Mems Market Report

Published Date: 31 January 2026 | Report Code: mems

Mems Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the MEMS (Micro-Electro-Mechanical Systems) market covering insights, trends, and forecasts for the years 2023 to 2033. It includes detailed information on market size, growth rates, industry dynamics, and regional trends.

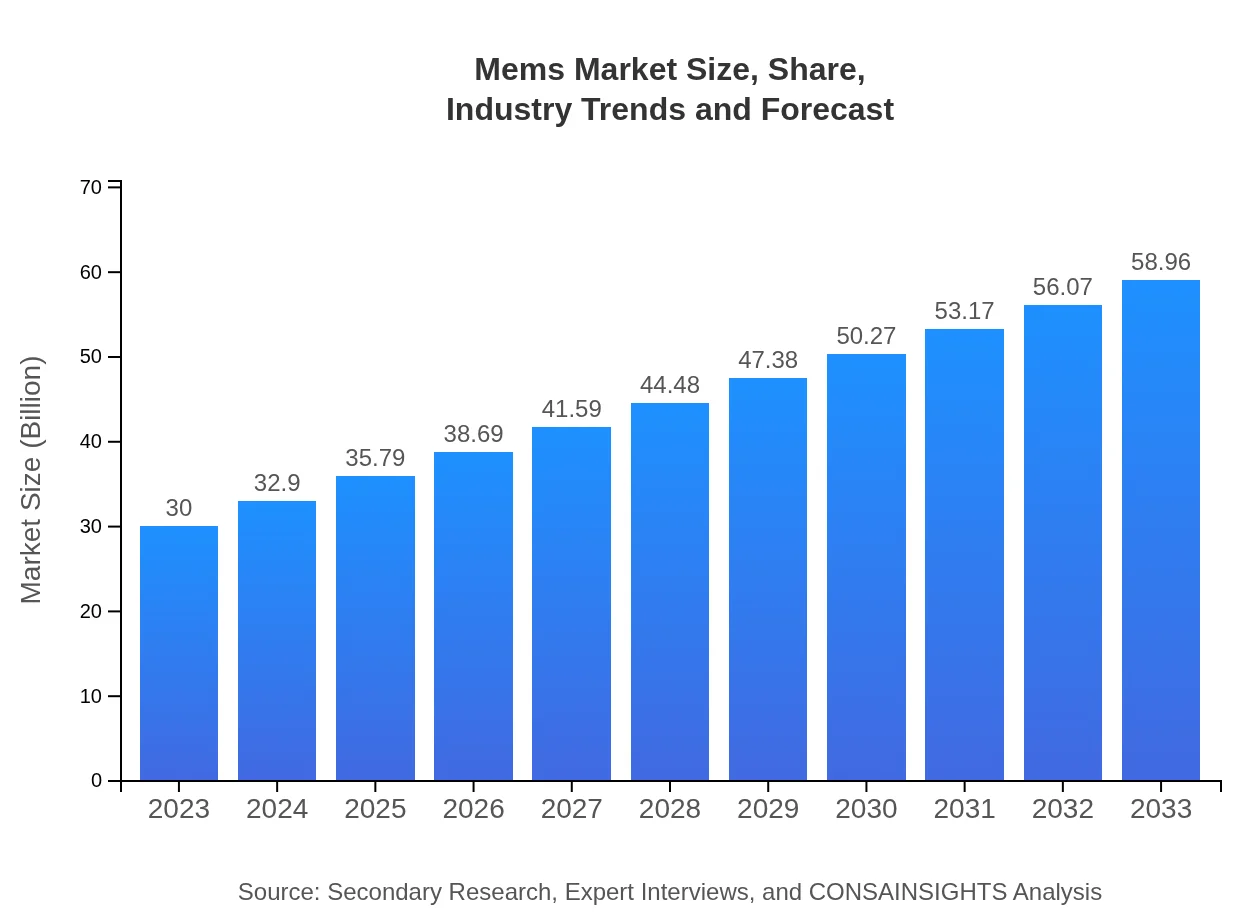

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $30.00 Billion |

| CAGR (2023-2033) | 6.8% |

| 2033 Market Size | $58.96 Billion |

| Top Companies | Bosch Sensortec, STMicroelectronics, Analog Devices, Texas Instruments, Qualcomm |

| Last Modified Date | 31 January 2026 |

MEMS Market Overview

Customize Mems Market Report market research report

- ✔ Get in-depth analysis of Mems market size, growth, and forecasts.

- ✔ Understand Mems's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Mems

What is the Market Size & CAGR of MEMS market in 2023?

MEMS Industry Analysis

MEMS Market Segmentation and Scope

Tell us your focus area and get a customized research report.

MEMS Market Analysis Report by Region

Europe Mems Market Report:

Europe's MEMS market, valued at $9.18 billion in 2023, is projected to nearly double, reaching $18.04 billion by 2033. The automotive and healthcare sectors are pivotal to this growth, emphasizing innovation and efficiency.Asia Pacific Mems Market Report:

In the Asia Pacific region, the MEMS market was valued at approximately $5.45 billion in 2023 and is expected to reach $10.71 billion by 2033. The growth is driven by the booming electronics and automotive industries, particularly in countries like China, Japan, and South Korea.North America Mems Market Report:

North America, with a market size of $10.96 billion in 2023, is expected to witness significant growth, reaching approximately $21.54 billion by 2033. The region benefits from a strong presence of key players and a robust focus on research and development in MEMS technologies.South America Mems Market Report:

The South American MEMS market is comparatively smaller, with a valuation of $0.77 billion in 2023, projected to grow to $1.52 billion by 2033. Growth factors include increasing demand for consumer electronics and automotive applications as the region’s economy stabilizes.Middle East & Africa Mems Market Report:

In the Middle East and Africa, the MEMS market was $3.64 billion in 2023 and is set to grow to $7.16 billion by 2033. Urbanization and technology adoption in various sectors boost market potential, particularly in sensors for smart infrastructure.Tell us your focus area and get a customized research report.

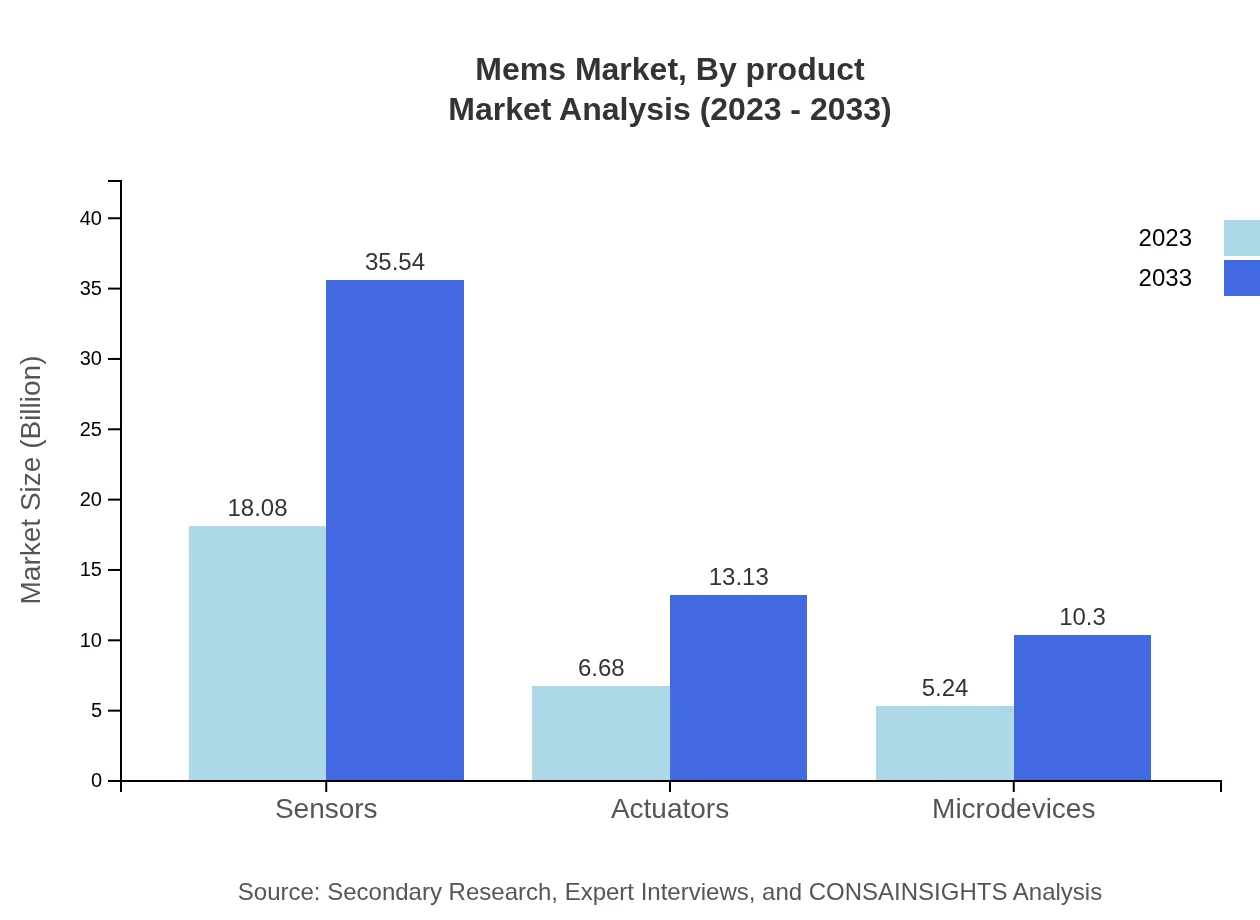

Mems Market Analysis By Product

The MEMS market by product segment is dominated by sensors, which constituted a market size of $18.08 billion in 2023, expected to grow to $35.54 billion by 2033. Actuators follow, with current sizes of $6.68 billion projected to reach $13.13 billion. Microdevices represent a significant share, growing from $5.24 billion to $10.30 billion. Manufacturing processes also highlight the MEMS market's favor, with a profound contribution estimated at $16.84 billion in size currently.

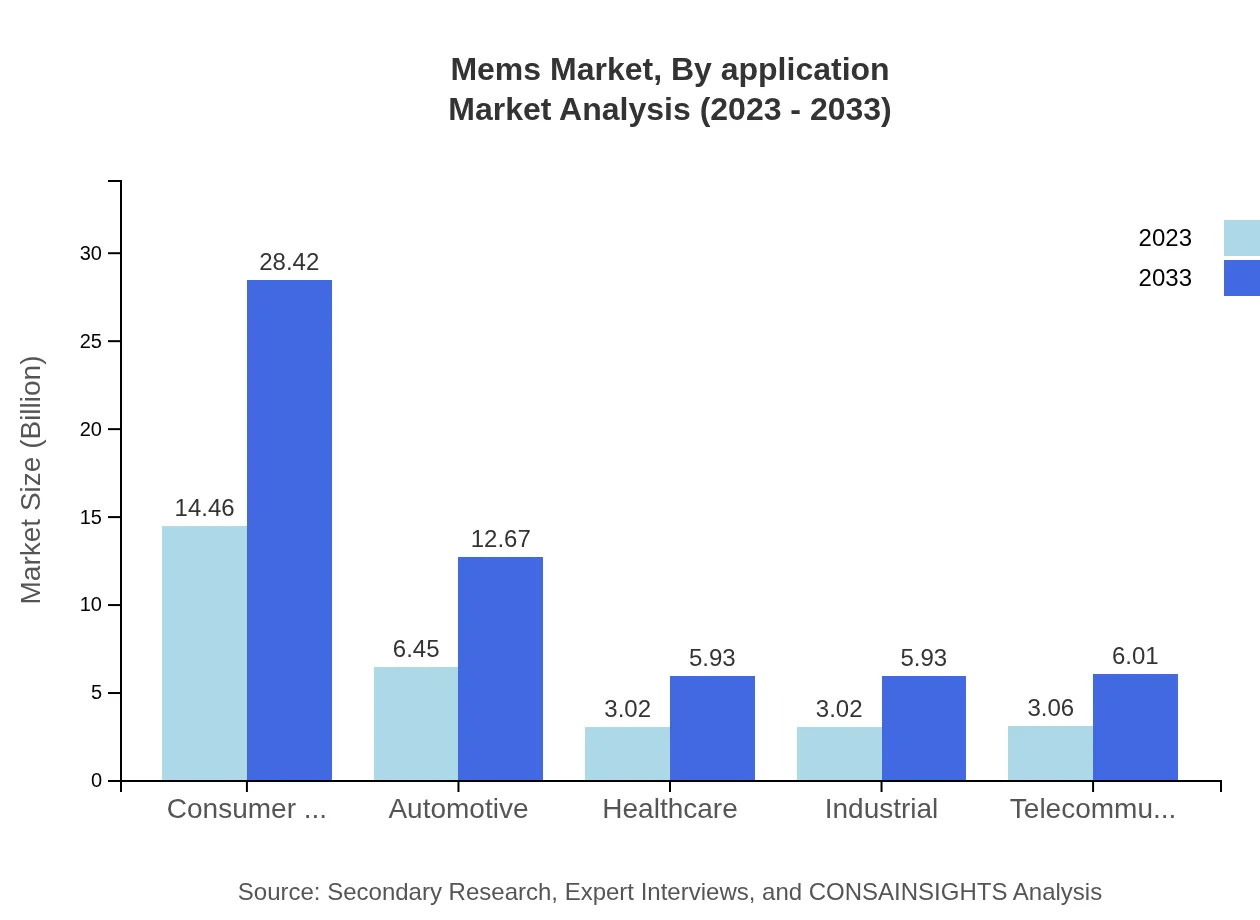

Mems Market Analysis By Application

The application segment highlights consumer electronics as a large market. In 2023, it was valued at $14.46 billion, with a projection to grow to $28.42 billion by 2033. The automotive application is growing significantly, forecasted to go from $6.45 billion to $12.67 billion. Healthcare applications also show promise, expanding from $3.02 billion to $5.93 billion.

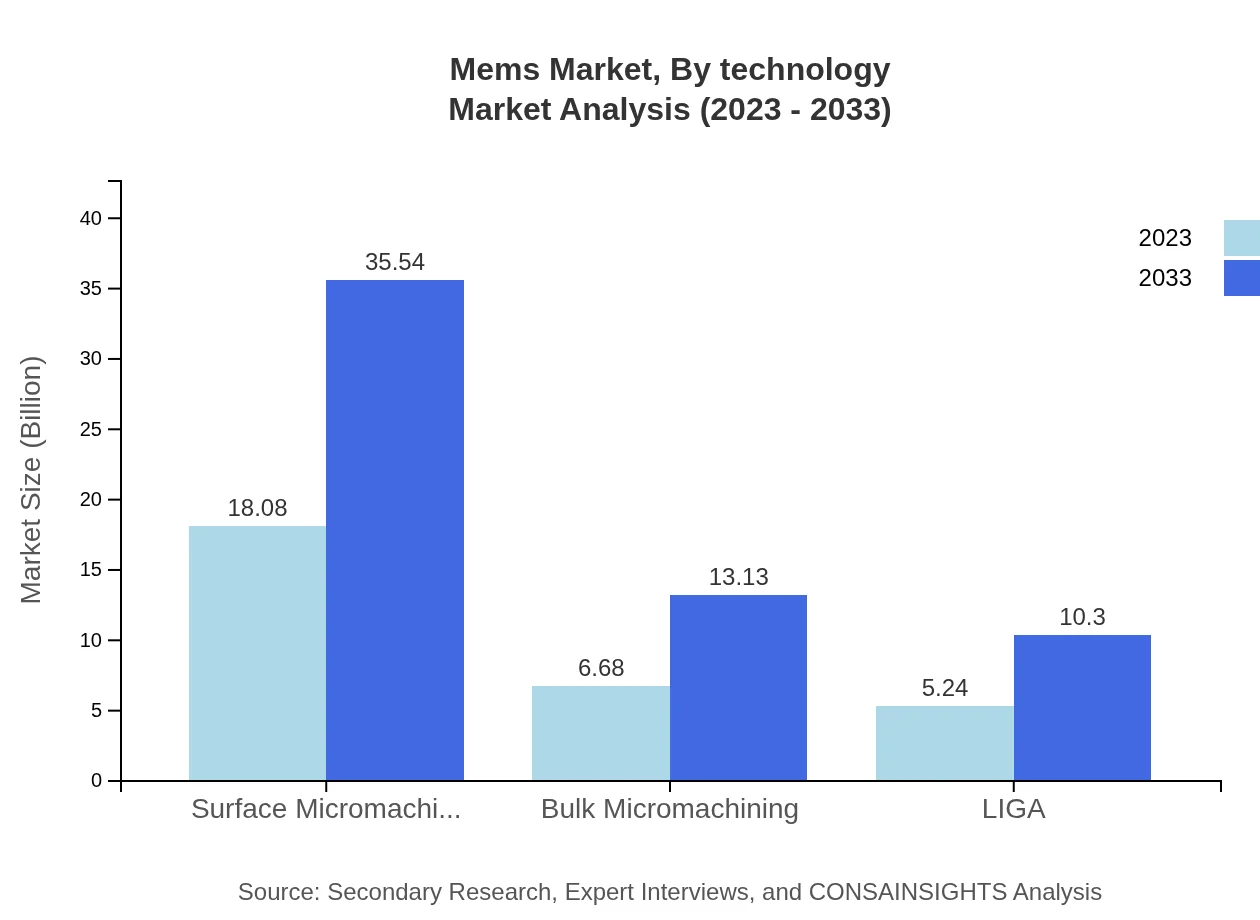

Mems Market Analysis By Technology

When analyzing technologies, surface micromachining leads the MEMS market with valuation soaring from $18.08 billion to $35.54 billion. Subsequently, bulk micromachining and LIGA also demonstrate confirmed growth forecasts of $6.68 billion to $13.13 billion and $5.24 billion to $10.30 billion, respectively.

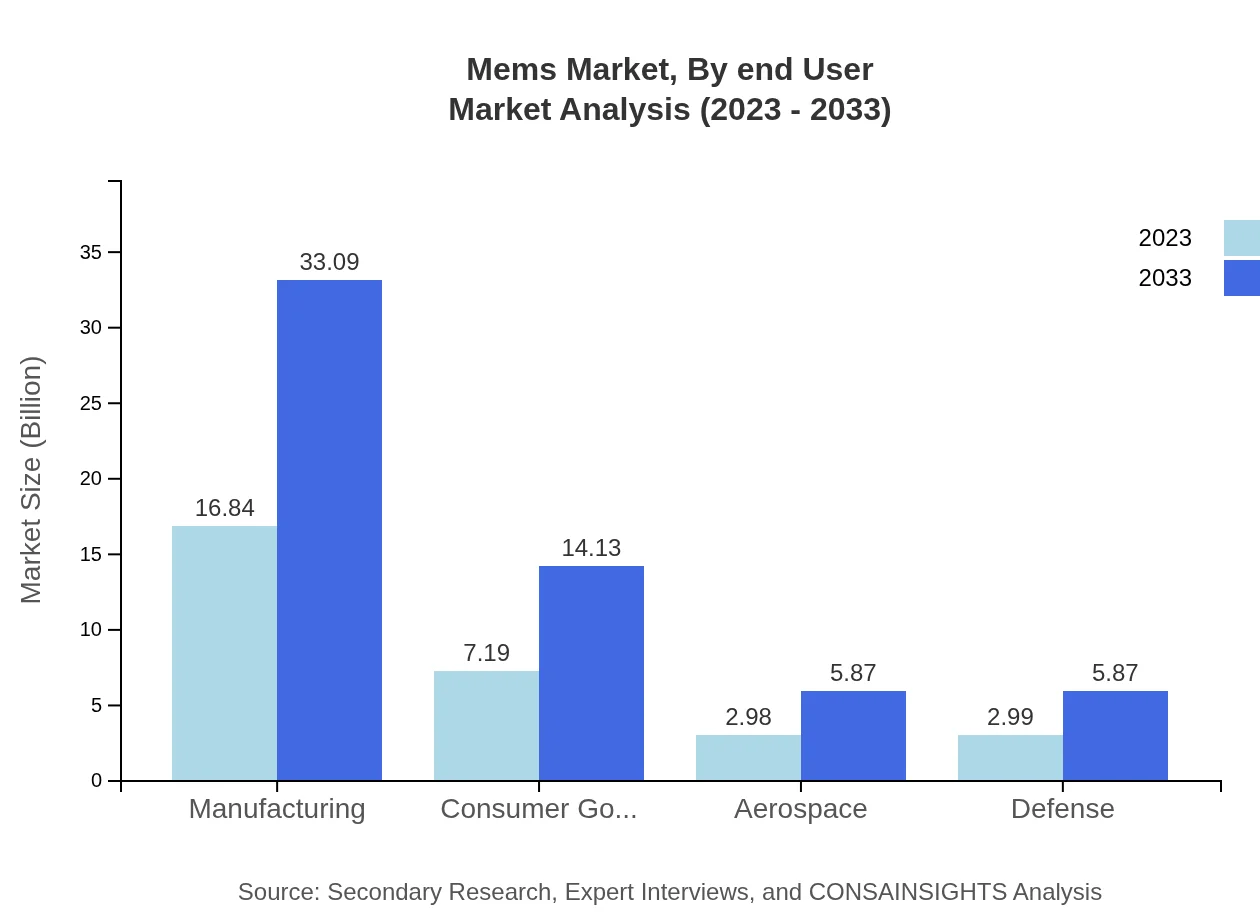

Mems Market Analysis By End User

Examining the MEMS industry by end-user, consumer electronics capture a significant 48.2% market share in 2023 with an expected increase through 2033. Automotive applications command 21.49%, while sectors such as healthcare, industrial, and telecommunications maintain noteworthy positions, indicating diverse growth across the market landscape.

MEMS Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in MEMS Industry

Bosch Sensortec:

Bosch Sensortec is a leading producer of MEMS sensors, crucial for consumer electronics, automotive, and industrial applications. Their continuous innovation has positioned them at the forefront of the MEMS market.STMicroelectronics:

STMicroelectronics specializes in MEMS technology and offers a wide range of MEMS sensors and actuators, emphasizing automotive and industrial applications.Analog Devices:

Analog Devices is known for its high-performance MEMS sensors, particularly in the industrial and telecommunications sectors.Texas Instruments:

Texas Instruments provides extensive MEMS solutions, focusing on performance and longevity, influencing various electronics applications.Qualcomm :

Qualcomm's innovation in MEMS technology supports advancements in mobile and communication systems, emphasizing consumer electronics devices.We're grateful to work with incredible clients.

FAQs

What is the market size of MEMS?

The MEMS market is valued at approximately $30 billion in 2023, with a projected compound annual growth rate (CAGR) of 6.8% through 2033, indicating a robust growth trajectory for the upcoming decade.

What are the key market players or companies in this MEMS industry?

Key players in the MEMS industry include companies such as Texas Instruments, Bosch Sensortec, STMicroelectronics, and Analog Devices, among others, that have established significant market presence through innovation and technology integration.

What are the primary factors driving the growth in the MEMS industry?

The growth in the MEMS industry is primarily driven by increasing demand for MEMS devices in consumer electronics, automotive applications, healthcare technologies, and advancements in IoT, which require miniaturized and high-performance sensors.

Which region is the fastest Growing in the MEMS market?

The MEMS market is witnessing rapid growth in North America, projected to grow from $10.96 billion in 2023 to $21.54 billion by 2033, fueled by technological advancements and rising investments in automation.

Does ConsaInsights provide customized market report data for the MEMS industry?

Yes, ConsaInsights offers customized market report data tailored to specific industry needs within the MEMS sector, enabling clients to obtain in-depth insights and analyses relevant to their interests.

What deliverables can I expect from this MEMS market research project?

Deliverables from the MEMS market research project typically include comprehensive reports, detailed market segment analyses, trend forecasts, and competitive insights that empower decision-making and strategy development.

What are the market trends of MEMS?

Current trends in the MEMS market include the increasing integration of smart sensors in automotive applications, a shift towards miniaturization of devices, and enhanced functionalities through advancements in micromachining techniques.