Methyl Methacrylate Mma Adhesive Market Report

Published Date: 22 January 2026 | Report Code: methyl-methacrylate-mma-adhesive

Methyl Methacrylate Mma Adhesive Market Size, Share, Industry Trends and Forecast to 2033

This report provides an in-depth analysis of the Methyl Methacrylate (MMA) adhesive market from 2023 to 2033. It includes insights into market size, growth trends, segmentation, and key players in the industry, providing vital data for stakeholders and decision-makers.

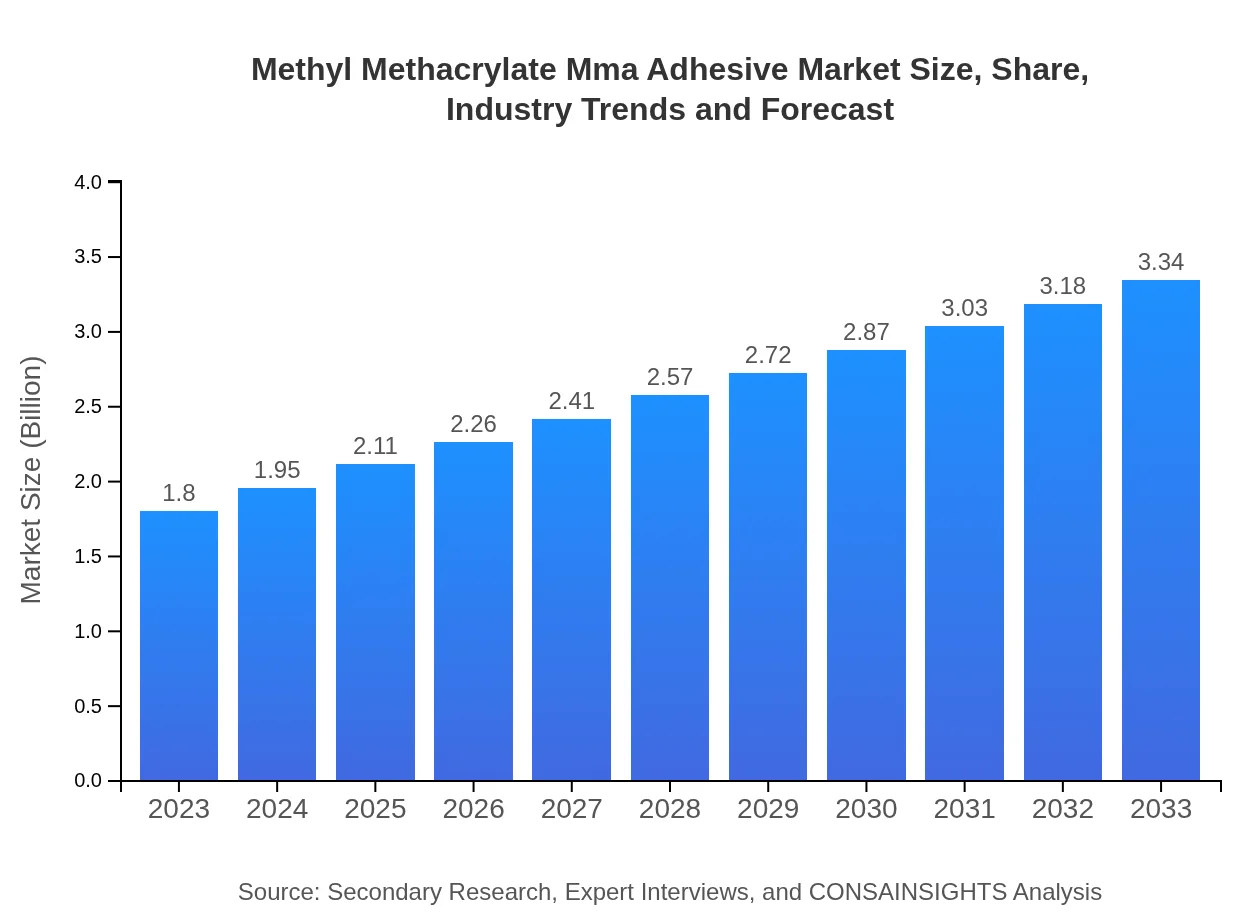

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $1.80 Billion |

| CAGR (2023-2033) | 6.2% |

| 2033 Market Size | $3.34 Billion |

| Top Companies | 3M Company, Henkel AG & Co. KGaA, Sika AG, Bostik, Dow Inc. |

| Last Modified Date | 22 January 2026 |

Methyl Methacrylate Mma Adhesive Market Overview

Customize Methyl Methacrylate Mma Adhesive Market Report market research report

- ✔ Get in-depth analysis of Methyl Methacrylate Mma Adhesive market size, growth, and forecasts.

- ✔ Understand Methyl Methacrylate Mma Adhesive's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Methyl Methacrylate Mma Adhesive

What is the Market Size & CAGR of Methyl Methacrylate Mma Adhesive market in 2023?

Methyl Methacrylate Mma Adhesive Industry Analysis

Methyl Methacrylate Mma Adhesive Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Methyl Methacrylate Mma Adhesive Market Analysis Report by Region

Europe Methyl Methacrylate Mma Adhesive Market Report:

Europe is forecasted to see significant growth in the MMA adhesive market, transitioning from USD 0.61 billion in 2023 to USD 1.13 billion in 2033. Stringent regulations favoring sustainable construction materials and a flourishing automotive market are pivotal in this growth.Asia Pacific Methyl Methacrylate Mma Adhesive Market Report:

The Asia-Pacific region is witnessing robust growth in the MMA adhesive market, with a projected market size of USD 0.60 billion by 2033, up from USD 0.32 billion in 2023. The rapid industrialization and urbanization, coupled with rising consumer spending on infrastructure projects, significantly contribute to market expansion.North America Methyl Methacrylate Mma Adhesive Market Report:

The North America MMA adhesive market is projected to increase from USD 0.61 billion in 2023 to USD 1.12 billion by 2033. The presence of a mature manufacturing base and a strong automotive industry drive the demand for high-performance adhesives.South America Methyl Methacrylate Mma Adhesive Market Report:

In South America, the MMA adhesive market is expected to grow from USD 0.05 billion in 2023 to USD 0.09 billion by 2033. The focus on improving infrastructural frameworks and the rising demand for quality adhesives in construction applications are crucial growth factors.Middle East & Africa Methyl Methacrylate Mma Adhesive Market Report:

The Middle East and Africa region is also contributing to market growth, with a forecasted increase from USD 0.21 billion in 2023 to USD 0.40 billion by 2033. Additionally, expanding construction initiatives and infrastructural developments are expected to contribute to the rising demand for MMA adhesives.Tell us your focus area and get a customized research report.

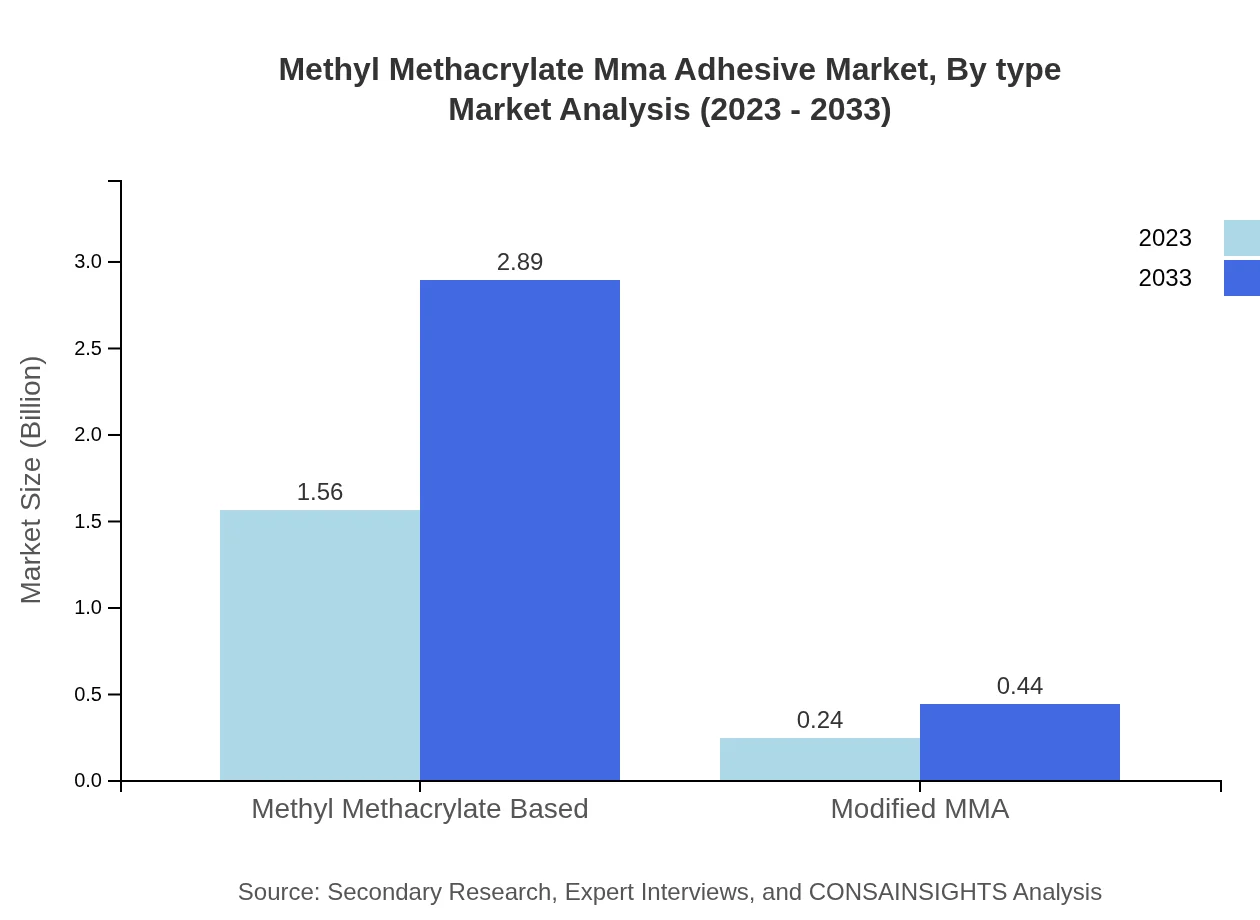

Methyl Methacrylate Mma Adhesive Market Analysis By Type

The Methyl Methacrylate based adhesives dominated the market in 2023, holding a size of USD 1.56 billion and projected to reach USD 2.89 billion by 2033, representing an 86.79% market share. Modified MMA adhesives also play a crucial role, expected to grow from USD 0.24 billion to USD 0.44 billion, maintaining 13.21% of the market.

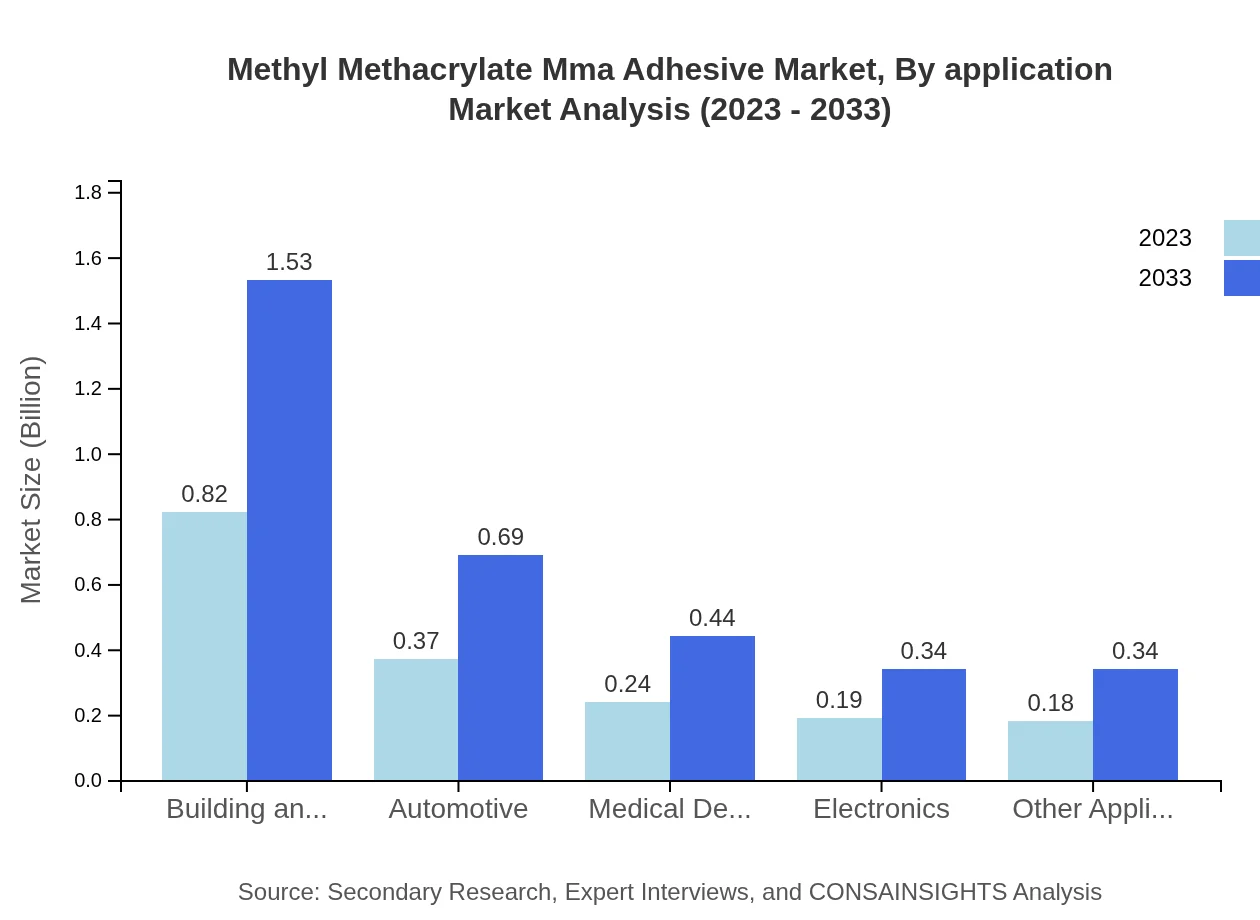

Methyl Methacrylate Mma Adhesive Market Analysis By Application

In the construction industry, the MMA adhesive market size is projected to increase from USD 0.93 billion in 2023 to USD 1.73 billion by 2033, capturing a market share of 51.89%. Automotive applications account for USD 0.44 billion growing to USD 0.82 billion, while healthcare and electronics applications currently hold shares of 10.57% and 12.92%, respectively.

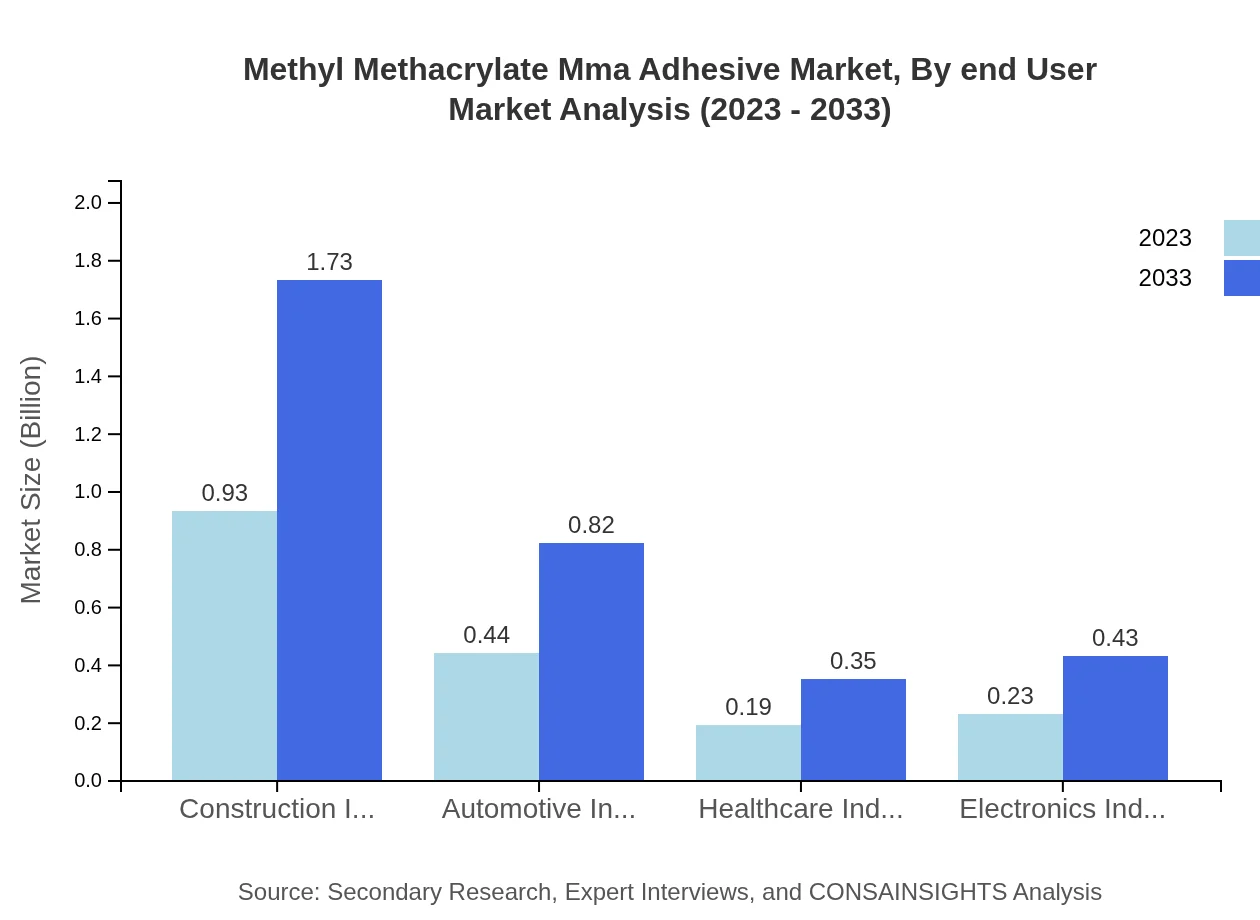

Methyl Methacrylate Mma Adhesive Market Analysis By End User

The market for MMA adhesives is significantly supported by the construction end-user segment, expected to expand from USD 0.93 billion in 2023 to USD 1.73 billion by 2033. Other significant sectors include automotive, healthcare, and electronics, with notable shares attributed to the need for durable bonding solutions across these industries.

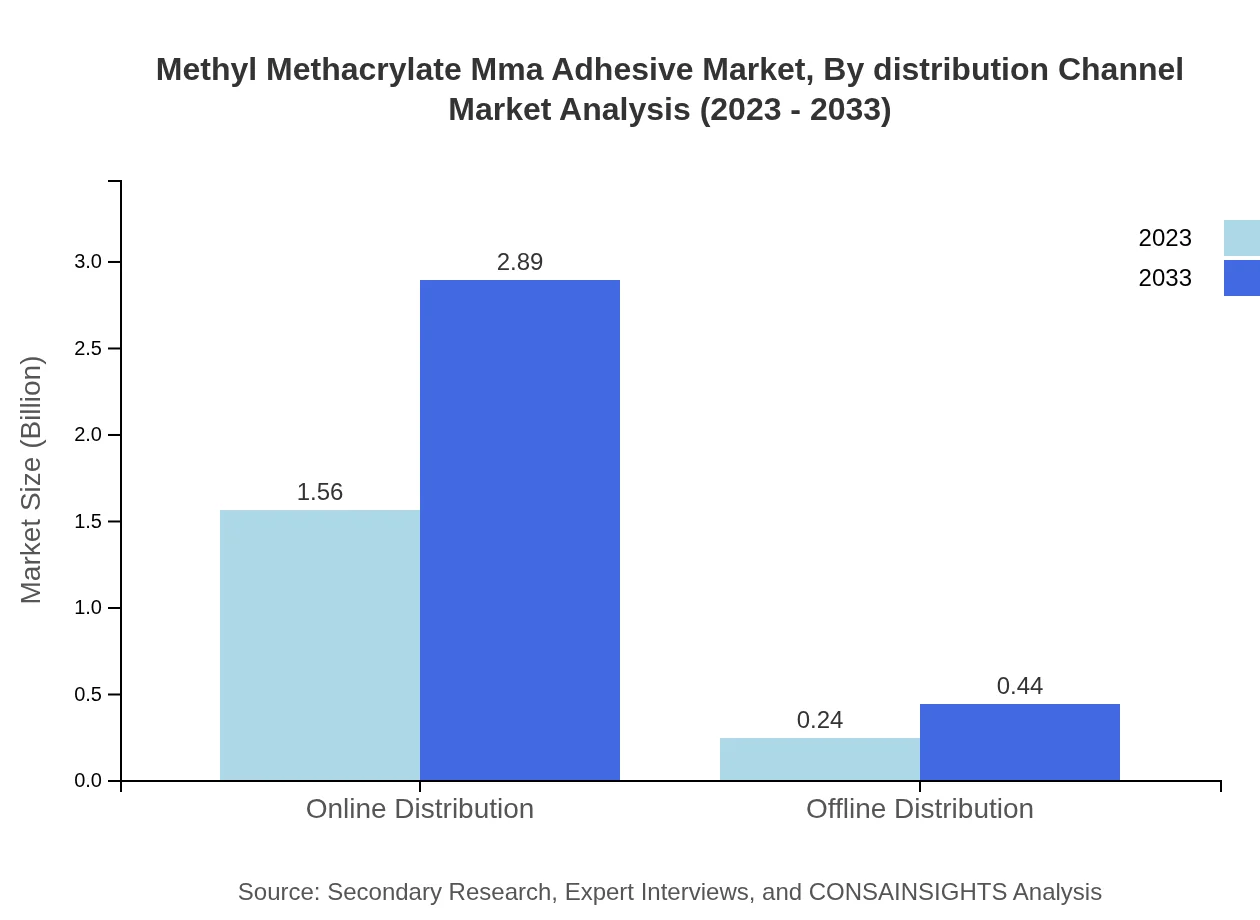

Methyl Methacrylate Mma Adhesive Market Analysis By Distribution Channel

Online distribution channels hold a significant portion, valued at USD 1.56 billion in 2023 and projected to grow to USD 2.89 billion by 2033. In contrast, offline channels are expected to expand from USD 0.24 billion to USD 0.44 billion, reflecting a growing trend towards digital purchasing in the adhesive market.

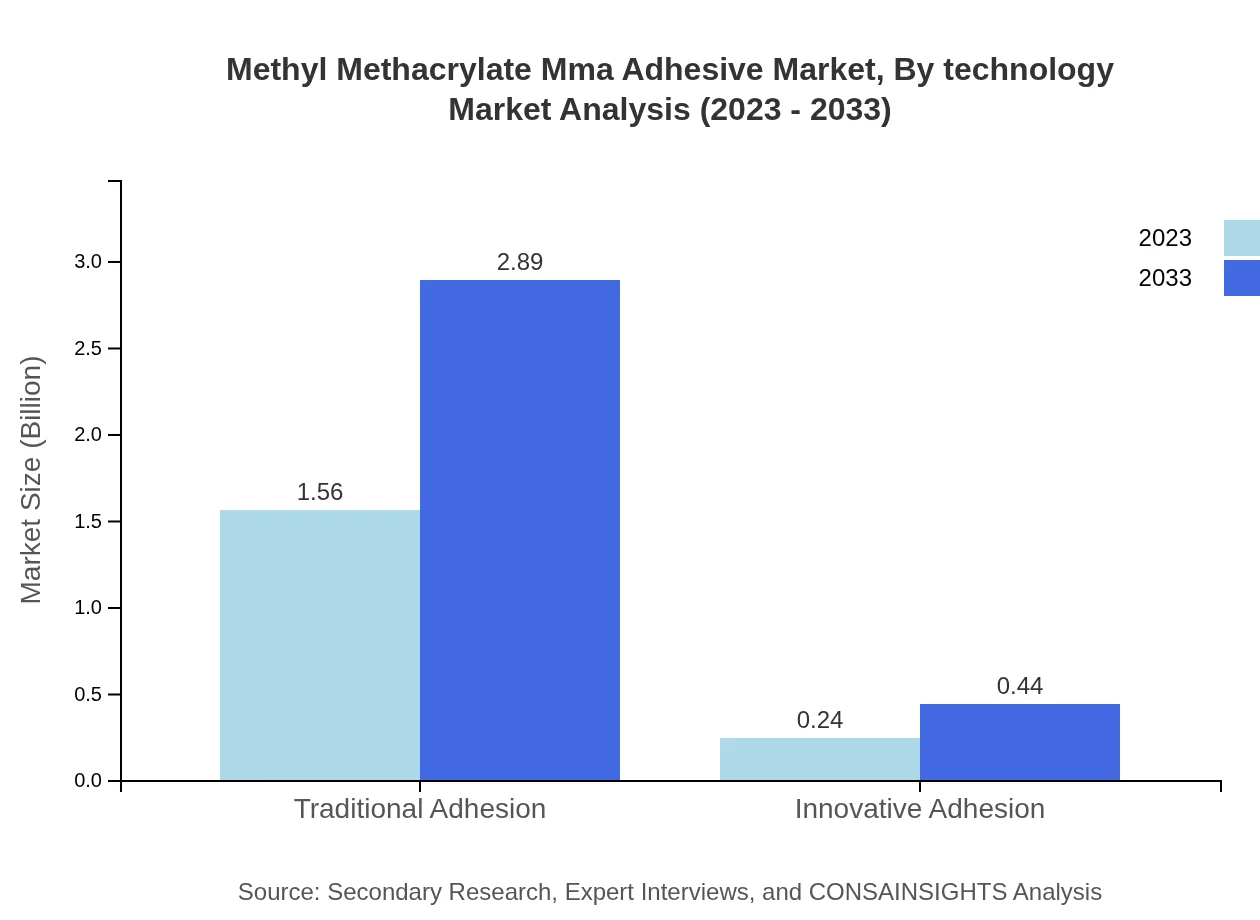

Methyl Methacrylate Mma Adhesive Market Analysis By Technology

The technological advancement in MMA adhesive formulations is driving growth, with traditional adhesion methods dominating the market at USD 1.56 billion, continuing robust performance through 2033. Innovative adhesion technologies are expected to increase from USD 0.24 billion to USD 0.44 billion, driven by the demand for more sustainable and high-performance products.

Methyl Methacrylate Mma Adhesive Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Methyl Methacrylate Mma Adhesive Industry

3M Company:

3M is a globally recognized leader in adhesives, known for its innovative solutions in various industries, including automotive and construction.Henkel AG & Co. KGaA:

Henkel is a leading manufacturer specializing in adhesives, sealants, and functional coatings, widely used across multiple sectors.Sika AG:

Sika focuses on specialty chemicals for construction and industrial applications, offering advanced MMA adhesive products.Bostik:

A part of Arkema Group, Bostik specializes in adhesives and sealants, with innovative formulations targeting specific market needs.Dow Inc.:

A major player in chemical manufacturing, Dow provides a range of high-performance adhesive solutions globally, including MMA products.We're grateful to work with incredible clients.

FAQs

What is the market size of methyl Methacrylate Mma Adhesive?

The global market size of methyl methacrylate (MMA) adhesives is projected at $1.8 billion in 2023, with a compound annual growth rate (CAGR) of 6.2%. This growth reflects increasing demand across various industries such as construction and automotive.

What are the key market players or companies in this industry?

Key players in the MMA adhesive market include renowned companies that specialize in adhesive manufacturing. These firms are pivotal in driving innovation, enhancing product formulations, and expanding their geographical reach to meet the growing market demands.

What are the primary factors driving the growth in the MMA adhesive industry?

Growth in the MMA adhesive market is propelled by advancements in adhesive technology, increasing applications in construction and automotive sectors, and rising demand for durable and high-performance adhesives. Regulatory support and eco-friendly product trends also contribute significantly.

Which region is the fastest Growing in the MMA adhesive market?

The Asia Pacific region is emerging as the fastest-growing market for MMA adhesives, with market size projected to increase from $0.32 billion in 2023 to $0.60 billion by 2033. This growth is driven by rapid industrialization and infrastructure development.

Does ConsaInsights provide customized market report data for the MMA adhesive industry?

Yes, ConsaInsights offers customized market report data tailored to specific requirements of clients within the MMA adhesive industry. This allows businesses to gain insights that are more relevant to their strategic objectives and market conditions.

What deliverables can I expect from this MMA adhesive market research project?

Deliverables from this market research project include comprehensive reports featuring market size, segmentation analysis, growth forecasts, detailed insights on competitive landscape, and trends that are shaping the MMA adhesive industry for a decade.

What are the market trends of MMA adhesive?

Current trends in the MMA adhesive market highlight a shift towards eco-friendly formulations, increased usage in medical device applications, and the rising popularity of online distribution channels. Innovations in adhesive technology are creating more robust and versatile products.