Microprocessor And Gpu Market Report

Published Date: 31 January 2026 | Report Code: microprocessor-and-gpu

Microprocessor And Gpu Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Microprocessor and GPU market, covering market size, growth rates, segmentation, regional performance, and trends from 2023 to 2033. It aims to offer valuable insights for stakeholders looking to invest or operate in this evolving industry.

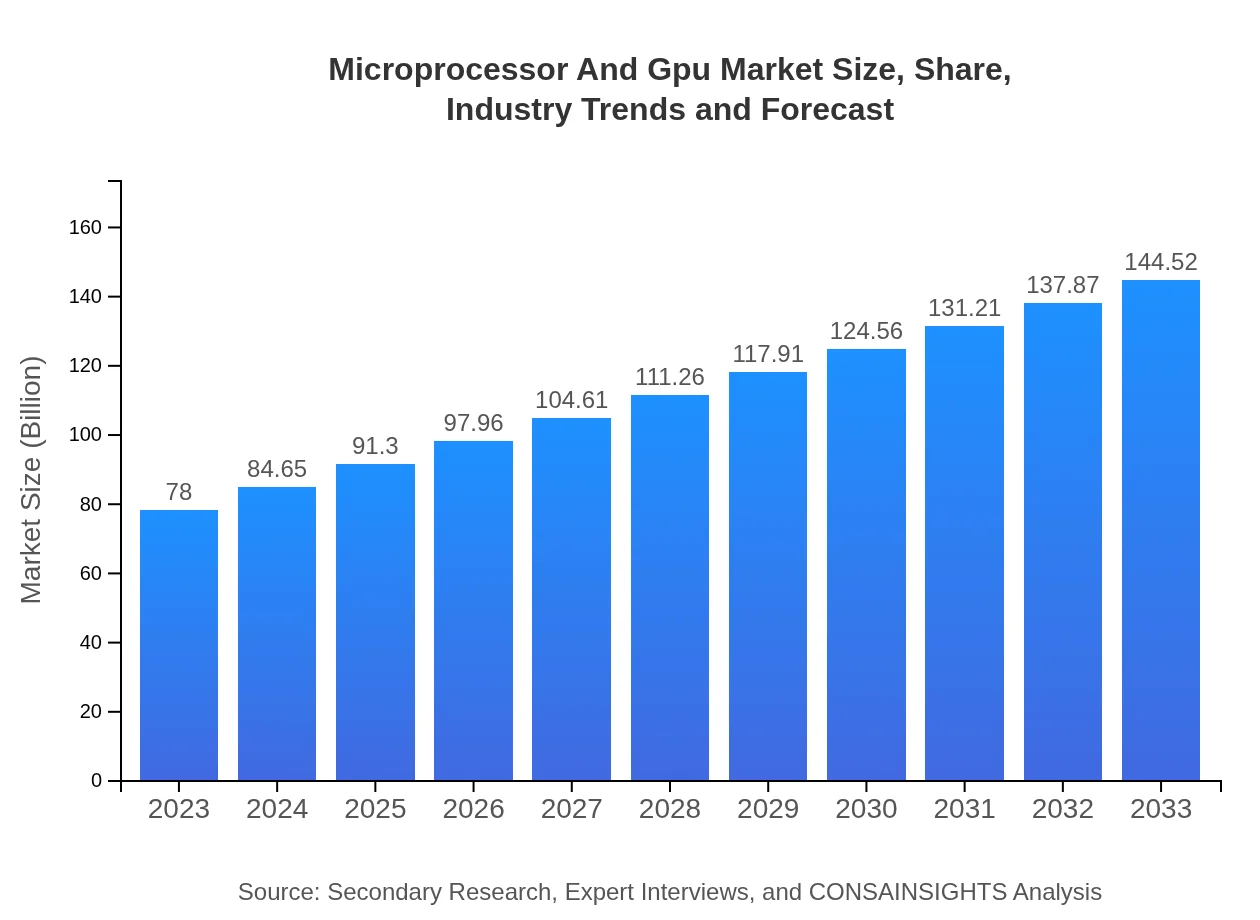

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $78.00 Billion |

| CAGR (2023-2033) | 6.2% |

| 2033 Market Size | $144.52 Billion |

| Top Companies | Intel Corporation, NVIDIA Corporation, AMD (Advanced Micro Devices), Apple Inc. |

| Last Modified Date | 31 January 2026 |

Microprocessor And GPU Market Overview

Customize Microprocessor And Gpu Market Report market research report

- ✔ Get in-depth analysis of Microprocessor And Gpu market size, growth, and forecasts.

- ✔ Understand Microprocessor And Gpu's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Microprocessor And Gpu

What is the Market Size & CAGR of Microprocessor And GPU market in 2023?

Microprocessor And GPU Industry Analysis

Microprocessor And GPU Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Microprocessor And GPU Market Analysis Report by Region

Europe Microprocessor And Gpu Market Report:

Europe shows substantial growth from a market value of $24.48 billion in 2023, projected to reach $45.36 billion by 2033. The region focuses on innovation and regulatory frameworks that support local manufacturers while also being a major consumer of technology products.Asia Pacific Microprocessor And Gpu Market Report:

In 2023, the Asia Pacific microprocessor and GPU market is valued at approximately $12.95 billion, expected to grow to $23.99 billion by 2033. This region benefits from rapid technological advancements and a significant manufacturing base, hosting major semiconductor companies that cater to global demand.North America Microprocessor And Gpu Market Report:

North America's microprocessor and GPU market is forecasted to rise from $29.59 billion in 2023 to $54.82 billion by 2033. The region is home to leading companies and innovative start-ups, driving growth particularly in data centers, AI applications, and gaming sectors.South America Microprocessor And Gpu Market Report:

The South American market is projected to grow from $2.01 billion in 2023 to $3.73 billion by 2033. Although smaller, this market shows promise due to increasing digital adoption and smartphone penetration, creating demand for microprocessors and GPUs for consumer electronics.Middle East & Africa Microprocessor And Gpu Market Report:

The Middle East and Africa market is estimated to grow from $8.97 billion in 2023 to $16.62 billion by 2033, driven by increasing investment in technology infrastructures and growing demand from the gaming and entertainment sectors.Tell us your focus area and get a customized research report.

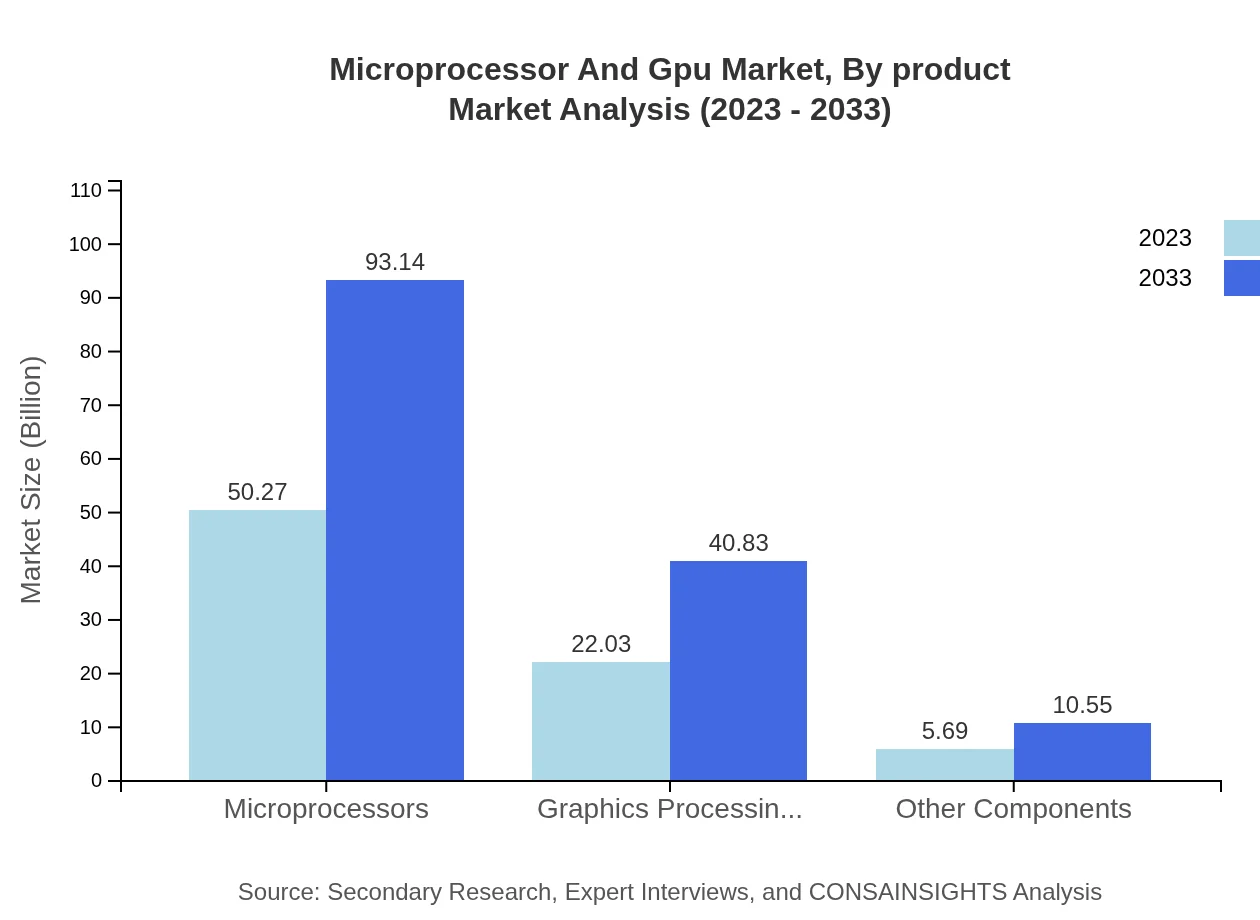

Microprocessor And Gpu Market Analysis By Product

In 2023, the Microprocessors segment dominates with a market size of $50.27 billion, expected to climb to $93.14 billion by 2033. Conversely, GPUs follow with significant growth from $22.03 billion in 2023 to $40.83 billion by 2033, reflecting their expanding roles in AI and gaming applications.

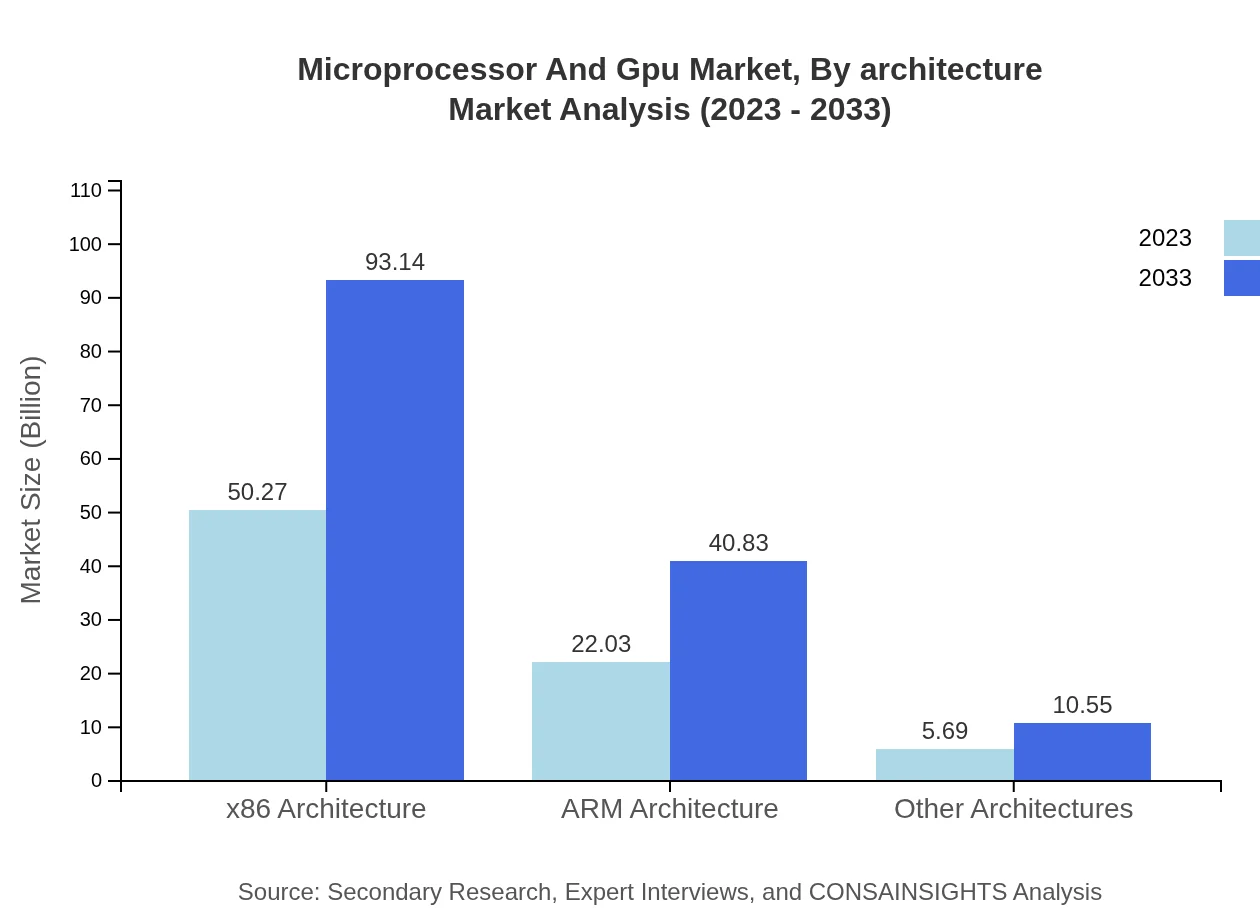

Microprocessor And Gpu Market Analysis By Architecture

The market is characterized by the x86 architecture representing $50.27 billion in 2023 with growth to $93.14 billion by 2033, while ARM architecture is projected to expand from $22.03 billion to $40.83 billion in the same timeframe, underscoring their respective roles in consumer and mobile devices.

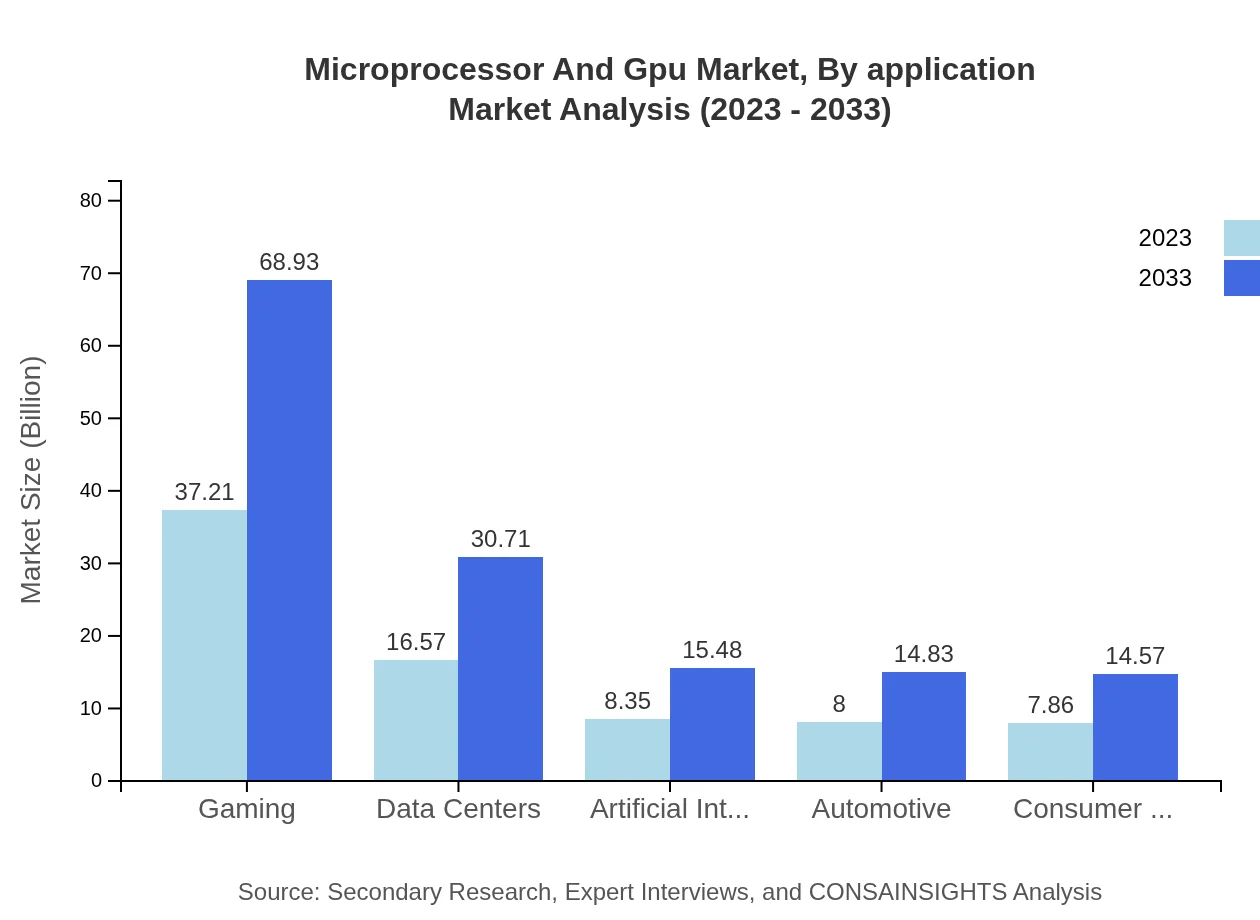

Microprocessor And Gpu Market Analysis By Application

The gaming industry remains the largest application segment with revenues of $37.21 billion in 2023, set to increase to $68.93 billion by 2033. Data centers and AI applications are notably growing, highlighting the demand for high-performance processing capabilities.

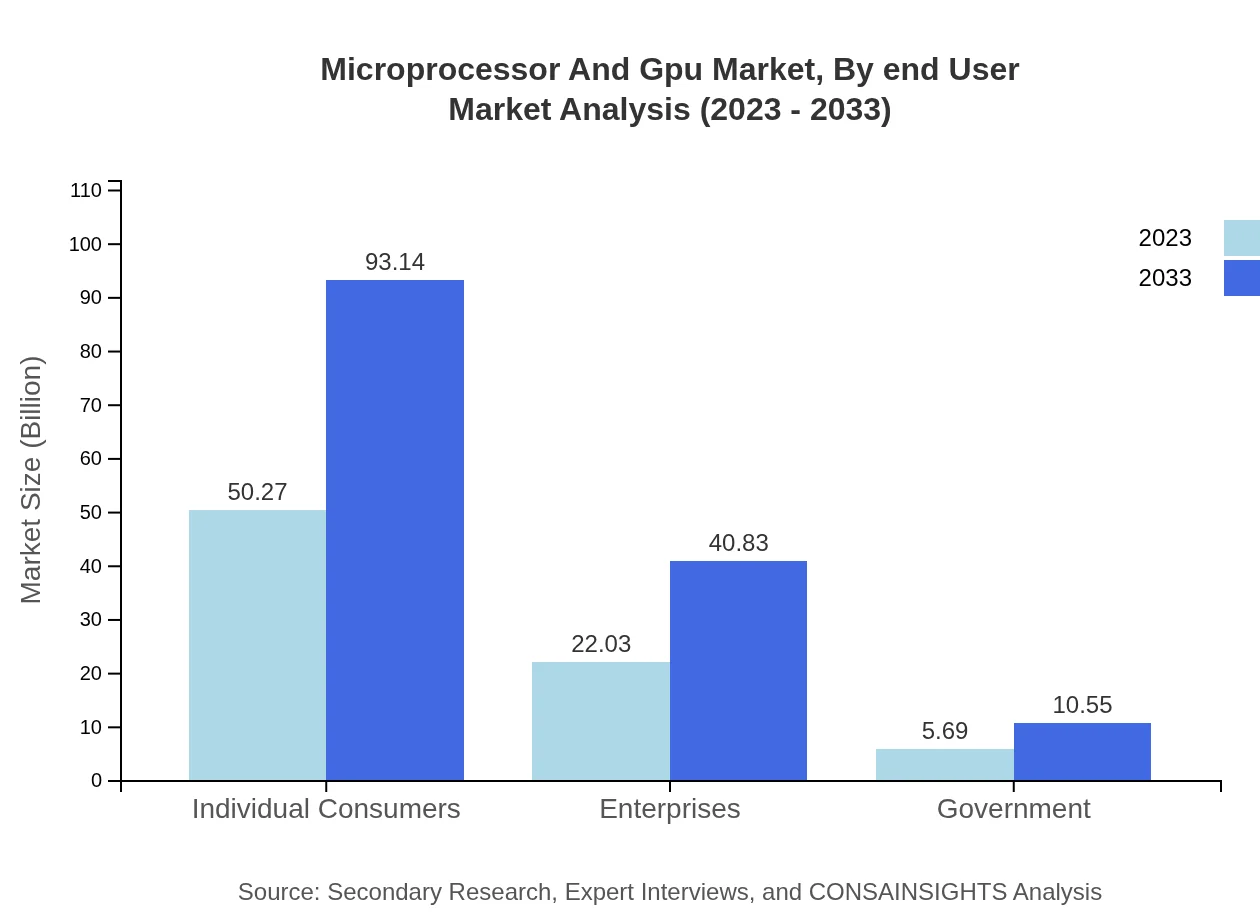

Microprocessor And Gpu Market Analysis By End User

Individual consumers hold a major market share, expected to account for $50.27 billion in 2023 and grow to $93.14 billion by 2033. The enterprise and government sectors also show promising growth as they increasingly rely on powerful processing capabilities for various applications.

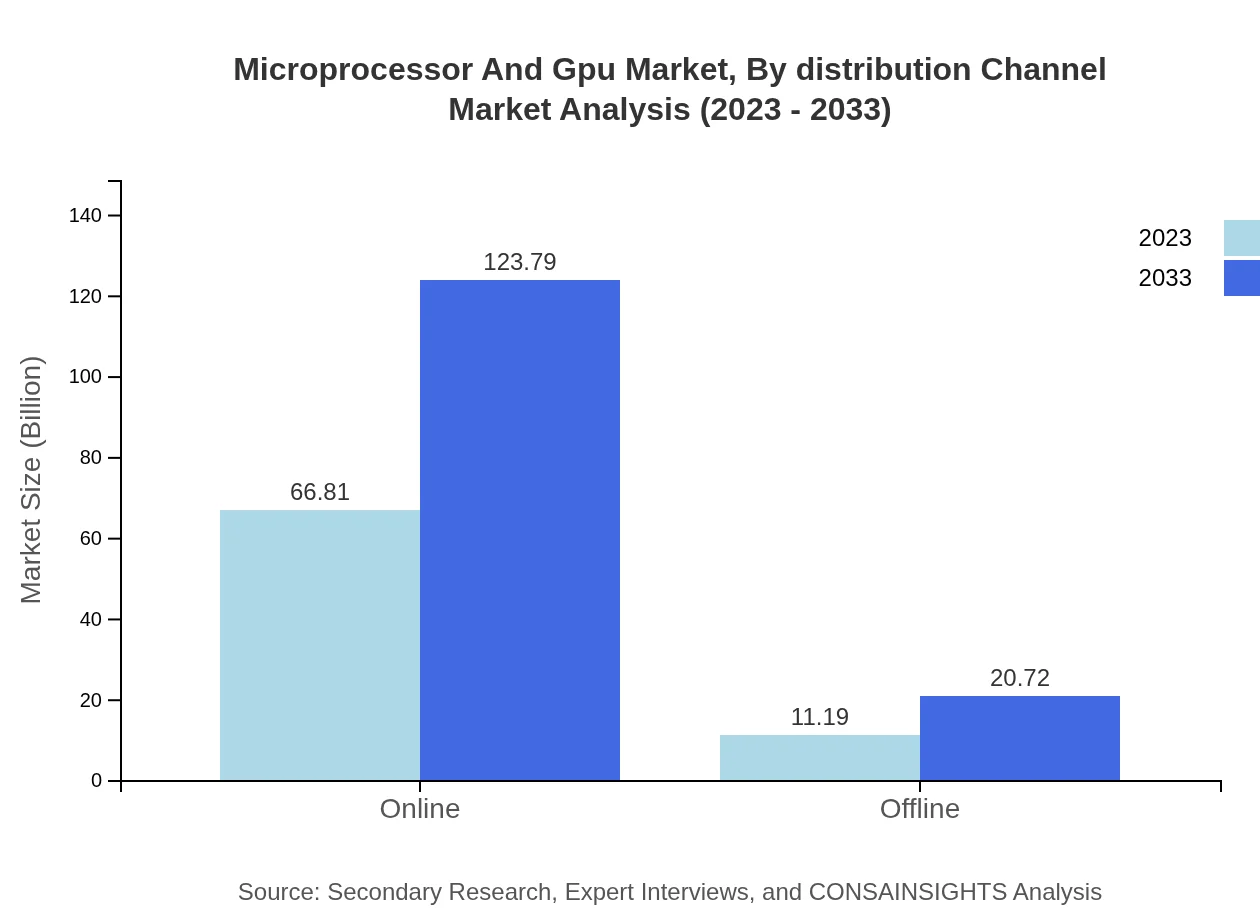

Microprocessor And Gpu Market Analysis By Distribution Channel

The online distribution channel is the leading segment, accounting for $66.81 billion in sales in 2023 and projected to rise to $123.79 billion by 2033. The offline channel, while smaller, is also growing as consumers increasingly purchase components through traditional retail channels.

Microprocessor And GPU Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Microprocessor And GPU Industry

Intel Corporation:

Intel is a leader in microprocessor design and manufacturing, providing solutions for personal computers, data centers, and enterprise servers.NVIDIA Corporation:

NVIDIA is renowned for its GPUs and AI technologies, powering industries from gaming to automotive with cutting-edge graphics and computing solutions.AMD (Advanced Micro Devices):

AMD is a key competitor in the CPU and GPU market, known for innovation in performance and efficiency across consumer and enterprise segments.Apple Inc.:

Apple's custom silicon, including their M1 and M2 chips, revolutionized performance in personal computing and mobile devices, creating new market dynamics.We're grateful to work with incredible clients.

FAQs

What is the market size of microprocessor And Gpu?

The microprocessor and GPU market size is projected at approximately $78 billion in 2023, with a robust CAGR of 6.2% expected through 2033, as technology accelerates across various sectors.

What are the key market players or companies in this microprocessor And Gpu industry?

Key players in the microprocessor and GPU industry include established companies like Intel, NVIDIA, AMD, Qualcomm, and ARM. Their innovative advancements and market strategies significantly influence industry dynamics and competition.

What are the primary factors driving the growth in the microprocessor And Gpu industry?

Factors driving growth in this industry include the increasing demand for high-performance computing in AI, gaming, and data centers. Additionally, advancements in technology and rising consumer electronics usage contribute to a thriving market.

Which region is the fastest Growing in the microprocessor And Gpu?

Asia Pacific is the fastest-growing region for microprocessors and GPUs, with a market size expected to grow from $12.95 billion in 2023 to $23.99 billion by 2033, fueled by increased technology adoption and investments.

Does ConsaInsights provide customized market report data for the microprocessor And Gpu industry?

Yes, ConsaInsights offers tailored market research reports for the microprocessor and GPU industry, allowing clients to access specific data and insights aligned with their strategic needs and goals.

What deliverables can I expect from this microprocessor And Gpu market research project?

Deliverables from the microprocessor and GPU market research project typically include detailed market analysis reports, data visualizations, trend insights, and actionable recommendations based on comprehensive research methodologies.

What are the market trends of microprocessor And Gpu?

Current market trends in the microprocessor and GPU industry encompass the rise of AI and machine learning applications, the shift towards cloud computing, and increasing consumer demand for high-performance gaming and VR experiences.