Microfinance

Published Date: 24 January 2026 | Report Code: microfinance

Microfinance Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Microfinance market from 2023 to 2033, including market size, trends, technological advancements, segmentation, and regional dynamics that influence the industry's growth.

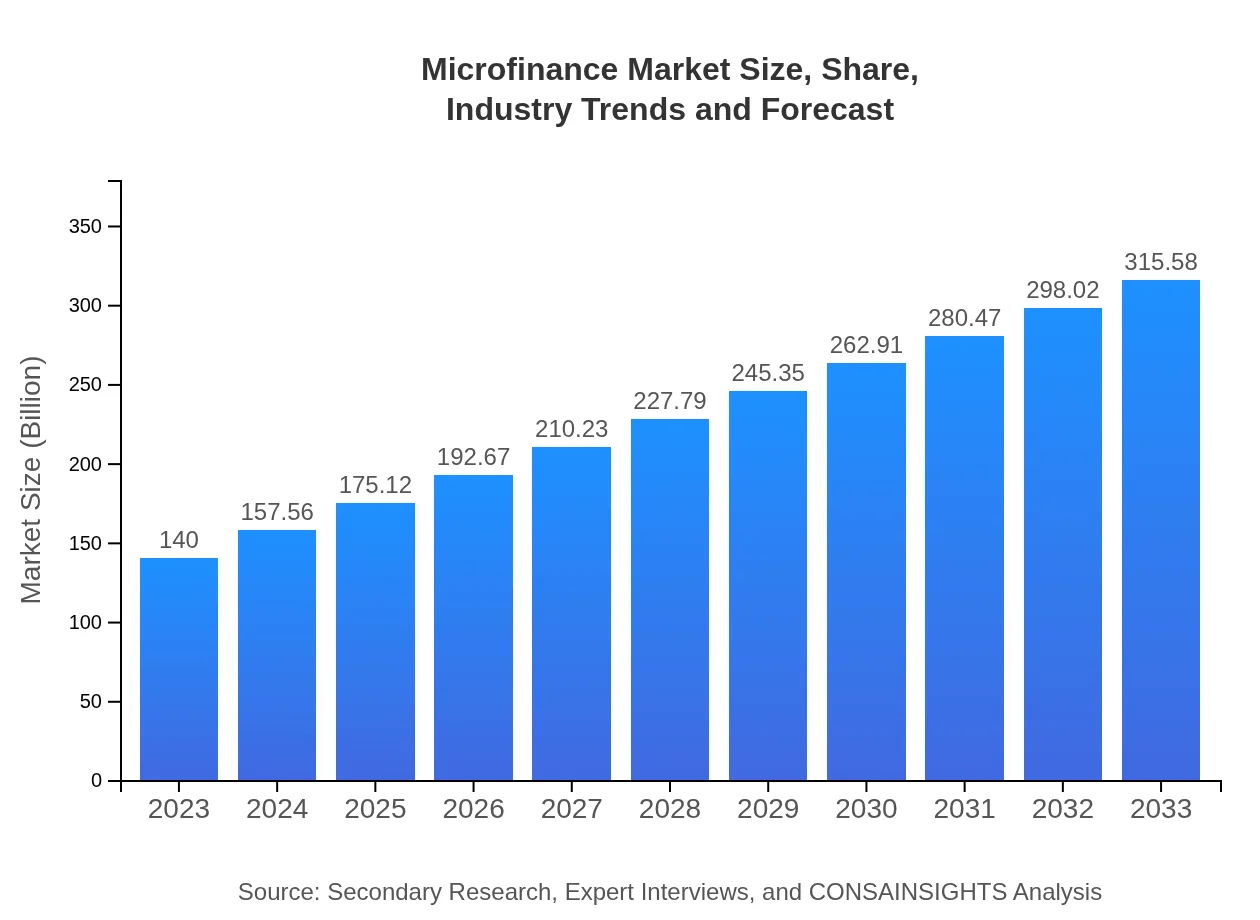

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $140.00 Billion |

| CAGR (2023-2033) | 8.2% |

| 2033 Market Size | $315.58 Billion |

| Top Companies | Kiva, Grameen Bank, BRAC, FINCA International |

| Last Modified Date | 24 January 2026 |

Microfinance Market Overview

Customize Microfinance market research report

- ✔ Get in-depth analysis of Microfinance market size, growth, and forecasts.

- ✔ Understand Microfinance's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Microfinance

What is the Market Size & CAGR of Microfinance market in 2033?

Microfinance Industry Analysis

Microfinance Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Microfinance Market Analysis Report by Region

Europe Microfinance:

The European market for microfinance is valued at approximately $39.13 billion in 2023, with a forecasted increase to $88.21 billion by 2033. The focus on social finance initiatives and support for entrepreneurship among disadvantaged groups are key growth drivers in this region.Asia Pacific Microfinance:

In 2023, the Microfinance market in the Asia Pacific region is valued at approximately $29.23 billion, with projections suggesting it can grow to around $65.89 billion by 2033. The region is leading in the microfinance technology space, driven by a high penetration rate of mobile banking and digital platforms, which significantly enhance service delivery and customer engagement.North America Microfinance:

North America is anticipated to grow from $48.59 billion in 2023 to $109.54 billion by 2033. The region's growth is fueled by the increasing participation of fintech companies in the microfinance space, providing innovative solutions that cater to diverse demographic needs, including low-income populations.South America Microfinance:

The South American microfinance landscape is expected to expand from $13.62 billion in 2023 to $30.71 billion by 2033. The region benefits from increasing support from local governments and international organizations focused on promoting financial inclusion, although challenges related to regulatory frameworks persist.Middle East & Africa Microfinance:

In the Middle East and Africa, the market is growing from $9.42 billion in 2023 to an estimated $21.24 billion by 2033. This region sees a combination of traditional microfinance practices and expanding digital platforms, addressing the unique financial needs of both urban and rural populations.Tell us your focus area and get a customized research report.

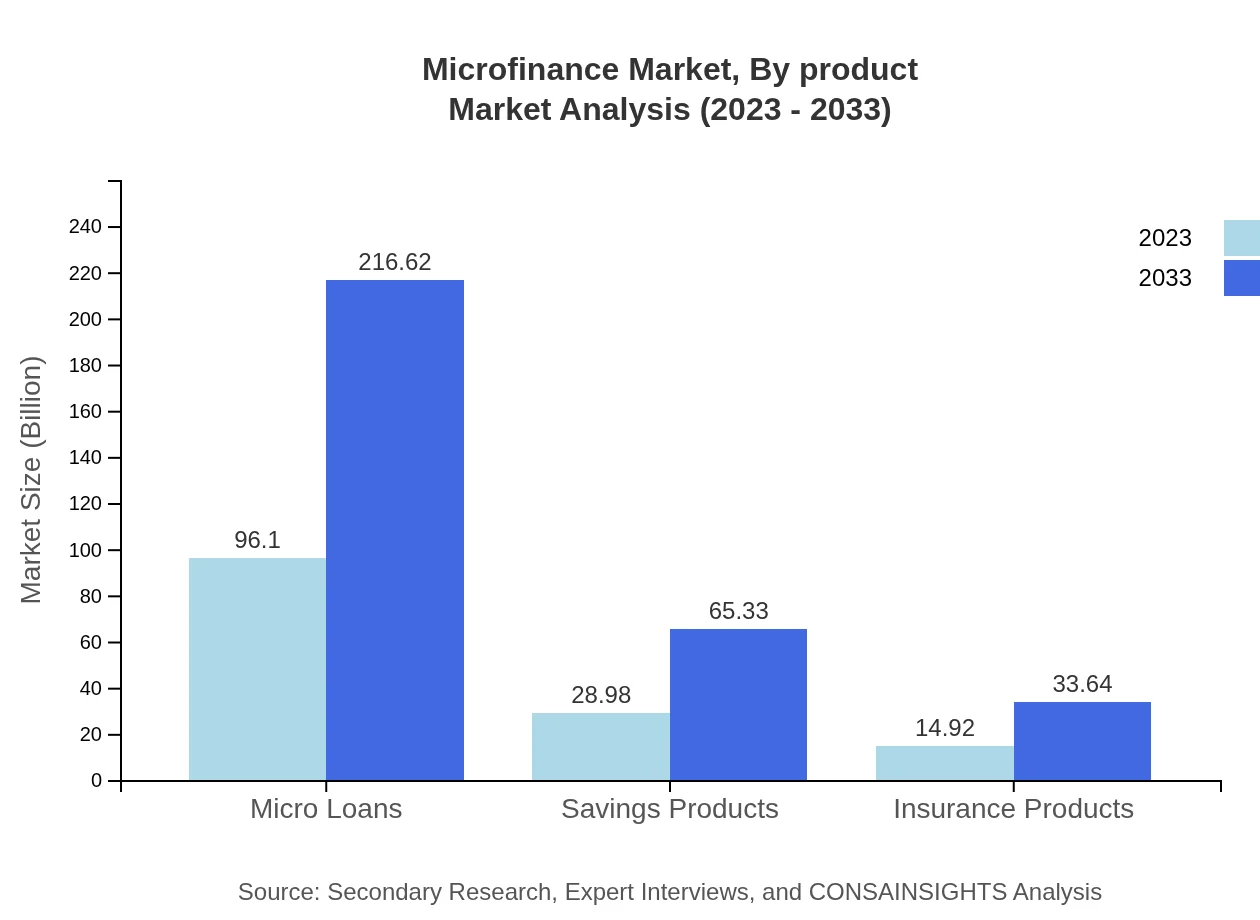

Microfinance Market Analysis By Product

The Microfinance market is fundamentally shaped by various product types aimed at addressing the diverse needs of clients. Micro-loans currently dominate the market, valued at $96.10 billion in 2023, expected to grow to $216.62 billion by 2033, accounting for approximately 68.64% of market share. Savings products also hold a significant market share, estimated at $28.98 billion in 2023, growing to $65.33 billion by 2033. Digital financial products, including mobile banking and blockchain-based solutions, are anticipated to gain increased traction, reflecting the growing reliance on technology in financial services.

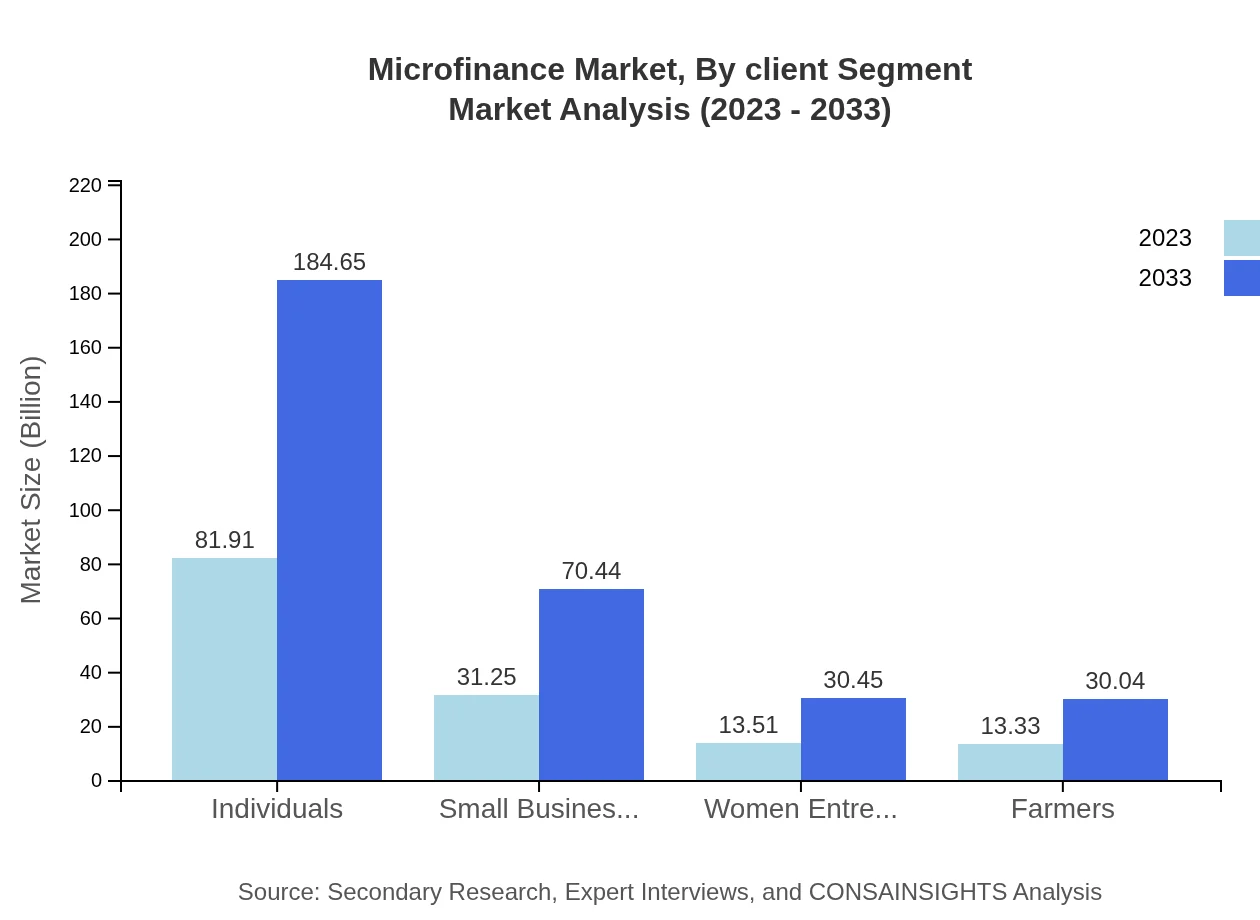

Microfinance Market Analysis By Client Segment

Client segmentation in microfinance primarily focuses on individuals, small businesses, women entrepreneurs, and farmers. Individuals represent the largest segment, projected to grow from $81.91 billion in 2023 to around $184.65 billion by 2033, capturing 58.51% of the market share. Small businesses and women entrepreneurs also exhibit substantial growth, highlighting the increasing shift towards empowering marginalized groups through financial services. These segments are essential as they reflect the socio-economic dynamics that drive the demand for microfinance.

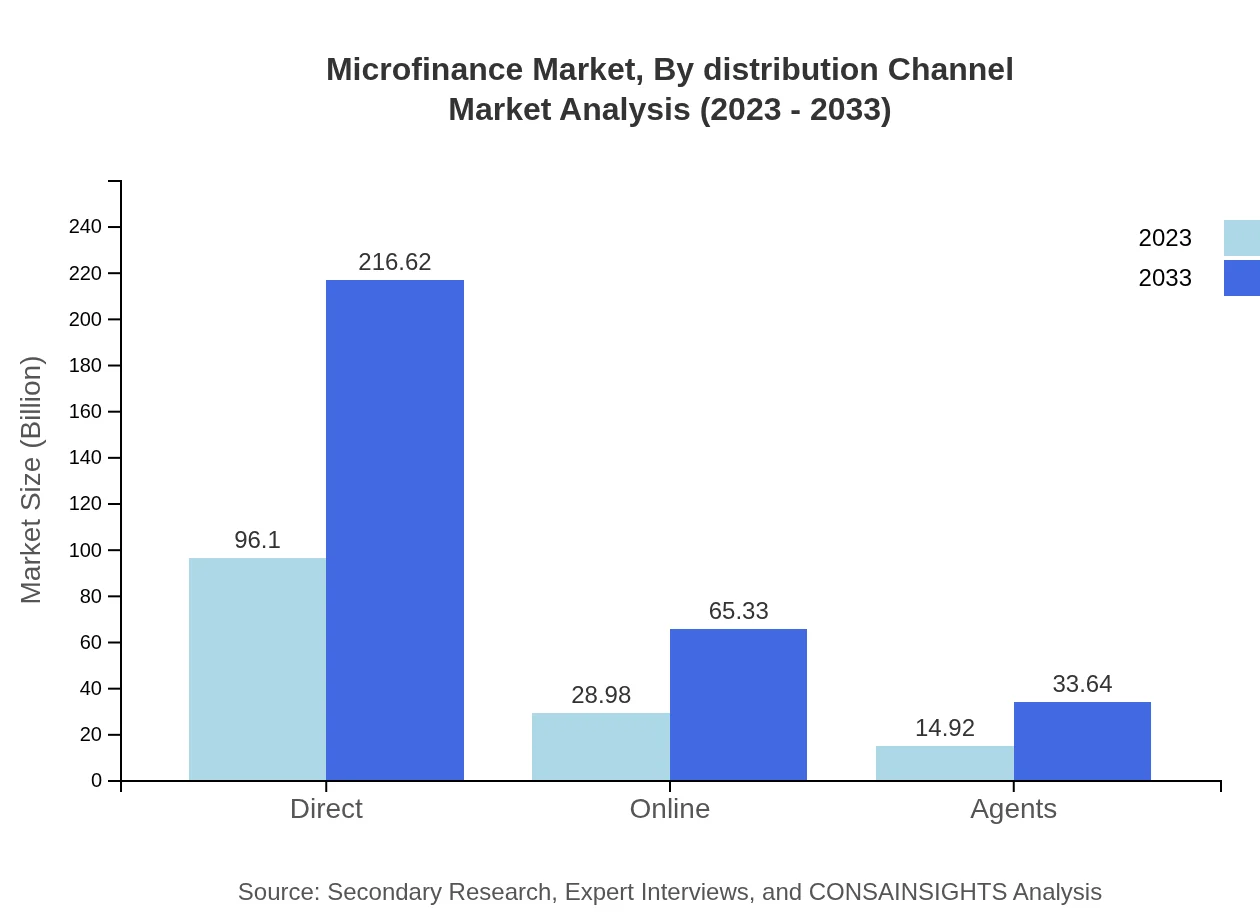

Microfinance Market Analysis By Distribution Channel

The distribution channels for microfinance services include direct, online, and agent-based methods. Direct channels dominate with a market size of $96.10 billion in 2023, projected to nearly double to $216.62 billion by 2033. Online distribution channels are also gaining importance, particularly among tech-savvy populations, increasing from $28.98 billion in 2023 to $65.33 billion by 2033. This evolution emphasizes the need for MFIs to adopt effective distribution strategies to enhance accessibility and customer satisfaction.

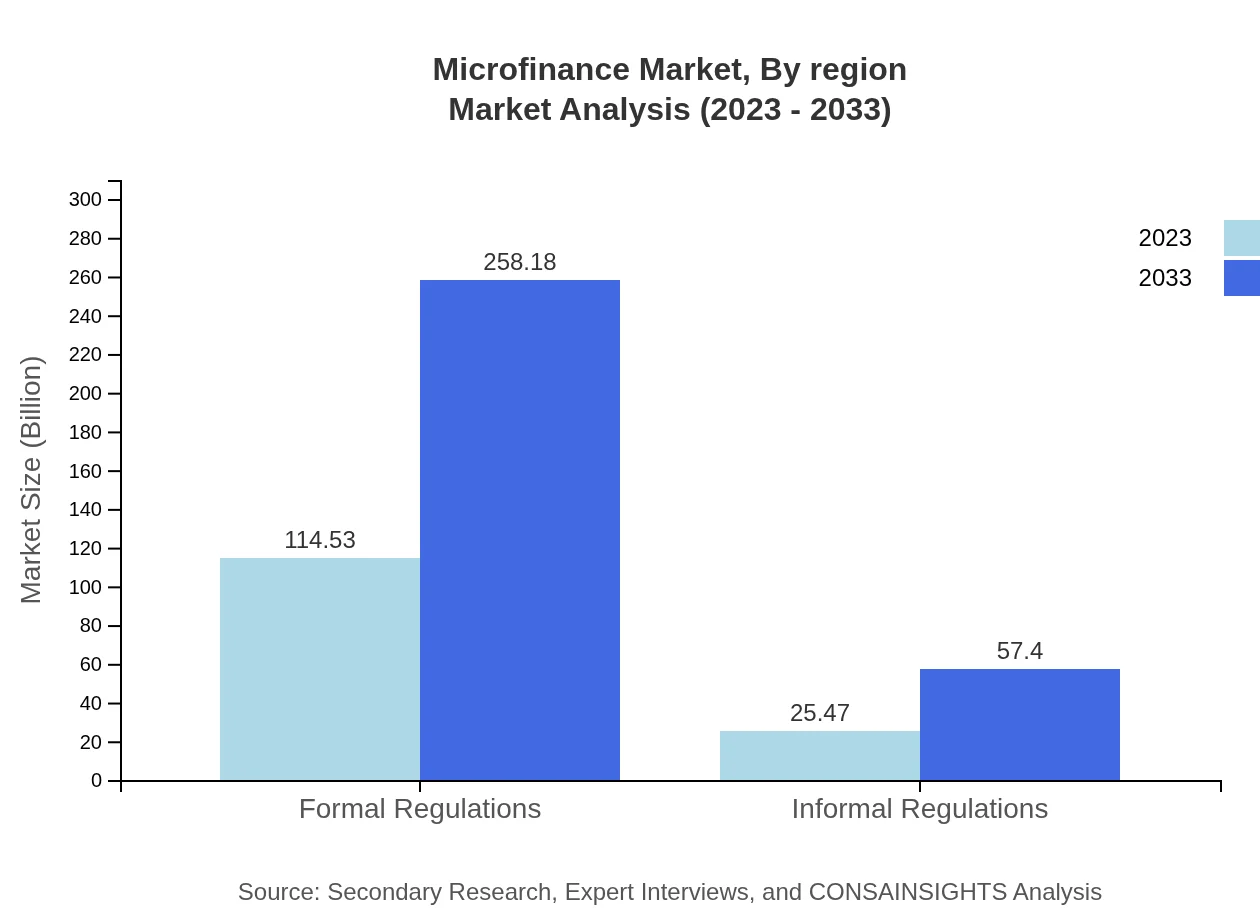

Microfinance Market Analysis By Region

The microfinance regulatory framework is pivotal in shaping the operational landscape of MFIs. The market under formal regulations has a current size of $114.53 billion in 2023, expected to reach $258.18 billion by 2033. Conversely, informal regulatory frameworks, while smaller—$25.47 billion in 2023—are projected to increase significantly, indicating a potential shift towards more regulated environments as the market matures.

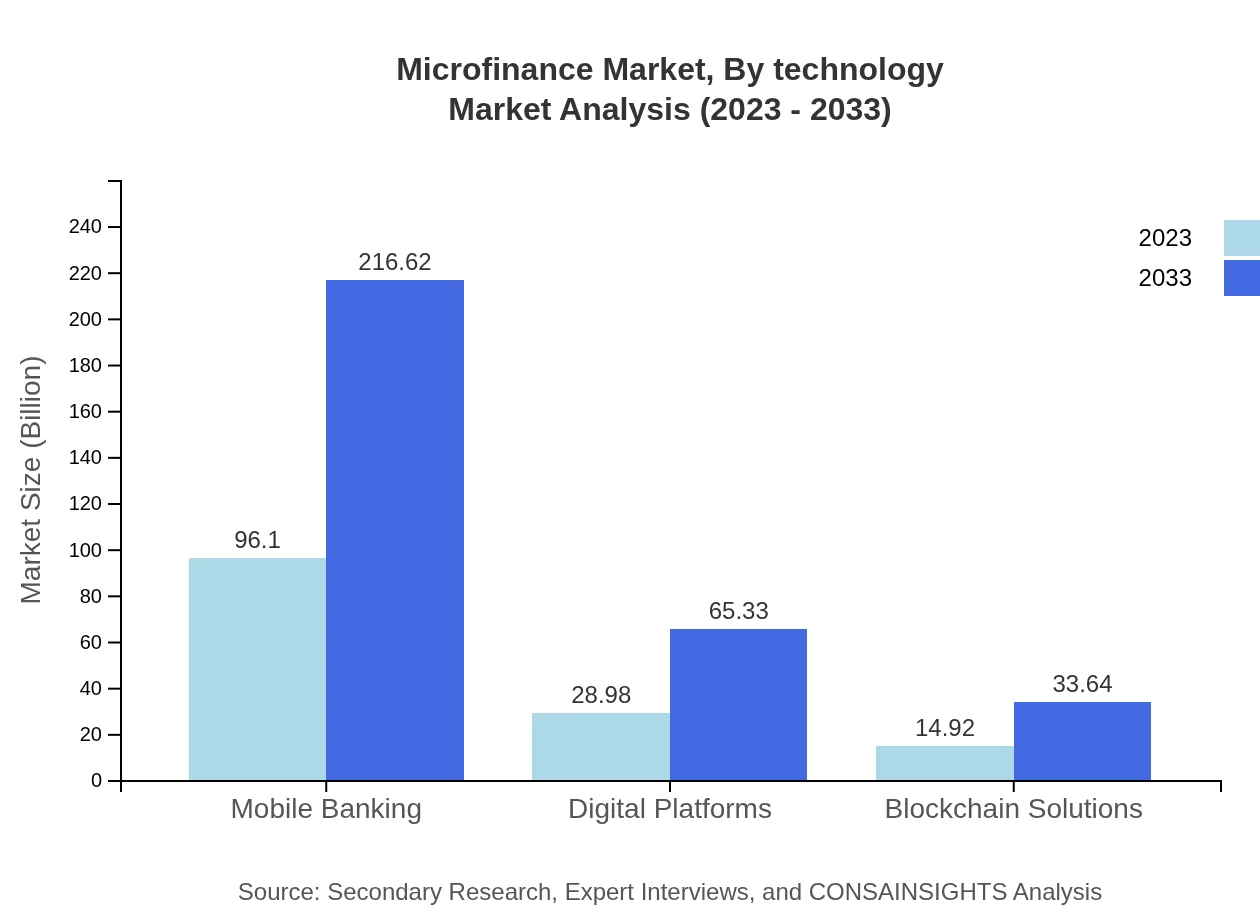

Microfinance Market Analysis By Technology

Technology plays a critical role in advancing microfinance services, facilitating innovations such as mobile banking and blockchain solutions. These technologies address barriers in accessibility and payment processes, effectively enhancing service delivery. Currently valued at $96.10 billion in 2023, mobile banking solutions are forecasted to expand significantly, replicating the expected growth in digital platforms, which are anticipated to reach $65.33 billion by 2033.

Microfinance Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Microfinance Industry

Kiva:

Kiva is a non-profit organization that provides microloans to entrepreneurs around the world, connecting lenders to individuals seeking funds for their businesses.Grameen Bank:

Founded by Nobel laureate Muhammad Yunus, Grameen Bank specializes in providing microfinance solutions to impoverished communities in Bangladesh, serving as a pioneering model for similar programs worldwide.BRAC:

BRAC is a global development organization based in Bangladesh, widely recognized for its microfinance initiatives, combining financial services with social programs to empower individuals and communities.FINCA International:

FINCA International is a global microfinance organization providing financial services to low-income entrepreneurs and communities, focusing on poverty alleviation through economic empowerment.We're grateful to work with incredible clients.

FAQs

What is the market size of microfinance?

The microfinance market size is estimated at $140 billion in 2023 and is projected to grow at a CAGR of 8.2%, reflecting significant demand and expansion in the sector over the next decade.

What are the key market players or companies in this microfinance industry?

Key players in the microfinance industry include Grameen Bank, BRAC, FINCA International, Kiva, and Accion among others. These organizations are pivotal in facilitating access to credit and financial services to underserved populations globally.

What are the primary factors driving the growth in the microfinance industry?

Growth in the microfinance industry is primarily driven by increased financial inclusion, advancements in digital banking technology, and rising awareness of microloans. Their affordability and accessibility help empower individuals and small businesses, stimulating economic development.

Which region is the fastest Growing in the microfinance?

The Asia Pacific region is the fastest-growing in the microfinance sector, with projected growth from $29.23 billion in 2023 to $65.89 billion by 2033, reflecting robust demand for inclusive financial services.

Does ConsaInsights provide customized market report data for the microfinance industry?

Yes, ConsaInsights offers customized market report data for the microfinance industry. Clients can request tailored insights that cater to specific needs regarding market dynamics, trends, and forecasts.

What deliverables can I expect from this microfinance market research project?

Deliverables from the microfinance market research project typically include comprehensive reports, data analytics, market forecasts, competitive analysis, and segmentation insights, tailored to inform strategic decision-making.

What are the market trends of microfinance?

Current trends in the microfinance industry include the rise of mobile banking solutions and digital platforms, increased focus on sustainable lending practices, and expanding support for entrepreneurship, particularly among women and marginalized communities.