Micro Led Market Report

Published Date: 31 January 2026 | Report Code: micro-led

Micro Led Market Size, Share, Industry Trends and Forecast to 2033

This report provides an in-depth analysis of the Micro Led market, highlighting current trends, future forecasts, and detailed insights for the period 2023 to 2033. It covers market size, growth potential, regional dynamics, technology analysis, and profiles of key industry players.

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

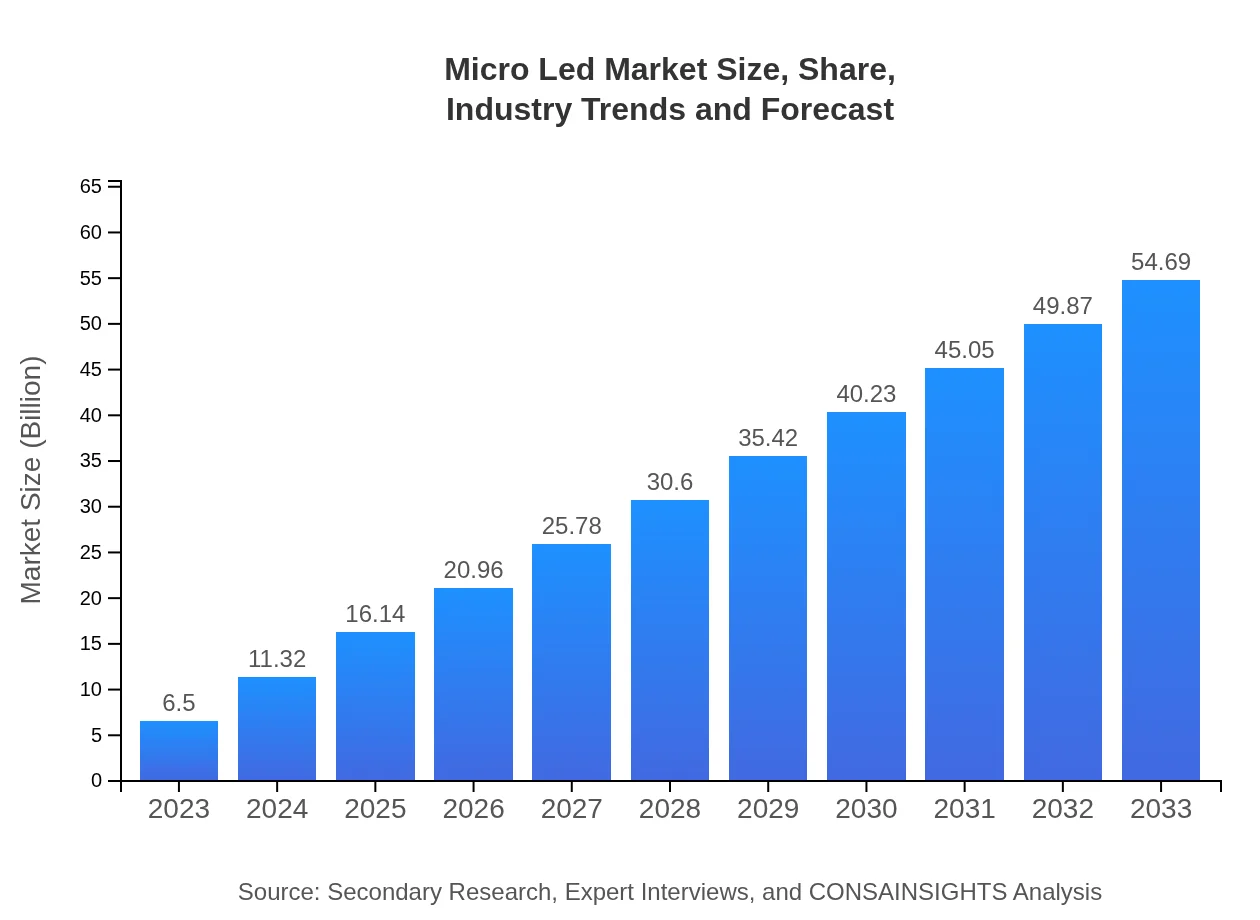

| 2023 Market Size | $6.50 Billion |

| CAGR (2023-2033) | 22.3% |

| 2033 Market Size | $54.69 Billion |

| Top Companies | Samsung Electronics, Sony Corporation, Apple Inc., MicroLED Technologies |

| Last Modified Date | 31 January 2026 |

Micro Led Market Overview

Customize Micro Led Market Report market research report

- ✔ Get in-depth analysis of Micro Led market size, growth, and forecasts.

- ✔ Understand Micro Led's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Micro Led

What is the Market Size & CAGR of Micro Led market in 2023?

Micro Led Industry Analysis

Micro Led Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Micro Led Market Analysis Report by Region

Europe Micro Led Market Report:

Europe's Micro LED market is predicted to grow from $1.84 billion in 2023 to $15.52 billion by 2033. The region is focusing on sustainability and energy-efficient display solutions, a factor leading to increased adoption of Micro LED technology across various sectors, including advertising and gaming.Asia Pacific Micro Led Market Report:

In 2023, the Micro LED market in Asia Pacific is valued at $1.31 billion and is expected to soar to $11.03 billion by 2033. The region is a significant hub for electronics manufacturing, driving demand for innovative display technologies. Companies in this region are heavily investing in R&D to enhance production capabilities, propelled by a growing market for consumer electronics and automotive applications.North America Micro Led Market Report:

North America holds a substantial share of the Micro LED market, with a valuation of $2.19 billion in 2023, expected to reach $18.46 billion by 2033. This demand is driven by advances in consumer technology, substantial investments in automotive displays, and the growing influence of major technology firms shaping the future of display technologies.South America Micro Led Market Report:

The South American market for Micro LED is projected to grow from $0.60 billion in 2023 to $5.06 billion in 2033. The region is seeing increased interest in high-quality displays for advertising and consumer electronics, supported by rising economic stability and investments in technology infrastructure.Middle East & Africa Micro Led Market Report:

The Micro LED market in the Middle East and Africa is expected to expand from $0.55 billion in 2023 to $4.62 billion in 2033, driven by the increasing use of advanced display technologies in sectors such as retail and automotive. Growth in infrastructure and tourism is also contributing to heightened demand for cutting-edge advertising solutions.Tell us your focus area and get a customized research report.

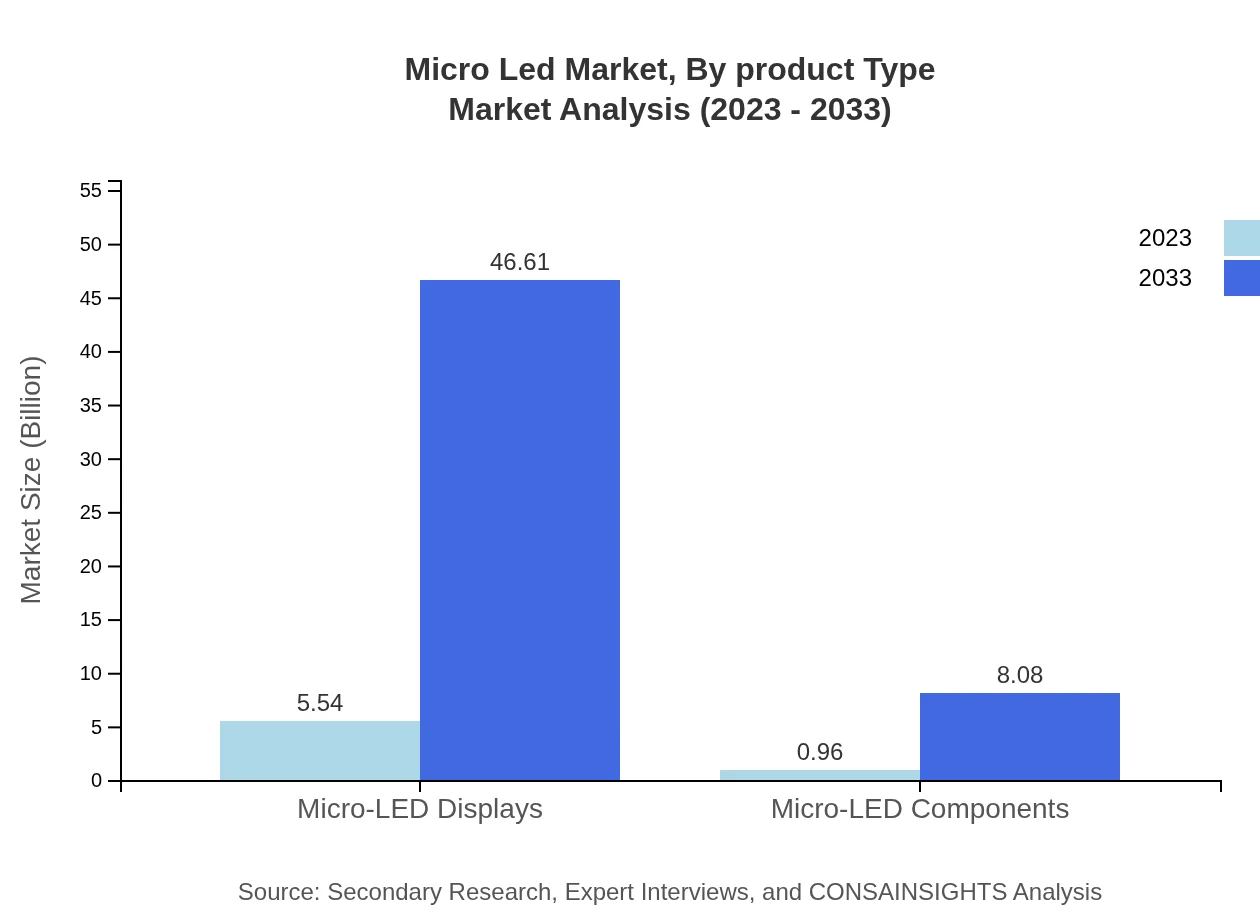

Micro Led Market Analysis By Product Type

The Micro-LED market is primarily segmented into Micro-LED Displays and Micro-LED Components. As of 2023, Micro-LED Displays dominate the market at $5.54 billion, comprising 85.22% of the market share. In contrast, Micro-LED Components are valued at $0.96 billion, accounting for 14.78% of the market. By 2033, the trends favor significant growth with Displays reaching $46.61 billion, maintaining the leading share, while Components expand to $8.08 billion.

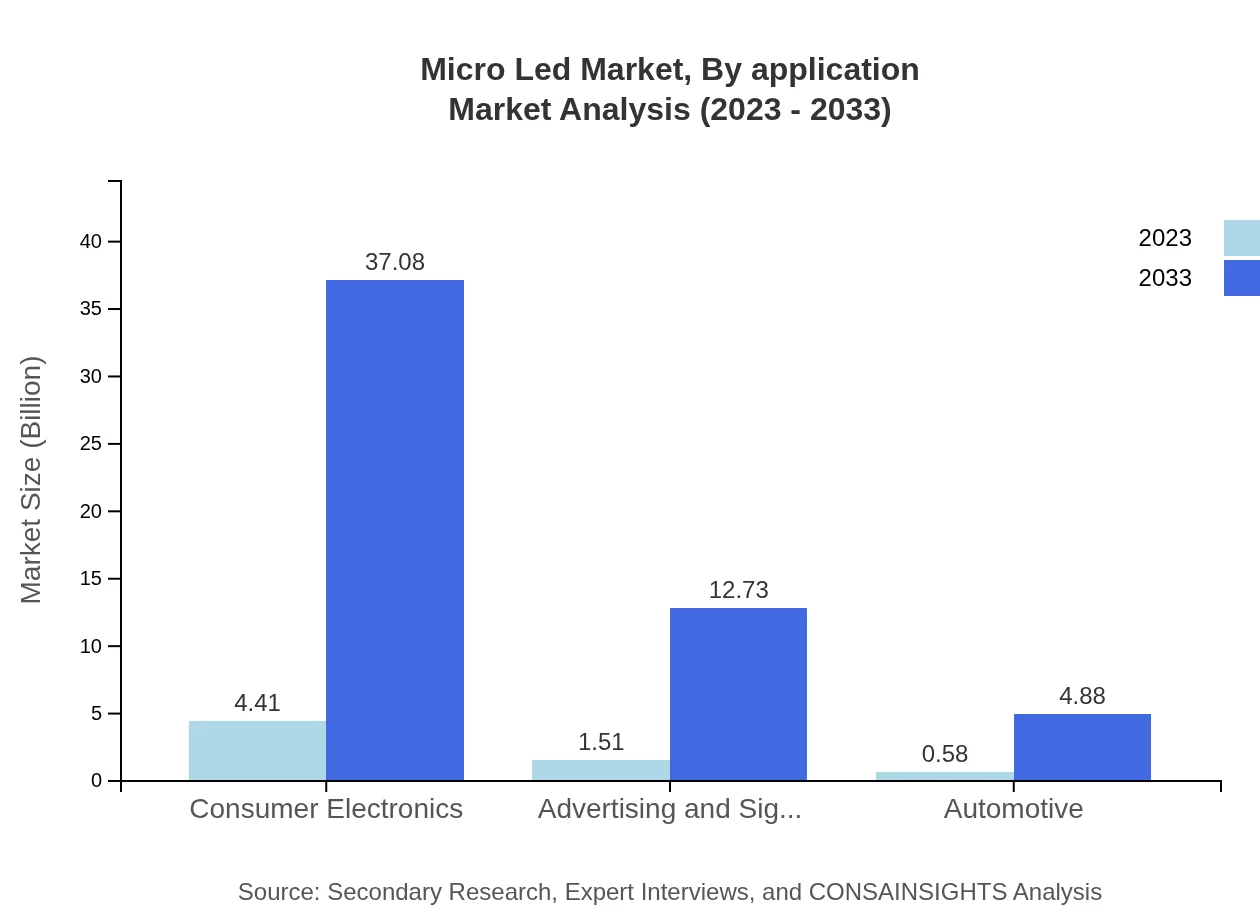

Micro Led Market Analysis By Application

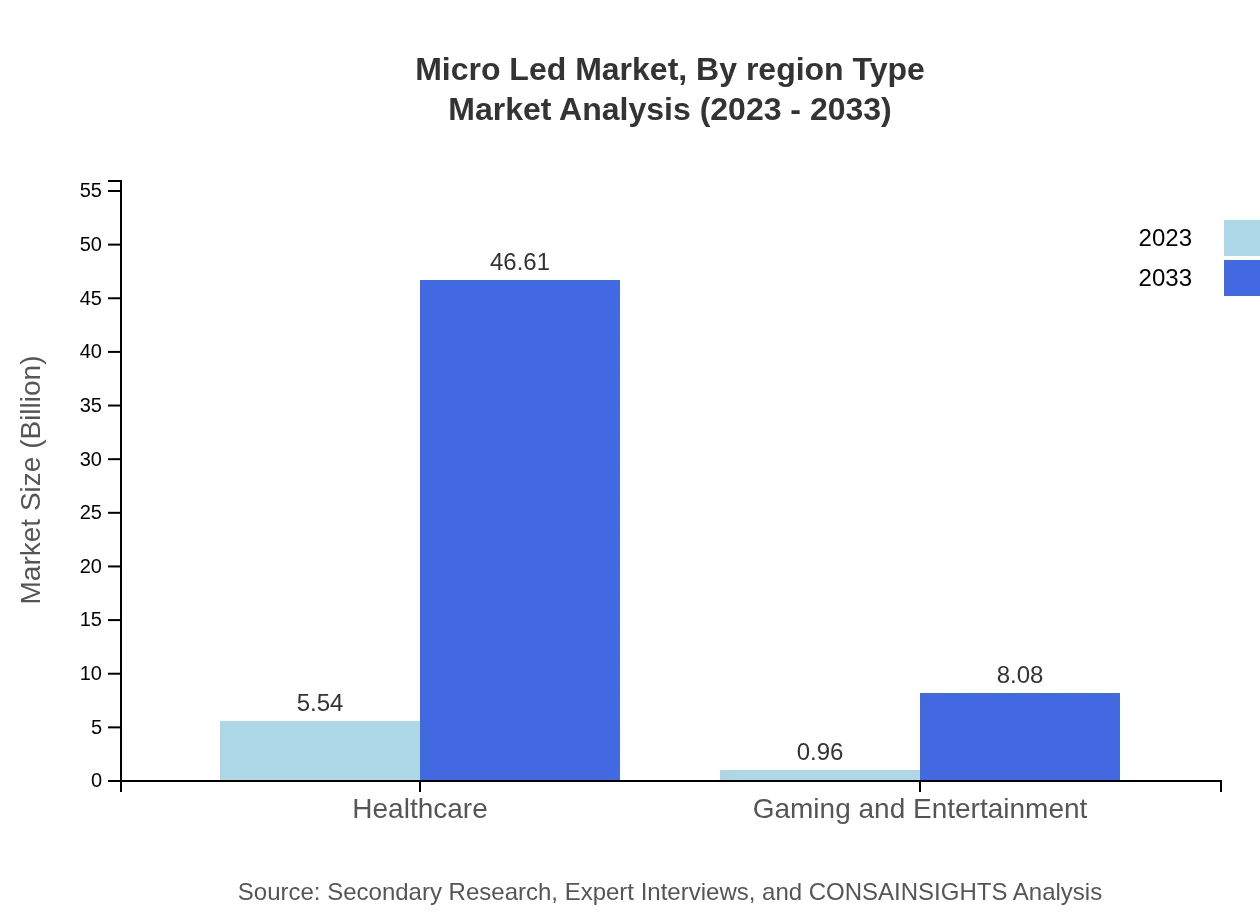

The major applications of Micro LED technology include Consumer Electronics ($4.41 billion in 2023), Healthcare ($5.54 billion), Automotive ($0.58 billion), and Advertising ($1.51 billion). By 2033, forecasts predict Consumer Electronics growing to $37.08 billion, Healthcare to $46.61 billion, Automotive to $4.88 billion, and Advertising to $12.73 billion, showcasing strong adoption across sectors.

Micro Led Market Analysis By Region Type

Regional dynamics play a crucial role in the overall Micro LED market. The Asia Pacific leads with a market size expected to reach $11.03 billion by 2033, followed by North America at $18.46 billion. Europe will see growth to $15.52 billion, while South America and the Middle East and Africa will reach $5.06 billion and $4.62 billion, respectively, emphasizing regional opportunities in technological adoption.

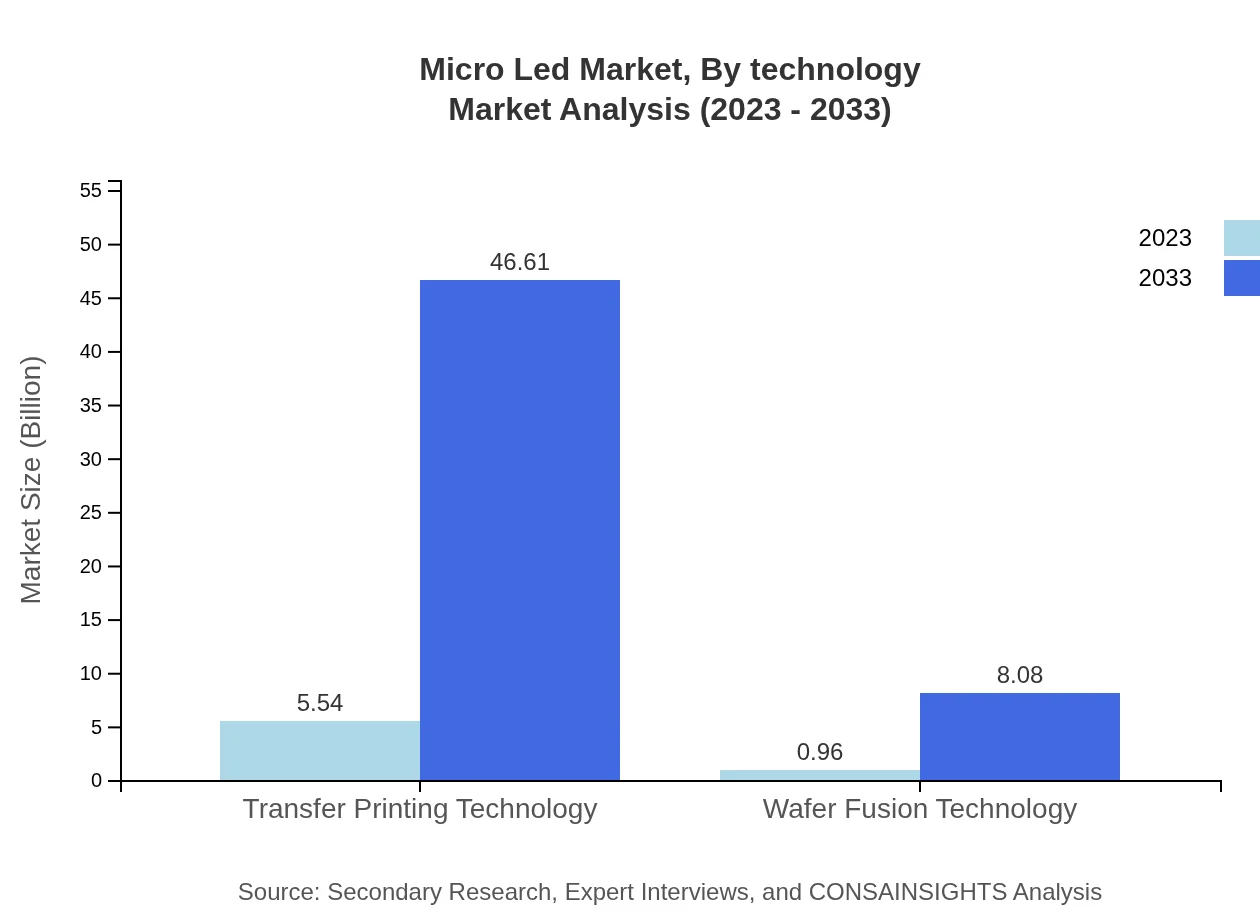

Micro Led Market Analysis By Technology

The technology employed in Micro LED systems is critical. Two prominent technologies are Transfer Printing and Wafer Fusion. Transfer Printing is forecasted to dominate with a size of $5.54 billion (85.22% market share) in 2023, expanding significantly to $46.61 billion by 2033. Wafer Fusion technology, while smaller, is anticipated to provide growth from $0.96 billion (14.78% market share) to $8.08 billion by 2033.

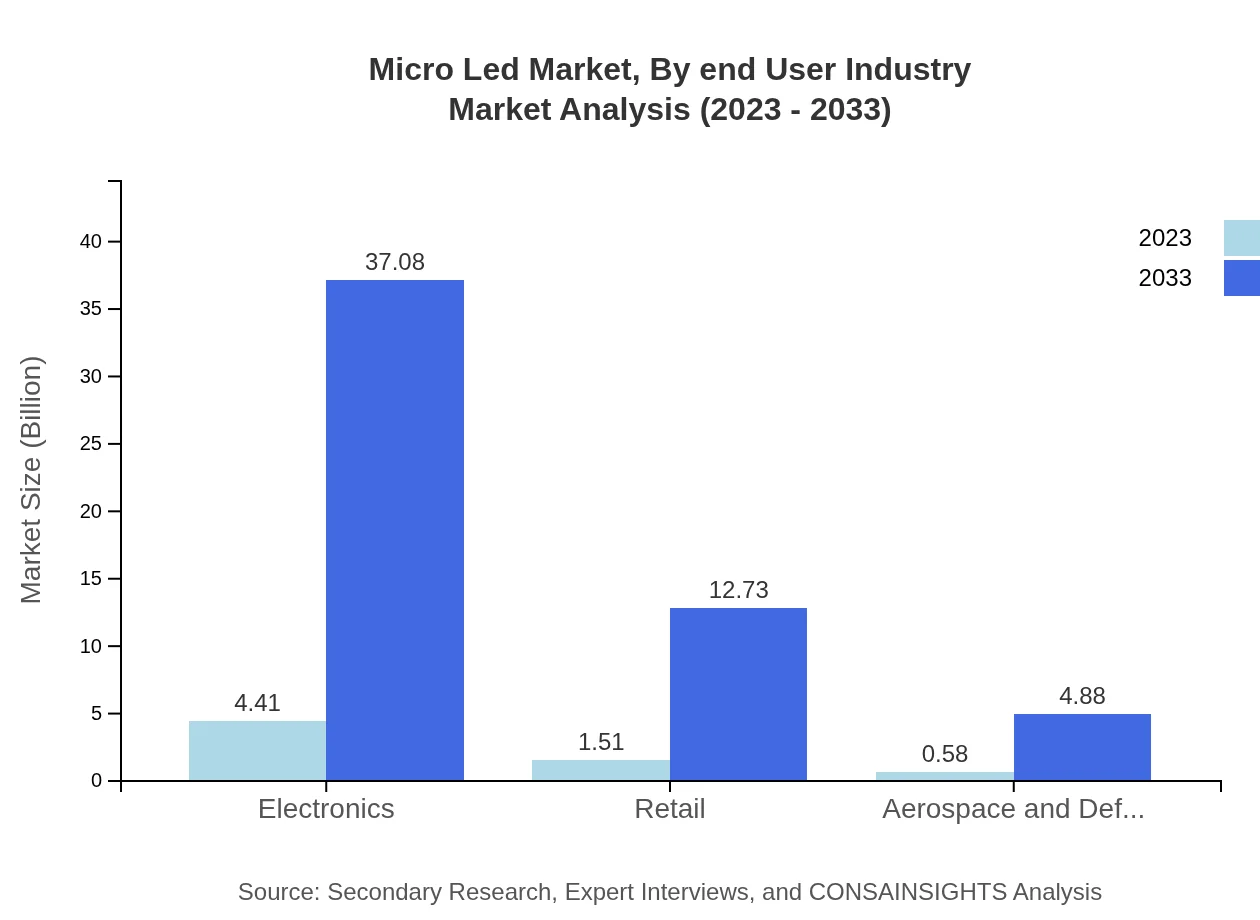

Micro Led Market Analysis By End User Industry

The end-user segmentation reveals industries such as Electronics, Automotive, Aerospace and Defense, Healthcare, and Retail investing heavily in Micro LED technology. Electronics show a dominant position with $4.41 billion in 2023, while Healthcare takes a significant share at $5.54 billion. By 2033, these segments are expected to expand to $37.08 billion and $46.61 billion, respectively, affirming strong upward trends.

Micro Led Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Micro Led Industry

Samsung Electronics:

A leading player in the micro LED market, Samsung is renowned for its cutting-edge display technologies and strong investments in R&D, contributing significantly to advancements in Micro LED applications.Sony Corporation:

Innovator in display technology, Sony has leveraged Micro LED for both consumer electronics and professional applications, enhancing market viability and developing advanced display solutions.Apple Inc.:

Through innovation in consumer mobile devices, Apple is poised to lead the micro LED market, focusing on integration in wearables and smart devices to enhance user experience.MicroLED Technologies:

A pioneer in manufacturing micro LED products, this company specializes in developing custom Micro LED solutions tailored for various applications and industries.We're grateful to work with incredible clients.

FAQs

What is the market size of micro-LED?

The global micro-LED market is valued at $6.5 billion in 2023 with a staggering CAGR of 22.3%. Predicted growth indicates it will significantly increase by 2033, reflecting a robust demand within the technology sector.

What are the key market players or companies in the micro-LED industry?

Key players in the micro-LED industry include major tech companies and innovative startups focused on micro-LED technology. These companies drive advancements and robust competition within the market, contributing to cutting-edge developments and strategic partnerships.

What are the primary factors driving the growth in the micro-LED industry?

Growth factors in the micro-LED industry include advancements in display technology, increasing demand for high-resolution displays, energy efficiency, and the rising popularity of consumer electronics requiring superior visual performance in various applications.

Which region is the fastest Growing in the micro-LED market?

North America is the fastest-growing region in the micro-LED market, projected to escalate from $2.19 billion in 2023 to $18.46 billion by 2033. Europe and Asia Pacific also show significant growth opportunities, reflecting expanding technological investments.

Does ConsaInsights provide customized market report data for the micro-LED industry?

Yes, ConsaInsights offers customized market reports tailored to specific needs in the micro-LED industry. This includes detailed insights, forecasts, and analyses that cater to various sectors and stakeholders seeking precise market information.

What deliverables can I expect from this micro-LED market research project?

Deliverables from the micro-LED market research project include comprehensive reports detailing market size, trends, competitive landscape analysis, growth forecasts, and segmented insights to inform strategic decision-making in the industry.

What are the market trends of micro-LED?

Market trends in micro-LED indicate a surge in applications across consumer electronics, automotive, and healthcare sectors. Innovations in display technology and expanded adoption in various industries further highlight the evolution and market potential of micro-LED.

What are the key segments in the micro-LED market?

Key segments in the micro-LED market include consumer electronics, advertising and signage, healthcare, and automotive. Notably, consumer electronics accounted for a significant market share of 67.79% in 2023, projected to grow substantially by 2033.