Micro Electro Mechanical Systems Market Report

Published Date: 22 January 2026 | Report Code: micro-electro-mechanical-systems

Micro Electro Mechanical Systems Market Size, Share, Industry Trends and Forecast to 2033

This report provides an in-depth analysis of the Micro Electro Mechanical Systems (MEMS) market, including current trends, future forecasts, and insights into market segmentation. The forecast period analyzed spans from 2023 to 2033.

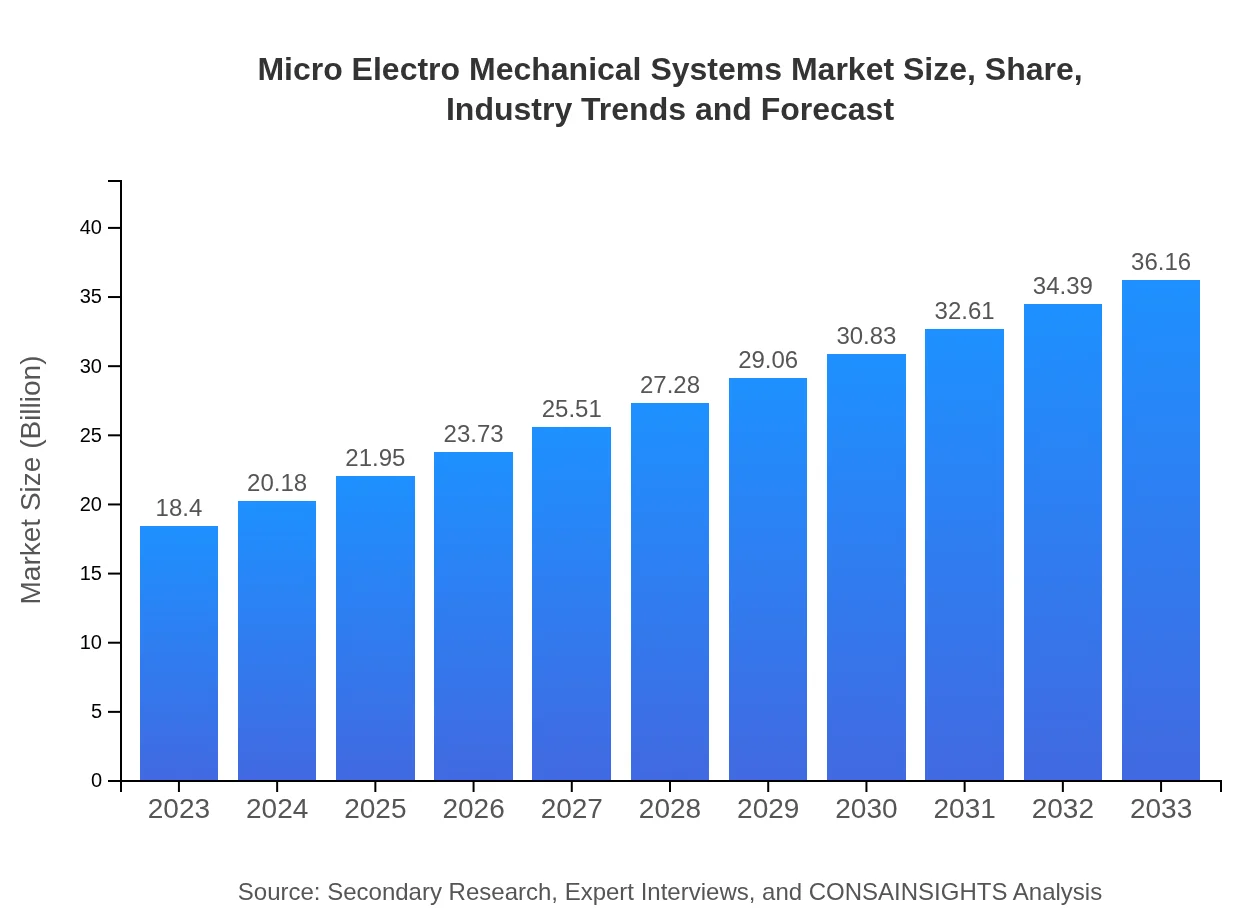

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $18.40 Billion |

| CAGR (2023-2033) | 6.8% |

| 2033 Market Size | $36.16 Billion |

| Top Companies | Texas Instruments, STMicroelectronics, Bosch Sensortec, Analog Devices, Honeywell |

| Last Modified Date | 22 January 2026 |

Micro Electro Mechanical Systems Market Overview

Customize Micro Electro Mechanical Systems Market Report market research report

- ✔ Get in-depth analysis of Micro Electro Mechanical Systems market size, growth, and forecasts.

- ✔ Understand Micro Electro Mechanical Systems's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Micro Electro Mechanical Systems

What is the Market Size & CAGR of Micro Electro Mechanical Systems market in 2023?

Micro Electro Mechanical Systems Industry Analysis

Micro Electro Mechanical Systems Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Micro Electro Mechanical Systems Market Analysis Report by Region

Europe Micro Electro Mechanical Systems Market Report:

Europe's MEMS market is anticipated to grow from USD 5.87 billion in 2023 to USD 11.54 billion by 2033, driven by advancements in automotive technologies and the integration of MEMS devices in healthcare monitoring systems.Asia Pacific Micro Electro Mechanical Systems Market Report:

The Asia Pacific region is witnessing significant growth in the MEMS market, projected to reach USD 6.29 billion by 2033 from USD 3.20 billion in 2023. Key drivers include rapid industrialization, increased adoption of smart gadgets, and a booming automotive sector.North America Micro Electro Mechanical Systems Market Report:

North America remains a critical market for MEMS, with projections of growth from USD 6.87 billion in 2023 to USD 13.50 billion in 2033. The region's focus on innovation, high penetration of technology, and robust consumer electronics market significantly contribute to this expansion.South America Micro Electro Mechanical Systems Market Report:

In South America, the MEMS market is relatively smaller but has potential growth opportunities. It is expected to increase from USD 0.12 billion in 2023 to USD 0.24 billion by 2033, primarily driven by advancements in healthcare technology and automotive applications.Middle East & Africa Micro Electro Mechanical Systems Market Report:

The Middle East and Africa are gradually emerging as significant contributors to the MEMS market. The expected growth from USD 2.33 billion in 2023 to USD 4.59 billion by 2033 is primarily fueled by technological advancements and increasing investments in smart city infrastructures.Tell us your focus area and get a customized research report.

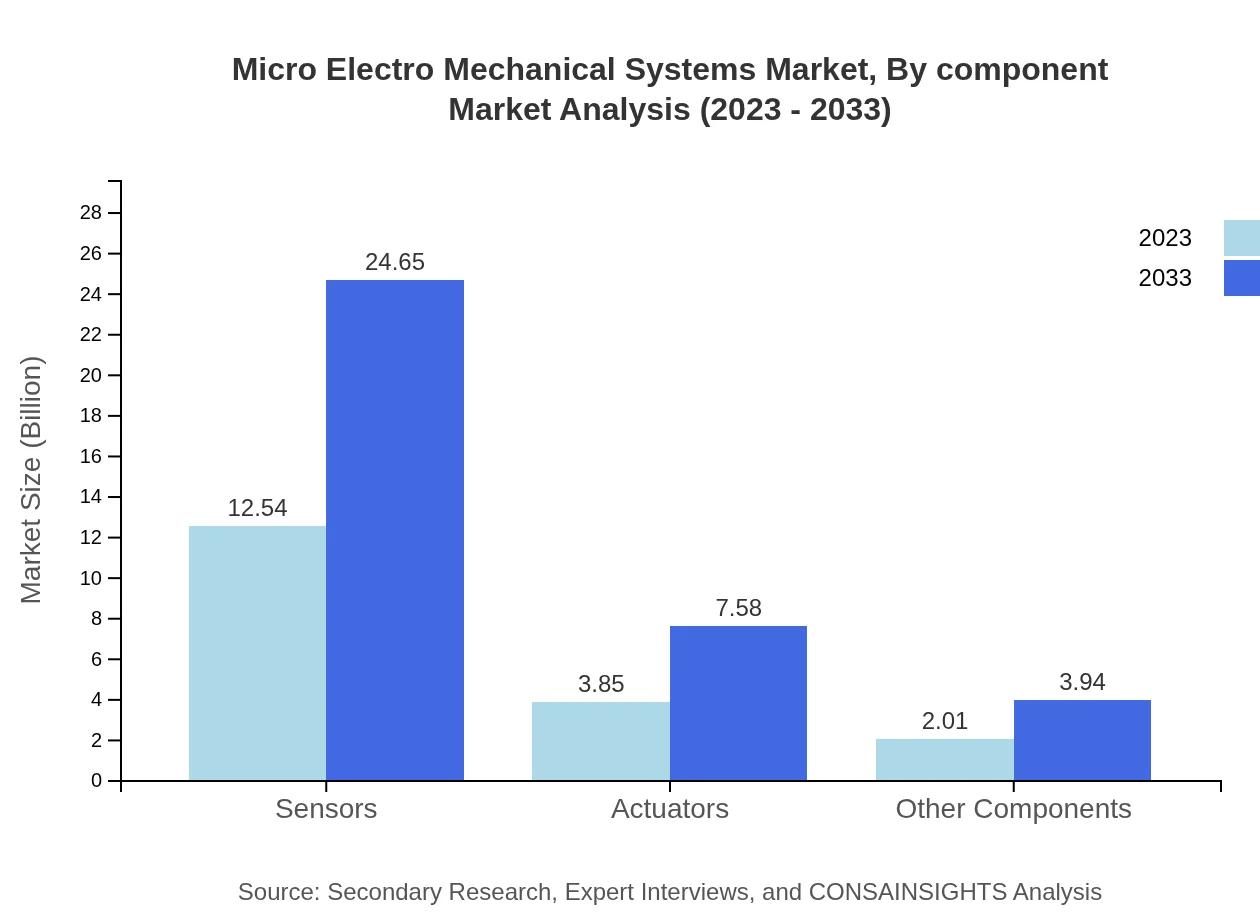

Micro Electro Mechanical Systems Market Analysis By Component

The MEMS market, by component, primarily includes sensors, actuators, and various other components. In 2023, sensors dominate the market with a size of approximately USD 12.54 billion, making up for about 68.15% of market share. Actuators and other components also contribute significantly, highlighting the importance of integrative technology across sectors, particularly in automotive and consumer applications.

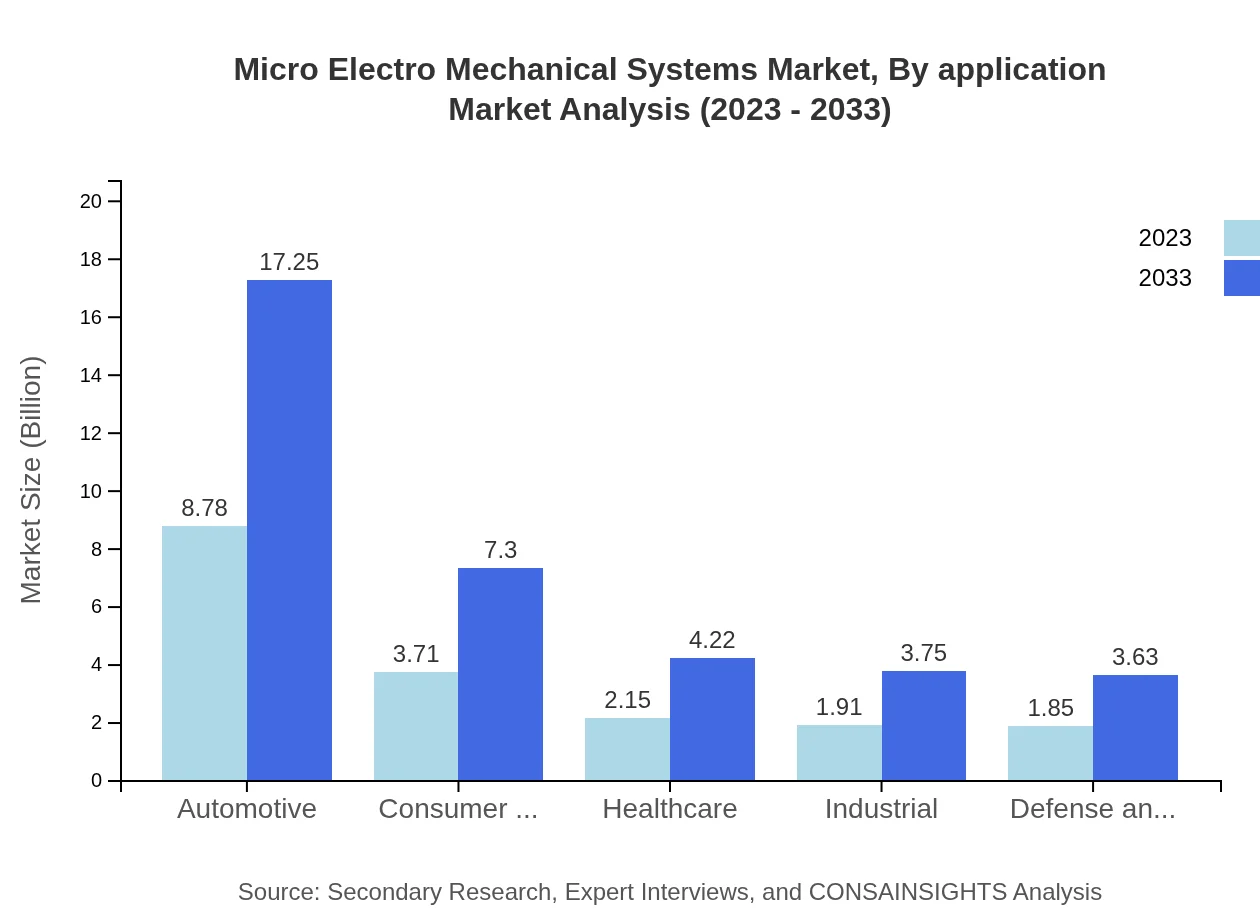

Micro Electro Mechanical Systems Market Analysis By Application

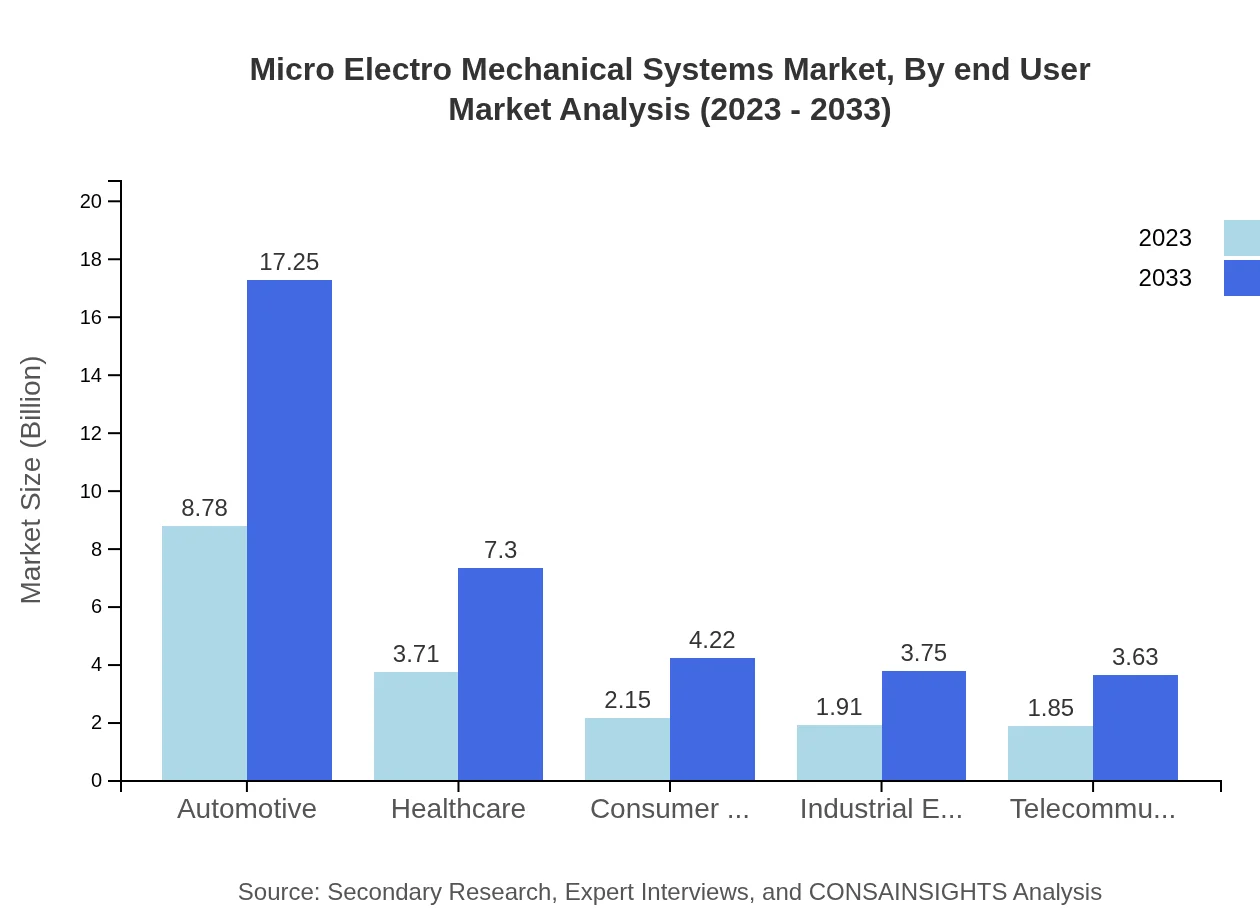

MEMS applications span automotive, healthcare, consumer electronics, telecommunications, and industrial equipment. The automotive segment, with a projected market size of USD 8.78 billion in 2023, represents 47.71% of the MEMS market. Healthcare applications expected to grow from USD 2.15 billion to USD 4.22 billion signify the critical demand in providing innovative solutions for health monitoring.

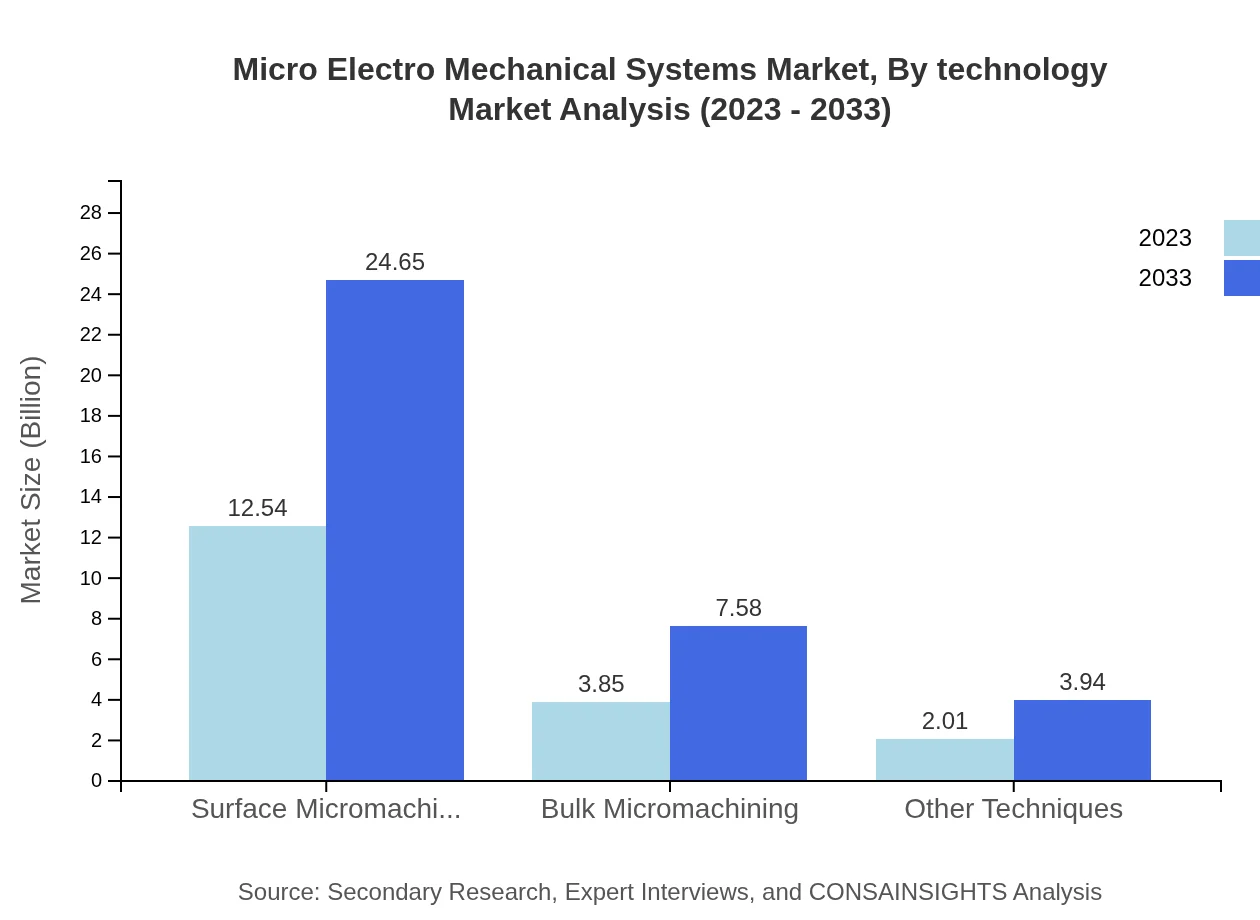

Micro Electro Mechanical Systems Market Analysis By Technology

The market segmentation by technology focuses on surface micromachining and bulk micromachining. Surface micromachining, leading the technological landscape, captures approximately USD 12.54 billion in 2023. Technological advancements in MEMS fabrication are crucial for enhancing device performance and efficiency across applications.

Micro Electro Mechanical Systems Market Analysis By End User

End-user industries for MEMS cover automotive, healthcare, consumer electronics, telecommunications, and industrial. Automotive applications are set to dominate with both market size and percentage share, showcasing a trend towards increased integration of MEMS in vehicular technology for safety and automation.

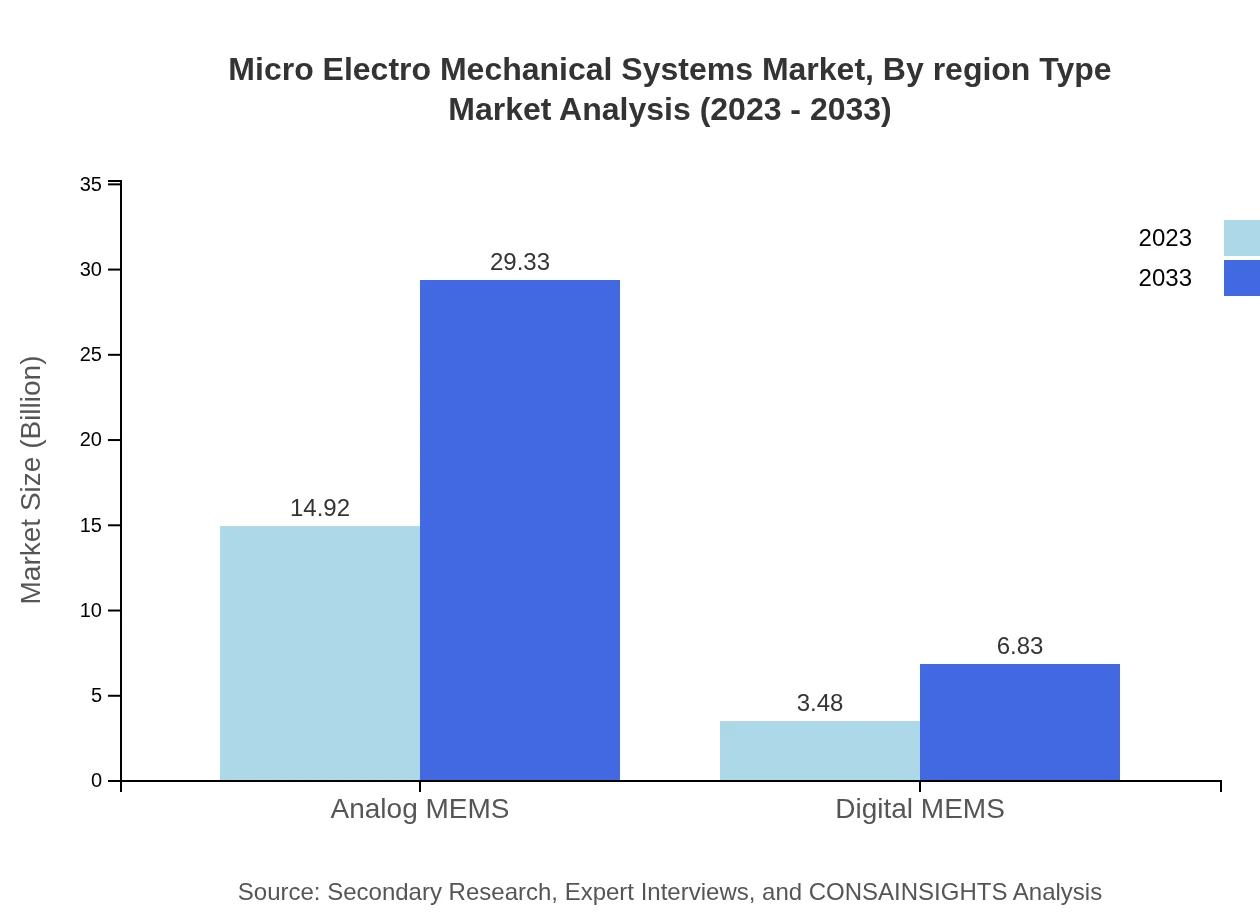

Micro Electro Mechanical Systems Market Analysis By Region Type

The MEMS market by type covers sensor types, actuators, and other MEMS components. The sensor market is expected to continue its robust growth, driven by innovations in smart technology and IoT integration, representing a major share of MEMS applications across industries.

Micro Electro Mechanical Systems Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Micro Electro Mechanical Systems Industry

Texas Instruments:

Texas Instruments is a leading company in the MEMS market, focusing on innovative semiconductor solutions and MEMS technology, particularly known for their integrated sensor solutions used in various consumer and industrial applications.STMicroelectronics:

STMicroelectronics is recognized for its robust portfolio of MEMS devices, including MEMS accelerometers and gyroscopes. Their extensive research and development efforts focus on enhancing MEMS applications across automotive and consumer electronics.Bosch Sensortec:

Bosch Sensortec is a prominent player in the MEMS market, specializing in sensor technology for the consumer electronics and automotive sectors, known for their high performance and innovative MEMS solutions.Analog Devices:

Analog Devices has carved a niche in the MEMS domain with their expertise in both analog and digital technologies, offering high-performance sensors tailored for various applications including industrial and medical sectors.Honeywell :

Honeywell is a major qualifier in sensor technology, providing MEMS solutions that are widely utilized across aerospace, defense, and industrial applications, focusing on precision and reliability.We're grateful to work with incredible clients.

FAQs

What is the market size of micro Electro Mechanical Systems?

The global micro-electro-mechanical-systems market size reached approximately $18.4 billion in 2023, with a projected compound annual growth rate (CAGR) of 6.8% over the next decade. This growth reflects increasing applications across various industries, necessitating sophisticated MEMS technologies.

What are the key market players or companies in the micro Electro Mechanical Systems industry?

Key players in the MEMS industry include Bosch Sensortec, STMicroelectronics, Analog Devices, and TE Connectivity. These companies are prominent for their advanced MEMS technologies, catering to sectors such as automotive, healthcare, and consumer electronics.

What are the primary factors driving the growth in the micro Electro Mechanical Systems industry?

Driving factors include the rising demand for miniaturized and high-performance devices across sectors such as healthcare and automotive, along with technological advancements in MEMS fabrication techniques which enhance device capabilities and functionality.

Which region is the fastest Growing in the micro Electro Mechanical Systems?

Asia-Pacific is emerging as the fastest-growing region, with the MEMS market projected to grow from $3.20 billion in 2023 to $6.29 billion by 2033. This growth is fueled by increasing electronics manufacturing and burgeoning consumer demand in the region.

Does ConsaInsights provide customized market report data for the micro Electro Mechanical Systems industry?

Yes, ConsaInsights offers customized market report data tailored to your specific needs in the MEMS industry. These reports include detailed analyses and projections that adapt to industry trends and regional demands.

What deliverables can I expect from this micro Electro Mechanical Systems market research project?

Expect comprehensive deliverables including detailed market analysis, segment insights, geographical breakdowns, and forecasts on market size and growth trends within the MEMS industry, all presented in an easily digestible format.

What are the market trends of micro Electro Mechanical Systems?

Market trends include increasing integration of MEMS in automation and IoT applications, advancements in sensor technology, and growing investments in MEMS research and development, particularly within healthcare and automotive sectors.