Mems Packaging Market Report

Published Date: 31 January 2026 | Report Code: mems-packaging

Mems Packaging Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the MEMS Packaging market, covering insights on market size, trends, and forecasts from 2023 to 2033. It highlights key segments, regional performance, and leading companies in the industry.

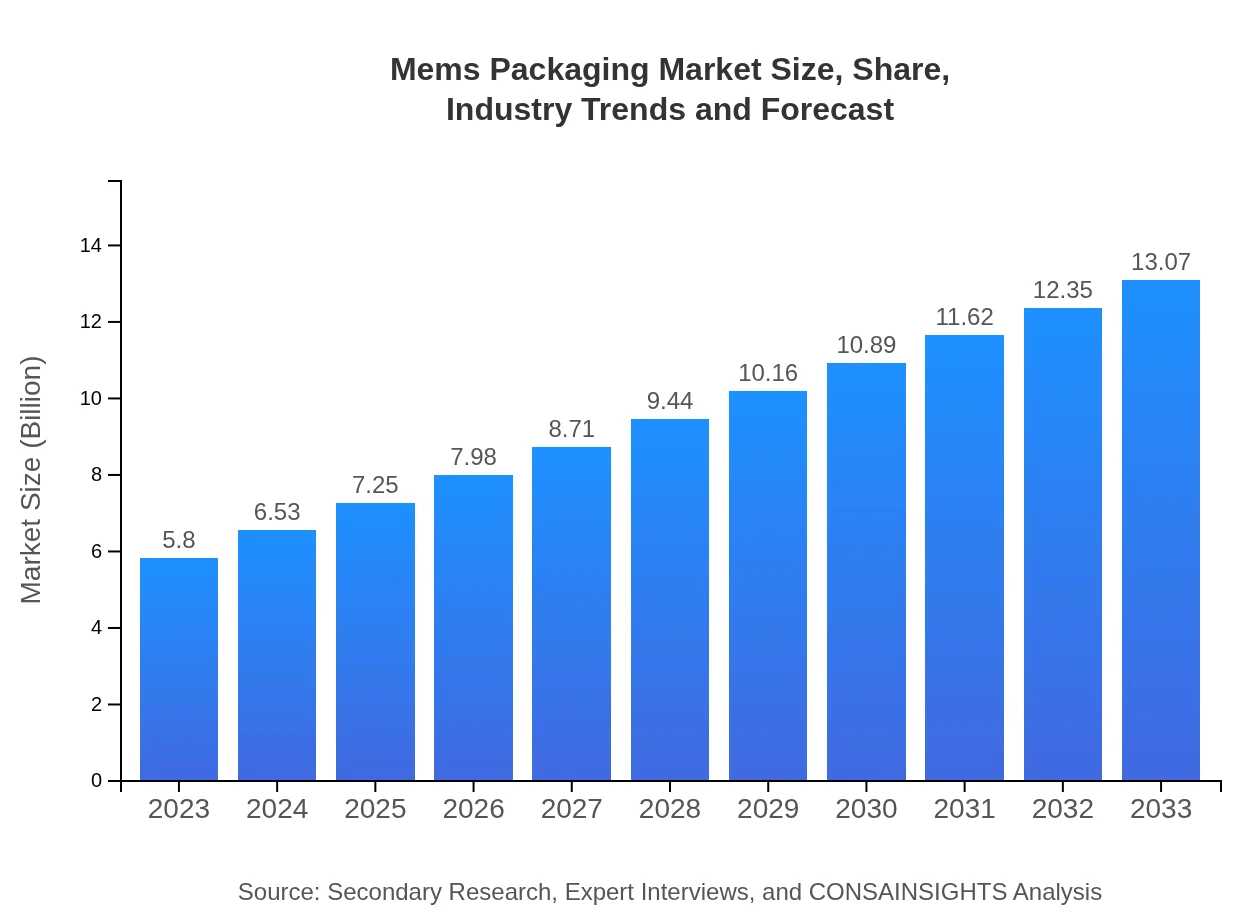

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $5.80 Billion |

| CAGR (2023-2033) | 8.2% |

| 2033 Market Size | $13.07 Billion |

| Top Companies | STMicroelectronics, Texas Instruments, Bosch Sensortec, Analog Devices |

| Last Modified Date | 31 January 2026 |

MEMS Packaging Market Overview

Customize Mems Packaging Market Report market research report

- ✔ Get in-depth analysis of Mems Packaging market size, growth, and forecasts.

- ✔ Understand Mems Packaging's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Mems Packaging

What is the Market Size & CAGR of MEMS Packaging market in 2023?

MEMS Packaging Industry Analysis

MEMS Packaging Market Segmentation and Scope

Tell us your focus area and get a customized research report.

MEMS Packaging Market Analysis Report by Region

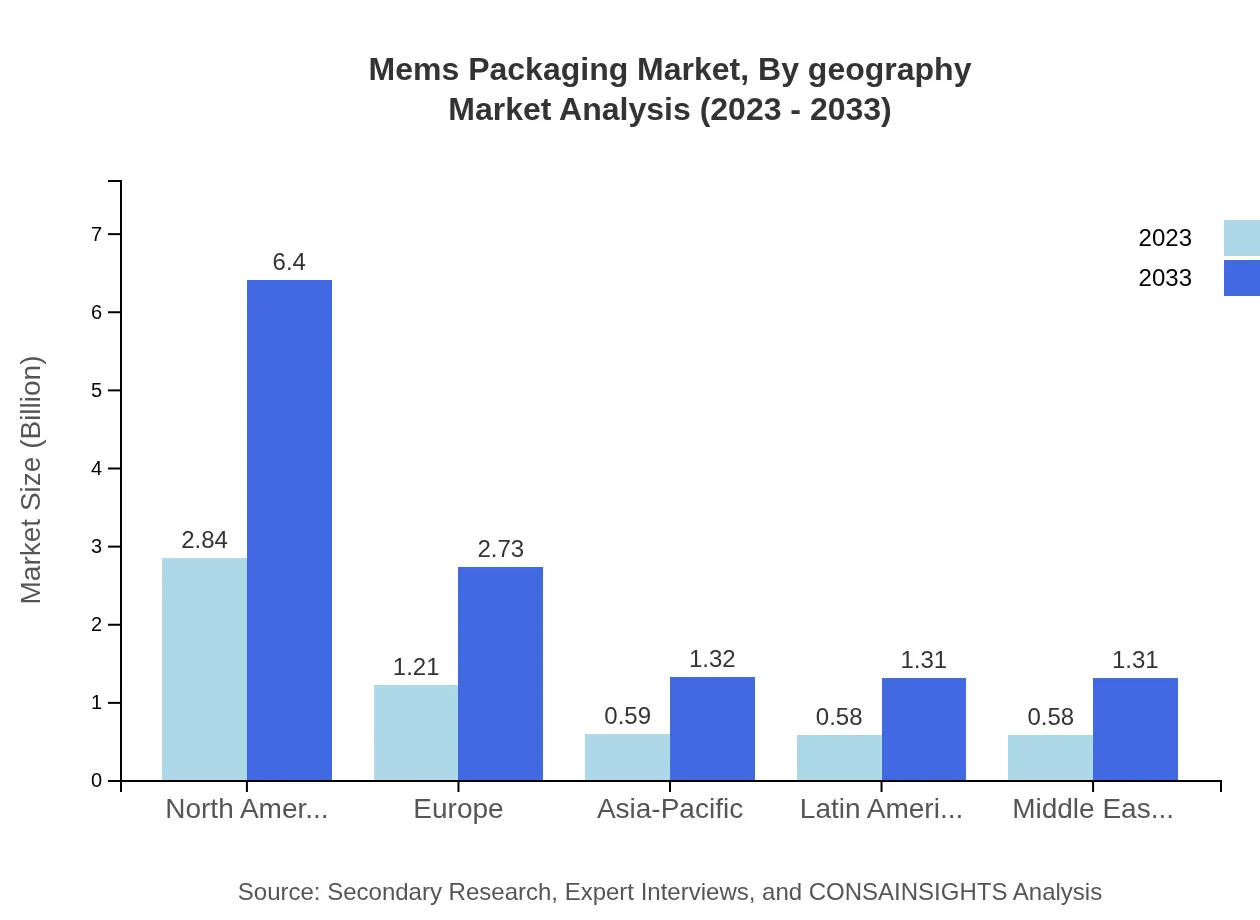

Europe Mems Packaging Market Report:

Europe’s MEMS Packaging market is set to grow from $1.57 billion in 2023 to $3.54 billion in 2033. The surge in R&D and strong governmental support for innovative packaging solutions are significant drivers.Asia Pacific Mems Packaging Market Report:

The Asia Pacific region is poised for significant growth, with a market size projected to reach $2.51 billion by 2033 from $1.11 billion in 2023. The rapid adoption of MEMS technology in consumer electronics and automotive sectors is driving this expansion.North America Mems Packaging Market Report:

North America leads the MEMS Packaging market with a projected market size of $4.96 billion in 2033, up from $2.20 billion in 2023. The presence of major electronics manufacturers and a growing automotive sector fuel this demand.South America Mems Packaging Market Report:

In South America, the MEMS Packaging market is expected to grow from $0.53 billion in 2023 to $1.18 billion by 2033. This growth is driven by increasing investments in technological advancements and infrastructure development.Middle East & Africa Mems Packaging Market Report:

The Middle East and Africa are expected to see growth from $0.39 billion in 2023 to $0.88 billion by 2033, supported by increasing technological advancements and the rise of electronic devices across various industries.Tell us your focus area and get a customized research report.

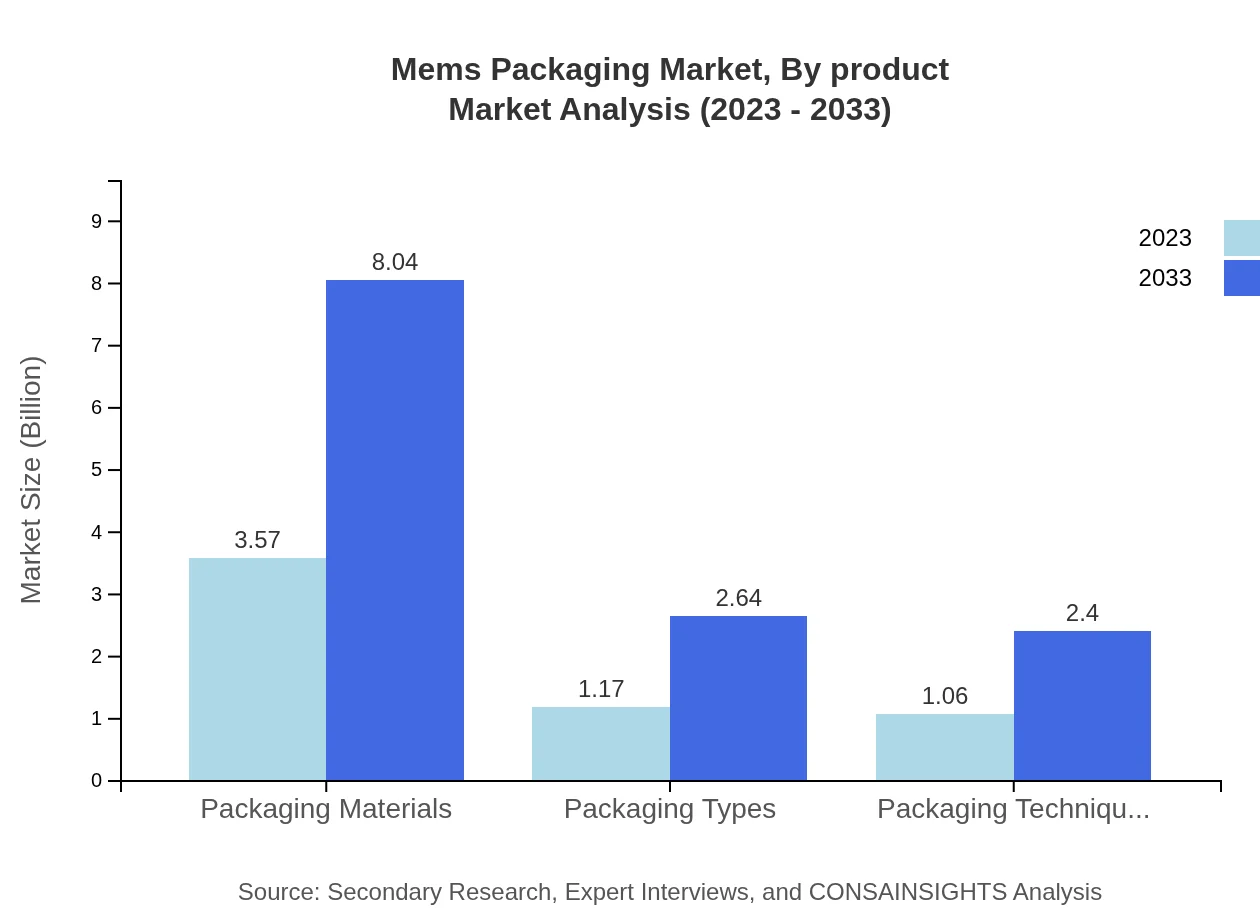

Mems Packaging Market Analysis By Product

The MEMS Packaging market is segmented into packaging materials, types, and techniques. In 2023, packaging materials represent a market size of $3.57 billion, projected to grow to $8.04 billion by 2033. Packaging types and techniques also present substantial contributions, with sizes of $1.17 billion and $1.06 billion, respectively, in 2023.

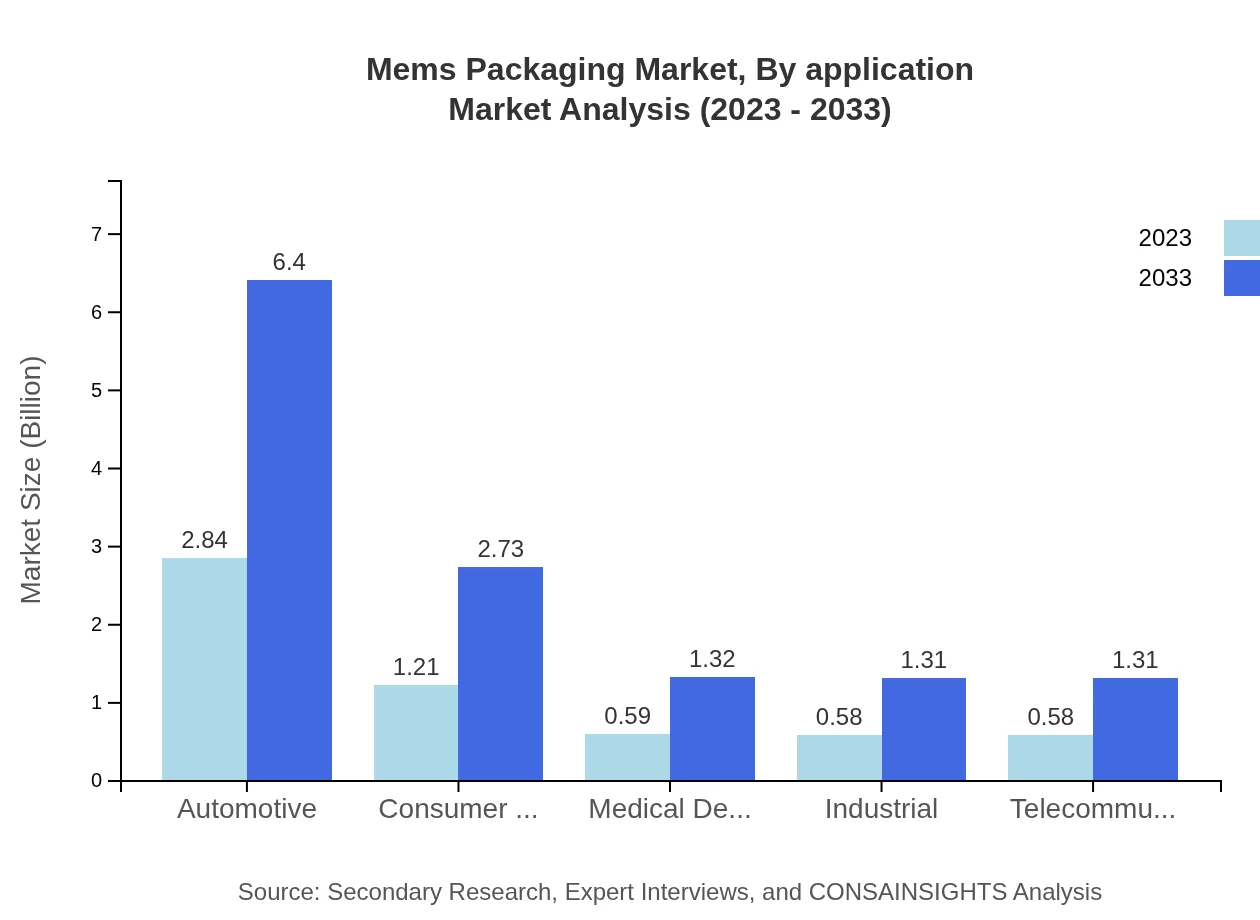

Mems Packaging Market Analysis By Application

Applications of MEMS packaging include automotive, electronics, healthcare, and telecommunications. The automotive sector is a strong segment, with a projected size of $6.40 billion by 2033, equating to a substantial 48.97% market share in 2023. The electronics segment follows closely behind, with similar growth patterns.

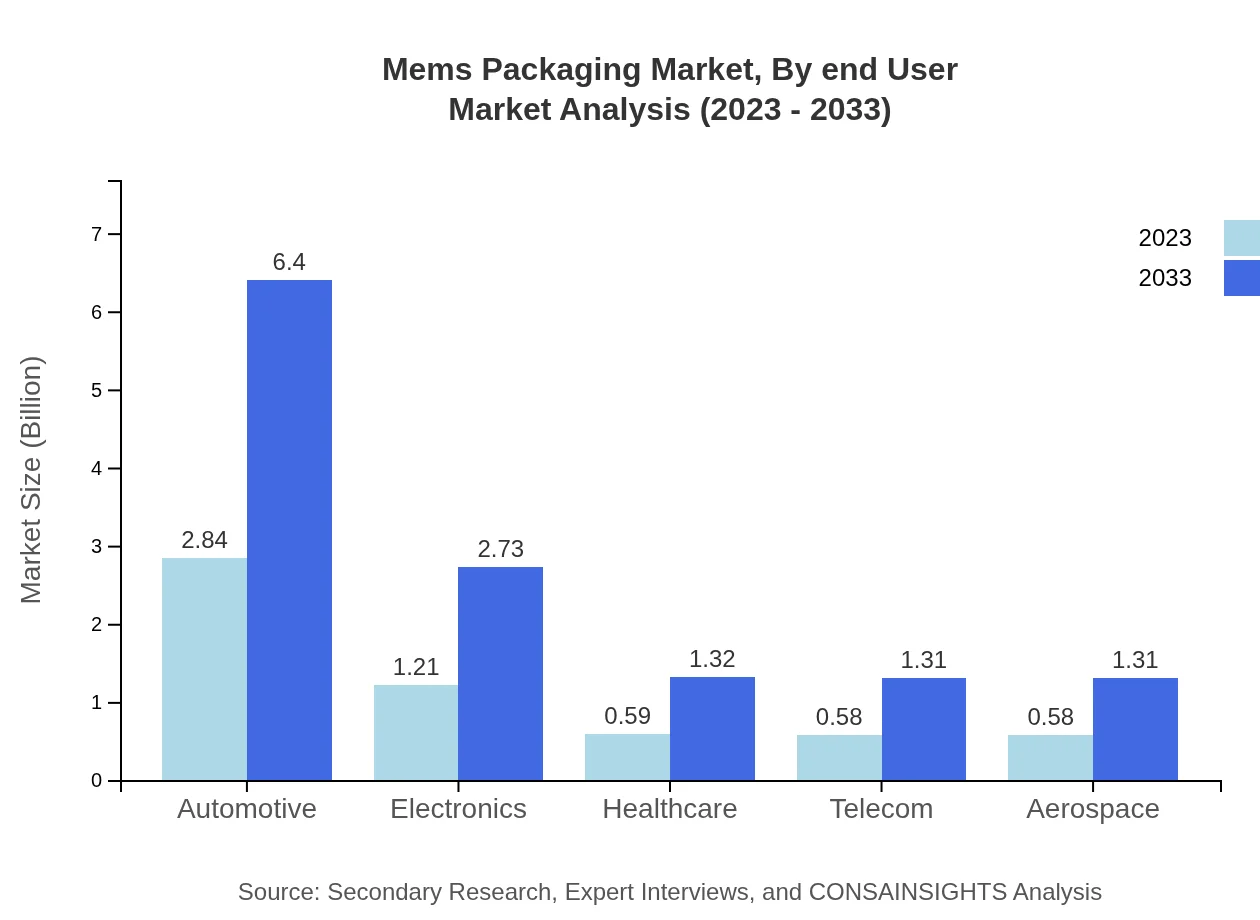

Mems Packaging Market Analysis By End User

The end-user industries are diverse, with crucial contributions from sectors such as consumer electronics, medical devices, and industrial applications. The consumer electronics sector is anticipated to see growth from $1.21 billion to $2.73 billion by 2033.

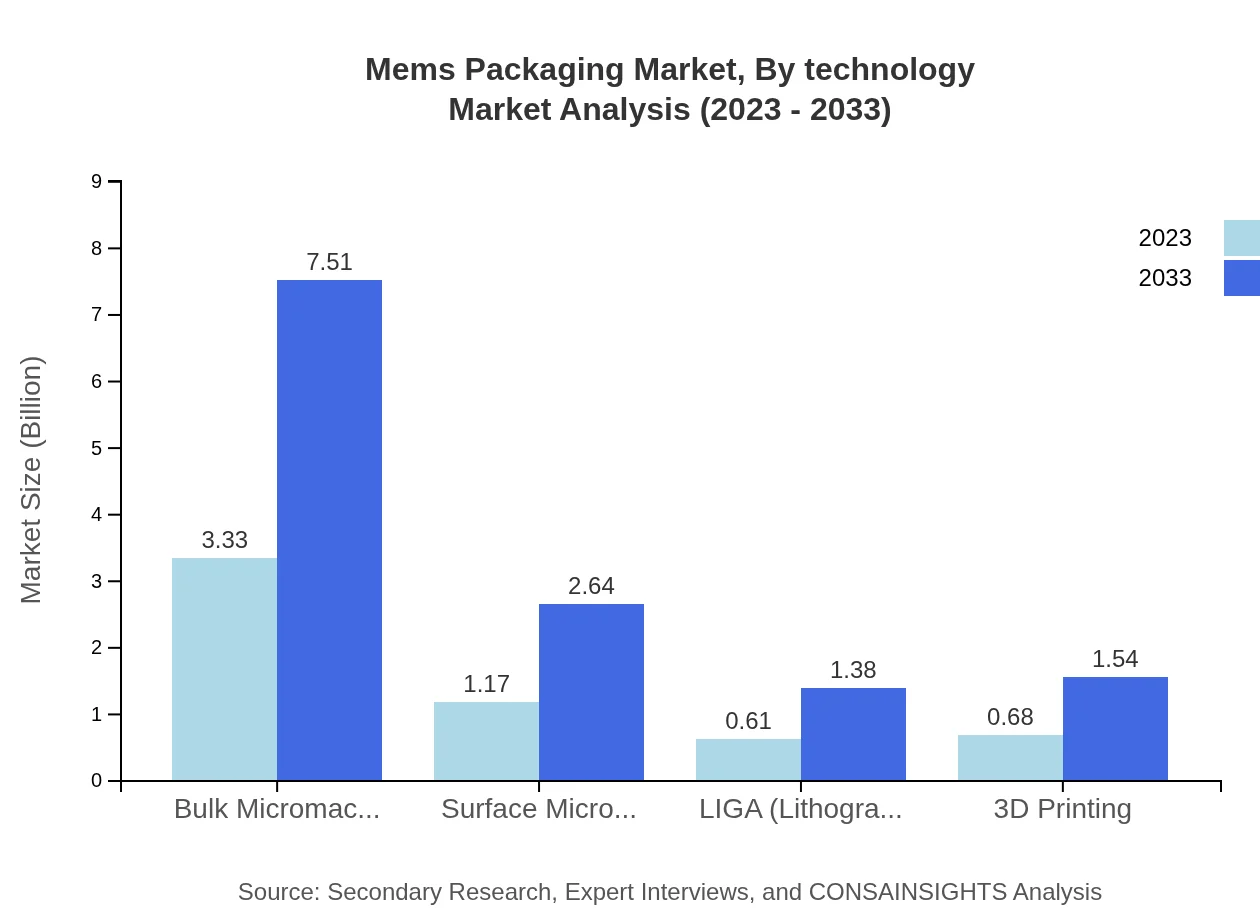

Mems Packaging Market Analysis By Technology

Advanced technologies such as bulk micromachining and surface micromachining dominate the MEMS Packaging landscape, capturing significant market shares of 57.47% and 20.21% respectively by 2023, indicating a preference for these techniques in product manufacturing.

Mems Packaging Market Analysis By Geography

Geographical analysis shows North America as a crucial market, while growth in Asia-Pacific indicates an expanding global footprint. Each region presents unique opportunities based on local demand, technological investment, and product applications.

MEMS Packaging Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in MEMS Packaging Industry

STMicroelectronics:

A major player in the MEMS packaging sector, known for its advanced MEMS sensors used in automotive, consumer electronics, and industrial applications.Texas Instruments:

Offers a wide range of MEMS devices and is recognized for its innovative packaging solutions that enhance reliability in various applications.Bosch Sensortec:

Pioneers in MEMS technology with a focus on consumer electronics, providing high-performance MEMS sensors globally.Analog Devices:

Specializes in precision MEMS devices and is known for their advanced packaging techniques that meet high performance and reliability standards.We're grateful to work with incredible clients.

FAQs

What is the market size of MEMS Packaging?

The MEMS packaging market is projected to reach $5.8 billion by 2033, growing at a CAGR of 8.2%. This growth reflects increasing demand across various sectors, showcasing its expansion potential in the coming years.

What are the key market players or companies in this MEMS Packaging industry?

Leading companies in the MEMS packaging industry include Texas Instruments, STMicroelectronics, and Infineon Technologies. These players are crucial in driving innovation and market trends, contributing significantly to the industry's growth.

What are the primary factors driving the growth in the MEMS Packaging industry?

Key drivers of growth in the MEMS packaging industry include technological advancements, increasing demand for miniaturization in electronics, and rising adoption in automotive and healthcare applications, all contributing to market expansion.

Which region is the fastest Growing in the MEMS Packaging?

Asia Pacific is the fastest-growing region in the MEMS packaging market, expected to grow from $1.11 billion in 2023 to $2.51 billion by 2033. This growth is mainly driven by rising electronics manufacturing and innovation in technology.

Does ConsInsights provide customized market report data for the MEMS Packaging industry?

Yes, ConsInsights offers customized market report data for the MEMS packaging industry, enabling clients to access tailored insights specific to their requirements and business goals within this dynamic sector.

What deliverables can I expect from this MEMS Packaging market research project?

Clients can expect detailed market analysis, trend reports, regional insights, and segmentation breakdowns as deliverables from the MEMS packaging market research project, providing comprehensive knowledge for strategic decision-making.

What are the market trends of MEMS Packaging?

Current trends in the MEMS packaging market include the rise of IoT devices, increased focus on sustainable materials, and advancements in packaging techniques, enhancing performance and driving innovation across multiple industries.