Microencapsulation Market Report

Published Date: 02 February 2026 | Report Code: microencapsulation

Microencapsulation Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Microencapsulation market, covering market trends, size, and growth forecasts from 2023 to 2033. It delves into industry dynamics, technological advancements, and regional insights, offering valuable data for stakeholders and decision-makers.

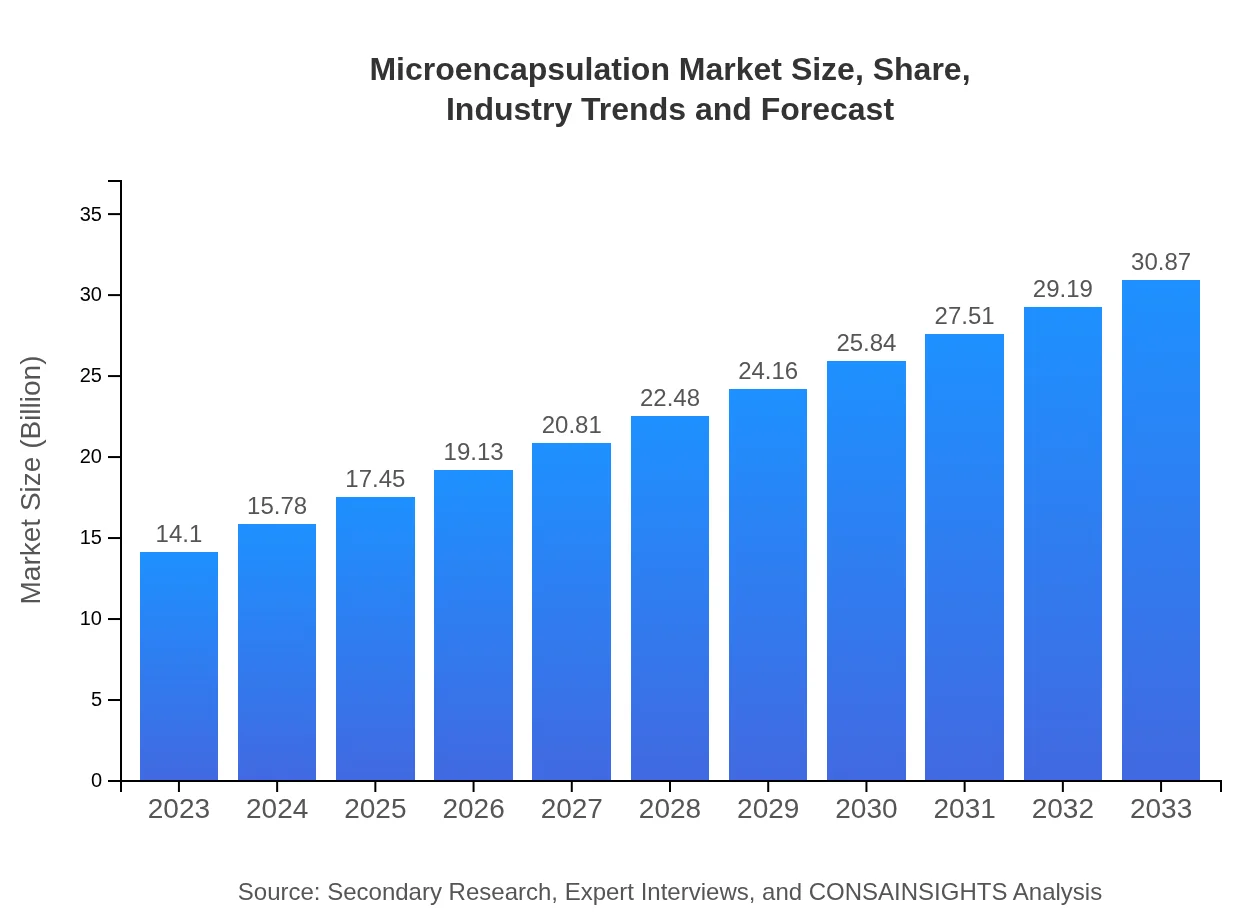

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $14.10 Billion |

| CAGR (2023-2033) | 7.9% |

| 2033 Market Size | $30.87 Billion |

| Top Companies | BASF SE, Evonik Industries AG, Givaudan SA, Syngenta AG |

| Last Modified Date | 02 February 2026 |

Microencapsulation Market Overview

Customize Microencapsulation Market Report market research report

- ✔ Get in-depth analysis of Microencapsulation market size, growth, and forecasts.

- ✔ Understand Microencapsulation's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Microencapsulation

What is the Market Size & CAGR of Microencapsulation Market in 2023?

Microencapsulation Industry Analysis

Microencapsulation Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Microencapsulation Market Analysis Report by Region

Europe Microencapsulation Market Report:

Europe's Microencapsulation market size in 2023 is estimated at $3.55 billion, with expectations to expand to $7.78 billion by 2033. The region's growth is propelled by a strong focus on research and development and ongoing innovation in the food and pharmaceutical sectors, driven by consumer demand for high-quality and safe products.Asia Pacific Microencapsulation Market Report:

In 2023, the Asia Pacific Microencapsulation market is valued at $3.05 billion, projected to grow to $6.68 billion by 2033, reflecting a strong CAGR of 9.2%. The region's growth is driven by the booming pharmaceutical and food industries, coupled with increasing consumer awareness of wellness products and stringent food safety regulations.North America Microencapsulation Market Report:

North America holds a significant share of the Microencapsulation market, valued at $5.02 billion in 2023. It is projected to increase to $10.99 billion by 2033, indicating a strong CAGR of 8.3%. Factors contributing to this growth include advancements in pharmaceutical formulations, increasing demand for nutritious food products, and a growing trend towards personalization in health and wellness.South America Microencapsulation Market Report:

The South American market for Microencapsulation is valued at $0.92 billion in 2023, anticipated to reach $2.01 billion by 2033. Expectations of a CAGR of 8.2% can be attributed to the expanding agricultural sector and rising health consciousness among consumers along with supportive government policies promoting food safety.Middle East & Africa Microencapsulation Market Report:

The Middle East and Africa Microencapsulation market is expected to grow from $1.55 billion in 2023 to $3.40 billion by 2033. A CAGR of 8.2% is driven by increasing investments in food safety and agriculture, alongside growing consumer demand for enhanced food quality and health supplements.Tell us your focus area and get a customized research report.

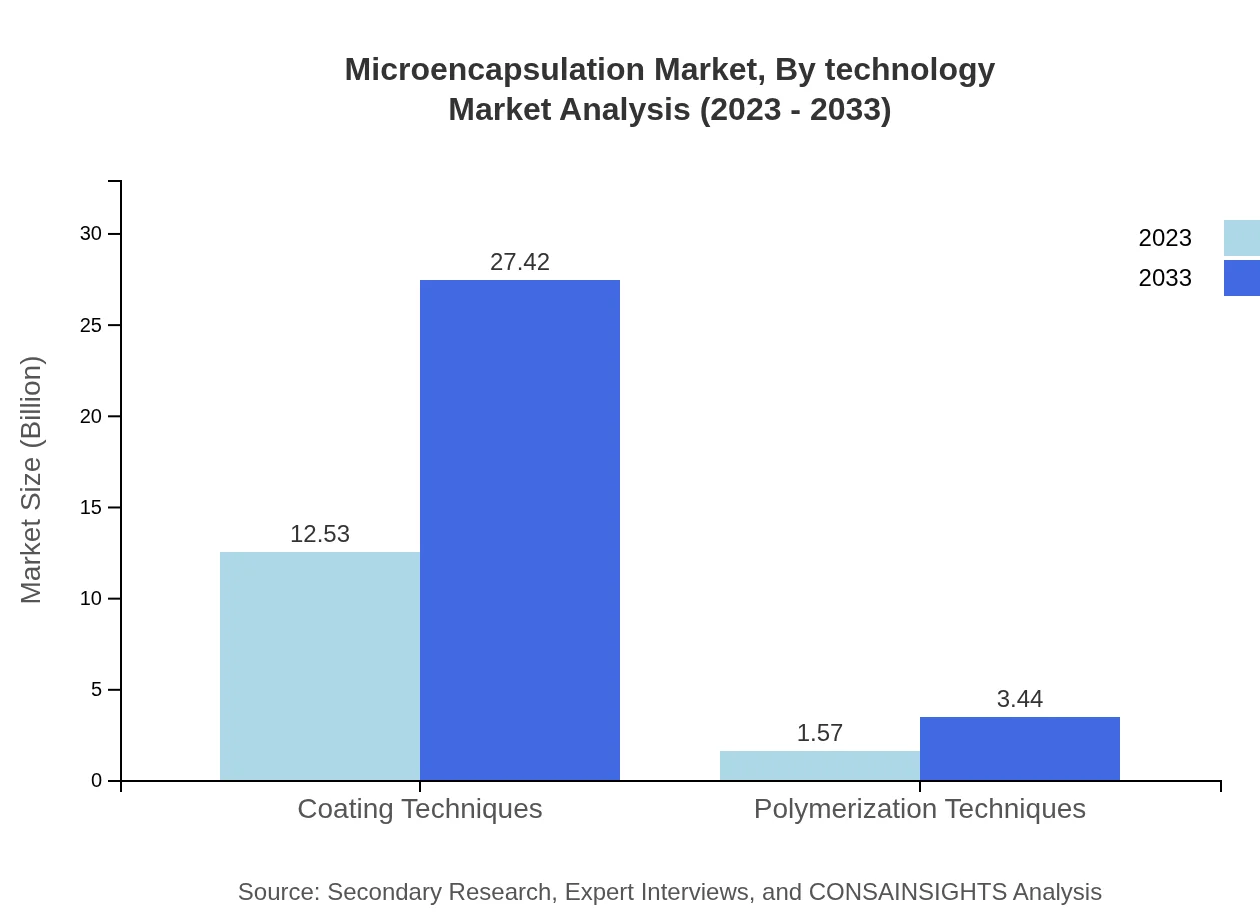

Microencapsulation Market Analysis By Technology

The market is dominated by coating techniques with a size of $12.53 billion in 2023, expected to reach $27.42 billion by 2033, maintaining an impressive market share of 88.85% throughout the decade. Polymerization techniques, while smaller in size at $1.57 billion, are expected to grow to $3.44 billion, capturing an 11.15% market share.

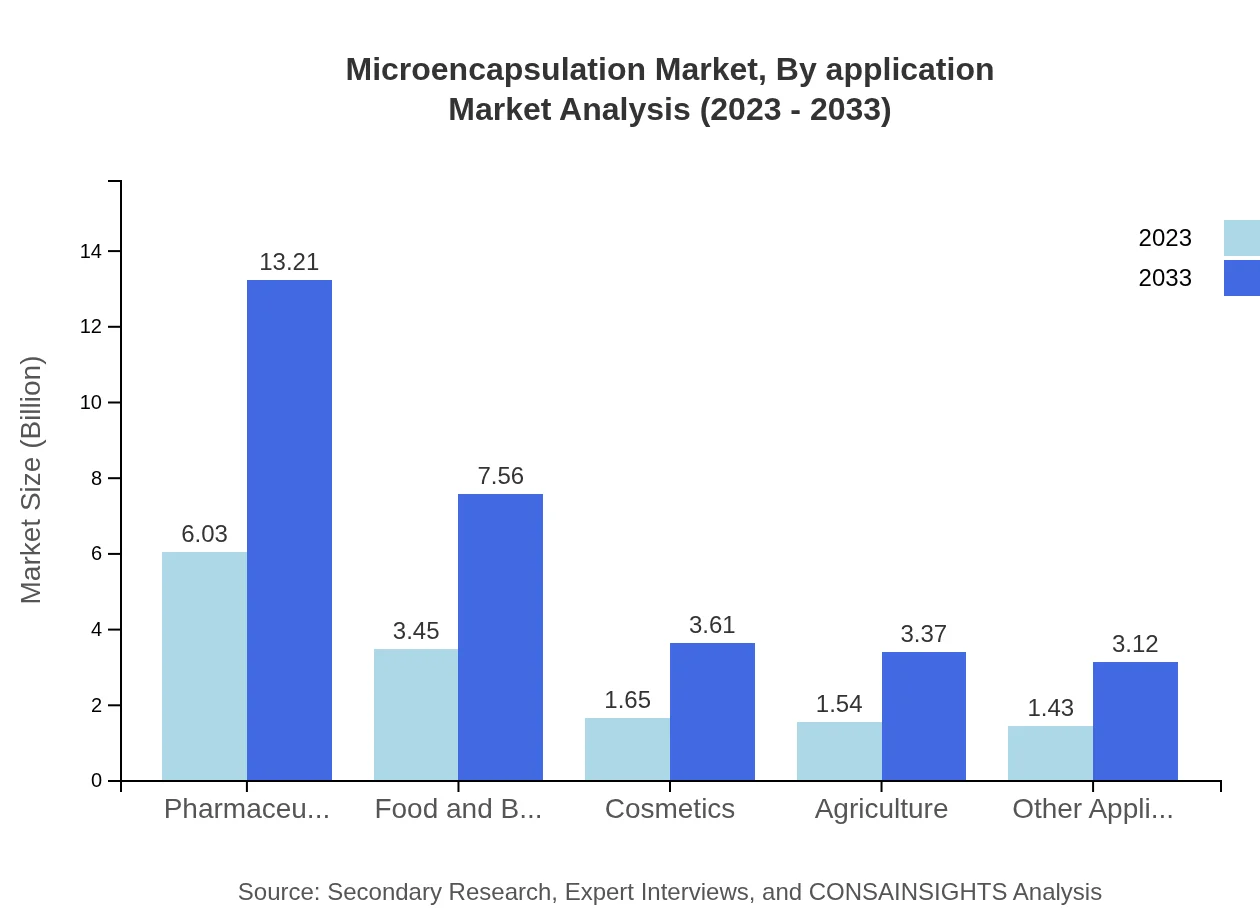

Microencapsulation Market Analysis By Application

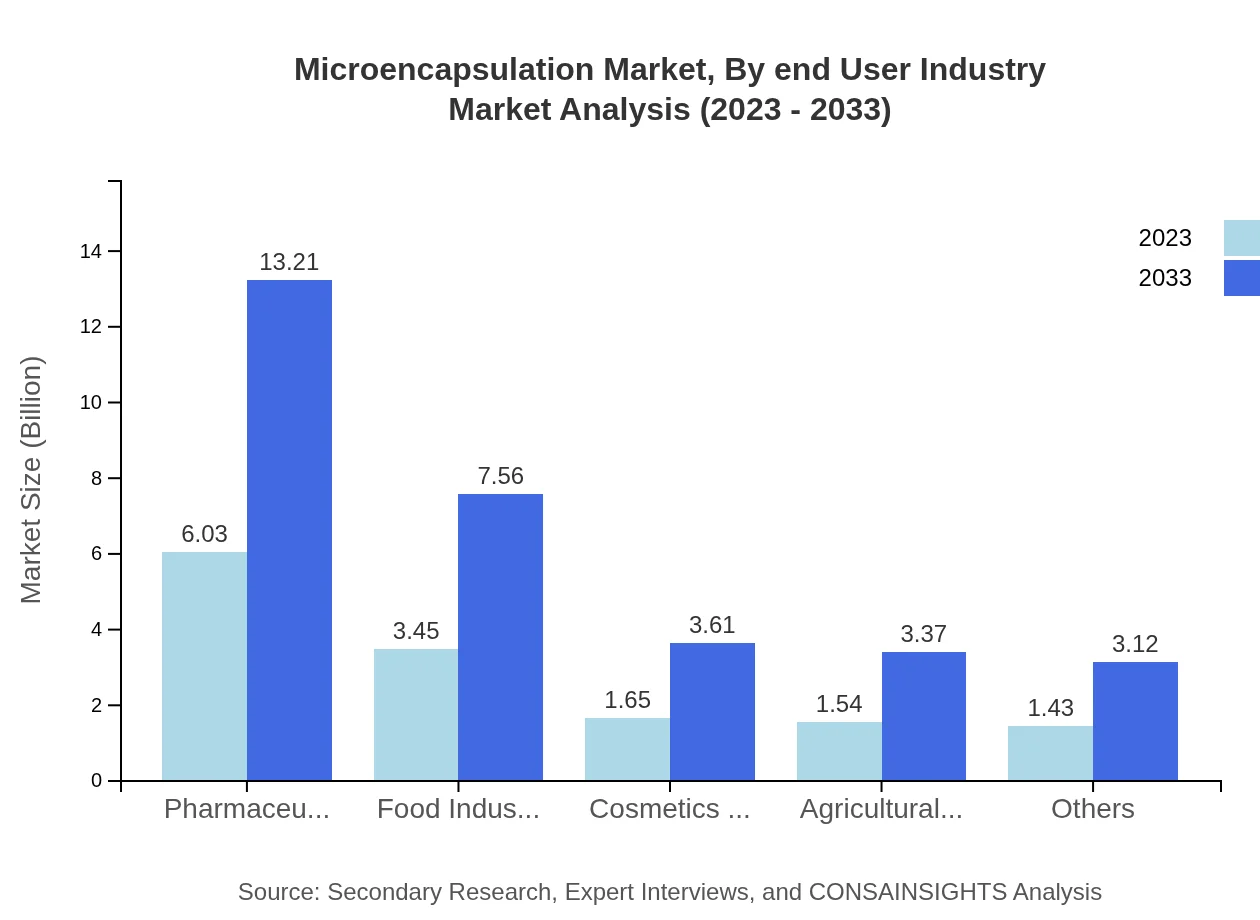

The pharmaceuticals segment leads the market with a size of $6.03 billion in 2023, projected to grow to $13.21 billion by 2033, maintaining a 42.79% market share. Food and beverages follow, with a market size from $3.45 billion to $7.56 billion, while cosmetics and agriculture also represent growing segments.

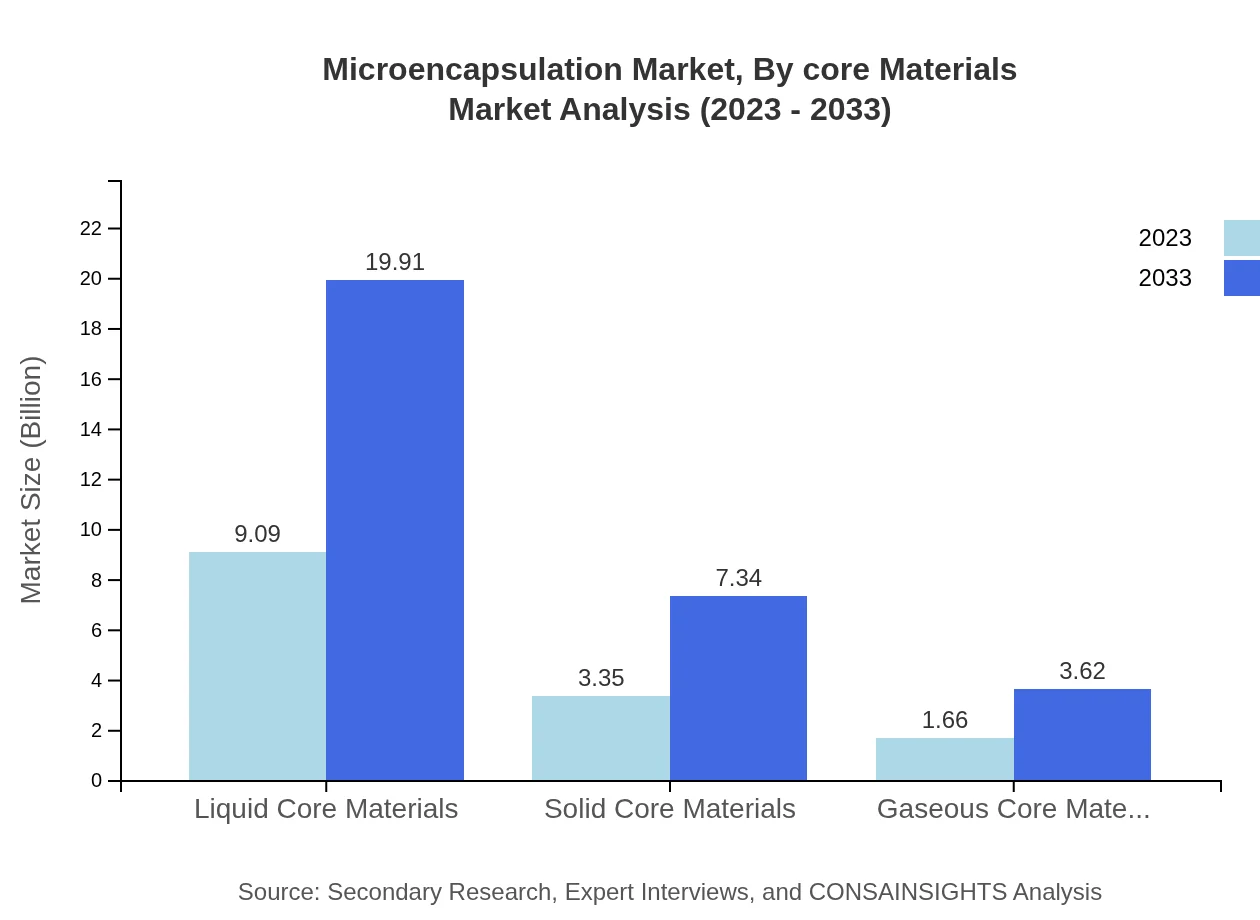

Microencapsulation Market Analysis By Core Materials

Liquid core materials dominate with a significant share of 64.49% in 2023 at $9.09 billion, expected to increase to $19.91 billion. Solid core and gaseous core materials, though smaller, are also on an upward trend.

Microencapsulation Market Analysis By End User Industry

The pharmaceuticals and healthcare industry prominently accounts for $6.03 billion of the Microencapsulation market in 2023, forecasted to reach $13.21 billion by 2033, representing 42.79% of the market share. Additionally, the food industry is witnessing parallel growth, emphasizing the relevance of microencapsulation across various sectors.

Microencapsulation Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Microencapsulation Industry

BASF SE:

BASF SE is a global leader in chemical manufacturing with a strong presence in microencapsulation technologies, innovating diverse applications particularly in food and pharmaceuticals.Evonik Industries AG:

Evonik Industries AG specializes in specialty chemicals and microencapsulation solutions, focusing on enhancing product quality and functionality across multiple industries.Givaudan SA:

Givaudan SA is an international leader in flavor and fragrance production, utilizing microencapsulation to improve stability and delivery of active ingredients.Syngenta AG:

Syngenta AG is a leading agricultural company employing microencapsulation techniques to enhance pesticide effectiveness and environmental safety.We're grateful to work with incredible clients.

FAQs

What is the market size of microencapsulation?

The global microencapsulation market size was valued at $14.1 billion in 2023 and is projected to grow at a CAGR of 7.9% between 2023 and 2033. This indicates strong demand across various applications and robust growth over the next decade.

What are the key market players or companies in this microencapsulation industry?

Key players in the microencapsulation industry include major companies such as BASF SE, Evonik Industries AG, and Bürkert Fluid Control Systems. These firms leverage advanced technologies and operational strategies to maintain market competitiveness and innovation.

What are the primary factors driving the growth in the microencapsulation industry?

The growth in the microencapsulation industry is driven by increasing demand in pharmaceuticals, food, and cosmetics. Factors such as technological advancements, rising consumer awareness, and the need for improved product stability also contribute significantly to the market expansion.

Which region is the fastest Growing in the microencapsulation industry?

The Asia Pacific region is the fastest-growing market for microencapsulation, expected to grow from $3.05 billion in 2023 to $6.68 billion by 2033. This reflects a rapidly expanding consumer base and industrial applications within the region.

Does ConsaInsights provide customized market report data for the microencapsulation industry?

Yes, ConsaInsights offers customized market report data specific to the microencapsulation industry. Clients can request tailored insights to meet their specific needs, ensuring comprehensive analysis and relevant data for strategic decision-making.

What deliverables can I expect from this microencapsulation market research project?

Deliverables from the microencapsulation market research project include detailed market analysis, segmentation data, growth forecasts, competitive landscape insights, and regional breakdowns, allowing stakeholders to make informed business decisions based on thorough data.

What are the market trends of microencapsulation?

Current trends in the microencapsulation market include increased adoption in pharmaceuticals for targeted delivery, growing use in the food industry for flavor protection, and rising demand in cosmetics for enhanced ingredient performance. Sustainability and innovation in technology also trend prominently.