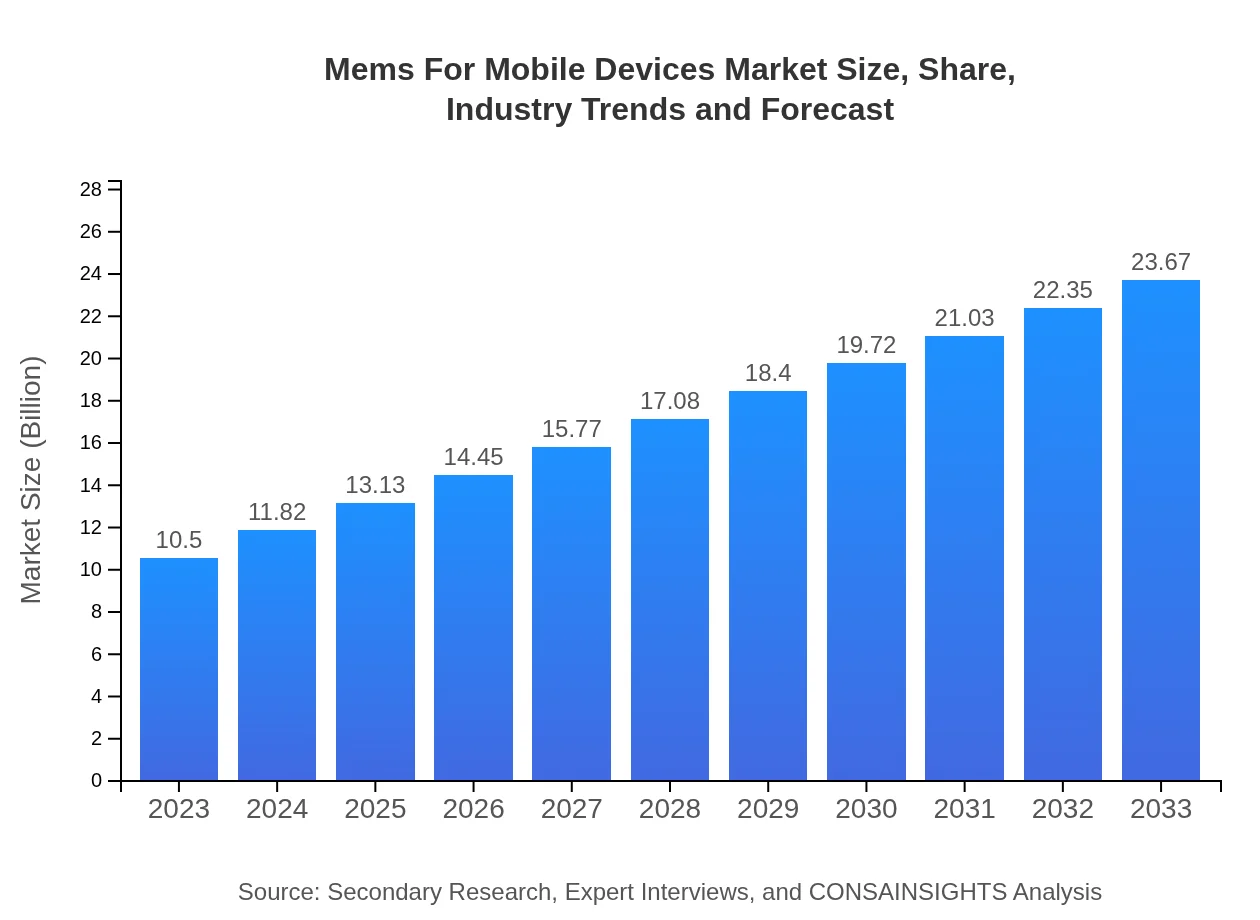

| 2023 Market Size | $10.50 Billion |

| CAGR (2023-2033) | 8.2% |

| 2033 Market Size | $23.67 Billion |

| Top Companies | Bosch Sensortec, STMicroelectronics, Analog Devices, Texas Instruments |

| Last Modified Date | 31 January 2026 |

MEMS For Mobile Devices Market Overview

Customize Mems For Mobile Devices Market Report market research report

- ✔ Get in-depth analysis of Mems For Mobile Devices market size, growth, and forecasts.

- ✔ Understand Mems For Mobile Devices's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Mems For Mobile Devices

What is the Market Size & CAGR of MEMS For Mobile Devices market in 2023?

MEMS For Mobile Devices Industry Analysis

MEMS For Mobile Devices Market Segmentation and Scope

Tell us your focus area and get a customized research report.

MEMS For Mobile Devices Market Analysis Report by Region

Europe Mems For Mobile Devices Market Report:

The European MEMS market for mobile devices is set to see an increase from $3.26 billion in 2023 to $7.35 billion by 2033. The region is focusing on smart device manufacturing and IoT integration, supported by the presence of major electronics manufacturers.Asia Pacific Mems For Mobile Devices Market Report:

In 2023, the MEMS market in the Asia-Pacific region is projected to be valued at $1.96 billion, growing to $4.42 billion by 2033. The rapid expansion of the consumer electronics industry in countries like China, India, and Japan is a significant growth driver, along with the increasing demand for smartphones and IoT devices.North America Mems For Mobile Devices Market Report:

North America shows robust growth in the MEMS market, anticipated to increase from $4.04 billion in 2023 to $9.10 billion by 2033. This growth is driven by technological innovation, a strong consumer base for high-tech products, and significant investments in R&D in the region.South America Mems For Mobile Devices Market Report:

The South American market for MEMS in mobile devices is expected to grow from $0.36 billion in 2023 to $0.81 billion by 2033. Factors contributing to this growth include rising disposable incomes and the growing adoption of smart technology products across South American countries.Middle East & Africa Mems For Mobile Devices Market Report:

In the Middle East and Africa, the MEMS market is projected to grow from $0.88 billion in 2023 to $1.99 billion by 2033. Rising investments in smart infrastructure and growing mobile penetration are key factors in this region's growth trajectory.Tell us your focus area and get a customized research report.

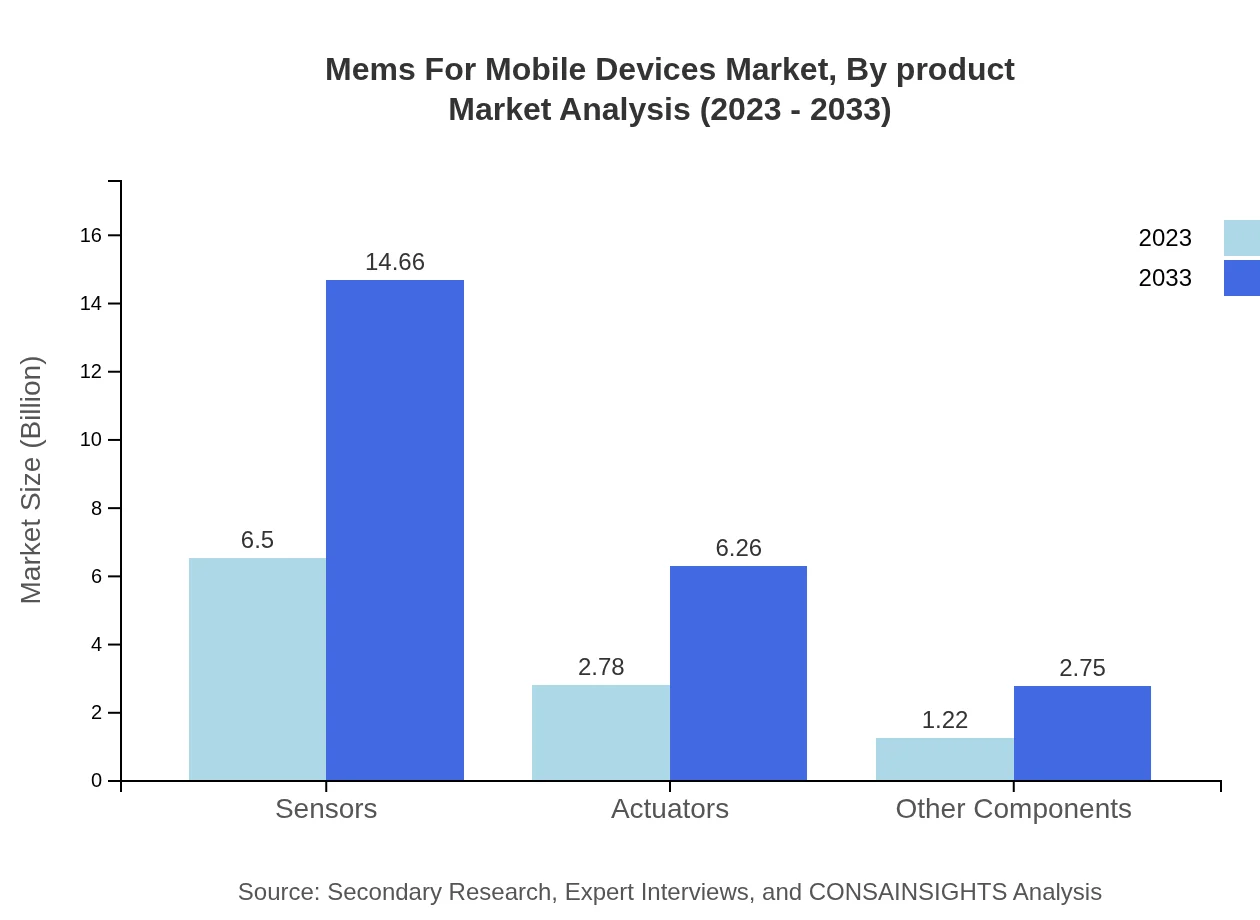

Mems For Mobile Devices Market Analysis By Product

The MEMS for Mobile Devices market is primarily segmented into sensors, actuators, and other components. As of 2023, sensors dominate the market with a size of $6.50 billion and a share of 61.93%. The market is expected to grow to $14.66 billion by 2033. Actuators also show significant growth, with an increase from $2.78 billion to $6.26 billion, maintaining a stable share of 26.46% over the forecast period.

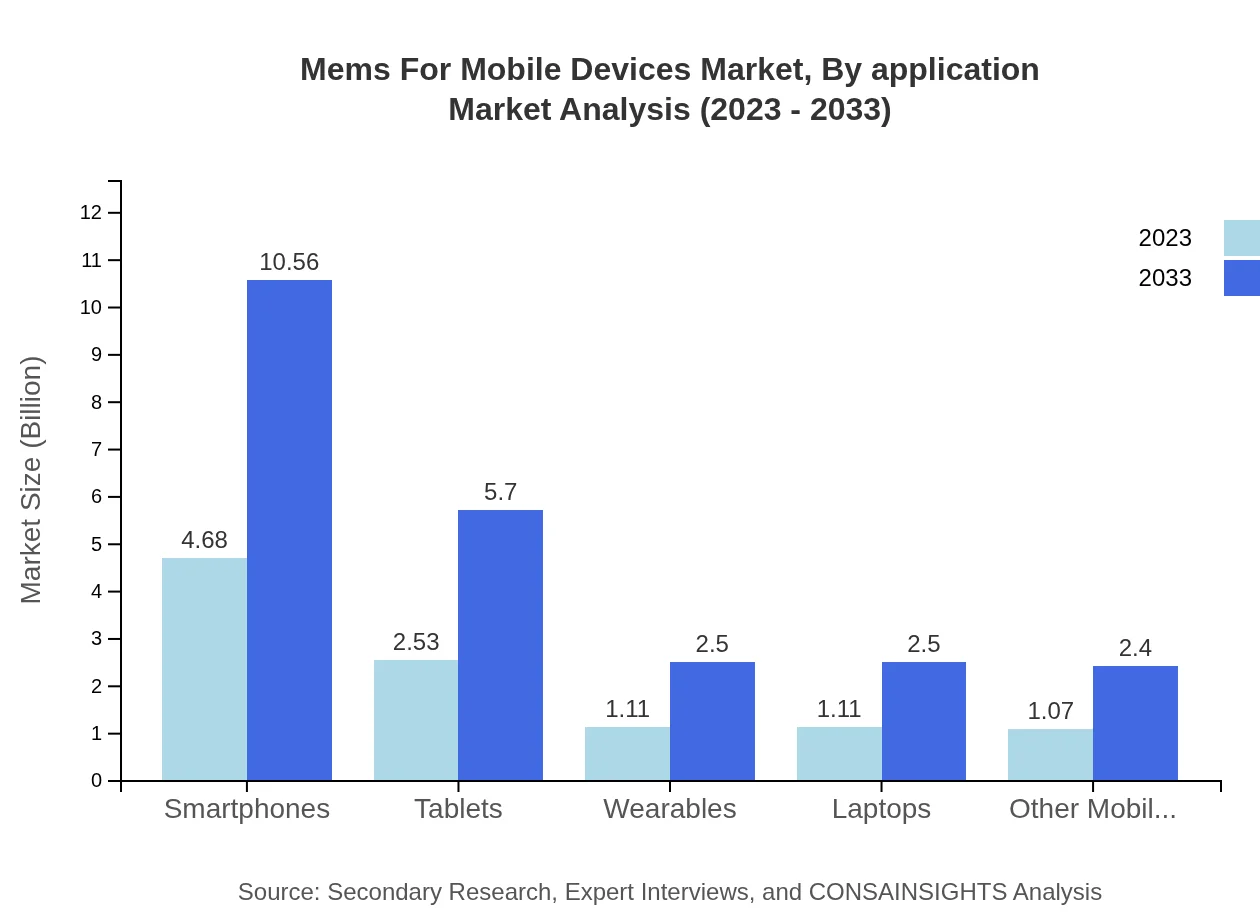

Mems For Mobile Devices Market Analysis By Application

Key applications of MEMS in mobile devices include smartphones, tablets, wearables, laptops, and other mobile devices. In 2023, the smartphone segment leads with a market size of $4.68 billion, comprising 44.61% of the market share, growing to $10.56 billion by 2033. Tablets follow with a size of $2.53 billion (24.08% share), while wearables, laptops, and other mobile devices collectively support the market's diverse application landscape.

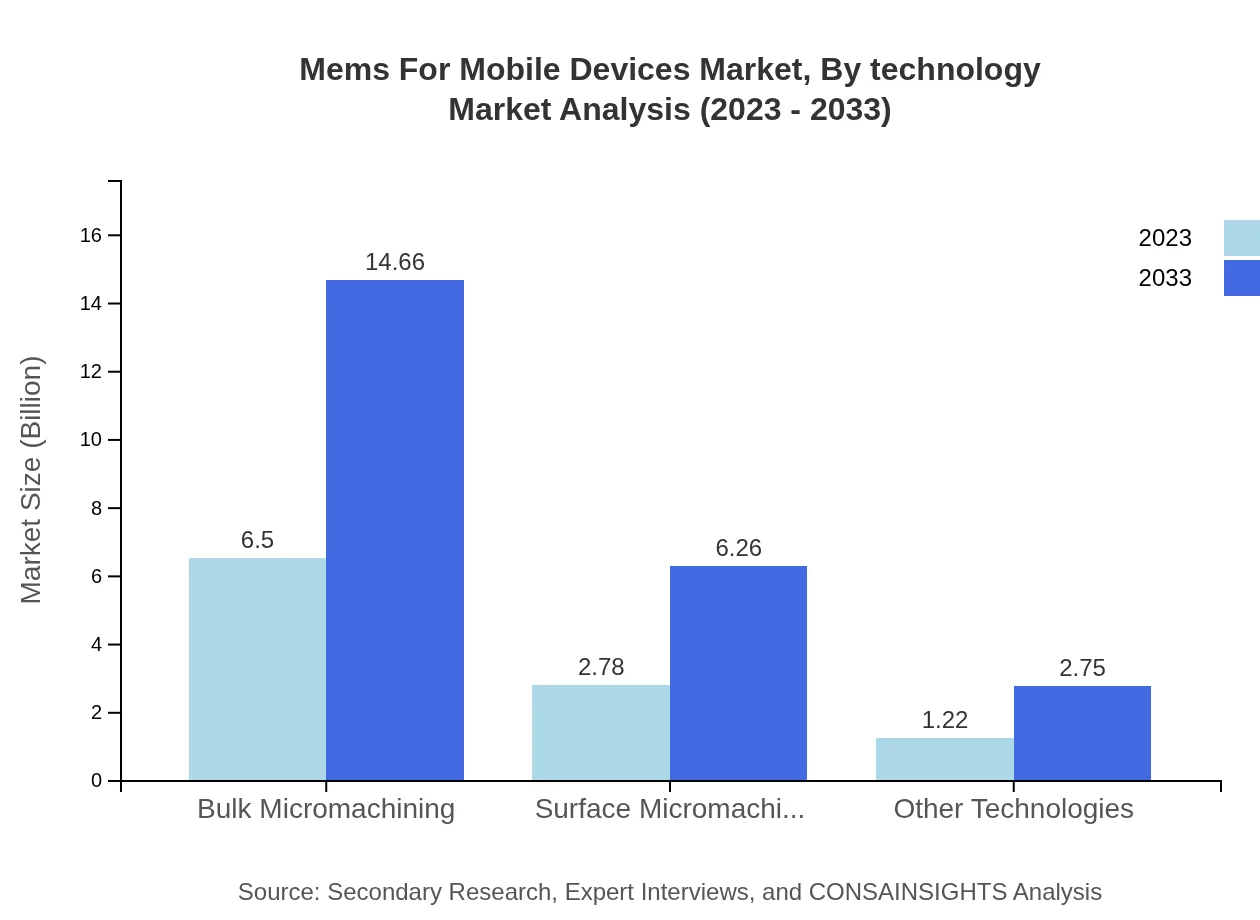

Mems For Mobile Devices Market Analysis By Technology

The technologies utilized in MEMS for mobile devices include bulk micromachining, surface micromachining, and others. Bulk micromachining worked up $6.50 billion in 2023, commanding a share of 61.93%, and is expected to reach $14.66 billion by 2033. Surface micromachining, maintaining a 26.46% share with a size of $2.78 billion in 2023, is expected to grow to $6.26 billion over the forecast period. Other technologies currently contribute $1.22 billion and are projected to reach $2.75 billion by 2033.

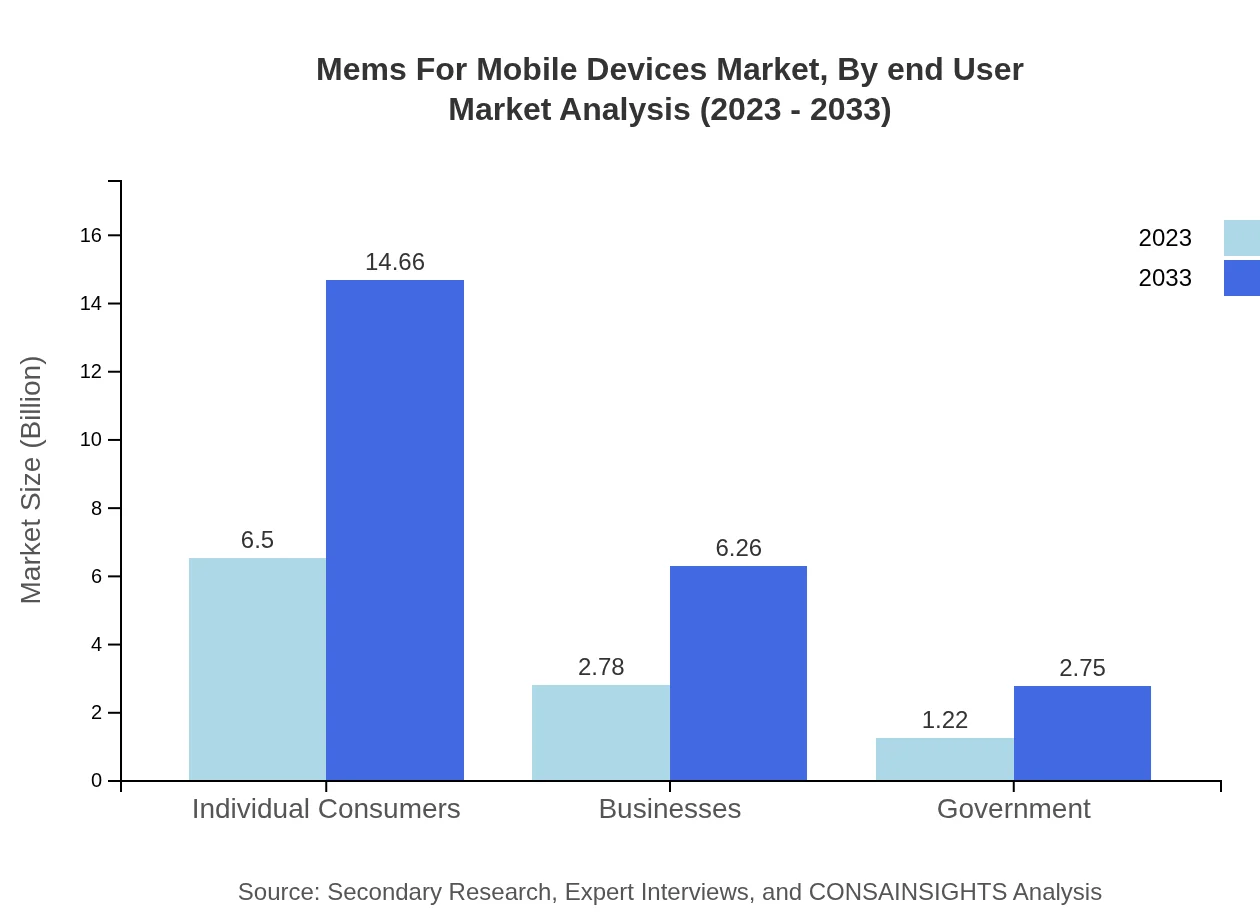

Mems For Mobile Devices Market Analysis By End User

The primary end-users of MEMS devices include individual consumers, businesses, and government entities. Individual consumers hold the largest share with a market size of $6.50 billion (61.93%) in 2023, projected to reach $14.66 billion by 2033. Businesses account for a market size of $2.78 billion (26.46% share), while government use contributes $1.22 billion (11.61%) and is expected to grow proportionally in the next decade.

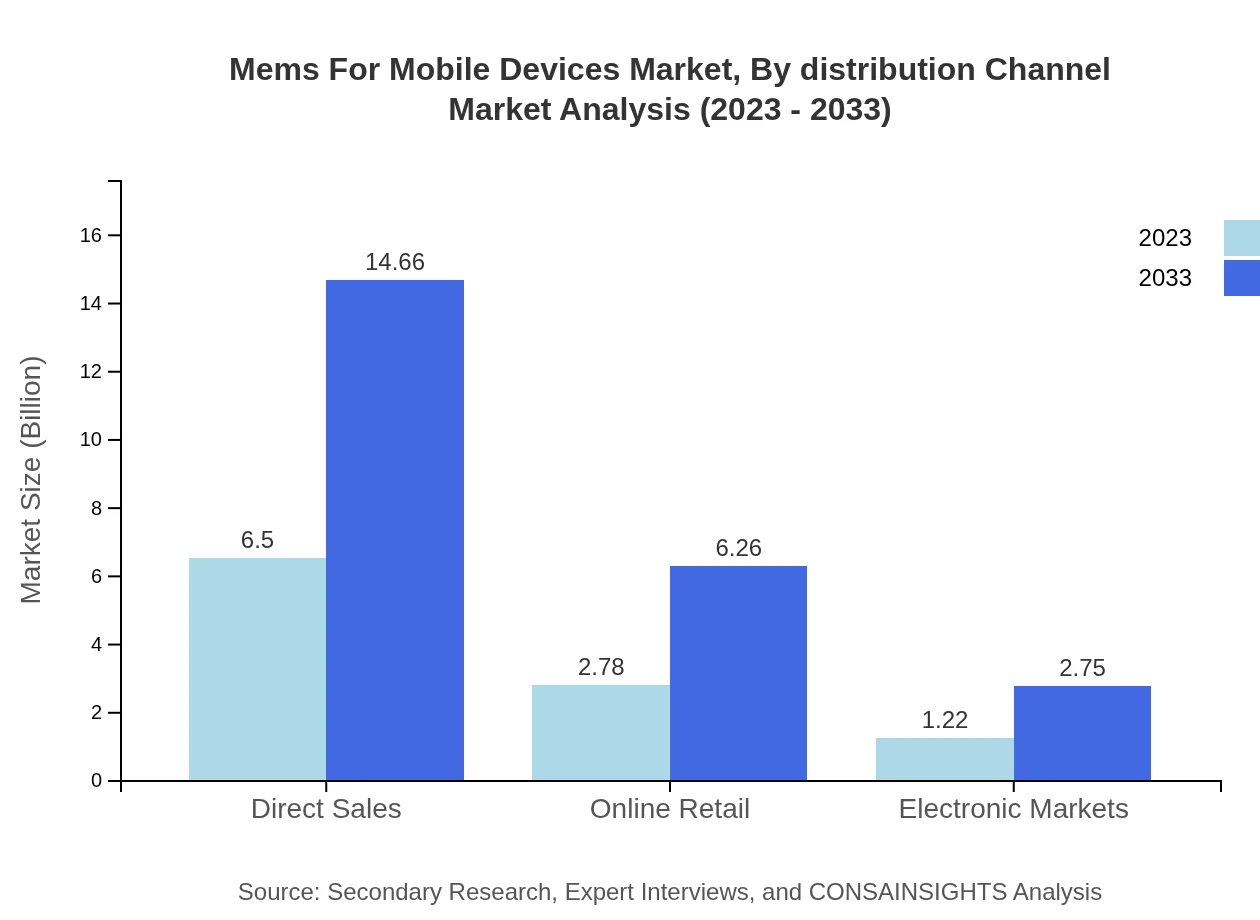

Mems For Mobile Devices Market Analysis By Distribution Channel

The distribution channels for MEMS include direct sales, online retail, and electronic markets. Direct sales are the leading channel with a size of $6.50 billion (61.93%) in 2023, set to expand to $14.66 billion by 2033. Online retail channels also show significant growth, moving from $2.78 billion to $6.26 billion, while electronic markets will grow from $1.22 billion to $2.75 billion, collectively enhancing the market penetration of MEMS devices.

MEMS For Mobile Devices Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in MEMS For Mobile Devices Industry

Bosch Sensortec:

A leader in MEMS sensor development, Bosch Sensortec specializes in sensor applications for mobile devices, with a significant focus on power efficiency and miniaturization.STMicroelectronics:

STMicroelectronics is recognized for its innovative MEMS solutions across various consumer electronic devices, providing cutting-edge technologies for smartphones and wearables.Analog Devices:

Analog Devices is a key player in the MEMS market, offering a wide range of MEMS-based sensors and actuators for applications across mobile and industrial sectors.Texas Instruments:

Texas Instruments is pivotal in developing MEMS technologies, particularly in the automotive and consumer electronics sectors, ensuring quality and precision in device applications.We're grateful to work with incredible clients.

FAQs

What is the market size of MEMS for Mobile Devices?

The MEMS for Mobile Devices market is valued at approximately 10.5 billion in 2023, with a projected CAGR of 8.2%, indicating robust growth in demand and technological advancements over the next decade.

What are the key market players or companies in the MEMS for Mobile Devices industry?

Leading companies in the MEMS for Mobile Devices industry include Bosch Sensortec, STMicroelectronics, and Analog Devices, among others, reflecting a competitive landscape driving innovation and market expansion.

What are the primary factors driving the growth in the MEMS for Mobile Devices industry?

Key growth drivers include increasing demand for smartphones, advancements in micro-electromechanical technologies, and the rising trend of automation and IoT, which collectively enhance functionality in mobile devices.

Which region is the fastest Growing in the MEMS for Mobile Devices?

Asia Pacific is projected to be the fastest growing region for MEMS for Mobile Devices, expanding from a market size of 1.96 billion in 2023 to 4.42 billion in 2033, reflecting its booming electronics industry.

Does ConsaInsights provide customized market report data for the MEMS for Mobile Devices industry?

Yes, ConsaInsights offers customized market report data tailored to specific needs within the MEMS for Mobile Devices industry, providing clients with deeper insights for strategic decision-making.

What deliverables can I expect from this MEMS for Mobile Devices market research project?

Expect detailed reports featuring market analysis, forecasts, competitive landscape, regional breakdowns, and insights into consumer behavior within the MEMS for Mobile Devices market.

What are the market trends of MEMS for Mobile Devices?

Current trends include increased integration of multi-sensor technologies in devices, focus on energy efficiency, and enhanced functionality in mobile applications, driving innovation in the MEMS for Mobile Devices sector.