Metrology Software Market Report

Published Date: 31 January 2026 | Report Code: metrology-software

Metrology Software Market Size, Share, Industry Trends and Forecast to 2033

This report analyzes the Metrology Software market, detailing current trends, future growth forecasts from 2023 to 2033, and key market players. Insights include market segmentation, regional dynamics, technological advancements, and industry challenges.

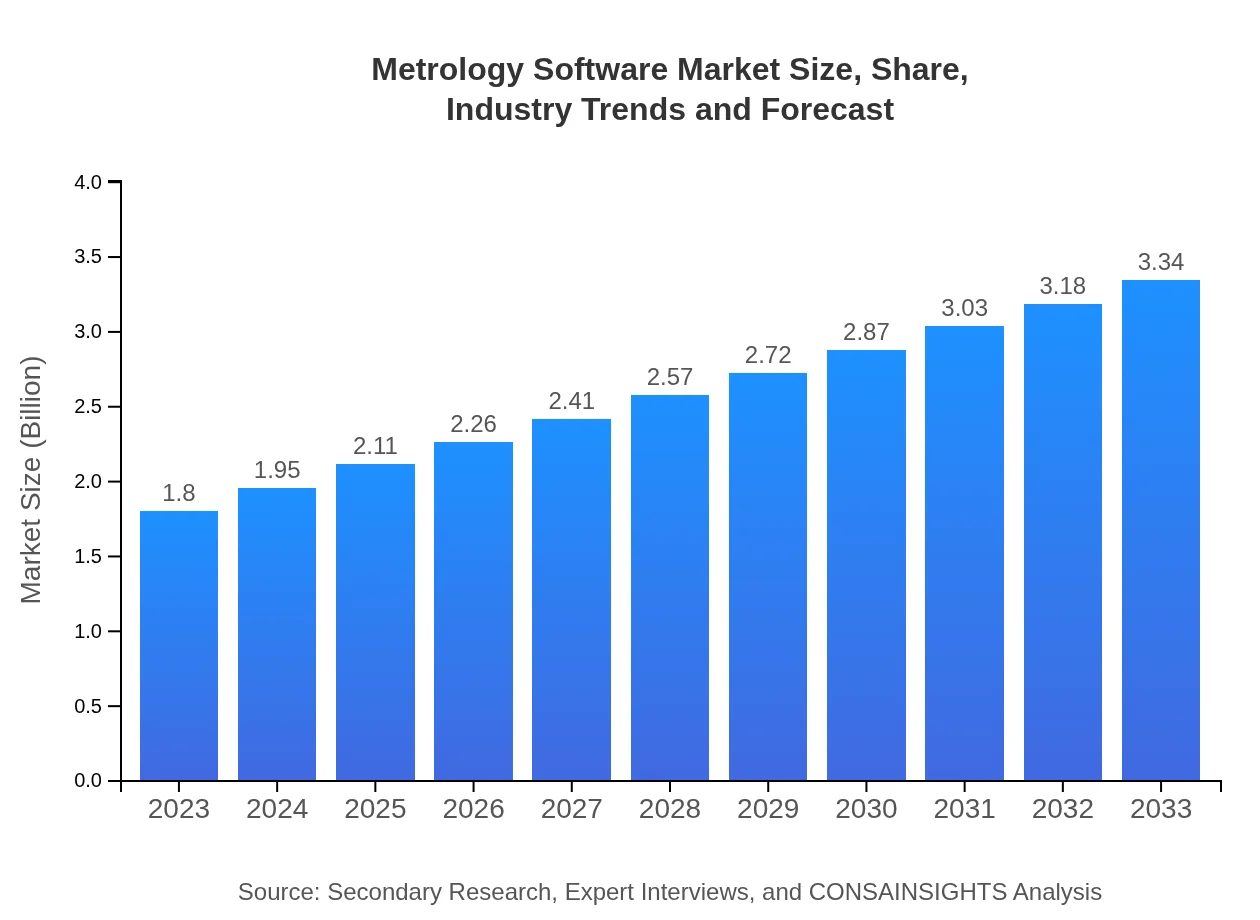

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $1.80 Billion |

| CAGR (2023-2033) | 6.2% |

| 2033 Market Size | $3.34 Billion |

| Top Companies | Hexagon AB, National Instruments Corporation, Carl Zeiss AG, FARO Technologies, Inc., Renishaw PLC |

| Last Modified Date | 31 January 2026 |

Metrology Software Market Overview

Customize Metrology Software Market Report market research report

- ✔ Get in-depth analysis of Metrology Software market size, growth, and forecasts.

- ✔ Understand Metrology Software's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Metrology Software

What is the Market Size & CAGR of the Metrology Software market in 2023?

Metrology Software Industry Analysis

Metrology Software Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Metrology Software Market Analysis Report by Region

Europe Metrology Software Market Report:

In Europe, the Metrology Software market is forecasted to grow from $0.43 billion in 2023 to $0.80 billion by 2033. European countries are emphasizing compliance and quality standards in manufacturing, driving the adoption of sophisticated metrology software. Additionally, green manufacturing practices are encouraging investments in efficient measurement technologies.Asia Pacific Metrology Software Market Report:

The Asia Pacific region is experiencing significant growth within the Metrology Software market, projected to grow from $0.35 billion in 2023 to $0.65 billion by 2033. Increased manufacturing activities, especially in countries like China and India, coupled with rising technological adoption, are driving this growth. The region is also witnessing a shift towards smart manufacturing practices, leading to increased investment in advanced metrology solutions.North America Metrology Software Market Report:

North America is currently the largest market for Metrology Software, with a value of $0.68 billion in 2023, anticipated to reach $1.26 billion by 2033. The region's dominance is attributed to advanced manufacturing sectors, robust industrial automation, and ongoing investments in R&D for high-precision manufacturing solutions. Major players are consistently innovating to maintain their competitive edge.South America Metrology Software Market Report:

South America shows a modest growth trajectory, with the market expected to expand from $0.12 billion in 2023 to $0.22 billion in 2033. The growth is supported by improving industrial capabilities and a burgeoning automotive sector, which necessitates stringent quality control measures. However, economic stability and technological investment remain challenges.Middle East & Africa Metrology Software Market Report:

The Middle East and Africa region is expected to see gradual growth in the Metrology Software market, with projections of an increase from $0.22 billion in 2023 to $0.40 billion by 2033. While the pace of growth is slower compared to other regions, investments in infrastructure and quality assurance practices in emerging economies are slowly improving market dynamics.Tell us your focus area and get a customized research report.

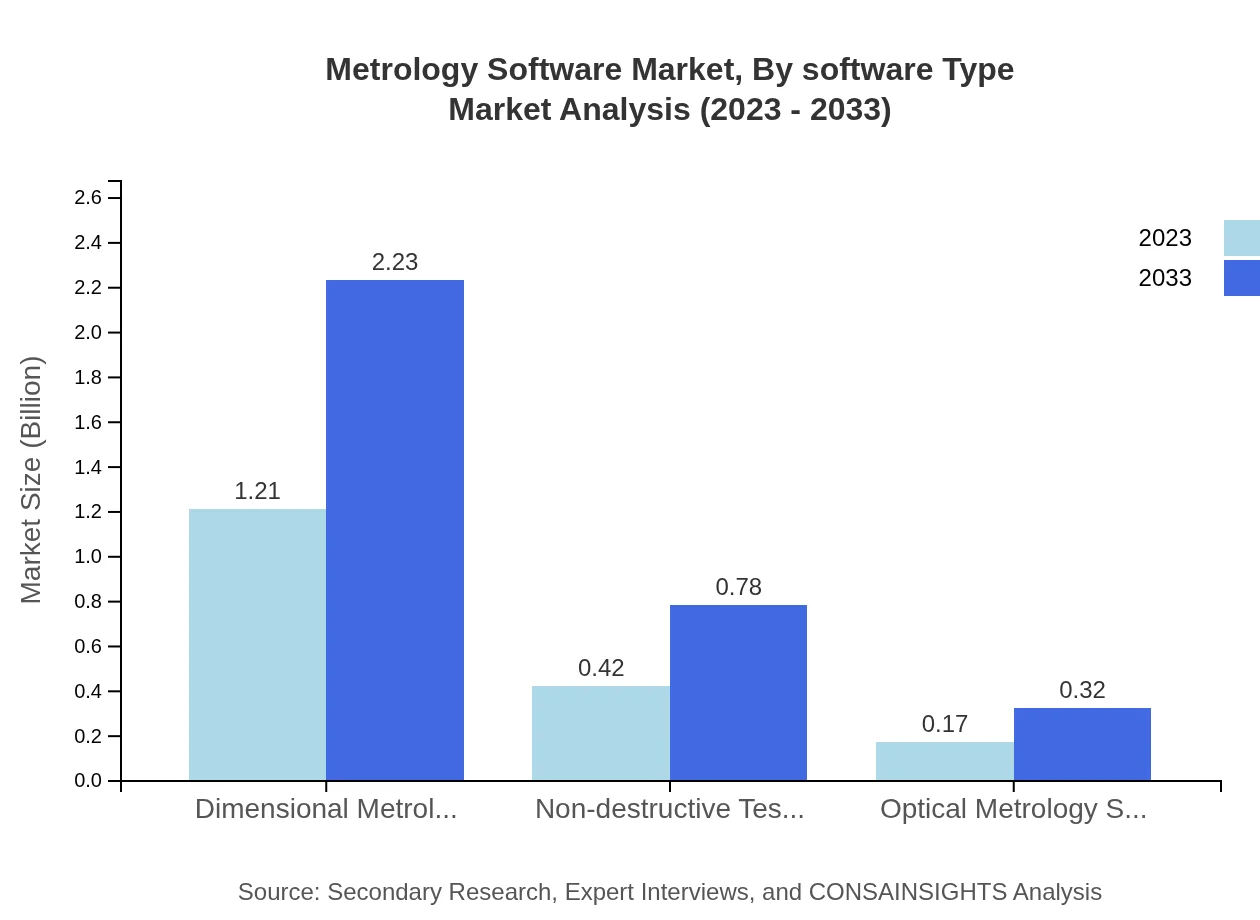

Metrology Software Market Analysis By Software Type

The metrology software market is primarily segmented into dimensional metrology software, non-destructive testing software, and optical metrology software. In 2023, dimensional metrology software holds the largest market size at approximately $1.21 billion, with a projected growth to $2.23 billion by 2033. This software is crucial for industries relying on precision and accuracy, particularly aerospace and automotive. Non-destructive testing software, valued at $0.42 billion in 2023, is anticipated to reach $0.78 billion by 2033, highlighting its importance in sectors requiring quality assurance without compromising material integrity. Optical metrology software is also gaining traction, expected to grow from $0.17 billion to $0.32 billion during the same period, driven by advancements in imaging technology.

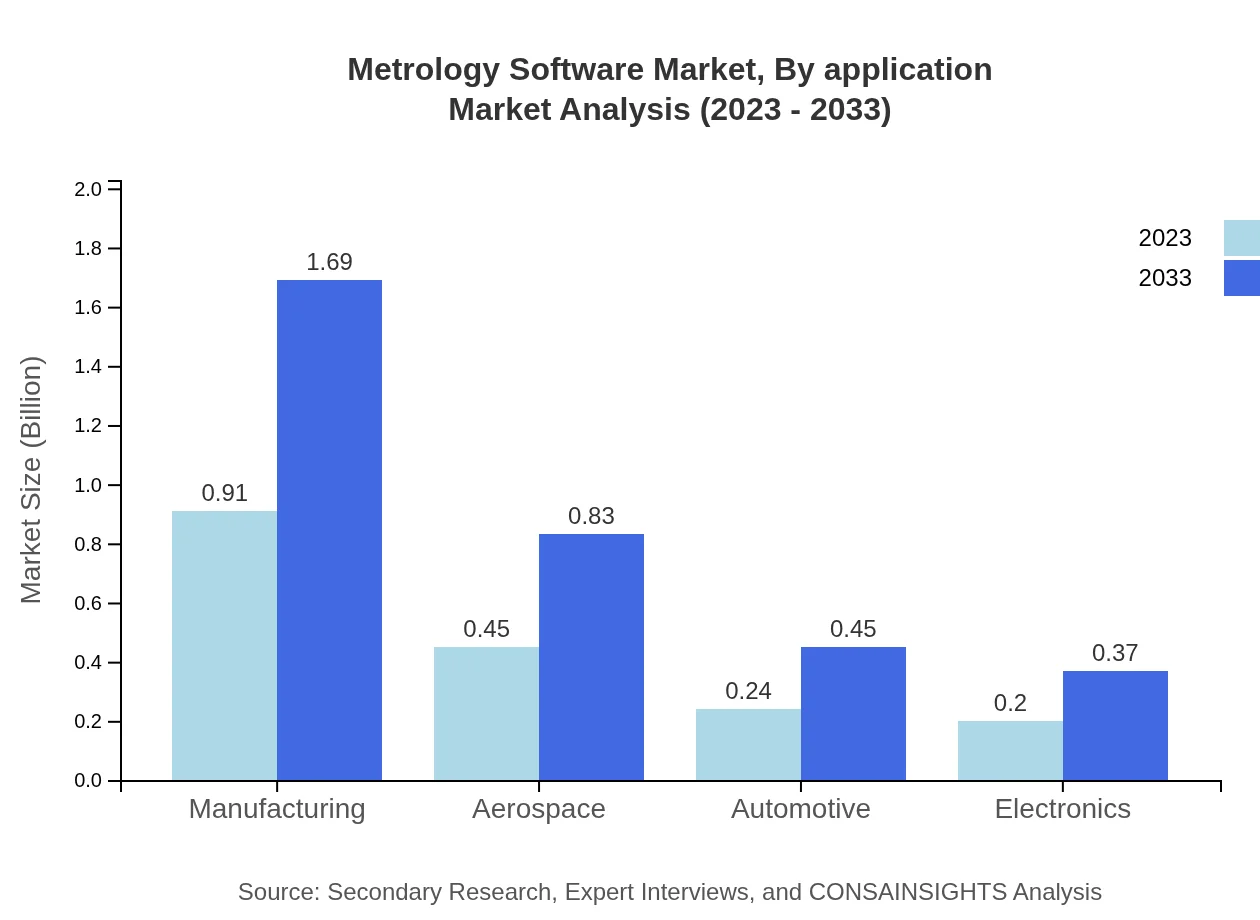

Metrology Software Market Analysis By Application

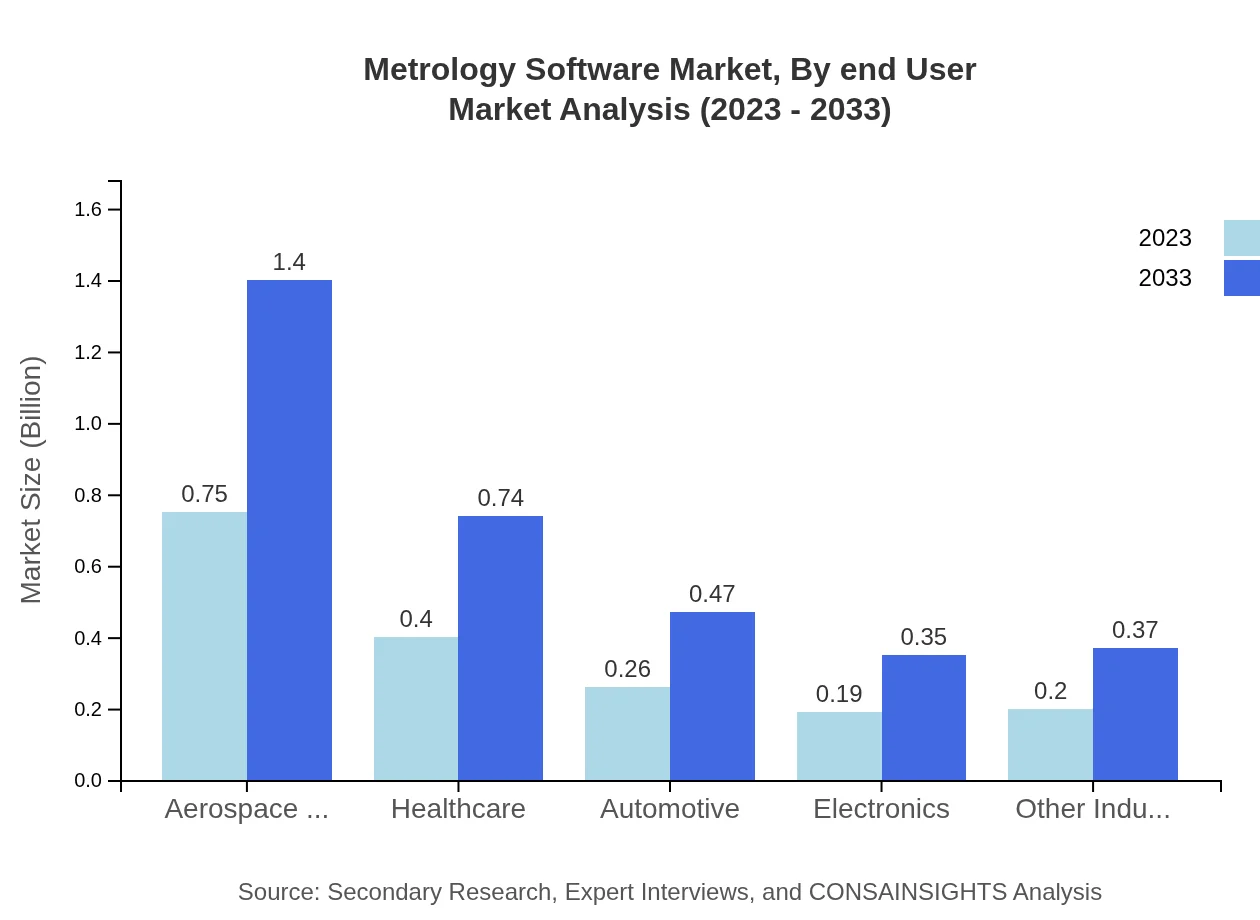

The Metrology Software market finds applications across several industries such as aerospace, healthcare, automotive, electronics, and other sectors. The aerospace application segment is projected to grow from $0.45 billion in 2023 to $0.83 billion by 2033, indicating the critical need for stringent quality standards in this industry. Healthcare follows, expected to increase from $0.40 billion to $0.74 billion, reflecting the sector's reliance on precise measurements for patient safety. The automotive sector is also significant, with market size advancing from $0.26 billion to $0.47 billion as advancements in automotive technologies demand higher quality control measures.

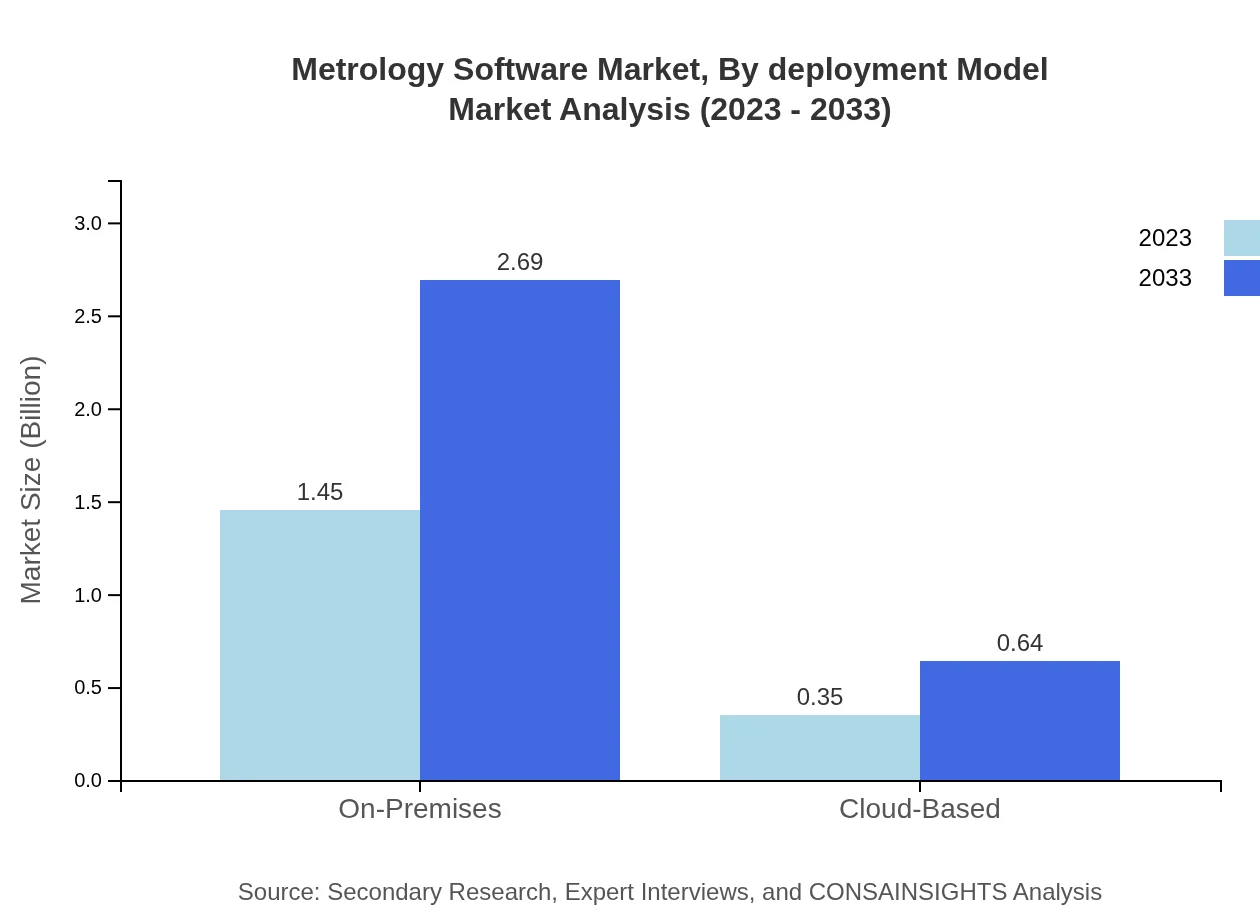

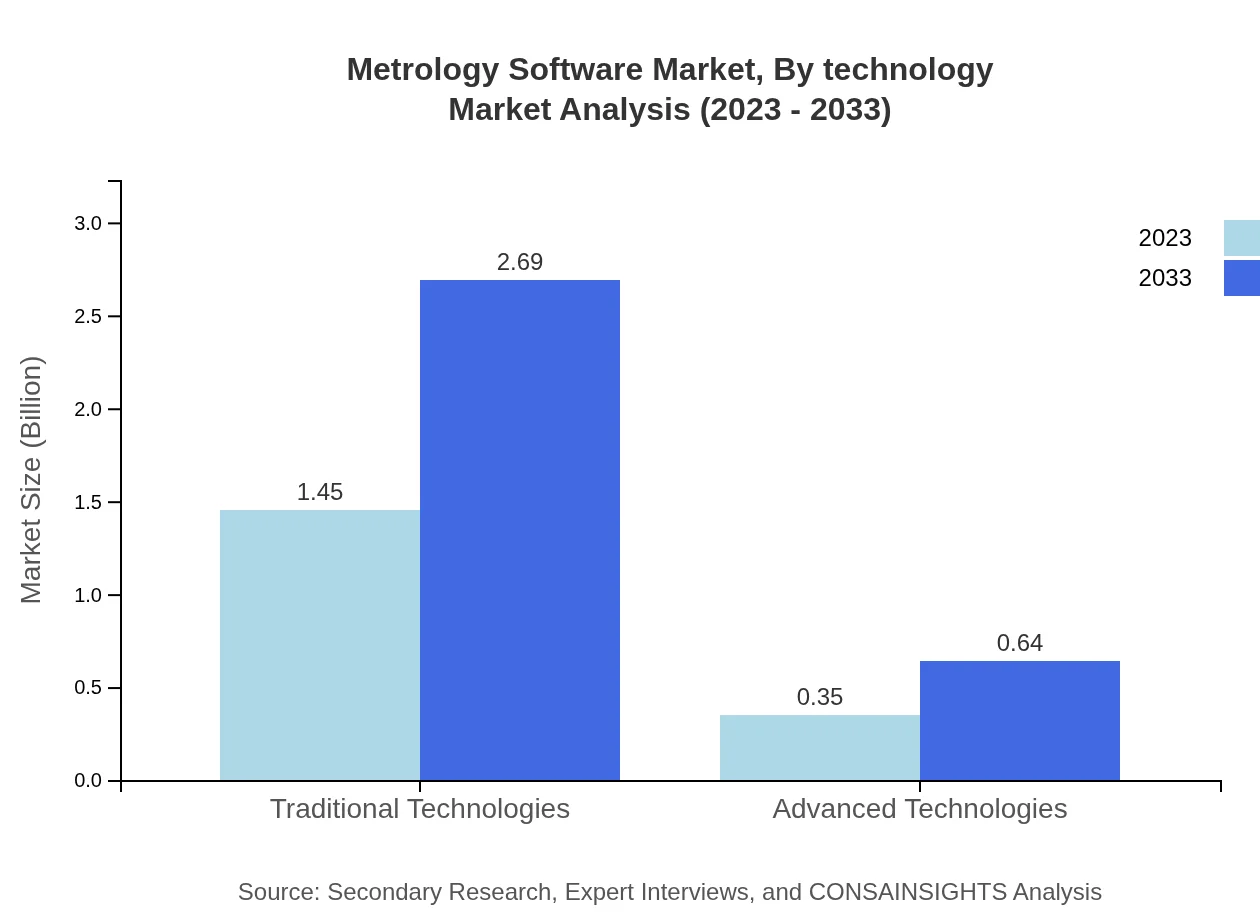

Metrology Software Market Analysis By Deployment Model

Metrology Software can be deployed either on-premises or in the cloud, each offering unique advantages. In 2023, on-premises solutions dominate the market with a share of $1.45 billion, holding an 80.77% share, predominantly preferred by industries requiring high security and control over their data. However, cloud-based solutions, currently valued at $0.35 billion, with a 19.23% market share, are gaining momentum due to their scalability and lower upfront costs, leading to an anticipated growth to $0.64 billion by 2033.

Metrology Software Market Analysis By End User

The end-user segment is diverse, encompassing manufacturing, aerospace, healthcare, automotive, and electronics. Manufacturing is the leading segment, valued at $0.91 billion in 2023, with projections to reach $1.69 billion by 2033, driven by increasing automation and a focus on precision. Aerospace follows closely, valued at $0.45 billion with expected growth to $0.83 billion, highlighting its critical need for rigorous metrology practices. Other industries, while smaller in size, are also experiencing growth as metrology practices become standardized.

Metrology Software Market Analysis By Technology

Technological advancements play a pivotal role in the Metrology Software market. Currently, traditional technologies are the most widely used, commanding a market share of 80.77% and a value of $1.45 billion, promoting a stable growth rate. However, advanced technologies, while currently valued at $0.35 billion, are anticipated to gain traction as manufacturing firms seek enhanced precision and efficiency, expected to grow to $0.64 billion by 2033. The incorporation of AI and machine learning into metrology software is set to redefine the market landscape, offering predictive capabilities and automation.

Metrology Software Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Metrology Software Industry

Hexagon AB:

Hexagon AB is a global leader in digital reality solutions, combining sensor, software, and autonomous technologies. They provide an extensive range of metrology tools and software for various applications, enhancing productivity through advanced measurement solutions.National Instruments Corporation:

National Instruments Corporation offers a wide array of solutions for test, measurement, and control systems. Their metrology software is widely recognized for its robustness and versatility, playing a critical role across several industrial sectors.Carl Zeiss AG:

Carl Zeiss AG specializes in optical systems and measurement technologies. Their metrology software solutions are integral in precision measurements, particularly in industrial and quality assurance applications.FARO Technologies, Inc.:

FARO Technologies provides advanced manufacturing solutions, including 3D measurement and imaging technology. Their software enables high-precision measurements, enhancing product quality and compliance.Renishaw PLC:

Renishaw PLC focuses on metrology and healthcare solutions. They are well-known for their innovative measurement systems and software, which are crucial for industries demanding precision.We're grateful to work with incredible clients.

FAQs

What is the market size of Metrology Software?

The global metrology software market is valued at $1.8 billion in 2023, with a projected compound annual growth rate (CAGR) of 6.2% through 2033.

What are the key market players or companies in this Metrology Software industry?

Key players in the metrology software industry include Dr. Johannes Heidenhain GmbH, Hexagon, FARO Technologies, ZEISS, and Renishaw, which dominate the market with their innovative solutions and technologies.

What are the primary factors driving the growth in the Metrology Software industry?

The growth of the metrology software industry is driven by advancements in automation, increased demand for quality control in manufacturing, and the rising need for precision measurement in various sectors.

Which region is the fastest Growing in the Metrology Software market?

The Asia Pacific region is the fastest-growing area in the metrology software market, expected to grow from $0.35 billion in 2023 to $0.65 billion by 2033, driven by rapid industrialization.

Does Cons Insights provide customized market report data for the Metrology Software industry?

Yes, Cons Insights offers customized market report data tailored to specific needs and insights regarding the metrology software industry, addressing unique market queries from clients.

What deliverables can I expect from this Metrology Software market research project?

Deliverables for the metrology software market research project include comprehensive market analysis, trend reports, competitive landscape overview, and actionable insights tailored to your business objectives.

What are the market trends of Metrology Software?

Current trends in the metrology software market include a shift towards cloud-based solutions, increasing use of AI in metrology applications, and a focus on non-destructive testing technologies for various industries.