Metering Pumps Market Report

Published Date: 22 January 2026 | Report Code: metering-pumps

Metering Pumps Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Metering Pumps market, including market dynamics, size, segmentation, and regional insights for the forecast period 2023-2033. It also discusses future trends and key players shaping industry growth.

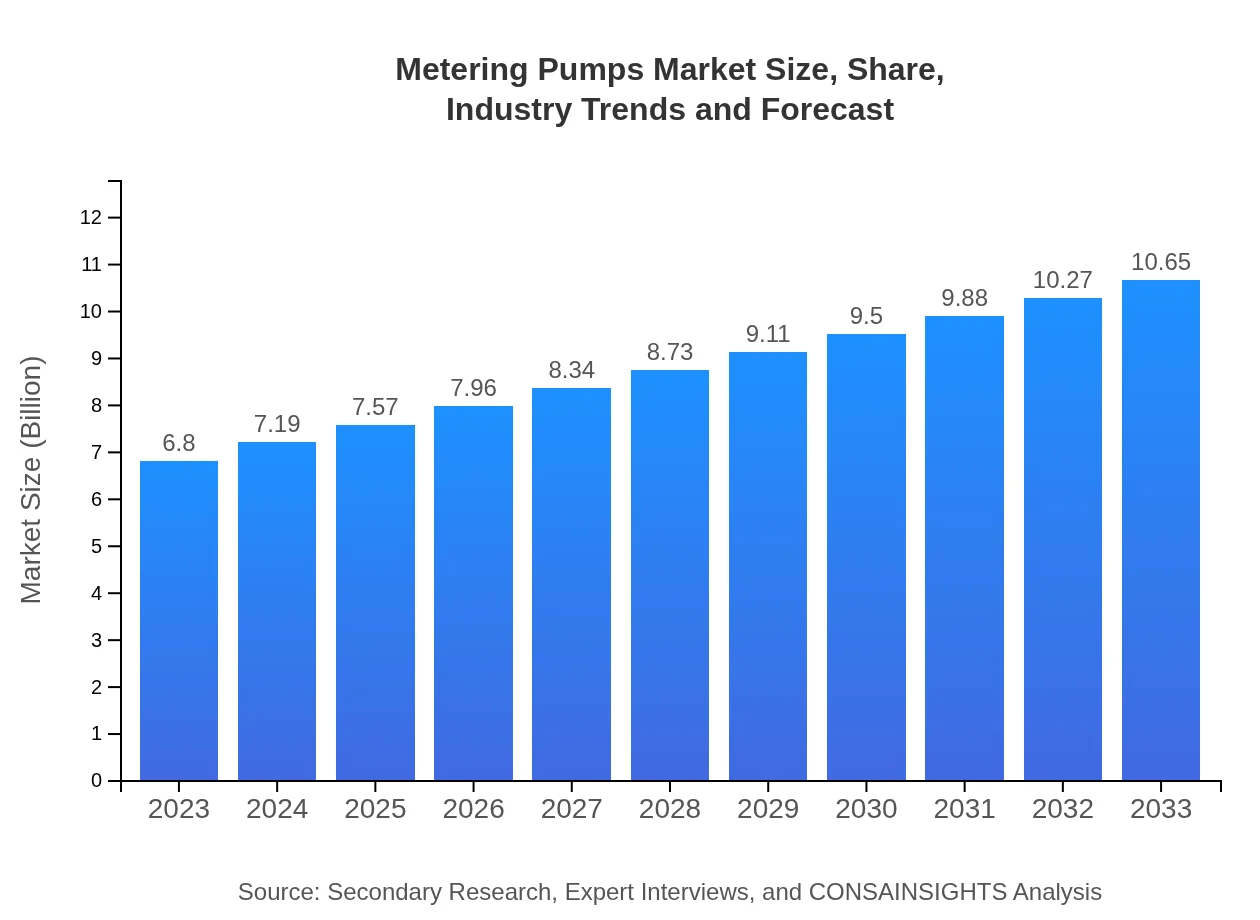

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $6.80 Billion |

| CAGR (2023-2033) | 4.5% |

| 2033 Market Size | $10.65 Billion |

| Top Companies | Grundfos, Flowserve Corporation, Dover Corporation, Xylem Inc. |

| Last Modified Date | 22 January 2026 |

Metering Pumps Market Overview

Customize Metering Pumps Market Report market research report

- ✔ Get in-depth analysis of Metering Pumps market size, growth, and forecasts.

- ✔ Understand Metering Pumps's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Metering Pumps

What is the Market Size & CAGR of Metering Pumps market in 2023?

Metering Pumps Industry Analysis

Metering Pumps Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Metering Pumps Market Analysis Report by Region

Europe Metering Pumps Market Report:

The European market is experiencing steady growth from $1.72 billion in 2023 to $2.69 billion by 2033, driven by stringent regulations focusing on energy efficiency and environmental sustainability. The need for precise dosing in pharmaceutical and chemical processes also plays a crucial role.Asia Pacific Metering Pumps Market Report:

The Asia Pacific region is witnessing rapid industrialization and urbanization, contributing to a market size of $1.38 billion in 2023, anticipated to grow to $2.16 billion by 2033. The increasing demand from the water treatment sector and growing chemical industries in countries like China and India is fueling this growth.North America Metering Pumps Market Report:

North America’s market was valued at $2.63 billion in 2023 and is projected to reach $4.12 billion by 2033, largely due to advancements in technology, increased adoption of automation across industries, and significant investment in water management projects.South America Metering Pumps Market Report:

In South America, the metering pumps market is expected to grow from $0.19 billion in 2023 to $0.30 billion by 2033. This growth is driven by increasing investments in infrastructure and the rising agricultural sector that requires metering solutions for fertilizers and water.Middle East & Africa Metering Pumps Market Report:

The Middle East and Africa metering pumps market, valued at $0.88 billion in 2023, is expected to reach $1.38 billion by 2033. This growth is fueled by increasing oil and gas exploration and the need for effective water management solutions.Tell us your focus area and get a customized research report.

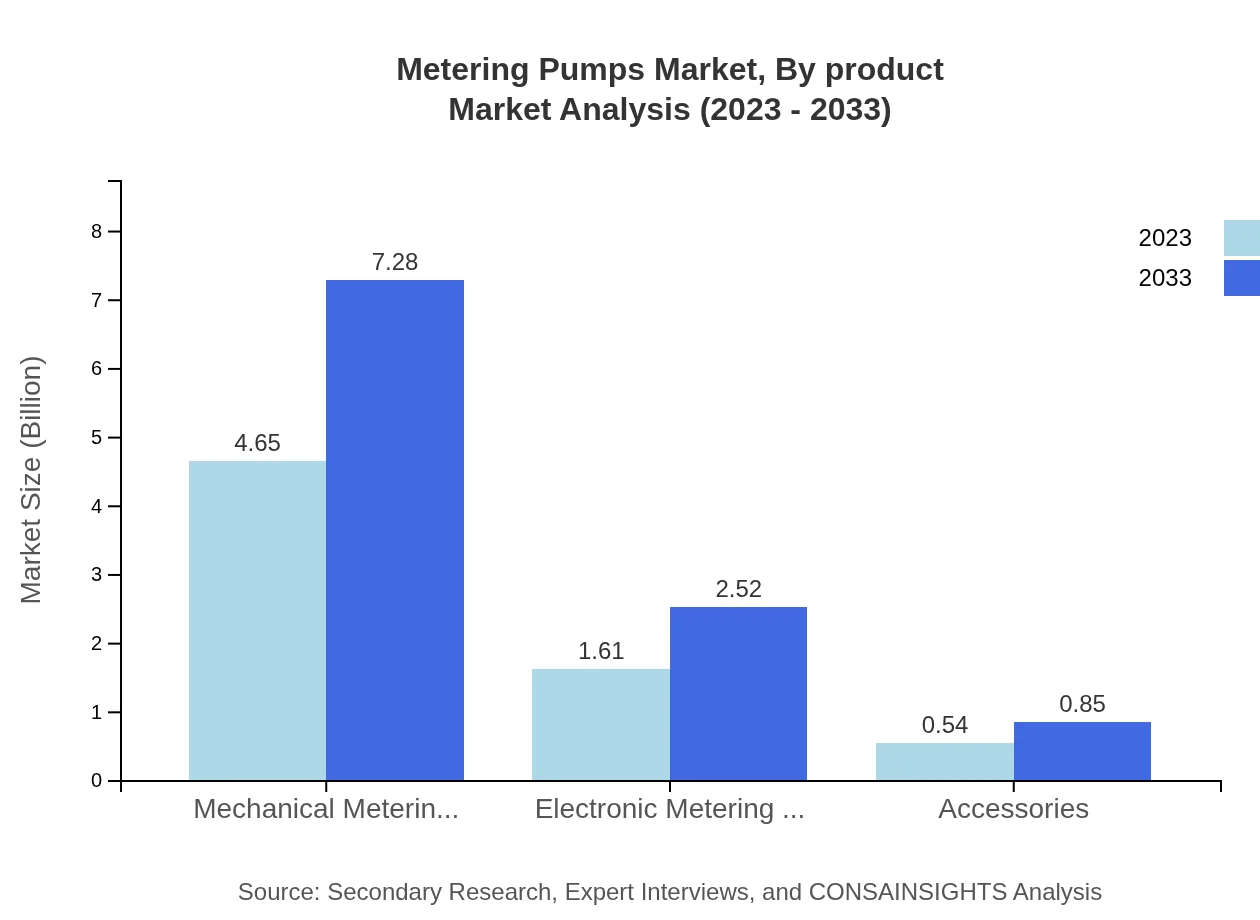

Metering Pumps Market Analysis By Product

The Metering Pumps market is segmented into Mechanical and Electronic Metering Pumps. Mechanical Metering Pumps dominate the market with a size of $4.65 billion in 2023, anticipated to reach $7.28 billion by 2033, holding a market share of 68.36%. Electronic Metering Pumps follow with a size of $1.61 billion in 2023, expected to grow to $2.52 billion by 2033, representing 23.64% of the total market.

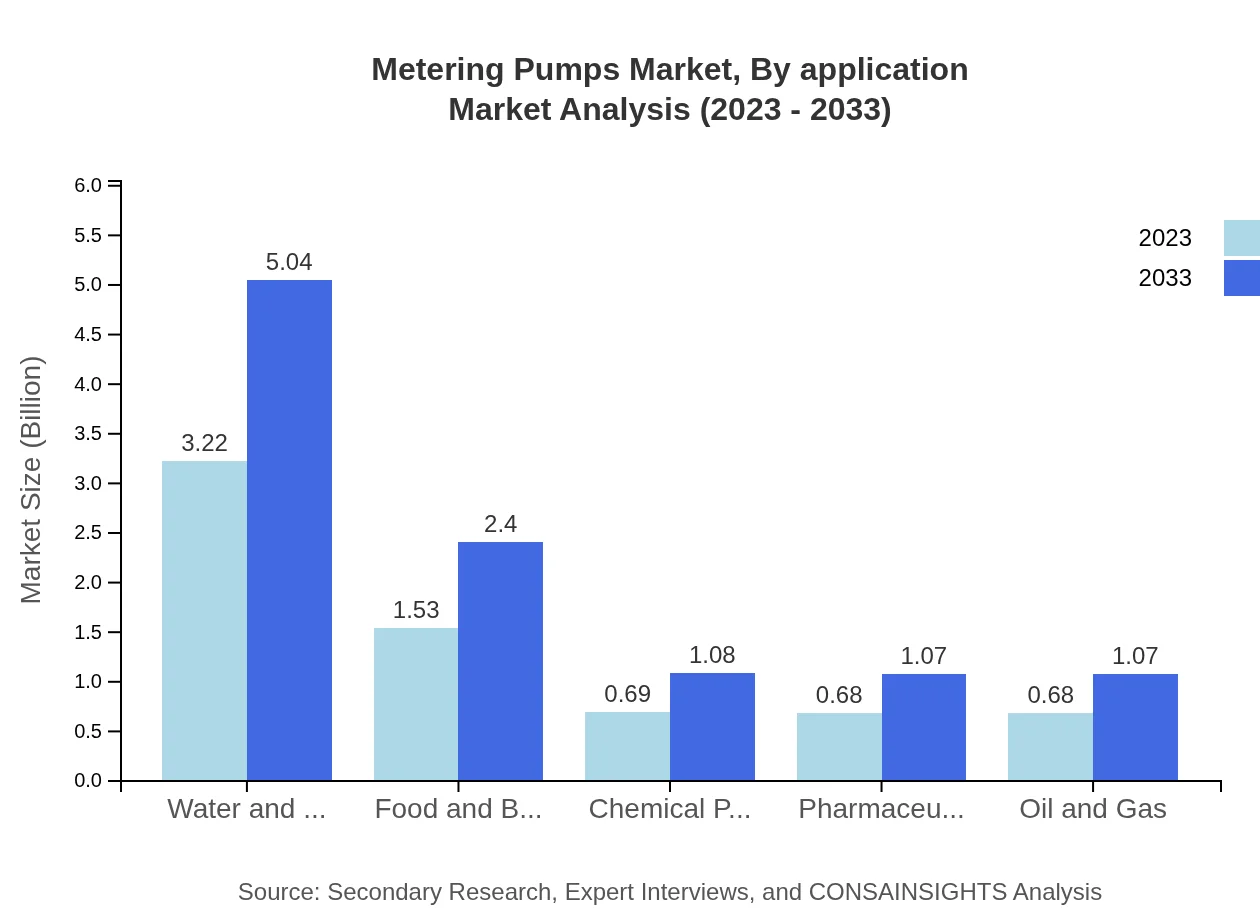

Metering Pumps Market Analysis By Application

Applications for Metering Pumps span across Water and Wastewater Treatment, Food and Beverage, Chemical Processing, and Pharmaceuticals. Water and Wastewater Treatment is the largest application segment with a market size of $3.22 billion in 2023, likely to grow to $5.04 billion by 2033.

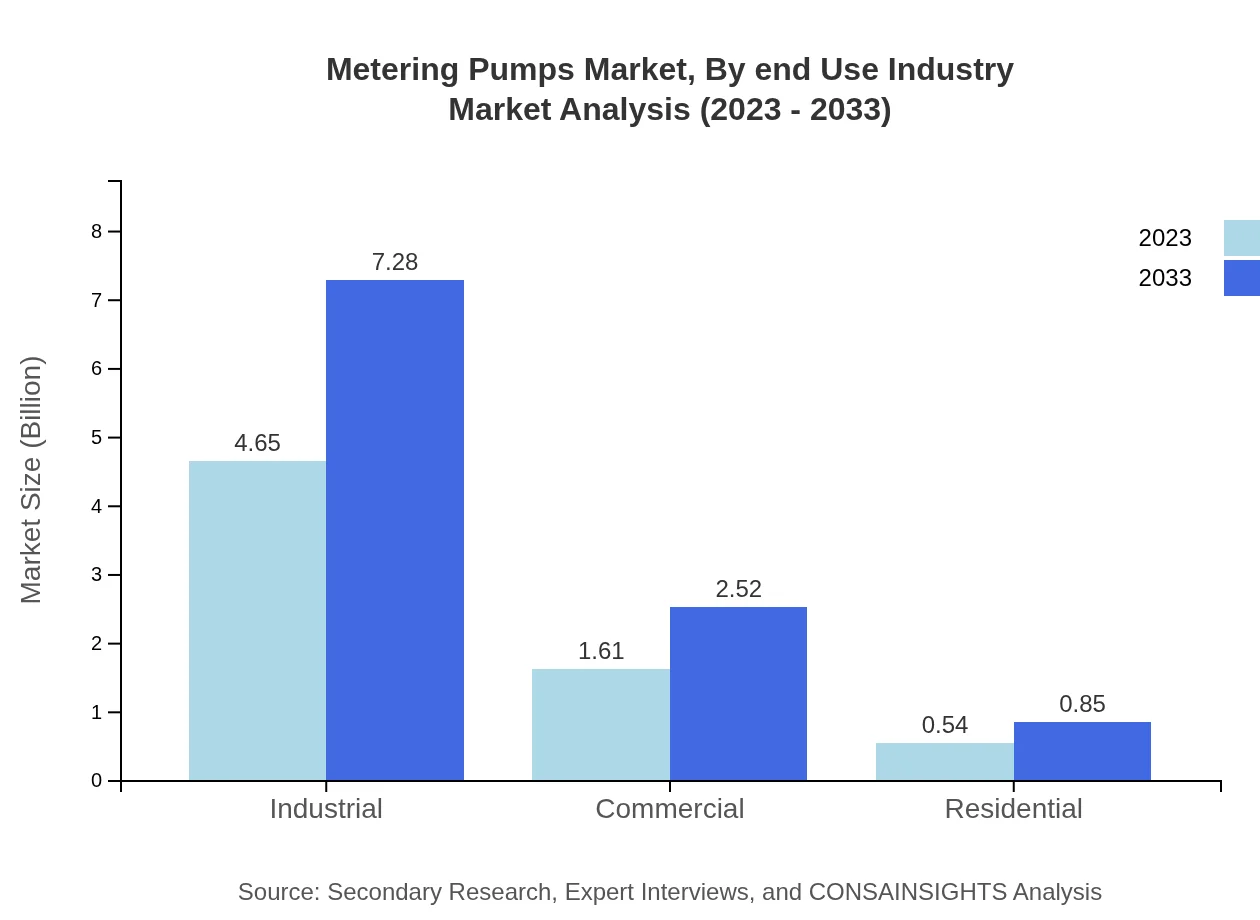

Metering Pumps Market Analysis By End Use Industry

The end-use industry segmentation includes Industrial, Commercial, and Residential markets. The Industrial segment leads with a size of $4.65 billion in 2023, expected to grow to $7.28 billion by 2033, representing 68.36% of the market, driven by rising demand for automation and precise material handling.

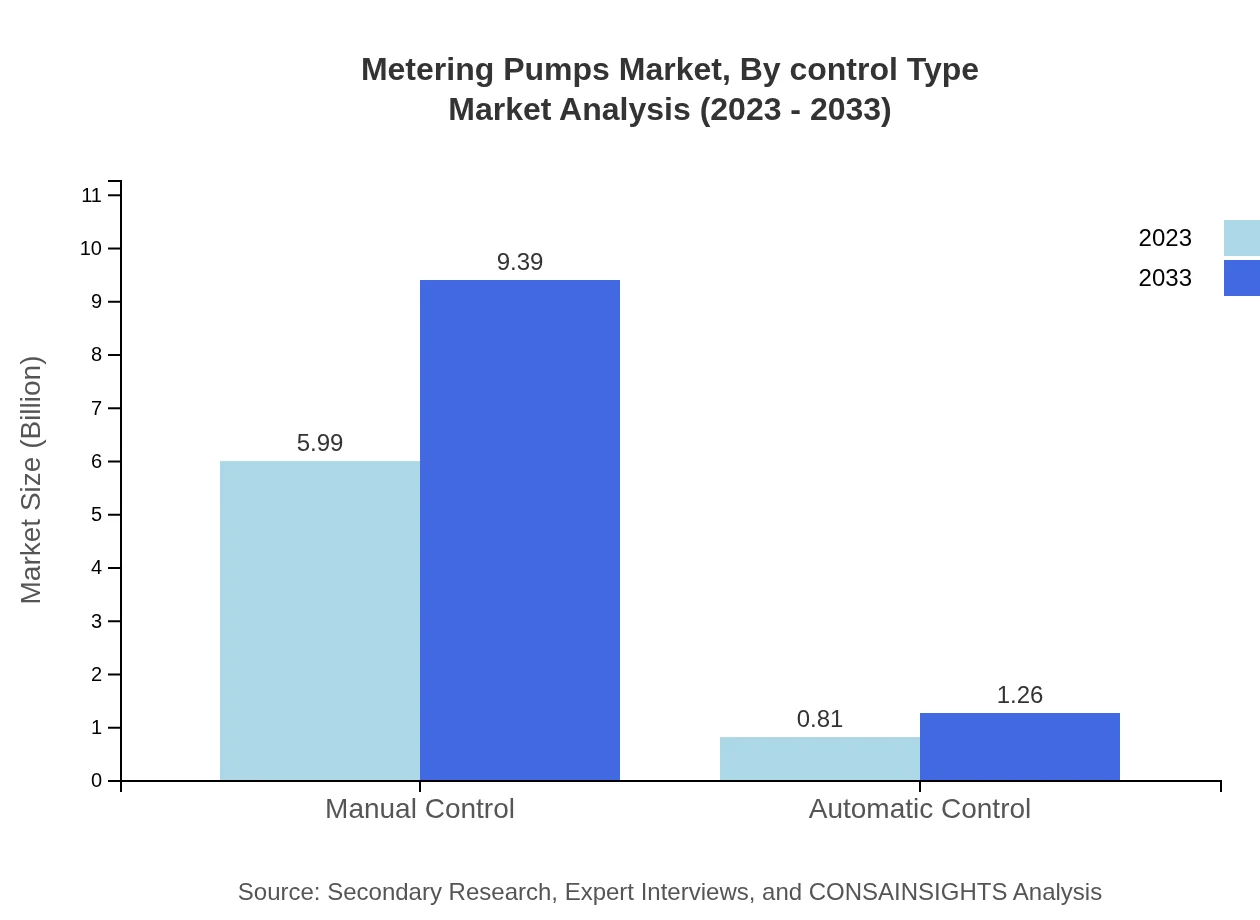

Metering Pumps Market Analysis By Control Type

The meter pump control types are Manual Control and Automatic Control. Manual Control, commanding a 88.14% share, has a market size of $5.99 billion in 2023, expanding to $9.39 billion by 2033. In contrast, Automatic Control constitutes a smaller segment with a 11.86% share.

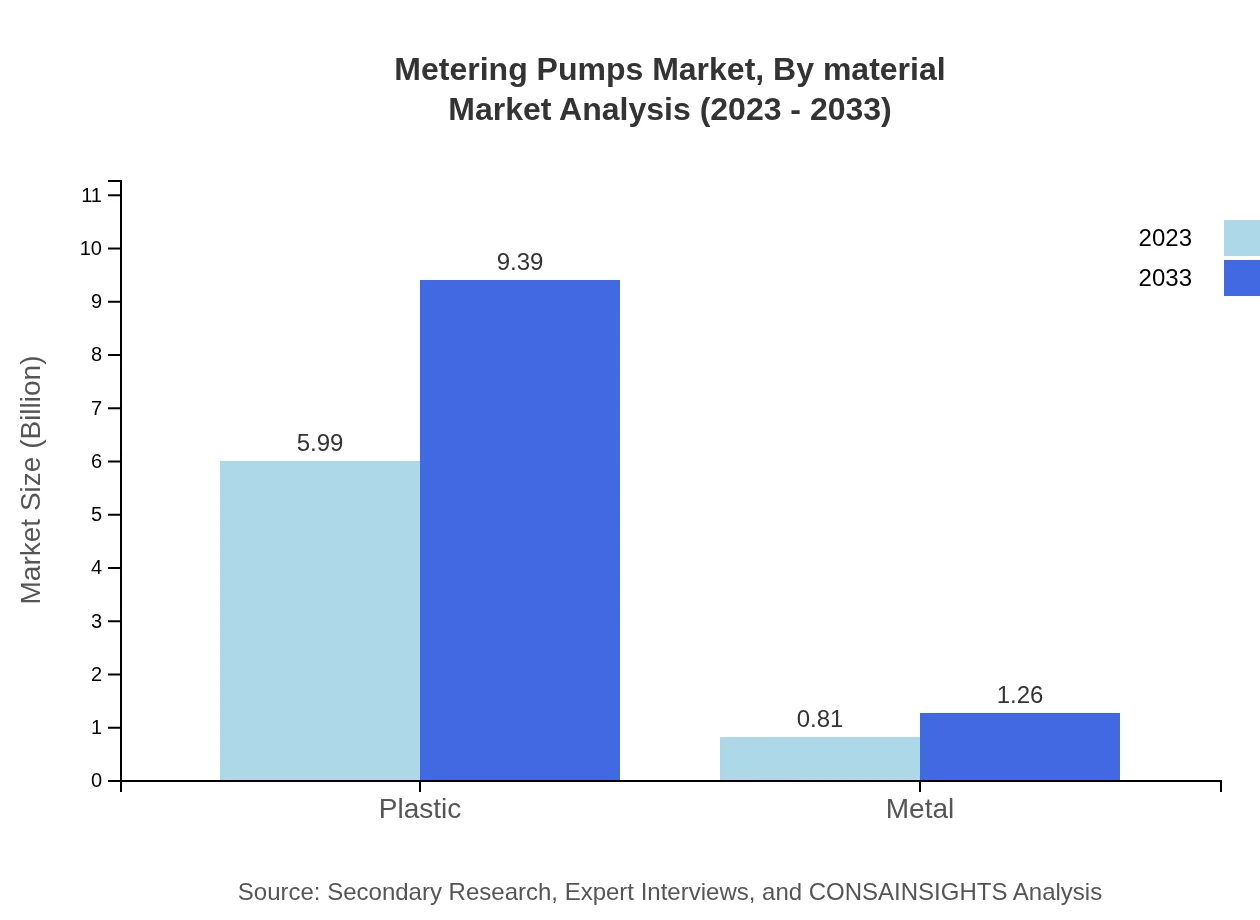

Metering Pumps Market Analysis By Material

Materials segment for Metering Pumps includes Plastic and Metal types. The Plastic segment dominates with a size of $5.99 billion in 2023, projected to grow to $9.39 billion by 2033, while the Metal segment, currently valued at $0.81 billion, is expected to reach $1.26 billion.

Metering Pumps Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Metering Pumps Industry

Grundfos:

A Danish multinational, Grundfos is known for its innovation in pump technology, providing energy-efficient and sustainable solutions.Flowserve Corporation:

Based in the USA, Flowserve specializes in fluid motion and control products, focusing on high-performance pumps and high-reliability sealing solutions.Dover Corporation:

Dover operates in various markets with high-quality pump solutions aimed at energy-efficient performance across different applications.Xylem Inc.:

Xylem is a leading water technology company, committed to developing sustainable solutions for water management and treatment.We're grateful to work with incredible clients.

FAQs

What is the market size of metering Pumps?

The global metering pumps market size is projected at $6.8 billion in 2023, with a CAGR of 4.5%, expected to grow consistently over the next decade.

What are the key market players or companies in the metering Pumps industry?

Key players in the metering pumps market include established industries such as Grundfos, Blue-White Industries, and Seko. These companies dominate the market by offering a range of innovative solutions tailored to various industrial applications.

What are the primary factors driving the growth in the metering pumps industry?

Factors driving growth in the metering pumps market include increasing demand across sectors like water treatment and pharmaceuticals, technological advancements, and the surge in industrial automation, alongside stringent regulations around fluid handling.

Which region is the fastest Growing in the metering pumps?

The Asia Pacific region is projected to be the fastest-growing in the metering pumps market, expanding from $1.38 billion in 2023 to $2.16 billion by 2033, fueled by rapid industrialization and urbanization.

Does ConsaInsights provide customized market report data for the metering pumps industry?

Yes, ConsaInsights offers customized market report data tailored to specific needs in the metering pumps industry, allowing clients to access detailed insights aligned with their market requirements.

What deliverables can I expect from this metering Pumps market research project?

Deliverables for the metering pumps market research project typically include comprehensive market analysis reports, detailed segment insights, regional market evaluations, and forecasts, ensuring actionable intelligence for strategic decision-making.

What are the market trends of metering Pumps?

Current trends in the metering pumps market include the shift towards automation, increasing use of electronic pumping solutions, and a focus on sustainable practices, as industries aim for efficiency and reduced environmental impact.