Micro Server Ic Market Report

Published Date: 31 January 2026 | Report Code: micro-server-ic

Micro Server Ic Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Micro Server IC market, detailing current insights, regional performances, segment analyses, and future forecasts from 2023 to 2033.

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

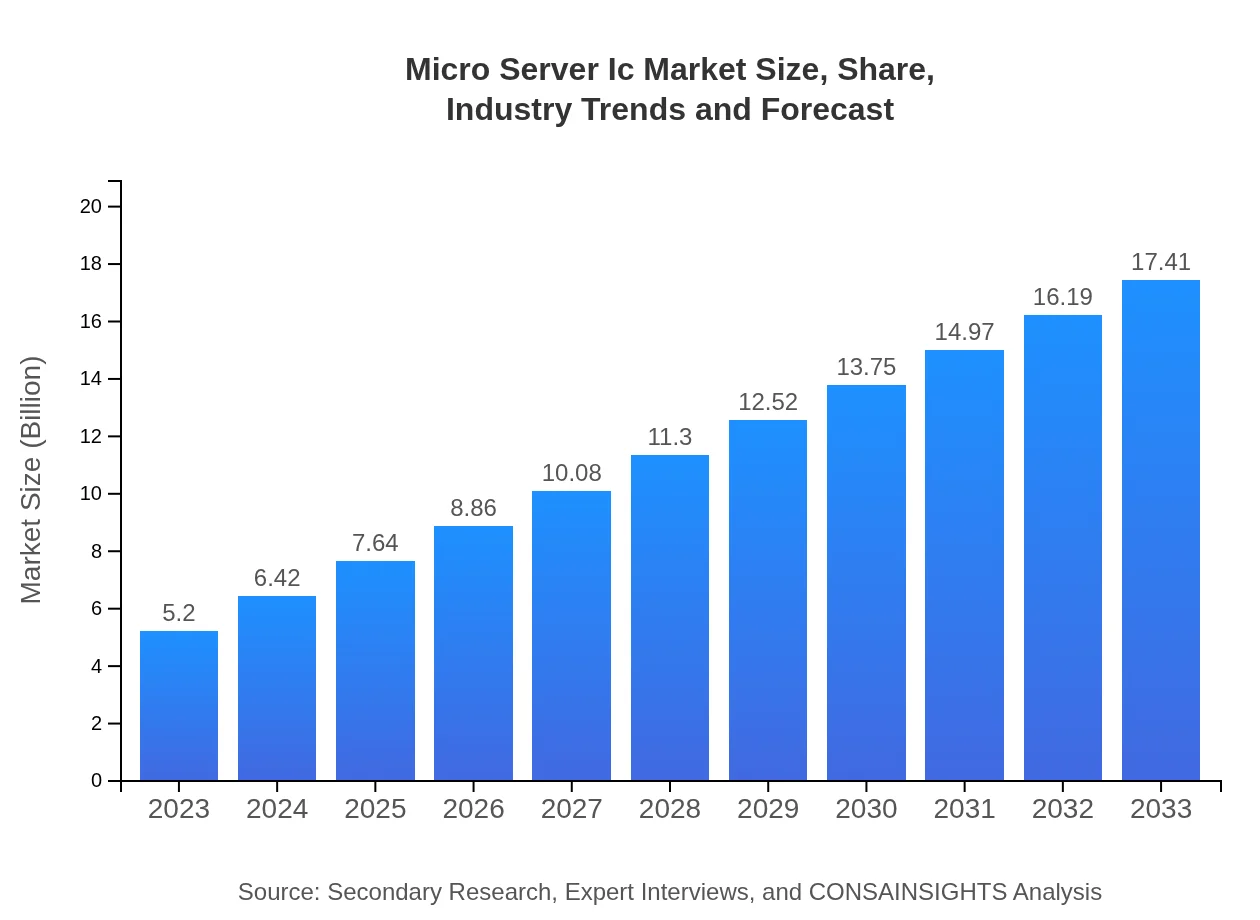

| 2023 Market Size | $5.20 Billion |

| CAGR (2023-2033) | 12.3% |

| 2033 Market Size | $17.41 Billion |

| Top Companies | Intel Corporation, AMD, ARM Holdings, NVIDIA Corporation |

| Last Modified Date | 31 January 2026 |

Micro Server Ic Market Overview

Customize Micro Server Ic Market Report market research report

- ✔ Get in-depth analysis of Micro Server Ic market size, growth, and forecasts.

- ✔ Understand Micro Server Ic's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Micro Server Ic

What is the Market Size & CAGR of Micro Server Ic market in 2023?

Micro Server Ic Industry Analysis

Micro Server Ic Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Micro Server Ic Market Analysis Report by Region

Europe Micro Server Ic Market Report:

The European Micro Server IC market, currently valued at $1.28 billion in 2023, is forecasted to grow to $4.30 billion by 2033. Growth drivers include increasing data compliance regulations and a focus on green technology solutions. Countries like Germany and the UK are seeing substantial market activity.Asia Pacific Micro Server Ic Market Report:

In the Asia Pacific region, the Micro Server IC market was valued at approximately $1.08 billion in 2023, with expectations to grow to $3.63 billion by 2033. The region's growth is driven by a surge in demand for cloud services and greater digitization of businesses. Countries like China and India are leading the charge, with heavy investments in IT infrastructure.North America Micro Server Ic Market Report:

North America represents a significant share of the Micro Server IC market, valued at $1.88 billion in 2023 and expected to reach $6.28 billion by 2033. The rapid digitization of industries and the presence of major cloud service providers underpin this growth, alongside governmental support for technology initiatives.South America Micro Server Ic Market Report:

South America’s Micro Server IC market is projected to expand from a market size of $0.41 billion in 2023 to $1.38 billion by 2033. The growth is attributed to increased adoption of technology in sectors such as retail and healthcare, coupled with expanding internet accessibility within the region.Middle East & Africa Micro Server Ic Market Report:

The market in the Middle East and Africa is relatively smaller, standing at $0.54 billion in 2023 but anticipated to grow to $1.81 billion by 2033. Investment in telecommunications infrastructure and rising demand for data centers are catalysts for growth in this evolving market.Tell us your focus area and get a customized research report.

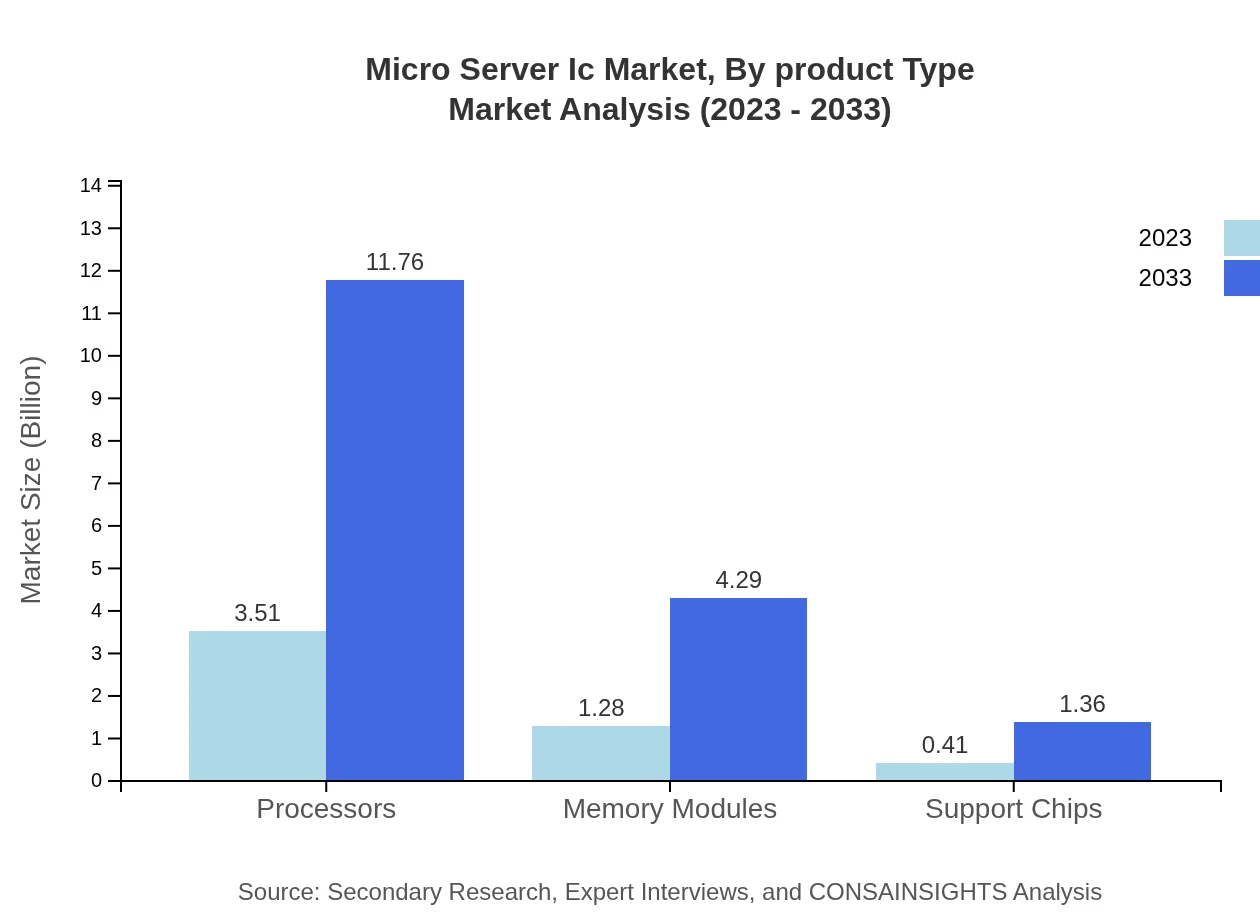

Micro Server Ic Market Analysis By Product Type

The Micro Server IC market is largely defined by product types, with processors holding the lion's share at $3.51 billion in 2023 and projected to reach $11.76 billion by 2033. Memory modules follow closely at $1.28 billion and expected to grow similarly. Support chips and micro servers contribute significantly to the overall market, highlighting the importance of diverse product offerings in meeting varied consumer needs.

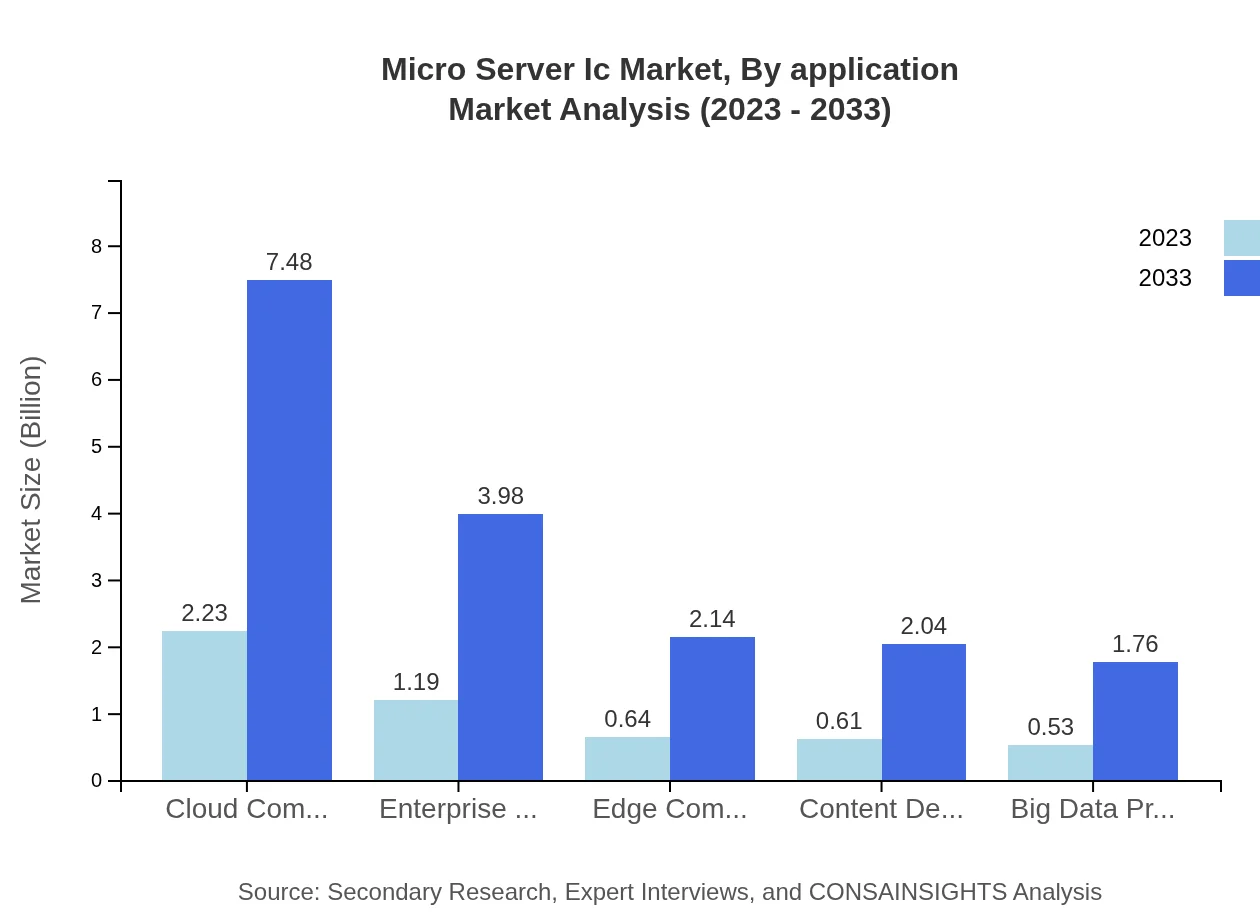

Micro Server Ic Market Analysis By Application

In terms of applications, cloud computing and gaming are at the forefront, each representing $2.23 billion in 2023 with substantial growth forecasts. Other significant applications include telecommunications and media and entertainment, indicating that customer demand is evolving towards applications requiring high-speed processing and storage solutions.

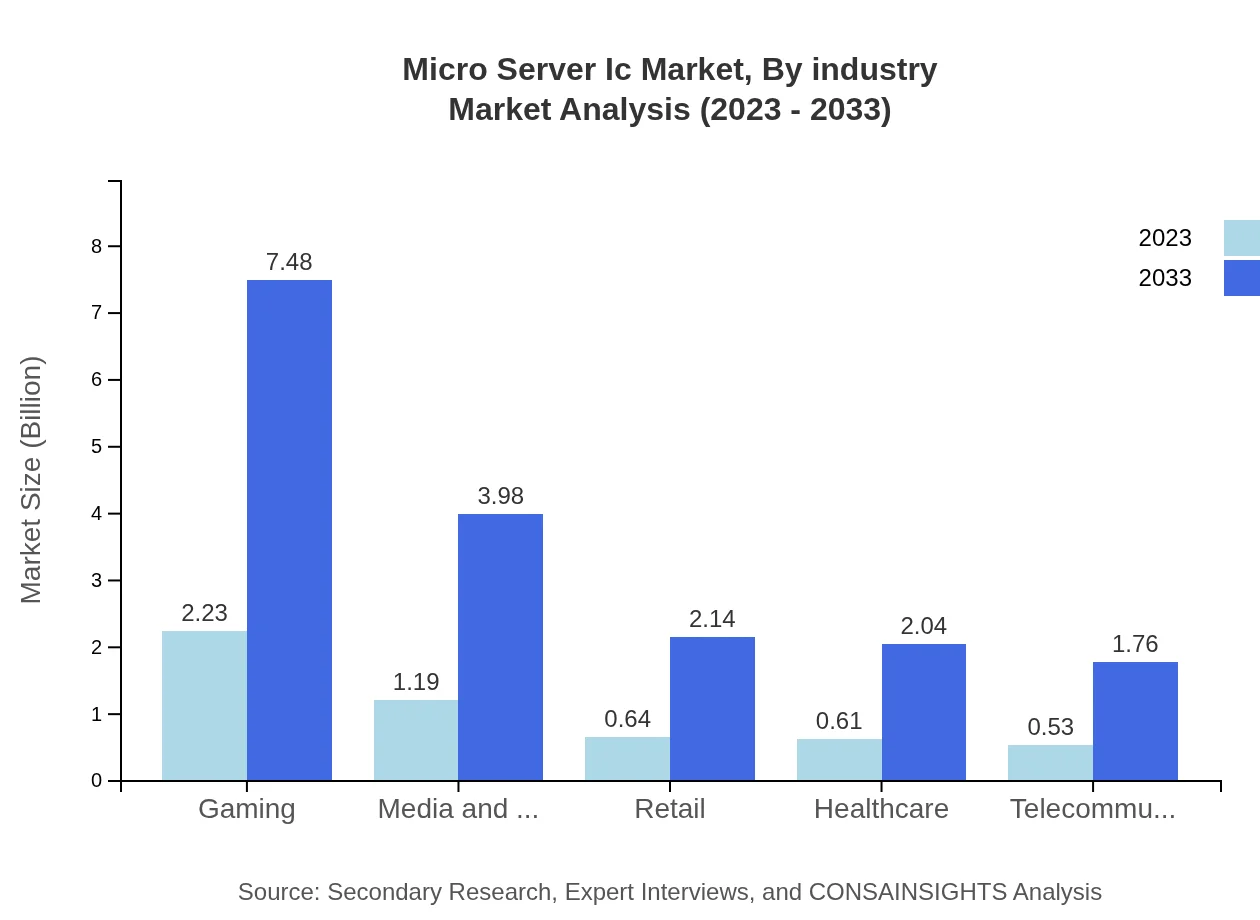

Micro Server Ic Market Analysis By Industry

The Micro Server IC market is utilized across various industries, including healthcare, telecommunications, and retail. Each industry exhibits strong growth projections, driven by technology adoption and the need for efficient data processing solutions, with healthcare seeing increased demand for telemedicine and data management.

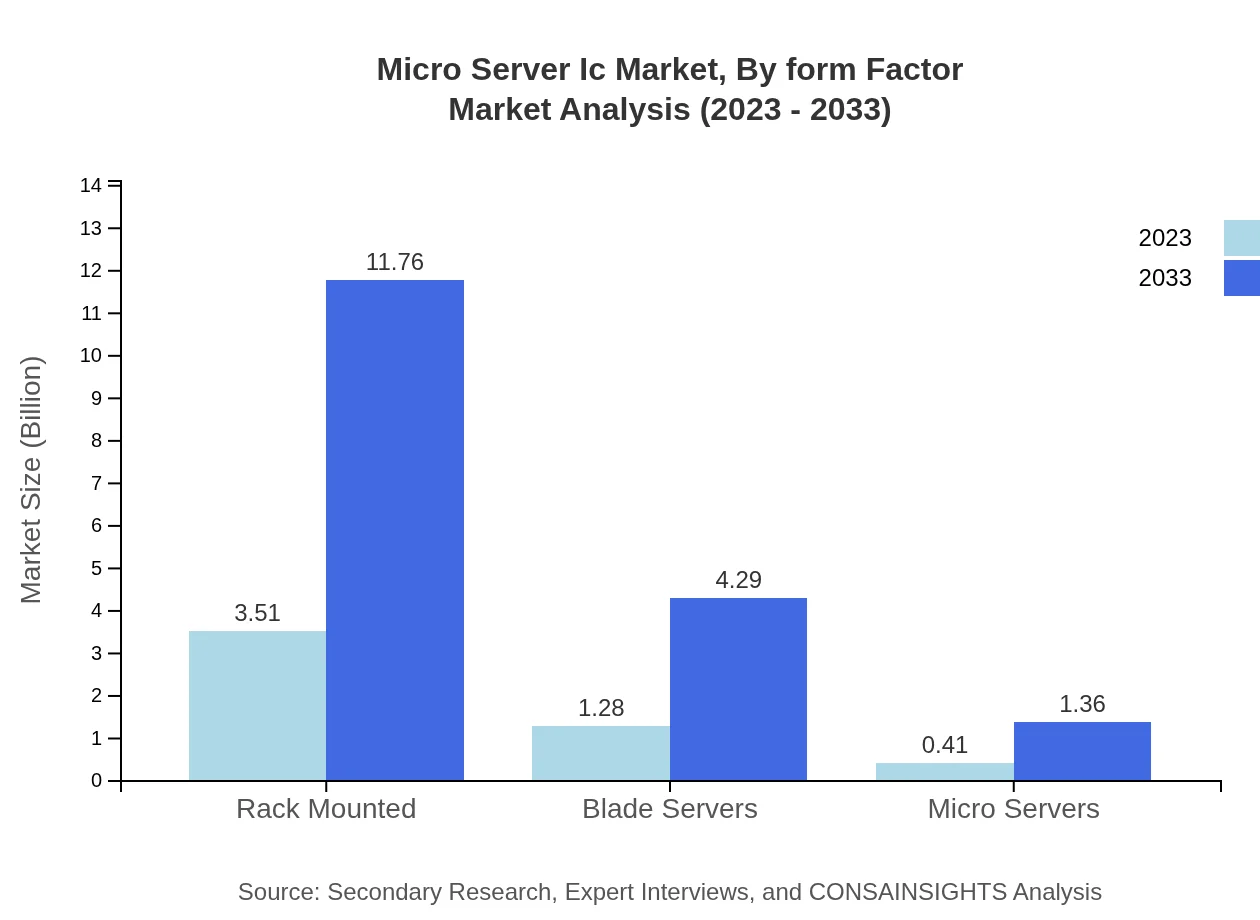

Micro Server Ic Market Analysis By Form Factor

Rack-mounted servers dominate the form factor segment, accounted for approximately 67.54% of the total market share in 2023. Blade servers also represented a considerable segment, showcasing the tendency of businesses to prefer scalable solutions over traditional server setups.

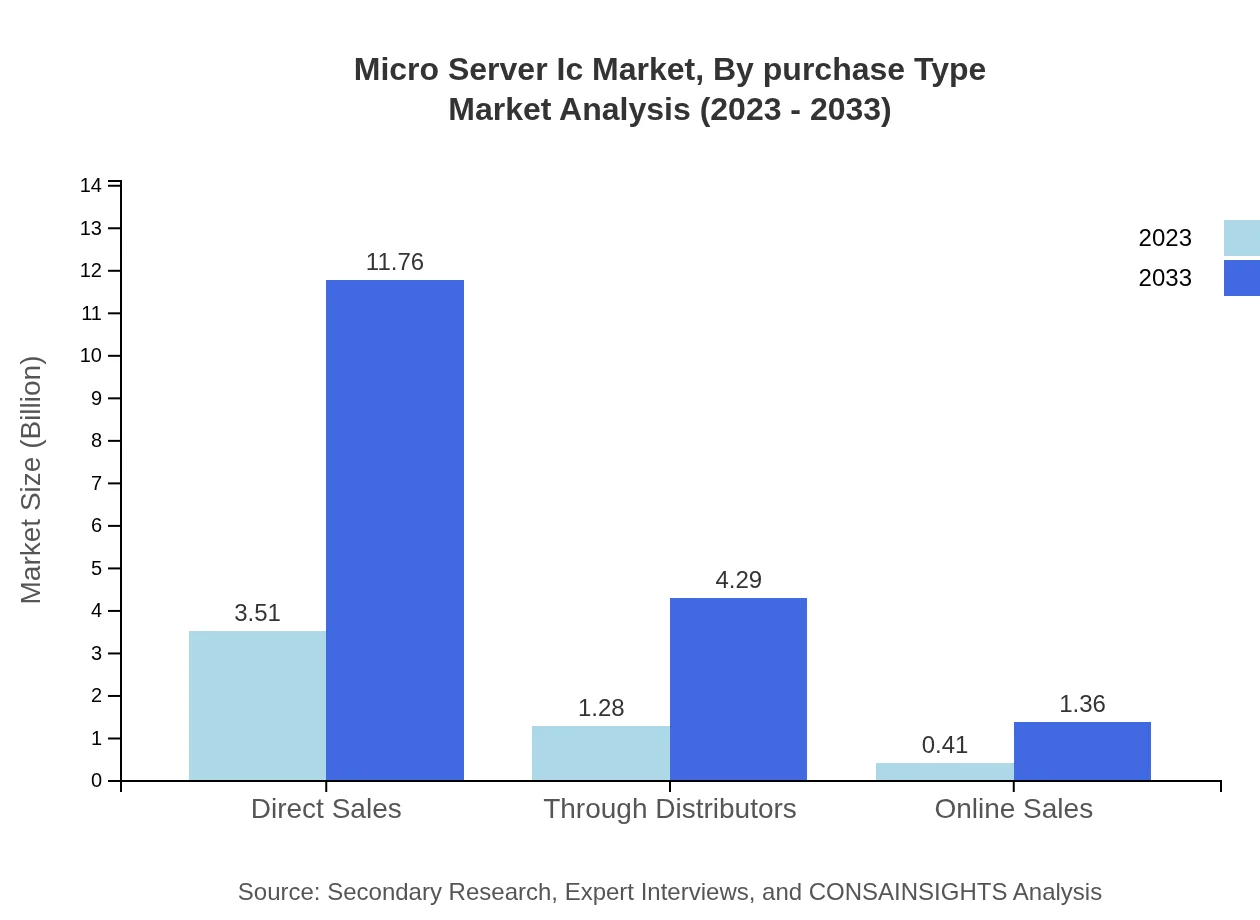

Micro Server Ic Market Analysis By Purchase Type

Direct sales make up the bulk of purchases at 67.54%, with growing trends in online sales indicating a shift in consumer behavior. Notably, distributors are increasingly relevant as more enterprises seek tailored computing solutions for specific needs.

Micro Server Ic Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Micro Server Ic Industry

Intel Corporation:

Intel is a leading manufacturer in the semiconductor industry, focusing on processors and microserver designs that are widely used globally.AMD:

AMD specializes in high-performance computing and has made significant advancements in microserver technology, competing effectively in the market.ARM Holdings:

ARM provides secure, low-power CPU architectures that are fundamental to micro server performance, playing a crucial role in energy-efficient computing.NVIDIA Corporation:

NVIDIA's developments in GPU technology complement micro servers, enhancing data processing and computing capabilities for gaming and AI applications.We're grateful to work with incredible clients.

FAQs

What is the market size of Micro Server IC?

The Micro Server IC market size is expected to reach approximately $5.2 billion by 2033, growing at a CAGR of 12.3% from 2023 onwards. This robust growth indicates increasing adoption and innovation in micro-server technologies across various industries.

What are the key market players or companies in the Micro Server IC industry?

Key players in the Micro Server IC industry include prominent semiconductor manufacturers and technology companies. Their continuous investment in research and development significantly drives innovation and advances the adoption of micro server solutions worldwide.

What are the primary factors driving the growth in the Micro Server IC industry?

Factors driving growth in the Micro Server IC industry include the increasing demand for cloud computing services, the rise of big data analytics, and the need for energy-efficient computing solutions in business operations and applications across various sectors.

Which region is the fastest Growing in the Micro Server IC?

The fastest-growing region in the Micro Server IC market is North America, projected to expand from $1.88 billion in 2023 to $6.28 billion by 2033. This growth is driven by technological advancements and increasing investments in data centers.

Does ConsaInsights provide customized market report data for the Micro Server IC industry?

Yes, ConsaInsights offers customized market report data tailored to specific client needs in the Micro Server IC industry, ensuring detailed insights and analysis that align with unique business goals and market strategies.

What deliverables can I expect from this Micro Server IC market research project?

From this Micro Server IC market research project, clients can expect comprehensive reports including market analysis, forecasts, competitive landscape assessments, and detailed insights into market trends, segments, and growth drivers.

What are the market trends of Micro Server IC?

Current market trends in the Micro Server IC segment include a shift towards energy-efficient designs, the proliferation of edge computing, and an increased emphasis on virtualization and software-defined infrastructure.