Micro Mobility Charging Infrastructure Market Report

Published Date: 31 January 2026 | Report Code: micro-mobility-charging-infrastructure

Micro Mobility Charging Infrastructure Market Size, Share, Industry Trends and Forecast to 2033

This report provides an in-depth analysis of the Micro Mobility Charging Infrastructure market, highlighting market trends, size, competitive landscape, and regional insights from 2023 to 2033. It aims to offer valuable data for stakeholders in making informed decisions and understanding market dynamics.

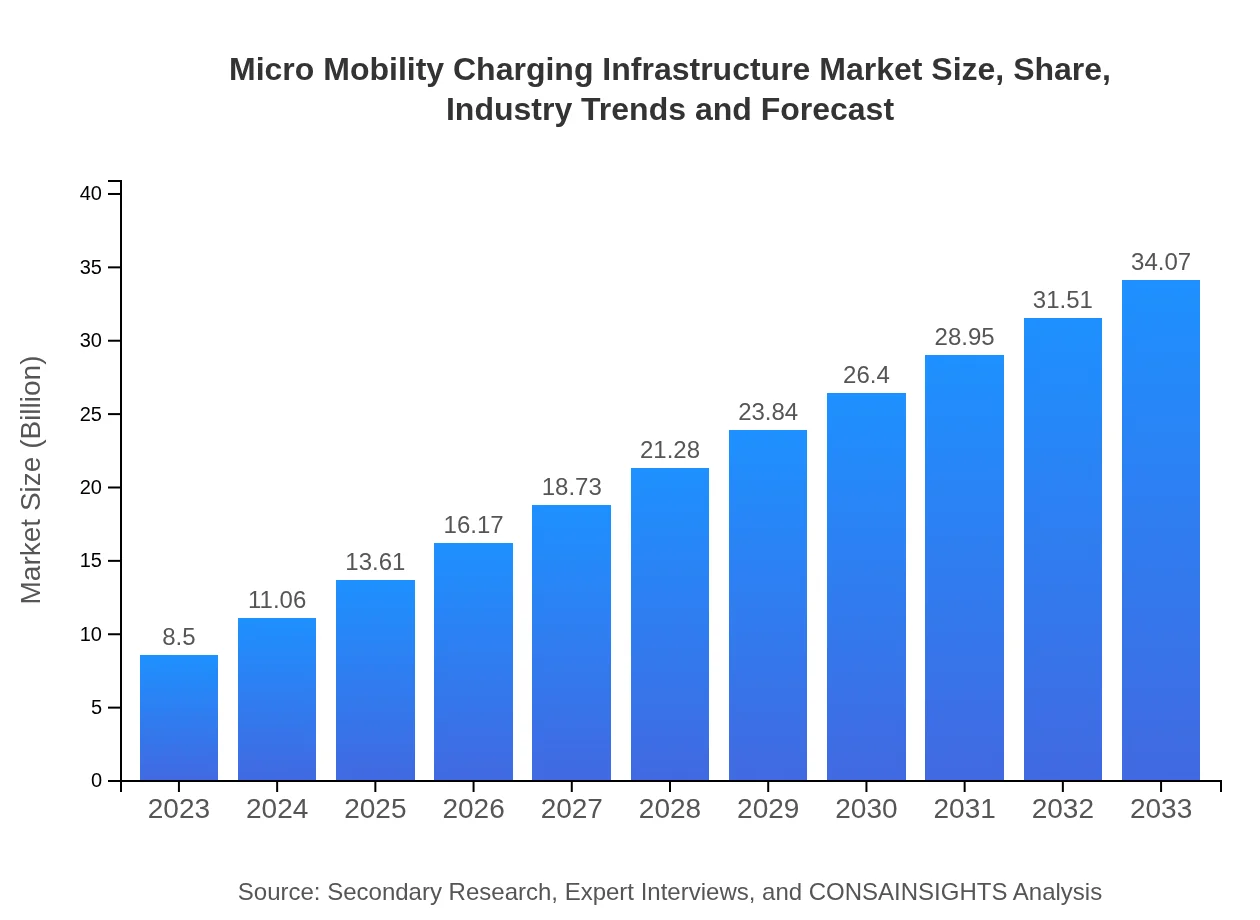

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $8.50 Billion |

| CAGR (2023-2033) | 14.2% |

| 2033 Market Size | $34.07 Billion |

| Top Companies | ChargePoint, Blink Charging, EVBox, Heliox, Wallbox |

| Last Modified Date | 31 January 2026 |

Micro Mobility Charging Infrastructure Market Overview

Customize Micro Mobility Charging Infrastructure Market Report market research report

- ✔ Get in-depth analysis of Micro Mobility Charging Infrastructure market size, growth, and forecasts.

- ✔ Understand Micro Mobility Charging Infrastructure's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Micro Mobility Charging Infrastructure

What is the Market Size & CAGR of Micro Mobility Charging Infrastructure market in 2023 and 2033?

Micro Mobility Charging Infrastructure Industry Analysis

Micro Mobility Charging Infrastructure Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Micro Mobility Charging Infrastructure Market Analysis Report by Region

Europe Micro Mobility Charging Infrastructure Market Report:

Europe's market is poised to increase from $2.08 billion in 2023 to $8.35 billion by 2033, driven by stringent environmental regulations and increased demand for personal mobility. Countries like Germany, France, and the Netherlands are leading in infrastructure investments, aligning with the EU's green mobility initiatives to facilitate the transition toward electric transport.Asia Pacific Micro Mobility Charging Infrastructure Market Report:

The Asia Pacific region, with a market size of approximately $1.73 billion in 2023 and projected to grow to $6.92 billion by 2033, is at the forefront of micro-mobility innovations. Countries like China and India are witnessing rapid urbanization leading to increased investments in electric mobility. The growth of smart cities and supportive government policies enhance the adoption of micro-mobility charging infrastructure.North America Micro Mobility Charging Infrastructure Market Report:

North America has a substantial market size of approximately $3.12 billion in 2023, set to expand to $12.49 billion by 2033. The region is characterized by technological advancements, with a strong emphasis on sustainability. This growth is bolstered by investments in electric vehicle infrastructure and a growing consumer preference for micro-mobility solutions.South America Micro Mobility Charging Infrastructure Market Report:

In South America, the market size stands at $0.44 billion in 2023, with projections reaching $1.75 billion by 2033. Emerging economies are gradually embracing e-mobility, driven by environmental motivations. However, infrastructural challenges remain a barrier, although government initiatives are paving the path for enhanced charging infrastructure.Middle East & Africa Micro Mobility Charging Infrastructure Market Report:

The Middle East and Africa exhibit modest growth, with a market size of $1.14 billion in 2023, projected to reach $4.57 billion by 2033. Urban areas are witnessing gradual adoption of micro-mobility solutions, yet technological and economic challenges persist. Investments in infrastructure are crucial for fostering market growth in the region.Tell us your focus area and get a customized research report.

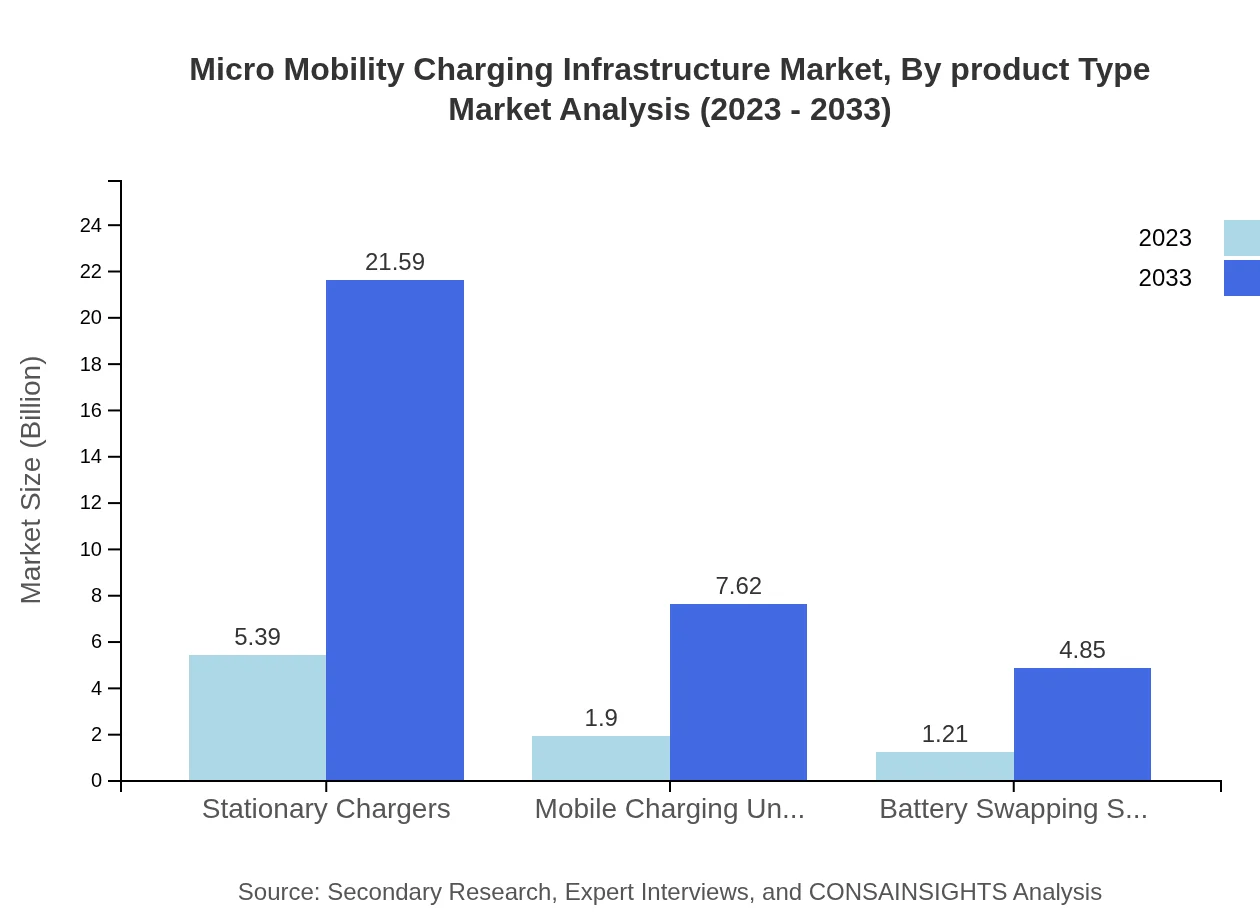

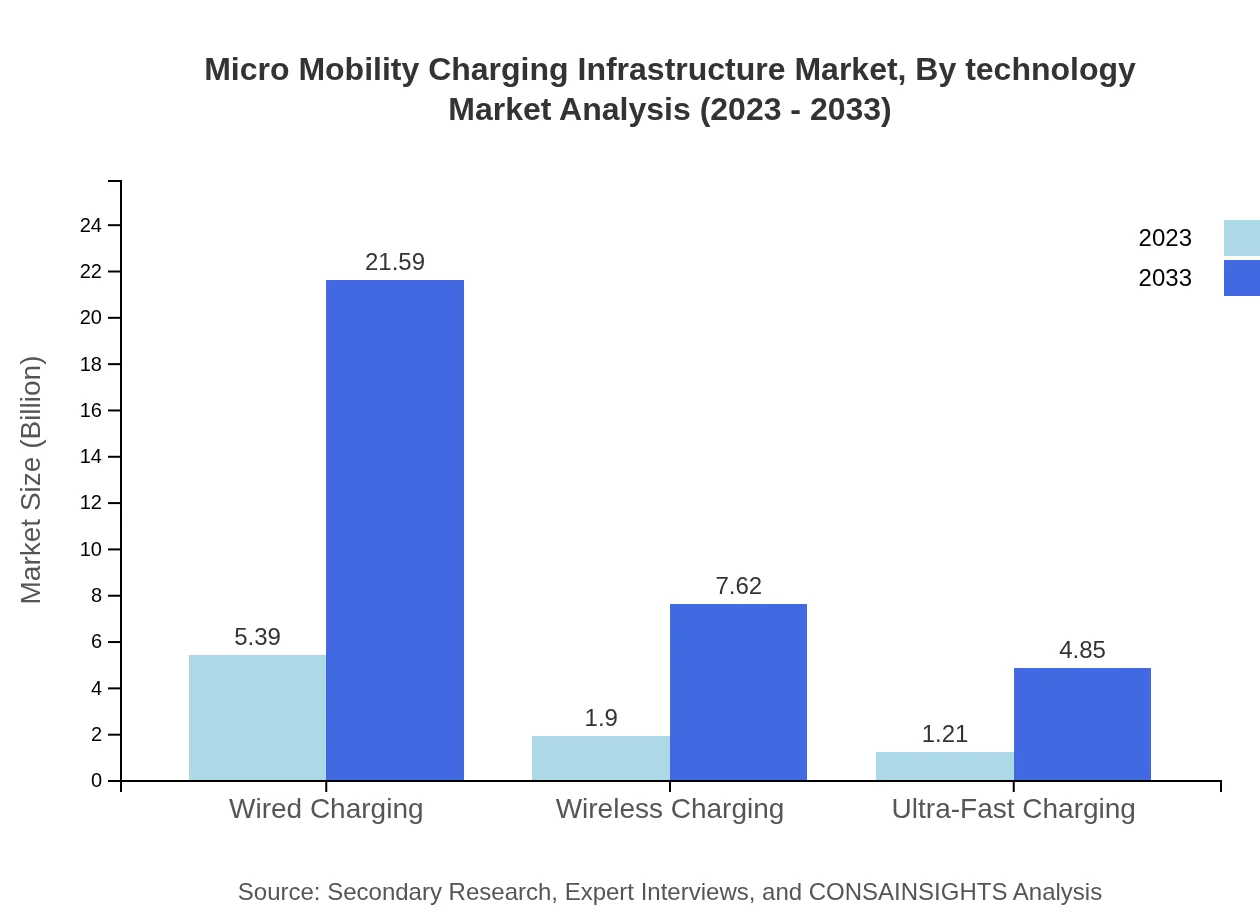

Micro Mobility Charging Infrastructure Market Analysis By Product Type

Wired charging dominates the market, accounting for a 63.39% share in 2023, growing to support an expected size of $21.59 billion by 2033. Wireless charging technology, while currently at $1.90 billion, is anticipated to grow significantly, representing 22.36% market share by 2033. Ultra-fast charging solutions are emerging as a vital offering, with a market size projected to reflect increasing demand as consumers seek convenience.

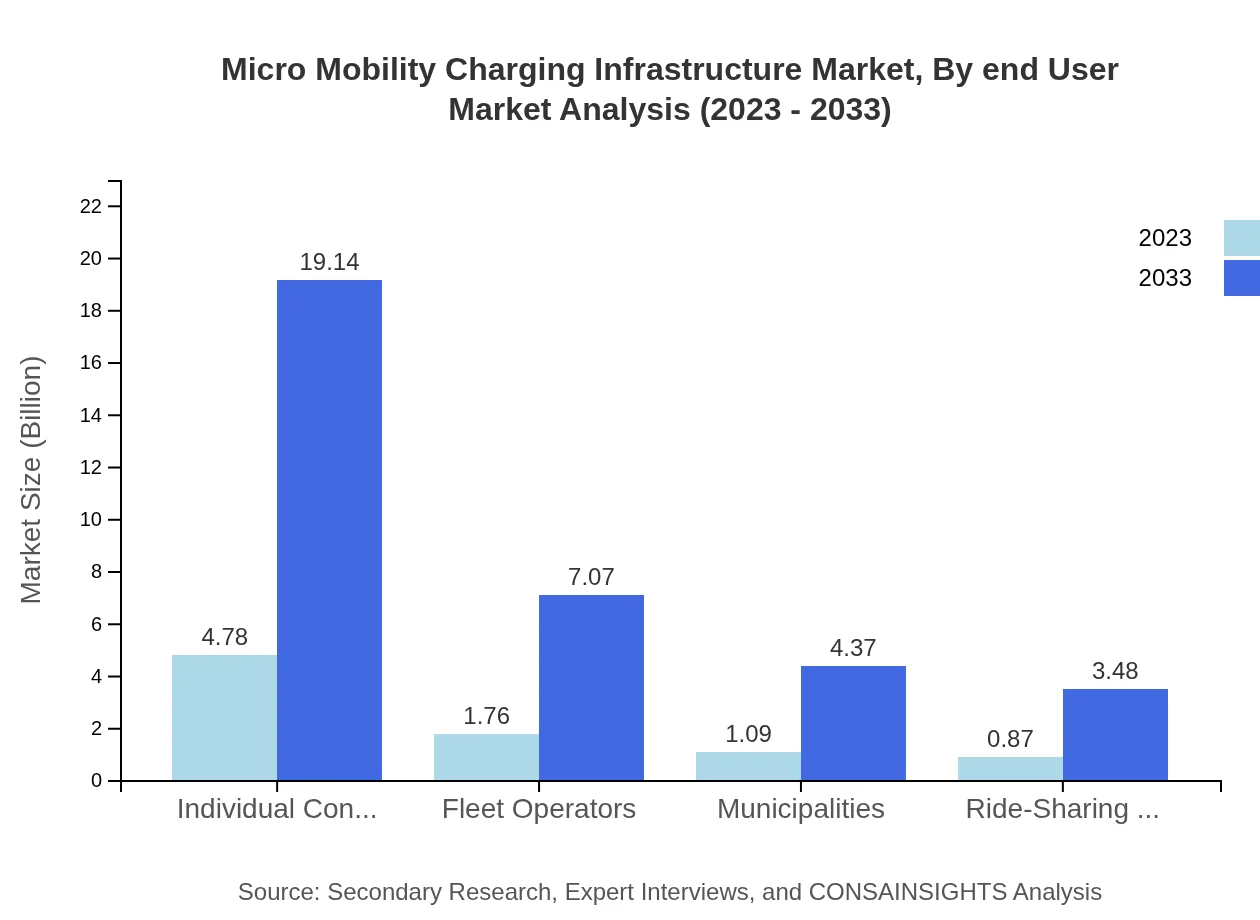

Micro Mobility Charging Infrastructure Market Analysis By End User

Individual consumers have the most significant market share, estimated at 56.19% in 2023 and poised to maintain a similar share by 2033. Fleet operators represent a crucial segment, expected to increase from 20.76% to cater to the expanding needs of e-scooter and e-bike rental services. Municipalities and ride-sharing companies represent growing user segments as urban mobility trends change.

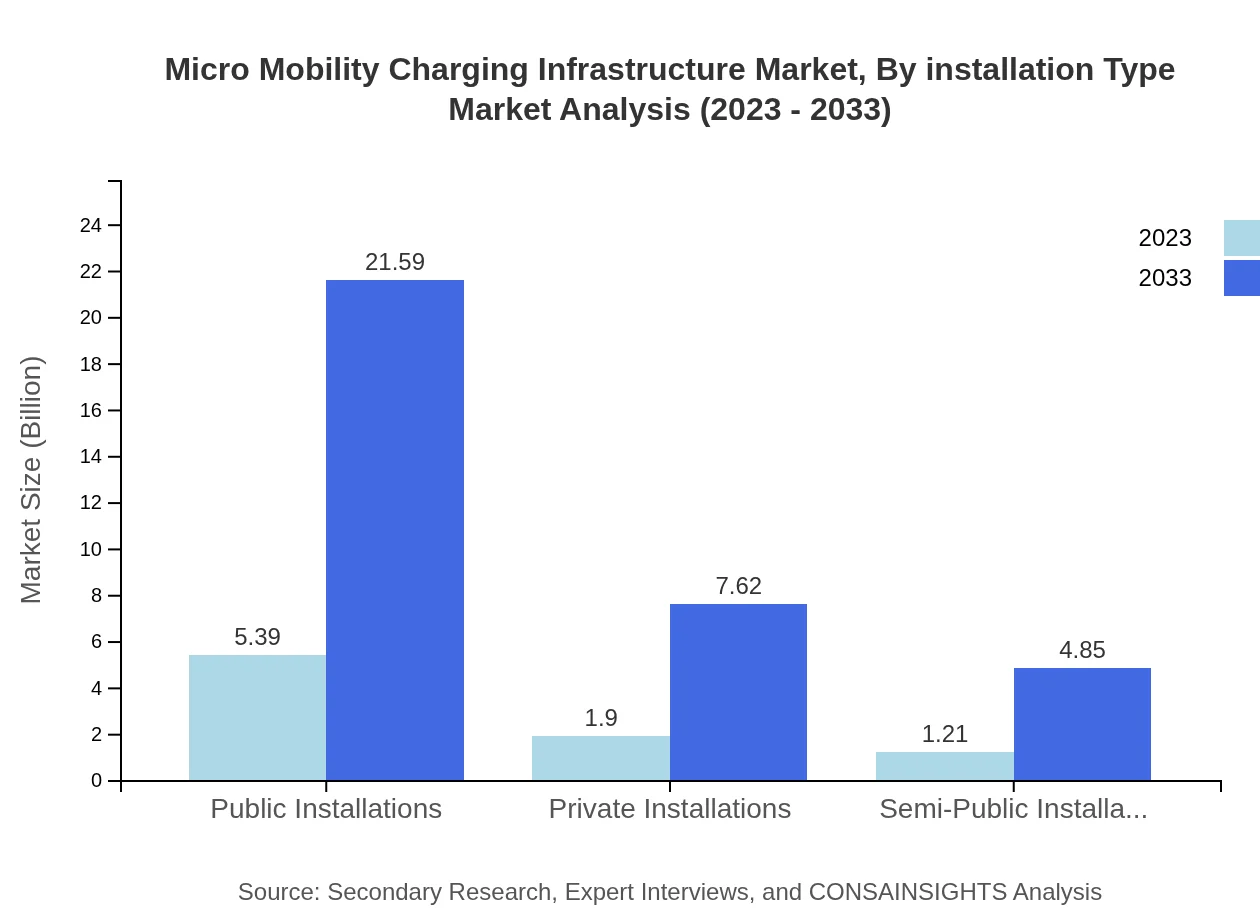

Micro Mobility Charging Infrastructure Market Analysis By Installation Type

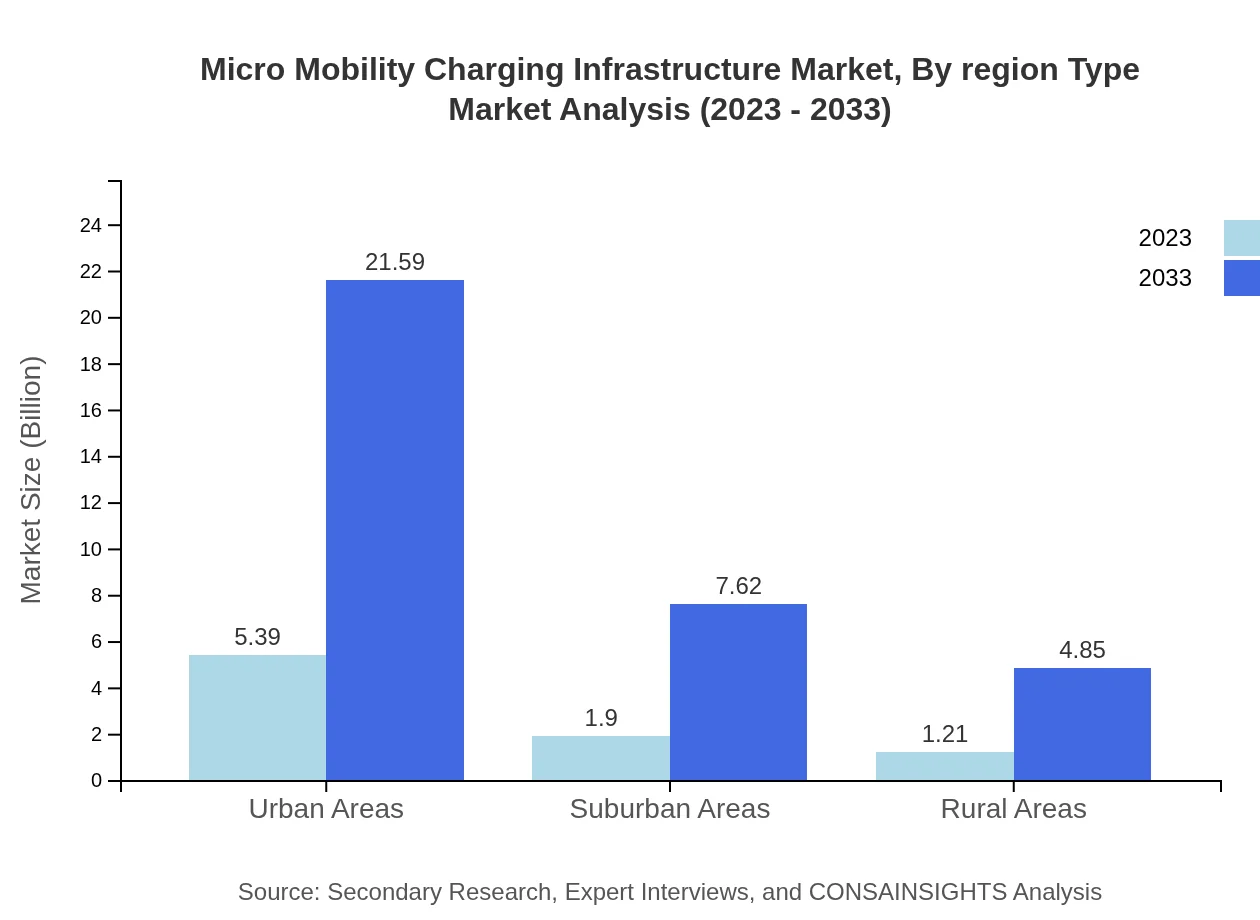

Public installations account for the majority share, expected to reach $21.59 billion by 2033. In contrast, semi-public and private installations represent unique growth opportunities, with respective market sizes projected at $4.85 billion, highlighting a shift towards accommodating private usage and specific business needs.

Micro Mobility Charging Infrastructure Market Analysis By Technology

Technological advancements are pivotal in shaping market dynamics. Smart charging solutions are on the rise, reflecting a shift toward advanced management systems that enhance charging efficiency and user experience. The integration of IoT in charging networks is set to revolutionize the industry, ensuring optimized energy utilization.

Micro Mobility Charging Infrastructure Market Analysis By Region Type

Regional analyses reveal substantial variations in growth patterns, with North America and Europe leading in investment and infrastructure development. Asia Pacific is also emerging rapidly as urban centers begin implementing comprehensive micro-mobility solutions, while South America remains in developmental stages, highlighting the disparate levels of market maturity across the globe.

Micro Mobility Charging Infrastructure Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Micro Mobility Charging Infrastructure Industry

ChargePoint:

ChargePoint is a leading provider of electric vehicle charging solutions, specializing in networked charging stations to support a range of electric mobility options, including micro-mobility vehicles.Blink Charging:

Blink Charging offers comprehensive electric vehicle charging solutions, focusing on innovative technologies for seamless charging experiences across public and private sectors.EVBox:

EVBox specializes in electric vehicle charging infrastructure, providing scalable solutions tailored for a diverse range of mobility applications, including micro-mobility.Heliox:

Heliox focuses on fast-charging solutions and charging networks for electric vehicles, including innovative systems for micro-mobility applications.Wallbox:

Wallbox is committed to developing smart and user-friendly charging solutions, supporting the transition to electric mobility including micro-mobility vehicles worldwide.We're grateful to work with incredible clients.

FAQs

What is the market size of micro Mobility Charging Infrastructure?

The micro-mobility charging infrastructure market is currently valued at $8.5 billion in 2023, with an impressive CAGR of 14.2% projected through 2033. This significant growth indicates a burgeoning demand for efficient and innovative charging solutions in the micro-mobility sector.

What are the key market players or companies in this micro Mobility Charging Infrastructure industry?

Key players in the micro-mobility charging infrastructure industry include established companies like ChargePoint, Blink Charging, and EVBox, as well as new startups focused on innovative solutions. These companies lead the charge in developing infrastructure to support electric scooters, bikes, and other micro-vehicles.

What are the primary factors driving the growth in the micro Mobility Charging Infrastructure industry?

Growth in the micro-mobility charging infrastructure industry is driven by urbanization trends, increasing environmental awareness, investment in electric mobility, and the need for efficient transport solutions. Furthermore, government initiatives and subsidies encourage the adoption of electric micro-mobility options.

Which region is the fastest Growing in the micro Mobility Charging Infrastructure?

North America is the fastest-growing region in the micro-mobility charging infrastructure market. With a market size projected to grow from $3.12 billion in 2023 to $12.49 billion by 2033, it reflects a 14% CAGR, driven by increased adoption of electric vehicles and supportive infrastructure.

Does ConsaInsights provide customized market report data for the micro Mobility Charging Infrastructure industry?

Yes, ConsaInsights offers customized market report data tailored to specific interests and needs within the micro-mobility charging infrastructure sector. Clients can request detailed insights that align with their strategic goals and market analysis requirements.

What deliverables can I expect from this micro Mobility Charging Infrastructure market research project?

Deliverables from the micro-mobility charging infrastructure market research project typically include comprehensive market reports, trend analyses, competitive landscape assessments, and forecasts, along with opportunities and challenges outlined for stakeholders in the industry.

What are the market trends of micro Mobility Charging Infrastructure?

Current trends in the micro-mobility charging infrastructure market include the rise of smart charging solutions, increased focus on renewable energy sources, partnerships between public and private sectors, and advancements in battery technologies, which all aim to enhance sustainability and efficiency in micro-mobility.