Metallic Stearates Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the metallic stearates market, covering its size, segmentation, industry dynamics, and trends over the forecast period from 2023 to 2033. Insights into market leaders and regional performance are also included.

| Metric | Value |

|---|---|

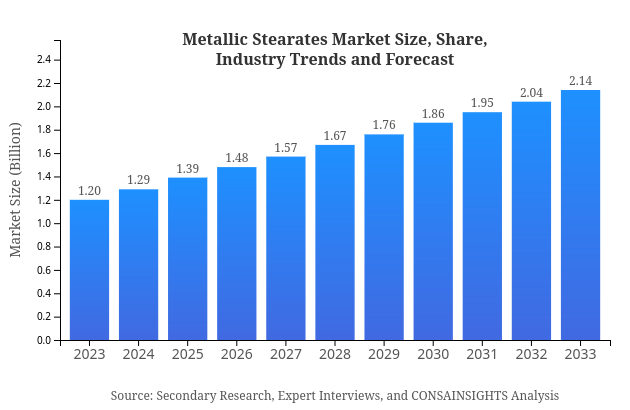

| Study Period | 2023 - 2033 |

| 2023 Market Size | $1.20 Billion |

| CAGR (2023-2033) | 5.8% |

| 2033 Market Size | $2.14 Billion |

| Top Companies | Cachet Ingredients, Peter Greven GmbH & Co. KG, Dover Chemical Corporation, Valtris Specialty Chemicals, Addivant LLC |

| Last Modified Date | 02 March 2025 |

Metallic Stearates Market Overview

What is the Market Size & CAGR of Metallic Stearates market in 2023?

Metallic Stearates Industry Analysis

Metallic Stearates Market Segmentation and Scope

Request a custom research report for industry.

Metallic Stearates Market Analysis Report by Region

Europe Metallic Stearates Market Report:

Europe's metallic stearates market is forecasted to grow from USD 0.31 billion in 2023 to USD 0.55 billion by 2033. The emphasis on food safety regulations and demand for high-quality pharmaceuticals drives the market in this region.Asia Pacific Metallic Stearates Market Report:

The Asia-Pacific region is witnessing rapid growth in the metallic stearates market, with a projected market size of USD 0.25 billion in 2023, increasing to USD 0.44 billion by 2033. This growth is propelled by industrialization, rising production capacities, and a flourishing cosmetics market in countries like China and India.North America Metallic Stearates Market Report:

North America holds a significant share of the metallic stearates market, projected to grow from USD 0.41 billion in 2023 to USD 0.74 billion in 2033. The robust demand from end-user industries, particularly in automotive and food processing, fuels market expansion.South America Metallic Stearates Market Report:

The South American metallic stearates market is smaller but growing, with a market size of USD 0.11 billion in 2023 and an expected increase to USD 0.20 billion by 2033. The rising demand for sustainable materials in construction and textiles is a driving force.Middle East & Africa Metallic Stearates Market Report:

The Middle East and Africa region shows potential with a market size anticipated to grow from USD 0.12 billion in 2023 to USD 0.21 billion by 2033, largely due to increasing industrial activities and the expansion of the food industry.Request a custom research report for industry.

Metallic Stearates Market Analysis By Type

Global Metallic Stearates Market, By Type Market Analysis (2024 - 2033)

Zinc Stearate leads the market in size, projected to grow from USD 0.61 billion in 2023 to USD 1.08 billion by 2033. It holds a market share of 50.56%. Calcium Stearate follows, with expected growth from USD 0.30 billion to USD 0.53 billion, capturing 24.8% of the market. Other stearates like Magnesium and Sodium also contribute significantly, showing steady growth.

Metallic Stearates Market Analysis By Application

Global Metallic Stearates Market, By Application Market Analysis (2024 - 2033)

The food industry represents the largest application segment, growing from USD 0.76 billion in 2023 to USD 1.35 billion by 2033, capturing a share of 63.37%. Other key applications include construction and textiles, with substantial growth expected due to rising urbanization and demand for specialty chemicals.

Metallic Stearates Market Analysis By Manufacturing Process

Global Metallic Stearates Market, By Manufacturing Process Market Analysis (2024 - 2033)

The manufacturing process for metallic stearates primarily includes chemical synthesis and biochemical methods, accounting for 85.53% and 14.47% market shares, respectively. Chemical synthesis remains dominant due to its efficiency, while biochemicals are emerging as sustainable alternatives.

Metallic Stearates Market Analysis By End User

Global Metallic Stearates Market, By End-User Industry Market Analysis (2024 - 2033)

The industrial use sector is predominant, representing 85.53% of the market share, forecasted to grow from USD 1.03 billion in 2023 to USD 1.83 billion by 2033. Applications in cosmetics and pharmaceuticals also show potential growth, driven by increasing demand for high-performance products.

Metallic Stearates Market Analysis By Geographical Use

Global Metallic Stearates Market, By Geographical Use Market Analysis (2024 - 2033)

Regional segmentation of the market reveals strong growth in North America and Europe due to advanced manufacturing capabilities and stringent regulations on product quality. In contrast, the Asia-Pacific shows rapid growth due to significant demand from emerging economies.

Metallic Stearates Market Trends and Future Forecast

Request a custom research report for industry.

Global Market Leaders and Top Companies in Metallic Stearates Industry

Cachet Ingredients:

A leading manufacturer of specialty chemicals including metallic stearates, known for innovation in sustainable product development and high-quality standards.Peter Greven GmbH & Co. KG:

A major player in the industry focusing on high-performance stearates, serving multiple sectors including pharmaceuticals and food with a strong commitment to technological advancement.Dover Chemical Corporation:

Renowned for its diverse portfolio of metallic stearates, providing excellent products and services across global markets with a focus on customer satisfaction.Valtris Specialty Chemicals:

An innovator in stearate compounds, Valtris emphasizes product development to meet evolving industry standards and market demands.Addivant LLC:

Specializes in polymer additives, including innovative metallic stearates that enhance performance and sustainability in various applications.We're grateful to work with incredible clients.

Related Industries

FAQs

What is the market size of metallic Stearates?

The metallic stearates market is valued at approximately $1.2 billion in 2023, with a forecasted CAGR of 5.8% through to 2033, indicating strong growth potential in various applications across multiple industries.

What are the key market players or companies in the metallic Stearates industry?

Key players in the metallic stearates industry include major chemical manufacturers such as Croda International Plc, Baerlocher GmbH, and other regional specialists, all contributing significantly to market innovation and expansion.

What are the primary factors driving the growth in the metallic Stearetes industry?

Growth in the metallic stearates market is driven by increasing demand in the pharmaceuticals, food, and plastics industries, along with expanding applications in construction and textiles, leading to diversified usage across multiple sectors.

Which region is the fastest Growing in the metallic Stearates?

The fastest-growing region for metallic stearates is North America, projected to increase from $0.41 billion in 2023 to $0.74 billion in 2033, propelled by robust industrial activities and rising demand across various sectors.

Does ConsaInsights provide customized market report data for the metallic Stearates industry?

Yes, ConsaInsights offers tailored market report data for the metallic stearates industry, catering to specific client needs and providing comprehensive insights across various segments and geographies.

What deliverables can I expect from this metallic Stearates market research project?

Expect detailed market analysis, comprehensive data segmentation, competitive landscape assessments, growth forecasting, and strategic recommendations tailored to your business objectives within the metallic stearates industry.

What are the market trends of metallic Stearates?

Key market trends in metallic stearates include increasing product innovation, expansion in application areas like food and cosmetics, and a heightened focus on sustainability and eco-friendly practices influencing manufacturing processes.