Metal Packaging Market Report

Published Date: 22 January 2026 | Report Code: metal-packaging

Metal Packaging Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Metal Packaging market, detailing key insights, trends, and forecasts from 2023 to 2033. It covers market size, segmentation, regional analysis, and the competitive landscape.

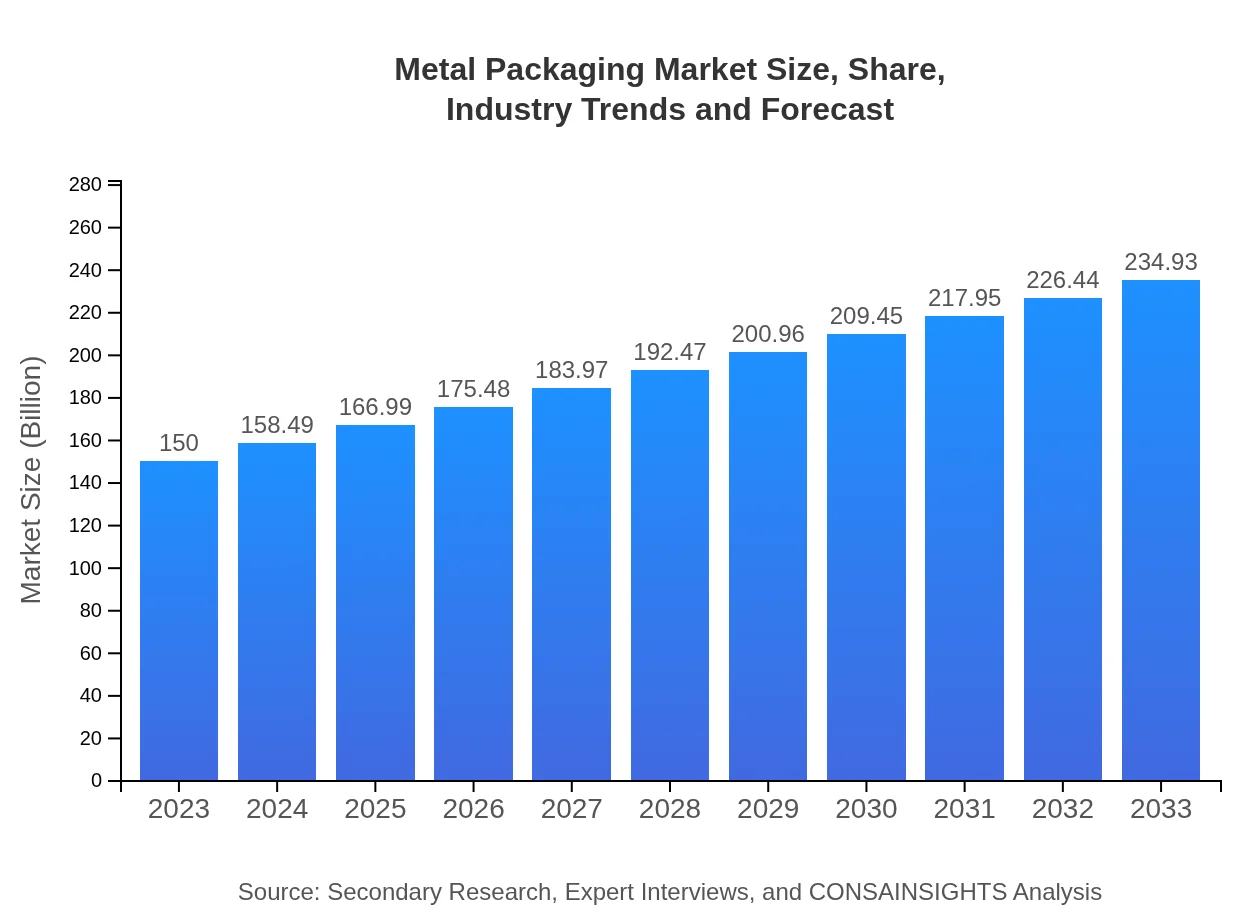

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $150.00 Billion |

| CAGR (2023-2033) | 4.5% |

| 2033 Market Size | $234.93 Billion |

| Top Companies | Crown Holdings, Inc., Ball Corporation, Ardagh Group, Tetra Pak |

| Last Modified Date | 22 January 2026 |

Metal Packaging Market Overview

Customize Metal Packaging Market Report market research report

- ✔ Get in-depth analysis of Metal Packaging market size, growth, and forecasts.

- ✔ Understand Metal Packaging's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Metal Packaging

What is the Market Size & CAGR of Metal Packaging market in 2023?

Metal Packaging Industry Analysis

Metal Packaging Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Metal Packaging Market Analysis Report by Region

Europe Metal Packaging Market Report:

Europe holds a significant share of the Metal Packaging market, expected to rise from $42.90 billion in 2023 to $67.19 billion by 2033. The region is focusing on regulatory compliance regarding recyclability and sustainability, driving manufacturers to innovate. The presence of major food and beverage companies fuels the demand for metal packaging solutions, particularly in countries like Germany and France.Asia Pacific Metal Packaging Market Report:

The Asia Pacific region is a key player in the Metal Packaging market, projected to grow from $26.87 billion in 2023 to $42.08 billion by 2033. Rapid urbanization, increased disposable income, and changing lifestyles are driving demand, particularly in countries like China and India. The region is also witnessing a surge in food consumption and demand for ready-to-drink beverages, further propelling market growth.North America Metal Packaging Market Report:

The North American market is already substantial, anticipated to grow from $58.24 billion in 2023 to $91.23 billion by 2033. The United States and Canada are at the forefront of adopting innovative packaging technologies and sustainability initiatives. Increasing health consciousness among consumers is also leading to a higher demand for safe and durable packaging.South America Metal Packaging Market Report:

In South America, the Metal Packaging market is expected to expand from $13.00 billion in 2023 to $20.37 billion by 2033. The region's growth is being driven by rising consumer demand for packaged goods and the expansion of retail channels. Companies are increasingly focusing on sustainable packaging solutions to cater to the environmentally conscious consumer base in this region.Middle East & Africa Metal Packaging Market Report:

The Middle East and Africa region shows promising growth, with the Metal Packaging market projected to increase from $8.98 billion in 2023 to $14.07 billion by 2033. Urbanization and economic growth are driving demand for packaged products, while a focus on health and safety standards in food packaging is enhancing market prospects.Tell us your focus area and get a customized research report.

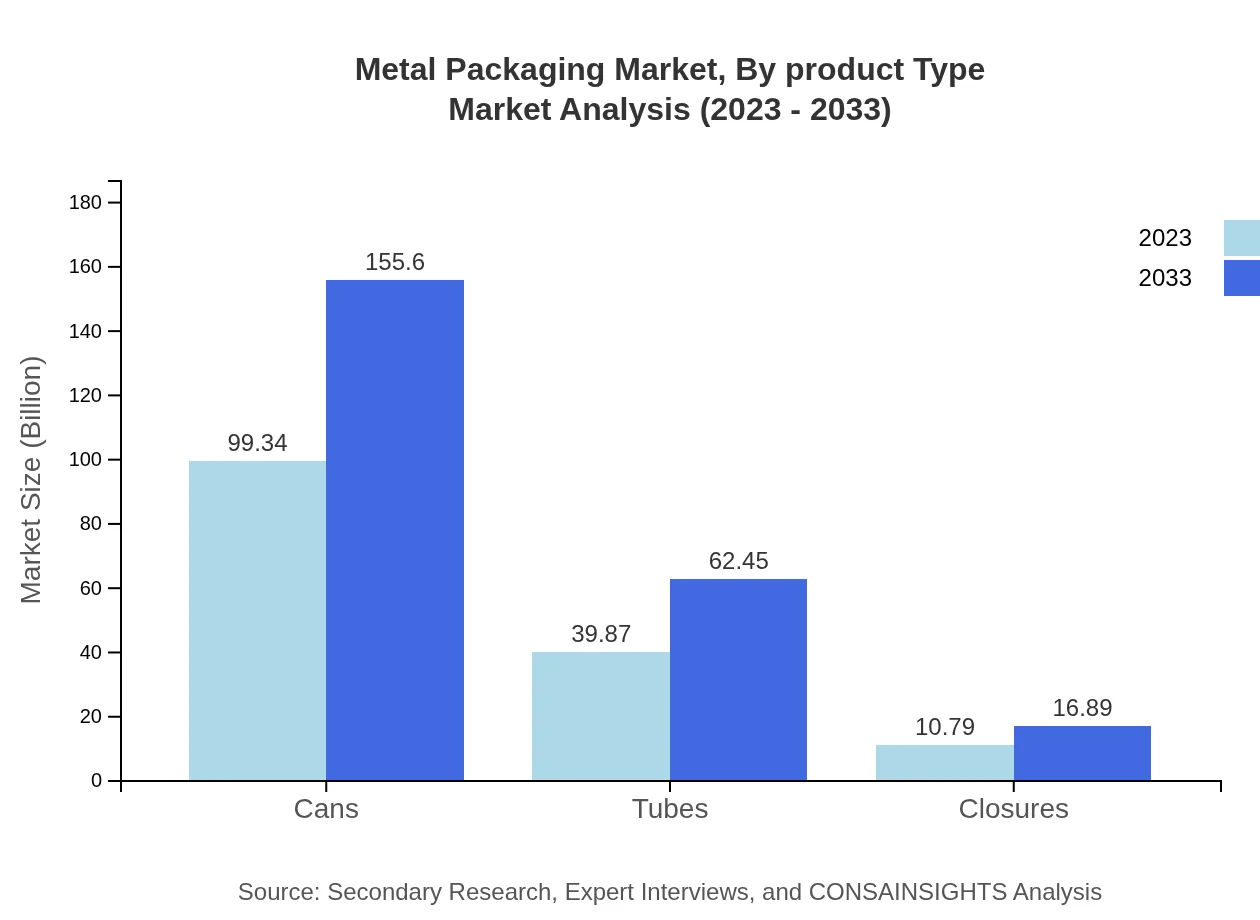

Metal Packaging Market Analysis By Product Type

The Metal Packaging market is primarily dominated by cans, which are expected to grow from $99.34 billion in 2023 to $155.60 billion by 2033, maintaining a market share of 66.23%. Tubes come next, rising from $39.87 billion to $62.45 billion, with a share of 26.58%, while closures are expected to increase from $10.79 billion to $16.89 billion, accounting for about 7.19% of the market. Each product type serves a vital role in packaging across various industries.

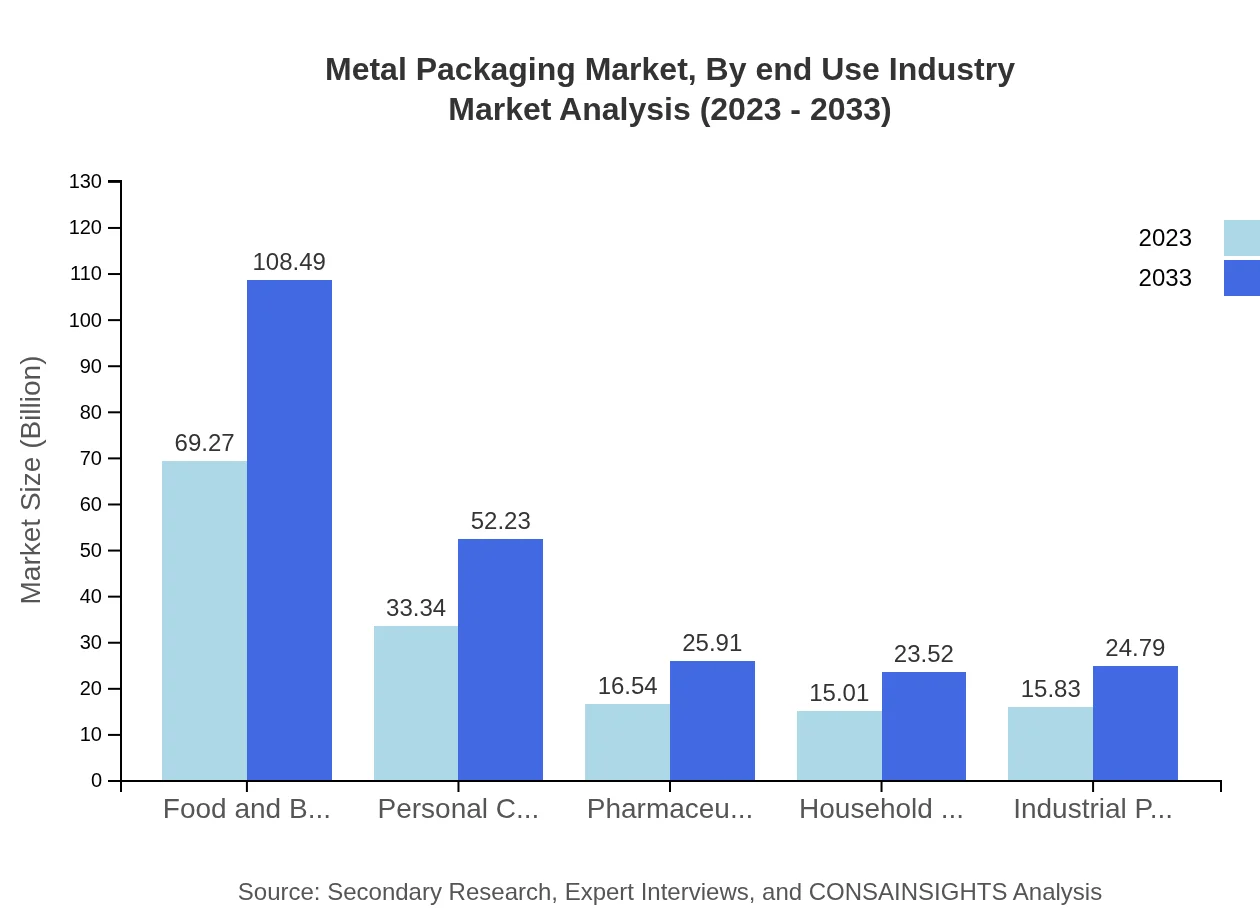

Metal Packaging Market Analysis By End Use Industry

The Food and Beverages segment leads the Metal Packaging market, with a size of $69.27 billion in 2023 and projected growth to $108.49 billion by 2033, claiming 46.18% of the market share. Personal Care follows, expanding from $33.34 billion to $52.23 billion (22.23% share). Pharmaceuticals and Household Products also contribute significantly, showcasing the critical role of metal packaging across diverse applications.

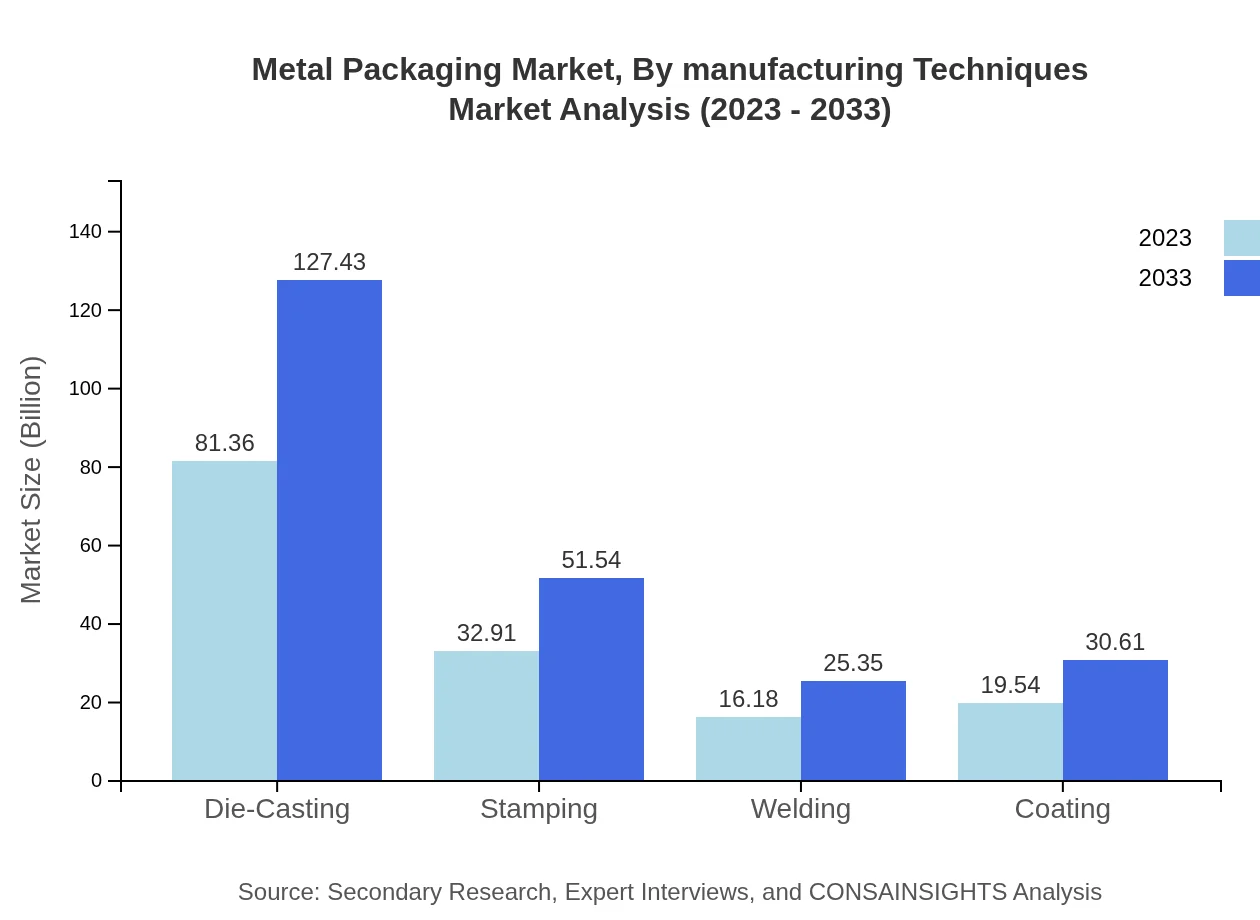

Metal Packaging Market Analysis By Manufacturing Techniques

Manufacturing techniques in the Metal Packaging market include die-casting, stamping, welding, and coating. Die-casting dominates with a market size of $81.36 billion in 2023, forecasted to reach $127.43 billion by 2033 (54.24% share). Stamping and welding also play essential roles, with respective sizes of $32.91 billion (projected to grow to $51.54 billion) and $16.18 billion (to reach $25.35 billion). Coating techniques are crucial for enhancing the durability and appeal of metal packaging.

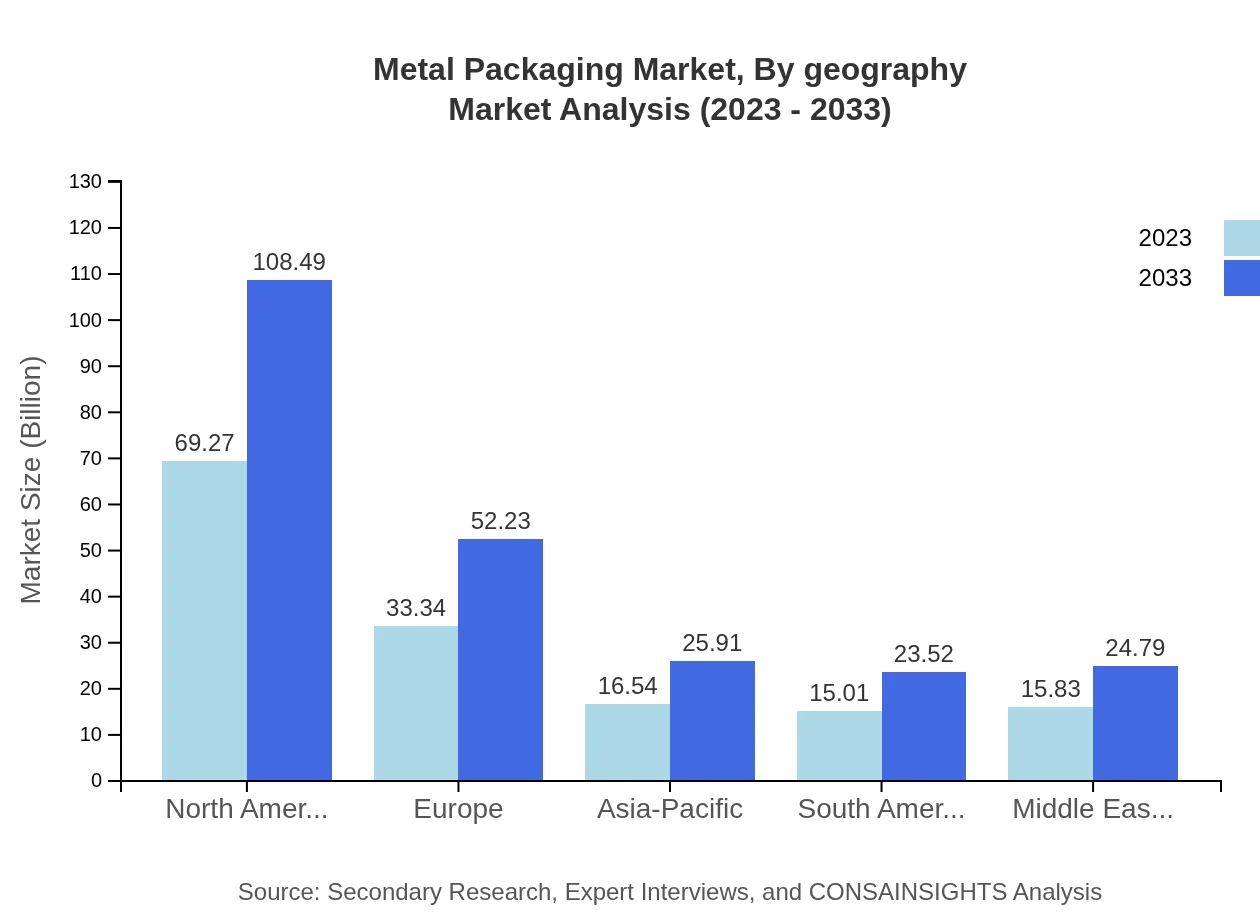

Metal Packaging Market Analysis By Geography

The geographical breakdown shows North America leading in revenue, followed by Europe and Asia Pacific. Each region displays distinct growth drivers. North America’s focus on health and safety regulations supports its growth, while Europe’s stringent sustainability mandates push innovation. The Asia Pacific region benefits from increasing urbanization and disposable income, significantly boosting the market.

Metal Packaging Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Metal Packaging Industry

Crown Holdings, Inc.:

Crown Holdings is a world leader in metal packaging, providing innovative solutions in food and beverage can production. The company is committed to sustainability and continually invests in research and development to improve efficiency.Ball Corporation:

Ball Corporation specializes in metal packaging for beverages, food, and household products. Their commitment to sustainability and recycled content positions them as a key player in the industry.Ardagh Group:

Ardagh Group focuses on manufacturing metal and glass packaging. With an emphasis on sustainability, they provide a range of solutions tailored for food and beverage industries.Tetra Pak:

Although primarily known for carton packaging, Tetra Pak has made significant strides into metal packaging, focusing on sustainability and innovation to meet market demands.We're grateful to work with incredible clients.

FAQs

What is the market size of metal Packaging?

The global metal packaging market is projected to reach approximately $150 billion by 2033 with a CAGR of 4.5%. This growth is primarily driven by increased demand in the food and beverage sector, as well as sustainable packaging initiatives.

What are the key market players or companies in this metal Packaging industry?

Key players in the metal packaging industry include major corporations like Crown Holdings, Ball Corporation, and Ardagh Group. These companies are recognized for their innovative solutions and significant market shares in producing cans, closures, and containers.

What are the primary factors driving the growth in the metal packaging industry?

Key growth drivers in the metal packaging industry include the rising demand for sustainable packaging, advancements in packaging technology, and a growing consumer preference for easily recyclable materials. The food and beverage sector remains a significant contributor to this trend.

Which region is the fastest Growing in the metal packaging?

The Asia-Pacific region is anticipated to be the fastest-growing area in the metal packaging market, expected to grow from $26.87 billion in 2023 to $42.08 billion by 2033. This growth is fueled by increasing industrialization and urbanization.

Does ConsaInsights provide customized market report data for the metal packaging industry?

Yes, ConsaInsights provides tailored market report data specifically for the metal packaging industry, allowing clients to access detailed and relevant insights that cater to their unique business needs and strategies.

What deliverables can I expect from this metal packaging market research project?

Clients can expect comprehensive deliverables including market forecasts, competitive analysis, regional market assessments, segment insights, and strategic recommendations tailored to enhance decision-making in the metal packaging industry.

What are the market trends of metal packaging?

Recent trends in the metal packaging market include increased automation in manufacturing processes, a focus on sustainability through eco-friendly materials, and innovative designs aimed at improving consumer appeal and functionality.