Microscopy Device Market Report

Published Date: 31 January 2026 | Report Code: microscopy-device

Microscopy Device Market Size, Share, Industry Trends and Forecast to 2033

This report provides an in-depth analysis of the Microscopy Device market, covering size, segmentation, technological advancements, key players, and future forecasts from 2023 to 2033.

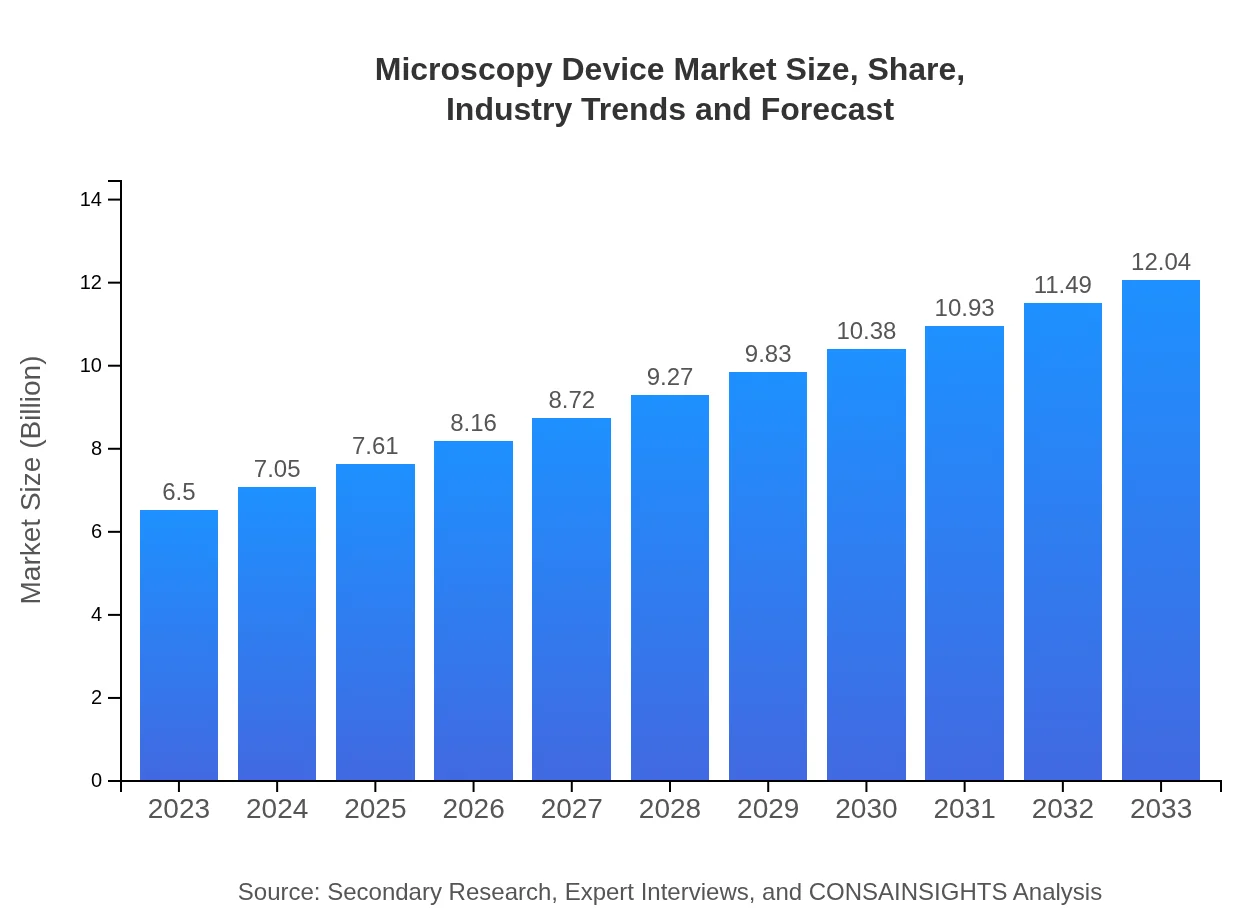

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $6.50 Billion |

| CAGR (2023-2033) | 6.2% |

| 2033 Market Size | $12.04 Billion |

| Top Companies | Zeiss, Nikon Instruments, Thermo Fisher Scientific, Leica Microsystems, Olympus Corporation |

| Last Modified Date | 31 January 2026 |

Microscopy Device Market Overview

Customize Microscopy Device Market Report market research report

- ✔ Get in-depth analysis of Microscopy Device market size, growth, and forecasts.

- ✔ Understand Microscopy Device's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Microscopy Device

What is the Market Size & CAGR of Microscopy Device market in 2023?

Microscopy Device Industry Analysis

Microscopy Device Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Microscopy Device Market Analysis Report by Region

Europe Microscopy Device Market Report:

In Europe, the marketplace showcased a value of USD 2.09 billion in 2023, projected to reach USD 3.87 billion by 2033. This growth is facilitated by an increase in industrial applications of microscopy as well as advancements in imaging techniques across laboratories.Asia Pacific Microscopy Device Market Report:

In the Asia Pacific region, the microscopy device market was valued at approximately USD 1.22 billion in 2023 and is expected to reach around USD 2.26 billion by 2033. Strong growth is driven by increasing investments in research and development initiatives, coupled with an expanding healthcare sector that demands advanced microscopy for diagnostics and research.North America Microscopy Device Market Report:

North America stands as a prominent player, with a market size of USD 2.21 billion in 2023, anticipated to grow to USD 4.10 billion by 2033. Strong demand stems from the significant presence of prominent research institutions and healthcare facilities, coupled with continual technological advancements in microscopy.South America Microscopy Device Market Report:

The South American market was valued at USD 0.50 billion in 2023 and is projected to reach approximately USD 0.92 billion by 2033. Growth in this region is primarily due to rising healthcare investments and the growing emphasis on education in stem cell and biotechnology research.Middle East & Africa Microscopy Device Market Report:

The Middle East and Africa exhibit a smaller yet growing value of USD 0.48 billion in 2023, expected to nearly double to USD 0.88 billion by 2033. The burgeoning healthcare infrastructure and increasing research activities are key contributors to this market expansion.Tell us your focus area and get a customized research report.

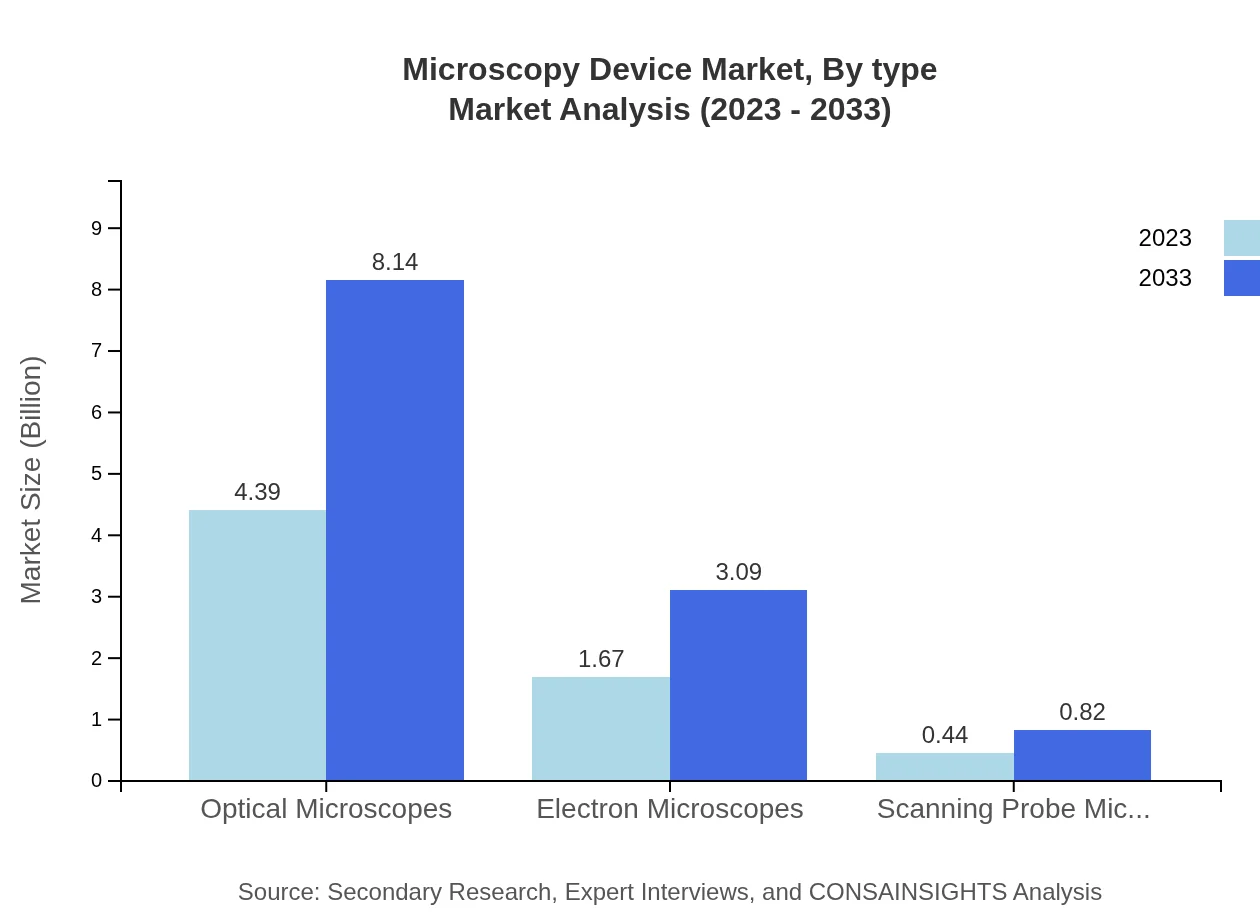

Microscopy Device Market Analysis By Type

The type segment of the microscopy device market is dominated by Optical Microscopes, which now hold significant market share and will continue to reach USD 8.14 billion by 2033 from USD 4.39 billion in 2023. Other categories, such as Electron Microscopes, are following, projected to expand from USD 1.67 billion in 2023 to USD 3.09 billion in 2033.

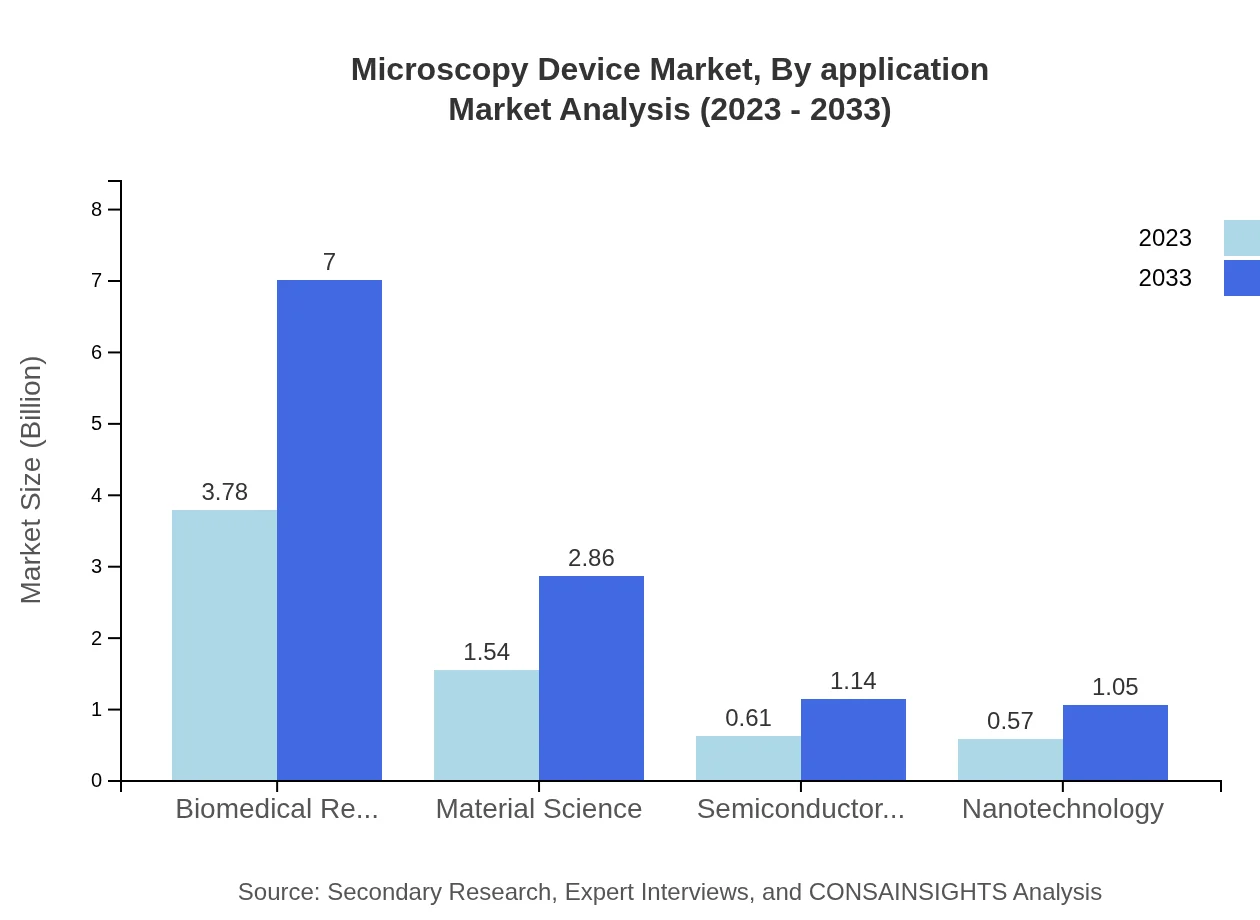

Microscopy Device Market Analysis By Application

Applications like Biomedical Research are significant, expected to maintain a market share of 58.1% in 2033, growing in revenue from USD 3.78 billion (2023) to USD 7.00 billion (2033). Increasing public funding for medical research is driving industry growth consistently.

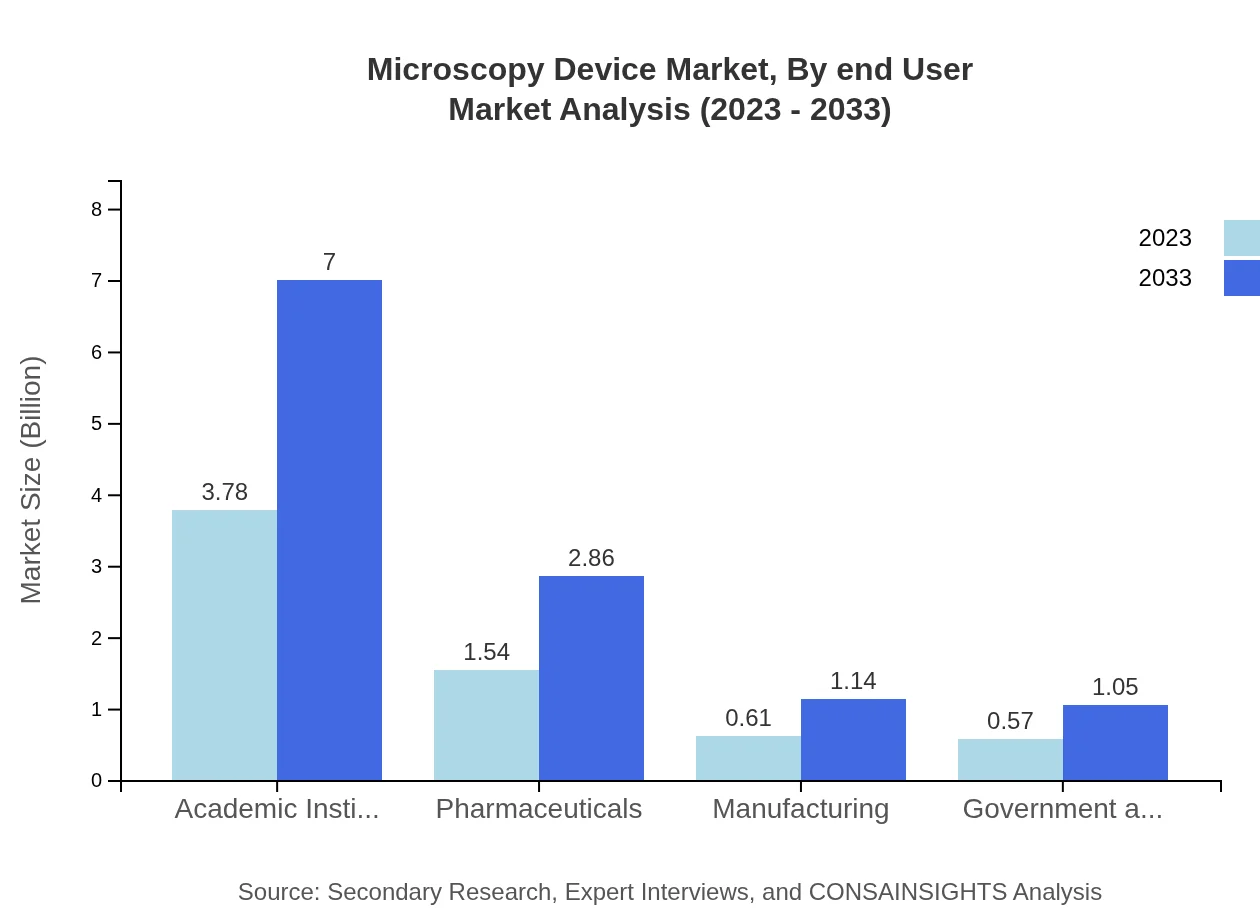

Microscopy Device Market Analysis By End User

In terms of end-users, academic institutions are projected to maintain leading positions within the industry, accounting for nearly 58.1% of share in 2023, reflecting significant dependency on educational and research activities aimed at health advancements by 2033.

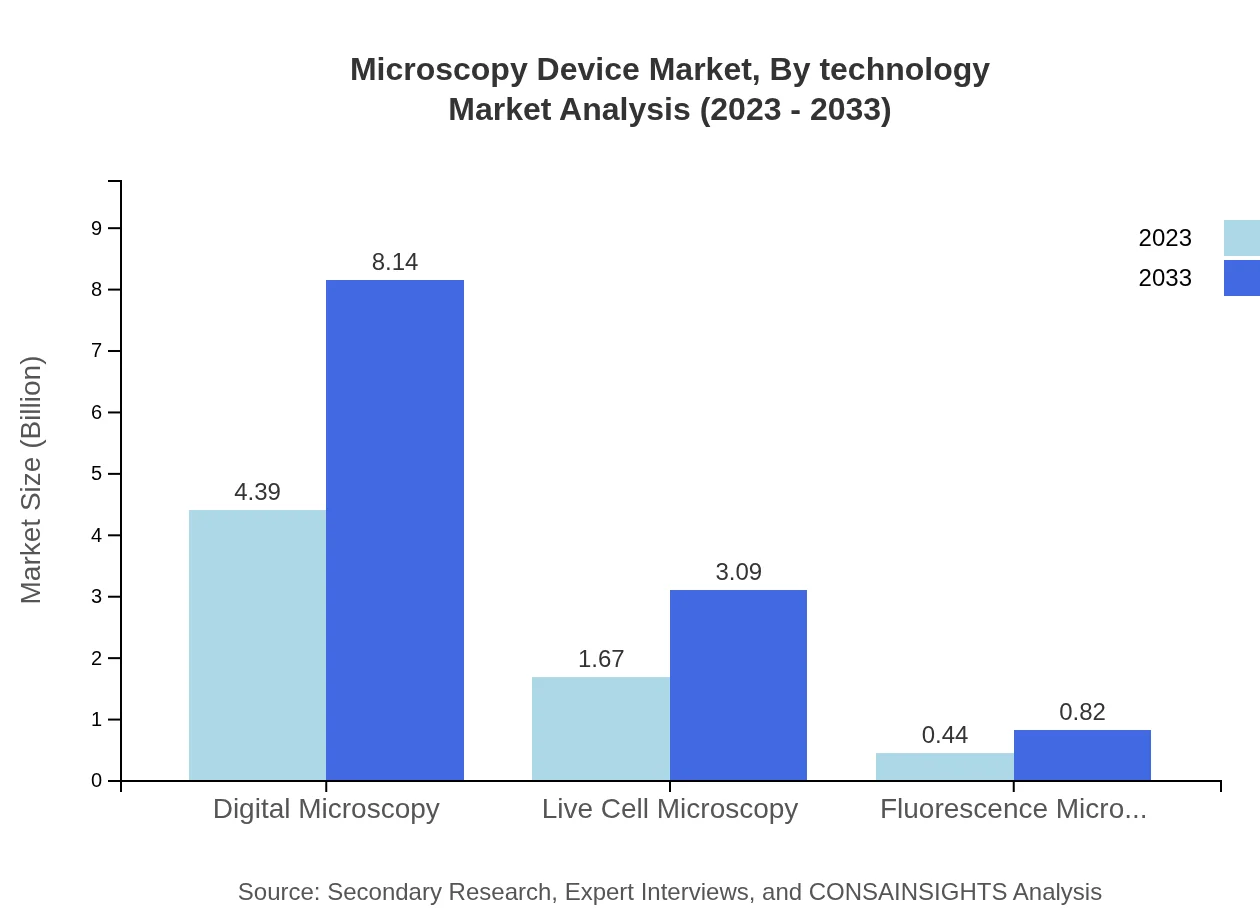

Microscopy Device Market Analysis By Technology

Technological advancements have critically enhanced the offerings in the microscopy space, particularly in digital imaging technologies. High-resolution images and improved accuracy in assessments lend to the growth of applications in diagnostics and research across various industries.

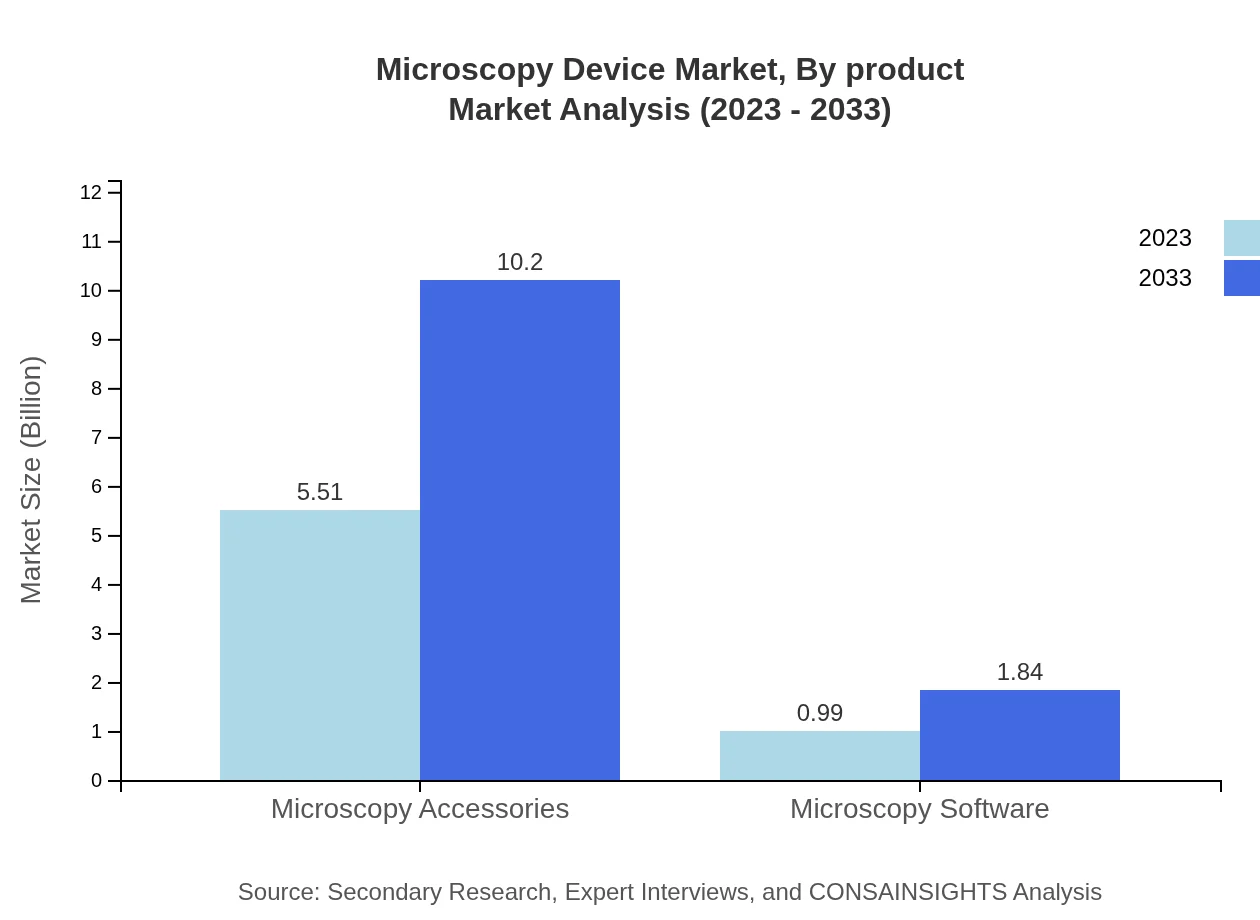

Microscopy Device Market Analysis By Product

In the product segment, microscopy accessories captured 84.72% market share in 2023, with revenues expected to grow from USD 5.51 billion to USD 10.20 billion by 2033, indicating significant reliance on accessory provisions for enhanced functionality in microscopy.

Microscopy Device Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Microscopy Device Industry

Zeiss:

A leader in the microscopy field, Zeiss specializes in manufacturing high-quality optical systems and software used for imaging and analysis in biological research.Nikon Instruments:

Nikon provides advanced solutions in optics with a focus on research and industrial applications, known for their innovative technologies delivering superior imaging quality.Thermo Fisher Scientific:

A prominent player in laboratory equipment, Thermo Fisher offers a broad range of microscopy devices supporting various scientific applications across research.Leica Microsystems:

Leica is known for providing high-precision microscopy solutions, focusing on enhancing imaging capabilities for life sciences and material sciences.Olympus Corporation:

Olympus specializes in optical and digital microscopes, aiding significant advancements in research methodologies and quality assurance across healthcare.We're grateful to work with incredible clients.

FAQs

What is the market size of microscopy Device?

The global microscopy device market is currently valued at approximately $6.5 billion as of 2023, with a robust growth projected at a CAGR of 6.2% from 2023 to 2033.

What are the key market players or companies in this microscopy Device industry?

Key players in the microscopy-device industry include major companies like Nikon Corporation, Olympus Corporation, Carl Zeiss AG, and Leica Microsystems, which contribute significantly to technological innovations and market growth.

What are the primary factors driving the growth in the microscopy device industry?

The growth of the microscopy device market is primarily driven by advancements in microscopy technology, increasing applications in biomedical research, and rising demand for high-resolution imaging in various sectors including pharmaceuticals and material science.

Which region is the fastest Growing in the microscopy Device market?

Asia Pacific is identified as the fastest-growing region in the microscopy-device market, with market growth projected from $1.22 billion in 2023 to $2.26 billion by 2033.

Does Consainsights provide customized market report data for the microscopy Device industry?

Yes, Consainsights.com offers customized market report data tailored to specific needs within the microscopy-device industry, ensuring comprehensive insights based on the latest market trends and data.

What deliverables can I expect from this microscopy Device market research project?

Deliverables from the microscopy-device market research project typically include detailed market analysis, competitive landscape assessments, regional insights, and trend reports, providing a comprehensive understanding for stakeholders.

What are the market trends of microscopy devices?

Current trends in the microscopy device market include the growing adoption of digital microscopy and live cell imaging, integration of advanced imaging software, and increasing investment in R&D across academia and pharmaceuticals.