Microelectronics Cleaning Equipment Market Report

Published Date: 31 January 2026 | Report Code: microelectronics-cleaning-equipment

Microelectronics Cleaning Equipment Market Size, Share, Industry Trends and Forecast to 2033

This report provides an extensive analysis of the Microelectronics Cleaning Equipment market, including current trends, insights, and forecasts from 2023 to 2033, highlighting market dynamics, segmentation, and regional variations.

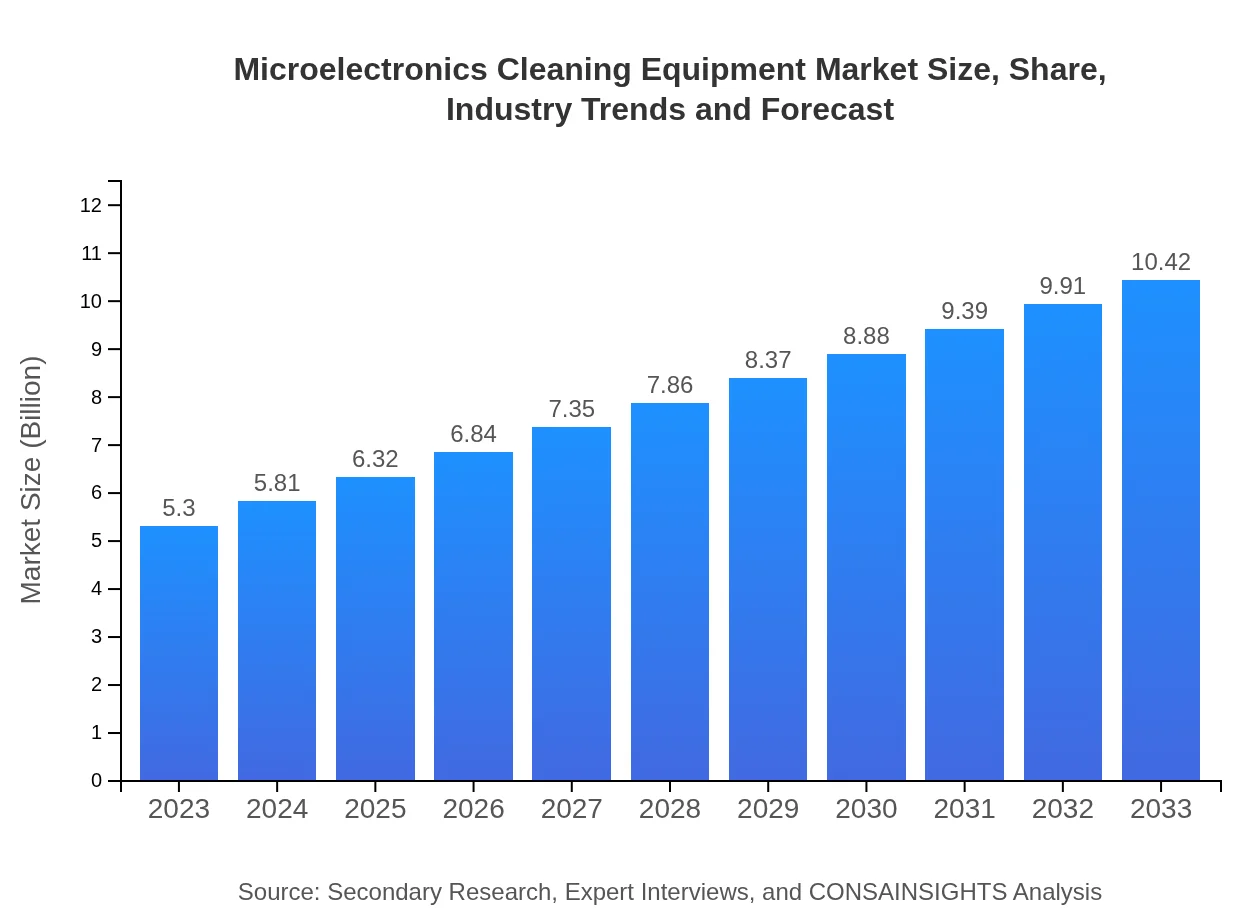

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $5.30 Billion |

| CAGR (2023-2033) | 6.8% |

| 2033 Market Size | $10.42 Billion |

| Top Companies | Clean Room Technology, Inc., Entegris, Inc., Tokyo Electron Limited, Applied Materials, Inc. |

| Last Modified Date | 31 January 2026 |

Microelectronics Cleaning Equipment Market Overview

Customize Microelectronics Cleaning Equipment Market Report market research report

- ✔ Get in-depth analysis of Microelectronics Cleaning Equipment market size, growth, and forecasts.

- ✔ Understand Microelectronics Cleaning Equipment's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Microelectronics Cleaning Equipment

What is the Market Size & CAGR of Microelectronics Cleaning Equipment market in 2023?

Microelectronics Cleaning Equipment Industry Analysis

Microelectronics Cleaning Equipment Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Microelectronics Cleaning Equipment Market Analysis Report by Region

Europe Microelectronics Cleaning Equipment Market Report:

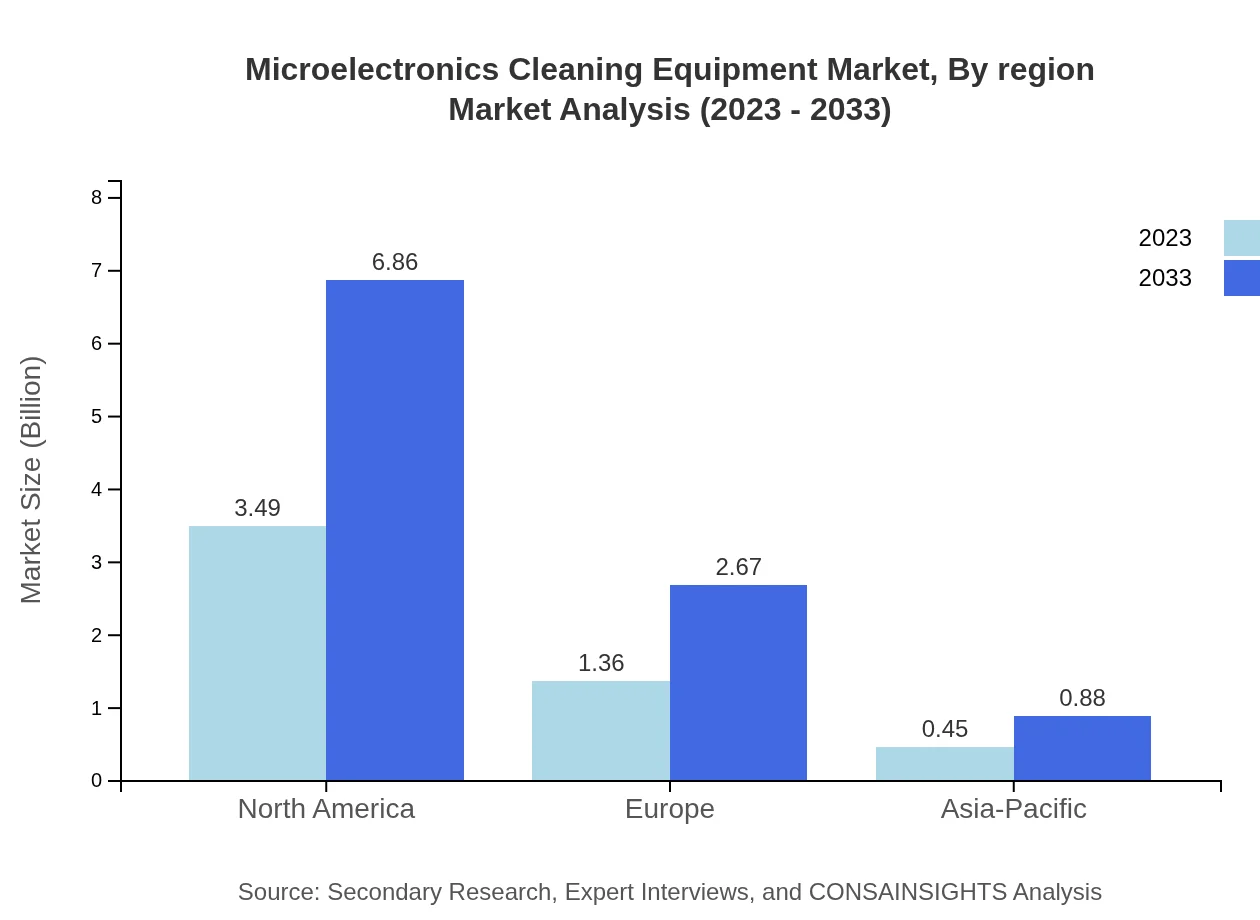

Europe's Microelectronics Cleaning Equipment market is significantly growing, valued at $1.77 billion in 2023, projected to grow to $3.49 billion by 2033. Factors such as stringent regulations and an emphasis on high-quality standards in manufacturing drive the demand for sophisticated cleaning technologies within the semiconductor and electronics industries.Asia Pacific Microelectronics Cleaning Equipment Market Report:

The Asia-Pacific region is anticipated to see substantial growth in the Microelectronics Cleaning Equipment market. In 2023, the market size is approximately $1.02 billion, and this is projected to grow to $2.00 billion by 2033. This region is a hub for semiconductor manufacturing, leading to increased investments in advanced cleaning technologies to meet production needs and quality standards.North America Microelectronics Cleaning Equipment Market Report:

North America remains one of the largest markets for Microelectronics Cleaning Equipment, with a valuation of $1.71 billion in 2023 and an anticipated growth to $3.36 billion by 2033. The region benefits from a strong presence of key market players and robust technological advancements, ensuring continuous demand for innovative cleaning solutions across various applications.South America Microelectronics Cleaning Equipment Market Report:

In South America, the Microelectronics Cleaning Equipment market is relatively smaller, with an estimated value of $0.25 billion in 2023, expected to reach $0.49 billion by 2033. Growth in this region is driven by increasing investments in telecommunications and consumer electronics sectors, catalyzing demand for effective cleaning solutions.Middle East & Africa Microelectronics Cleaning Equipment Market Report:

The Middle East and Africa are expected to experience moderate growth in the Microelectronics Cleaning Equipment market. From a size of $0.55 billion in 2023, it is projected to reach $1.08 billion by 2033. The region's growth is supported by increased investments in technology and electronics, requiring effective cleaning processes.Tell us your focus area and get a customized research report.

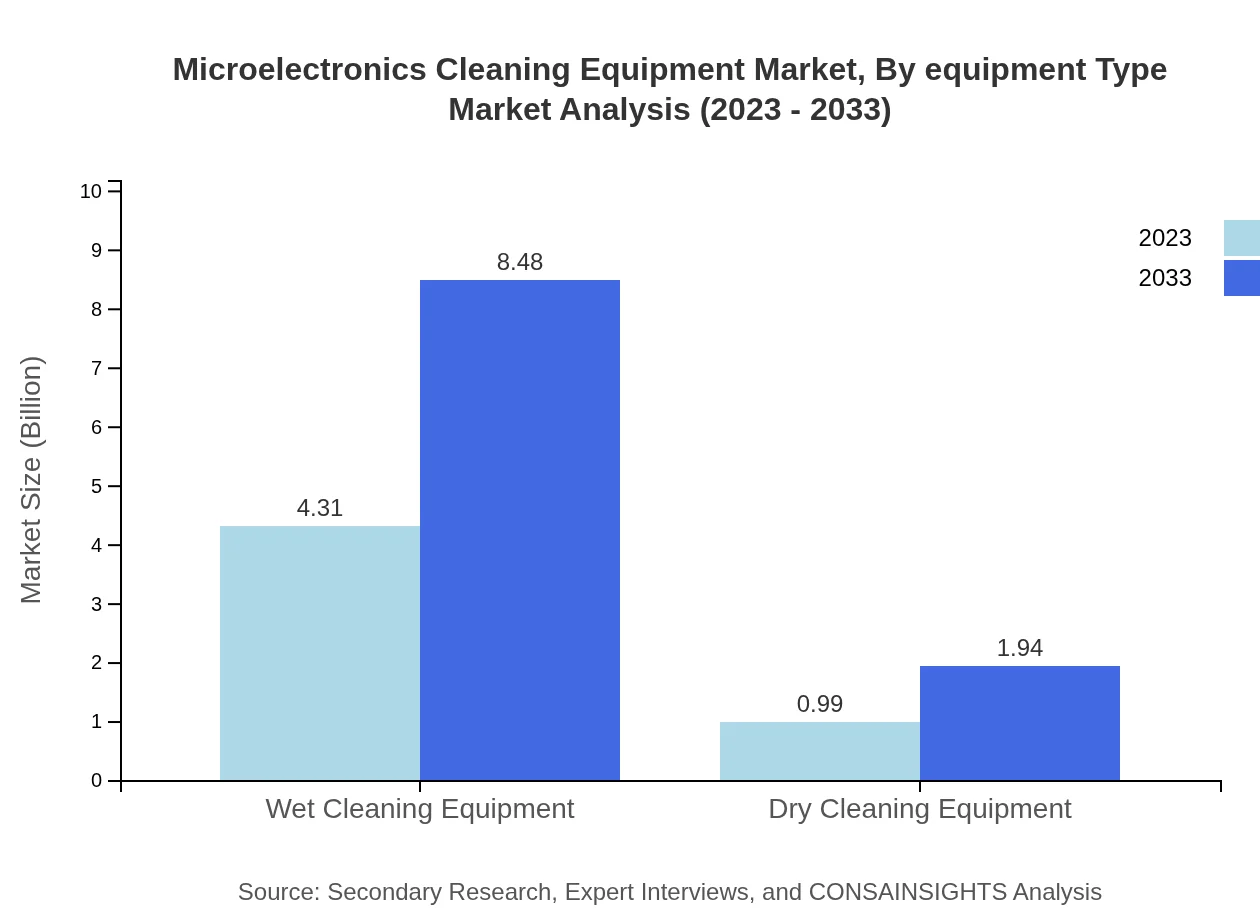

Microelectronics Cleaning Equipment Market Analysis By Equipment Type

The analysis of Microelectronics Cleaning Equipment by equipment type reveals that Wet Cleaning Equipment dominates the market due to its effectiveness in removing contaminants from microelectronic surfaces, holding a market size of $4.31 billion by 2023 and expanding to $8.48 billion by 2033. Dry Cleaning Equipment, while smaller in scale, is anticipated to grow from $0.99 billion in 2023 to $1.94 billion by 2033 as demand arises from settings requiring less moisture.

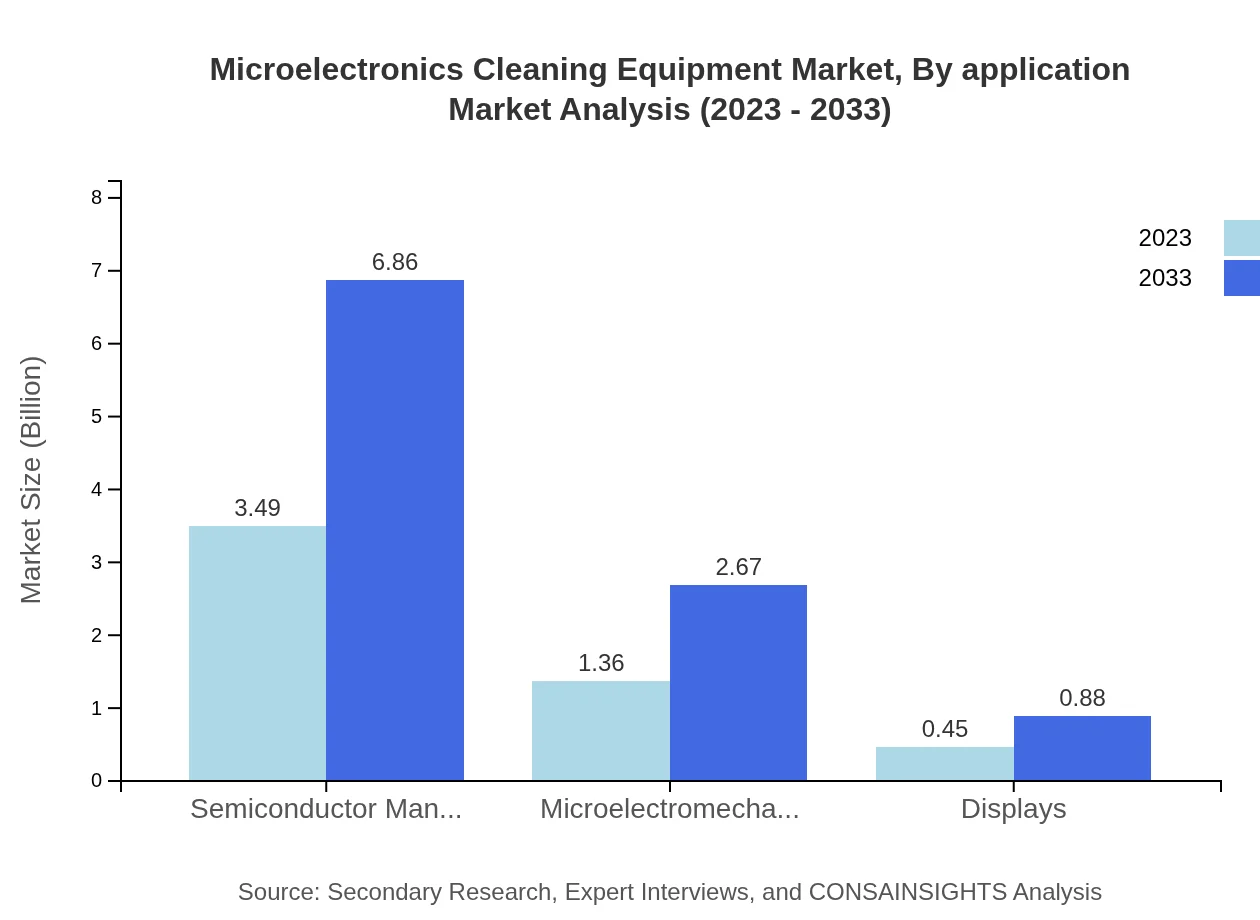

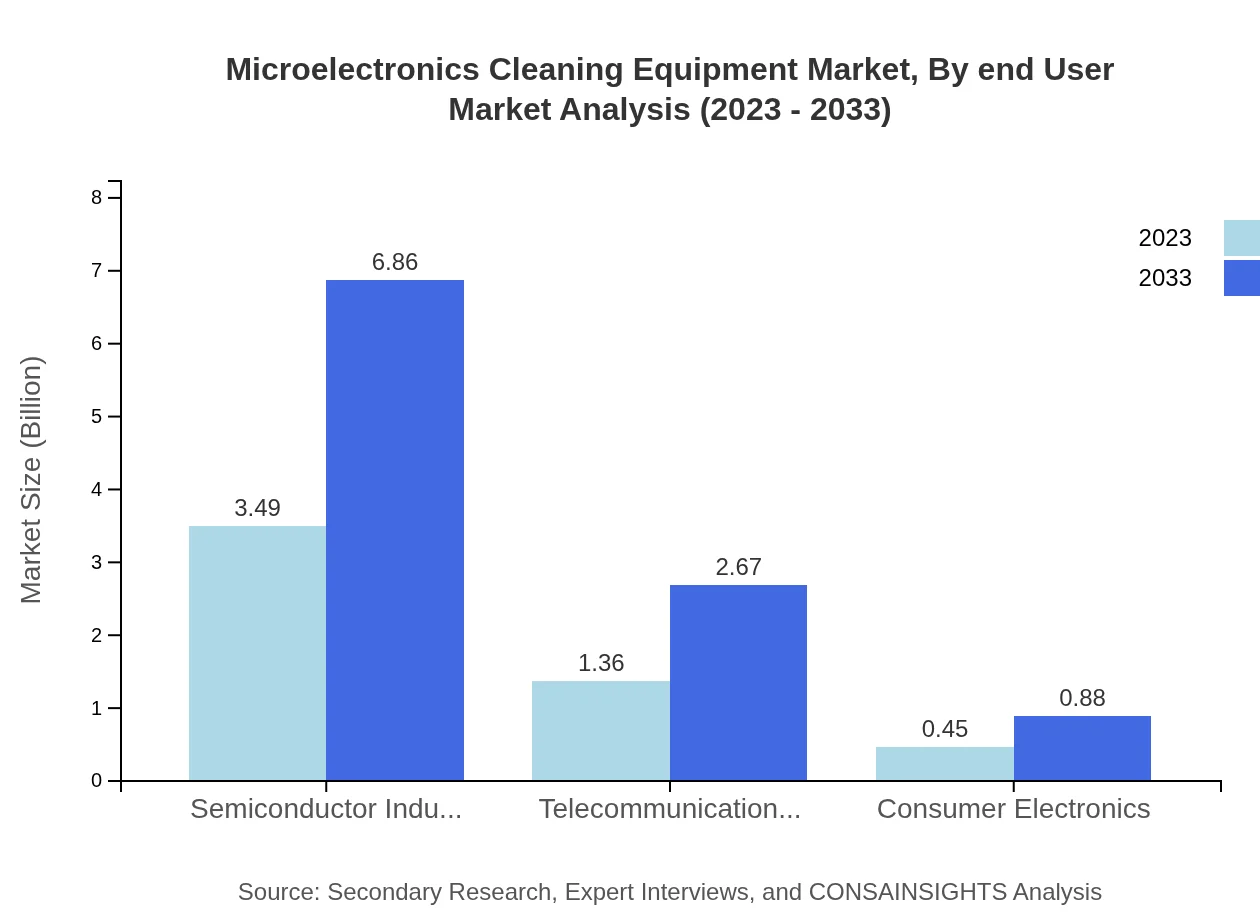

Microelectronics Cleaning Equipment Market Analysis By Application

The application segment highlights that Semiconductor Manufacturing accounts for the majority share of the market, valued at $3.49 billion in 2023, with growth projections aiming towards $6.86 billion by 2033. The Telecommunications Industry follows closely, showing a growing interest in advanced cleaning technologies to ensure product reliability, with sizes escalating from $1.36 billion to $2.67 billion during the same period.

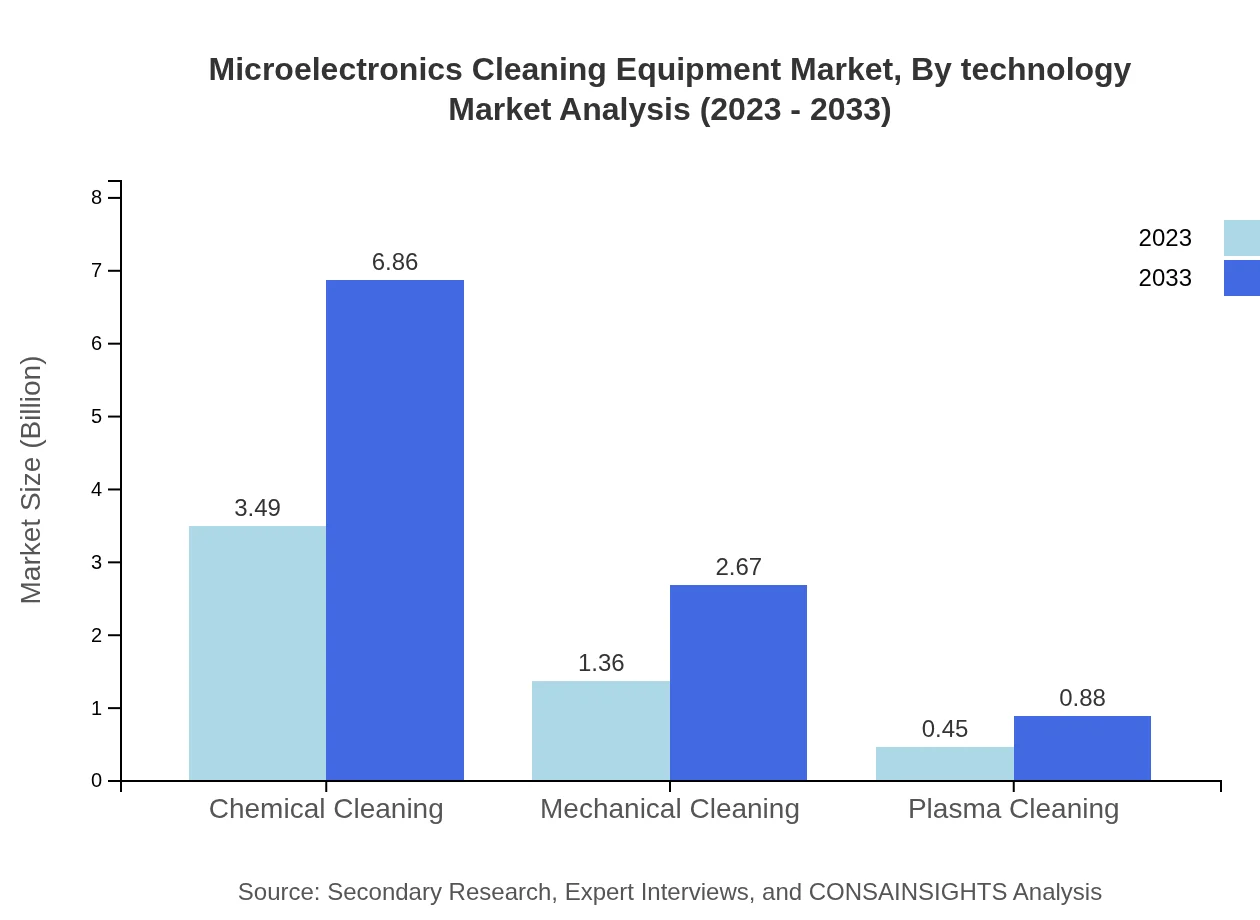

Microelectronics Cleaning Equipment Market Analysis By Technology

The technology segment reflects a strong market inclination toward Chemical Cleaning, maintaining a dominant share of 65.9% in revenue by harnessing powerful solvents and surfactants for effective cleaning processes. Mechanical Cleaning represents another significant approach, projected to maintain a share of 25.66% as industries develop cleaner and safer production methodologies.

Microelectronics Cleaning Equipment Market Analysis By End User

Examining end-users, the Semiconductor Industry captures the largest market share, driven by increasing demand for reliable, high-performing chips, with a market size of $3.49 billion in 2023. The Telecommunications Industry follows, showing solid growth momentum, whereas Consumer Electronics, though smaller (projected at $0.45 billion in 2023), exhibits an increasing need for improved product cleanliness, ensuring device longevity.

Microelectronics Cleaning Equipment Market Analysis By Region

The regional landscape indicates that North America is projected to dominate the market over the coming decade, attributed to its advanced technological frameworks and significant research investments. The Asia-Pacific region, while currently smaller, is anticipated to expand rapidly, driven by its semiconductor industry. Europe remains a key player with stringent quality standards reinforcing the need for specialized cleaning solutions. Latin America and the Middle East are gradually evolving markets that will contribute to global growth.

Microelectronics Cleaning Equipment Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Microelectronics Cleaning Equipment Industry

Clean Room Technology, Inc.:

A significant player specializing in cleanroom-compatible equipment and processes, focusing on revolutionary cleaning methods that meet stringent industry needs.Entegris, Inc.:

Known for its advanced filtration and purification solutions in the semiconductor sector, Entegris brings innovative cleanroom technologies that enhance cleaning efficacy.Tokyo Electron Limited:

A major supplier of semiconductor production equipment, providing highly advanced cleaning solutions pivotal for maintaining device quality.Applied Materials, Inc.:

Focuses on developing leading-edge manufacturing equipment, including cleaning systems essential for semiconductor fabrication.We're grateful to work with incredible clients.

FAQs

What is the market size of microelectronics Cleaning Equipment?

The microelectronics cleaning equipment market is valued at approximately $5.3 billion in 2023, with a projected CAGR of 6.8%, indicating significant growth potential through 2033.

What are the key market players or companies in this microelectronics Cleaning Equipment industry?

Key players in the microelectronics cleaning equipment market include major corporations such as Tokyo Electron Ltd., ASML Holding N.V., and Applied Materials, which drive innovation and market growth.

What are the primary factors driving the growth in the microelectronics Cleaning Equipment industry?

Growth in the microelectronics cleaning equipment market is primarily driven by advancements in semiconductor manufacturing, increased demand for consumer electronics, and stringent cleanliness standards in production processes.

Which region is the fastest Growing in the microelectronics Cleaning Equipment?

The Asia Pacific region is the fastest-growing segment in the microelectronics cleaning equipment market, with an increase from $1.02 billion in 2023 to $2.00 billion by 2033.

Does ConsaInsights provide customized market report data for the microelectronics Cleaning Equipment industry?

Yes, ConsaInsights offers customized market report data tailored to specific needs within the microelectronics cleaning equipment industry, ensuring clients receive relevant insights.

What deliverables can I expect from this microelectronics Cleaning Equipment market research project?

Deliverables from the microelectronics cleaning equipment market research project include detailed market analysis, segmentation data, trend forecasts, and competitive landscape overviews.

What are the market trends of microelectronics Cleaning Equipment?

Current trends in the microelectronics cleaning equipment market involve increasing automation in processes, a shift towards eco-friendly cleaning agents, and the expansion of wet cleaning technologies.